EGRAGCRYPTO

No content yet

EGRAGCRYPTO

- Reward

- 2

- Comment

- Repost

- Share

🛑 Washington Post: The Senate is holding a preliminary vote tonight to prevent Trump from issuing orders for additional strikes on Iran.???

Any confirmation or source of this? Since I got it via WhatsApp media group but not trusted one.

Any confirmation or source of this? Since I got it via WhatsApp media group but not trusted one.

- Reward

- like

- Comment

- Repost

- Share

Due to the events of 9/11, the Patriot Act was passed and since then the world changed for ever.

Now, amid the current mini-world war, with further escalation likely, the GENIUS Act is set to pass and the financial world will change for ever.

Now, amid the current mini-world war, with further escalation likely, the GENIUS Act is set to pass and the financial world will change for ever.

- Reward

- 2

- Comment

- Repost

- Share

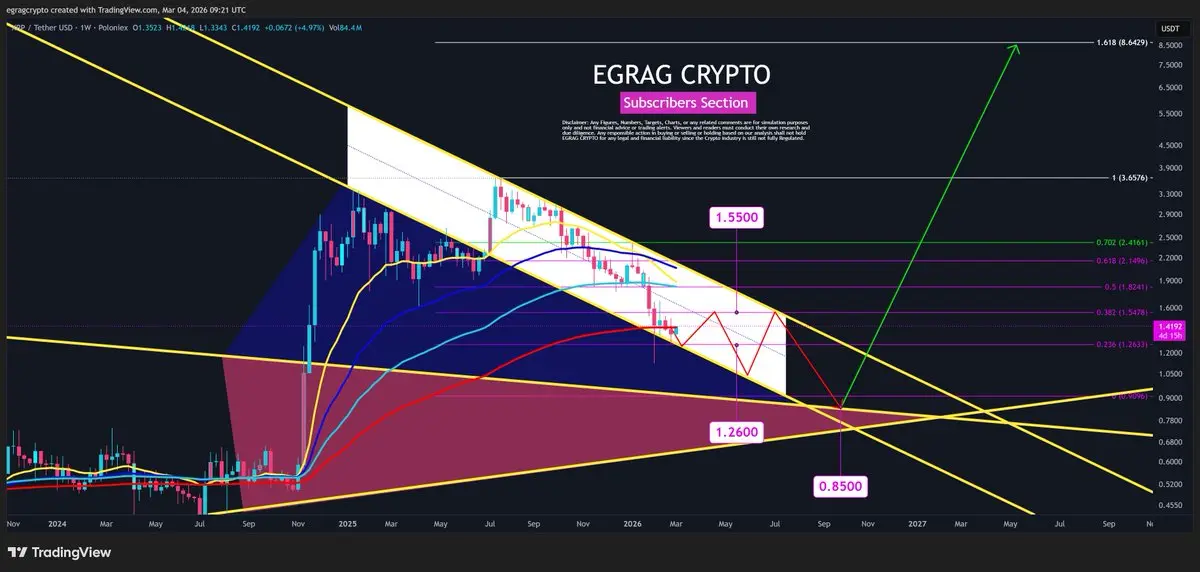

#XRP – Is Pushing Above 200 EMA:

Can the #bulls make it?

If we get a weekly close above the 200 EMA and $1.55, then short-term strength increases and momentum shifts.

But remember:

Price is still inside the descending channel, meaning the broader structure remains corrective.

Key levels:

📌 $1.55 reclaim → short-term strength

📌 $2.20 weekly close → bullish expansion

📌 Rejection below $1.55 → potential sweep toward $1.26 → $0.95–$0.85

Structure > Noise

Can the #bulls make it?

If we get a weekly close above the 200 EMA and $1.55, then short-term strength increases and momentum shifts.

But remember:

Price is still inside the descending channel, meaning the broader structure remains corrective.

