Falcon_Official

No content yet

Pin

Falcon_Official

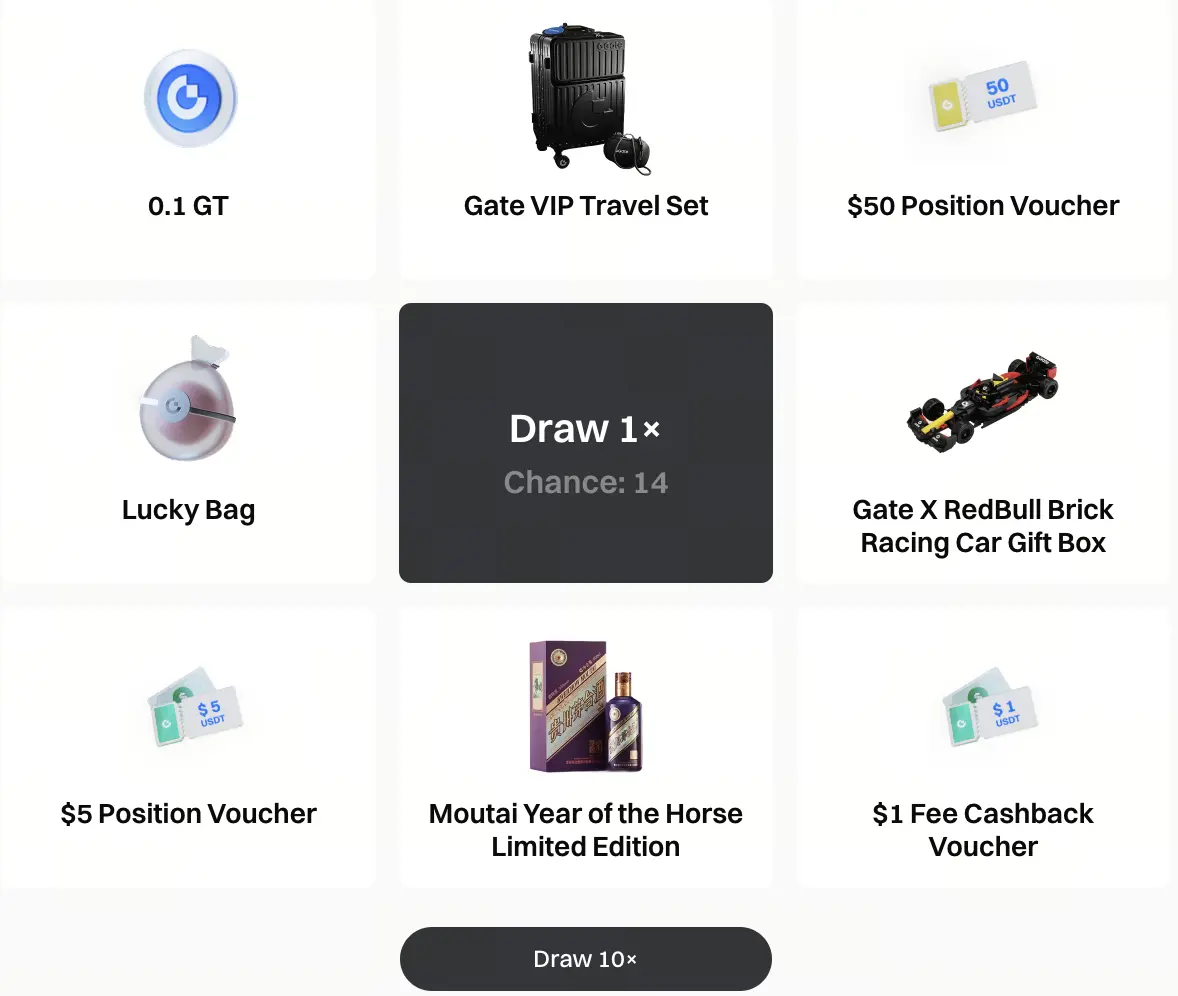

🔥 Watch-to-Earn Round 17 Is Live | New Prize Pool

The lucky draw is back.

Watch streams and interact to earn Heat Points and unlock draw chances.

