Post content & earn content mining yield

placeholder

TraderXNehal

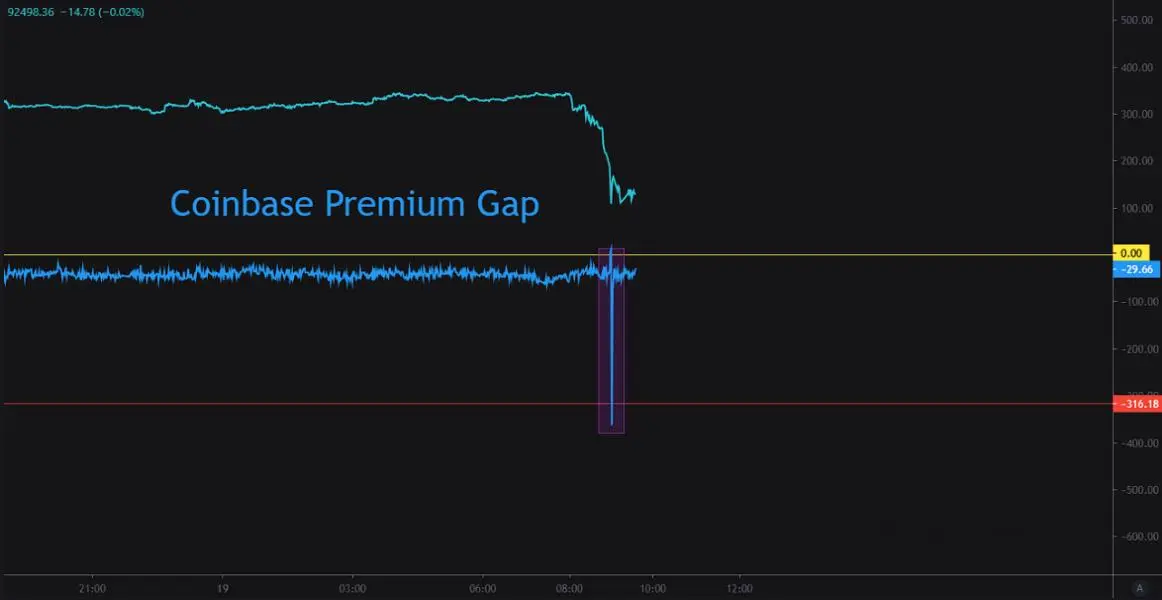

🇺🇸🐳 Strongest CPG Premium in Recent Periods

“Since the ETF market was not open at the time, this selling pressure is coming from U.S. whales operating outside of ETFs.” #etf

“Since the ETF market was not open at the time, this selling pressure is coming from U.S. whales operating outside of ETFs.” #etf

