# FedRateCutComing

63.85K

How do you see the Fed’s rate-cut path in 2026? Considering inflation trends, economic growth, employment data, and financial stability, will cuts be gradual, accelerate quickly, or remain on hold? How might this policy outlook impact U.S. equities, bonds, and the crypto market? Share your view and reasoning.

Crypto_Buzz_with_Alex

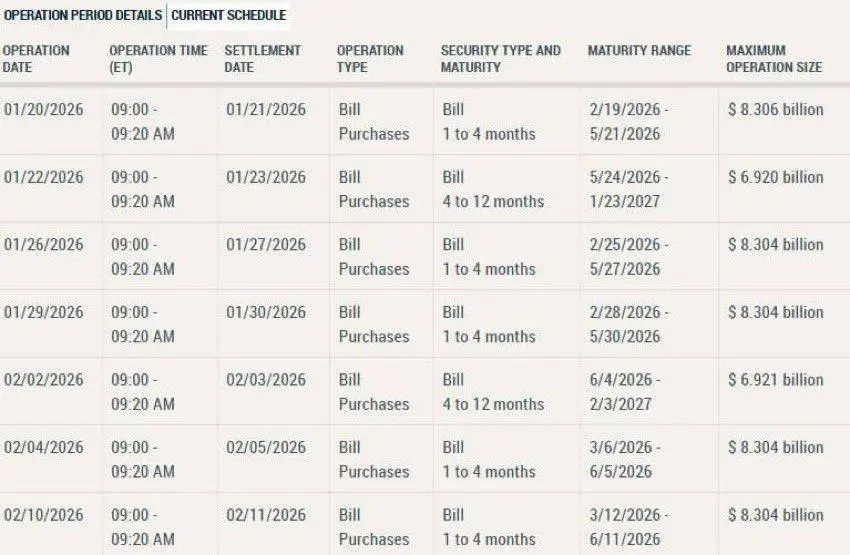

🇺🇸The US Federal Reserve is set to add more liquidity to markets.

🔜The Fed will buy up to 55 billion dollars in Treasury bills starting January 20.

🔜This follows the completion of its 40 billion dollar reserve purchases and could support a crypto rally as Bitcoin eyes the 100K level.

#FedRateCutComing

🔜The Fed will buy up to 55 billion dollars in Treasury bills starting January 20.

🔜This follows the completion of its 40 billion dollar reserve purchases and could support a crypto rally as Bitcoin eyes the 100K level.

#FedRateCutComing

BTC0,18%

- Reward

- 16

- 14

- Repost

- Share

MissCrypto :

:

Buy To Earn 💎View More

#FedRateCutComing

The one macro narrative is dominating conversations across global financial markets: the growing expectation that the U.S. Federal Reserve is moving closer to a rate-cut cycle. From Wall Street trading desks to crypto communities and emerging markets, investors are actively reassessing positioning, liquidity exposure, and risk appetite based on a single question is monetary easing finally on the horizon?

After an extended period of restrictive policy aimed at controlling inflation, the economic environment is beginning to shift. Inflation has cooled from its previous highs,

The one macro narrative is dominating conversations across global financial markets: the growing expectation that the U.S. Federal Reserve is moving closer to a rate-cut cycle. From Wall Street trading desks to crypto communities and emerging markets, investors are actively reassessing positioning, liquidity exposure, and risk appetite based on a single question is monetary easing finally on the horizon?

After an extended period of restrictive policy aimed at controlling inflation, the economic environment is beginning to shift. Inflation has cooled from its previous highs,

- Reward

- 6

- 7

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

#FedRateCutComing

The one macro narrative is dominating conversations across global financial markets: the growing expectation that the U.S. Federal Reserve is moving closer to a rate-cut cycle. From Wall Street trading desks to crypto communities and emerging markets, investors are actively reassessing positioning, liquidity exposure, and risk appetite based on a single question is monetary easing finally on the horizon?

After an extended period of restrictive policy aimed at controlling inflation, the economic environment is beginning to shift. Inflation has cooled from its previous highs,

The one macro narrative is dominating conversations across global financial markets: the growing expectation that the U.S. Federal Reserve is moving closer to a rate-cut cycle. From Wall Street trading desks to crypto communities and emerging markets, investors are actively reassessing positioning, liquidity exposure, and risk appetite based on a single question is monetary easing finally on the horizon?

