ox_Alan

No content yet

ox_Alan

#USSECPushesCryptoReform

The regulatory landscape for digital assets may be approaching a turning point as the U.S. Securities and Exchange Commission continues signaling a more structured approach toward crypto oversight. After years of enforcement-driven policy, growing industry pressure, legal challenges, and market evolution appear to be reshaping how regulators think about digital assets.

For a long time, the crypto industry has criticized regulation in the United States as unclear, reactive, and heavily dependent on lawsuits rather than formal rulemaking. Many companies argued they were

The regulatory landscape for digital assets may be approaching a turning point as the U.S. Securities and Exchange Commission continues signaling a more structured approach toward crypto oversight. After years of enforcement-driven policy, growing industry pressure, legal challenges, and market evolution appear to be reshaping how regulators think about digital assets.

For a long time, the crypto industry has criticized regulation in the United States as unclear, reactive, and heavily dependent on lawsuits rather than formal rulemaking. Many companies argued they were

- Reward

- 1

- Comment

- Repost

- Share

#TrumpAnnouncesNewTariffs

🔥 #TrumpAnnouncesNewTariffs — MACRO SHOCK OR POLITICAL SIGNAL? 🔥

When tariff headlines hit the market, crypto doesn’t stay neutral.

It reacts to liquidity expectations, USD strength, and risk sentiment shifts.

If new tariffs are introduced, here’s what traders should watch carefully 👇

📊 Macro Impact Breakdown

1️⃣ Risk-Off Pressure

Tariffs → Trade tension → Equity volatility

In early reactions, BTC often correlates with risk assets.

2️⃣ Dollar Strength vs Liquidity

If tariffs strengthen USD short-term:

• Emerging markets feel pressure

• Capital tightens

• Crypto l

🔥 #TrumpAnnouncesNewTariffs — MACRO SHOCK OR POLITICAL SIGNAL? 🔥

When tariff headlines hit the market, crypto doesn’t stay neutral.

It reacts to liquidity expectations, USD strength, and risk sentiment shifts.

If new tariffs are introduced, here’s what traders should watch carefully 👇

📊 Macro Impact Breakdown

1️⃣ Risk-Off Pressure

Tariffs → Trade tension → Equity volatility

In early reactions, BTC often correlates with risk assets.

2️⃣ Dollar Strength vs Liquidity

If tariffs strengthen USD short-term:

