#BitcoinBouncesBack

Bitcoin Bounce

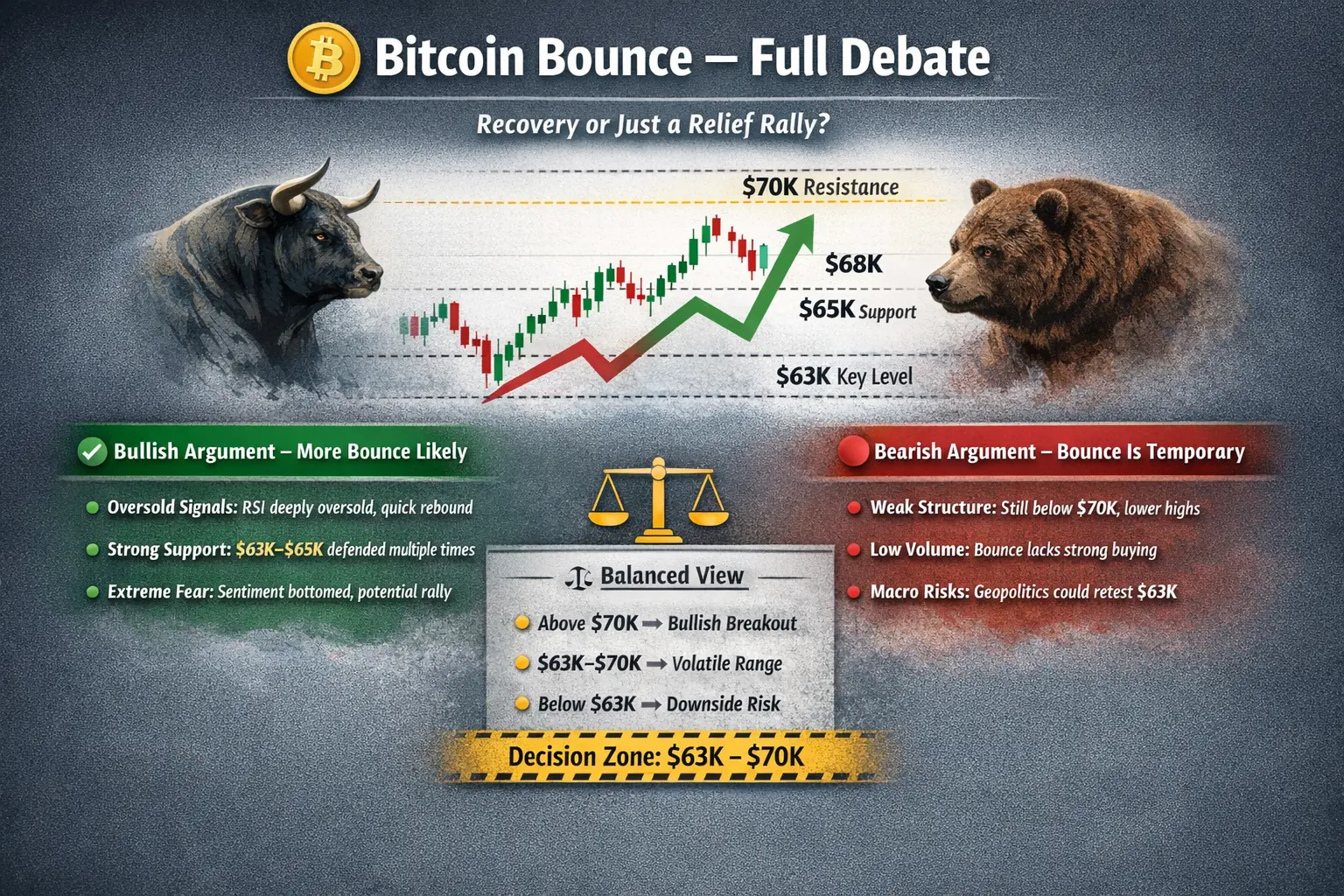

The recent move in Bitcoin from the $63,000 zone toward $68,000 has triggered an intense debate among traders, analysts, and institutional observers. The key question is simple but critical: Is this the beginning of a sustainable recovery, or just a temporary relief rally inside a broader corrective phase?

