# FedRateCutPrediction

124.12K

Pin

Gate广场_Official

December 8 #FedRateCutPrediction

💰 Please include the hashtag and #美联储降息预测 in your post. 5 high-quality posters * $50 position experience vouchers for each.

This week marks the Fed's final rate meeting of the year, with the interest rate decision to be announced at 3:00 AM (UTC+8) on Thursday. The market estimates an 84% probability of a 25BP rate cut. If the rate is really cut, do you think the market will rebound? Share your rate cut predictions and recent trading strategies to split the posting rewards!

📅 Event time: December 8, 13:00 - December 12, 18:00 (UTC+8)

⚠️ Note: Plagiarism is

View Original💰 Please include the hashtag and #美联储降息预测 in your post. 5 high-quality posters * $50 position experience vouchers for each.

This week marks the Fed's final rate meeting of the year, with the interest rate decision to be announced at 3:00 AM (UTC+8) on Thursday. The market estimates an 84% probability of a 25BP rate cut. If the rate is really cut, do you think the market will rebound? Share your rate cut predictions and recent trading strategies to split the posting rewards!

📅 Event time: December 8, 13:00 - December 12, 18:00 (UTC+8)

⚠️ Note: Plagiarism is

- Reward

- 18

- 10

- Repost

- Share

GateUser-a630f911 :

:

Bull Run 🐂View More

🎉 Congratulations to Our Outstanding Contributors! 🎉

We’re thrilled to announce the winners of the Plaza Recommended Topic Posting Activity!

Your insights, creativity, and passion continue to light up the community. 👏

🏆 Prize Winners:

1️⃣ #加密行情预测 (Crypto Market Prediction)

LittleQueen, Mr. LV, K-Line Prince, Cryptoself, Crypto Rhino Brother Community

2️⃣ #非农数据超预期 (NFP Data Above Expectations)

HighAmbition💐🎉, MakingMoneyEatMeat, KatyPaty, Luna_Star, Ryakpanda

3️⃣ #市场触底了吗? (Has the Market Bottomed?)

repanzal, Cryptochampion, Spicy Hand Toning Coins, Eagle Eye, yusfirah

4️⃣ #加密市场反弹 (Crypto

We’re thrilled to announce the winners of the Plaza Recommended Topic Posting Activity!

Your insights, creativity, and passion continue to light up the community. 👏

🏆 Prize Winners:

1️⃣ #加密行情预测 (Crypto Market Prediction)

LittleQueen, Mr. LV, K-Line Prince, Cryptoself, Crypto Rhino Brother Community

2️⃣ #非农数据超预期 (NFP Data Above Expectations)

HighAmbition💐🎉, MakingMoneyEatMeat, KatyPaty, Luna_Star, Ryakpanda

3️⃣ #市场触底了吗? (Has the Market Bottomed?)

