# FedWatch

200.21K

MissCrypto

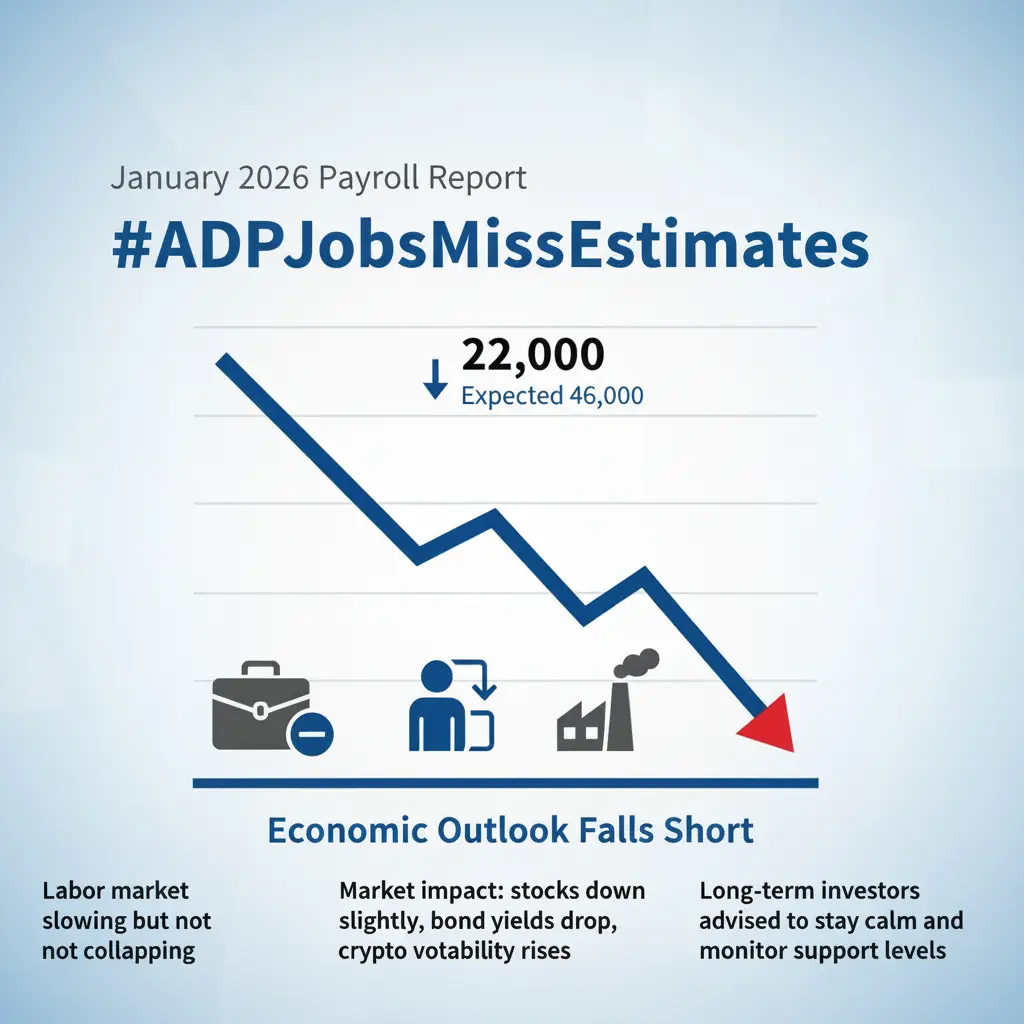

#ADPJobsMissEstimates

What Happened:

The latest ADP report revealed that U.S. private companies added only 22,000 jobs in January 2026, falling short of the 46,000 jobs expected — a noticeable miss.

Why It Matters:

This indicates that the labor market is slowing down, but not collapsing. ADP data often influences market sentiment as it hints at future Fed policy and overall economic growth.

Market Impact:

Stocks: Slight declines in major indexes

Bonds: Yields drop as investors anticipate a more dovish Fed

Crypto: Bitcoin and Ethereum experience short-term dips with rising volatility

Bottom Lin

What Happened:

The latest ADP report revealed that U.S. private companies added only 22,000 jobs in January 2026, falling short of the 46,000 jobs expected — a noticeable miss.

