# MarketStructure

5.42K

dragon_fly2

#BuyTheDipOrWaitNow? “Buy the dip” is the most abused phrase in crypto.

It sounds smart. It feels brave.

But in reality, it’s where most portfolios go to die.

Because a dip is not a gift.

A dip is information.

Markets don’t move randomly.

They move based on liquidity shifts, macro pressure, leverage unwinding, and human panic.

If you ignore that context and buy anyway, you’re not investing — you’re donating liquidity to smarter players.

Smart money never asks: “Is this cheap?”

They ask: “Who is forced to sell… and why?”

There’s a massive difference between: • A healthy retracement in a strong

It sounds smart. It feels brave.

But in reality, it’s where most portfolios go to die.

Because a dip is not a gift.

A dip is information.

Markets don’t move randomly.

They move based on liquidity shifts, macro pressure, leverage unwinding, and human panic.

If you ignore that context and buy anyway, you’re not investing — you’re donating liquidity to smarter players.

Smart money never asks: “Is this cheap?”

They ask: “Who is forced to sell… and why?”

There’s a massive difference between: • A healthy retracement in a strong

- Reward

- 7

- 9

- Repost

- Share

AylaShinex :

:

To The Moon 🌕View More

#BuyTheDipOrWaitNow?

📉⚡ #BuyTheDipOrWaitNow

The market pulled back.

Now comes the real test — discipline.

Every dip feels like opportunity.

But not every dip is support.

🔎 The Real Question Isn’t “Buy or Wait?”

It’s:

• Is structure still intact?

• Are buyers stepping in with volume?

• Is risk clearly defined?

• Or are you reacting to fear?

🧠 Smart Approach

🟢 Buy the dip when price holds strong demand zones and risk is small.

🟡 Wait when price is mid-range, unclear, or momentum is weak.

Sometimes patience makes more money than action.

🎯 Remember:

Capital preservation > catching bottoms.

📉⚡ #BuyTheDipOrWaitNow

The market pulled back.

Now comes the real test — discipline.

Every dip feels like opportunity.

But not every dip is support.

🔎 The Real Question Isn’t “Buy or Wait?”

It’s:

• Is structure still intact?

• Are buyers stepping in with volume?

• Is risk clearly defined?

• Or are you reacting to fear?

🧠 Smart Approach

🟢 Buy the dip when price holds strong demand zones and risk is small.

🟡 Wait when price is mid-range, unclear, or momentum is weak.

Sometimes patience makes more money than action.

🎯 Remember:

Capital preservation > catching bottoms.

- Reward

- 3

- 2

- Repost

- Share

AYATTAC :

:

To The Moon 🌕View More

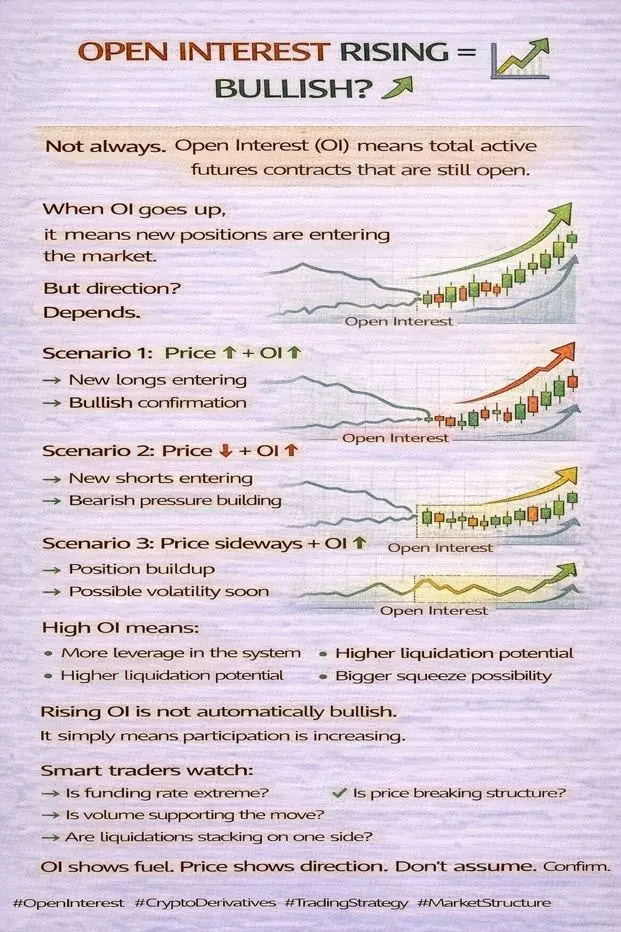

OPEN INTEREST RISING = BULLISH? 📈

Not always.

