# MarketStructure

5.63K

Maxi024

Everyone is watching price… but the real signal right now is TIME ⏳

Let’s break it down:

$BTC

🔹 The first range of this downtrend lasted 55 days (~21%)

🔹 The current range is 22 days in (~20%) and still developingSame size. Different duration.

Why does this matter?

Price shows the level.

Time shows the battle between buyers and sellers.

A long range = strong demand absorbing supply.

A short range = sellers are in control and buyers are just liquidity.

The first structure took nearly 2 months to break → buyers were active, defending value.If this current range breaks down faster, it means:

➡

Let’s break it down:

$BTC

🔹 The first range of this downtrend lasted 55 days (~21%)

🔹 The current range is 22 days in (~20%) and still developingSame size. Different duration.

Why does this matter?

Price shows the level.

Time shows the battle between buyers and sellers.

A long range = strong demand absorbing supply.

A short range = sellers are in control and buyers are just liquidity.

The first structure took nearly 2 months to break → buyers were active, defending value.If this current range breaks down faster, it means:

➡

BTC-1,31%

- Reward

- 2

- Comment

- Repost

- Share

#CryptoSurvivalGuide

🔥 #CryptoSurvivalGuide — HOW TO STAY ALIVE IN A BLEEDING MARKET 🔥

When BTC struggles near major levels and alts keep printing lower highs, this is no longer a “make money fast” phase.

This is a capital preservation phase.

Survival first. Profits later.

🛡 1️⃣ Rule #1 — Protect Capital

In drawdown conditions:

• Reduce position size

• Avoid over-leverage

• Cut weak setups fast

• Keep majority capital in stable form

If you survive the storm, you trade the sunshine.

📊 2️⃣ Trade Structure, Not Hope

Ask yourself before every entry:

✔ Is market structure bullish or broken?

✔

🔥 #CryptoSurvivalGuide — HOW TO STAY ALIVE IN A BLEEDING MARKET 🔥

When BTC struggles near major levels and alts keep printing lower highs, this is no longer a “make money fast” phase.

This is a capital preservation phase.

Survival first. Profits later.

🛡 1️⃣ Rule #1 — Protect Capital

In drawdown conditions:

• Reduce position size

• Avoid over-leverage

• Cut weak setups fast

• Keep majority capital in stable form

If you survive the storm, you trade the sunshine.

📊 2️⃣ Trade Structure, Not Hope

Ask yourself before every entry:

✔ Is market structure bullish or broken?

✔

BTC-1,31%

- Reward

- 14

- 17

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#CLARITYActAdvances y

#CLARITYActAdvances 🇺🇸📜

📅 22 Feb

The CLARITY Act is moving forward — and this is more than just another headline.

For years, crypto markets have operated in regulatory gray zones. Now, policymakers are pushing toward clearer definitions around digital assets, oversight, and market structure.

Why This Matters 👇

🔹 Clearer distinction between securities and commodities

🔹 Defined roles for regulators

🔹 Reduced uncertainty for builders and investors

🔹 Potential boost in institutional confidence

Markets don’t just move on hype — they move on certainty.

Regulatory clari

#CLARITYActAdvances 🇺🇸📜

📅 22 Feb

The CLARITY Act is moving forward — and this is more than just another headline.

For years, crypto markets have operated in regulatory gray zones. Now, policymakers are pushing toward clearer definitions around digital assets, oversight, and market structure.

Why This Matters 👇

🔹 Clearer distinction between securities and commodities

🔹 Defined roles for regulators

🔹 Reduced uncertainty for builders and investors

🔹 Potential boost in institutional confidence

Markets don’t just move on hype — they move on certainty.

Regulatory clari

- Reward

- 11

- 20

- Repost

- Share

AngelEye :

:

To The Moon 🌕View More

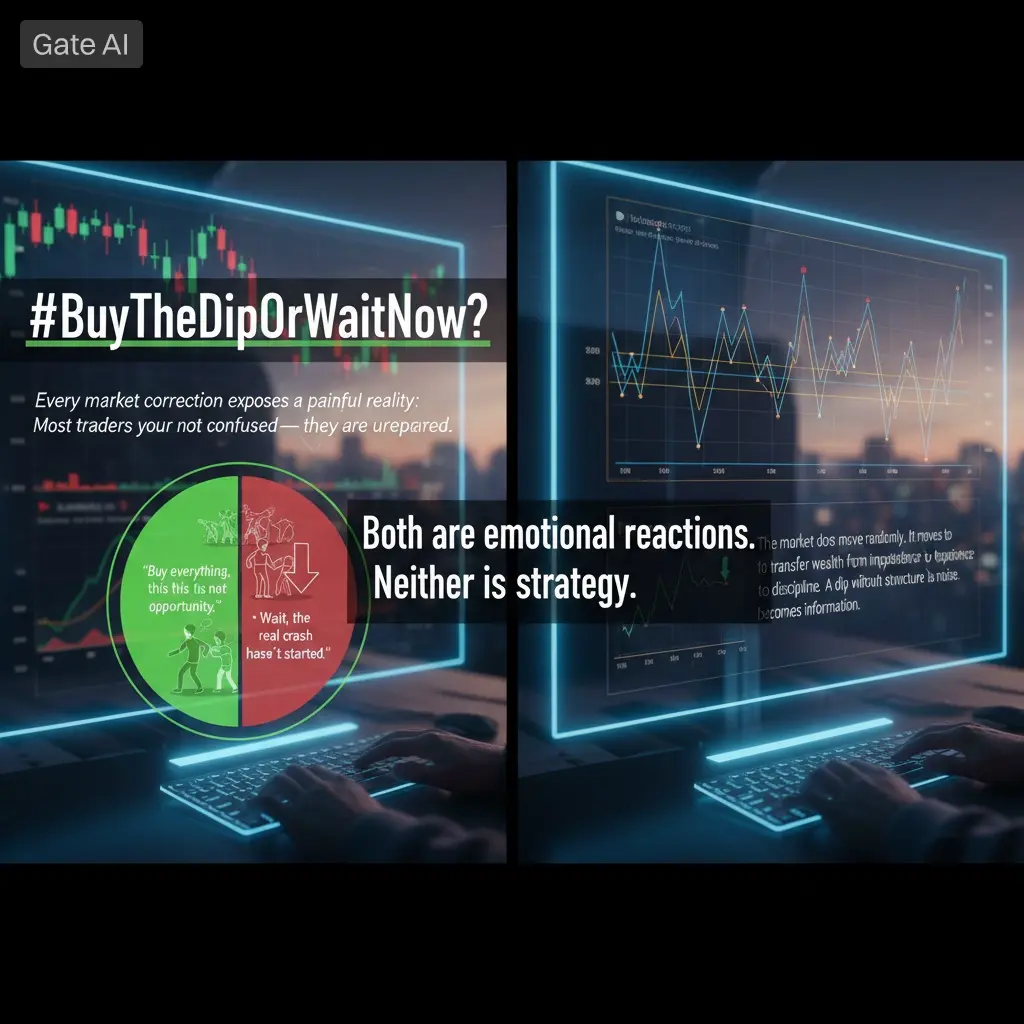

#BuyTheDipOrWaitNow? Every market correction exposes a painful reality:

Most traders are not confused — they are unprepared.

When price drops, social feeds split into two camps: • “Buy everything, this is the opportunity.”

• “Wait, the real crash hasn’t started.”

Both are emotional reactions.

Neither is a strategy.

The market does not move randomly.

It moves to transfer wealth from impatience to discipline.

A dip without context is noise.

A dip with structure becomes information.

Before entering any position, experienced traders evaluate the market from the top down:

1️⃣ Market Structure Comes

Most traders are not confused — they are unprepared.

When price drops, social feeds split into two camps: • “Buy everything, this is the opportunity.”

• “Wait, the real crash hasn’t started.”

Both are emotional reactions.

Neither is a strategy.

The market does not move randomly.

It moves to transfer wealth from impatience to discipline.

A dip without context is noise.

A dip with structure becomes information.

Before entering any position, experienced traders evaluate the market from the top down:

1️⃣ Market Structure Comes

- Reward

- 11

- 11

- Repost

- Share

AYATTAC :

:

LFG 🔥View More

#BuyTheDipOrWaitNow?

📉⚡ #BuyTheDipOrWaitNow

The market pulled back.

Now comes the real test — discipline.

Every dip feels like opportunity.

But not every dip is support.

🔎 The Real Question Isn’t “Buy or Wait?”

It’s:

• Is structure still intact?

• Are buyers stepping in with volume?

• Is risk clearly defined?

• Or are you reacting to fear?

🧠 Smart Approach

🟢 Buy the dip when price holds strong demand zones and risk is small.