- Reward

- like

- Comment

- Repost

- Share

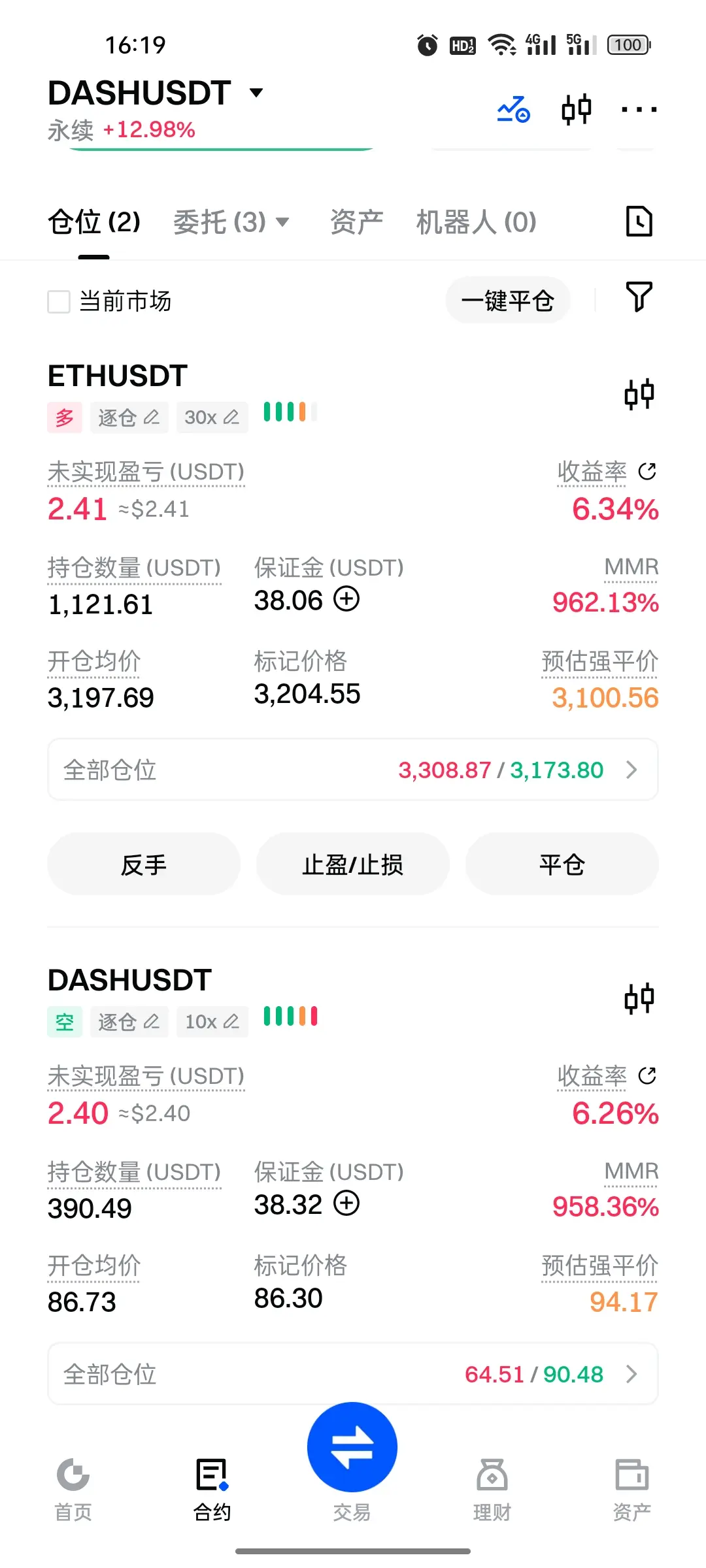

DASH Short-term Downtrend Confirmed, Technical Collapse Approaching

From a technical perspective, DASH's upward momentum has been completely exhausted. After an initial rally, the price faced resistance at 96.50, forming a double top pattern. The subsequent correction directly broke the key neckline, confirming a reversal signal.

Currently, the MACD indicator has formed a death cross at a high level, with the red histogram continuously shrinking and the green histogram rapidly expanding, indicating that the bearish force is dominating the market. Although the KDJ indicator has temporarily rebo

From a technical perspective, DASH's upward momentum has been completely exhausted. After an initial rally, the price faced resistance at 96.50, forming a double top pattern. The subsequent correction directly broke the key neckline, confirming a reversal signal.

Currently, the MACD indicator has formed a death cross at a high level, with the red histogram continuously shrinking and the green histogram rapidly expanding, indicating that the bearish force is dominating the market. Although the KDJ indicator has temporarily rebo

DASH9,41%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

666

牛马崛起

Created By@GateUser-9bdc5b17

Subscription Progress

0.00%

MC:

$0

Create My Token

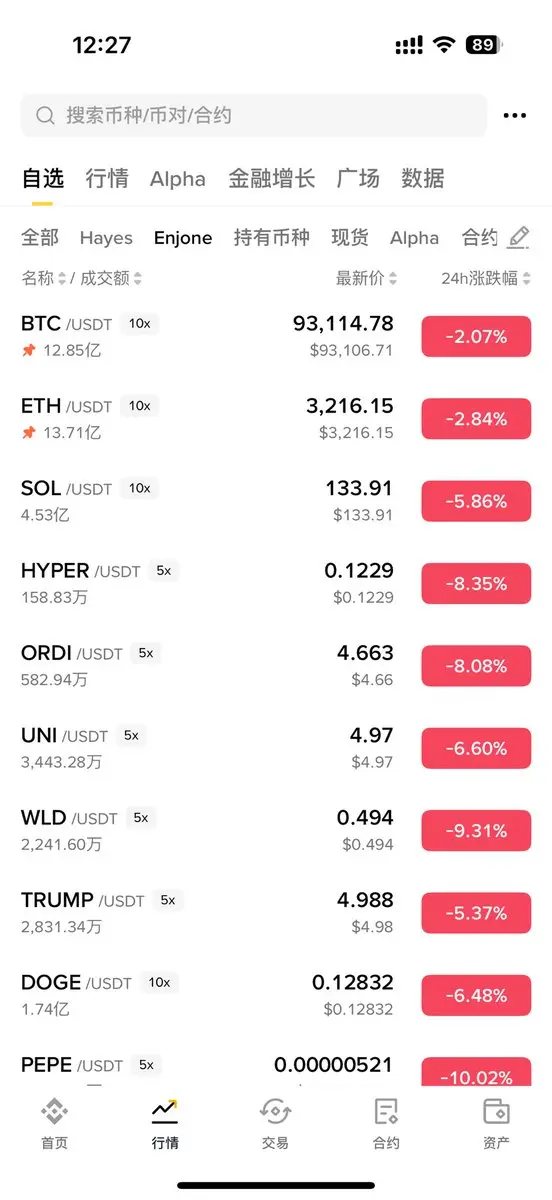

This wave of market movement

Short or bottom-fishing

View OriginalShort or bottom-fishing

- Reward

- like

- Comment

- Repost

- Share

🚨 TRUMP: GREENLAND IS NO LONGER NEGOTIABLE

Big statement from Trump: NATO warned Denmark for 20 years about the threat from Russia, but no action was taken.

Now Trump has clearly stated, "Now it is time, and it will be done!"

Big statement from Trump: NATO warned Denmark for 20 years about the threat from Russia, but no action was taken.

Now Trump has clearly stated, "Now it is time, and it will be done!"

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

BTC.D is compressing after a strong move up.

This is usually the deceptive part of the cycle where nothing looks clear.

If dominance starts accepting lower from here, that’s historically when alts get room to run.

Until then, I’m treating this as a grind, not a trend.

This is usually the deceptive part of the cycle where nothing looks clear.

If dominance starts accepting lower from here, that’s historically when alts get room to run.

Until then, I’m treating this as a grind, not a trend.

BTC-2,08%

- Reward

- like

- Comment

- Repost

- Share

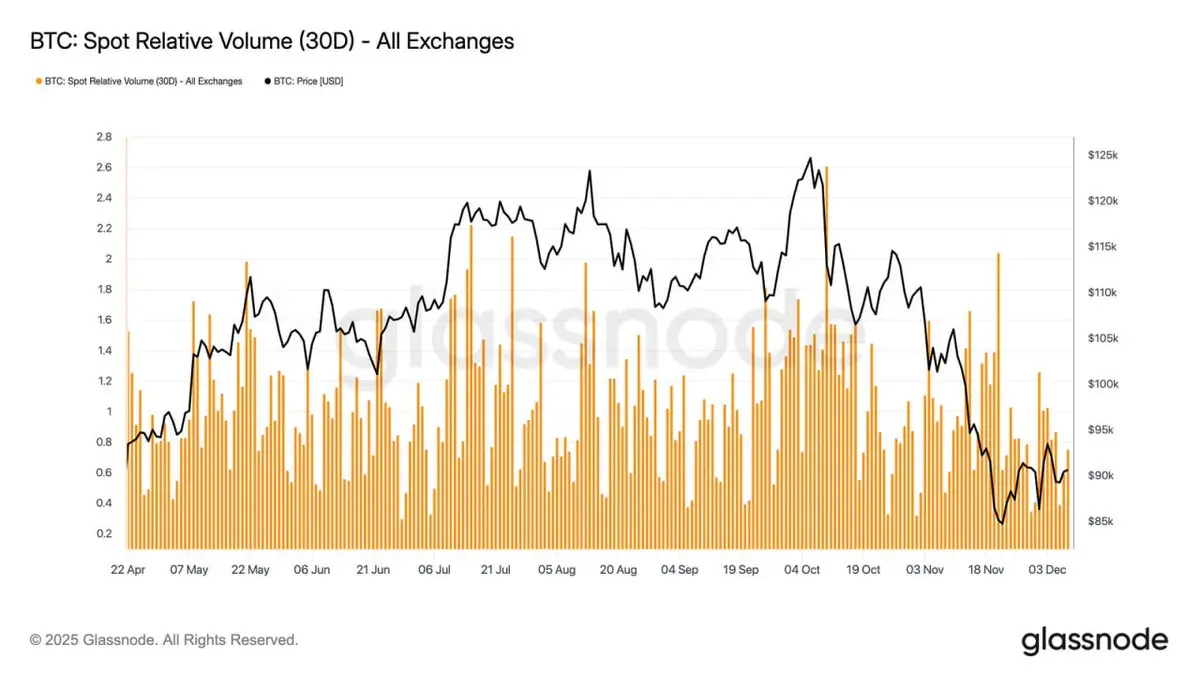

Bitcoin's spot volume near 30-day range lows 📉📊. Activity weakened through November-December, mirroring price decline and showing participation retreat ⚡️💼.

