# GeopoliticalRiskImpact

25.69K

Rising geopolitical tensions are pushing gold, silver, and oil higher, benefiting safe-haven assets overall. Crypto markets are also feeling the macro pressure, with volatility likely to increase. Do you see this environment as bullish or bearish for crypto? Would you reduce exposure or look for defensive crypto assets?

repanzal

#MiddleEastTensionsEscalate

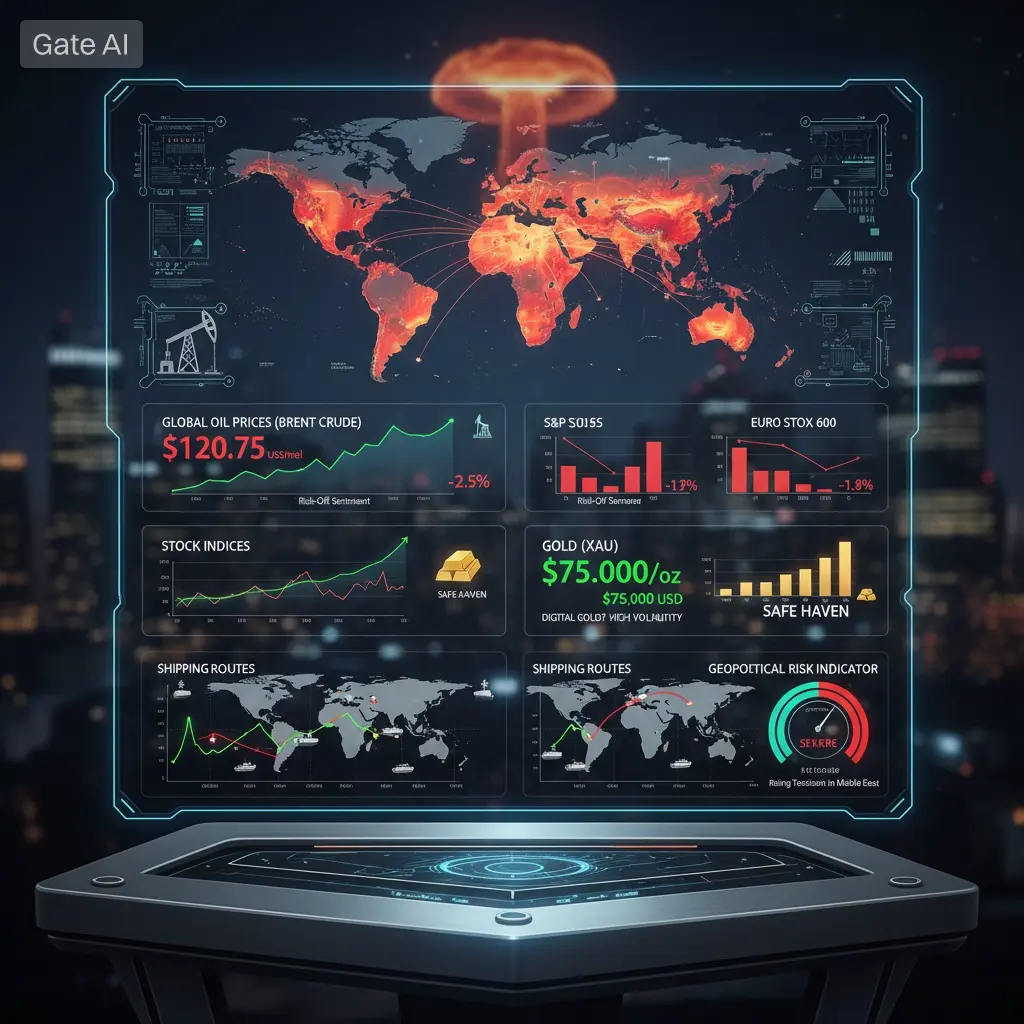

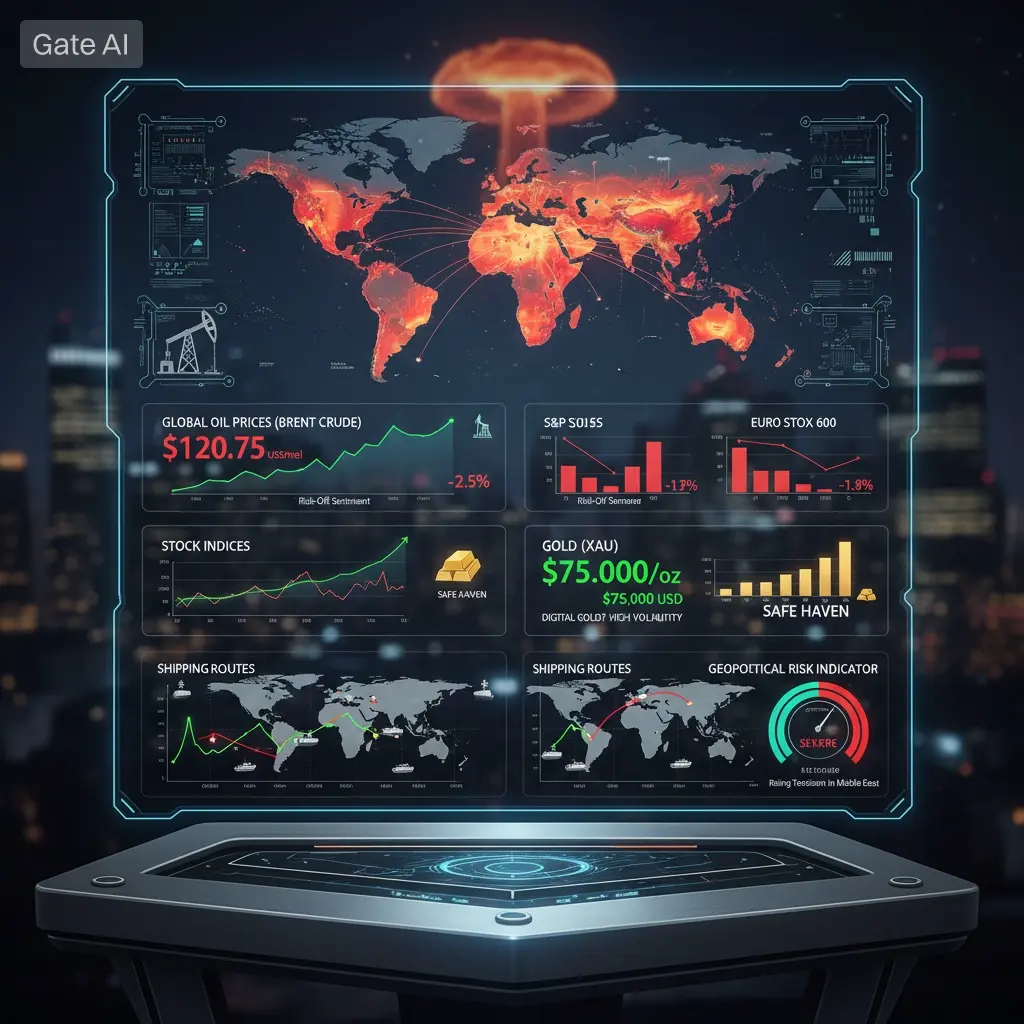

Rising tensions in the Middle East are once again reshaping global market dynamics. As geopolitical risks intensify, investors across traditional and digital markets are reassessing exposure, risk appetite, and safe-haven strategies. The region’s strategic importance to energy supply, trade routes, and global stability makes these developments highly significant.

Below is a detailed, point-by-point breakdown of the market implications.

1️⃣ Geopolitical Risk Premium Is Rising

Escalating tensions increase uncertainty across global markets. Investors tend to price in

Rising tensions in the Middle East are once again reshaping global market dynamics. As geopolitical risks intensify, investors across traditional and digital markets are reassessing exposure, risk appetite, and safe-haven strategies. The region’s strategic importance to energy supply, trade routes, and global stability makes these developments highly significant.

Below is a detailed, point-by-point breakdown of the market implications.

1️⃣ Geopolitical Risk Premium Is Rising

Escalating tensions increase uncertainty across global markets. Investors tend to price in

- Reward

- 6

- 3