Why It Matters:

This indicates that the labor market is slowing down, but not collapsing. ADP data often influences market sentiment as it hints at future Fed policy and overall economic growth.

Market Impact:

Stocks: Slight declines in major indexes

Bonds: Yields drop as investors anticipate a more dovish Fed

Crypto: Bitcoin and Ethereum experience short-term dips with rising volatility

Bottom Lin

- Reward

- 10

- 19

- Repost

- Share

CryptoFiler :

:

2026 GOGOGO 👊View More

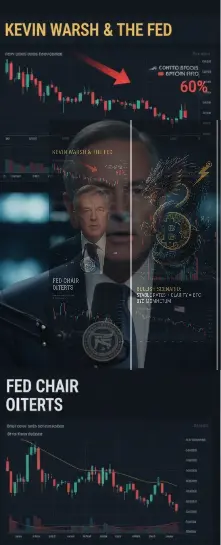

#WarshLeadsFedChairRace

🏛️ Kevin Warsh & the Fed — What It Means for Crypto!

Kevin Warsh’s odds of becoming Fed Chair have risen to 60%, with rates expected to stay unchanged in January. The big question: Bullish or bearish for crypto? 🤔

🔍 Key Points

1️⃣ Policy stance: Warsh is moderately hawkish → could weigh on crypto if tightening signals appear.

2️⃣ Rate expectations: No immediate hikes → may support BTC and risk assets if stability continues.

3️⃣ Market psychology: Crypto loves clarity; consistent guidance could reduce volatility.

📊 Possible Scenarios

Bullish: Stable rates + clear co

🏛️ Kevin Warsh & the Fed — What It Means for Crypto!

Kevin Warsh’s odds of becoming Fed Chair have risen to 60%, with rates expected to stay unchanged in January. The big question: Bullish or bearish for crypto? 🤔

🔍 Key Points

1️⃣ Policy stance: Warsh is moderately hawkish → could weigh on crypto if tightening signals appear.

2️⃣ Rate expectations: No immediate hikes → may support BTC and risk assets if stability continues.

3️⃣ Market psychology: Crypto loves clarity; consistent guidance could reduce volatility.

📊 Possible Scenarios

Bullish: Stable rates + clear co

- Reward

- 18

- 9

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

#WarshLeadsFedChairRace

A Hawk at the Helm: What a Warsh-Led Fed Could Mean for Crypto’s Next Phase

Markets are already looking ahead. With prediction platforms signaling a strong probability that Kevin Warsh could become the next U.S. Federal Reserve Chair, investors are beginning to price in not just a name — but a policy mindset.

Warsh is widely viewed as inflation-focused and policy-disciplined. That matters.

🔍 Why This Shift Is Important

A new Fed Chair often marks a change in tempo, not just direction. Under a Warsh-style framework:

• Aggressive rate cuts become less likely

• Inflation

A Hawk at the Helm: What a Warsh-Led Fed Could Mean for Crypto’s Next Phase

Markets are already looking ahead. With prediction platforms signaling a strong probability that Kevin Warsh could become the next U.S. Federal Reserve Chair, investors are beginning to price in not just a name — but a policy mindset.

Warsh is widely viewed as inflation-focused and policy-disciplined. That matters.

🔍 Why This Shift Is Important

A new Fed Chair often marks a change in tempo, not just direction. Under a Warsh-style framework:

• Aggressive rate cuts become less likely

• Inflation

- Reward

- 2

- Comment

- Repost

- Share

#WeekendMarketAnalysis 📊 Market Prediction | When One Sentence Moves Global Markets

A single remark from Trump was enough to shift market expectations — and suddenly, Kevin Warsh is being priced in as the frontrunner for the next Fed Chair.

This isn’t about politics alone. It’s about how markets trade probability, not announcements.

Warsh is widely seen as more disciplined on monetary policy, less tolerant of prolonged easing, and more focused on financial stability. That changes everything — from bond yields and the US dollar to equities and crypto.

