# InterestRates

12.84K

bulbul

💰 Why US Interest Rates Affect Crypto Like Bitcoin 📉

When the US Federal Reserve raises interest rates, borrowing becomes expensive and safer investments like bonds give better returns.

👉 What happens?

• Investors move money out of risky assets like **Bitcoin ($BTC )** and crypto.

• Market liquidity drops.

• Big funds reduce exposure to volatile assets.

⚠️ Result: Crypto markets often see selling pressure and price dips.

But when rates are cut, money flows back into risk assets — which can fuel strong rallies in BTC and the overall crypto market 🚀

#Bitcoin #Crypto #InterestRates #MarketUpd

When the US Federal Reserve raises interest rates, borrowing becomes expensive and safer investments like bonds give better returns.

👉 What happens?

• Investors move money out of risky assets like **Bitcoin ($BTC )** and crypto.

• Market liquidity drops.

• Big funds reduce exposure to volatile assets.

⚠️ Result: Crypto markets often see selling pressure and price dips.

But when rates are cut, money flows back into risk assets — which can fuel strong rallies in BTC and the overall crypto market 🚀

#Bitcoin #Crypto #InterestRates #MarketUpd

BTC-2,06%

- Reward

- like

- Comment

- Repost

- Share

🏦📊 #FedKeepsRatesUnchanged | Policy Update

The U.S. Federal Reserve has decided to keep interest rates unchanged, signaling a cautious stance as it assesses inflation trends and economic conditions. Markets are closely watching forward guidance for clues on the future path of monetary policy. 👀💵

🔍 Market Implications:

📈 Short-term stability across risk assets

💱 Focus shifts to Fed commentary and data dependency

🌐 Potential impact on USD, equities, and crypto sentiment

💡 Macro decisions like this often set the tone for market direction. Stay informed and manage risk using Gate.io’s rea

The U.S. Federal Reserve has decided to keep interest rates unchanged, signaling a cautious stance as it assesses inflation trends and economic conditions. Markets are closely watching forward guidance for clues on the future path of monetary policy. 👀💵

🔍 Market Implications:

📈 Short-term stability across risk assets

💱 Focus shifts to Fed commentary and data dependency

🌐 Potential impact on USD, equities, and crypto sentiment

💡 Macro decisions like this often set the tone for market direction. Stay informed and manage risk using Gate.io’s rea

- Reward

- 3

- Comment

- Repost

- Share

#NextFedChairPredictions

The race for the next Federal Reserve Chair is heating up! Global investors and VIP traders are closely watching potential candidates as the Fed’s next moves could reshape interest rates, markets, and macro strategies.

🔹 Top Contenders & Predictions:

1️⃣ Kevin Warsh – Market-friendly, potential for gradual rate adjustments, favored by financial institutions.

2️⃣ Lael Brainard – Focused on financial stability and inflation control, may maintain cautious approach.

3️⃣ Jerome Powell (Reappointment) – Continuity in policy, likely steady but reactive to inflation and empl

The race for the next Federal Reserve Chair is heating up! Global investors and VIP traders are closely watching potential candidates as the Fed’s next moves could reshape interest rates, markets, and macro strategies.

🔹 Top Contenders & Predictions:

1️⃣ Kevin Warsh – Market-friendly, potential for gradual rate adjustments, favored by financial institutions.

2️⃣ Lael Brainard – Focused on financial stability and inflation control, may maintain cautious approach.

3️⃣ Jerome Powell (Reappointment) – Continuity in policy, likely steady but reactive to inflation and empl

BTC-2,06%

- Reward

- 8

- 4

- Repost

- Share

BabaJi :

:

2026 GOGOGO 👊View More

🏦 #FedRateCutComing | Macro Market Update 📉✨

Markets are anticipating a potential Federal Reserve rate cut, which could influence global liquidity, risk appetite, and crypto market momentum. Traders are closely watching developments to adjust strategies and manage risk effectively. 🌍💹

🔍 What to Watch:

Potential boost to risk assets, including BTC and major altcoins 🚀

Impact on USD strength and global trading sentiment 💱

Increased volatility around macroeconomic announcements ⚠️

Stay informed and trade smart with Gate.io’s real-time market insights and advanced tools. ⚡💼

#Gateio #FedWa

Markets are anticipating a potential Federal Reserve rate cut, which could influence global liquidity, risk appetite, and crypto market momentum. Traders are closely watching developments to adjust strategies and manage risk effectively. 🌍💹

🔍 What to Watch:

Potential boost to risk assets, including BTC and major altcoins 🚀

Impact on USD strength and global trading sentiment 💱

Increased volatility around macroeconomic announcements ⚠️

Stay informed and trade smart with Gate.io’s real-time market insights and advanced tools. ⚡💼

