#我在Gate广场过新年 Market volatility and divergence intensify, with structural opportunities and risks coexist—Morning analysis and trading strategies for the cryptocurrency market on February 22, 2026

This morning, the cryptocurrency market shows a significant divergence pattern. Bitcoin (BTC) price remains in a consolidation range between $67,000 and $69,000, with a 24-hour volatility of approximately 1.83%, and the total market capitalization is about $1.36 trillion. Meanwhile, the DeFi and infrastructure sectors perform strongly, with Morpho (MORPHO) leading with a 14.84% increase, followed by L

View OriginalThis morning, the cryptocurrency market shows a significant divergence pattern. Bitcoin (BTC) price remains in a consolidation range between $67,000 and $69,000, with a 24-hour volatility of approximately 1.83%, and the total market capitalization is about $1.36 trillion. Meanwhile, the DeFi and infrastructure sectors perform strongly, with Morpho (MORPHO) leading with a 14.84% increase, followed by L

- Reward

- 6

- 13

- Repost

- Share

LittleGodOfWealthPlutus :

:

Experienced driver, please guide me.View More

🚨 Market Update | February 19

BTC: ~$66,900

ETH: ~$1,980

The market remains in a consolidation phase as volatility continues to influence short-term price action.

🔹 Bitcoin (BTC)

BTC is trading slightly below the $67K region after recent fluctuations.

Price behavior suggests ongoing stabilization, but momentum remains cautious.

Market participants are closely monitoring how price reacts around current support zones.

🔹 Ethereum (ETH)

ETH continues to hover just under the $2,000 psychological level.

Price action mirrors BTC, with selective positioning rather than aggressive expansion.

🔹 Curr

BTC: ~$66,900

ETH: ~$1,980

The market remains in a consolidation phase as volatility continues to influence short-term price action.

🔹 Bitcoin (BTC)

BTC is trading slightly below the $67K region after recent fluctuations.

Price behavior suggests ongoing stabilization, but momentum remains cautious.

Market participants are closely monitoring how price reacts around current support zones.

🔹 Ethereum (ETH)

ETH continues to hover just under the $2,000 psychological level.

Price action mirrors BTC, with selective positioning rather than aggressive expansion.

🔹 Curr

- Reward

- 6

- 7

- Repost

- Share

Vortex_King :

:

To The Moon 🌕View More

#我在Gate广场过新年 Web3 Today’s Must-Read | February 21

Today’s Highlights

• Bit mistakenly sends $43 billion, South Korean regulators may face a major shakeup.

• U.S. Supreme Court rules tariffs unconstitutional, $150 billion tax rebate boosts crypto liquidity.

• SEC allows brokerages to treat stablecoins as cash, drastically lowering institutional entry barriers.

• Industry calls for revision of Basel Accords’ 1250% high-risk weight.

• Deutsche Bank integrates Ripple, XRP enters banking settlement infrastructure.

• Dubai launches secondary market trading of $16 billion real estate RWA.

• CLARITY A

View OriginalToday’s Highlights

• Bit mistakenly sends $43 billion, South Korean regulators may face a major shakeup.

• U.S. Supreme Court rules tariffs unconstitutional, $150 billion tax rebate boosts crypto liquidity.

• SEC allows brokerages to treat stablecoins as cash, drastically lowering institutional entry barriers.

• Industry calls for revision of Basel Accords’ 1250% high-risk weight.

• Deutsche Bank integrates Ripple, XRP enters banking settlement infrastructure.

• Dubai launches secondary market trading of $16 billion real estate RWA.

• CLARITY A

- Reward

- 7

- 11

- Repost

- Share

LittleGodOfWealthPlutus :

:

Thank you, Jingpin Daily, a must-read every day😘View More

- Reward

- 1

- 6

- Repost

- Share

Ink-DyedQingyang :

:

It's okay to pull back now; otherwise, this isn't a standard 5-minute consolidation. Currently, it's a secondary rebound. If it can't go higher, it's a 3-sell on the 5-minute level.View More

Hello my all fan's Come and join my live stream and Trade with me.

