# Dusk

297.74K

SfSiyam

#BuyTheDipOrWaitNow?

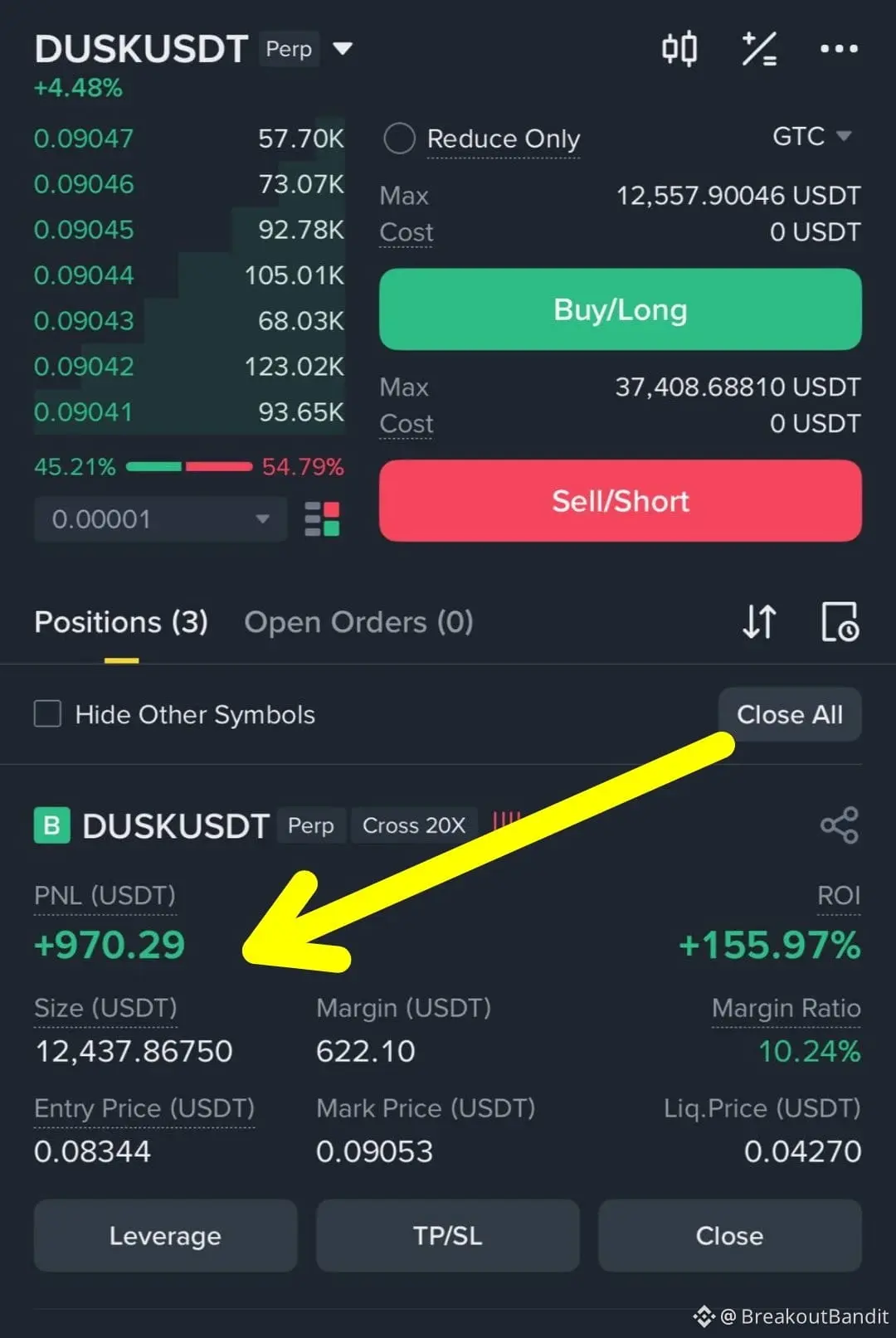

$DUSK profit

I blinked... profits appeared

Taking my gains out like: "You paying tonight?"

Ex watching my balance like "Why is he rich at night only?#dusk

$DUSK profit

I blinked... profits appeared

Taking my gains out like: "You paying tonight?"

Ex watching my balance like "Why is he rich at night only?#dusk

DUSK-7,87%

- Reward

- 2

- Comment

- Repost

- Share

#Dusk #Pioneering Privacy in Blockchain 🔐

DUSK is a groundbreaking blockchain project with a sharp focus on privacy. By harnessing advanced cryptographic techniques like zero-knowledge proofs, DUSK enables secure, confidential transactions and smart-contract applications, carving out a unique niche in the blockchain ecosystem.

Key Features of DUSK's Privacy-Centric Protocol

- Zero-Knowledge Proofs: Facilitates confidential transactions without exposing sensitive data, ensuring user privacy.

- Decentralized Privacy: Gives users full control over their data and transaction privacy, aligning wit

DUSK is a groundbreaking blockchain project with a sharp focus on privacy. By harnessing advanced cryptographic techniques like zero-knowledge proofs, DUSK enables secure, confidential transactions and smart-contract applications, carving out a unique niche in the blockchain ecosystem.

Key Features of DUSK's Privacy-Centric Protocol

- Zero-Knowledge Proofs: Facilitates confidential transactions without exposing sensitive data, ensuring user privacy.

- Decentralized Privacy: Gives users full control over their data and transaction privacy, aligning wit

DUSK-7,87%

- Reward

- 2

- Comment

- Repost

- Share

#Dusk #Pioneering Privacy in Blockchain 🔐

DUSK is a groundbreaking blockchain project with a sharp focus on privacy. By harnessing advanced cryptographic techniques like zero-knowledge proofs, DUSK enables secure, confidential transactions and smart-contract applications, carving out a unique niche in the blockchain ecosystem.

