# WeekendMarketAnalysis

8.51K

Sunway

#WeekendMarketAnalysis #BTC

This weekend is over and we really saw some easing of pressure from sellers, but over the last two days the sellers have been pushing hard and we all saw the results. On Tuesday my short order worked successfully and I'm happy. Regarding favorite assets, my favorite coin is Dogecoin and BERA.

This weekend is over and we really saw some easing of pressure from sellers, but over the last two days the sellers have been pushing hard and we all saw the results. On Tuesday my short order worked successfully and I'm happy. Regarding favorite assets, my favorite coin is Dogecoin and BERA.

- Reward

- 5

- 2

- Repost

- Share

AnnaCryptoWriter :

:

Vibe at 1000x 🤑View More

#WeekendMarketAnalysis #WeekendMarketAnalysis

Global Market Sentiment: "Technological Wind"

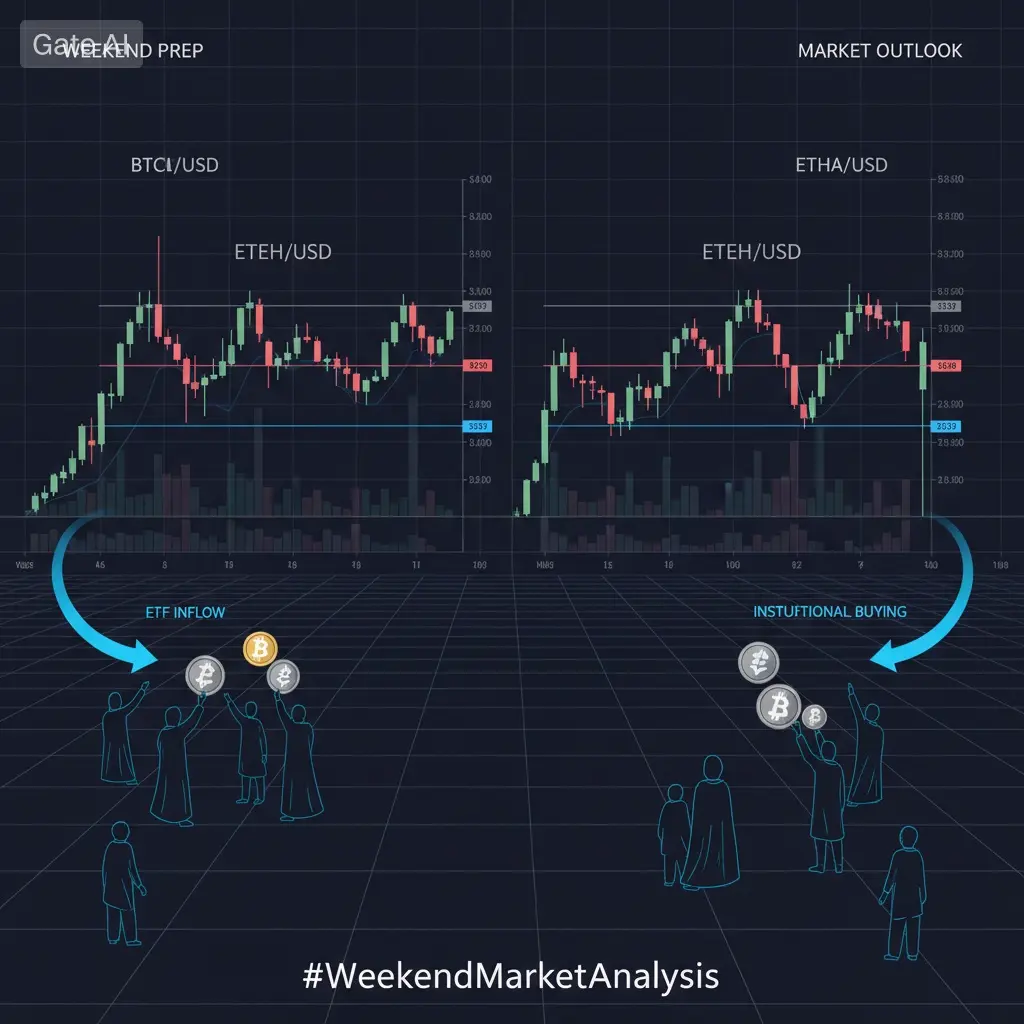

Global markets began 2026 amidst geopolitical risks but were buoyed by a technological revolution. The prominence of AI is evident as the S&P 500 and Nasdaq set records with robust earnings in the AI and semiconductor sectors. The concept of "K-Shaped Recovery" highlights the contrast between tech-driven growth and traditional sectors that struggle with high costs.