🟡 Wait when price is mid-range, unclear, or momentum is weak.

Sometimes patience makes more money than action.

🎯 Remember:

Capital preservation > catching bottoms.

📉⚡ #BuyTheDipOrWaitNow

The market pulled back.

Now comes the real test — discipline.

Every dip feels like opportunity.

But not every dip is support.

🔎 The Real Question Isn’t “Buy or Wait?”

It’s:

• Is structure still intact?

• Are buyers stepping in with volume?

• Is risk clearly defined?

• Or are you reacting to fear?

🧠 Smart Approach

🟢 Buy the dip when price holds strong demand zones and risk is small.

🟡 Wait when price is mid-range, unclear, or momentum is weak.

Sometimes patience makes more money than action.

🎯 Remember:

Capital preservation > catching bottoms.

- Reward

- 3

- 2

- Repost

- Share

AYATTAC :

:

To The Moon 🌕View More

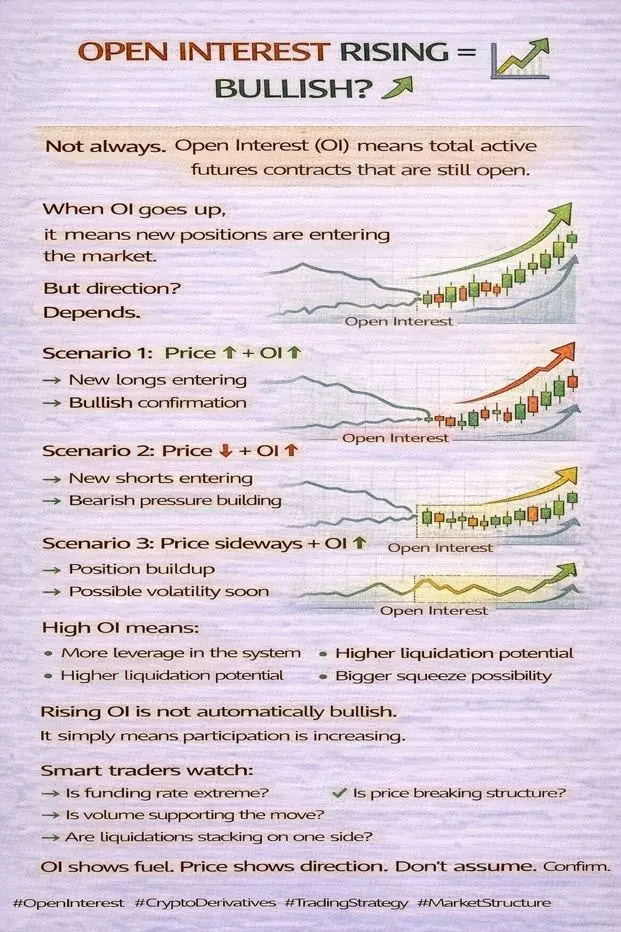

OPEN INTEREST RISING = BULLISH? 📈

Not always.

Open Interest (OI)

means total active futures contracts

that are still open.

When OI goes up,

it means new positions are entering the market.

But direction?

Depends.

Scenario 1:

Price ↑ + OI ↑

→ New longs entering

→ Bullish confirmation

Scenario 2:

Price ↓ + OI ↑

→ New shorts entering

→ Bearish pressure building

Scenario 3:

Price sideways + OI ↑

→ Position buildup

→ Possible volatility soon

High OI means:

• More leverage in the system

• Higher liquidation potential

• Bigger squeeze possibility

Rising OI is not automatically bullish.

It simply mean

Not always.

Open Interest (OI)

means total active futures contracts

that are still open.

When OI goes up,

it means new positions are entering the market.

But direction?

Depends.

Scenario 1:

Price ↑ + OI ↑

→ New longs entering

→ Bullish confirmation

Scenario 2:

Price ↓ + OI ↑

→ New shorts entering

→ Bearish pressure building

Scenario 3:

Price sideways + OI ↑

→ Position buildup

→ Possible volatility soon

High OI means:

• More leverage in the system

• Higher liquidation potential

• Bigger squeeze possibility

Rising OI is not automatically bullish.

It simply mean

- Reward

- 6

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? #BuyTheDipOrWaitNow? 📊

₿ Decision Zone for Bitcoin: $69K–$70K

Mid-February 2026 finds BTC hovering near the $70,000 mark after a sharp rebound from the $65K sell-off. That move lower was not gentle — leverage got wiped, sentiment collapsed, ETFs saw pressure, and macro uncertainty spiked.

