MrFlower_XingChen

No content yet

MrFlower_XingChen

#LatestMarketInsights 📈 Latest Market Insights – February 25, 2026

Markets remain at a critical inflection point as volatility continues across crypto and equities. While stocks are attempting stabilization, digital assets remain under sustained pressure from macro headwinds, tariff uncertainty, and liquidity tightening. With major catalysts ahead, including Nvidia earnings and further tariff developments, risk sentiment could shift rapidly.

Global Equities: Stabilization Attempt, But Fragile

U.S. equity markets staged a notable rebound after earlier heavy selling pressure. The S&P 500, Nasda

Markets remain at a critical inflection point as volatility continues across crypto and equities. While stocks are attempting stabilization, digital assets remain under sustained pressure from macro headwinds, tariff uncertainty, and liquidity tightening. With major catalysts ahead, including Nvidia earnings and further tariff developments, risk sentiment could shift rapidly.

Global Equities: Stabilization Attempt, But Fragile

U.S. equity markets staged a notable rebound after earlier heavy selling pressure. The S&P 500, Nasda

- Reward

- 6

- 8

- 1

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#EthereumFoundationAdvancesDeFipunk The Ethereum Foundation has introduced a new strategic direction aimed at revitalizing decentralized finance through what it calls the “DeFipunk” philosophy — a vision designed to return Ethereum development to its cypherpunk-inspired roots of privacy, autonomy, and permissionless innovation.

The newly established DeFi-focused unit under the Foundation’s App Relations division is intended to accelerate the creation of financial protocols that go beyond traditional financial replication. Instead of simply optimizing existing banking structures, the initiative

The newly established DeFi-focused unit under the Foundation’s App Relations division is intended to accelerate the creation of financial protocols that go beyond traditional financial replication. Instead of simply optimizing existing banking structures, the initiative

- Reward

- 16

- 38

- 1

- Share

AYATTAC :

:

2026 GOGOGO 👊View More

#AIFearsSendIBMDown11% Shares of IBM experienced a sharp drop of roughly 11% amid growing market concern surrounding the competitive pressure of artificial intelligence technologies and shifting enterprise technology expectations.

The sell-off reflects broader investor anxiety about how legacy technology companies will adapt to the rapid acceleration of AI infrastructure and software ecosystems. As AI models become more capable and cost-efficient, corporate clients are reassessing spending allocation between traditional enterprise software systems and next-generation AI platforms.

Market parti

The sell-off reflects broader investor anxiety about how legacy technology companies will adapt to the rapid acceleration of AI infrastructure and software ecosystems. As AI models become more capable and cost-efficient, corporate clients are reassessing spending allocation between traditional enterprise software systems and next-generation AI platforms.

Market parti

- Reward

- 15

- 29

- 1

- Share

ybaser :

:

2026 GOGOGO 👊View More

#TrumpGroupMullsGazaStablecoin 🧠 What’s Being Discussed

Officials connected to the Board of Peace initiative led by Donald Trump are reportedly exploring the possibility of launching a U.S. dollar–pegged stablecoin for use in Gaza.

The idea centers on creating a digital payment mechanism to support economic activity in a region where traditional banking infrastructure has been heavily disrupted and access to physical cash remains limited.

The proposal remains in the discussion phase — no formal launch framework has been publicly confirmed.

💡 Why This Matters

1️⃣ Economic Stabilization Tool

S

Officials connected to the Board of Peace initiative led by Donald Trump are reportedly exploring the possibility of launching a U.S. dollar–pegged stablecoin for use in Gaza.

The idea centers on creating a digital payment mechanism to support economic activity in a region where traditional banking infrastructure has been heavily disrupted and access to physical cash remains limited.

The proposal remains in the discussion phase — no formal launch framework has been publicly confirmed.

💡 Why This Matters

1️⃣ Economic Stabilization Tool

S

- Reward

- 15

- 32

- 1

- Share

ChingYang :

:

To The Moon 🌕View More

#BuyTheDipOrWaitNow? Every cycle brings the same psychological test. Prices turn red. Timelines fill with fear. Volatility expands. And the question resurfaces:

Do you buy the dip — or wait for confirmation?

This isn’t just a trading decision. It’s a discipline test.

📉 Understanding the Nature of the Dip

Not all corrections are equal.

Before acting, ask: why is price falling?

Is it:

Macro-driven? (Interest rates, liquidity tightening, dollar strength)

News-driven? (Regulation, geopolitical headlines, ETF flows)

Structural? (Weak fundamentals, declining adoption, internal instability)

A liquid

Do you buy the dip — or wait for confirmation?