Key levels:

📌 $1.55 reclaim → short-term strength

📌 $2.20 weekly close → bullish expansion

📌 Rejection below $1.55 → potential sweep toward $1.26 → $0.95–$0.85

Structure > Noise

XRP4,26%

- Reward

- like

- Comment

- Repost

- Share

#OIL – $90 DECIDES EVERYTHING 🛢️

As of Now #OIL is sitting at a HISTORICAL inflection point.

📌 A close above $90 War is Real

📌The white channel rejection = Means Noise.

🌍 Macro Reality:

This isn’t COVID demand destruction. This is potential SUPPLY constriction.

▫️Venezuela flows pressured

▫️Iran tightening possible cutting off Chinese from Iranian Oil Supply.

▫️GCC aligned with U.S.

▫️Geopolitical premium rising

💡If China loses access to major barrels…..Where does supply come from?

▫️Strategic reserves? Temporary.

▫️Spot market? Expensive.

▫️Russia? Limited flexibility.

🎲This is a cal

As of Now #OIL is sitting at a HISTORICAL inflection point.

📌 A close above $90 War is Real

📌The white channel rejection = Means Noise.

🌍 Macro Reality:

This isn’t COVID demand destruction. This is potential SUPPLY constriction.

▫️Venezuela flows pressured

▫️Iran tightening possible cutting off Chinese from Iranian Oil Supply.

▫️GCC aligned with U.S.

▫️Geopolitical premium rising

💡If China loses access to major barrels…..Where does supply come from?

▫️Strategic reserves? Temporary.

▫️Spot market? Expensive.

▫️Russia? Limited flexibility.

🎲This is a cal

- Reward

- like

- Comment

- Repost

- Share

#XRP – Weekly Structure Breakdown:

📔We’re still inside the white descending channel. Momentum is corrective , not impulsive. As long as we remain inside this channel, this is distribution… not breakout.

📌Bullish Flip Levels:

📍First trigger: $1.55. Reclaiming this weakens the red trajectory.

📍Major invalidation: $2.20. Weekly close above $2.20

▫️Descending structure broken

▫️Bear thesis invalid

▫️Bullish continuation activated

📍Above $2.20 →Opens $2.70–$3.60 opens New ATH

📌Bearish Scenario (Red Trajectory):

📍If rejected below $1.55:

▫️Relief bounce

▫️Lower high

▫️Drift toward $1.26

▫️P

📔We’re still inside the white descending channel. Momentum is corrective , not impulsive. As long as we remain inside this channel, this is distribution… not breakout.

📌Bullish Flip Levels:

📍First trigger: $1.55. Reclaiming this weakens the red trajectory.

📍Major invalidation: $2.20. Weekly close above $2.20

▫️Descending structure broken

▫️Bear thesis invalid

▫️Bullish continuation activated

📍Above $2.20 →Opens $2.70–$3.60 opens New ATH

📌Bearish Scenario (Red Trajectory):

📍If rejected below $1.55:

▫️Relief bounce

▫️Lower high

▫️Drift toward $1.26

▫️P

XRP4,26%

- Reward

- like

- Comment

- Repost

- Share

#Gold & #Silver Down… During War Headlines?

Isn’t the textbook reaction a flight to safety?

When fear rises, capital usually rotates into hard assets.

But markets don’t move on headlines , they move on positioning and liquidity.

If Gold and Silver are not rallying, ask yourself:

Who is selling?

Who is raising cash?

What does the bond market know?

Structure > Noise.

ONLY FEW 🧠

Isn’t the textbook reaction a flight to safety?

When fear rises, capital usually rotates into hard assets.

But markets don’t move on headlines , they move on positioning and liquidity.

If Gold and Silver are not rallying, ask yourself:

Who is selling?

Who is raising cash?

What does the bond market know?

Structure > Noise.