The Fed and ECB's softer tones are easing global liquidity conditions, thereby fueling risk appetite. Spot ETF inflows in the US, surpassing

Global Market Sentiment: "Technological Wind"

Global markets began 2026 amidst geopolitical risks but were buoyed by a technological revolution. The prominence of AI is evident as the S&P 500 and Nasdaq set records with robust earnings in the AI and semiconductor sectors. The concept of "K-Shaped Recovery" highlights the contrast between tech-driven growth and traditional sectors that struggle with high costs.

The Fed and ECB's softer tones are easing global liquidity conditions, thereby fueling risk appetite. Spot ETF inflows in the US, surpassing

- Reward

- 3

- 1

- Repost

- Share

#WeekendMarketAnalysis #WeekendMarketAnalysis

Global Market Sentiment: "Technological Wind"

Global markets began 2026 amidst geopolitical risks but were buoyed by a technological revolution. The prominence of AI is evident as the S&P 500 and Nasdaq set records with robust earnings in the AI and semiconductor sectors. The concept of "K-Shaped Recovery" highlights the contrast between tech-driven growth and traditional sectors that struggle with high costs.

The Fed and ECB's softer tones are easing global liquidity conditions, thereby fueling risk appetite. Spot ETF inflows in the US, surpassing

Global Market Sentiment: "Technological Wind"

Global markets began 2026 amidst geopolitical risks but were buoyed by a technological revolution. The prominence of AI is evident as the S&P 500 and Nasdaq set records with robust earnings in the AI and semiconductor sectors. The concept of "K-Shaped Recovery" highlights the contrast between tech-driven growth and traditional sectors that struggle with high costs.

The Fed and ECB's softer tones are easing global liquidity conditions, thereby fueling risk appetite. Spot ETF inflows in the US, surpassing

- Reward

- 2

- 2

- Repost

- Share

Yanlin :

:

2026 GOGOGO 👊View More

#WeekendMarketAnalysis #WeekendMarketAnalysis

Global Market Sentiment: "Technological Wind"

Global markets began 2026 amidst geopolitical risks but were buoyed by a technological revolution. The prominence of AI is evident as the S&P 500 and Nasdaq set records with robust earnings in the AI and semiconductor sectors. The concept of "K-Shaped Recovery" highlights the contrast between tech-driven growth and traditional sectors that struggle with high costs.

The Fed and ECB's softer tones are easing global liquidity conditions, thereby fueling risk appetite. Spot ETF inflows in the US, surpassing

Global Market Sentiment: "Technological Wind"

Global markets began 2026 amidst geopolitical risks but were buoyed by a technological revolution. The prominence of AI is evident as the S&P 500 and Nasdaq set records with robust earnings in the AI and semiconductor sectors. The concept of "K-Shaped Recovery" highlights the contrast between tech-driven growth and traditional sectors that struggle with high costs.

The Fed and ECB's softer tones are easing global liquidity conditions, thereby fueling risk appetite. Spot ETF inflows in the US, surpassing