🎯 80 Heat Points = 1 draw

Unused Heat Points from the previous round carry over to this round

🎁 This round’s prizes

Year Limited Maotai

Gate VIP Travel Kit

Gate × Red Bull Brick Racing Set

GT | Trading Vouchers | Fee Rebates

🎊 Token Lucky Bags guaranteed — 100% win

📌 How to join

Watch streams, interact, or copy trade on Gate Live

Your activity automatically converts into draw chances.

👉 Watch & earn Heat Points

https://www.gate.com/live

🎰 Ente

The lucky draw is back.

Watch streams and interact to earn Heat Points and unlock draw chances.

🎯 80 Heat Points = 1 draw

Unused Heat Points from the previous round carry over to this round

🎁 This round’s prizes

Year Limited Maotai

Gate VIP Travel Kit

Gate × Red Bull Brick Racing Set

GT | Trading Vouchers | Fee Rebates

🎊 Token Lucky Bags guaranteed — 100% win

📌 How to join

Watch streams, interact, or copy trade on Gate Live

Your activity automatically converts into draw chances.

👉 Watch & earn Heat Points

https://www.gate.com/live

🎰 Ente

- Reward

- 11

- 19

- 1

- Share

Korean_Girl :

:

I like and comments on your All posts So please back like and comments on my posts 👍View More

Crypto Markets React to Ongoing Middle East Tensions

#DeepCreationCamp captures a pivotal moment for the cryptocurrency markets in early March 2026, as global geopolitical conflict centered on the widening confrontation between the U.S., Israel, and Iran exerts powerful influence on risk assets across the financial world. Over the past week, cryptocurrencies including Bitcoin, Ethereum, XRP and others have shown sharp volatility, dipping aggressively at times before stabilizing, while safe‑haven flows toward traditional assets like gold, the U.S. dollar, and even certain cryptocurrencies have

#DeepCreationCamp captures a pivotal moment for the cryptocurrency markets in early March 2026, as global geopolitical conflict centered on the widening confrontation between the U.S., Israel, and Iran exerts powerful influence on risk assets across the financial world. Over the past week, cryptocurrencies including Bitcoin, Ethereum, XRP and others have shown sharp volatility, dipping aggressively at times before stabilizing, while safe‑haven flows toward traditional assets like gold, the U.S. dollar, and even certain cryptocurrencies have

- Reward

- 3

- 4

- Repost

- Share

ShainingMoon :

:

To The Moon 🌕View More

Global Rate‑Cut Expectations Cool Off Amid Inflation, Oil and Geopolitical Risks #GlobalRate‑CutExpectationsCoolOff is the defining financial market theme of early March 2026 as traders, investors, and economists around the world reassess the likelihood of interest rate cuts by major central banks. Just a short time ago, markets were pricing in multiple rate reductions for 2026 from the U.S. Federal Reserve, Bank of England (BoE), European Central Bank (ECB) and others a scenario that typically signals easier borrowing costs, potential economic growth support, and improved risk sentiment. Howe

- Reward

- 2

- 3

- Repost

- Share

ShainingMoon :

:

LFG 🔥View More

Visa to Launch Next‑Gen Crypto Credit Card Globally #VisatoLaunchCryptoCreditCard is rapidly becoming one of the biggest financial and cryptocurrency headlines of early 2026 as Visa Inc., the world’s largest payment network, moves forward with a strategic expansion of crypto‑linked payment cards that bridge digital assets and everyday spending. Unlike past crypto card experiments where users loaded crypto and then converted to fiat before making purchases, Visa is now pushing a more integrated and scalable solution that allows stablecoins cryptocurrencies pegged to real‑world values like the U

- Reward

- 2

- 4

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

Sudden Market Collapse in Asia-Pacific Triggers Circuit Breakers #AsiaPacificStocksTriggerCircuitBreakers refers to a critical event in Asia-Pacific equity markets where major stock indices experienced a sudden and severe decline, forcing automatic “circuit breaker” mechanisms to activate. This hashtag highlights not just the price drops themselves, but the systemic response designed to prevent panic-driven market collapses. Circuit breakers are predefined thresholds that temporarily halt trading when a market index falls by a significant percentage in a very short period. They are essential s

- Reward

- 2

- 2

- Repost

- Share

ShainingMoon :

:

To The Moon 🌕View More

🤝 Trump Meets Merz at the White House #TrumpMeetsMerz is trending globally as U.S. President Donald Trump held a high-profile meeting with German Chancellor Friedrich Merz at the White House, marking a critical diplomatic moment amid rising global tensions. This meeting took place at a time when international politics are under severe strain due to escalating conflicts, energy market instability, and shifting alliances. The face-to-face discussion between the two leaders highlighted the renewed importance of U.S.–Germany relations as both countries navigate complex security, economic, and geo

- Reward

- 3

- 1

- Repost

- Share

ShainingMoon :

:

To The Moon 🌕U.S. Markets Show Resilience Amid Volatility #USStocksTrimLosses

#USStocksTrimLosses is trending today because U.S. stock markets experienced sharp intraday declines but managed to recover a significant portion of those losses before the session ended. Early trading was dominated by heavy selling pressure as investors reacted to rising geopolitical tensions and surging oil prices, which triggered fears of renewed inflation and slower economic growth. Major indexes opened deep in the red, reflecting a global risk-off mood, but as the day progressed, buyers stepped in at lower levels, allowing m

#USStocksTrimLosses is trending today because U.S. stock markets experienced sharp intraday declines but managed to recover a significant portion of those losses before the session ended. Early trading was dominated by heavy selling pressure as investors reacted to rising geopolitical tensions and surging oil prices, which triggered fears of renewed inflation and slower economic growth. Major indexes opened deep in the red, reflecting a global risk-off mood, but as the day progressed, buyers stepped in at lower levels, allowing m

- Reward

- 3

- 2

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#OilPricesSurge is not just a trending phrase today; it represents a major shift unfolding in global energy markets as of the current date. Oil prices have surged sharply due to intensifying geopolitical tensions, especially in the Middle East, which remains the backbone of global crude supply. In today’s trading environment, major benchmarks such as Brent crude and West Texas Intermediate have climbed to multi-month highs, reflecting growing fear among investors and governments that supply disruptions may worsen. This surge is not driven by speculation alone but by real, measurable risks that

- Reward

- 3

- 2

- Repost

- Share

ShainingMoon :

:

LFG 🔥View More

⏳ Gate Plaza $50,000 Red Envelope Rain Countdown 1️⃣ Day!

Post for a 100% chance to win, with the reward cap increased again!

New and old users can post to receive rewards, with a maximum of 28U per post!

Daily reward limits have been increased. The more you post, the more红包 you can get!

Join now:

1️⃣ Update the App to v8.8.0

2️⃣ Click to post, rewards will be automatically credited

Post now to receive红包 👉 https://www.gate.com/post

Details: https://www.gate.com/announcements/article/49773

Post for a 100% chance to win, with the reward cap increased again!

New and old users can post to receive rewards, with a maximum of 28U per post!

Daily reward limits have been increased. The more you post, the more红包 you can get!

Join now:

1️⃣ Update the App to v8.8.0

2️⃣ Click to post, rewards will be automatically credited

Post now to receive红包 👉 https://www.gate.com/post

Details: https://www.gate.com/announcements/article/49773

- Reward

- 2

- 2

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#BitcoinHoldsFirm reflects a powerful moment in the ongoing evolution of digital finance, signaling resilience in a market that has been tested repeatedly by uncertainty, regulation, macroeconomic pressure, and shifting investor sentiment. When Bitcoin holds firm, it is not merely about price stability on a chart; it represents confidence, conviction, and the maturation of an asset class that was once dismissed as a speculative experiment. Stability in Bitcoin often emerges after periods of extreme volatility, and this firmness suggests that buyers and long-term holders are stepping in with pu

BTC7,43%

- Reward

- 3

- 4

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/lantern-festival?ref=VLIWBLOKUW&ref_type=132

- Reward

- 5

- 5

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

Referral Party: Rewards for Both You and Your Friends, Earn Up to $2,170 + GT https://www.gate.com/campaigns/4143?ref=VLIWBLOKUW&ref_type=132&utm_cmp=uK2DSefg

- Reward

- 12

- 21

- Repost

- Share

Korean_Girl :

:

To The Moon 🌕View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4151?ch=MVeOvjrT&ref=VLIWBLOKUW&ref_type=132

- Reward

- 13

- 22

- Repost

- Share

Korean_Girl :

