- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Ethereum Foundation releases 2026 Protocol Priority Update: Glamsterdam upgrade scheduled for the first half of the year

ChainCatcher News, according to official sources, the Ethereum Foundation has released the 2026 protocol priority update, which outlines three main tracks: scalability (integrating L1 execution and Blob scalability), improving user experience (focusing on native account abstraction and cross-chain interoperability), and strengthening the L1 layer (enhancing security, censorship resistance, and network resilience).

Moreover, the Ethereum Foundation stated that it will continue to push for the Gas Limit to reach 100M and above, promote ePBS and further increase Blob parameters, advance zkEVM attester client, and work on censorship resistance and post-quantum security measures; the next major upgrade, Glamsterdam, is targeted for 2026.

Moreover, the Ethereum Foundation stated that it will continue to push for the Gas Limit to reach 100M and above, promote ePBS and further increase Blob parameters, advance zkEVM attester client, and work on censorship resistance and post-quantum security measures; the next major upgrade, Glamsterdam, is targeted for 2026.

ETH0,23%

- Reward

- like

- Comment

- Repost

- Share

Sources reveal: U.S. military activities in the Yellow Sea, PLA responds effectively

According to sources, recently, the U.S. military organized aircraft to conduct activities in the Yellow Sea and my airspace. The Chinese People's Liberation Army organized naval and air forces to monitor, guard, respond, and handle the situation in accordance with laws and regulations. (Global Times)

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQNFBloK

View Original

- Reward

- 2

- Comment

- Repost

- Share

Stock Market Rotates Into Staples As Tech Sell-Off Hits Software, Chip Stocks

The Nasdaq composite fell below its 50-day moving average due to selling in the software and semiconductor sectors, despite strong earnings from Palantir, which rose 6% but failed to reach its 200-day moving average.

- Reward

- like

- Comment

- Repost

- Share

Rentschler Biopharma appoints Dr. Veit Bergendahl as Chief Operating Officer and member of the executive board

This is a paid press release. Contact the press release distributor directly with any inquiries.

Rentschler Biopharma appoints Dr. Veit Bergendahl as Chief Operating Officer and member of the executive

- Reward

- like

- Comment

- Repost

- Share

Sanae Takashi elected as Japan's new Prime Minister

On February 18th, Japan local time, in the second round of the Japanese Senate Prime Minister nomination election, the Liberal Democratic Party President Sanae Takaichi received more than half of the votes, confirming her as Japan's new Prime Minister. On the morning of February 18th, the Japanese government held a cabinet meeting, and the Takaichi Cabinet collectively resigned. Later that day, in the first round of the Japanese House of Representatives Prime Minister nomination election, Sanae Takaichi received 354 votes, more than half of the votes, and won the election. According to the Japanese Constitution, a special Diet must be convened within 30 days after the House of Representatives election to conduct the Prime Minister nomination election. On the day the current special Diet convened, the current cabinet resigned collectively, and the newly elected members of the House of Representatives and the existing Senate members voted separately to select the new Prime Minister and accordingly reassemble the cabinet. (CCTV News)

- Reward

- 2

- Comment

- Repost

- Share

As the Spring Festival approaches, gifts are here. Gate is launching a series of festive campaigns, including red envelope giveaways, trading competitions, horse racing predictions, global asset challenges, and more. Whether you're a new user or an active trader, you can unlock a variety of rewards this holiday season.

View Original- Reward

- 2

- Comment

- Repost

- Share

$BTC

A Bitcoin bought for over 30,000 is now worth over 10,000,

and it has been increasing all along,

never decreasing.

The road to success is often not crowded,

because few people persist.

The strategy of accumulating coins for the long term remains great,

precisely because it strips away all the superficial tricks,

returning to the most fundamental business logic

— holding truly scarce assets, and then waiting.

A Bitcoin bought for over 30,000 is now worth over 10,000,

and it has been increasing all along,

never decreasing.

The road to success is often not crowded,

because few people persist.

The strategy of accumulating coins for the long term remains great,

precisely because it strips away all the superficial tricks,

returning to the most fundamental business logic

— holding truly scarce assets, and then waiting.

BTC-0,01%

- Reward

- 2

- Comment

- Repost

- Share

i believe nothing good happens to me because i am the good that happens to others.

and that’s okay.

and that’s okay.