• Emerging markets feel pressure

• Capital tightens

• Crypto l

BTC-5,1%

- Reward

- 1

- Comment

- Repost

- Share

Option 1 – Informative & Professional

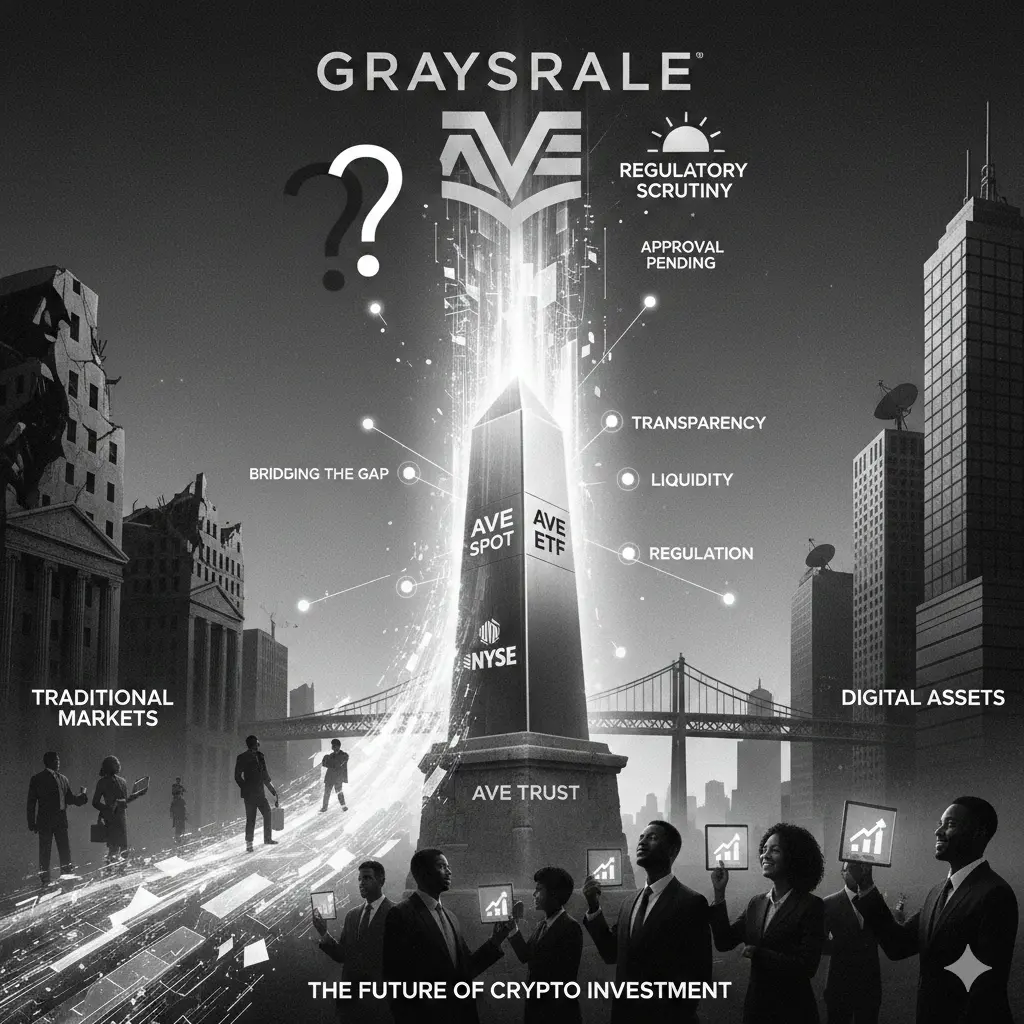

🚨 #GrayscaleEyesAVESpotETFConversion

Grayscale is reportedly exploring the conversion of its AVE trust into a spot ETF. If approved, this move could significantly increase accessibility, liquidity, and institutional participation in AVE.

A spot ETF structure may reduce tracking gaps and provide a more efficient investment vehicle for traditional markets.

Big step for AVE adoption if this moves forward. 📈

Option 2 – Short & Impactful

#GrayscaleEyesAVESpotETFConversion

Grayscale is eyeing a spot ETF conversion for AVE.

More access. More liquidity. More mai

🚨 #GrayscaleEyesAVESpotETFConversion

Grayscale is reportedly exploring the conversion of its AVE trust into a spot ETF. If approved, this move could significantly increase accessibility, liquidity, and institutional participation in AVE.

A spot ETF structure may reduce tracking gaps and provide a more efficient investment vehicle for traditional markets.

Big step for AVE adoption if this moves forward. 📈

Option 2 – Short & Impactful

#GrayscaleEyesAVESpotETFConversion

Grayscale is eyeing a spot ETF conversion for AVE.

More access. More liquidity. More mai

- Reward

- 2

- Comment

- Repost

- Share

#TrumpAnnouncesNewTariffs

The confirmation of the new tariff framework associated with Donald Trump’s trade policy signals a continued shift in global commerce strategy, with the latest ruling establishing a baseline 15% global import duty structure. Implemented within the broader economic policy environment of the United States, this adjustment represents one of the most consequential trade policy recalibrations in recent years, influencing cross-border supply chains, inflation expectations, and financial market sentiment.

From a macroeconomic perspective, the policy has not triggered system

The confirmation of the new tariff framework associated with Donald Trump’s trade policy signals a continued shift in global commerce strategy, with the latest ruling establishing a baseline 15% global import duty structure. Implemented within the broader economic policy environment of the United States, this adjustment represents one of the most consequential trade policy recalibrations in recent years, influencing cross-border supply chains, inflation expectations, and financial market sentiment.