- Reward

- 6

- 2

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

#WeekendMarketAnalysis

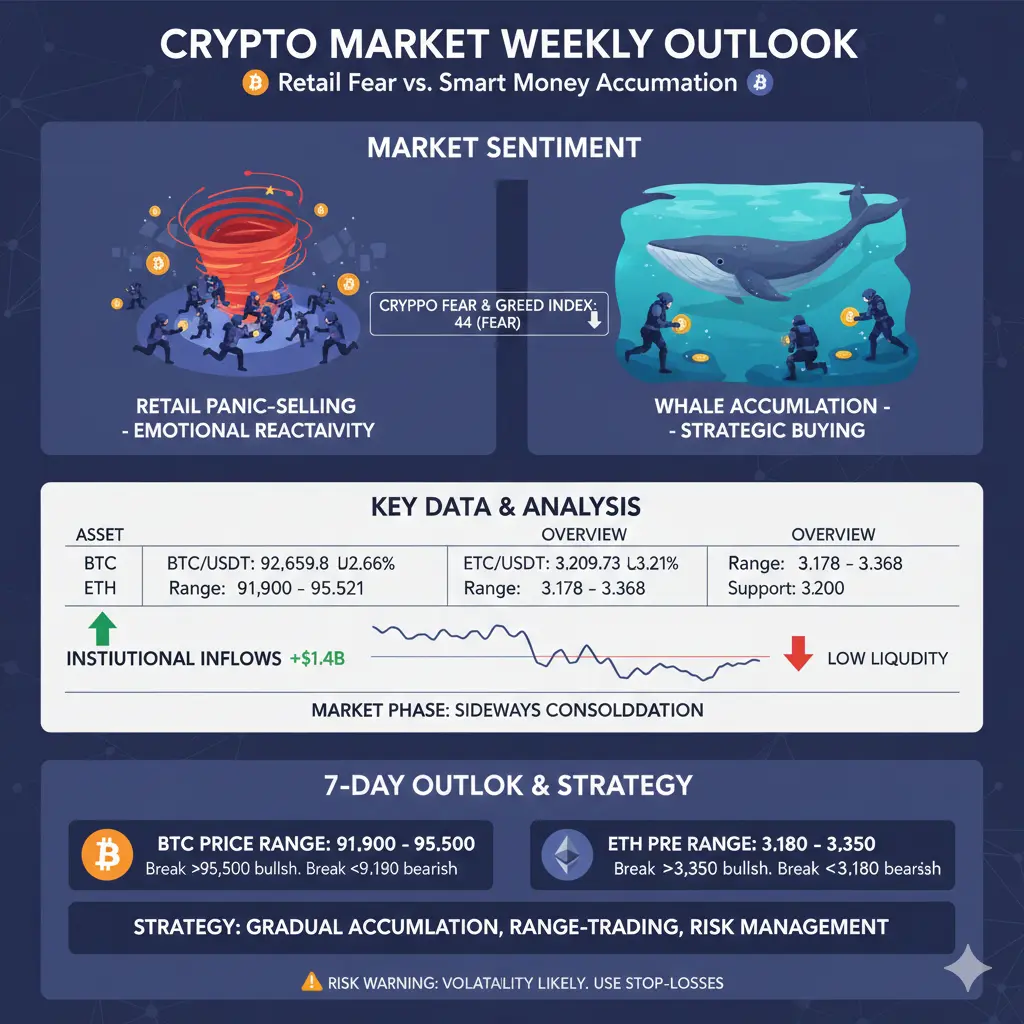

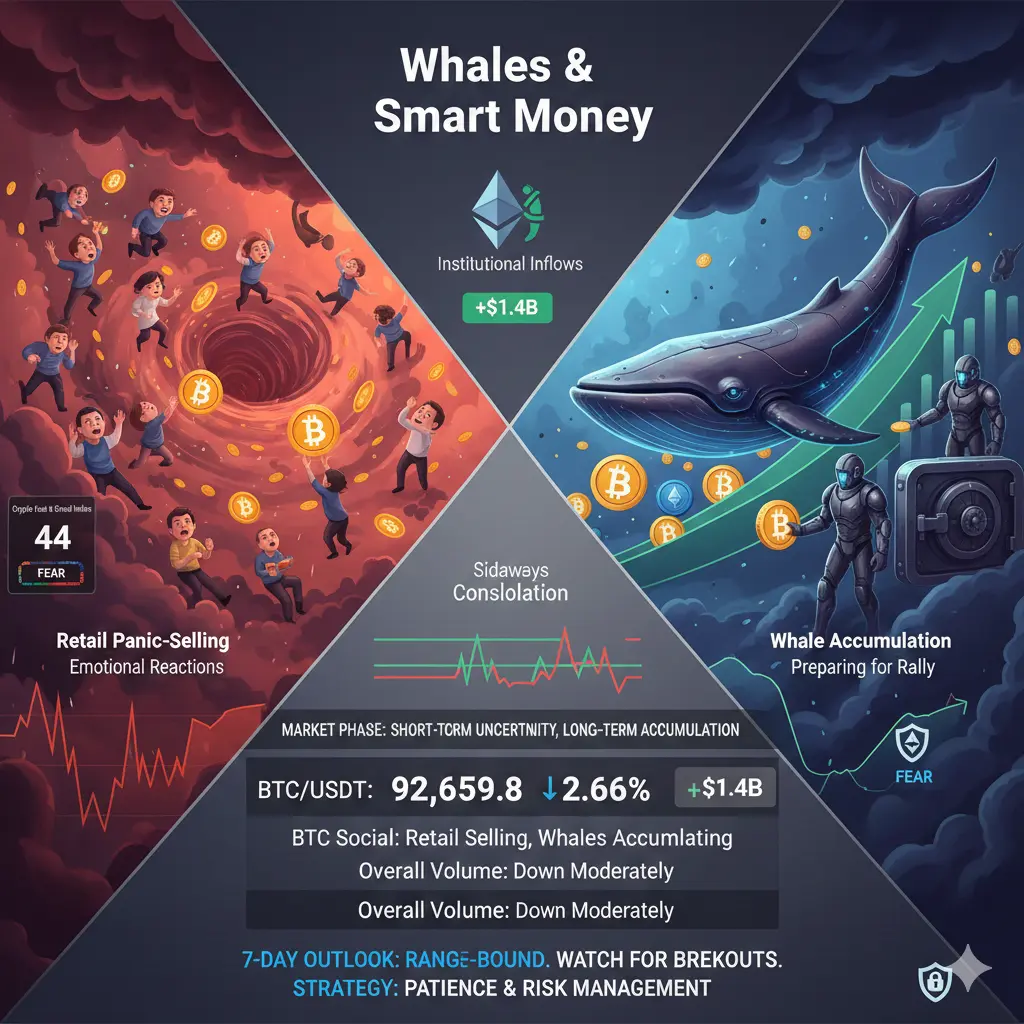

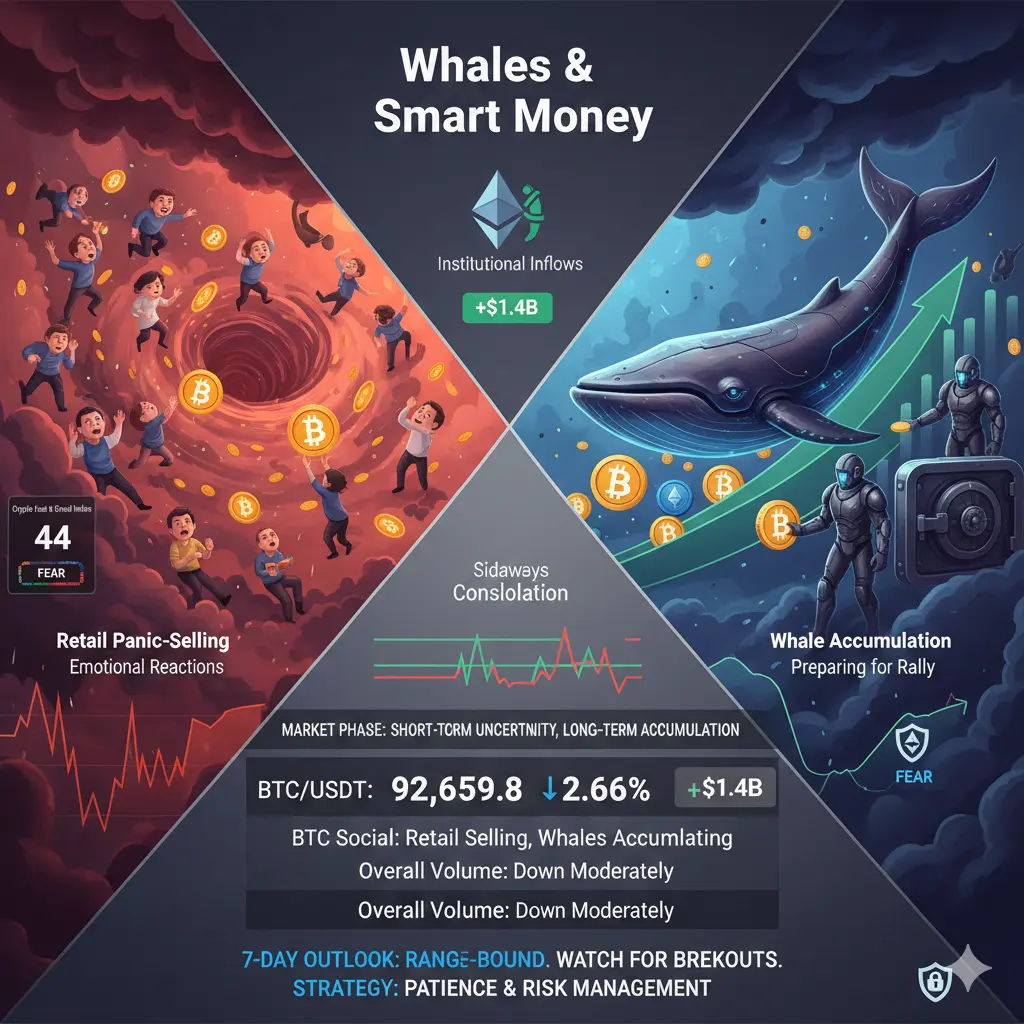

📊 Core Takeaways