This isn’t just a trading decision. It’s a discipline test.

📉 Understanding the Nature of the Dip

Not all corrections are equal.

Before acting, ask: why is price falling?

Is it:

Macro-driven? (Interest rates, liquidity tightening, dollar strength)

News-driven? (Regulation, geopolitical headlines, ETF flows)

Structural? (Weak fundamentals, declining adoption, internal instability)

A liquid

BTC3,44%

- Reward

- 10

- 25

- 2

- Share

SheenCrypto :

:

LFG 🔥View More

#GateSquare$50KRedPacketGiveaway Community Liquidity Activation on Gate.io Square

The #GateSquare$50KRedPacketGiveaway campaign represents more than a promotional event — it reflects the structural evolution of exchange ecosystems in 2026. Hosted within Gate Square, the interactive social layer of Gate.io, the initiative merges cultural symbolism with Web3-native engagement mechanics.

With a $50,000 pooled reward allocation distributed through digital “red packets,” the campaign demonstrates how centralized exchanges are integrating social participation directly into liquidity architecture.

🧧

The #GateSquare$50KRedPacketGiveaway campaign represents more than a promotional event — it reflects the structural evolution of exchange ecosystems in 2026. Hosted within Gate Square, the interactive social layer of Gate.io, the initiative merges cultural symbolism with Web3-native engagement mechanics.

With a $50,000 pooled reward allocation distributed through digital “red packets,” the campaign demonstrates how centralized exchanges are integrating social participation directly into liquidity architecture.

🧧

- Reward

- 11

- 27

- 1

- Share

ChingYang :

:

To The Moon 🌕View More

#VitalikSells21.7KETH Strategic Liquidity or Bearish Signal? Understanding the February ETH Transfers

Vitalik Buterin, co-founder of Ethereum, has once again become a focal point of market discussion following a series of ETH sales throughout February 2026. On-chain monitoring platforms have tracked multiple structured transactions totaling thousands of ETH, triggering debate across the crypto ecosystem.

However, context matters more than headlines.

Size, Structure, and Timing of the Sales

Blockchain data indicates that the transactions were:

Gradual and distributed, not a single large dump

Ex

Vitalik Buterin, co-founder of Ethereum, has once again become a focal point of market discussion following a series of ETH sales throughout February 2026. On-chain monitoring platforms have tracked multiple structured transactions totaling thousands of ETH, triggering debate across the crypto ecosystem.

However, context matters more than headlines.

Size, Structure, and Timing of the Sales

Blockchain data indicates that the transactions were:

Gradual and distributed, not a single large dump

Ex

- Reward

- 13

- 21

- 1

- Share

Yunna :

:

To The Moon 🌕View More

#LatestMarketInsights Opening Move of the Fire Horse Year – Commanding Tempo on Gate.io Square

#马年开工第一帖

The Lunar New Year silence has closed.

Screens illuminate. Order books refill. Spreads tighten. Liquidity begins to pulse again.

But the return is not explosive — it is cautious. Measured. Observational.

2026, the Year of the Fire Horse, symbolizes acceleration layered with intensity. In cyclical philosophy, the Horse represents motion, autonomy, and forward thrust. Fire amplifies those traits — turning movement into momentum, and momentum into conviction.

Yet markets teach a deeper lesson:

#马年开工第一帖

The Lunar New Year silence has closed.

Screens illuminate. Order books refill. Spreads tighten. Liquidity begins to pulse again.

But the return is not explosive — it is cautious. Measured. Observational.

2026, the Year of the Fire Horse, symbolizes acceleration layered with intensity. In cyclical philosophy, the Horse represents motion, autonomy, and forward thrust. Fire amplifies those traits — turning movement into momentum, and momentum into conviction.

Yet markets teach a deeper lesson:

BTC3,44%

- Reward

- 13

- 20

- 1

- Share

ybaser :

:

Wishing you great wealth in the Year of the Horse 🐴View More

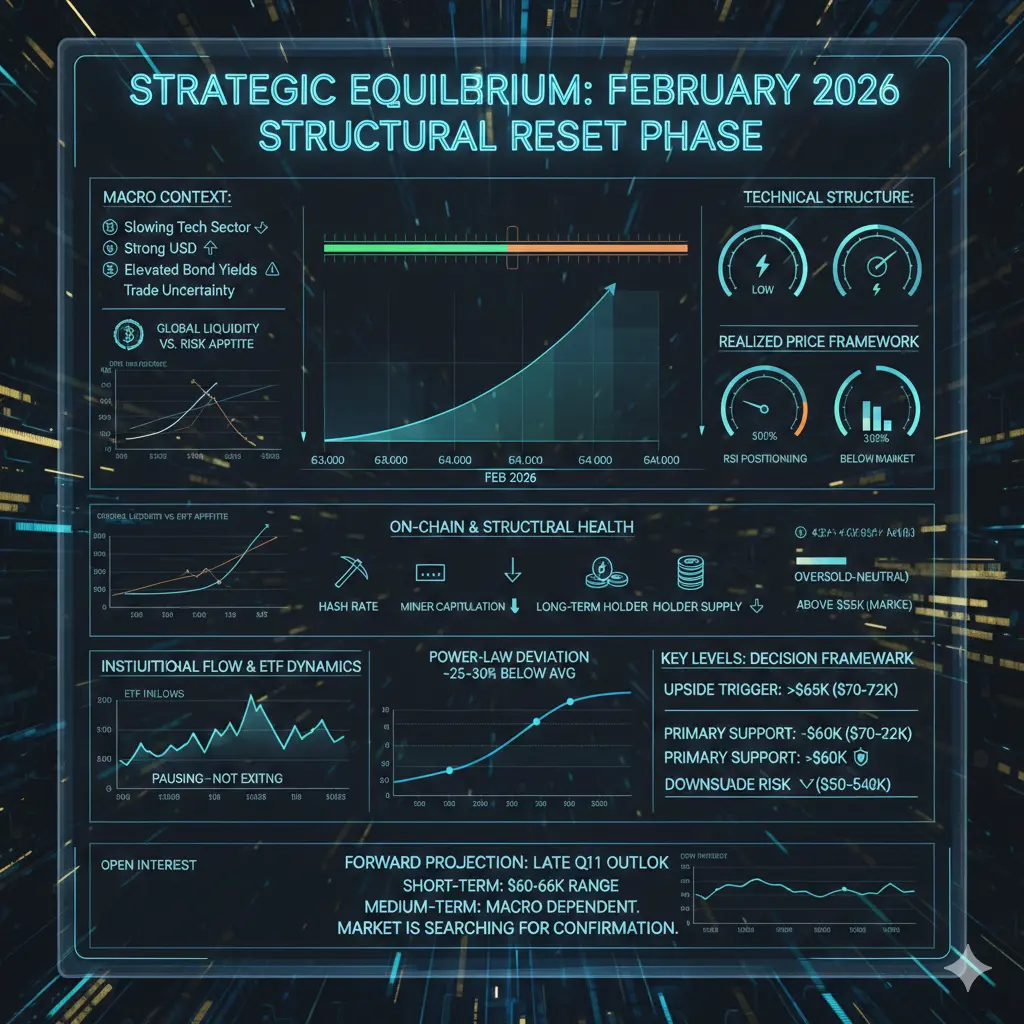

#BitcoinMarketAnalysis Strategic Equilibrium: February 2026 Structural Reset Phase

As February 2026 enters its final stretch, Bitcoin remains locked in a strategic equilibrium zone between $63,000 and $64,000. This range is no longer just a price consolidation — it represents a macro-technical compression phase where liquidity, sentiment, and positioning are recalibrating after the 2025 expansion cycle.

Markets are no longer reacting purely to crypto-native catalysts. Instead, Bitcoin is being evaluated within a broader cross-asset framework shaped by shifting dollar strength, bond yield dynam

As February 2026 enters its final stretch, Bitcoin remains locked in a strategic equilibrium zone between $63,000 and $64,000. This range is no longer just a price consolidation — it represents a macro-technical compression phase where liquidity, sentiment, and positioning are recalibrating after the 2025 expansion cycle.

Markets are no longer reacting purely to crypto-native catalysts. Instead, Bitcoin is being evaluated within a broader cross-asset framework shaped by shifting dollar strength, bond yield dynam

- Reward

- 11

- 21

- 1

- Share

Yunna :

:

To The Moon 🌕View More

#TrumpAnnouncesNewTariffs Tariff Shockwave 2.0: Global Liquidity Repricing Enters a New Phase

The latest tariff announcement from Donald Trump has reactivated a powerful macro catalyst across global markets. Trade policy is no longer a background headline — it has moved to the center of liquidity repricing. While tariffs traditionally impact equities, commodities, and foreign exchange first, crypto markets now sit directly within the global liquidity transmission chain. This is not just a policy update. It is a volatility expansion trigger with cross-asset consequences.