🟢 Bullish Argument – More Bounce Likely

The bullish camp argues that the market showed strong resilience. Despite geopolitical shock headlines and heavy fear sentiment, BTC did not collapse further. Instead, it quickly rebounded nearly 7–8% from the lows. Historically, when markets stop falling on bad news, it often signals seller exhaustion.

Technical indicators support this view. Daily RSI reached deeply oversold territory, marking one of the most stretched conditions in recent history. Funding rates compressed, leverage flushed, and weak hands exited. That type of reset often creates fuel for short squeezes and relief extensions.

Support between $63,000–$65,000 has now been defended multiple times. Each retest produced higher intraday lows on lower timeframes. Bulls argue that as long as $65,000 holds on daily closes, the probability of another push toward $70,000 increases. A confirmed breakout above $70,000 with volume could open expansion toward $73,000–$80,000.

Sentiment is also a factor. Extreme fear readings historically align closer to bottoms than tops. When the majority expects further collapse, markets sometimes reverse unexpectedly. From this angle, the bounce may not be random — it may be structural accumulation beginning quietly.

🔴 Bearish Argument – Bounce Is Temporary

The bearish camp counters with structure. Since the October 2025 peak near $126,000, the trend remains defined by lower highs and corrective formations. The recent bounce has not broken any major resistance. $68,000–$70,000 remains heavy supply, and every approach so far has been rejected.

Volume on the rebound appears muted compared to prior breakdown candles. That suggests short covering rather than strong new demand. Without expanding volume, upside continuation becomes statistically weaker.

Macro conditions also remain uncertain. Risk assets are sensitive to geopolitical stress and rate expectations. If external volatility spikes again, BTC could easily retest $63,000. A daily close below that level would likely accelerate downside momentum toward $60,000 or lower.

From a cycle perspective, bears argue the correction phase may not be fully mature. Historically, deeper consolidations often include multiple relief rallies before final stabilization. Therefore, this bounce could simply be another mid-correction move.

⚖️ Balanced Assessment

Both sides present valid data-driven arguments. The bounce itself is real and technically measurable. However, structure remains neutral-to-bearish until $70,000 is decisively reclaimed.

Holding above $65,000 increases odds of another attempt at resistance. Losing $63,000 weakens the entire recovery thesis.

In short:

Above $70,000 → structure shifts bullish.

Between $63,000–$70,000 → volatile compression zone.

Below $63,000 → downside risk expands.

The market is not at confirmation yet. It is at decision.

Bitcoin (BTC) – Current Forecast, Bounce %, Trader Positioning & Next Trading Plan (2026)