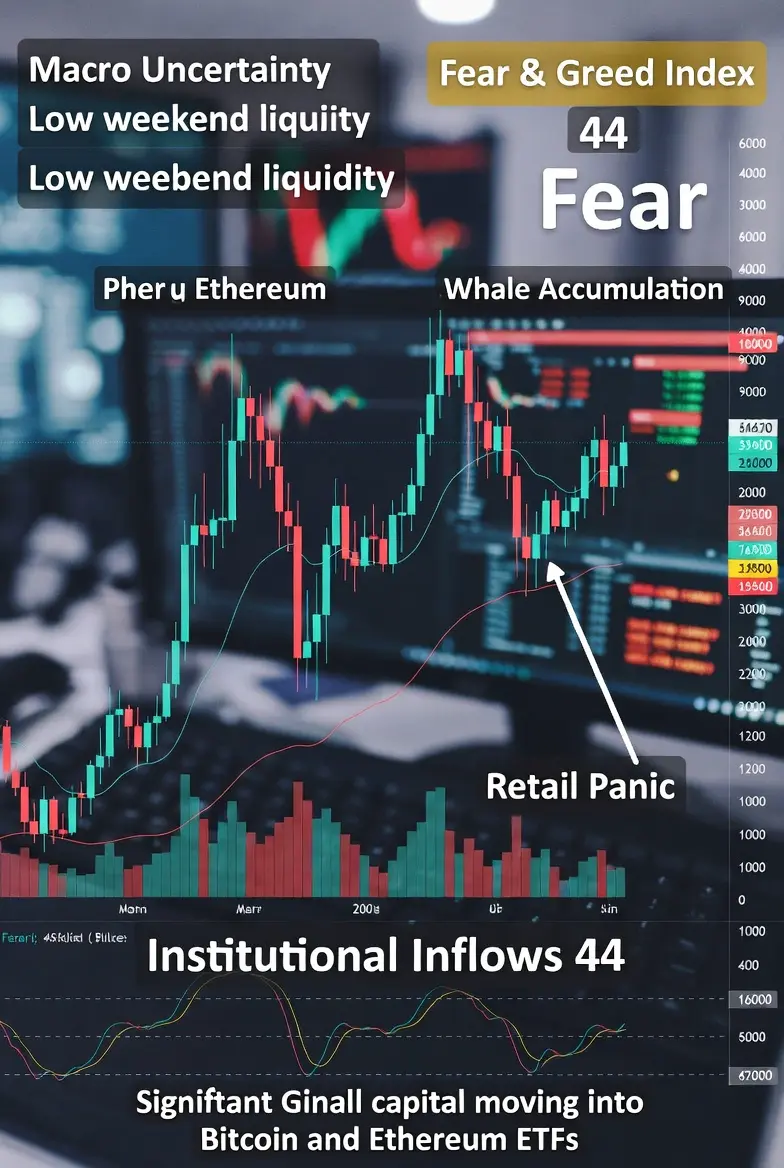

Crypto markets went through a cautious and choppy weekend, with both Bitcoin (BTC) and Ethereum (ETH) seeing moderate pullbacks amid macro uncertainty, political developments, and low weekend liquidity.

While retail traders reacted emotionally, selling into short-term weakness, large holders (“whales”) and institutional players quietly accumulated. This divergence between retail fear and smart money buying is often a signal that the market is preparing for the next significant move.