From a macroeconomic perspective, the policy has not triggered system

- Reward

- 3

- 1

- Repost

- Share

ybaser :

:

Wishing you great wealth in the Year of the Horse 🐴#RussiaStudiesNationalStablecoin Russia and the Strategic Exploration of a National Stablecoin

Reports that Russia is studying the development of a national stablecoin framework signal a potential evolution in the country’s digital financial infrastructure. The initiative is widely viewed as part of a broader effort to strengthen monetary sovereignty while improving the efficiency of cross-border settlements. By exploring state-backed digital currency models, Russia may aim to reduce dependency on traditional international payment networks and create alternative liquidity channels for global t

Reports that Russia is studying the development of a national stablecoin framework signal a potential evolution in the country’s digital financial infrastructure. The initiative is widely viewed as part of a broader effort to strengthen monetary sovereignty while improving the efficiency of cross-border settlements. By exploring state-backed digital currency models, Russia may aim to reduce dependency on traditional international payment networks and create alternative liquidity channels for global t

- Reward

- 3

- 2

- Repost

- Share

HighAmbition :

:

good information 👍View More

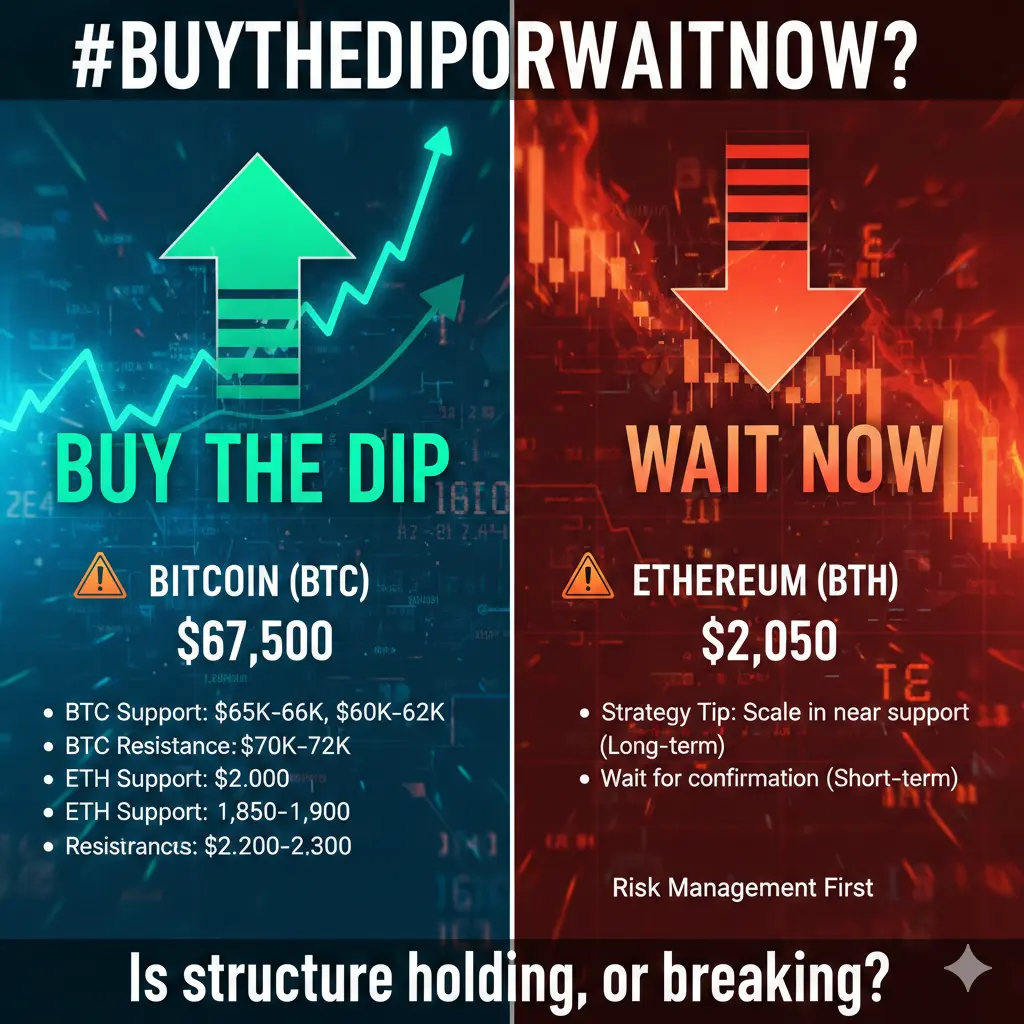

#BuyTheDipOrWaitNow? Markets are sitting at decision zones, and structure matters more than emotion right now.

Currently:

• Bitcoin trading around $67,000 – $68,000

• Ethereum trading near $2,000 – $2,100

These are not random numbers — they’re compression zones where momentum either rebuilds or breaks.

📊 Key Levels to Watch

🟠 Bitcoin (BTC)

Strong Support: $65,000 – $66,000

Major Support: $60,000 – $62,000

Resistance: $70,000 – $72,000

If BTC continues to defend the $65K area with rising spot volume and decreasing sell pressure, this zone may act as a higher-low structure within a broader upt

Currently:

• Bitcoin trading around $67,000 – $68,000

• Ethereum trading near $2,000 – $2,100

These are not random numbers — they’re compression zones where momentum either rebuilds or breaks.

📊 Key Levels to Watch

🟠 Bitcoin (BTC)

Strong Support: $65,000 – $66,000

Major Support: $60,000 – $62,000

Resistance: $70,000 – $72,000

If BTC continues to defend the $65K area with rising spot volume and decreasing sell pressure, this zone may act as a higher-low structure within a broader upt