Markets are entering a

The latest tariff announcement from Donald Trump has reactivated a powerful macro catalyst across global markets. Trade policy is no longer a background headline — it has moved to the center of liquidity repricing. While tariffs traditionally impact equities, commodities, and foreign exchange first, crypto markets now sit directly within the global liquidity transmission chain. This is not just a policy update. It is a volatility expansion trigger with cross-asset consequences.

Markets are entering a

BTC3,44%

- Reward

- 10

- 15

- 1

- Share

MrFlower_XingChen :

:

To The Moon 🌕View More

#LatestMarketInsights

#马年开工第一帖

This year, I hope the cryptocurrency market brings meaningful positive changes to my life and opens new opportunities for growth and financial progress. I believe that dedication, learning, and smart trading strategies can help turn small steps into bigger achievements over time.

Through the power of blockchain and digital finance, I hope to explore a broader world beyond limits, gain new perspectives, and move closer to my personal and professional goals. Cryptocurrency represents innovation, opportunity, and the future of global finance.

I also wish Gate.io a

#马年开工第一帖

This year, I hope the cryptocurrency market brings meaningful positive changes to my life and opens new opportunities for growth and financial progress. I believe that dedication, learning, and smart trading strategies can help turn small steps into bigger achievements over time.

Through the power of blockchain and digital finance, I hope to explore a broader world beyond limits, gain new perspectives, and move closer to my personal and professional goals. Cryptocurrency represents innovation, opportunity, and the future of global finance.

I also wish Gate.io a

- Reward

- 18

- 32

- 2

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#LatestMarketInsights The crypto market continues to evolve rapidly, creating new opportunities for traders and investors around the world. Platforms like Gate.io are playing an important role in building a global trading ecosystem where innovation, liquidity, and community interaction grow together.

In the current market environment, I believe technology-driven assets are becoming increasingly important. The rise of blockchain-based financial infrastructure, combined with artificial intelligence advancement, is changing how markets operate. Many investors are now focusing not only on short-te

In the current market environment, I believe technology-driven assets are becoming increasingly important. The rise of blockchain-based financial infrastructure, combined with artificial intelligence advancement, is changing how markets operate. Many investors are now focusing not only on short-te

- Reward

- 15

- 30

- 2

- Share

ChingYang :

:

To The Moon 🌕View More

#LatestMarketInsights As the new working season begins, I feel excited to share my thoughts on the future of trading and market opportunities on Gate.io.

2026 is shaping up to be an interesting year for digital finance. The market is moving toward stronger technological integration, especially in sectors connected with artificial intelligence, data infrastructure, and blockchain adoption. I believe the next major growth momentum may come from projects that combine innovation with real-world economic applications.

Right now, I am paying close attention to early market signals before entering an

2026 is shaping up to be an interesting year for digital finance. The market is moving toward stronger technological integration, especially in sectors connected with artificial intelligence, data infrastructure, and blockchain adoption. I believe the next major growth momentum may come from projects that combine innovation with real-world economic applications.

Right now, I am paying close attention to early market signals before entering an

- Reward

- 14

- 25

- 2

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#BTCMarketAnalysis Bitcoin (BTC) continues to show dynamic price action as markets wrestle with macroeconomic forces, investor sentiment, and evolving crypto-specific factors. Here’s a clear, up-to-date analysis of where BTC stands and what could influence its next moves:

Current Price Condition

Bitcoin has been trading with notable volatility — alternating between short-term rallies and pullbacks. This choppiness reflects a market that is still searching for clear direction, with buyers and sellers reacting to both global economic signals and crypto-specific data.

Bullish Signals

1. Instituti

Current Price Condition

Bitcoin has been trading with notable volatility — alternating between short-term rallies and pullbacks. This choppiness reflects a market that is still searching for clear direction, with buyers and sellers reacting to both global economic signals and crypto-specific data.

Bullish Signals

1. Instituti

BTC3,44%

- Reward

- 14

- 24

- 2

- Share

Ryakpanda :

:

Wishing you great wealth in the Year of the Horse 🐴View More

#ThreeMajorUSIndexesDecline The three major U.S. stock market indexes recently posted declines, signaling a broad pullback in equities after a period of mixed economic data and renewed investor caution. This downturn affected the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite, which together serve as key barometers of U.S. economic and corporate health.