- Reward

- 2

- 5

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#我在Gate广场过新年

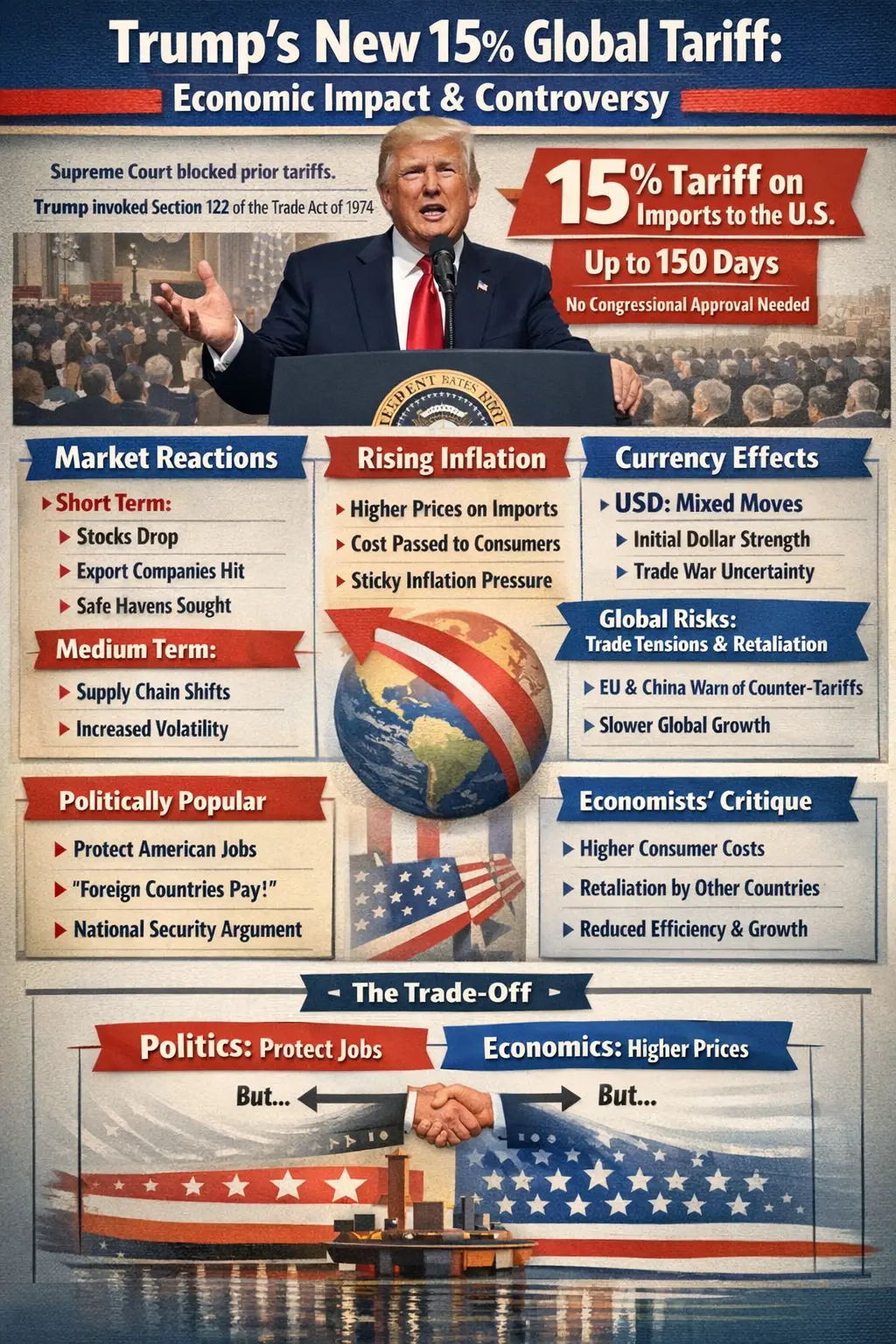

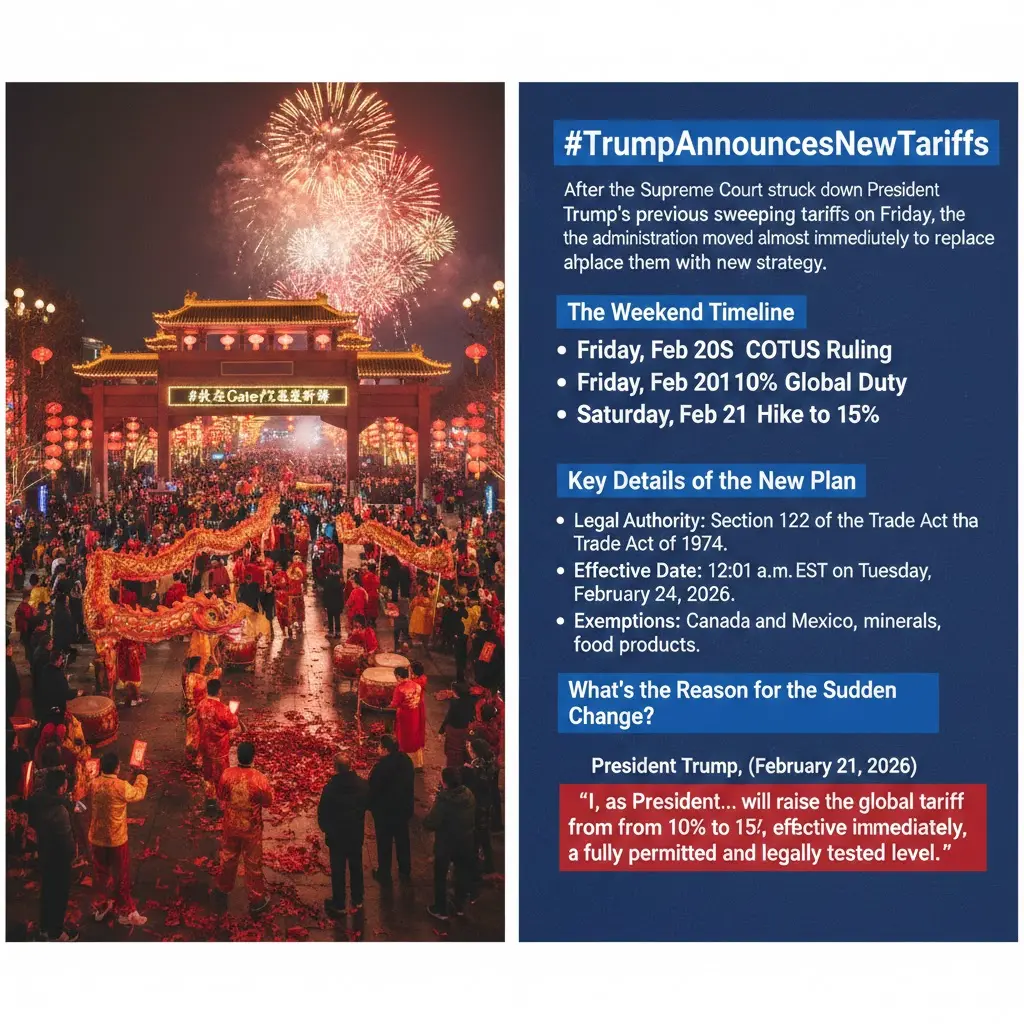

#TrumpAnnouncesNewTariffs

U.S. President Donald Trump announced a new global tariff on imports:

15% tariff on goods imported into the United States

Applies to imports from almost all countries

Announced after the U.S. Supreme Court blocked his earlier tariff policy

Originally, Trump introduced a 10% global tariff, then quickly said he would raise it to 15%.

Why This Happened

The key trigger was a Supreme Court ruling:

The court ruled Trump exceeded presidential authority by using emergency powers to impose sweeping tariffs.

U.S. law generally gives Congress, not the president

#TrumpAnnouncesNewTariffs

U.S. President Donald Trump announced a new global tariff on imports:

15% tariff on goods imported into the United States

Applies to imports from almost all countries

Announced after the U.S. Supreme Court blocked his earlier tariff policy

Originally, Trump introduced a 10% global tariff, then quickly said he would raise it to 15%.

Why This Happened

The key trigger was a Supreme Court ruling:

The court ruled Trump exceeded presidential authority by using emergency powers to impose sweeping tariffs.

U.S. law generally gives Congress, not the president

- Reward

- 4

- 5

- Repost

- Share

Vortex_King :

:

To The Moon 🌕View More

#BuyTheDipOrWaitNow?