Yet the recovery tells us something important: buyers didn’t disappear.

Still, context matters. Price remains well below the late-2025 peak near $126K. This is best viewed as a post-bull-cycle correction, not a fresh breakout into new highs.

🧩 What Caused the Drop?

• Profit-taking after

₿ Decision Zone for Bitcoin: $69K–$70K

Mid-February 2026 finds BTC hovering near the $70,000 mark after a sharp rebound from the $65K sell-off. That move lower was not gentle — leverage got wiped, sentiment collapsed, ETFs saw pressure, and macro uncertainty spiked.

Yet the recovery tells us something important: buyers didn’t disappear.

Still, context matters. Price remains well below the late-2025 peak near $126K. This is best viewed as a post-bull-cycle correction, not a fresh breakout into new highs.

🧩 What Caused the Drop?

• Profit-taking after

BTC-1,31%

- Reward

- 7

- 13

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

📊 OM/USDT – Momentum Breakout & Technical Outlook (4H)

Current Price: ~$0.0581

24H Change: +24%

Context: Strong volatility expansion after prolonged consolidation

🔍 Market Structure

OM spent a significant period in range-bound accumulation, followed by a high-momentum breakout.

Price has now expanded well above EMA(7), EMA(25), and EMA(99), confirming a trend shift to bullish on the 4H timeframe.

The impulsive candle suggests aggressive participation, often seen at the start of a new directional move.

📈 Momentum & Indicators

Williams %R (~ −44):

Momentum is neutral-to-strong, not yet overbo

Current Price: ~$0.0581

24H Change: +24%

Context: Strong volatility expansion after prolonged consolidation

🔍 Market Structure

OM spent a significant period in range-bound accumulation, followed by a high-momentum breakout.

Price has now expanded well above EMA(7), EMA(25), and EMA(99), confirming a trend shift to bullish on the 4H timeframe.

The impulsive candle suggests aggressive participation, often seen at the start of a new directional move.

📈 Momentum & Indicators

Williams %R (~ −44):