Several factors contributed to this decline. Persistent concerns about interest rate uncertainty have made investors wary. When central banks signal that interest rates may remain higher for longer, growth stocks — especially in te

Several factors contributed to this decline. Persistent concerns about interest rate uncertainty have made investors wary. When central banks signal that interest rates may remain higher for longer, growth stocks — especially in te

- Reward

- 15

- 23

- 2

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#EthereumFoundationAdvancesDeFipunk The Ethereum Foundation has announced a meaningful update in its support for DeFi + NFT innovation, especially in areas that blend decentralized finance (DeFi) with culture and community-driven assets — sometimes termed “DeFiPunk” projects. This initiative reflects the foundation’s growing focus on expanding the Ethereum ecosystem beyond purely technical upgrades and into creative financial infrastructure.

At its core, the move is designed to encourage builders who are innovating at the intersection of decentralized finance and digital culture. These are pro

At its core, the move is designed to encourage builders who are innovating at the intersection of decentralized finance and digital culture. These are pro

ETH4,87%

- Reward

- 13

- 22

- 2

- Share

ChingYang :

:

To The Moon 🌕View More

#AIFearsSendIBMDown11% Shares of IBM recently dropped about 11%, reflecting growing investor concern over the company’s ability to compete in the rapidly evolving artificial intelligence (AI) landscape. This decline is one of the most significant pullbacks in IBM’s stock in months and underscores how sensitive markets have become to AI leadership and growth expectations.

Investors and analysts have pointed to several key factors behind the sell-off. First, despite IBM’s long history in enterprise technology and early investments in AI through its Watson platform, the company has struggled to g

Investors and analysts have pointed to several key factors behind the sell-off. First, despite IBM’s long history in enterprise technology and early investments in AI through its Watson platform, the company has struggled to g

- Reward

- 12

- 20

- 2

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#TrumpGroupMullsGazaStablecoin A U.S. government-linked group chaired by Donald Trump is reportedly exploring the creation of a U.S. dollar-pegged stablecoin for the Gaza Strip as part of post-war reconstruction discussions. The idea is being reviewed by members of a newly formed advisory initiative often referred to as a “Board of Peace,” focused on humanitarian and economic rebuilding efforts in the region.

The proposed stablecoin would not replace any existing currency. Instead, it would function as a digital payment tool to help facilitate transactions in an environment where traditional b

The proposed stablecoin would not replace any existing currency. Instead, it would function as a digital payment tool to help facilitate transactions in an environment where traditional b

- Reward

- 12

- 19

- 1

- Share

Ryakpanda :

:

Wishing you great wealth in the Year of the Horse 🐴View More

#SpotBTCETFsLogFiveWeekOutflows Spot Bitcoin ETFs have recorded five straight weeks of net outflows, marking a notable shift in market behavior for one of the crypto world’s most closely watched investment products. Instead of new money flowing into Bitcoin via these funds, investors have been withdrawing capital over several consecutive weeks — a trend that reflects changing sentiment and positioning among institutional and retail players.

Outflows typically signal a reduction in demand for exposure to Bitcoin through regulated investment vehicles. This can happen for several reasons. First,

Outflows typically signal a reduction in demand for exposure to Bitcoin through regulated investment vehicles. This can happen for several reasons. First,

BTC3,44%

- Reward

- 12

- 17

- 1

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#GoldTops$5,190

#GoldTops$5,190

Gold has climbed above $5,190 per ounce, marking a major milestone in the global commodities market. The surge reflects growing investor demand for safe-haven assets as uncertainty increases across financial markets. When economic risks rise, gold often becomes a preferred store of value.

One of the key drivers behind this rally is global instability. Ongoing geopolitical tensions and trade concerns have made investors more cautious. Instead of holding riskier assets like stocks or cryptocurrencies, many are shifting funds into gold to protect their wealth.

Ano

#GoldTops$5,190

Gold has climbed above $5,190 per ounce, marking a major milestone in the global commodities market. The surge reflects growing investor demand for safe-haven assets as uncertainty increases across financial markets. When economic risks rise, gold often becomes a preferred store of value.

One of the key drivers behind this rally is global instability. Ongoing geopolitical tensions and trade concerns have made investors more cautious. Instead of holding riskier assets like stocks or cryptocurrencies, many are shifting funds into gold to protect their wealth.

Ano

- Reward

- 12

- 20

- 1

- Share

Ryakpanda :

:

Wishing you great wealth in the Year of the Horse 🐴View More

Trending Topics

View More74.17K Popularity

166.8K Popularity

33.11K Popularity

8.48K Popularity

416.26K Popularity

Pin