:

I like and comments on your All posts So please back like and comments on my posts 👍View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4030?ch=1028&ref=VLIWBLOKUW&ref_type=132

- Reward

- 12

- 15

- Repost

- Share

Korean_Girl :

:

2026 GOGOGO 👊View More

To show our appreciation for the strong support of our users for Gate TradFi, we are launching the limited-time “Gold Rush” Leaderboard Challenge. During the campaign, simply trade on TradFi to accumulate trading volume and climb the rankings, sharing a 60,000 USDT prize pool, with exciting XAUT rewards awaiting you. https://www.gate.com/campaigns/4129?ch=VAqsrHDb&ref=VLIWBLOKUW&ref_type=132

- Reward

- 10

- 15

- Repost

- Share

Korean_Girl :

:

2026 GOGOGO 👊View More

#Gate全球注册用户突破5000万

Gate has officially surpassed 50 million registered users worldwide, a number that speaks not just to growth, but to real systemic capacity and maturity. In an industry where “explosive growth” is often thrown around casually, the key question isn’t how many users a platform can attract it’s how efficiently it can support them, maintain liquidity, and integrate complex trading ecosystems.

Massive Ecosystem & Liquidity Depth

Reaching this scale is impressive, but what truly matters is how this user base translates into activity:

Spot trading now ranks second globally in dail

Gate has officially surpassed 50 million registered users worldwide, a number that speaks not just to growth, but to real systemic capacity and maturity. In an industry where “explosive growth” is often thrown around casually, the key question isn’t how many users a platform can attract it’s how efficiently it can support them, maintain liquidity, and integrate complex trading ecosystems.

Massive Ecosystem & Liquidity Depth

Reaching this scale is impressive, but what truly matters is how this user base translates into activity:

Spot trading now ranks second globally in dail

- Reward

- 9

- 12

- Repost

- Share

Korean_Girl :

:

2026 GOGOGO 👊View More

#50K红包活动

⏳ Gate Plaza $50,000 Red Envelope Rain – Only 2 Days Left!

The countdown is on, and the excitement is building! For the next 48 hours, every post you make can earn you rewards, with the cap for each post now increased to 28U. Whether you’re a veteran or a new community member, this is your chance to claim your share of the red envelope rain.

The rules are simple but powerful: the more you contribute, the more opportunities you unlock. Each post is not just a message it’s a ticket to rewards, a way to showcase your insights, and a step toward multiplying your benefits. Gate Plaza has

⏳ Gate Plaza $50,000 Red Envelope Rain – Only 2 Days Left!

The countdown is on, and the excitement is building! For the next 48 hours, every post you make can earn you rewards, with the cap for each post now increased to 28U. Whether you’re a veteran or a new community member, this is your chance to claim your share of the red envelope rain.

The rules are simple but powerful: the more you contribute, the more opportunities you unlock. Each post is not just a message it’s a ticket to rewards, a way to showcase your insights, and a step toward multiplying your benefits. Gate Plaza has

- Reward

- 9

- 15

- Repost

- Share

Korean_Girl :

:

2026 GOGOGO 👊View More

This Week’s First Order Public Trading Plan

Market Outlook (Current Week)

The crypto market is currently moving in a mixed and range-bound structure. Volatility remains moderate, and price action suggests that the market is waiting for a clear directional catalyst. Under such conditions, a disciplined and level-based trading plan is more effective than emotional entries.

Asset Focus: Bitcoin (BTC)

Current Price Area: 66,000 – 67,000

BTC is consolidating below a major psychological resistance. Momentum is neutral, and liquidity is building on both sides of the range.

Key Levels Analysis

Major R

Market Outlook (Current Week)

The crypto market is currently moving in a mixed and range-bound structure. Volatility remains moderate, and price action suggests that the market is waiting for a clear directional catalyst. Under such conditions, a disciplined and level-based trading plan is more effective than emotional entries.

Asset Focus: Bitcoin (BTC)

Current Price Area: 66,000 – 67,000

BTC is consolidating below a major psychological resistance. Momentum is neutral, and liquidity is building on both sides of the range.

Key Levels Analysis

Major R

BTC7,43%

- Reward

- 8

- 11

- Repost

- Share

ybaser :

:

To The Moon 🌕View More