#Gateio #FedWa

BTC-2,06%

- Reward

- 3

- Comment

- Repost

- Share

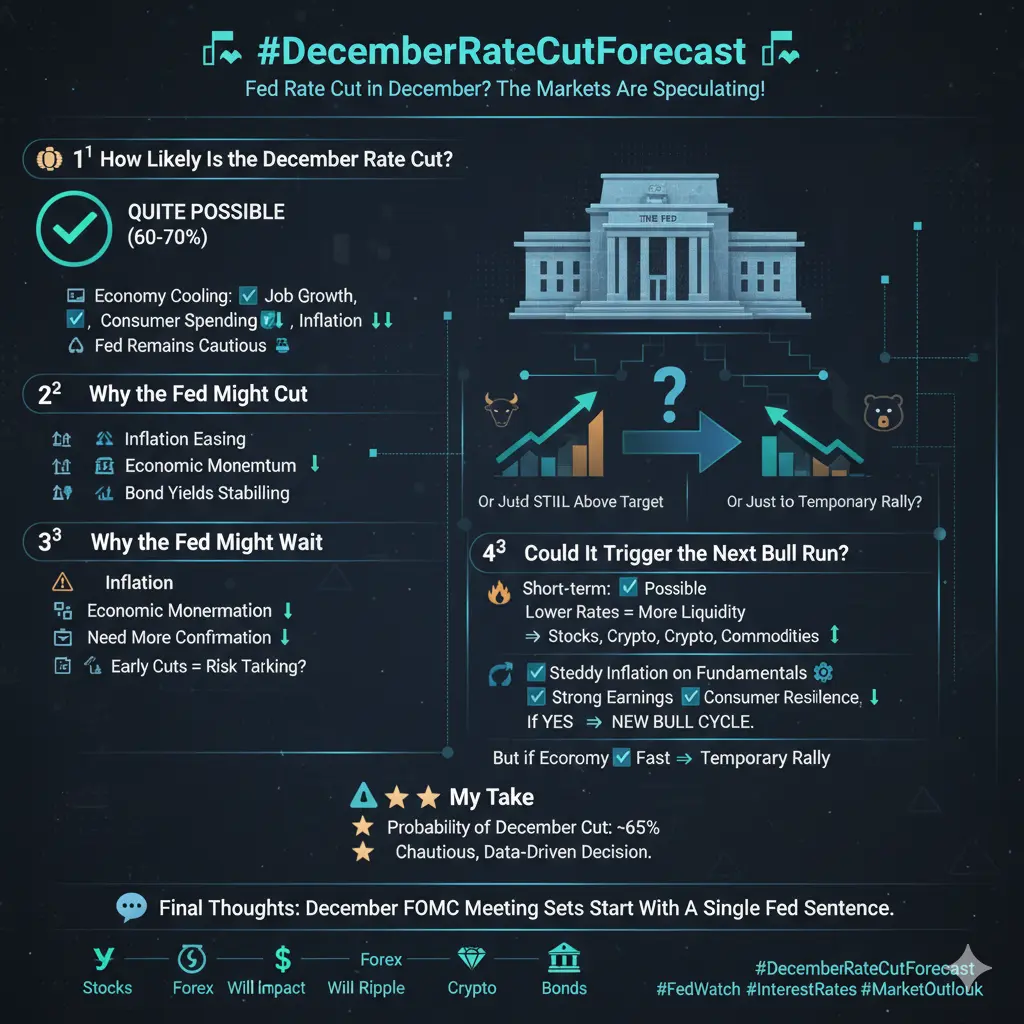

📉 #DecemberRateCutForecast

Market expectations for a December Fed rate cut are cooling down — now around 60–65% odds.

With inflation still above target and the job market strong, Jerome Powell signaled that cuts aren’t guaranteed yet. ⚖️

Investors are watching upcoming inflation data closely — a weak report could tilt the odds back in favor of a December cut. 📊

#FederalReserve #InterestRates #MacroUpdate #ShowMyAlphaPoints GateSquare

Market expectations for a December Fed rate cut are cooling down — now around 60–65% odds.

With inflation still above target and the job market strong, Jerome Powell signaled that cuts aren’t guaranteed yet. ⚖️

Investors are watching upcoming inflation data closely — a weak report could tilt the odds back in favor of a December cut. 📊

#FederalReserve #InterestRates #MacroUpdate #ShowMyAlphaPoints GateSquare

- Reward

- like

- Comment

- Repost

- Share

📉 #DecemberRateCutForecast 📉

The Fed may cut rates again this December, and the markets are heating up with speculation.

But the real question is 👇

💭 How likely is the rate cut?

💭 Could it ignite the next bull run?

Let’s break it down 🔍

💰 1️⃣ How Likely Is the December Rate Cut?

✅ Quite possible — but not guaranteed.

The economy is cooling down — job growth is slowing, consumer spending is softening, and inflation is gradually coming under control. These are exactly the conditions that could push the Fed to ease rates to prevent a sharper slowdown.