Bitcoin (BTC/USDT) continues to show volatility, leaving traders with the critical question: Should you buy the dip or wait for clearer signals? Making the wrong move can cost profits—or even capital—so strategy and risk management are key.

🔹 Current Market Overview

• Price Zone: BTC hovering around $59,000 – $60,000

• Support: $58,500 – $59,000

• Resistance: $60,500 – $61,500

• Trend: Short-term consolidation with lower highs, indicating uncertainty

Candlestick patterns suggest the market is testing its support levels. Buyers are defending key zones, but volatility rema

Bitcoin (BTC/USDT) continues to show volatility, leaving traders with the critical question: Should you buy the dip or wait for clearer signals? Making the wrong move can cost profits—or even capital—so strategy and risk management are key.

🔹 Current Market Overview

• Price Zone: BTC hovering around $59,000 – $60,000

• Support: $58,500 – $59,000

• Resistance: $60,500 – $61,500

• Trend: Short-term consolidation with lower highs, indicating uncertainty

Candlestick patterns suggest the market is testing its support levels. Buyers are defending key zones, but volatility rema

BTC-0,01%

- Reward

- 3

- 6

- Repost

- Share

ybaser :

:

good information shared with youView More

#GateSquare$50KRedPacketGiveaway Big rewards, bigger excitement, and one incredible opportunity — the GateSquare $50K Red Packet Giveaway is here! This is more than just a campaign; it’s a celebration of community, engagement, and the power of shared opportunities in the crypto space.

GateSquare has rapidly become a dynamic hub for traders, investors, and crypto enthusiasts who love staying ahead of the curve. Now, with this massive $50,000 Red Packet Giveaway, users have a chance to turn participation into real rewards.

What makes this event truly special isn’t just the prize pool — it’s how

GateSquare has rapidly become a dynamic hub for traders, investors, and crypto enthusiasts who love staying ahead of the curve. Now, with this massive $50,000 Red Packet Giveaway, users have a chance to turn participation into real rewards.

What makes this event truly special isn’t just the prize pool — it’s how

- Reward

- 3

- 11

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

- Reward

- 1

- 3

- Repost

- Share

LostHeartbeat :

:

Entered! Who wants to plummet all the way 😂🤣View More

🌈 #GateLiveStreamingInspiration - Feb.22

Today's Topic Recommendations:

🔹 From frenzy to fear: Is the AI sector's "faith crumbling" as US investors flee risk assets in droves?

🔹 Vitalik is selling! Has dumped over 7,000 ETH this month — is Ethereum facing a "crisis of faith"?

🔹 Project team cashing out big time? Pump.fun-linked addresses sell $10M+ in tokens — who's left holding the bag for MEME coins?

🔹 HYPE's largest on-chain whale "Loracle" takes profits for the first time — is this profit-taking or a bearish signal after cutting position by nearly half?

🔹 Analysis: BTC true believers

Today's Topic Recommendations:

🔹 From frenzy to fear: Is the AI sector's "faith crumbling" as US investors flee risk assets in droves?

🔹 Vitalik is selling! Has dumped over 7,000 ETH this month — is Ethereum facing a "crisis of faith"?

🔹 Project team cashing out big time? Pump.fun-linked addresses sell $10M+ in tokens — who's left holding the bag for MEME coins?

🔹 HYPE's largest on-chain whale "Loracle" takes profits for the first time — is this profit-taking or a bearish signal after cutting position by nearly half?

🔹 Analysis: BTC true believers

- Reward

- 3

- 3

- Repost

- Share

SiYu :

:

Good luck and prosperity 🧧View More

Yesterday during the broadcast, the three orders given, two of them were all about eating meat.