repanzal, Cryptochampion, Spicy Hand Toning Coins, Eagle Eye, yusfirah

4️⃣ #加密市场反弹 (Crypto

- Reward

- 6

- 3

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

#FedRateCutPrediction

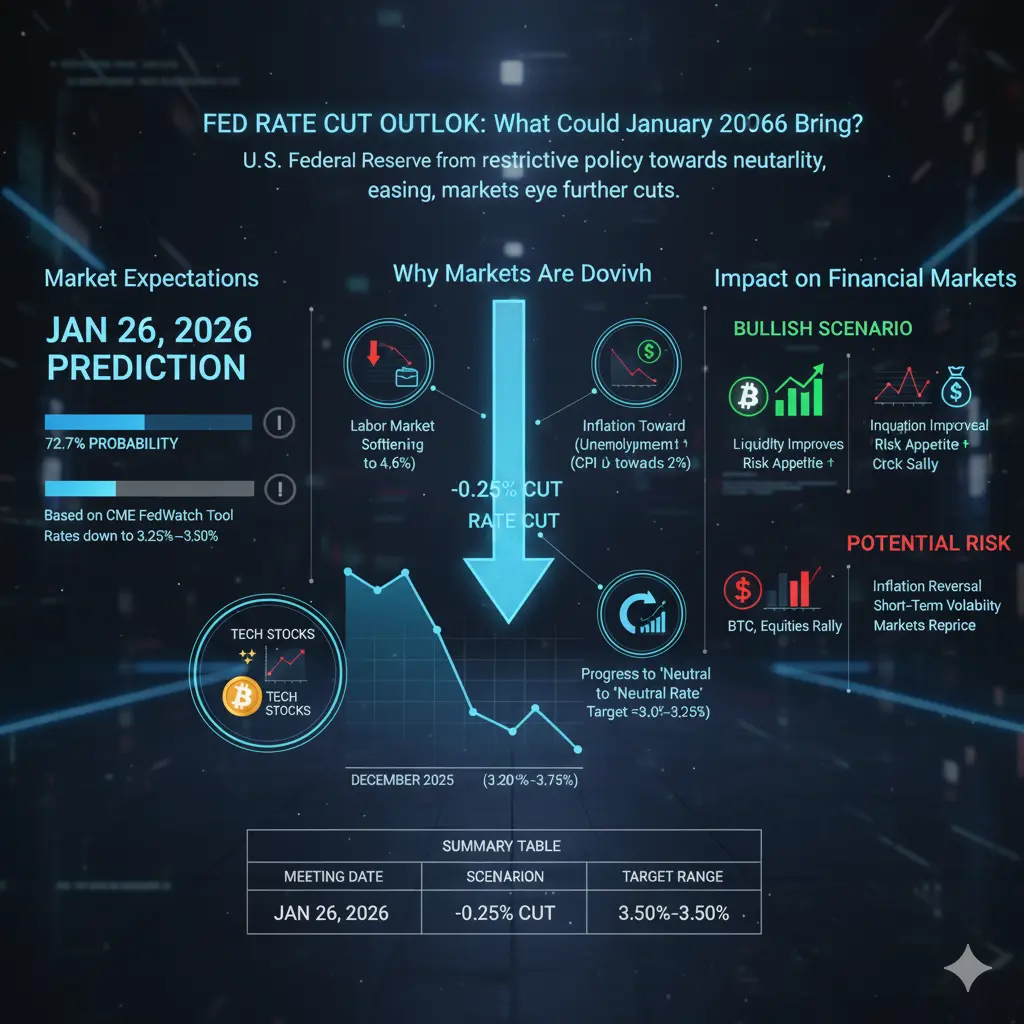

Fed Rate Cut Outlook: What Could January 2026 Bring?

The U.S. Federal Reserve has officially entered an easing phase. On December 10, 2025, the Fed delivered a 25 basis point (0.25%) rate cut, lowering the federal funds target range to 3.50% – 3.75%. This marked the third consecutive rate reduction of the year, reinforcing expectations that policymakers are prioritizing economic stability over restrictive policy.

As markets look ahead, attention is now firmly focused on the January 26, 2026 FOMC meeting.

🎯 Market Expectations for January 2026

According to the latest CME

Fed Rate Cut Outlook: What Could January 2026 Bring?

The U.S. Federal Reserve has officially entered an easing phase. On December 10, 2025, the Fed delivered a 25 basis point (0.25%) rate cut, lowering the federal funds target range to 3.50% – 3.75%. This marked the third consecutive rate reduction of the year, reinforcing expectations that policymakers are prioritizing economic stability over restrictive policy.

As markets look ahead, attention is now firmly focused on the January 26, 2026 FOMC meeting.

