#CapitalRotation

Capital Rotation in Financial Markets: A Complete Deep-Dive Guide

Capital rotation is one of the most powerful yet often misunderstood forces driving financial markets. Whether you are trading stocks, cryptocurrencies, commodities, or global indices, understanding how and why capital rotates can give you a serious edge. Markets do not move randomly—money flows with purpose, responding to changing conditions, expectations, and risk appetite.

This extended guide explores capital rotation in depth, covering its mechanics, drivers, real-world examples, indicators, strategies, and common mistakes investors make.

1. Understanding Capital Rotation at a Deeper Level

At its core, capital rotation is the reallocation of money from one asset, sector, or market to another in search of better risk-adjusted returns. Instead of new money entering the market, existing capital is simply moving around.

This means:

One sector rising often comes at the expense of another

Market leadership constantly changes

What worked last month may underperform next month

Capital rotation reflects the mindset of professional investors, institutions, and “smart money,” who rarely stay married to one asset for too long.

2. The Psychology Behind Capital Rotation

Markets are driven as much by human behavior as by numbers.

Key psychological drivers include:

Profit-taking: After strong rallies, investors lock in gains

Fear & greed cycles: Fear pushes money into defensive assets; optimism pushes it into growth assets

Narrative shifts: New stories (AI, Web3, rate cuts, ETFs) attract capital rapidly

Relative opportunity: Investors compare “what’s already up” vs “what hasn’t moved yet”

This psychological rotation creates repeating market patterns across decades.

3. Capital Rotation Across Economic Cycles

Capital rotation closely follows the business cycle:

Early Recovery Phase

Capital flows into: Industrials, small caps, growth assets

Crypto: BTC and ETH lead initial recovery

Expansion Phase

Capital favors: Technology, consumer discretionary, high-growth sectors

Crypto: ETH and large-cap altcoins outperform

Late Cycle

Rotation into: Commodities, energy, inflation-hedge assets

Crypto: Select narratives outperform, volatility increases

Recession / Risk-Off Phase

Capital moves to: Cash, bonds, utilities, defensive stocks

Crypto: BTC dominance rises, altcoins weaken

Understanding where the economy stands helps anticipate where capital goes next, not where it has already been.