ONLY FEW 🧠

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

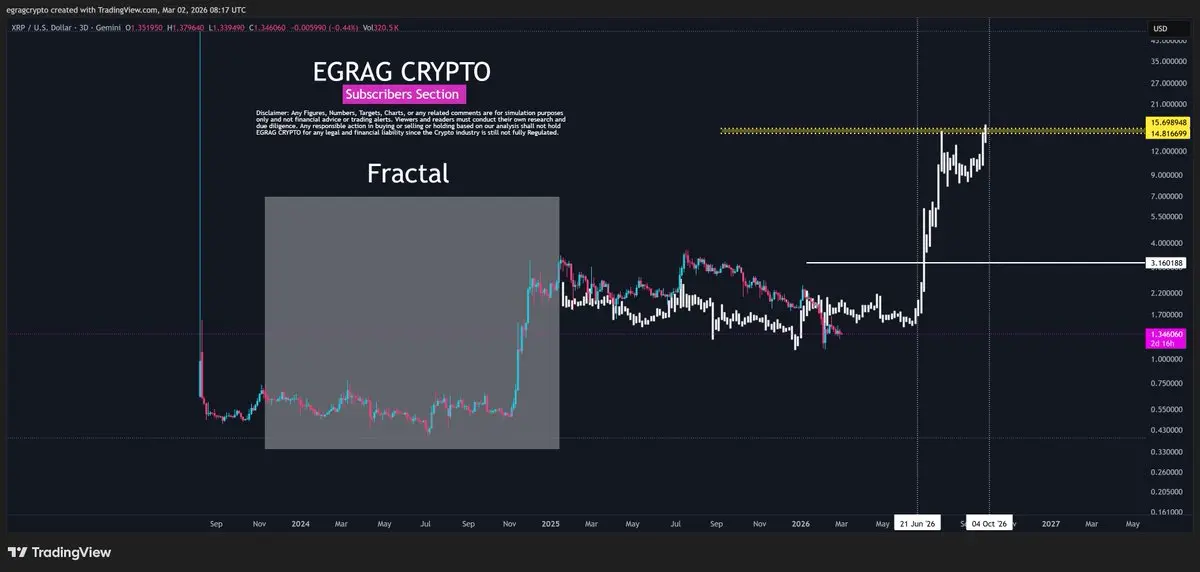

#XRP – Fractals Give Clues, Not Certainty 🎲:

Let me clarify my position on fractals:

🔹Fractals are not prediction tools.

🔹They don’t guarantee outcomes.

🔹They only show behavioral symmetry.

🔹They give us a glimpse, not a promise.

#XRP Chart and Fractal :

🔹If symmetry plays out, Upside projection sits in the $14–$16 zone.

🔹But…Fractals rhyme. They don’t copy-paste.

Probability:

🔹~40–55% chance it follows closely.

🔹Higher probability of expansion but timing may differ.

Fractal = Context but Structure = Confirmation.

Structure > Pattern Illusion.

Let me clarify my position on fractals:

🔹Fractals are not prediction tools.

🔹They don’t guarantee outcomes.

🔹They only show behavioral symmetry.

🔹They give us a glimpse, not a promise.

#XRP Chart and Fractal :

🔹If symmetry plays out, Upside projection sits in the $14–$16 zone.

🔹But…Fractals rhyme. They don’t copy-paste.

Probability:

🔹~40–55% chance it follows closely.

🔹Higher probability of expansion but timing may differ.

Fractal = Context but Structure = Confirmation.

Structure > Pattern Illusion.

XRP4,26%

- Reward

- 2

- Comment

- Repost

- Share

Hey All,

I am reading lots of confusing post about X latest policy about paid promotions.

This is how I see it: TA or charts is not paid promotion.

If you are posting your own charts, sharing your own analysis, and doing what you always do , that’s normal content.

What people mean by “paid promotion” is different.

If someone with 2 million followers , who is known as an artist or singer , suddenly starts posting about some random low-cap coin for a week straight… that’s obviously paid promotion.

That’s not organic. That’s marketing.