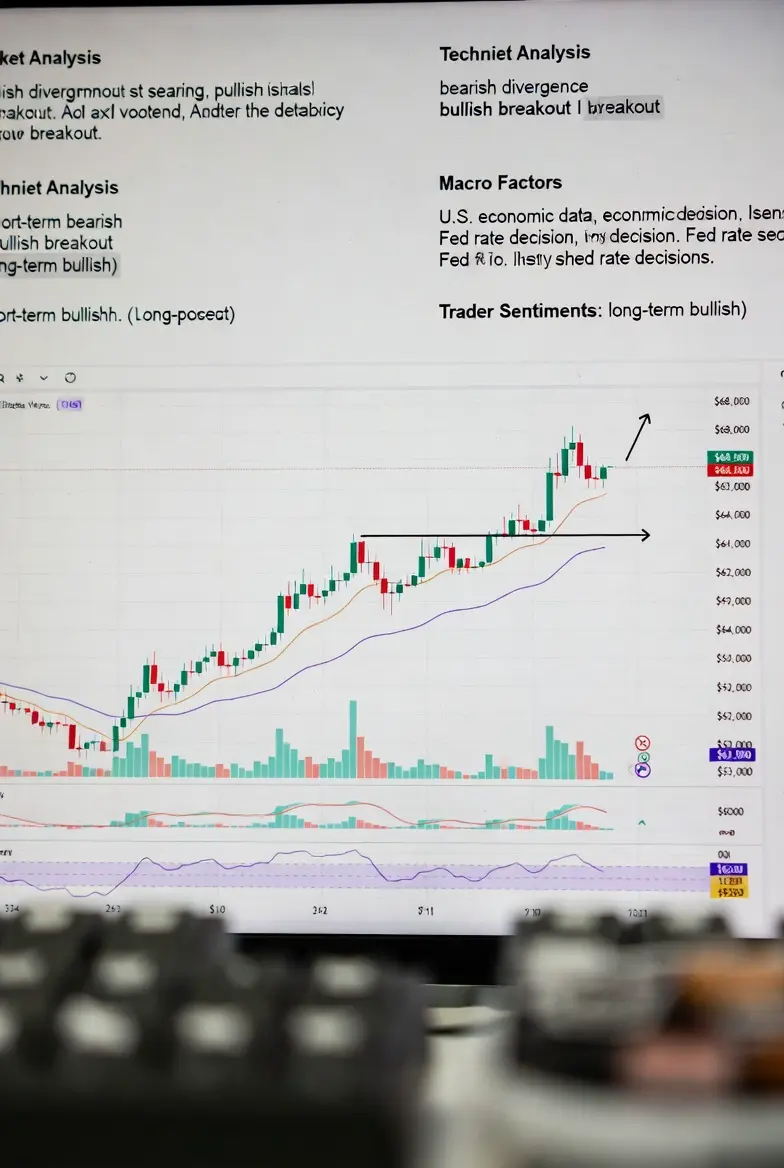

This is a fully extended, execution-oriented update based on aggregated real-time market data as of March 2, 2026.

Bitcoin is trading around $65,700–$66,200 after bouncing from intraday lows near $63,000. The move represents approximately a 7–8% recovery from the swing low to the recent $68,000 zone.

1️⃣ How Much Has BTC Bounced?

From ~$63,000 to ~$68,200 → ~7–8% recovery.

From March 1 close near ~$65,700 to ~$66,000+ → ~1–2% stabilization.

From the October 2025 all-time high near $126,000, price remains roughly 47–48% lower. This confirms the broader correction remains intact despite short-term relief.

The bounce improved sentiment but did not yet confirm trend reversal.

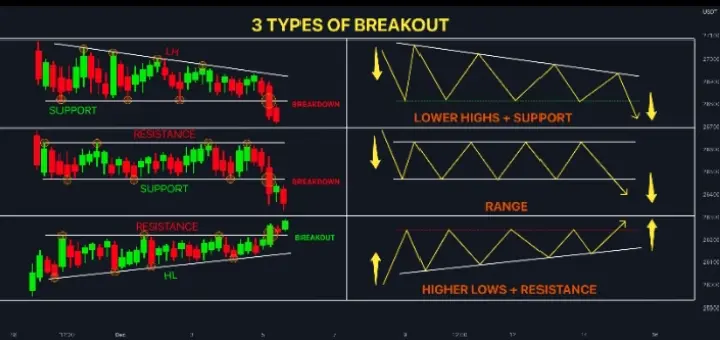

2️⃣ Current Market Structure

Daily chart shows corrective consolidation with lower highs.

4H chart shows defended support at $63K–$65K but resistance near $68K–$70K.

Weekly bias remains cautious while below major moving averages.

The active range is $63K–$70K. A breakout or breakdown from this compression is likely to define the next directional move.

3️⃣ Trader Positioning

Sentiment remains cautious. Extreme fear conditions triggered capitulation selling, but derivatives funding has normalized. Leverage is lighter than during prior peaks.

Institutional flows appear mixed but stabilizing. Retail positioning remains divided between dip-buyers and breakdown sellers.