🎯 Market Expectations for January 2026

According to the latest CME

BTC-0,93%

- Reward

- 21

- 13

- Repost

- Share

BabaJi :

:

Christmas Bull Run! 🐂View More

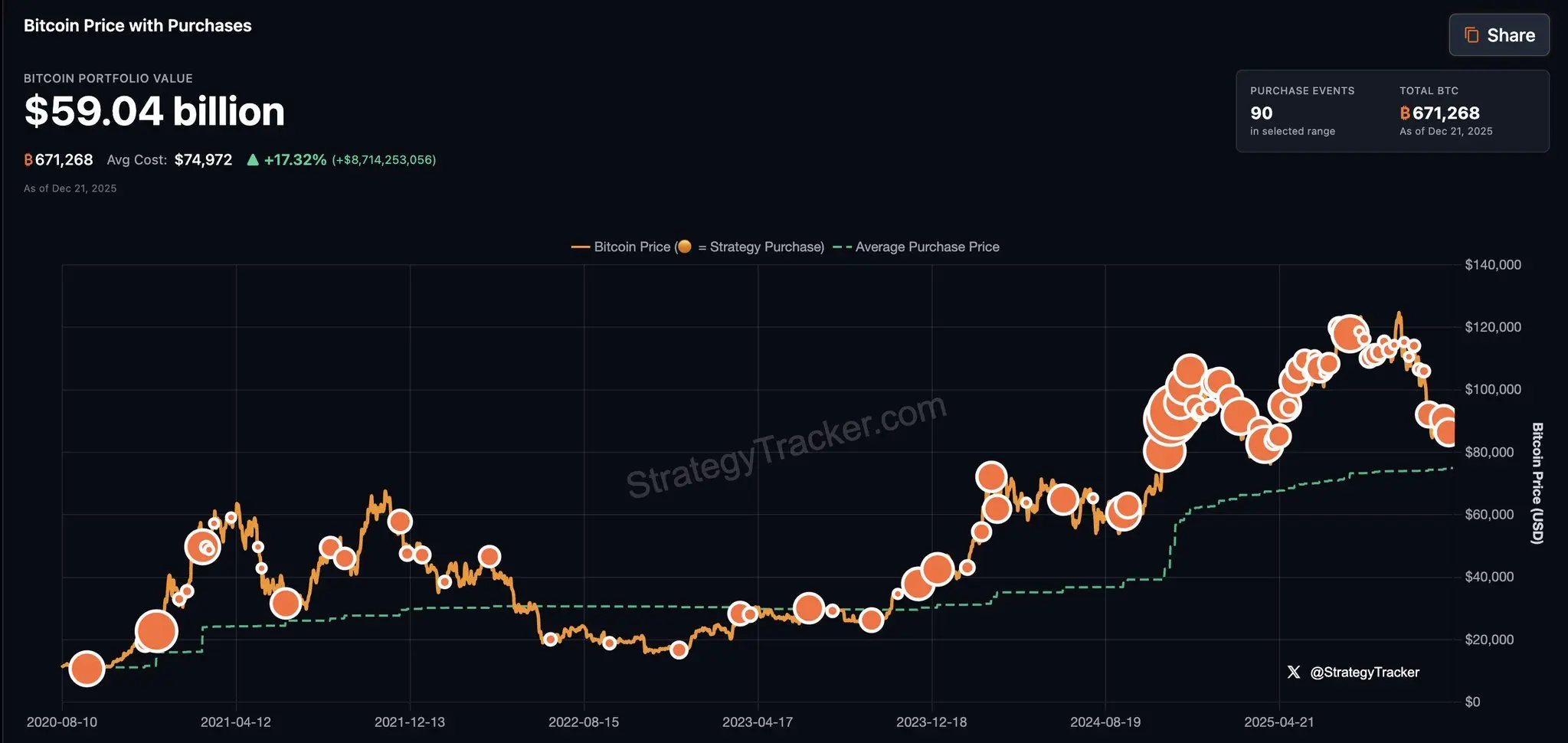

JUST IN: Michael Saylor hints at buying more Bitcoin.

“Green dots ₿eget orange dots.”