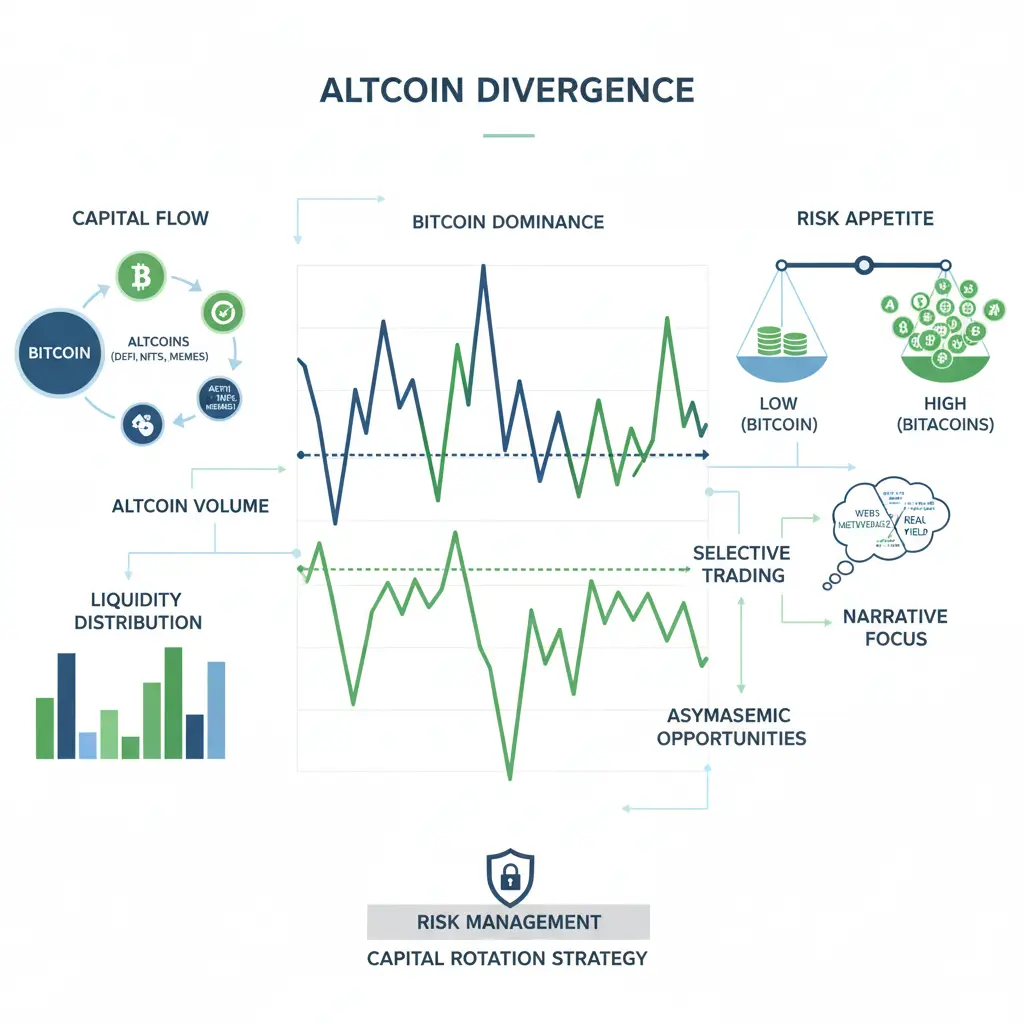

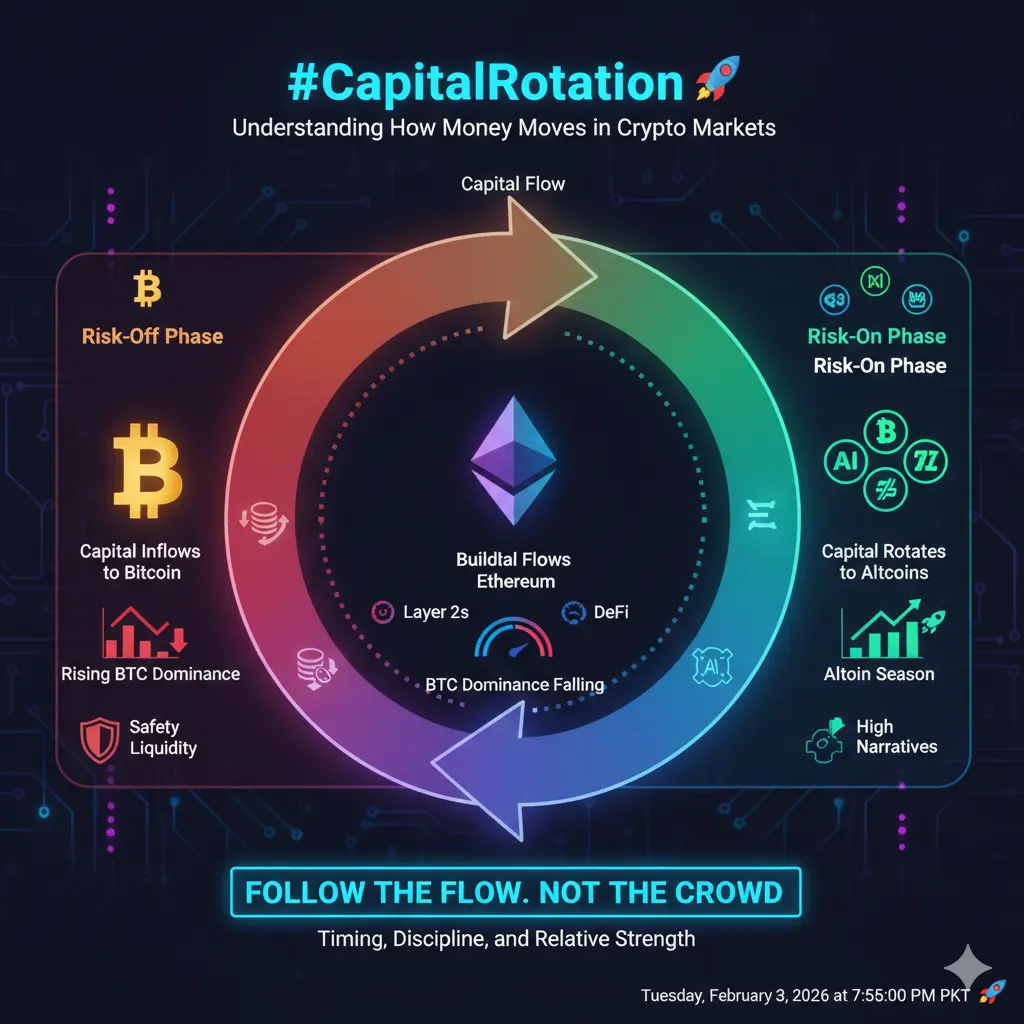

4. Capital Rotation in Crypto Markets

Crypto markets are a textbook example of rotation due to high speculation and fast sentiment shifts.