Overall mood: defensive but not panic-driven.

4️⃣ Key Technical Levels

Support: $65,000–$66,000

$63,000–$64,000

$60,000–$62,000

Resistance: $68,000–$68,600

$70,000

$72,000–$73,000

These levels define all short-term trade decisions.

5️⃣ Forecast Scenarios

Scenario A – Controlled Relief Rally

Hold $65K → Break $70K → Target $73K–$80K

Scenario B – Pullback Then Rally

Reject $68K → Retest $63K → Bounce if holds

Scenario C – Bear Continuation

Break $63K → Target $60K or lower

Scenario D – Strong Momentum Shift

Clean reclaim $70K → Acceleration above $80K

Current bias remains neutral-to-bearish until resistance is reclaimed.

6️⃣ Short-Term Trading Strategy

Breakout Entry: Daily close above $70K

Targets: $72K → $73K–$80K

Stop: Below $66K

Pullback Entry: Buy zone $63K–$65K

Targets: $68.6K → $70K

Stop: Below $62.5K

Risk per trade should remain controlled and structured.

7️⃣ Swing Plan (2–6 Weeks)

Accumulate near strong support confirmations.

Distribute into resistance expansions.

Maintain disciplined risk-to-reward structure.

8️⃣ Macro Influences

Geopolitical volatility, rate expectations, ETF flows, and equity correlation remain primary drivers. Bitcoin remains sensitive to global risk shifts.

9️⃣ Invalidation Levels

Daily close below $63,000 weakens bullish thesis.

Break below $60,000 expands downside targets.

Final Strategic View

Bitcoin’s 7–8% rebound is technically meaningful but not structurally decisive. The market sits inside a compression zone between $63K and $70K.

Above $70K → bullish momentum builds.

Below $63K → correction deepens.

Until confirmation appears, disciplined positioning and controlled exposure remain the optimal approach.

Bitcoin Bounce

The recent move in Bitcoin from the $63,000 zone toward $68,000 has triggered an intense debate among traders, analysts, and institutional observers. The key question is simple but critical: Is this the beginning of a sustainable recovery, or just a temporary relief rally inside a broader corrective phase?

🟢 Bullish Argument – More Bounce Likely

The bullish camp argues that the market showed strong resilience. Despite geopolitical shock headlines and heavy fear sentiment, BTC did not collapse further. Instead, it quickly rebounded nearly 7–8% from the lows. Historically, when markets stop falling on bad news, it often signals seller exhaustion.

Technical indicators support this view. Daily RSI reached deeply oversold territory, marking one of the most stretched conditions in recent history. Funding rates compressed, leverage flushed, and weak hands exited. That type of reset often creates fuel for short squeezes and relief extensions.

Support between $63,000–$65,000 has now been defended multiple times. Each retest produced higher intraday lows on lower timeframes. Bulls argue that as long as $65,000 holds on daily closes, the probability of another push toward $70,000 increases. A confirmed breakout above $70,000 with volume could open expansion toward $73,000–$80,000.

Sentiment is also a factor. Extreme fear readings historically align closer to bottoms than tops. When the majority expects further collapse, markets sometimes reverse unexpectedly. From this angle, the bounce may not be random — it may be structural accumulation beginning quietly.

🔴 Bearish Argument – Bounce Is Temporary

The bearish camp counters with structure. Since the October 2025 peak near $126,000, the trend remains defined by lower highs and corrective formations. The recent bounce has not broken any major resistance. $68,000–$70,000 remains heavy supply, and every approach so far has been rejected.

Volume on the rebound appears muted compared to prior breakdown candles. That suggests short covering rather than strong new demand. Without expanding volume, upside continuation becomes statistically weaker.

Macro conditions also remain uncertain. Risk assets are sensitive to geopolitical stress and rate expectations. If external volatility spikes again, BTC could easily retest $63,000. A daily close below that level would likely accelerate downside momentum toward $60,000 or lower.

