📢 Gate Plaza Daily Report | March 6

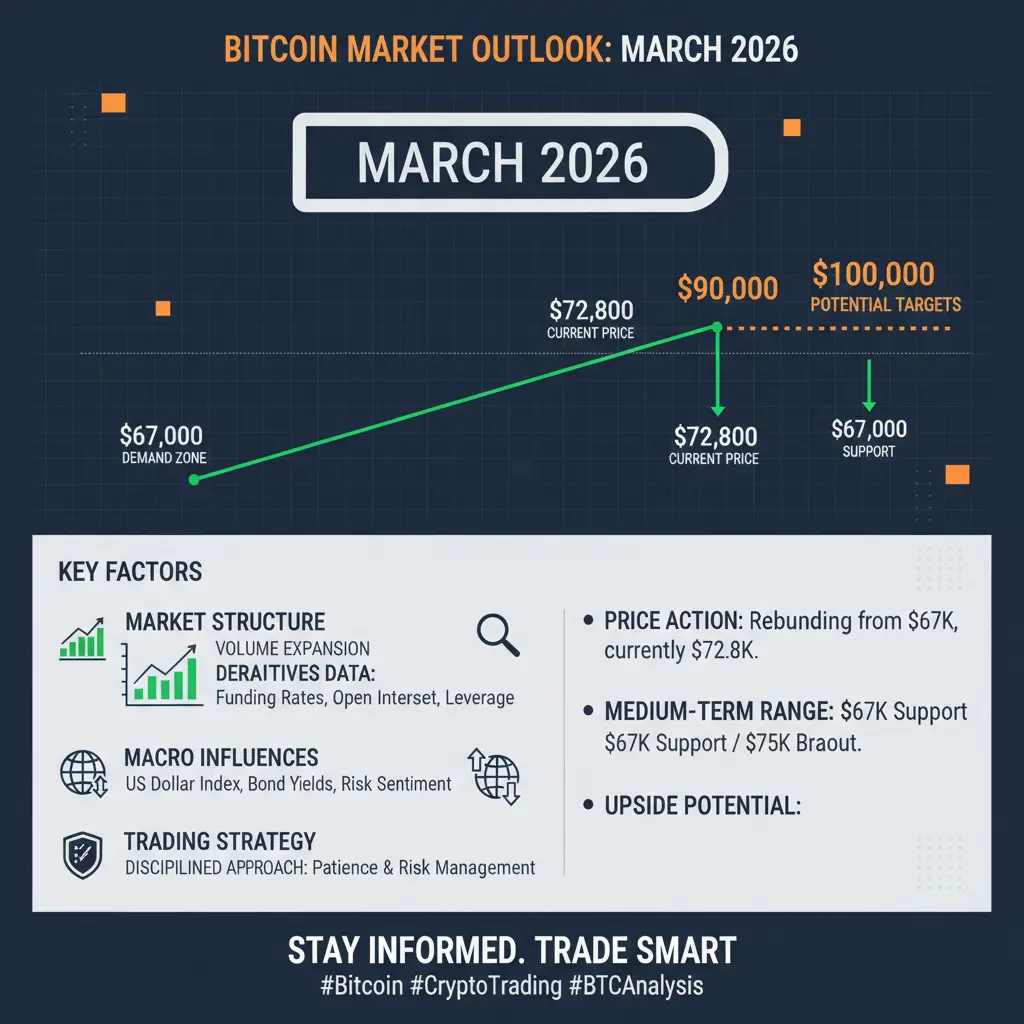

1️⃣ Market Overview: The crypto market shows mixed gains and losses, with BTC dropping below $72,000; the AI sector rises nearly 2% against the trend.

2️⃣ Product Updates: Gate proudly launches Gate for AI, the industry's first integrated AI portal combining CEX, DEX, wallets, news, and data capabilities.

3️⃣ Institutional Movements: Short-selling firm Culper Research announced it has shorted Ethereum and related securities.