⚠️ Warning:

Every time he buys, the market usually does the opposite. His buys have often lined up with local tops, followed by sharp selloffs. Treat the news as liquidity bait, not a green light. Chasing after these announcements is how people get trapped. Trend and liquidity matter more than headlines.

#FedRateCutPrediction #CryptoMarketWatch #BitcoinLiquidity #BTCMarketAnalysis #BigWhaleMovement

“Green dots ₿eget orange dots.”

⚠️ Warning:

Every time he buys, the market usually does the opposite. His buys have often lined up with local tops, followed by sharp selloffs. Treat the news as liquidity bait, not a green light. Chasing after these announcements is how people get trapped. Trend and liquidity matter more than headlines.

#FedRateCutPrediction #CryptoMarketWatch #BitcoinLiquidity #BTCMarketAnalysis #BigWhaleMovement

BTC-0,93%

- Reward

- 11

- 7

- Repost

- Share

MoonGirl :

:

Ape In 🚀View More

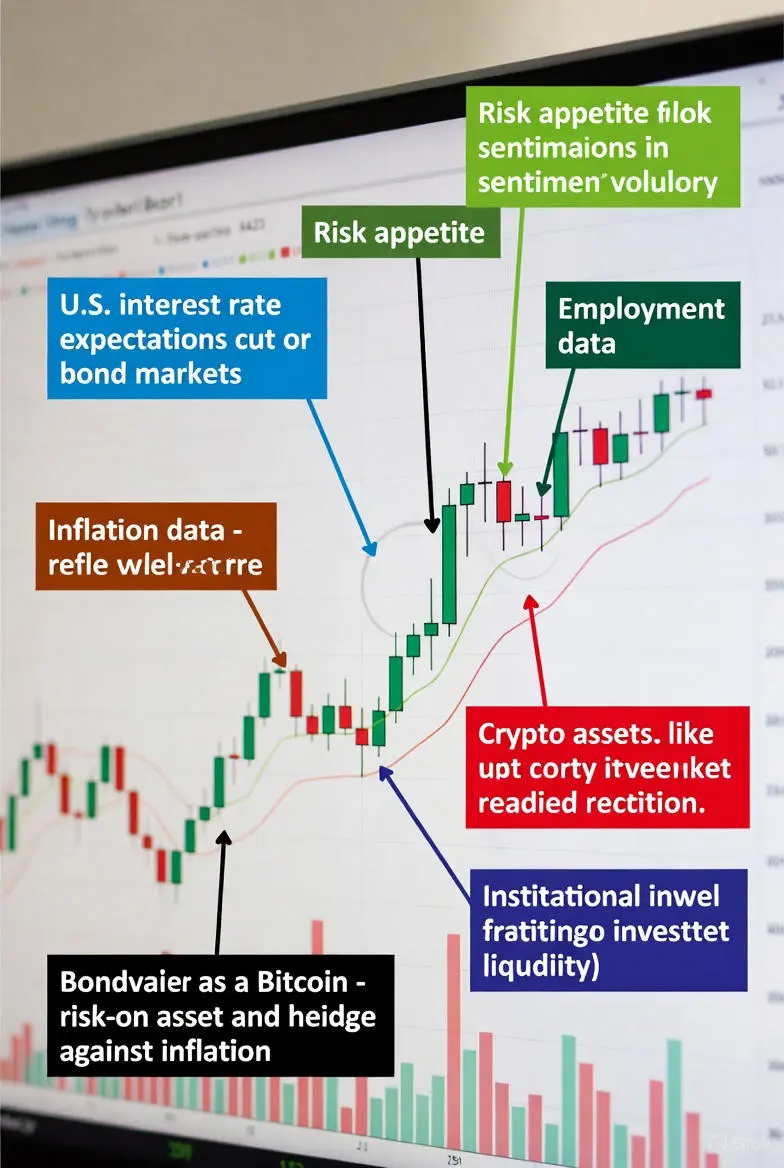

#FedRateCutPrediction #CryptoMarketWatch 📉📈 Why is the Crypto Market Sensitive to Fed Policy?