View Original

- Reward

- 2

- 4

- Repost

- Share

PotatoTomatoSoup :

:

吃上了View More

Market fluctuations continue to narrow, trading volume remains sluggish. Last night’s high was 1995, and after a night, the low was 1967, with less than 30 points of movement. A trend reversal is highly likely tonight. Currently, there is oscillation on the 15-minute and 1-hour charts. The oscillating market favors shorting high and buying low#特朗普宣布新关税政策

View Original

- Reward

- like

- 2

- Repost

- Share

ChivesQiTongwei :

:

Are there any new location points?View More

- Reward

- like

- 2

- Repost

- Share

OldPa'sSecretExtraLarge :

:

All day barkingView More

$LADYS 2026 will mark the twentieth year of the third Yuan and the ninth cycle entering the Ninth Purple Fire 🔥 cycle. This is a favorable time for women, and the world will see a trend of Yin dominance over Yang. Women in various industries will emerge as leaders and set new trends. This LADYS will shine brightly and have great potential. Stay tuned!

LADYS9,17%

- Reward

- 1

- 2

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Wow! This perspective really resonates! 🔥 In 2026, the Ninth Purple Fire Luck officially enters the "Flame Center." LADYS, as a meme coin representing the "middle-aged woman" power, is riding the wave of the times! This trend of "yin dominance and yang decline," combined with LADYS' inherent community culture, is truly a perfect storm of timing, geography, and human harmony! Looking forward to it shining brightly in 2026 and leading us to witness the rise of female power! 🚀View More