Volume contraction reflects defensive positioning with less liquidity for volatility 👀. Attention shifts to FOMC meeting for potential catalyst 🎯💰.

Volume contraction reflects defensive positioning with less liquidity for volatility 👀. Attention shifts to FOMC meeting for potential catalyst 🎯💰.

BTC-2,08%

- Reward

- like

- Comment

- Repost

- Share

Gate Annual Report is out! Let's take a look at my yearly performance

Click the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VQUQBWXBAG&ref_type=126&shareUid=U1lEXV9aCQcO0O0O

View OriginalClick the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VQUQBWXBAG&ref_type=126&shareUid=U1lEXV9aCQcO0O0O

- Reward

- like

- Comment

- Repost

- Share

#Gate 2025 Year-End Community Gala#

Top Streamers & Content Creators Year-End Awards

Who will be the Top Streamers of the Year? Who will claim the top spot on the Content Creator leaderboard? Join me in voting to support your favorite streamers and creators, and witness the rise of community stars!

https://www.gate.com/activities/community-vote-2025?ref=VVHFUFELUQ&refUid=43079898&ref_type=165&utm_cmp=xjdtmcgP

Top Streamers & Content Creators Year-End Awards

Who will be the Top Streamers of the Year? Who will claim the top spot on the Content Creator leaderboard? Join me in voting to support your favorite streamers and creators, and witness the rise of community stars!

https://www.gate.com/activities/community-vote-2025?ref=VVHFUFELUQ&refUid=43079898&ref_type=165&utm_cmp=xjdtmcgP

- Reward

- like

- Comment

- Repost

- Share

What's the Next Hot Spot in Crypto?

- Reward

- like

- Comment

- Repost

- Share

Today you can follow $ORDI

1. Conservative Long Positions: 4.40–4.45 USDT

This range is the recent low support zone for the pullback and also a key support level below the lower band of the Bollinger Bands. If the price retraces to this range and shows signs of stabilization (such as a doji or a lower shadow), you can enter a small position, with a stop loss set below 4.30 USDT.

2. Aggressive Long Positions: 4.55–4.60 USDT

If the price rebounds quickly and stabilizes above the Bollinger Bands lower band (4.646 USDT) in a consolidation zone, you can try a small long position in the 4.55–4.60

1. Conservative Long Positions: 4.40–4.45 USDT

This range is the recent low support zone for the pullback and also a key support level below the lower band of the Bollinger Bands. If the price retraces to this range and shows signs of stabilization (such as a doji or a lower shadow), you can enter a small position, with a stop loss set below 4.30 USDT.

2. Aggressive Long Positions: 4.55–4.60 USDT

If the price rebounds quickly and stabilizes above the Bollinger Bands lower band (4.646 USDT) in a consolidation zone, you can try a small long position in the 4.55–4.60

ORDI-9,01%

- Reward

- like

- Comment

- Repost

- Share

I've said many times in various occasions, "Money can't be spent all, but it can be lost all," most people's bullets are consumed in some meaningless market movements. When the real trend arrives, they find their bullets are gone, so sometimes it's better to deliberately slow down.

Trading is definitely about earning from cycles and trends, not about making quick scalp profits every day. Making big money through trading usually happens at a specific moment—when you are heavily invested in a certain coin and happen to catch a wave of trend.

The recent market conditions are, for me, considered d

Trading is definitely about earning from cycles and trends, not about making quick scalp profits every day. Making big money through trading usually happens at a specific moment—when you are heavily invested in a certain coin and happen to catch a wave of trend.