For crypto traders, this matters deeply. H

A single remark from Trump was enough to shift market expectations — and suddenly, Kevin Warsh is being priced in as the frontrunner for the next Fed Chair.

This isn’t about politics alone. It’s about how markets trade probability, not announcements.

Warsh is widely seen as more disciplined on monetary policy, less tolerant of prolonged easing, and more focused on financial stability. That changes everything — from bond yields and the US dollar to equities and crypto.

For crypto traders, this matters deeply. H

BTC-0,35%

- Reward

- 5

- 6

- Repost

- Share

MissCrypto :

:

2026 GOGOGO 👊View More

🚨 Powell Under Investigation? Markets on Alert

#FedWatch #MacroRisk #CryptoVolatility

Recent reports have sparked headlines around U.S. Fed Chair Jerome Powell and an alleged investigation tied to Fed HQ renovation spending.

⚠️ No verdict, no confirmation yet — but markets don’t wait for outcomes, they react to uncertainty.

📉 Why Markets Care The Federal Reserve runs on credibility and trust.

Even perceived governance risk can: • Shake investor confidence

• Increase volatility

• Delay risk-taking across markets

📊 Immediate Market Reaction 🔹 Stocks & Crypto: Sensitive to policy clarity → ch

#FedWatch #MacroRisk #CryptoVolatility

Recent reports have sparked headlines around U.S. Fed Chair Jerome Powell and an alleged investigation tied to Fed HQ renovation spending.

⚠️ No verdict, no confirmation yet — but markets don’t wait for outcomes, they react to uncertainty.

📉 Why Markets Care The Federal Reserve runs on credibility and trust.

Even perceived governance risk can: • Shake investor confidence

• Increase volatility

• Delay risk-taking across markets

📊 Immediate Market Reaction 🔹 Stocks & Crypto: Sensitive to policy clarity → ch

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

🏛️ *Global Central Banks Quietly Back Powell — Why It Matters for Markets* 🌍

As U.S. political pressure mounts on Jerome Powell, central bank leaders worldwide are sending a subtle but unified message: *defend independence*.

Why is this significant?

✔️ *Monetary trust is global* — When the Fed’s credibility is questioned, markets everywhere feel the tremors.

✔️ *Policy needs stability* — Interest rate moves take time to work. Political interference undermines confidence and damages outcomes.

✔️ *History warns us* — Many economies have paid the price when politics dictated central bank ac

As U.S. political pressure mounts on Jerome Powell, central bank leaders worldwide are sending a subtle but unified message: *defend independence*.

Why is this significant?

✔️ *Monetary trust is global* — When the Fed’s credibility is questioned, markets everywhere feel the tremors.

✔️ *Policy needs stability* — Interest rate moves take time to work. Political interference undermines confidence and damages outcomes.

✔️ *History warns us* — Many economies have paid the price when politics dictated central bank ac

BTC-0,35%

- Reward

- like

- Comment

- Repost

- Share

🏦 #FedRateCutComing | Macro Market Alert 📉✨

Markets are anticipating a potential Federal Reserve rate cut, a move that could impact global liquidity, risk sentiment, and crypto market momentum. Traders are watching closely to adjust strategies and manage risk. 🌍💹

🔍 Key Points to Monitor:

Potential boost to risk assets, including crypto 🚀

Impact on USD strength and global trading sentiment 💱

Volatility around macroeconomic announcements ⚠️

Stay informed and trade smart with Gate.io’s real-time market insights and advanced tools. ⚡💼

#Gateio #FedWatch #InterestRates #CryptoMarket 🚀✨

Markets are anticipating a potential Federal Reserve rate cut, a move that could impact global liquidity, risk sentiment, and crypto market momentum. Traders are watching closely to adjust strategies and manage risk. 🌍💹

🔍 Key Points to Monitor:

Potential boost to risk assets, including crypto 🚀

Impact on USD strength and global trading sentiment 💱

Volatility around macroeconomic announcements ⚠️

Stay informed and trade smart with Gate.io’s real-time market insights and advanced tools. ⚡💼