- Reward

- 3

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊📊 Will the Altcoin Rally Start on March 1?

There’s a lot happening in crypto right now, and one date keeps coming up: March 1. Some investors are wondering if that could mark the beginning of the next altcoin rally.

The reason? Major regulatory movement in Washington.

🔸 March 1 Could Be a Turning Point

The White House has set a March 1 deadline to resolve the stablecoin rewards dispute that has been holding up the broader crypto market structure bill, often called the Clarity Act.

This bill aims to create clearer rules for crypto in the United States. And clarity is something the market has

There’s a lot happening in crypto right now, and one date keeps coming up: March 1. Some investors are wondering if that could mark the beginning of the next altcoin rally.

The reason? Major regulatory movement in Washington.

🔸 March 1 Could Be a Turning Point

The White House has set a March 1 deadline to resolve the stablecoin rewards dispute that has been holding up the broader crypto market structure bill, often called the Clarity Act.

This bill aims to create clearer rules for crypto in the United States. And clarity is something the market has

- Reward

- 4

- Comment

- Repost

- Share

So a while back, I called the dip on $pippin

It did over 8X from that dip entry a lot of people printed hard

Being a big coin, throwing in $1000 you’d come out with $8000 now

I’ve found multiple others printing a lot more X’s and I’ve more coming that I’ll be sharing

Be ready

It did over 8X from that dip entry a lot of people printed hard

Being a big coin, throwing in $1000 you’d come out with $8000 now

I’ve found multiple others printing a lot more X’s and I’ve more coming that I’ll be sharing

Be ready

PIPPIN8,02%

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

Wishing you great wealth in the Year of the Horse 🐴# ApollotoBuy90MMORPHOin4Years

🔥 APOLLO ARMY: LISTEN UP! 🔥

I see a lot of people panic-selling

over short-term charts. Turn off the 15-minute chart. Look at the 4-year

horizon.

We are building something here that

aims to rival the giants. We aren't just playing for small pumps; we are

playing for a valuation that competes with the top dogs like Morpho.

🎯 The Target: A position strong enough to represent

90M $MORPHO in value. 🗓️ The Timeline: 4 Years.

This is a marathon, not a sprint.