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🌱 “Growth mindset activated! Learning so much from these posts.”View More

#MiddleEastTensionsEscalate

Rising tensions in the Middle East are once again reshaping global market dynamics. As geopolitical risks intensify, investors across traditional and digital markets are reassessing exposure, risk appetite, and safe-haven strategies. The region’s strategic importance to energy supply, trade routes, and global stability makes these developments highly significant.

Below is a detailed, point-by-point breakdown of the market implications.

1️⃣ Geopolitical Risk Premium Is Rising

Escalating tensions increase uncertainty across global markets. Investors tend to price in

Rising tensions in the Middle East are once again reshaping global market dynamics. As geopolitical risks intensify, investors across traditional and digital markets are reassessing exposure, risk appetite, and safe-haven strategies. The region’s strategic importance to energy supply, trade routes, and global stability makes these developments highly significant.

Below is a detailed, point-by-point breakdown of the market implications.

1️⃣ Geopolitical Risk Premium Is Rising

Escalating tensions increase uncertainty across global markets. Investors tend to price in

- Reward

- 1

- Comment

- Repost

- Share

#GeopoliticalRiskImpact 🌍💹

Geopolitics, Power Shifts, and Crypto: The Digital Shield Narrative of 2026

In 2026, global markets are no longer driven solely by interest rates and earnings. Geopolitical tensions, strategic alliances, and economic pressure tactics are shaping capital flows—and cryptocurrencies are emerging as strategic defensive assets.