Crypto assets are highly sensitive, especially to liquidity conditions and global risk appetite. Therefore, the Fed's interest rate policy has an indirect but strong effect on pricing.

What do macroeconomic data say about crypto?

• Inflation trend: The decline in inflation strengthens the perception that the end of tight monetary policy is approaching.

• Interest rate expectations: Market pricing reflects an expectation of gradual and cautious easing rather than sudden cuts.

• Liquidity effect: Whil

Crypto assets are highly sensitive, especially to liquidity conditions and global risk appetite. Therefore, the Fed's interest rate policy has an indirect but strong effect on pricing.

What do macroeconomic data say about crypto?

• Inflation trend: The decline in inflation strengthens the perception that the end of tight monetary policy is approaching.

• Interest rate expectations: Market pricing reflects an expectation of gradual and cautious easing rather than sudden cuts.

• Liquidity effect: Whil

- Reward

- 20

- 8

- Repost

- Share

ümhn1 :

:

Merry Christmas ⛄View More

#FedRateCutPrediction

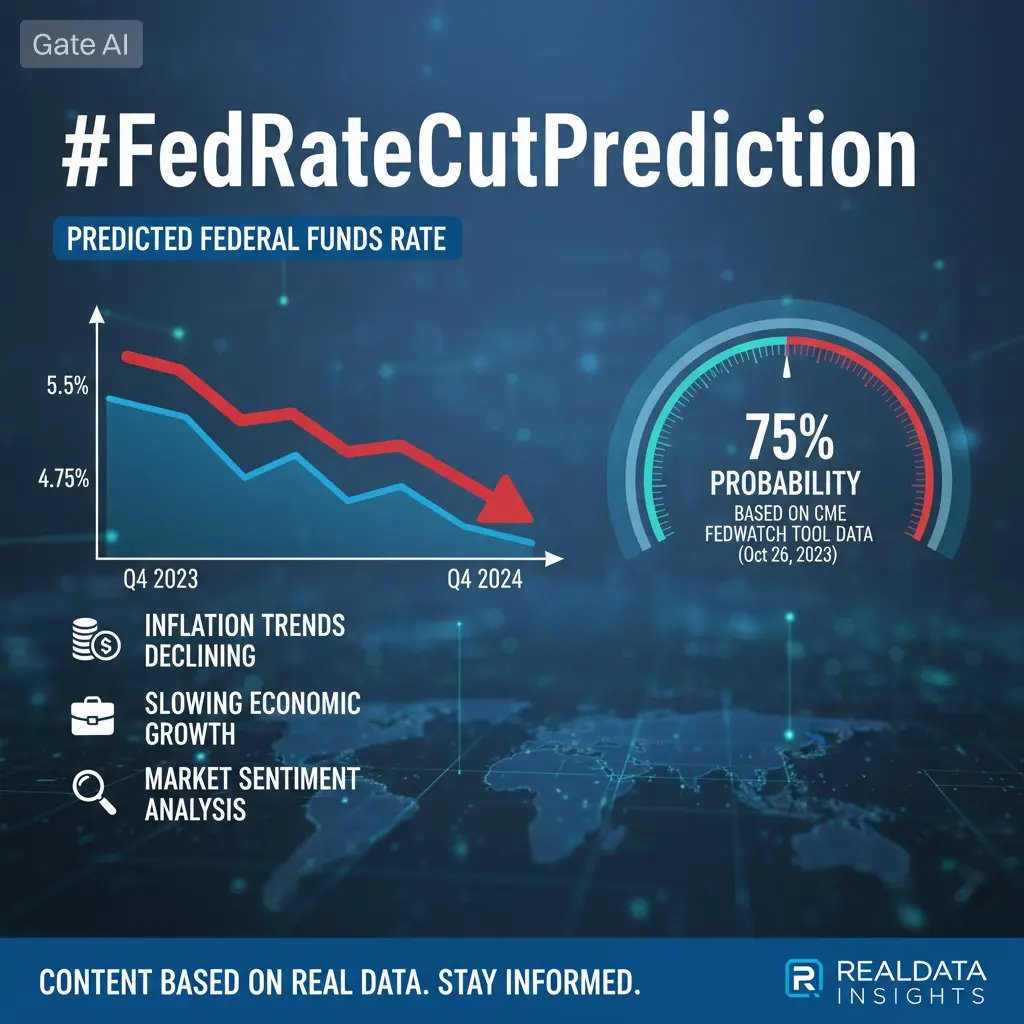

#FedRateCutPrediction has become a major focus for global markets, as expectations around U.S. interest rates strongly influence capital flow, risk appetite, and overall financial sentiment.

2. A Fed rate cut means the U.S. central bank lowers borrowing costs, making money cheaper for businesses, institutions, and investors. This often encourages spending, investing, and risk-taking.

3. Markets don’t wait for rate cuts to happen — they move based on expectations. This is why predictions and signals from the Federal Reserve are often more powerful than the decision itself

#FedRateCutPrediction has become a major focus for global markets, as expectations around U.S. interest rates strongly influence capital flow, risk appetite, and overall financial sentiment.

2. A Fed rate cut means the U.S. central bank lowers borrowing costs, making money cheaper for businesses, institutions, and investors. This often encourages spending, investing, and risk-taking.

3. Markets don’t wait for rate cuts to happen — they move based on expectations. This is why predictions and signals from the Federal Reserve are often more powerful than the decision itself