From a cycle perspective, bears argue the correction phase may not be fully mature. Historically, deeper consolidations often include multiple relief rallies before final stabilization. Therefore, this bounce could simply be another mid-correction move.

⚖️ Balanced Assessment

Both sides present valid data-driven arguments. The bounce itself is real and technically measurable. However, structure remains neutral-to-bearish until $70,000 is decisively reclaimed.

Holding above $65,000 increases odds of another attempt at resistance. Losing $63,000 weakens the entire recovery thesis.

In short:

Above $70,000 → structure shifts bullish.

Between $63,000–$70,000 → volatile compression zone.

Below $63,000 → downside risk expands.

The market is not at confirmation yet. It is at decision.

Bitcoin (BTC) – Current Forecast, Bounce %, Trader Positioning & Next Trading Plan (2026)

This is a fully extended, execution-oriented update based on aggregated real-time market data as of March 2, 2026.

Bitcoin is trading around $65,700–$66,200 after bouncing from intraday lows near $63,000. The move represents approximately a 7–8% recovery from the swing low to the recent $68,000 zone.

1️⃣ How Much Has BTC Bounced?

From ~$63,000 to ~$68,200 → ~7–8% recovery.

From March 1 close near ~$65,700 to ~$66,000+ → ~1–2% stabilization.

From the October 2025 all-time high near $126,000, price remains roughly 47–48% lower. This confirms the broader correction remains intact despite short-term relief.

The bounce improved sentiment but did not yet confirm trend reversal.

2️⃣ Current Market Structure

Daily chart shows corrective consolidation with lower highs.

4H chart shows defended support at $63K–$65K but resistance near $68K–$70K.

Weekly bias remains cautious while below major moving averages.

The active range is $63K–$70K. A breakout or breakdown from this compression is likely to define the next directional move.

3️⃣ Trader Positioning

Sentiment remains cautious. Extreme fear conditions triggered capitulation selling, but derivatives funding has normalized. Leverage is lighter than during prior peaks.

Institutional flows appear mixed but stabilizing. Retail positioning remains divided between dip-buyers and breakdown sellers.

Overall mood: defensive but not panic-driven.

4️⃣ Key Technical Levels

Support: $65,000–$66,000

$63,000–$64,000

$60,000–$62,000

Resistance: $68,000–$68,600

$70,000

$72,000–$73,000

These levels define all short-term trade decisions.

5️⃣ Forecast Scenarios

Scenario A – Controlled Relief Rally

Hold $65K → Break $70K → Target $73K–$80K

Scenario B – Pullback Then Rally

Reject $68K → Retest $63K → Bounce if holds

Scenario C – Bear Continuation

Break $63K → Target $60K or lower

Scenario D – Strong Momentum Shift

Clean reclaim $70K → Acceleration above $80K

Current bias remains neutral-to-bearish until resistance is reclaimed.

6️⃣ Short-Term Trading Strategy

Breakout Entry: Daily close above $70K

Targets: $72K → $73K–$80K

Stop: Below $66K

Pullback Entry: Buy zone $63K–$65K

Targets: $68.6K → $70K

Stop: Below $62.5K

Risk per trade should remain controlled and structured.

7️⃣ Swing Plan (2–6 Weeks)

Accumulate near strong support confirmations.

Distribute into resistance expansions.

Maintain disciplined risk-to-reward structure.

8️⃣ Macro Influences

Geopolitical volatility, rate expectations, ETF flows, and equity correlation remain primary drivers. Bitcoin remains sensitive to global risk shifts.

9️⃣ Invalidation Levels

Daily close below $63,000 weakens bullish thesis.

Break below $60,000 expands downside targets.

Final Strategic View

Bitcoin’s 7–8% rebound is technically meaningful but not structurally decisive. The market sits inside a compression zone between $63K and $70K.

Above $70K → bullish momentum builds.

Below $63K → correction deepens.

Until confirmation appears, disciplined positioning and controlled exposure remain the optimal approach.