- Reward

- 2

- Comment

- Repost

- Share

if i launch something right now

and it goes to 10M.

is that a cook?

Seems to me like it

and it goes to 10M.

is that a cook?

Seems to me like it

- Reward

- 2

- Comment

- Repost

- Share

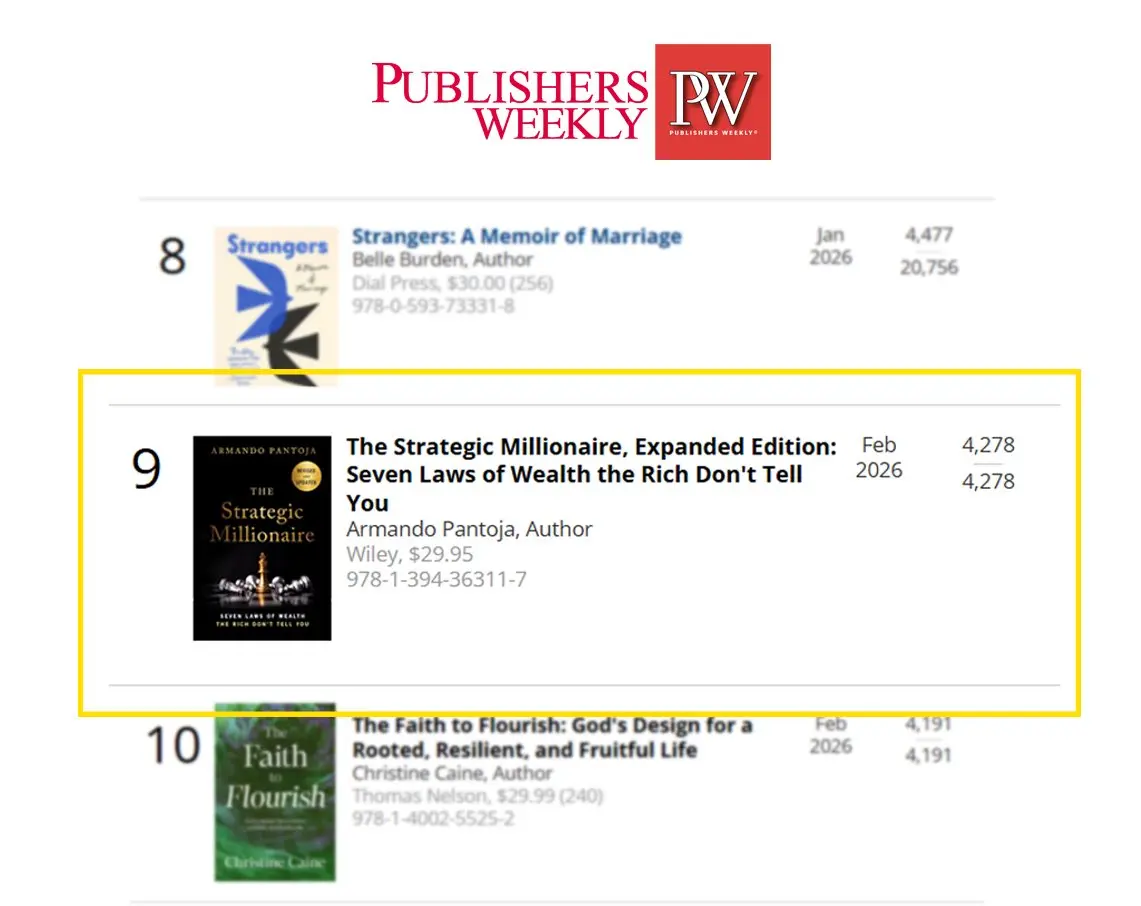

Super blessed! 🙏🏾 my book the strategic millionaire is #9 in the U.S. this week! 🎊😱😱🎊💪🏽

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 2

- 1

- Repost

- Share

newpublic :

:

which coin is enough for todayJoin the VITAIX Token Presale and earn rewards! Use my referral link:

@zain85097650

@Juttianaya5

@blockwin_top

@zain85097650

@Juttianaya5

@blockwin_top

- Reward

- 2

- Comment

- Repost

- Share

Load More

Trending Topics

View More318.29K Popularity

102.83K Popularity

418.97K Popularity

3.68K Popularity

101.3K Popularity

Pin