Open Interest (OI)

means total active futures contracts

that are still open.

When OI goes up,

it means new positions are entering the market.

But direction?

Depends.

Scenario 1:

Price ↑ + OI ↑

→ New longs entering

→ Bullish confirmation

Scenario 2:

Price ↓ + OI ↑

→ New shorts entering

→ Bearish pressure building

Scenario 3:

Price sideways + OI ↑

→ Position buildup

→ Possible volatility soon

High OI means:

• More leverage in the system

• Higher liquidation potential

• Bigger squeeze possibility

Rising OI is not automatically bullish.

It simply mean

Not always.

Open Interest (OI)

means total active futures contracts

that are still open.

When OI goes up,

it means new positions are entering the market.

But direction?

Depends.

Scenario 1:

Price ↑ + OI ↑

→ New longs entering

→ Bullish confirmation

Scenario 2:

Price ↓ + OI ↑

→ New shorts entering

→ Bearish pressure building

Scenario 3:

Price sideways + OI ↑

→ Position buildup

→ Possible volatility soon

High OI means:

• More leverage in the system

• Higher liquidation potential

• Bigger squeeze possibility

Rising OI is not automatically bullish.

It simply mean

- Reward

- 3

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? #BuyTheDipOrWaitNow? 📊

₿ Decision Zone for Bitcoin: $69K–$70K

Mid-February 2026 finds BTC hovering near the $70,000 mark after a sharp rebound from the $65K sell-off. That move lower was not gentle — leverage got wiped, sentiment collapsed, ETFs saw pressure, and macro uncertainty spiked.

Yet the recovery tells us something important: buyers didn’t disappear.

Still, context matters. Price remains well below the late-2025 peak near $126K. This is best viewed as a post-bull-cycle correction, not a fresh breakout into new highs.

🧩 What Caused the Drop?

• Profit-taking after

₿ Decision Zone for Bitcoin: $69K–$70K

Mid-February 2026 finds BTC hovering near the $70,000 mark after a sharp rebound from the $65K sell-off. That move lower was not gentle — leverage got wiped, sentiment collapsed, ETFs saw pressure, and macro uncertainty spiked.

Yet the recovery tells us something important: buyers didn’t disappear.

Still, context matters. Price remains well below the late-2025 peak near $126K. This is best viewed as a post-bull-cycle correction, not a fresh breakout into new highs.

🧩 What Caused the Drop?

• Profit-taking after

BTC1,18%

- Reward

- 5

- 9

- Repost

- Share

Peacefulheart :

:

To The Moon 🌕View More

📊 OM/USDT – Momentum Breakout & Technical Outlook (4H)

Current Price: ~$0.0581

24H Change: +24%

Context: Strong volatility expansion after prolonged consolidation

🔍 Market Structure

OM spent a significant period in range-bound accumulation, followed by a high-momentum breakout.

Price has now expanded well above EMA(7), EMA(25), and EMA(99), confirming a trend shift to bullish on the 4H timeframe.

The impulsive candle suggests aggressive participation, often seen at the start of a new directional move.

📈 Momentum & Indicators

Williams %R (~ −44):

Momentum is neutral-to-strong, not yet overbo

Current Price: ~$0.0581

24H Change: +24%

Context: Strong volatility expansion after prolonged consolidation

🔍 Market Structure

OM spent a significant period in range-bound accumulation, followed by a high-momentum breakout.

Price has now expanded well above EMA(7), EMA(25), and EMA(99), confirming a trend shift to bullish on the 4H timeframe.

The impulsive candle suggests aggressive participation, often seen at the start of a new directional move.

📈 Momentum & Indicators

Williams %R (~ −44):