After an extended period of restrictive policy aimed at controlling inflation, the economic environment is beginning to shift. Inflation has cooled from its previous highs,

- Reward

- 4

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#FedRateCutComing

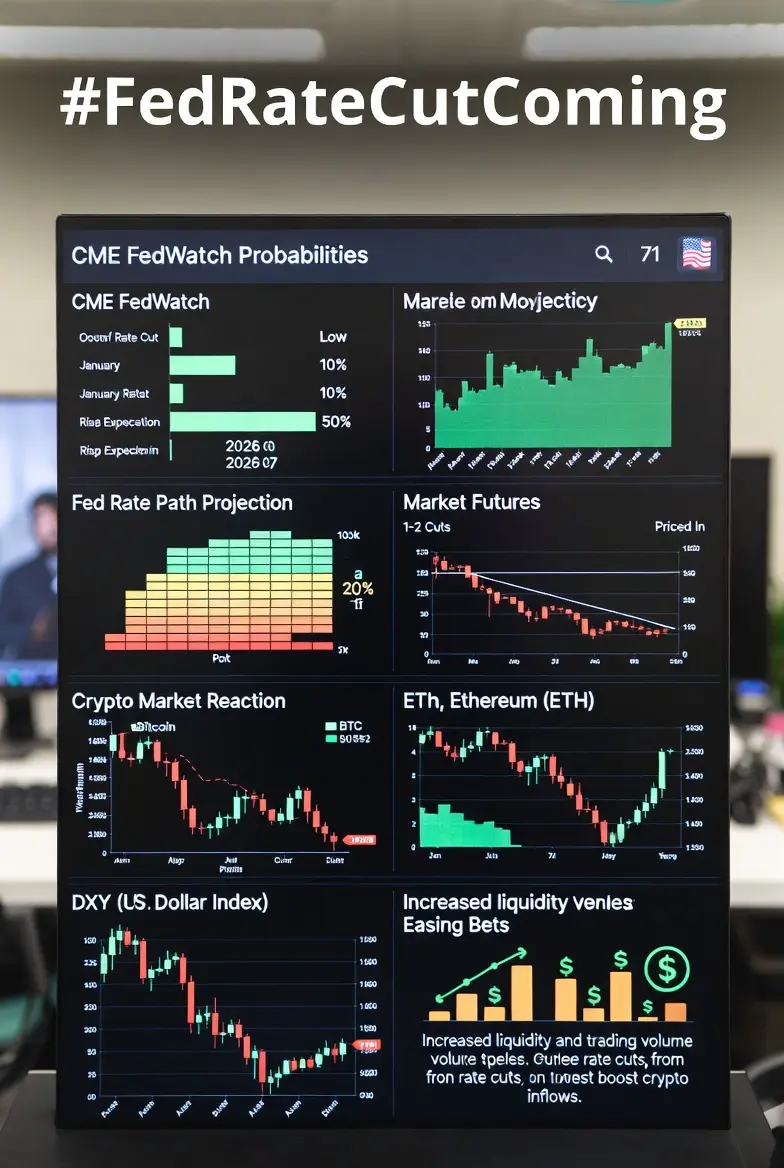

Current Fed Funds Rate & Near‑Term Outlook

After three Fed rate cuts in late 2025, the benchmark Federal Funds Rate now sits at ~3.50%–3.75%.

January 27–28 FOMC meeting: Markets are overwhelmingly pricing in no rate cut — with only ~2–20% odds of a 25 bp cut and ~80–97% odds of holding rates steady.

The Fed is digesting sticky inflation (above 2%) and a resilient but cooling labor market — stable unemployment around ~4.4% and slowing job growth.

👉 Key takeaway: January is likely a pause, not a cut — markets are now adjusting expectations accordingly.

📊 2026 Rate Cut Exp

Current Fed Funds Rate & Near‑Term Outlook

After three Fed rate cuts in late 2025, the benchmark Federal Funds Rate now sits at ~3.50%–3.75%.

January 27–28 FOMC meeting: Markets are overwhelmingly pricing in no rate cut — with only ~2–20% odds of a 25 bp cut and ~80–97% odds of holding rates steady.