Momentum is neutral-to-strong, not yet overbo

OM-4,38%

- Reward

- like

- Comment

- Repost

- Share

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵🚀

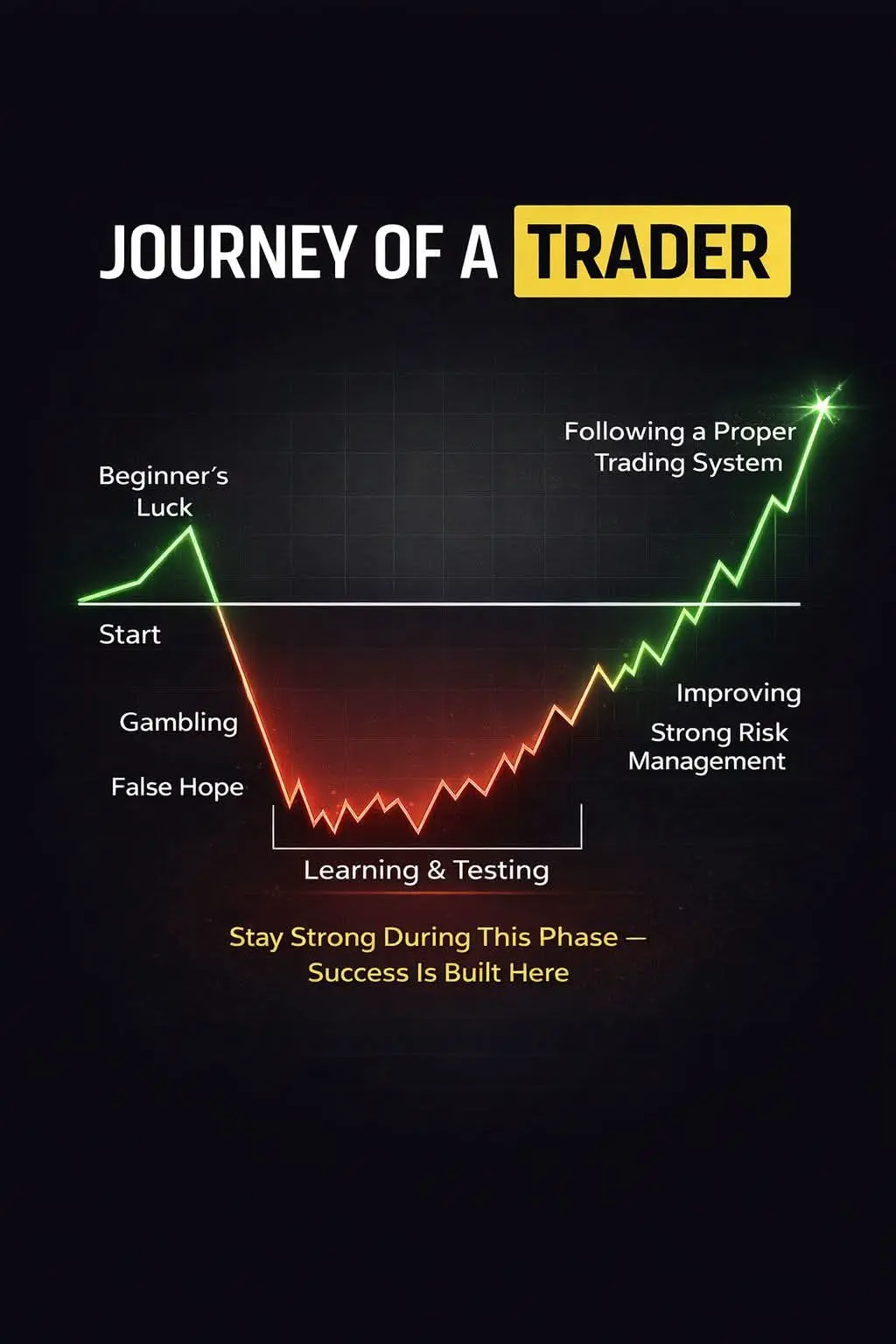

Every trader starts with excitement. Some get lucky. Most face losses. The real difference? The ones who don’t quit during the learning phase.

Losses teach. Discipline builds. Risk management protects.

And consistency creates success. 📈

If you’re in the “Learning & Testing” phase right now — stay strong. This is where real traders are made.

#tradingjourney #swingtrading #financialfreedom #marketstructure #GateSquare$50KRedPacketGiveaway $BTC $SOL $THE

Every trader starts with excitement. Some get lucky. Most face losses. The real difference? The ones who don’t quit during the learning phase.

Losses teach. Discipline builds. Risk management protects.

And consistency creates success. 📈

If you’re in the “Learning & Testing” phase right now — stay strong. This is where real traders are made.

#tradingjourney #swingtrading #financialfreedom #marketstructure #GateSquare$50KRedPacketGiveaway $BTC $SOL $THE

- Reward

- 3

- Comment

- Repost

- Share

#BitcoinBouncesBack

As of today, Bitcoin’s bounce feels more like a calculated response than an emotional relief rally. After a period of pressure and uncertainty, price action is showing signs of stabilization, suggesting that buyers are stepping in selectively rather than chasing momentum. This kind of rebound often reflects improving confidence, but not blind optimism.

What stands out is how the bounce is forming. Volume remains controlled, volatility is cooling, and panic selling appears to have faded. Historically, these conditions tend to favor short-term consolidation before the market

As of today, Bitcoin’s bounce feels more like a calculated response than an emotional relief rally. After a period of pressure and uncertainty, price action is showing signs of stabilization, suggesting that buyers are stepping in selectively rather than chasing momentum. This kind of rebound often reflects improving confidence, but not blind optimism.

What stands out is how the bounce is forming. Volume remains controlled, volatility is cooling, and panic selling appears to have faded. Historically, these conditions tend to favor short-term consolidation before the market

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

Watching Closely 🔍️View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

289.43K Popularity

21.95K Popularity

35.31K Popularity

11.68K Popularity

448.57K Popularity

340.5K Popularity

2.93K Popularity

98.43K Popularity

11.28K Popularity

94.04K Popularity

14.85K Popularity

10.71K Popularity

5.29K Popularity

5.68K Popularity

38.84K Popularity

News

View MoreTraditional Finance Drop Alert: JPN225 Falls Over 1.5%

8 m

Grayscale: As AI impacts tech stocks, blockchain may become a long-term beneficiary

14 m

Netflix stock surged nearly 8% after the disk, showing strong performance

19 m

MARA expands its AI data center business, stock price rises 17% after hours

20 m

Benchmark is optimistic about Strategy's shift to the STRC financing model, setting a target price of $705.

25 m

Pin