In short:

Retail: Panic-selling, short-term reactive behavior

Whales /

📊 Core Takeaways

Crypto markets went through a cautious and choppy weekend, with both Bitcoin (BTC) and Ethereum (ETH) seeing moderate pullbacks amid macro uncertainty, political developments, and low weekend liquidity.

While retail traders reacted emotionally, selling into short-term weakness, large holders (“whales”) and institutional players quietly accumulated. This divergence between retail fear and smart money buying is often a signal that the market is preparing for the next significant move.

In short:

Retail: Panic-selling, short-term reactive behavior

Whales /

- Reward

- 1

- Comment

- Repost

- Share

#WeekendMarketAnalysis

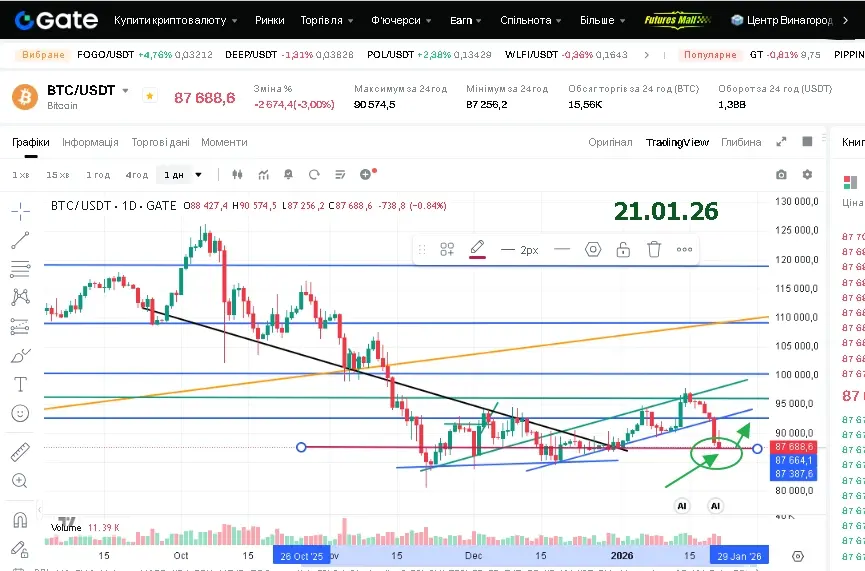

This weekend’s crypto market reflects a classic preparation phase rather than a clear directional move. Both Bitcoin and Ethereum are consolidating near critical levels, while volume contraction and neutral sentiment signal hesitation on the surface—but growing institutional activity suggests something is building underneath.

Bitcoin has traded between $94,293 and $97,188 over the past few days, currently hovering near the mid-range. Momentum is weak, with RSI around 35 and trading volume down over 50%, making short-term trend confirmation difficult. However, this calm

This weekend’s crypto market reflects a classic preparation phase rather than a clear directional move. Both Bitcoin and Ethereum are consolidating near critical levels, while volume contraction and neutral sentiment signal hesitation on the surface—but growing institutional activity suggests something is building underneath.

Bitcoin has traded between $94,293 and $97,188 over the past few days, currently hovering near the mid-range. Momentum is weak, with RSI around 35 and trading volume down over 50%, making short-term trend confirmation difficult. However, this calm

- Reward

- 66

- 105

- Repost

- Share

alex19x :

:

2026 GOGOGO 👊View More

#WeekendMarketAnalysis

#周末行情分析 Weekend Market Outlook & Trading Strategy

As we head into the weekend, the crypto market is showing clear signs of easing selling pressure, but conviction is still mixed. After a volatile week, price action across major assets suggests the market has entered a consolidation phase, where smart money is patiently waiting for confirmation rather than chasing momentum.

From a technical perspective, BTC and ETH remain the key anchors. Bitcoin is attempting to stabilize above its short-term support zone, and while volume is still relatively muted, the lack of aggressi

#周末行情分析 Weekend Market Outlook & Trading Strategy

As we head into the weekend, the crypto market is showing clear signs of easing selling pressure, but conviction is still mixed. After a volatile week, price action across major assets suggests the market has entered a consolidation phase, where smart money is patiently waiting for confirmation rather than chasing momentum.