The Fed is digesting sticky inflation (above 2%) and a resilient but cooling labor market — stable unemployment around ~4.4% and slowing job growth.

👉 Key takeaway: January is likely a pause, not a cut — markets are now adjusting expectations accordingly.

📊 2026 Rate Cut Exp

- Reward

- 34

- 27

- Repost

- Share

BeautifulDay :

:

Buy To Earn 💎View More

New gem of the day $EPT 💎

I traded both $TANSSI & $BDXN & both exploded 100-200% & I personally think that $EPT is next one.

Expecting a big move from this one but it can be volatile!#GateSquareCreatorNewYearIncentives #DoubleRewardsWithGUSD #FedRateCutComing #CryptoMarketWatch #WeekendMarketAnalysis

I traded both $TANSSI & $BDXN & both exploded 100-200% & I personally think that $EPT is next one.

Expecting a big move from this one but it can be volatile!#GateSquareCreatorNewYearIncentives #DoubleRewardsWithGUSD #FedRateCutComing #CryptoMarketWatch #WeekendMarketAnalysis

- Reward

- 1

- 2

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

🏦📉 #FedRateCutComing | Market Update 🚀✨

Traders and investors are watching closely as speculation grows around a potential Fed rate cut. Interest rate decisions can significantly influence crypto market sentiment, liquidity, and risk appetite. 💹⚡

📸 Visual Suggestion:

Image of the Federal Reserve building with a downward arrow 📉

Overlay text: “Fed Rate Cut Coming?”

Optional: Crypto or stock charts in the background to indicate market impact 📊

🔍 Key Market Implications:

📈 Potential boost for risk-on assets like cryptocurrencies

⚖️ Influence on stablecoins and lending rates

💡 Traders sh

Traders and investors are watching closely as speculation grows around a potential Fed rate cut. Interest rate decisions can significantly influence crypto market sentiment, liquidity, and risk appetite. 💹⚡

📸 Visual Suggestion:

Image of the Federal Reserve building with a downward arrow 📉

Overlay text: “Fed Rate Cut Coming?”

Optional: Crypto or stock charts in the background to indicate market impact 📊

🔍 Key Market Implications:

📈 Potential boost for risk-on assets like cryptocurrencies

⚖️ Influence on stablecoins and lending rates

💡 Traders sh

- Reward

- 4

- Comment

- Repost

- Share

#FedRateCutComing

Federal Reserve 2026 Rate-Cut Outlook: What It Means for Markets & Crypto

As 2026 unfolds, investors are closely watching the Federal Reserve’s next move. The debate centers on when, how fast, and how deep rate cuts may go—and the implications for equities, bonds, and crypto markets.

Key macro drivers shaping the Fed’s decision:

Inflation: Cooling trends support gradual cuts, while sticky inflation could delay easing

Economic Growth: Strong GDP = slower cuts; weak growth = faster easing

Employment: A resilient labor market limits aggressive cuts; cooling jobs accelerate them

Federal Reserve 2026 Rate-Cut Outlook: What It Means for Markets & Crypto

As 2026 unfolds, investors are closely watching the Federal Reserve’s next move. The debate centers on when, how fast, and how deep rate cuts may go—and the implications for equities, bonds, and crypto markets.

Key macro drivers shaping the Fed’s decision:

Inflation: Cooling trends support gradual cuts, while sticky inflation could delay easing

Economic Growth: Strong GDP = slower cuts; weak growth = faster easing

Employment: A resilient labor market limits aggressive cuts; cooling jobs accelerate them

BTC0,18%

- Reward

- 2

- 2

- Repost

- Share

🚀 CRYPTO MOMENTUM BLAST — SMALL CAPS ON FIRE 🔥

Money is rotating FAST into low-cap movers. Here’s what’s exploding right now 👇

💥 $SQT

Price: $0.0010074

Change: +199.82% 🚀

➡️ Parabolic move — extreme momentum, expect volatility

⚡ $VGX

Price: $0.0011446

Change: +99.40% 📈

➡️ Nearly a clean 2x — bulls firmly in control

🔥$ARW

Price: $0.25542

Change: +84.00%

➡️ Strong breakout, trend continuation possible

📌 Trader Notes:

• Late entries = higher risk ⚠️

• Trail stops, protect profits

• Momentum phase favors quick decision-making

#GateSquareCreatorNewYearIncentives #DoubleRewardsWithGUS

Money is rotating FAST into low-cap movers. Here’s what’s exploding right now 👇

💥 $SQT

Price: $0.0010074

Change: +199.82% 🚀

➡️ Parabolic move — extreme momentum, expect volatility

⚡ $VGX

Price: $0.0011446

Change: +99.40% 📈

➡️ Nearly a clean 2x — bulls firmly in control

🔥$ARW

Price: $0.25542

Change: +84.00%

➡️ Strong breakout, trend continuation possible

📌 Trader Notes:

• Late entries = higher risk ⚠️

• Trail stops, protect profits

• Momentum phase favors quick decision-making

#GateSquareCreatorNewYearIncentives #DoubleRewardsWithGUS

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 4

- Comment

- Repost

- Share

#FedRateCutComing

📉 #FedRateCutComing — The Markets Are Poised for a Shift

The Federal Reserve signaling a potential rate cut isn’t just another headline — it’s a structural turning point for global risk assets. With inflation showing signs of cooling and economic data softening, markets are pricing in easier monetary policy ahead.

Here’s why this matters:

🔹 Equities & Risk Assets: Lower rates reduce the cost of capital, improve valuations, and can fuel buying momentum across stocks & crypto. Historically, rate cuts have supported market rallies as liquidity increases.

🔹 Bitcoin & Crypto:

📉 #FedRateCutComing — The Markets Are Poised for a Shift

The Federal Reserve signaling a potential rate cut isn’t just another headline — it’s a structural turning point for global risk assets. With inflation showing signs of cooling and economic data softening, markets are pricing in easier monetary policy ahead.

Here’s why this matters:

🔹 Equities & Risk Assets: Lower rates reduce the cost of capital, improve valuations, and can fuel buying momentum across stocks & crypto. Historically, rate cuts have supported market rallies as liquidity increases.

🔹 Bitcoin & Crypto:

BTC0,18%

- Reward

- 5

- 4

- Repost

- Share

#FedRateCutComing 🦅

Fed Rate Cuts in 2026: A Strategic Lens on Monetary Policy, Inflation Cycles, and Market Behavior

As 2026 unfolds, global financial markets are navigating one of the most closely watched monetary environments of the decade. The Federal Reserve’s anticipated rate-cut cycle has become more than just a macroeconomic talking point — it is now a defining force shaping investor psychology, capital allocation, and risk appetite across equities, bonds, and crypto markets. From an EagleEye macro perspective, the question is no longer if rate cuts will happen, but how, when, and at

Fed Rate Cuts in 2026: A Strategic Lens on Monetary Policy, Inflation Cycles, and Market Behavior

As 2026 unfolds, global financial markets are navigating one of the most closely watched monetary environments of the decade. The Federal Reserve’s anticipated rate-cut cycle has become more than just a macroeconomic talking point — it is now a defining force shaping investor psychology, capital allocation, and risk appetite across equities, bonds, and crypto markets. From an EagleEye macro perspective, the question is no longer if rate cuts will happen, but how, when, and at

- Reward

- 3

- 4

- Repost

- Share

Satosh陌Nakamato :

:

kdkdkdkdkdkdkdkdldldldkdkdkdkkkdkdkkdkkfkfkkView More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

40K Popularity

42.65M Popularity

414.07K Popularity

272.17K Popularity

1.11M Popularity

4.11K Popularity

247.83K Popularity

11.71K Popularity

4.5K Popularity

153.34K Popularity

3.45M Popularity

1.25M Popularity

6.08M Popularity

61.57K Popularity

393.76K Popularity

News

View MoreByreal advances towards Agent-Native DEX, the first open-source AI Skill supporting strategy replication

1 m

Gate launches the new Gate Card, with cashback and level system fully upgraded

4 m

Lamborghini dealerships in the United States now accept Ethereum payments, with ETH expanding luxury car consumption scenarios

6 m

Bitcoin ETF attracts $1.4 billion in five days, but BTC price remains stagnant—analysts reveal the underlying mechanism

9 m

The U.S. Senate advances CBDC ban bill, digital dollar restricted until 2030

11 m

Pin