However… the Fed remains cautious ⚖️

O

The Fed may cut rates again this December, and the markets are heating up with speculation.

But the real question is 👇

💭 How likely is the rate cut?

💭 Could it ignite the next bull run?

Let’s break it down 🔍

💰 1️⃣ How Likely Is the December Rate Cut?

✅ Quite possible — but not guaranteed.

The economy is cooling down — job growth is slowing, consumer spending is softening, and inflation is gradually coming under control. These are exactly the conditions that could push the Fed to ease rates to prevent a sharper slowdown.

However… the Fed remains cautious ⚖️

O

- Reward

- 4

- 2

- Repost

- Share

TheRealKing :

:

niceView More

🧊 A Chilling Read Today…

I came across an article that truly sent shivers down my spine — not because it lacked logic, but because the data-backed arguments directly contradicted my own outlook.

While I can’t share the piece verbatim due to restrictions, here’s the essence:

📉 Powell’s recent “hawkish” tone has been overinterpreted.

💬 The author argues that rate cuts are still on track — supported by labor demand, cooling inflation, and key economic metrics.

It’s a strong reminder that in markets, data can challenge even the most confident narratives.

📊 (See the image below for the supporti

I came across an article that truly sent shivers down my spine — not because it lacked logic, but because the data-backed arguments directly contradicted my own outlook.

While I can’t share the piece verbatim due to restrictions, here’s the essence:

📉 Powell’s recent “hawkish” tone has been overinterpreted.

💬 The author argues that rate cuts are still on track — supported by labor demand, cooling inflation, and key economic metrics.

It’s a strong reminder that in markets, data can challenge even the most confident narratives.

📊 (See the image below for the supporti

- Reward

- like

- Comment

- Repost

- Share

TRUMP 💥🇺🇸

🚨🗽 Donald Trump Turns Up the Heat on the Federal Reserve! 💣📜

In a bold and very Trump move, President Donald Trump just fired off a handwritten note to Fed Chair Jerome Powell — demanding a massive rate cut! 💸🔥

The note reads: “Jerome, you’re late again! The U.S. is losing hundreds of billions because of you. Cut the rates — big time!” 😤📉

💬 Trump’s Demands:

🔹 Slash Interest Rates: Trump insists the Fed must take action fast to power up the American economy 🚀💰

🔹 Rate Comparison: He even included charts comparing U.S. rates with places like Switzerland and Japan (rangi

🚨🗽 Donald Trump Turns Up the Heat on the Federal Reserve! 💣📜

In a bold and very Trump move, President Donald Trump just fired off a handwritten note to Fed Chair Jerome Powell — demanding a massive rate cut! 💸🔥

The note reads: “Jerome, you’re late again! The U.S. is losing hundreds of billions because of you. Cut the rates — big time!” 😤📉

💬 Trump’s Demands:

🔹 Slash Interest Rates: Trump insists the Fed must take action fast to power up the American economy 🚀💰

🔹 Rate Comparison: He even included charts comparing U.S. rates with places like Switzerland and Japan (rangi

- Reward

- 1

- Comment

- Repost

- Share

🇺🇸 TODAY: Fed Chair Jerome Powell will speak at 8:30 AM ET during the Community Bank Conference 🏦

👀 Let’s see if he drops any hints about rate cuts — markets are watching closely! 💬💰

#FederalReserve #JeromePowell #InterestRates

👀 Let’s see if he drops any hints about rate cuts — markets are watching closely! 💬💰

#FederalReserve #JeromePowell #InterestRates

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING:

🇺🇸 US Treasury Secretary Bessent says Powell should have cut rates by 100–150 bps.

Markets were expecting a soft cut… this is a sledgehammer.

👀 All eyes now on the Fed.

#FOMC #Powell #InterestRates #Macro #Markets #Crypto#

🇺🇸 US Treasury Secretary Bessent says Powell should have cut rates by 100–150 bps.

Markets were expecting a soft cut… this is a sledgehammer.

👀 All eyes now on the Fed.

#FOMC #Powell #InterestRates #Macro #Markets #Crypto#

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

42.46M Popularity

151.22K Popularity

97.65K Popularity

1.66M Popularity

494.79K Popularity

9.39K Popularity

8.11K Popularity

21.74K Popularity

4.61K Popularity

366.41K Popularity

45.72K Popularity

103.2K Popularity

17.61K Popularity

70.63K Popularity

8.26K Popularity

News

View MoreIranian Foreign Minister: Iran does not have the capability to strike the U.S. mainland and will not develop missiles capable of targeting the United States.

21 m

Newly Created Wallet Opens Leveraged Long Positions on SILVER and GOLD Tokens

23 m

Data shows: You need to hold Bitcoin for at least three years to avoid losses

32 m

Polymarket users bet that the US and Israel would not strike Iran, and after earning over $2 million in two months, they experienced a single-day loss of $6.5 million

32 m

BTC breaks through 65,000 USDT

57 m

Pin