BTC-0,93%

- Reward

- 15

- 11

- Repost

- Share

EagleEye :

:

🎄🎅✨Santa Claus is here! Holiday mood activated!View More

#FedRateCutPrediction

Federal Reserve’s Final 2025 Rate Decision: What a 25-Basis-Point Cut Could Mean for Markets

December 8 marks the Federal Reserve’s final rate meeting of the year, and all eyes are on the highly anticipated interest rate decision, scheduled for 3:00 AM (UTC+8) on Thursday. The market currently estimates an 84% probability of a 25-basis-point rate cut, reflecting widespread expectations that the Fed may take action to support the economy heading into 2026. This decision is particularly significant as it will set the tone for global financial markets during the final weeks

Federal Reserve’s Final 2025 Rate Decision: What a 25-Basis-Point Cut Could Mean for Markets

December 8 marks the Federal Reserve’s final rate meeting of the year, and all eyes are on the highly anticipated interest rate decision, scheduled for 3:00 AM (UTC+8) on Thursday. The market currently estimates an 84% probability of a 25-basis-point rate cut, reflecting widespread expectations that the Fed may take action to support the economy heading into 2026. This decision is particularly significant as it will set the tone for global financial markets during the final weeks

- Reward

- 10

- 8

- Repost

- Share

ShizukaKazu :

:

Merry Christmas, bull up! 🐂View More

#FedRateCutPrediction

Markets are closely watching the Federal Reserve as inflation cools and economic data shows mixed signals. While an immediate rate cut may be unlikely, expectations are building for potential easing later in the year if inflation continues to trend lower and growth slows.

🔍 Key Points to Watch: • Inflation trajectory & CPI data

• Labor market strength

• Economic growth and consumer demand

• Fed officials’ forward guidance

📉 A confirmed rate cut could boost risk assets like stocks and crypto, while a delay may keep markets volatile in the short term.

Stay alert — macro d

Markets are closely watching the Federal Reserve as inflation cools and economic data shows mixed signals. While an immediate rate cut may be unlikely, expectations are building for potential easing later in the year if inflation continues to trend lower and growth slows.