#Gateio #FedWatch #InterestRates #CryptoMarket 🚀✨

- Reward

- 3

- Comment

- Repost

- Share

🏦 #FedRateCutComing | Macro Market Update 📉✨

Markets are anticipating a potential Federal Reserve rate cut, which could influence global liquidity, risk appetite, and crypto market momentum. Traders are closely watching developments to adjust strategies and manage risk effectively. 🌍💹

🔍 What to Watch:

Potential boost to risk assets, including BTC and major altcoins 🚀

Impact on USD strength and global trading sentiment 💱

Increased volatility around macroeconomic announcements ⚠️

Stay informed and trade smart with Gate.io’s real-time market insights and advanced tools. ⚡💼

#Gateio #FedWa

Markets are anticipating a potential Federal Reserve rate cut, which could influence global liquidity, risk appetite, and crypto market momentum. Traders are closely watching developments to adjust strategies and manage risk effectively. 🌍💹

🔍 What to Watch:

Potential boost to risk assets, including BTC and major altcoins 🚀

Impact on USD strength and global trading sentiment 💱

Increased volatility around macroeconomic announcements ⚠️

Stay informed and trade smart with Gate.io’s real-time market insights and advanced tools. ⚡💼

#Gateio #FedWa

BTC-0,35%

- Reward

- 3

- Comment

- Repost

- Share

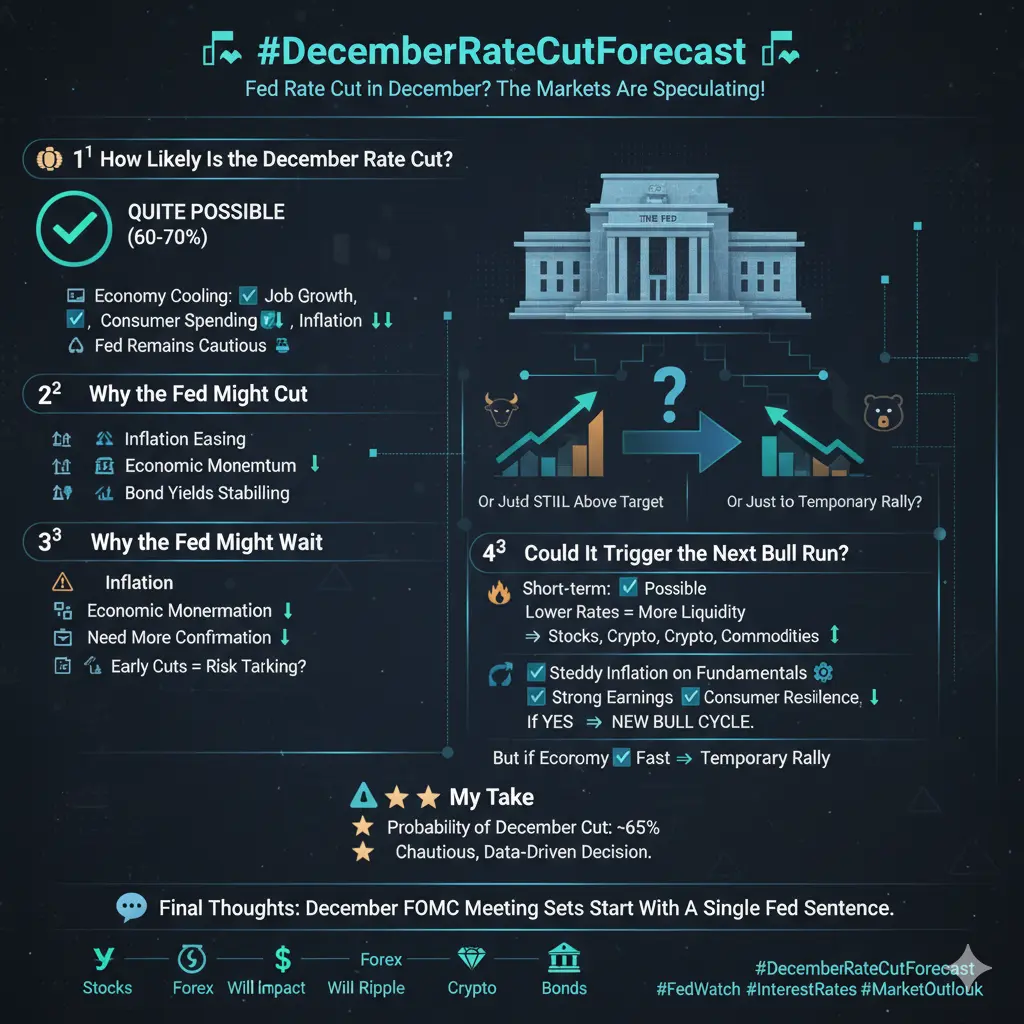

📉 #DecemberRateCutForecast 📉

The Fed may cut rates again this December, and the markets are heating up with speculation.

But the real question is 👇

💭 How likely is the rate cut?

💭 Could it ignite the next bull run?

Let’s break it down 🔍

💰 1️⃣ How Likely Is the December Rate Cut?

✅ Quite possible — but not guaranteed.

The economy is cooling down — job growth is slowing, consumer spending is softening, and inflation is gradually coming under control. These are exactly the conditions that could push the Fed to ease rates to prevent a sharper slowdown.

However… the Fed remains cautious ⚖️

O

The Fed may cut rates again this December, and the markets are heating up with speculation.

But the real question is 👇

💭 How likely is the rate cut?

💭 Could it ignite the next bull run?

Let’s break it down 🔍

💰 1️⃣ How Likely Is the December Rate Cut?

✅ Quite possible — but not guaranteed.

The economy is cooling down — job growth is slowing, consumer spending is softening, and inflation is gradually coming under control. These are exactly the conditions that could push the Fed to ease rates to prevent a sharper slowdown.