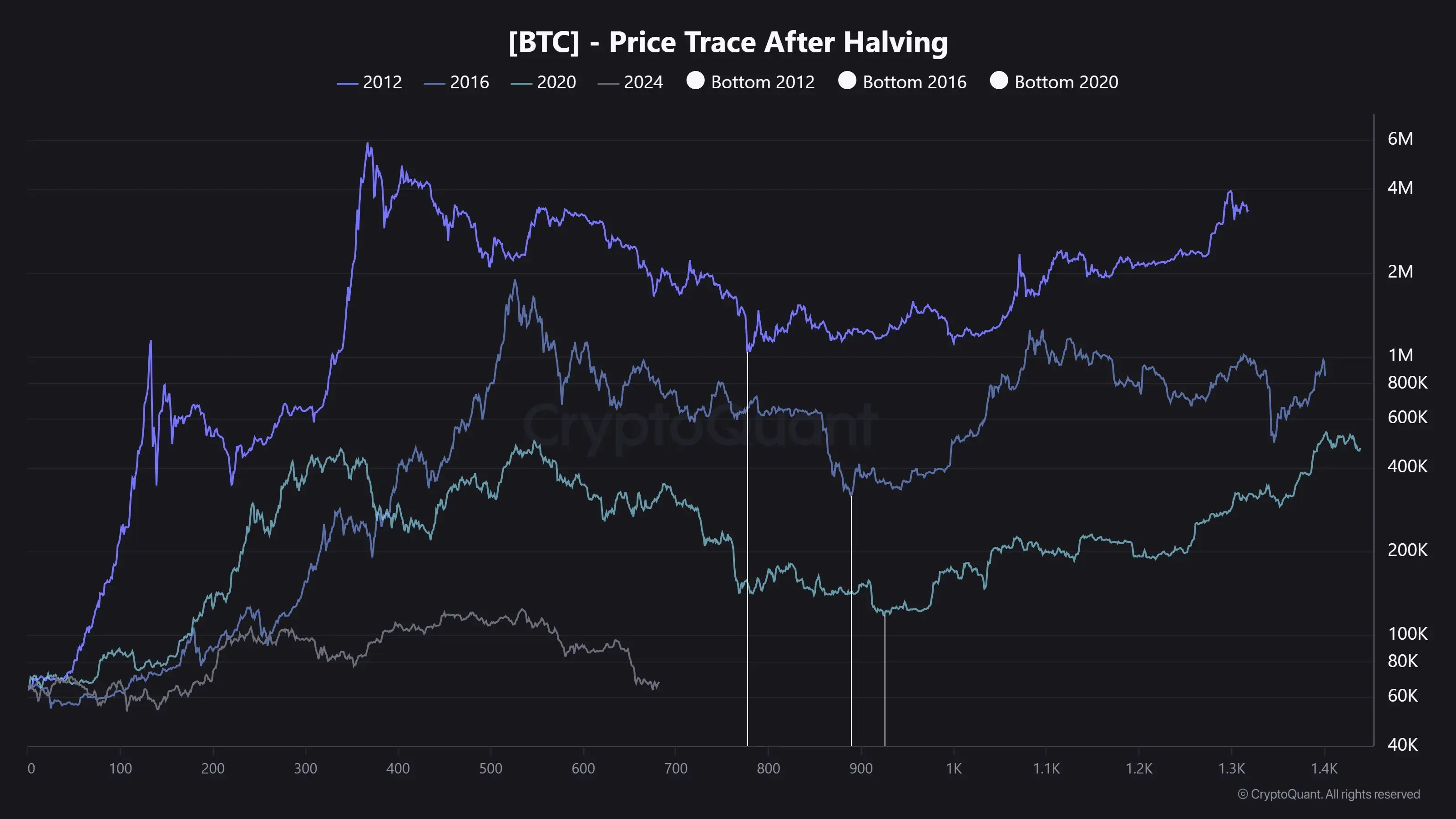

4️⃣ Data Insights: CryptoQuant indicates that Bitcoin's current rebound is more likely a short-term "relief rally" rather than the start of a new bull market.

5️⃣ Regulatory Developments: SEC Chairperson expressed anticipation of collaboration with CFTC Chairperson to jointly promote the CLARITY Act.

1️⃣ Market Overview: The crypto market shows mixed gains and losses, with BTC dropping below $72,000; the AI sector rises nearly 2% against the trend.

2️⃣ Product Updates: Gate proudly launches Gate for AI, the industry's first integrated AI portal combining CEX, DEX, wallets, news, and data capabilities.

3️⃣ Institutional Movements: Short-selling firm Culper Research announced it has shorted Ethereum and related securities.

4️⃣ Data Insights: CryptoQuant indicates that Bitcoin's current rebound is more likely a short-term "relief rally" rather than the start of a new bull market.

5️⃣ Regulatory Developments: SEC Chairperson expressed anticipation of collaboration with CFTC Chairperson to jointly promote the CLARITY Act.