# GoldPrintsNewATH

61.96K

Spot gold broke above its Oct 20 high at $4,381.4/oz, setting a new all-time high. Does gold’s strength reflect falling global risk appetite? For BTC, is this a hedge narrative—or a headwind for risk assets?

Fatema12

#现货黄金再创新高 The spot gold price has recently continued to rise and hit new highs, reflecting a surge in global market risk aversion due to geopolitical risks and economic uncertainties. This trend typically leads to some traditional funds flowing into safe-haven assets like gold, which may temporarily divert speculative enthusiasm away from the cryptocurrency market. However, in the long term, the strong performance of gold reinforces the consensus that it is an "inflation hedge asset," potentially indirectly encouraging investors to view cryptocurrencies like Bitcoin as "digital gold" for dive

BTC3,49%

- Reward

- like

- Comment

- Repost

- Share

1.21 Evening Viewpoint (Recommendation 3%, 100x leverage, total position not exceeding 5%):

ETH Long Position: Dip buy around 2848, stop loss at 2818, take profit based on rebound strength of 60-80 points, break 200 points+

ETH Short Position: Dip sell around 3042, stop loss at 3072, no specific take profit

Remarks (Below are resistance levels to monitor and consider entering):

1. Support below 2908, consider 1-2%, test long positions, stop loss at 2878, take profit at 2945-2996-3042

2. Do not over-leverage, test with small positions, set proper stop losses to avoid being caught, find good opp

ETH Long Position: Dip buy around 2848, stop loss at 2818, take profit based on rebound strength of 60-80 points, break 200 points+

ETH Short Position: Dip sell around 3042, stop loss at 3072, no specific take profit

Remarks (Below are resistance levels to monitor and consider entering):

1. Support below 2908, consider 1-2%, test long positions, stop loss at 2878, take profit at 2945-2996-3042

2. Do not over-leverage, test with small positions, set proper stop losses to avoid being caught, find good opp

ETH2,95%

- Reward

- 4

- 3

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

2026 Go Go Go 👊View More

GOLD IS SURGING. 🚨

Gold hit an astronomical record of $4,650 this week.

The market knows the dollar has been depreciating.

Gold supply at record low. 🥇🏛️🔥

Gold hit an astronomical record of $4,650 this week.

The market knows the dollar has been depreciating.

Gold supply at record low. 🥇🏛️🔥

- Reward

- 1

- Comment

- Repost

- Share

#BREAKING

Spot Gold and Silver Hit All-Time High

#Bitcoin $BTC

Spot Gold and Silver Hit All-Time High

#Bitcoin $BTC

BTC3,49%

- Reward

- like

- Comment

- Repost

- Share

#GoldPrintsNewATH

In the financial world, the term "ATH" (All-Time High) is more than just a number. It is a symbol of market confidence, liquidity, and the dawn of a new era. As frequently highlighted in Gate io’s global communications, we are currently in the heart of a "Dual Bull Market" period.

1. Why is Gold "Printing New Prints"?

Gold has been recognized as a store of value for thousands of years. However, as of 2026, global market uncertainties and the aggressive reserve accumulation strategies of central banks have made gold more valuable than ever.

Hedge Against Inflation: When confi

In the financial world, the term "ATH" (All-Time High) is more than just a number. It is a symbol of market confidence, liquidity, and the dawn of a new era. As frequently highlighted in Gate io’s global communications, we are currently in the heart of a "Dual Bull Market" period.

1. Why is Gold "Printing New Prints"?

Gold has been recognized as a store of value for thousands of years. However, as of 2026, global market uncertainties and the aggressive reserve accumulation strategies of central banks have made gold more valuable than ever.

Hedge Against Inflation: When confi

BTC3,49%

- Reward

- 103

- 225

- Repost

- Share

User_any :

:

Buy To Earn 💎View More

#GoldPrintsNewATH Gold printing fresh all-time highs is more than just a price milestone—it is a macro signal. When gold decisively breaks prior resistance and establishes new highs, it reflects a deeper shift in global capital behavior. Investors typically turn to gold not for growth, but for preservation. Its strength suggests rising uncertainty beneath the surface: tightening liquidity expectations, uneven global growth, persistent geopolitical stress, and growing skepticism toward fiat stability. This move indicates that markets are quietly repositioning for protection rather than chasing

BTC3,49%

- Reward

- 15

- 6

- Repost

- Share

GateUser-1bd59de8 :

:

2026 GOGOGO 👊View More

#GoldPrintsNewATH

In the financial world, the term "ATH" (All-Time High) is more than just a number. It is a symbol of market confidence, liquidity, and the dawn of a new era. As frequently highlighted in Gate io’s global communications, we are currently in the heart of a "Dual Bull Market" period.

1. Why is Gold "Printing New Prints"?

Gold has been recognized as a store of value for thousands of years. However, as of 2026, global market uncertainties and the aggressive reserve accumulation strategies of central banks have made gold more valuable than ever.

Hedge Against Inflation: When confi

In the financial world, the term "ATH" (All-Time High) is more than just a number. It is a symbol of market confidence, liquidity, and the dawn of a new era. As frequently highlighted in Gate io’s global communications, we are currently in the heart of a "Dual Bull Market" period.

1. Why is Gold "Printing New Prints"?

Gold has been recognized as a store of value for thousands of years. However, as of 2026, global market uncertainties and the aggressive reserve accumulation strategies of central banks have made gold more valuable than ever.