Typical Crypto Rotation Flow

Bitcoin (BTC) – Safety, liquidity, institutional entry

Ethereum (ETH) – Smart contracts, ecosystem confidence

Large-cap Altcoins – Layer-1s, infrastructure

Mid & Small-cap Altcoins – Higher risk, higher reward

Narrative Coins – Memes, trends, hype-driven assets

When BTC dominance peaks and starts to fall, it often signals capital rotating outward, setting the stage for broader market participation.

5. Capital Rotation in Equity Markets

In traditional markets, rotation often occurs between:

Growth ↔ Value

Cyclical ↔ Defensive

Large-cap ↔ Small-cap

For example:

Rising interest rates often rotate capital away from tech

Falling rates encourage flows back into growth stocks

Inflation concerns push capital toward energy and commodities

Sector ETFs and relative strength charts are key tools professionals use to track these movements.

6. How Institutions Use Capital Rotation

Large funds and institutions:

Rarely go “all-in” on one sector

Gradually rotate capital over weeks or months

Accumulate before narratives become popular

Distribute when retail interest peaks

This creates the illusion that markets move suddenly, while in reality, capital was positioning quietly in advance.

7. Indicators That Signal Capital Rotation

To spot rotation early, investors monitor:

Relative Strength (RS): Comparing asset performance against benchmarks

Volume Shifts: Rising volume in lagging sectors

Market Breadth: More assets participating in rallies

Dominance Metrics (Crypto): BTC dominance trends

Yield Curves & Rates: Signals of economic transitions

Sector Performance Tables: Weekly and monthly comparisons

No single indicator is perfect—rotation is best identified through confluence.

8. Strategies to Trade Capital Rotation

Rotation Anticipation Strategy

Identify lagging but fundamentally strong sectors

Enter before momentum turns obvious

Rotation Confirmation Strategy

Wait for trend reversal signals

Lower risk, smaller upside

Partial Rotation Strategy

Gradually shift capital instead of sudden moves

Reduces timing risk

Smart traders rotate with the market, not against it.

9. Common Mistakes Investors Make

Chasing assets after major rallies

Ignoring macroeconomic context

Over-rotating too frequently

Confusing short-term noise with real rotation

Going all-in instead of scaling positions

Capital rotation rewards patience, discipline, and awareness, not emotional decisions.

10. Risks and Limitations of Capital Rotation

While powerful, rotation is not guaranteed:

False rotations can trap traders

Macro shocks can disrupt patterns

Timing remains difficult even for professionals

Risk management, diversification, and position sizing are essential companions to rotation-based strategies.

Final Thoughts

Capital rotation is the invisible engine driving market leadership changes. Markets do not simply rise or fall—they shift, rebalance, and reposition continuously. Those who learn to read these movements gain insight into where opportunity is forming before it becomes obvious.

For traders and investors alike, understanding capital rotation is not optional—it is foundational. The goal is not to predict perfectly, but to align with the flow of money, because in markets, capital always tells the truth before headlines do.

Capital Rotation in Financial Markets: A Complete Deep-Dive Guide

Capital rotation is one of the most powerful yet often misunderstood forces driving financial markets. Whether you are trading stocks, cryptocurrencies, commodities, or global indices, understanding how and why capital rotates can give you a serious edge. Markets do not move randomly—money flows with purpose, responding to changing conditions, expectations, and risk appetite.

This extended guide explores capital rotation in depth, covering its mechanics, drivers, real-world examples, indicators, strategies, and common mistakes investors make.

1. Understanding Capital Rotation at a Deeper Level

At its core, capital rotation is the reallocation of money from one asset, sector, or market to another in search of better risk-adjusted returns. Instead of new money entering the market, existing capital is simply moving around.

This means:

One sector rising often comes at the expense of another

Market leadership constantly changes

What worked last month may underperform next month

Capital rotation reflects the mindset of professional investors, institutions, and “smart money,” who rarely stay married to one asset for too long.