From a technical perspective, BTC and ETH remain the key anchors. Bitcoin is attempting to stabilize above its short-term support zone, and while volume is still relatively muted, the lack of aggressi

- Reward

- 6

- 7

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

#WeekendMarketAnalysis

A Deep Dive into Market Sentiment, Trends, and What Lies Ahead

As the global financial markets move into the weekend, traders and investors shift their focus from fast-paced execution to strategic evaluation. Weekend market analysis plays a crucial role in understanding broader trends, assessing risk, and preparing for the week ahead. With reduced liquidity and limited institutional participation, weekend price action often reflects pure market sentiment—making it a valuable period for analysis rather than aggressive trading.

Market Overview

This week, markets showed a

A Deep Dive into Market Sentiment, Trends, and What Lies Ahead

As the global financial markets move into the weekend, traders and investors shift their focus from fast-paced execution to strategic evaluation. Weekend market analysis plays a crucial role in understanding broader trends, assessing risk, and preparing for the week ahead. With reduced liquidity and limited institutional participation, weekend price action often reflects pure market sentiment—making it a valuable period for analysis rather than aggressive trading.

Market Overview

This week, markets showed a

BTC-5,48%

- Reward

- 21

- 14

- Repost

- Share

MissCrypto :

:

2026 GOGOGO 👊View More

#WeekendMarketAnalysis

📊 Core Takeaways

Crypto markets went through a cautious and choppy weekend, with both Bitcoin (BTC) and Ethereum (ETH) seeing moderate pullbacks amid macro uncertainty, political developments, and low weekend liquidity.

While retail traders reacted emotionally, selling into short-term weakness, large holders (“whales”) and institutional players quietly accumulated. This divergence between retail fear and smart money buying is often a signal that the market is preparing for the next significant move.

In short:

Retail: Panic-selling, short-term reactive behavior

Whales /

📊 Core Takeaways

Crypto markets went through a cautious and choppy weekend, with both Bitcoin (BTC) and Ethereum (ETH) seeing moderate pullbacks amid macro uncertainty, political developments, and low weekend liquidity.

While retail traders reacted emotionally, selling into short-term weakness, large holders (“whales”) and institutional players quietly accumulated. This divergence between retail fear and smart money buying is often a signal that the market is preparing for the next significant move.

In short:

Retail: Panic-selling, short-term reactive behavior

Whales /

- Reward

- 28

- 17

- Repost

- Share

BeautifulDay :

:

2026 GOGOGO 👊View More

#WeekendMarketAnalysis Tom Lee, in an interview with CNBC, stated that Bitcoin could reach a new all-time high this year, and Ethereum will surpass Bitcoin.

Lee, Chairman of BitMine and co-founder of Fundstrat, claimed that the market performance in the early days of the year signals a positive outlook for the rest of the period.

Lee said, “From a general market perspective, the gains in the first days of January are very good news. This is a very positive sign for the entire year and suggests upward potential toward our 7,700 target for the S&P 500.”

Noting that recent fluctuations in financi

Lee, Chairman of BitMine and co-founder of Fundstrat, claimed that the market performance in the early days of the year signals a positive outlook for the rest of the period.

Lee said, “From a general market perspective, the gains in the first days of January are very good news. This is a very positive sign for the entire year and suggests upward potential toward our 7,700 target for the S&P 500.”

Noting that recent fluctuations in financi

- Reward

- 1

- 1

- Repost

- Share

MuzammilYasin :

:

bad to get the top 10 most of the time to call me back to the kids to the kids to bed now I love you tomorrow and seeLoad More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

42.45M Popularity

149.88K Popularity

91.23K Popularity

1.66M Popularity

489.42K Popularity

8.15K Popularity

7.1K Popularity

20.26K Popularity

4.07K Popularity

360.86K Popularity

44.83K Popularity

101.33K Popularity

17.02K Popularity

70.31K Popularity

7.36K Popularity

News

View MoreIran's Supreme National Security Council: Has Responded to US and Israeli Military Actions

2 m

A piece of shrapnel falling in the UAE results in the death of an Asian individual

9 m

Iran missile attack on U.S. military base in Jordan

10 m

Trump is expected to deliver another speech to the nation on Saturday morning local time.

14 m

Trader CBB holds over $30 million in short positions across the AI industry chain, currently the largest on-chain Nvidia short.

15 m

Pin