🔹 Crypto as a Hedge Against Geopolitical Stress

Ongoing conflicts (e.g., US–Venezuela standoff) disrupt energy markets, sparking inflation and supply concerns.

Traditionally, capital flowed into gold—but now Bitcoin is increasingly absorbing tha

Geopolitics, Power Shifts, and Crypto: The Digital Shield Narrative of 2026

In 2026, global markets are no longer driven solely by interest rates and earnings. Geopolitical tensions, strategic alliances, and economic pressure tactics are shaping capital flows—and cryptocurrencies are emerging as strategic defensive assets.

🔹 Crypto as a Hedge Against Geopolitical Stress

Ongoing conflicts (e.g., US–Venezuela standoff) disrupt energy markets, sparking inflation and supply concerns.

Traditionally, capital flowed into gold—but now Bitcoin is increasingly absorbing tha

- Reward

- 1

- 2

- Repost

- Share

PEUNDU :

:

fhcchgchchcView More

#GeopoliticalRiskImpact

#GeopoliticalRiskImpact

Geopolitical risk is becoming one of the most powerful forces shaping global markets, including crypto, stocks, gold, and commodities. Every conflict, election, sanction, or political tension changes how money flows around the world. Traders and investors now react not only to charts but also to headlines.

When geopolitical tension rises, fear usually enters the market. Investors move away from risky assets and look for safety. Gold, the US dollar, and sometimes oil benefit from this fear. At the same time, stocks and high risk assets often face

#GeopoliticalRiskImpact

Geopolitical risk is becoming one of the most powerful forces shaping global markets, including crypto, stocks, gold, and commodities. Every conflict, election, sanction, or political tension changes how money flows around the world. Traders and investors now react not only to charts but also to headlines.

When geopolitical tension rises, fear usually enters the market. Investors move away from risky assets and look for safety. Gold, the US dollar, and sometimes oil benefit from this fear. At the same time, stocks and high risk assets often face

BTC0,95%

- Reward

- 1

- Comment

- Repost

- Share

#GeopoliticalRiskImpact

#GeopoliticalRiskImpact

Geopolitical risk is becoming one of the most powerful forces shaping global markets, including crypto, stocks, gold, and commodities. Every conflict, election, sanction, or political tension changes how money flows around the world. Traders and investors now react not only to charts but also to headlines.

When geopolitical tension rises, fear usually enters the market. Investors move away from risky assets and look for safety. Gold, the US dollar, and sometimes oil benefit from this fear. At the same time, stocks and high risk assets often face

#GeopoliticalRiskImpact

Geopolitical risk is becoming one of the most powerful forces shaping global markets, including crypto, stocks, gold, and commodities. Every conflict, election, sanction, or political tension changes how money flows around the world. Traders and investors now react not only to charts but also to headlines.

When geopolitical tension rises, fear usually enters the market. Investors move away from risky assets and look for safety. Gold, the US dollar, and sometimes oil benefit from this fear. At the same time, stocks and high risk assets often face

BTC0,95%

- Reward

- 5

- 6

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

*#GeopoliticalRiskImpact 🌍⚠️ | Global Tensions Reshaping Crypto Markets**

Geopolitical risks are becoming one of the most influential macro forces driving global financial markets — and crypto is no exception. Escalating conflicts, strategic power shifts, sanctions, trade restrictions, and political instability are increasingly shaping liquidity flows, investor psychology, and long-term adoption trends.

In periods of geopolitical stress, markets move less on technicals and more on headlines. Understanding this dynamic is critical for navigating volatility.

🌐 Key Geopolitical Drivers Impactin

Geopolitical risks are becoming one of the most influential macro forces driving global financial markets — and crypto is no exception. Escalating conflicts, strategic power shifts, sanctions, trade restrictions, and political instability are increasingly shaping liquidity flows, investor psychology, and long-term adoption trends.

In periods of geopolitical stress, markets move less on technicals and more on headlines. Understanding this dynamic is critical for navigating volatility.

🌐 Key Geopolitical Drivers Impactin

BTC0,95%

- Reward

- 3

- 2

- Repost

- Share

JenaTran :

:

Buy to make money 💎View More

#GeopoliticalRiskImpact Geopolitics, Power Shifts, and Crypto: The Digital Shield Narrative of 2026

As 2026 unfolds, global financial markets are no longer responding solely to interest rate decisions or corporate earnings. Today’s landscape is defined by geopolitical maneuvering, strategic alliances, and economic pressure tactics. In this environment, cryptocurrencies have moved far beyond their early speculative identity and are increasingly recognized as strategic financial instruments within global power dynamics.