2. The Psychology Behind Capital Rotation

Markets are driven as much by human behavior as by numbers.

Key psychological drivers include:

Profit-taking: After strong rallies, investors lock in gains

Fear & greed cycles: Fear pushes money into defensive assets; optimism pushes it into growth assets

Narrative shifts: New stories (AI, Web3, rate cuts, ETFs) attract capital rapidly

Relative opportunity: Investors compare “what’s already up” vs “what hasn’t moved yet”

This psychological rotation creates repeating market patterns across decades.

3. Capital Rotation Across Economic Cycles

Capital rotation closely follows the business cycle:

Early Recovery Phase

Capital flows into: Industrials, small caps, growth assets

Crypto: BTC and ETH lead initial recovery

Expansion Phase

Capital favors: Technology, consumer discretionary, high-growth sectors

Crypto: ETH and large-cap altcoins outperform

Late Cycle

Rotation into: Commodities, energy, inflation-hedge assets

Crypto: Select narratives outperform, volatility increases

Recession / Risk-Off Phase

Capital moves to: Cash, bonds, utilities, defensive stocks

Crypto: BTC dominance rises, altcoins weaken

Understanding where the economy stands helps anticipate where capital goes next, not where it has already been.

4. Capital Rotation in Crypto Markets

Crypto markets are a textbook example of rotation due to high speculation and fast sentiment shifts.

Typical Crypto Rotation Flow

Bitcoin (BTC) – Safety, liquidity, institutional entry

Ethereum (ETH) – Smart contracts, ecosystem confidence

Large-cap Altcoins – Layer-1s, infrastructure

Mid & Small-cap Altcoins – Higher risk, higher reward

Narrative Coins – Memes, trends, hype-driven assets

When BTC dominance peaks and starts to fall, it often signals capital rotating outward, setting the stage for broader market participation.

5. Capital Rotation in Equity Markets

In traditional markets, rotation often occurs between:

Growth ↔ Value

Cyclical ↔ Defensive

Large-cap ↔ Small-cap

For example:

Rising interest rates often rotate capital away from tech

Falling rates encourage flows back into growth stocks

Inflation concerns push capital toward energy and commodities

Sector ETFs and relative strength charts are key tools professionals use to track these movements.

6. How Institutions Use Capital Rotation

Large funds and institutions:

Rarely go “all-in” on one sector

Gradually rotate capital over weeks or months

Accumulate before narratives become popular

Distribute when retail interest peaks

This creates the illusion that markets move suddenly, while in reality, capital was positioning quietly in advance.

7. Indicators That Signal Capital Rotation

To spot rotation early, investors monitor:

Relative Strength (RS): Comparing asset performance against benchmarks

Volume Shifts: Rising volume in lagging sectors

Market Breadth: More assets participating in rallies

Dominance Metrics (Crypto): BTC dominance trends

Yield Curves & Rates: Signals of economic transitions

Sector Performance Tables: Weekly and monthly comparisons

No single indicator is perfect—rotation is best identified through confluence.

8. Strategies to Trade Capital Rotation

Rotation Anticipation Strategy

Identify lagging but fundamentally strong sectors

Enter before momentum turns obvious

Rotation Confirmation Strategy

Wait for trend reversal signals

Lower risk, smaller upside

Partial Rotation Strategy

Gradually shift capital instead of sudden moves

Reduces timing risk

Smart traders rotate with the market, not against it.

9. Common Mistakes Investors Make

Chasing assets after major rallies

Ignoring macroeconomic context

Over-rotating too frequently

Confusing short-term noise with real rotation

Going all-in instead of scaling positions

Capital rotation rewards patience, discipline, and awareness, not emotional decisions.

10. Risks and Limitations of Capital Rotation

While powerful, rotation is not guaranteed:

False rotations can trap traders

Macro shocks can disrupt patterns

Timing remains difficult even for professionals

Risk management, diversification, and position sizing are essential companions to rotation-based strategies.

Final Thoughts

Capital rotation is the invisible engine driving market leadership changes. Markets do not simply rise or fall—they shift, rebalance, and reposition continuously. Those who learn to read these movements gain insight into where opportunity is forming before it becomes obvious.

For traders and investors alike, understanding capital rotation is not optional—it is foundational. The goal is not to predict perfectly, but to align with the flow of money, because in markets, capital always tells the truth before headlines do.