Accumulate, stake, and trust the tech. When the rest of the market realizes

what we're building, the

🔥 APOLLO ARMY: LISTEN UP! 🔥

I see a lot of people panic-selling

over short-term charts. Turn off the 15-minute chart. Look at the 4-year

horizon.

We are building something here that

aims to rival the giants. We aren't just playing for small pumps; we are

playing for a valuation that competes with the top dogs like Morpho.

🎯 The Target: A position strong enough to represent

90M $MORPHO in value. 🗓️ The Timeline: 4 Years.

This is a marathon, not a sprint.

Accumulate, stake, and trust the tech. When the rest of the market realizes

what we're building, the

MORPHO-6,09%

- Reward

- 3

- 1

- Repost

- Share

ybaser :

:

Wishing you great wealth in the Year of the Horse 🐴#GrayscaleEyesAVESpotETFConversion

Grayscale is taking a bold step in the crypto investment world with its push to convert the Grayscale AVE Trust into a spot ETF. This move marks a potential turning point for institutional and retail investors looking for direct exposure to AVE without the complexities of owning the underlying asset. A spot ETF provides a more transparent, liquid, and regulated way to invest compared to traditional trusts that often trade at significant premiums or discounts.

The conversion signals Grayscale’s confidence in the maturation of the crypto market. By offering a

Grayscale is taking a bold step in the crypto investment world with its push to convert the Grayscale AVE Trust into a spot ETF. This move marks a potential turning point for institutional and retail investors looking for direct exposure to AVE without the complexities of owning the underlying asset. A spot ETF provides a more transparent, liquid, and regulated way to invest compared to traditional trusts that often trade at significant premiums or discounts.

The conversion signals Grayscale’s confidence in the maturation of the crypto market. By offering a

- Reward

- 1

- Comment

- Repost

- Share

#ApollotoBuy90MMORPHOin4Years 🚀

Big news in the crypto space! 🌍 Apollo has officially announced its long-term plan to buy $90 million worth of MORPHO over the next four years — a move that signals strong confidence in the future of decentralized finance.

Apollo Global Management stepping into the MORPHO ecosystem is not just another investment headline. It represents institutional belief in sustainable DeFi growth. MORPHO has been gaining traction as a next-generation lending protocol, aiming to optimize capital efficiency and offer better yields for users compared to traditional DeFi platfo

Big news in the crypto space! 🌍 Apollo has officially announced its long-term plan to buy $90 million worth of MORPHO over the next four years — a move that signals strong confidence in the future of decentralized finance.

Apollo Global Management stepping into the MORPHO ecosystem is not just another investment headline. It represents institutional belief in sustainable DeFi growth. MORPHO has been gaining traction as a next-generation lending protocol, aiming to optimize capital efficiency and offer better yields for users compared to traditional DeFi platfo

MORPHO-6,09%

- Reward

- 3

- 2

- Repost

- Share

Yunna :

:

Wishing you great wealth in the Year of the Horse 🐴View More

#CelebratingNewYearOnGateSquare

#我在Gate广场过新年

Gate Square Ignites 2026: The Year of the Horse Grand Celebration

As the vibrant heart of the crypto community, Gate Square is charging into the 2026 Year of the Horse with an explosion of energy and rewards. This digital carnival unites the global community, blending festive cheer with a massive $50,000 prize pool. Running until mid-February, this event is expertly designed to transform your creativity into tangible earnings.

A Cascade of Rewards: Red Packets and GateToken Opportunities

One of the most thrilling aspects of the campaign is the c

#我在Gate广场过新年

Gate Square Ignites 2026: The Year of the Horse Grand Celebration

As the vibrant heart of the crypto community, Gate Square is charging into the 2026 Year of the Horse with an explosion of energy and rewards. This digital carnival unites the global community, blending festive cheer with a massive $50,000 prize pool. Running until mid-February, this event is expertly designed to transform your creativity into tangible earnings.