Key Features of DUSK's Privacy-Centric Protocol

- Zero-Knowledge Proofs: Facilitates confidential transactions without exposing sensitive data, ensuring user privacy.

- Decentralized Privacy: Gives users full control over their data and transaction privacy, aligning wit

DUSK is a groundbreaking blockchain project with a sharp focus on privacy. By harnessing advanced cryptographic techniques like zero-knowledge proofs, DUSK enables secure, confidential transactions and smart-contract applications, carving out a unique niche in the blockchain ecosystem.

Key Features of DUSK's Privacy-Centric Protocol

- Zero-Knowledge Proofs: Facilitates confidential transactions without exposing sensitive data, ensuring user privacy.

- Decentralized Privacy: Gives users full control over their data and transaction privacy, aligning wit

DUSK-7,87%

- Reward

- 1

- 1

- Repost

- Share

Sachin1104 :

:

Watching Closely 🔍️📊 Dusk Network (DUSK): Technical Reset Meets Real Utility

After weeks of steady downside pressure, DUSK is showing early signs of stabilization near historical demand zones. On the lower timeframes, price has been compressing inside a descending structure, with multiple higher lows forming near support — a classic setup that often precedes volatility expansion. The attached chart highlights this compression phase, along with a potential breakout path toward prior liquidity levels if momentum flips.

But beyond short-term price action, what makes Dusk truly interesting is its fundamentals.

Dusk

After weeks of steady downside pressure, DUSK is showing early signs of stabilization near historical demand zones. On the lower timeframes, price has been compressing inside a descending structure, with multiple higher lows forming near support — a classic setup that often precedes volatility expansion. The attached chart highlights this compression phase, along with a potential breakout path toward prior liquidity levels if momentum flips.

But beyond short-term price action, what makes Dusk truly interesting is its fundamentals.

Dusk

Is $DUSK ready for a trend reversal?

✅ Yes, breakout soon

0

0

🤔 Wait for confirmation

0

0

📉 Still bearish

0

0

💎 Long-term hold

0

0

0 ParticipantsVoting Finished

- Reward

- 1

- Comment

- Repost

- Share

Dusk: Privacy Meets Regulated Finance

Dusk is a Layer‑1 blockchain that brings privacy and compliance to digital finance. Using zero-knowledge proofs and a modular architecture, it enables institutions to issue tokenized assets and securities on-chain confidentially. The DUSK token powers staking, fees, and smart contracts. With a strong team and real-world use cases, Dusk bridges traditional finance and blockchain.

#Dusk $DUSK

Dusk is a Layer‑1 blockchain that brings privacy and compliance to digital finance. Using zero-knowledge proofs and a modular architecture, it enables institutions to issue tokenized assets and securities on-chain confidentially. The DUSK token powers staking, fees, and smart contracts. With a strong team and real-world use cases, Dusk bridges traditional finance and blockchain.

#Dusk $DUSK

DUSK-7,87%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 3

- 1

- Repost

- Share

Vortex_King :

:

Buy To Earn 💎$DUSK is stabilizing after a strong expansion and healthy pullback.

Holding the $0.21–$0.22 zone keeps the bullish structure intact.

A reclaim of $0.25 can open the door toward $0.28–$0.30.

Losing support may bring a deeper retest near $0.19.

Volatility compression hints at the next big move soon.

$DUSK #dusk

Holding the $0.21–$0.22 zone keeps the bullish structure intact.

A reclaim of $0.25 can open the door toward $0.28–$0.30.

Losing support may bring a deeper retest near $0.19.

Volatility compression hints at the next big move soon.

$DUSK #dusk

DUSK-7,87%

- Reward

- 2

- Comment

- Repost

- Share

#DUSKJumps53.6%

DUSK has surged by 53.6% in the last 24 hours. This is not a typical short-term spike; it is a clear sign of genuine buying interest and strong accumulation pressure building in the market.

The speed and scale of this upward move indicate that buyers are entering with conviction, shifting short-term momentum decisively in their favor. The accompanying increase in trading volume confirms that the rally is supported by real participation rather than pure speculation.

At this point, DUSK has moved firmly into the spotlight. Some holders are adding to positions, others are looking

DUSK has surged by 53.6% in the last 24 hours. This is not a typical short-term spike; it is a clear sign of genuine buying interest and strong accumulation pressure building in the market.

The speed and scale of this upward move indicate that buyers are entering with conviction, shifting short-term momentum decisively in their favor. The accompanying increase in trading volume confirms that the rally is supported by real participation rather than pure speculation.

At this point, DUSK has moved firmly into the spotlight. Some holders are adding to positions, others are looking

DUSK-7,87%

- Reward

- 69

- 51

- Repost

- Share

Seyyidetünnisa :

:

Happy New Year! 🤑View More

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

42.47M Popularity

152.38K Popularity

102.61K Popularity

1.66M Popularity

496.09K Popularity

9.89K Popularity

8.93K Popularity

22.38K Popularity

4.98K Popularity

363.11K Popularity

45.93K Popularity

103.71K Popularity

17.96K Popularity

71.23K Popularity

8.77K Popularity

News

View MoreBULLA increased by 50.55% after launching Alpha, current price is 0.02304 USDT

1 h

Data: In the past 24 hours, the total liquidation across the network was $498 million, with long positions liquidated at $357 million and short positions at $141 million.

2 h

CIA assessment: Even if Hamedani is killed, hardliners in Iran will succeed him

2 h

Vitalik: EIP-8141 is expected to be implemented within a year, fully resolving the account abstraction issue

2 h

The EU states that they received radio signals from Iran stating "No ships are allowed to pass through the Strait of Hormuz"

2 h

Pin