⚡ Geopolitical Stress and Crypto as a Defensive Asset

Heightened diplomatic

As 2026 unfolds, global financial markets are no longer responding solely to interest rate decisions or corporate earnings. Today’s landscape is defined by geopolitical maneuvering, strategic alliances, and economic pressure tactics. In this environment, cryptocurrencies have moved far beyond their early speculative identity and are increasingly recognized as strategic financial instruments within global power dynamics.

⚡ Geopolitical Stress and Crypto as a Defensive Asset

Heightened diplomatic

- Reward

- 13

- 8

- Repost

- Share

rameshmattu :

:

Happy New Year! 🤑View More

#GeopoliticalRiskImpact Geopolitics, Power Shifts, and Crypto: The Digital Shield Narrative of 2026

As 2026 unfolds, global financial markets are no longer responding solely to interest rate decisions or corporate earnings. Today’s landscape is defined by geopolitical maneuvering, strategic alliances, and economic pressure tactics. In this environment, cryptocurrencies have moved far beyond their early speculative identity and are increasingly recognized as strategic financial instruments within global power dynamics.

⚡ Geopolitical Stress and Crypto as a Defensive Asset

Heightened diplomatic

As 2026 unfolds, global financial markets are no longer responding solely to interest rate decisions or corporate earnings. Today’s landscape is defined by geopolitical maneuvering, strategic alliances, and economic pressure tactics. In this environment, cryptocurrencies have moved far beyond their early speculative identity and are increasingly recognized as strategic financial instruments within global power dynamics.

⚡ Geopolitical Stress and Crypto as a Defensive Asset

Heightened diplomatic

- Reward

- 9

- 6

- Repost

- Share

ybaser :

:

Watching Closely 🔍️View More

#GeopoliticalRiskImpact

🛡️ Is This THE Moment of Truth for Crypto as a Safe Haven?

As of mid‑January 2026, the global macro backdrop looks extremely volatile:

🎯 Traditional Safe Havens Are Roaring

Gold has smashed records, trading above ~$4,600/oz and flirting with price discovery toward $5,000 — driven by geopolitical tensions, central bank accumulation, and safe‑haven demand. Silver has also surged to new historic highs above ~$86–$88/oz.

This reflects broad capital flows into traditional hedges when uncertainty spikes — and suggests investors are still leaning on metals for protection.

🛡️ Is This THE Moment of Truth for Crypto as a Safe Haven?

As of mid‑January 2026, the global macro backdrop looks extremely volatile:

🎯 Traditional Safe Havens Are Roaring

Gold has smashed records, trading above ~$4,600/oz and flirting with price discovery toward $5,000 — driven by geopolitical tensions, central bank accumulation, and safe‑haven demand. Silver has also surged to new historic highs above ~$86–$88/oz.

This reflects broad capital flows into traditional hedges when uncertainty spikes — and suggests investors are still leaning on metals for protection.

- Reward

- 6

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#GeopoliticalRiskImpact GeopoliticalRiskImpact | Crypto as the Digital Shield of 2026 🚀

2026 isn’t shaping up like previous market cycles — it feels structural.

As geopolitical pressure intensifies globally, financial markets are responding not just to monetary policy, but to power dynamics, sanctions, and strategic alliances. In this evolving landscape, cryptocurrencies are no longer fringe instruments — they are becoming strategic financial hedges.

🌐 1. Geopolitical Stress Is Real and Growing

From U.S.–Venezuela tensions to multifaceted regional conflicts, global instability is now a core

2026 isn’t shaping up like previous market cycles — it feels structural.

As geopolitical pressure intensifies globally, financial markets are responding not just to monetary policy, but to power dynamics, sanctions, and strategic alliances. In this evolving landscape, cryptocurrencies are no longer fringe instruments — they are becoming strategic financial hedges.

🌐 1. Geopolitical Stress Is Real and Growing

From U.S.–Venezuela tensions to multifaceted regional conflicts, global instability is now a core

- Reward

- 5

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

42.47M Popularity

152.69K Popularity

102.92K Popularity

1.67M Popularity

497.59K Popularity

9.9K Popularity

9.44K Popularity

22.42K Popularity

4.93K Popularity

362.29K Popularity

46.07K Popularity

103.76K Popularity

18.07K Popularity

71.39K Popularity

8.92K Popularity

News

View MoreBTC Breaks Through 66,000 USDT

10 m

Freedom of Money surged 6715.35% after launching Alpha, current price 0.0070307 USDT

16 m

Data: If BTC drops below $61,952, the total long liquidation strength on mainstream CEXs will reach $1.216 billion.

34 m

Data: If ETH drops below $1,809, the total long liquidation strength on major CEXs will reach $791 million.

35 m

BULLA increased by 50.55% after launching Alpha, current price is 0.02304 USDT

2 h

Pin