But if your profession is technical analysis…

If your con

I am reading lots of confusing post about X latest policy about paid promotions.

This is how I see it: TA or charts is not paid promotion.

If you are posting your own charts, sharing your own analysis, and doing what you always do , that’s normal content.

What people mean by “paid promotion” is different.

If someone with 2 million followers , who is known as an artist or singer , suddenly starts posting about some random low-cap coin for a week straight… that’s obviously paid promotion.

That’s not organic. That’s marketing.

But if your profession is technical analysis…

If your con

- Reward

- like

- Comment

- Repost

- Share

Monday (Tomorrow) Dump or Pump⁉️ Tell me your stance and I will tell you what i think

- Reward

- like

- Comment

- Repost

- Share

28 of February 2026 The New Middle East is born - ONLY FEW 🧠:

The Perfect Alignment ➡️ 2+8=10 and 2+2+6=10

10=10. 🤝

"Everything Is A Lie Except People That Die" @egragcrypto

The Perfect Alignment ➡️ 2+8=10 and 2+2+6=10

10=10. 🤝

"Everything Is A Lie Except People That Die" @egragcrypto

- Reward

- 2

- Comment

- Repost

- Share

#BTC – 33 EMA Test: Bottoming… or $250K Next? 🧠

History is clear.

Every major cycle:

▫️ #BTC breaks below the 33 EMA

▫️ Stays there ~120–180 days (avg ≈ 151 days)

▫️ Forms base

▫️ Reclaims → Expansion begins

▫️4 cycles. Same rhythm.

Right now? Price broke 33 EMA, but no deep time reset yet.

So structurally:

▫️ Either we complete the reset below 33 EMA as historical pattern and then target $200K–$250K

▫️ Or we get a curveball with the 33 EMA and V-shaped expansion

History favors the reset first.

Structure > Hope. 🧠

History is clear.

Every major cycle:

▫️ #BTC breaks below the 33 EMA

▫️ Stays there ~120–180 days (avg ≈ 151 days)

▫️ Forms base

▫️ Reclaims → Expansion begins

▫️4 cycles. Same rhythm.

Right now? Price broke 33 EMA, but no deep time reset yet.

So structurally:

▫️ Either we complete the reset below 33 EMA as historical pattern and then target $200K–$250K

▫️ Or we get a curveball with the 33 EMA and V-shaped expansion

History favors the reset first.

Structure > Hope. 🧠

BTC5,68%

- Reward

- like

- Comment

- Repost

- Share

#XRP / #BTC – Bullish Rectangle Is STILL Holding🔥:

Let’s be clear:

▫️ #XRP / #USDT → Broke down

▫️ #XRP / #USDC → Broke down

▫️ #XRP / #USD → Broke down

But… The one that actually matters for cycle rotation?

#XRP / #BTC is still holding the Bullish Rectangular Formation LIKE A BOSS 🤠. That tells you something important:

👉#XRP is showing relative strength against #BTC, even while #USD pairs look weak.

👉When dominance shifts, it starts here, not in the noise of other pairs ( #USDT - #USDC - #USD).

If #XRP holds strength vs #BTC, the story changes into #Bullish coiling Phase.

Structure > Noi

Let’s be clear:

▫️ #XRP / #USDT → Broke down

▫️ #XRP / #USDC → Broke down

▫️ #XRP / #USD → Broke down

But… The one that actually matters for cycle rotation?

#XRP / #BTC is still holding the Bullish Rectangular Formation LIKE A BOSS 🤠. That tells you something important:

👉#XRP is showing relative strength against #BTC, even while #USD pairs look weak.

👉When dominance shifts, it starts here, not in the noise of other pairs ( #USDT - #USDC - #USD).

If #XRP holds strength vs #BTC, the story changes into #Bullish coiling Phase.

Structure > Noi

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More69.35K Popularity

101.86K Popularity

198.26K Popularity

21.49K Popularity

11.67K Popularity

Pin