However… the Fed remains cautious ⚖️

O

- Reward

- 4

- 2

- Repost

- Share

TheRealKing :

:

niceView More

#FederalReserve #RateCut

#FedWatch | Federal Reserve Governor Lisa Cook Hints at Possible December Rate Cut But the Data Will Tell the Story

The financial world is on high alert after Federal Reserve Governor Lisa Cook suggested that a December interest rate cut remains on the table, but only if upcoming economic data confirms that inflation is cooling and growth is slowing. Speaking at the Brookings Institution, Cook emphasized the Fed’s continued data-driven approach, reinforcing that every decision from here will be based on evidence not assumptions.

📊 A “Live” December Meeting Policy Fle

#FedWatch | Federal Reserve Governor Lisa Cook Hints at Possible December Rate Cut But the Data Will Tell the Story

The financial world is on high alert after Federal Reserve Governor Lisa Cook suggested that a December interest rate cut remains on the table, but only if upcoming economic data confirms that inflation is cooling and growth is slowing. Speaking at the Brookings Institution, Cook emphasized the Fed’s continued data-driven approach, reinforcing that every decision from here will be based on evidence not assumptions.

📊 A “Live” December Meeting Policy Fle

- Reward

- 2

- 4

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

42.47M Popularity

152.38K Popularity

102.61K Popularity

1.66M Popularity

496.09K Popularity

9.89K Popularity

8.93K Popularity

22.38K Popularity

4.98K Popularity

363.11K Popularity

45.93K Popularity

103.71K Popularity

17.96K Popularity

71.23K Popularity

8.77K Popularity

News

View MoreBULLA increased by 50.55% after launching Alpha, current price is 0.02304 USDT

1 h

Data: In the past 24 hours, the total liquidation across the network was $498 million, with long positions liquidated at $357 million and short positions at $141 million.

2 h

CIA assessment: Even if Hamedani is killed, hardliners in Iran will succeed him

2 h

Vitalik: EIP-8141 is expected to be implemented within a year, fully resolving the account abstraction issue

2 h

The EU states that they received radio signals from Iran stating "No ships are allowed to pass through the Strait of Hormuz"

2 h

Pin