Momentum is neutral-to-strong, not yet overbo

OM7,63%

- Reward

- like

- Comment

- Repost

- Share

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵🚀

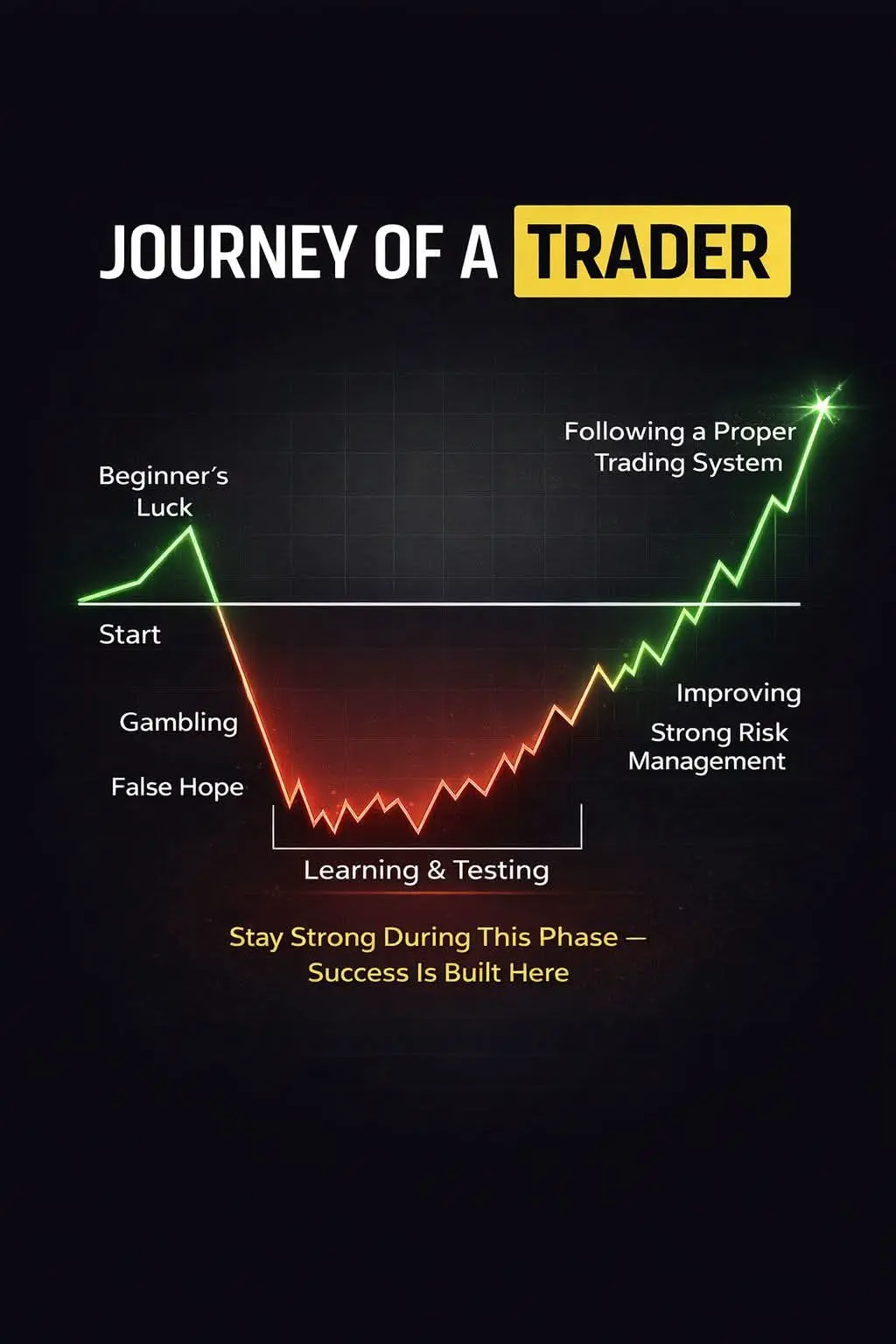

Every trader starts with excitement. Some get lucky. Most face losses. The real difference? The ones who don’t quit during the learning phase.

Losses teach. Discipline builds. Risk management protects.

And consistency creates success. 📈

If you’re in the “Learning & Testing” phase right now — stay strong. This is where real traders are made.

#tradingjourney #swingtrading #financialfreedom #marketstructure #GateSquare$50KRedPacketGiveaway $BTC $SOL $THE

Every trader starts with excitement. Some get lucky. Most face losses. The real difference? The ones who don’t quit during the learning phase.

Losses teach. Discipline builds. Risk management protects.

And consistency creates success. 📈

If you’re in the “Learning & Testing” phase right now — stay strong. This is where real traders are made.

#tradingjourney #swingtrading #financialfreedom #marketstructure #GateSquare$50KRedPacketGiveaway $BTC $SOL $THE

- Reward

- 3

- Comment

- Repost

- Share

#BitcoinBouncesBack

As of today, Bitcoin’s bounce feels more like a calculated response than an emotional relief rally. After a period of pressure and uncertainty, price action is showing signs of stabilization, suggesting that buyers are stepping in selectively rather than chasing momentum. This kind of rebound often reflects improving confidence, but not blind optimism.