The recent market conditions are, for me, considered d

ETH-3,18%

- Reward

- like

- Comment

- Repost

- Share

mb

mr beard

Created By@GateUser-2696e609

Subscription Progress

0.00%

MC:

$0

Create My Token

GM guys

The grind started when you woke up

The grind started when you woke up

- Reward

- like

- Comment

- Repost

- Share

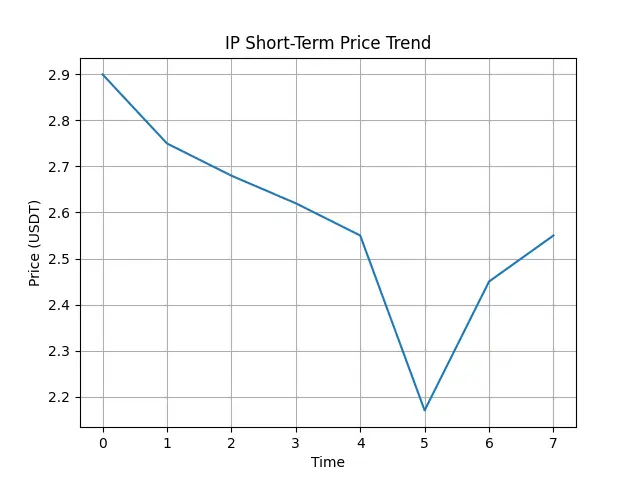

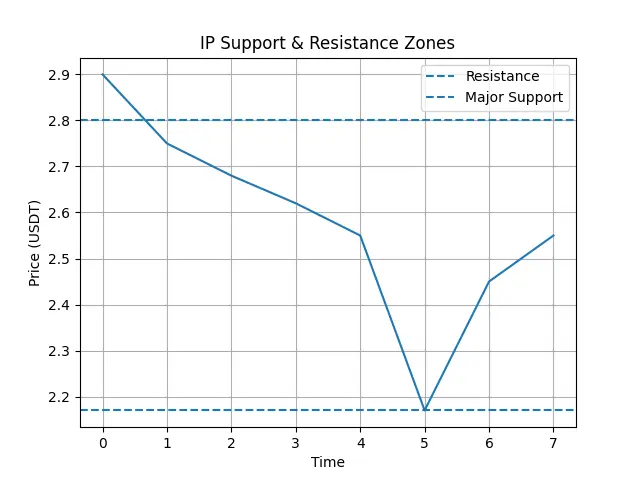

$IP IP saw a strong rejection near the 2.90 zone, followed by a sharp downside move toward 2.17. That drop looks like a fast liquidity sweep. After touching that low, price bounced and is now stabilizing around 2.55.

Selling pressure has slowed, but buyers are still cautious.

🔍 Short-Term View (15m – 1h)

Price is below short EMAs, showing short-term weakness

Momentum indicators are mixed, not fully oversold

2.45–2.40 is the nearest support area

Holding above this zone keeps the structure stable.

⏳ Mid-Term View (4h)

Trend is bearish to neutral

Strong resistance sits around 2.70–2.80

A real

Selling pressure has slowed, but buyers are still cautious.

🔍 Short-Term View (15m – 1h)

Price is below short EMAs, showing short-term weakness

Momentum indicators are mixed, not fully oversold

2.45–2.40 is the nearest support area

Holding above this zone keeps the structure stable.

⏳ Mid-Term View (4h)

Trend is bearish to neutral

Strong resistance sits around 2.70–2.80

A real

IP-8,89%

- Reward

- like

- Comment

- Repost

- Share

🔹 ETH breaks below $3,200 — is this a short-term panic flush or a signal of trend reversal?

- Reward

- like

- Comment

- Repost

- Share

$老子

If it doesn’t bounce from here, it’s dead. I’m reopening my short position based on this chart.

A move above 0.003 means recovery, but if it breaks below 0.0025, it’s the death signal…

If the 0.003 level is broken and price holds above it, I won’t open any more positions.

If the price comes back to 0.0027, I’ll open a short again.

If it doesn’t bounce from here, it’s dead. I’m reopening my short position based on this chart.

A move above 0.003 means recovery, but if it breaks below 0.0025, it’s the death signal…

If the 0.003 level is broken and price holds above it, I won’t open any more positions.

If the price comes back to 0.0027, I’ll open a short again.

老子-26,74%

- Reward

- 1

- 1

- Repost

- Share

TenMillionUAndThenStop. :

:

It's already in a downtrend; it's probably going to fall further.- Reward

- 1

- 1

- Repost

- Share

deltapro :

:

Amid record activity on the Ethereum blockchain, transaction costs dropped to a historic low of $0.15. 💪 A clear result of the developers' efforts to scale the network in recent years.

$ASTER ASTER saw a sharp drop recently and is now trying to stabilize after that heavy sell-off. Price reacted strongly from the lower zone, which shows buyers are active near support, but recovery still looks slow and cautious.