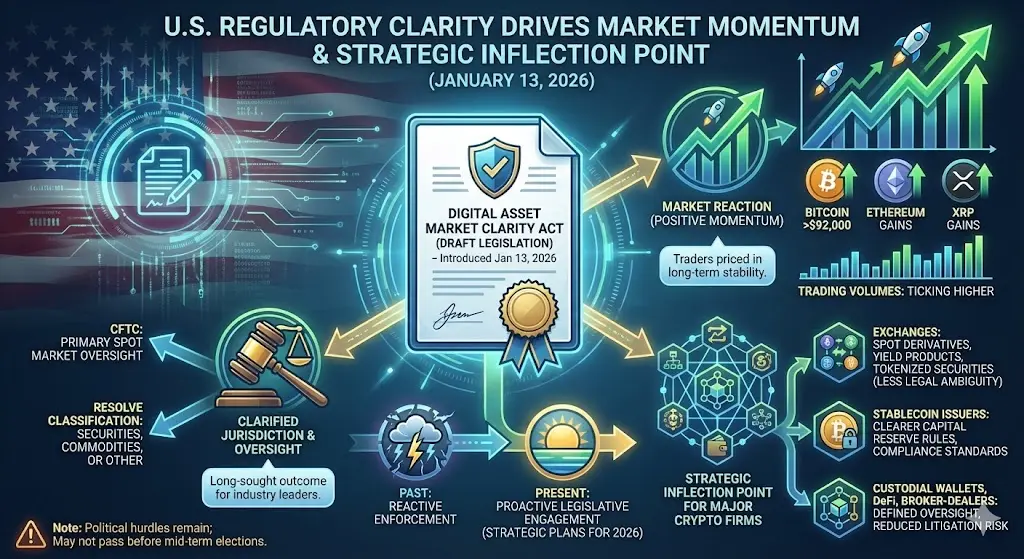

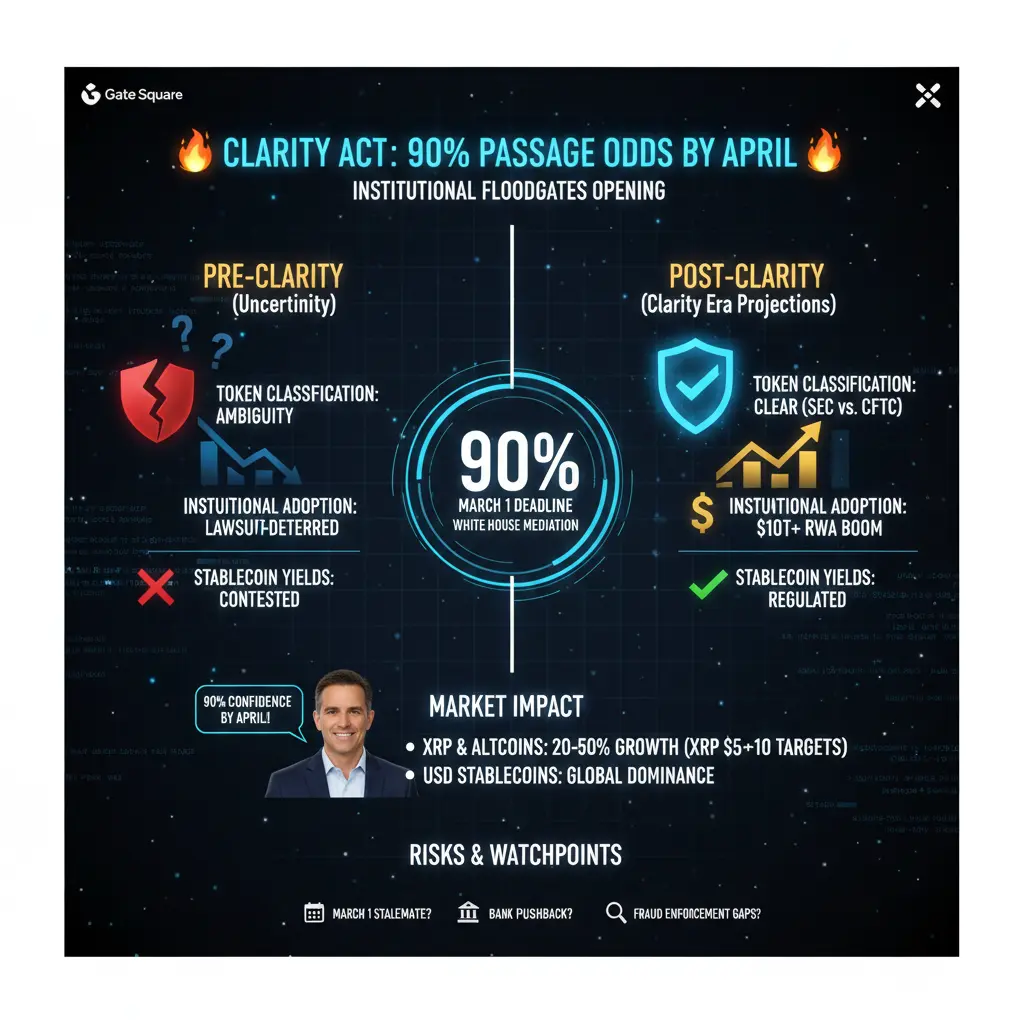

#CLARITYActAdvances

🚨 CLARITY ACT BOMBSHELL: 90% Passage Odds by April – Institutional Floodgates About to Open! 🔥

🚀 Crypto Regulation 2026: U.S. CLARITY Act Momentum Surge – Ripple CEO Optimistic, Bull Run Catalyst Incoming!

💥 BREAKING: CLARITY Act Hits 90% Odds – March 1 Deadline Looms, Banks vs Crypto Yield Battle Escalates!

The CLARITY Act: Full 2026 Deep Dive & Market Implications

As of February 22, 2026, the Digital Asset Market Clarity Act of 2025 (CLARITY Act – H.R. 3633) stands as the single biggest U.S. crypto catalyst. After its bipartisan House victory (July 2025: 294–134 land

🚨 CLARITY ACT BOMBSHELL: 90% Passage Odds by April – Institutional Floodgates About to Open! 🔥

🚀 Crypto Regulation 2026: U.S. CLARITY Act Momentum Surge – Ripple CEO Optimistic, Bull Run Catalyst Incoming!

💥 BREAKING: CLARITY Act Hits 90% Odds – March 1 Deadline Looms, Banks vs Crypto Yield Battle Escalates!

The CLARITY Act: Full 2026 Deep Dive & Market Implications

As of February 22, 2026, the Digital Asset Market Clarity Act of 2025 (CLARITY Act – H.R. 3633) stands as the single biggest U.S. crypto catalyst. After its bipartisan House victory (July 2025: 294–134 land

- Reward

- 4

- 3

- Repost

- Share

GateUser-95194dd2 :

:

Paying Close Attention🔍View More

- Reward

- 2

- 3

- Repost

- Share

PiHero :

:

2026 Go Go Go 👊View More

- Reward

- like

- 2

- Repost

- Share

GateUser-ee33ba8f :

:

Don't be afraid; the more it falls, the more you buy the dip.View More

Load More

Trending Topics

View More318.29K Popularity

102.83K Popularity

418.97K Popularity

3.68K Popularity

101.3K Popularity

Pin