What stands out is how the bounce is forming. Volume remains controlled, volatility is cooling, and panic selling appears to have faded. Historically, these conditions tend to favor short-term consolidation before the market

As of today, Bitcoin’s bounce feels more like a calculated response than an emotional relief rally. After a period of pressure and uncertainty, price action is showing signs of stabilization, suggesting that buyers are stepping in selectively rather than chasing momentum. This kind of rebound often reflects improving confidence, but not blind optimism.

What stands out is how the bounce is forming. Volume remains controlled, volatility is cooling, and panic selling appears to have faded. Historically, these conditions tend to favor short-term consolidation before the market

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

Watching Closely 🔍️View More

Altcoin Focus

Headline: SUI and ADA at Critical Levels: Opportunity or Risk? 📊

Body:

Both $SUI and $ADA A are testing major support zones, with daily RSI approaching oversold conditions.

Historically, long-term capital begins gradual accumulation during periods of elevated fear, not euphoria. That said, confirmation remains key.

This is a zone for strategy — not emotion.

#Altcoins #MarketStructure #SUI #Cardano

Headline: SUI and ADA at Critical Levels: Opportunity or Risk? 📊

Body:

Both $SUI and $ADA A are testing major support zones, with daily RSI approaching oversold conditions.

Historically, long-term capital begins gradual accumulation during periods of elevated fear, not euphoria. That said, confirmation remains key.

This is a zone for strategy — not emotion.

#Altcoins #MarketStructure #SUI #Cardano

- Reward

- like

- Comment

- Repost

- Share

📈# Top Coins Rising Against the Trend

In a market dominated by volatility and broad sell-offs, a few cryptocurrencies are standing firm — and even moving higher. While high-beta assets and tech stocks face pressure, these counter-trend coins are proving that not all markets move the same way.

💡 Why are these coins holding up?

🔹 Strong network fundamentals & real-world utility

🔹 Active developer ecosystems and growing adoption

🔹 Deep liquidity and healthier market structure

🔹 Loyal, engaged communities supporting long-term vision

📊 Market Insight

Coins with solid fundamentals and lower c

In a market dominated by volatility and broad sell-offs, a few cryptocurrencies are standing firm — and even moving higher. While high-beta assets and tech stocks face pressure, these counter-trend coins are proving that not all markets move the same way.

💡 Why are these coins holding up?

🔹 Strong network fundamentals & real-world utility

🔹 Active developer ecosystems and growing adoption

🔹 Deep liquidity and healthier market structure

🔹 Loyal, engaged communities supporting long-term vision

📊 Market Insight

Coins with solid fundamentals and lower c

- Reward

- 4

- Comment

- Repost

- Share

#CryptoSurvivalGuide

The crypto market right now is not just volatile — it’s selectively brutal. This phase is designed to shake out impatience, over-leverage, and weak conviction. Understanding where we are matters more than predicting the next 5% move.

1️⃣ Market Structure: Distribution, Not Capitulation (Yet)

Despite sharp pullbacks, we are not seeing classic panic signals:

Funding rates are cooling, not collapsing

Open interest is decreasing in an orderly way

No extreme volume spike that usually marks full capitulation

This suggests the market is in a distribution + re-pricing phase, not

The crypto market right now is not just volatile — it’s selectively brutal. This phase is designed to shake out impatience, over-leverage, and weak conviction. Understanding where we are matters more than predicting the next 5% move.

1️⃣ Market Structure: Distribution, Not Capitulation (Yet)

Despite sharp pullbacks, we are not seeing classic panic signals:

Funding rates are cooling, not collapsing

Open interest is decreasing in an orderly way

No extreme volume spike that usually marks full capitulation

This suggests the market is in a distribution + re-pricing phase, not

BTC1,18%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

265.95K Popularity

881.14K Popularity

10.64M Popularity

103.64K Popularity

547.27K Popularity

304.18K Popularity

64.38K Popularity

44.65K Popularity

31.23K Popularity

29.64K Popularity

28.86K Popularity

25.66K Popularity

28.25K Popularity

56K Popularity

News

View MoreData: If BTC drops below $64,270, the total long liquidation strength on major CEXs will reach $1.66 billion.

6 m

Data: If ETH breaks through $2,051, the total liquidation strength of short positions on mainstream CEXs will reach $739 million.

6 m

Federal Reserve's Logan: The target should be shifted to the repurchase agreement market interest rate

8 m

Federal Reserve's Logan, aims to provide central clearing support for repurchase operations

23 m

Federal Reserve's Logan, concerned that economic demand exceeds supply

42 m

Pin