A Cascade of Rewards: Red Packets and GateToken Opportunities

One of the most thrilling aspects of the campaign is the c

GT-4,73%

- Reward

- 4

- 2

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#GrayscaleEyesAVESpotETFConversion

Grayscale Investments, one of the largest digital asset management firms, is reportedly considering the conversion of its AVE (Aave) holdings into a spot ETF, signaling a potentially significant shift in the way institutional and retail investors gain exposure to decentralized finance (DeFi) tokens. This move comes at a pivotal time in the cryptocurrency market, as regulators, institutional participants, and market infrastructure increasingly converge around the concept of regulated, transparent, and easily accessible crypto investment products. A spot ETF w

Grayscale Investments, one of the largest digital asset management firms, is reportedly considering the conversion of its AVE (Aave) holdings into a spot ETF, signaling a potentially significant shift in the way institutional and retail investors gain exposure to decentralized finance (DeFi) tokens. This move comes at a pivotal time in the cryptocurrency market, as regulators, institutional participants, and market infrastructure increasingly converge around the concept of regulated, transparent, and easily accessible crypto investment products. A spot ETF w

- Reward

- 2

- Comment

- Repost

- Share

#GrayscaleEyesAVESpotETFConversion

Grayscale Investments, one of the largest digital asset management firms, is reportedly considering the conversion of its AVE (Aave) holdings into a spot ETF, signaling a potentially significant shift in the way institutional and retail investors gain exposure to decentralized finance (DeFi) tokens. This move comes at a pivotal time in the cryptocurrency market, as regulators, institutional participants, and market infrastructure increasingly converge around the concept of regulated, transparent, and easily accessible crypto investment products. A spot ETF w

Grayscale Investments, one of the largest digital asset management firms, is reportedly considering the conversion of its AVE (Aave) holdings into a spot ETF, signaling a potentially significant shift in the way institutional and retail investors gain exposure to decentralized finance (DeFi) tokens. This move comes at a pivotal time in the cryptocurrency market, as regulators, institutional participants, and market infrastructure increasingly converge around the concept of regulated, transparent, and easily accessible crypto investment products. A spot ETF w

- Reward

- 3

- Comment

- Repost

- Share

#GrayscaleEyesAVESpotETFConversion

Grayscale Investments, one of the largest digital asset management firms, is reportedly considering the conversion of its AVE (Aave) holdings into a spot ETF, signaling a potentially significant shift in the way institutional and retail investors gain exposure to decentralized finance (DeFi) tokens. This move comes at a pivotal time in the cryptocurrency market, as regulators, institutional participants, and market infrastructure increasingly converge around the concept of regulated, transparent, and easily accessible crypto investment products. A spot ETF w

Grayscale Investments, one of the largest digital asset management firms, is reportedly considering the conversion of its AVE (Aave) holdings into a spot ETF, signaling a potentially significant shift in the way institutional and retail investors gain exposure to decentralized finance (DeFi) tokens. This move comes at a pivotal time in the cryptocurrency market, as regulators, institutional participants, and market infrastructure increasingly converge around the concept of regulated, transparent, and easily accessible crypto investment products. A spot ETF w

- Reward

- 2

- Comment

- Repost

- Share

How the fuck did we go from "Trump will send crypto to the moon" to the worst sentiment I've ever seen?

I'm a 2nd cycler. Roundtripped 7 figures to 5 figures. TWICE. That year alone. Did the same in the previous cycle. Writing this near the Trump inauguration anniversary. The flashbacks are real.

I got PTSD from cycle 1. Tried to be objective this time. But "objective" slowly morphed into the same FOMO as before — just on different coins, different narratives. This time it was political full adoption. "If not now, never."

The setup looked perfect. Gensler out. Friendlier SEC. David Sacks. Stra

I'm a 2nd cycler. Roundtripped 7 figures to 5 figures. TWICE. That year alone. Did the same in the previous cycle. Writing this near the Trump inauguration anniversary. The flashbacks are real.

I got PTSD from cycle 1. Tried to be objective this time. But "objective" slowly morphed into the same FOMO as before — just on different coins, different narratives. This time it was political full adoption. "If not now, never."