What the chart is saying

Strong rejection from the lower area around 0.55, which is acting as a key support.

Price is still trading below major moving averages, so overall momentum remains weak.

Volume spike during the drop suggests panic selling may already be done.

Multi-timeframe view

Short-term: Price may move sideways between 0.60 – 0.66 as the market cools down

What the chart is saying

Strong rejection from the lower area around 0.55, which is acting as a key support.

Price is still trading below major moving averages, so overall momentum remains weak.

Volume spike during the drop suggests panic selling may already be done.

Multi-timeframe view

Short-term: Price may move sideways between 0.60 – 0.66 as the market cools down

ASTER-12,06%

- Reward

- 1

- Comment

- Repost

- Share

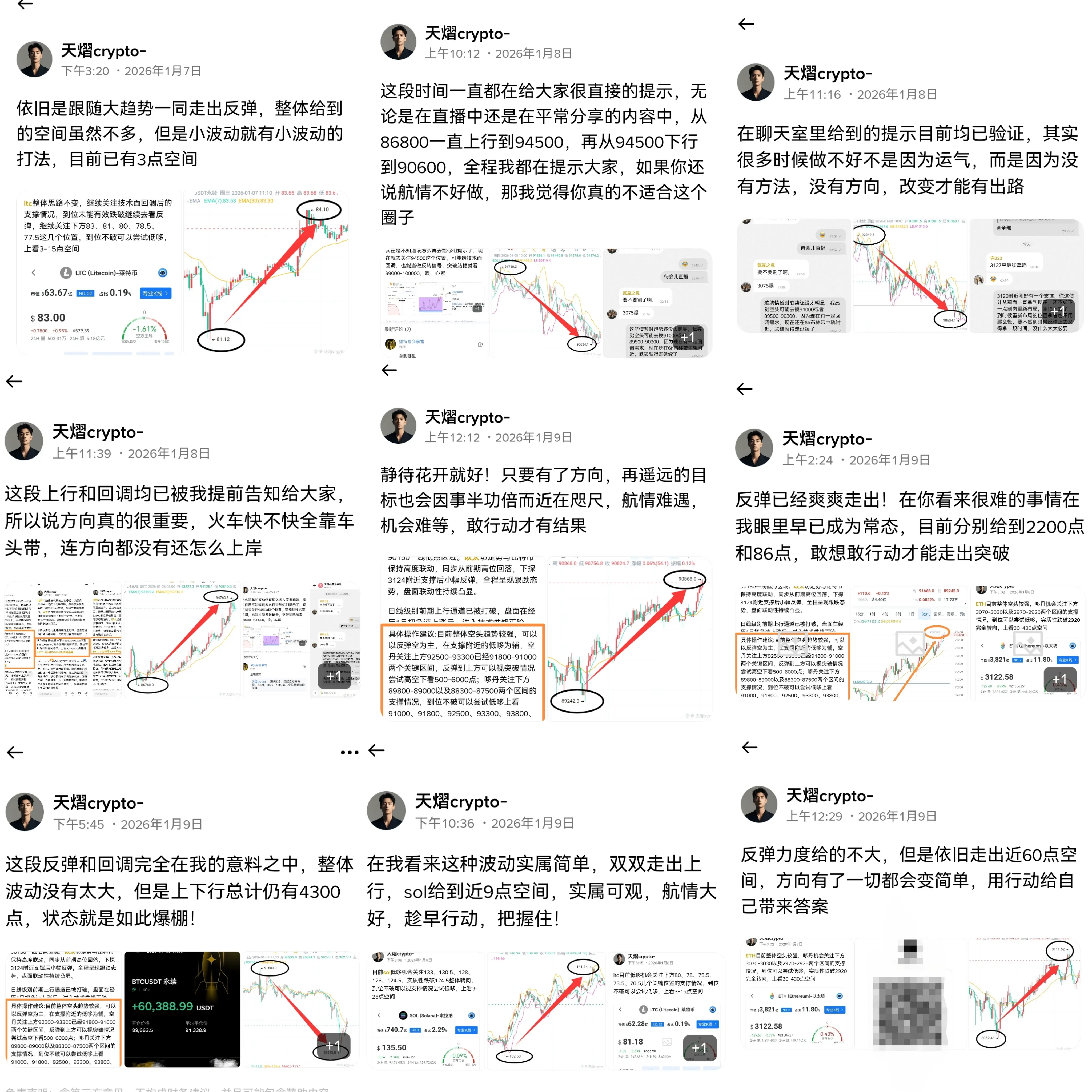

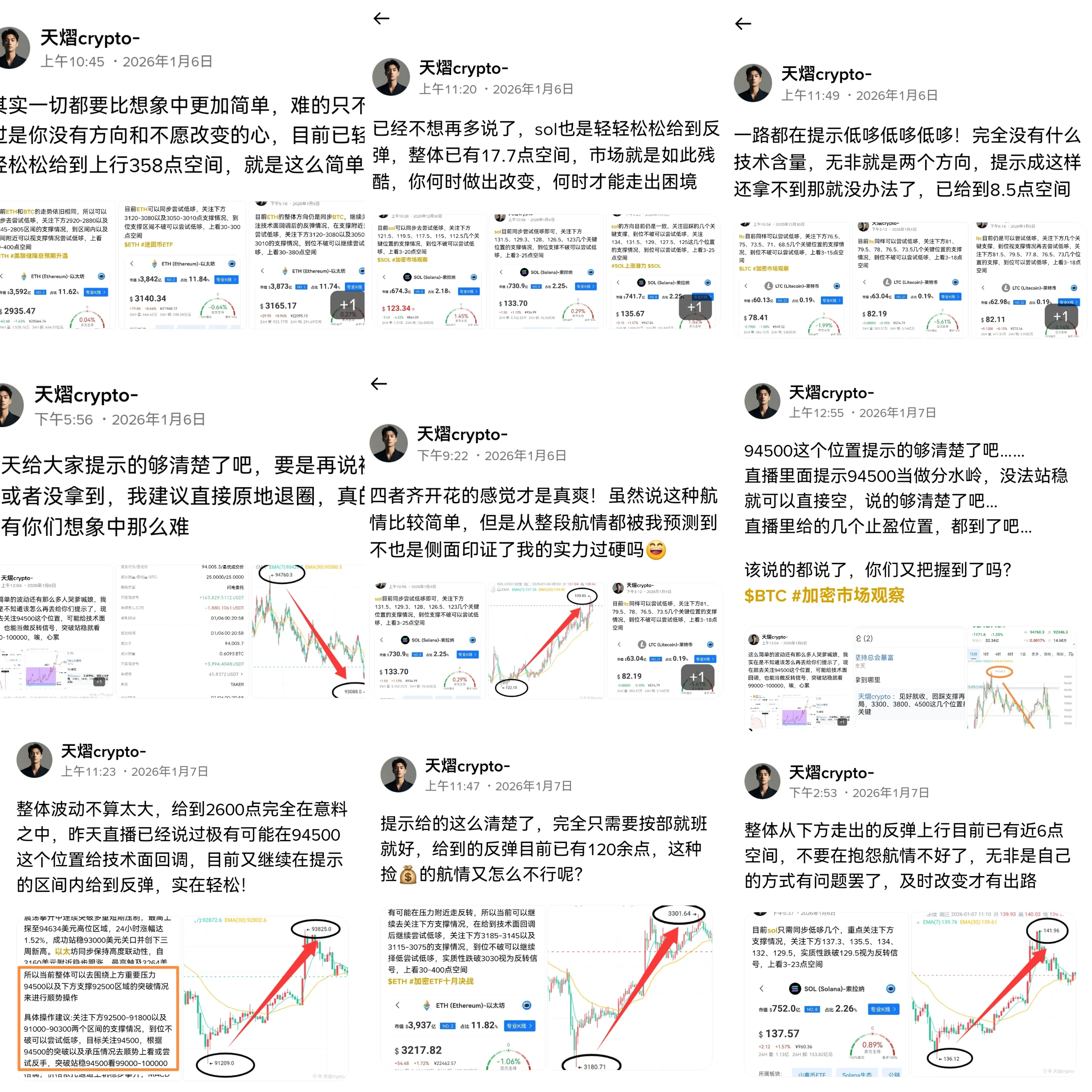

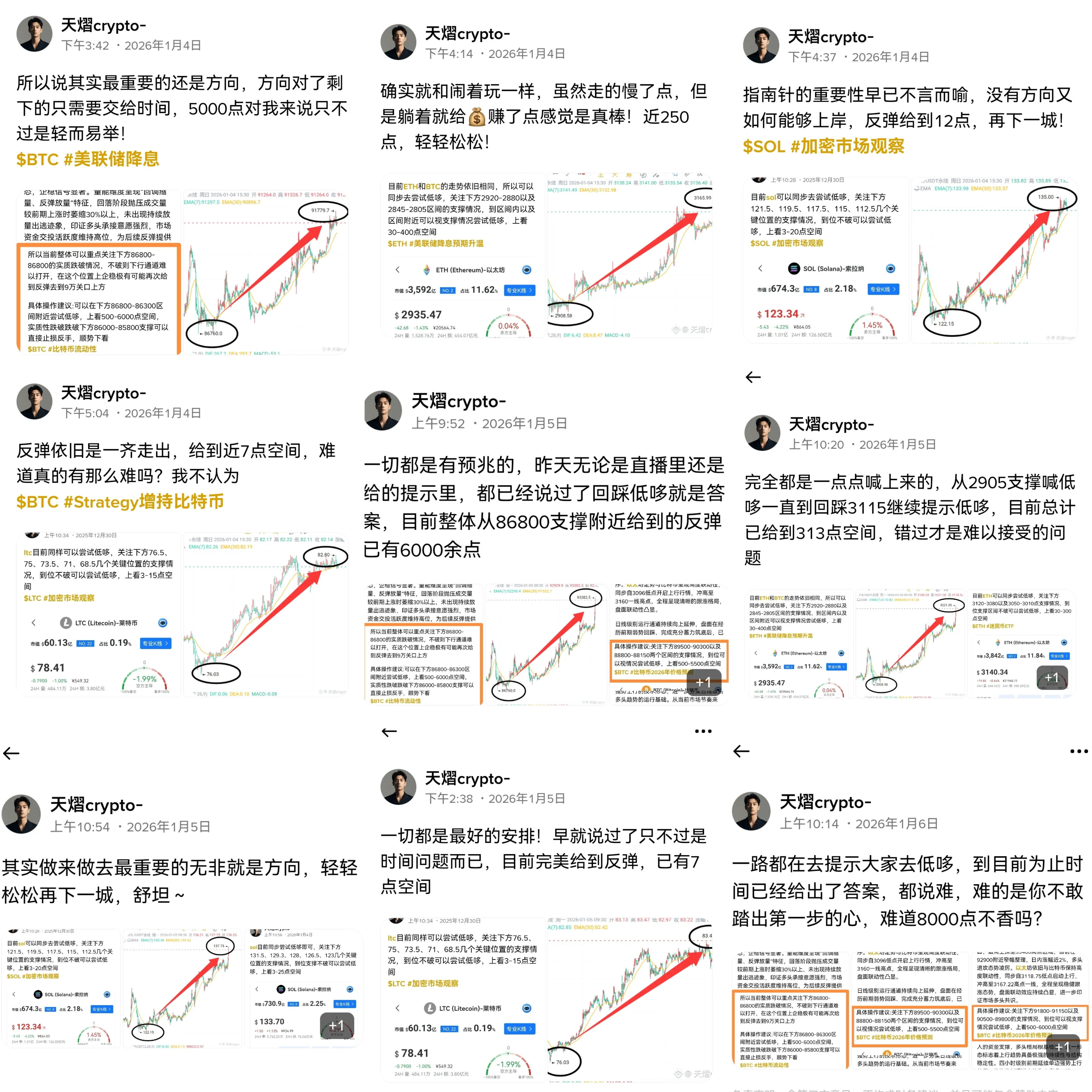

Lately, I don't know if you can feel it, but we are in an era where practical experience and win rate are king. The direction is truly too important, and those who are willing to take action will always be the winners.

#欧美关税风波冲击市场 #加密市场回调 #GateLaunchpadIMU

View Original#欧美关税风波冲击市场 #加密市场回调 #GateLaunchpadIMU

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More5.02K Popularity

326.16K Popularity

36.66K Popularity

2.02K Popularity

1.85K Popularity

News

View MoreHuang Licheng continues to reduce HYPE long positions and increase ETH long positions, with a loss of approximately $1.87 million in the past day.

1 m

A certain whale is bullish on the future market and is simultaneously going long on BTC and HYPE

2 m

Immunefi(IMU) will be launched on the Gate Instant Exchange platform on January 22, supporting one-click exchange for 2200 cryptocurrencies.

19 m

Japanese Prime Minister: Dissolving the House of Representatives on January 23 and holding early elections

27 m

SNP500 rose 2535.68% after launching Alpha, current price 0.0024177 USDT

43 m

Pin