🔍 Key Points to Watch: • Inflation trajectory & CPI data

• Labor market strength

• Economic growth and consumer demand

• Fed officials’ forward guidance

📉 A confirmed rate cut could boost risk assets like stocks and crypto, while a delay may keep markets volatile in the short term.

Stay alert — macro d

- Reward

- 5

- 1

- Repost

- Share

BeautifulDay :

:

Merry Christmas ⛄🚀 $BEAT / USDT — Trade Setup

💰 Current Price: 3.7059 USDT

📊 Market Structure

• Trend: Bullish 🟢

• Momentum: Buyers in control

• Liquidity: Absorption below support

📍 Key Levels

• Support: 3.20 – 3.40

• Resistance: 3.90 – 4.10

🎯 Targets

• TP1: 3.90

• TP2: 4.30

• TP3: 4.80+ (extension)

🛑 Invalidation

• Breakdown below 3.00 with volume

⚠️ Notes

• Prefer entries on pullbacks or retests

• Volatility expected — manage risk

📈 Bias: Bullish above 3.20

💎 R:R: Favorable

Follow for more high-probability setups 🔥

$BEAT $BTC $ETH #2025GateYearEndSummary #JoinGrowthPointsDrawToWinGoldenBar #ET

💰 Current Price: 3.7059 USDT

📊 Market Structure

• Trend: Bullish 🟢

• Momentum: Buyers in control

• Liquidity: Absorption below support

📍 Key Levels

• Support: 3.20 – 3.40

• Resistance: 3.90 – 4.10

🎯 Targets

• TP1: 3.90

• TP2: 4.30

• TP3: 4.80+ (extension)

🛑 Invalidation

• Breakdown below 3.00 with volume

⚠️ Notes

• Prefer entries on pullbacks or retests

• Volatility expected — manage risk

📈 Bias: Bullish above 3.20

💎 R:R: Favorable

Follow for more high-probability setups 🔥

$BEAT $BTC $ETH #2025GateYearEndSummary #JoinGrowthPointsDrawToWinGoldenBar #ET

MC:$3.6KHolders:3

0.00%

- Reward

- like

- Comment

- Repost

- Share

#FedRateCutPrediction

Fed Rate Cut Expectations on December 21 What It Means for the Crypto Market Today

As of December 21, global financial markets are actively pricing in expectations around future Federal Reserve rate cuts, making this moment especially important for crypto market participants. Current macro conditions show cooling inflation trends, moderating bond yields, and increasing speculation that the Fed’s next policy move may lean toward easing rather than tightening. For crypto, this environment is not just noise it represents a potential shift in liquidity dynamics that can shap

Fed Rate Cut Expectations on December 21 What It Means for the Crypto Market Today

As of December 21, global financial markets are actively pricing in expectations around future Federal Reserve rate cuts, making this moment especially important for crypto market participants. Current macro conditions show cooling inflation trends, moderating bond yields, and increasing speculation that the Fed’s next policy move may lean toward easing rather than tightening. For crypto, this environment is not just noise it represents a potential shift in liquidity dynamics that can shap

- Reward

- 2

- 2

- Repost

- Share

Luna_Star :

:

Watching Closely 🔍View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

42.47M Popularity

165.8K Popularity

138.6K Popularity

1.67M Popularity

525.19K Popularity

15.65K Popularity

14.82K Popularity

27.94K Popularity

9.86K Popularity

370.5K Popularity

50.6K Popularity

195.93K Popularity

21.26K Popularity

76.09K Popularity

14.62K Popularity

News

View MoreETH drops below 1950 USDT

13 m

Data: If BTC breaks through $69,628, the total liquidation strength of long positions on mainstream CEXs will reach $1.257 billion.

1 h

Data: If ETH drops below $1,882, the total long liquidation strength on major CEXs will reach $698 million.

1 h

European Central Bank's Nagel: The US dollar's safe-haven status is being questioned, and the weak exchange rate will persist

1 h

BTC drops below 66,000 USDT

3 h

Pin