The setup looked perfect. Gensler out. Friendlier SEC. David Sacks. Stra

- Reward

- 1

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow?

Markets are once again at a critical decision point, forcing investors to choose between buying the dip or waiting for clearer confirmation. Recent price pullbacks across crypto and traditional markets have attracted opportunistic buyers who view these declines as healthy corrections within a broader long-term uptrend. Historically, disciplined dip-buying during periods of fear has rewarded patient investors, especially when supported by strong fundamentals, on-chain data, and improving macro conditions.

However, caution remains equally important. Volatility is still eleva

Markets are once again at a critical decision point, forcing investors to choose between buying the dip or waiting for clearer confirmation. Recent price pullbacks across crypto and traditional markets have attracted opportunistic buyers who view these declines as healthy corrections within a broader long-term uptrend. Historically, disciplined dip-buying during periods of fear has rewarded patient investors, especially when supported by strong fundamentals, on-chain data, and improving macro conditions.

However, caution remains equally important. Volatility is still eleva

- Reward

- like

- Comment

- Repost

- Share

BlackRock just revealed it will be bringing its Treasury-backed digital token $BUIDL onto Uniswap $UNI where it will be bought and sold by institutional traders...

Part of the deal, BlackRock is also purchasing an undisclosed amount of Uniswap’s own UNI token.

Bear market? Nope.

Best time to learn how to trade #SmartSignals before professional and retail traders come on chain? Yes.

Part of the deal, BlackRock is also purchasing an undisclosed amount of Uniswap’s own UNI token.

Bear market? Nope.

Best time to learn how to trade #SmartSignals before professional and retail traders come on chain? Yes.

UNI-5,57%

- Reward

- like

- Comment

- Repost

- Share

🏇🎉 #GateSpringRacingChallenge 🎉🏇

The horse racing action has kicked off at Gate Square! 🚀

Join the Spring Festival fun — complete missions, collect race tickets, and compete for exclusive rewards 🎁💰

✨ Why you should participate:

• Grab tickets through daily activities

• Race in the exciting horse racing challenge

• Win rewards and share with the community

• Experience the festive energy of Gate Square

It’s not just trading — it’s strategy, competition, and celebration all in one 🧧

Don’t let the starting gate pass you by!

Are you ready to race for rewards? 🏁👇

#GateSquare #CryptoFestiv

The horse racing action has kicked off at Gate Square! 🚀

Join the Spring Festival fun — complete missions, collect race tickets, and compete for exclusive rewards 🎁💰

✨ Why you should participate:

• Grab tickets through daily activities

• Race in the exciting horse racing challenge

• Win rewards and share with the community

• Experience the festive energy of Gate Square

It’s not just trading — it’s strategy, competition, and celebration all in one 🧧

Don’t let the starting gate pass you by!

Are you ready to race for rewards? 🏁👇

#GateSquare #CryptoFestiv

- Reward

- like

- Comment

- Repost

- Share

🎉 Gate Spring Festival Horse Racing Event – Where Tradition Meets Innovation 🐎

The Gate Spring Festival Horse Racing Event brings the spirit of celebration, speed, and strategy together in a vibrant showcase that blends cultural festivity with modern digital engagement. Designed to capture the excitement of the Spring Festival season, this event reflects Gate’s commitment to creating immersive experiences that go beyond traditional trading. Through dynamic visuals, competitive racing themes, and interactive participation, users are invited to enjoy a festive atmosphere while engaging with th

The Gate Spring Festival Horse Racing Event brings the spirit of celebration, speed, and strategy together in a vibrant showcase that blends cultural festivity with modern digital engagement. Designed to capture the excitement of the Spring Festival season, this event reflects Gate’s commitment to creating immersive experiences that go beyond traditional trading. Through dynamic visuals, competitive racing themes, and interactive participation, users are invited to enjoy a festive atmosphere while engaging with th

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More146.69K Popularity

127.18K Popularity

32.7K Popularity

53.97K Popularity

401.58K Popularity

Pin