#CryptoSurvivalGuide Crypto is not just about profits—it’s about survival first, growth second. Markets move fast, emotions move faster, and only disciplined participants stay in the game long enough to win. Here’s a practical, no-hype survival guide for every crypto user 👇

1️⃣ Capital Protection Comes First

Rule number one: don’t lose your capital.

Never go all-in on one trade or one coin

Risk only what you can afford to lose

Use proper position sizing instead of chasing “easy money”

Survivors think long-term. Gamblers think short-term.

2️⃣ Understand Market Cycles

Crypto moves in cycles:

Accumulation → Uptrend → Distribution → Downtrend

Most losses happen when people buy late in hype and sell in fear.

Smart users buy when sentiment is quiet and sell when everyone is excited.

3️⃣ Control Emotions (Your Real Enemy)

Fear and greed destroy more accounts than bad analysis.

FOMO makes you buy tops

Panic makes you sell bottoms

If a trade makes you emotional, your position size is probably too big.

4️⃣ Don’t Overtrade

More trades ≠ more profits.

Wait for high-probability setups

Avoid revenge trading after a loss

Sometimes the best trade is no trade.

5️⃣ Diversification Is Defense

Putting everything into one coin is risky.

Mix majors (BTC, ETH) with strong altcoins

Keep some funds in stable assets

Diversification won’t make you rich overnight—but it can save you from wipeouts.

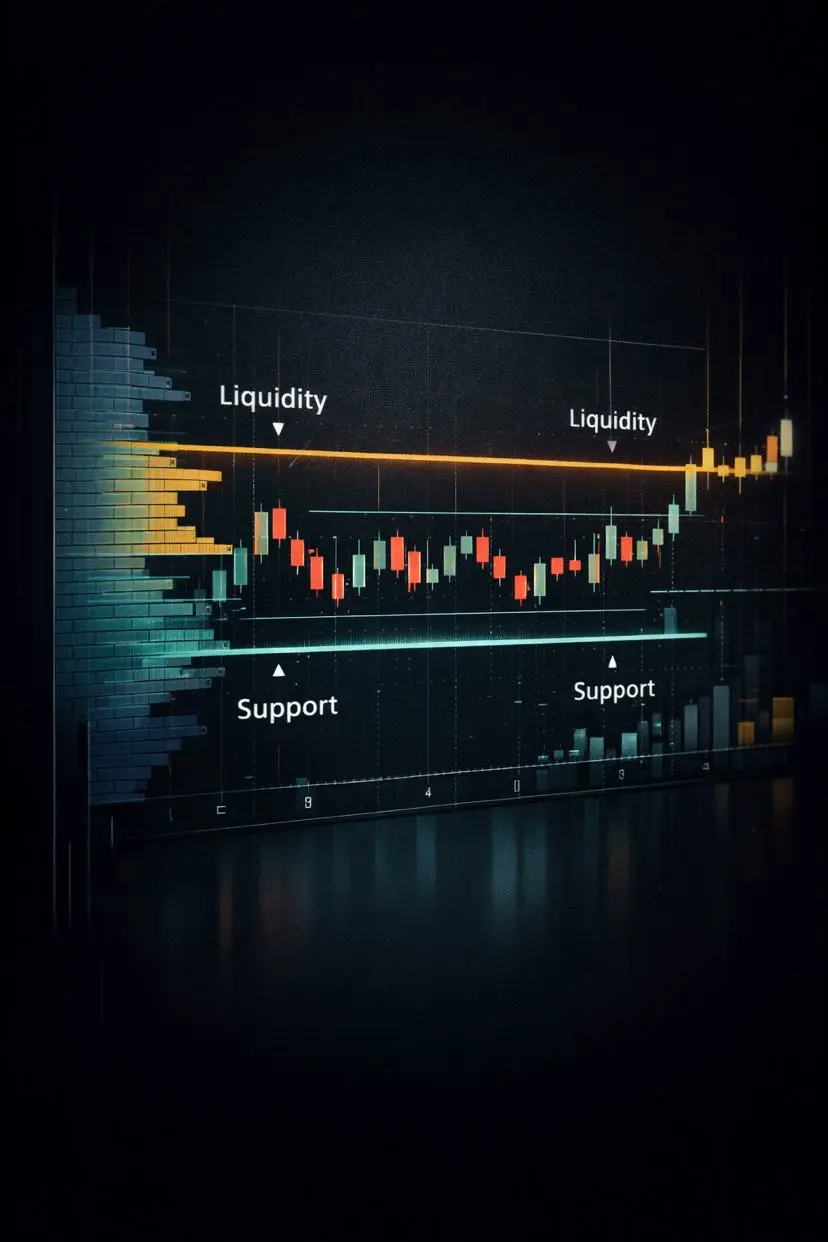

6️⃣ Risk Management Is Mandatory

Every trade should have:

A clear entry

A defined stop-loss

A realistic target

If you don’t know where to exit, you shouldn’t enter.

7️⃣ News ≠ Signal

Headlines move markets short-term, not fundamentals.

Don’t blindly trade breaking news

Separate noise from real adoption and data

By the time news goes viral, smart money has already acted.

8️⃣ Learn Constantly

Crypto evolves fast. Survivors:

Study charts, on-chain data, and macro trends

Learn from losses instead of repeating them

Education is a long-term investment with the highest ROI.

9️⃣ Community Wisdom, Not Herd Mentality

Communities are useful—but dangerous if followed blindly.

Listen, but verify

Make decisions based on your own plan

Following the crowd usually means arriving late.

🔟 Patience Is the Ultimate Edge

Markets reward patience, not panic.

Those who survive bear markets are the ones who benefit most in bull markets.

Final Thought:

Crypto is a marathon, not a lottery ticket.

Survive the volatility, protect your capital, stay disciplined—and the opportunities will come