Hedge Against Inflation: When confi

BTC3,49%

- Reward

- 19

- 16

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

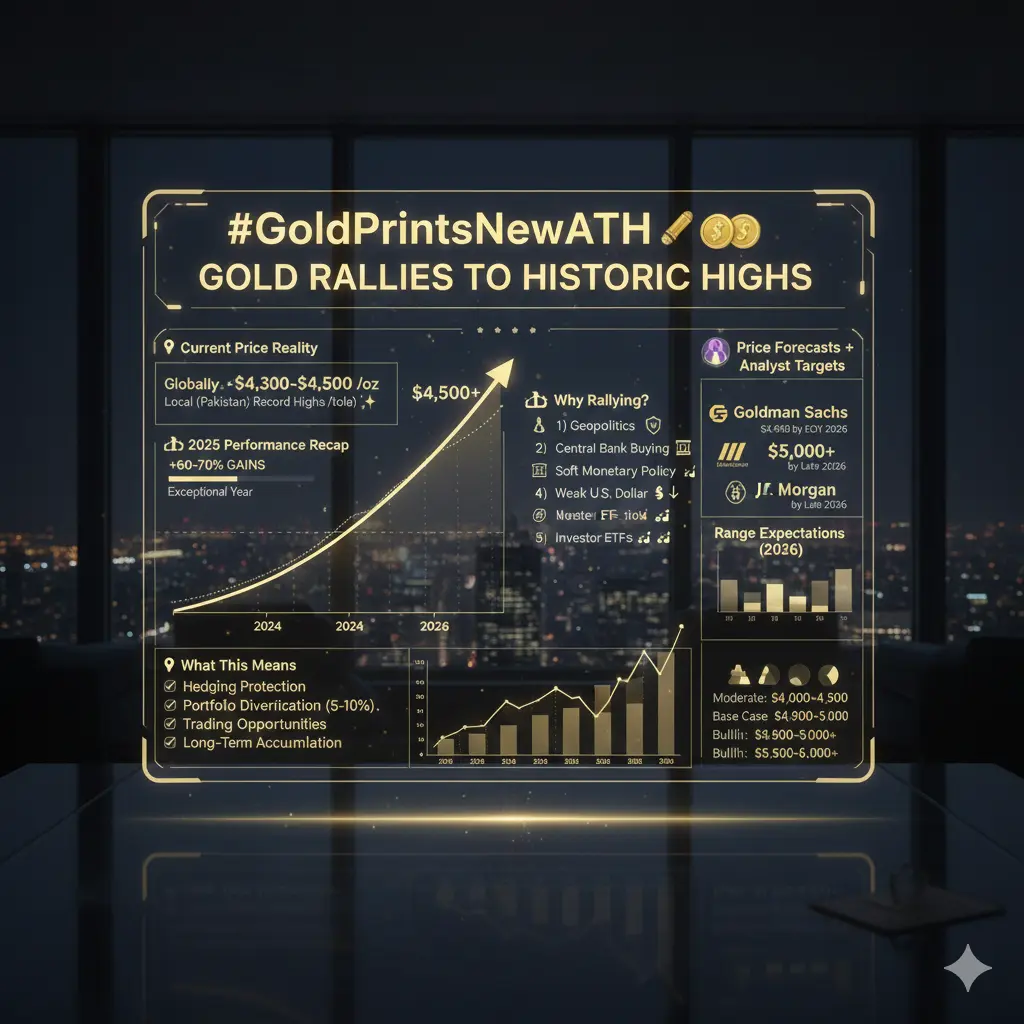

#GoldPrintsNewATH

#GoldPrintsNewATH 🚀💰

Gold has smashed another record — breaking previous price ceilings and confirming its role as the ultimate safe‑haven and wealth‑preservation asset in uncertain times.

📌 Current Price Reality

• Globally, gold has recently traded around $4,300–$4,500 per ounce, marking fresh ATH levels and a truly historic run.

• Local markets like Pakistan have also seen 24‑carat gold hitting record highs per tola, reflecting global momentum in local currency terms too.

🔥 2025 Performance Recap

Gold delivered an exceptional year in 2025 — with gains exceeding 60–70

#GoldPrintsNewATH 🚀💰

Gold has smashed another record — breaking previous price ceilings and confirming its role as the ultimate safe‑haven and wealth‑preservation asset in uncertain times.

📌 Current Price Reality

• Globally, gold has recently traded around $4,300–$4,500 per ounce, marking fresh ATH levels and a truly historic run.

• Local markets like Pakistan have also seen 24‑carat gold hitting record highs per tola, reflecting global momentum in local currency terms too.

🔥 2025 Performance Recap

Gold delivered an exceptional year in 2025 — with gains exceeding 60–70

XAUT-1,43%

- Reward

- 28

- 19

- Repost

- Share

Sand谋3S :

:

Gold 🏆🏆🏆 is Gold 🏆🏆🏆View More

#GoldPrintsNewATH 🚀💰

Gold has printed a fresh all-time high, breaking previous price ceilings and once again proving its role as the ultimate safe-haven and wealth-preservation asset in uncertain global conditions.

📌 Current Price Reality

• Globally, gold is trading near historic ATH levels, confirming a powerful long-term bullish structure.

• In local markets such as Pakistan, 24-carat gold has also surged to record highs per tola, reflecting strong global momentum combined with currency dynamics.

🔥 2025 Performance Recap

Gold delivered an exceptional performance in 2025, posting 60–70%+

Gold has printed a fresh all-time high, breaking previous price ceilings and once again proving its role as the ultimate safe-haven and wealth-preservation asset in uncertain global conditions.

📌 Current Price Reality

• Globally, gold is trading near historic ATH levels, confirming a powerful long-term bullish structure.

• In local markets such as Pakistan, 24-carat gold has also surged to record highs per tola, reflecting strong global momentum combined with currency dynamics.

🔥 2025 Performance Recap

Gold delivered an exceptional performance in 2025, posting 60–70%+

XAUT-1,43%

- Reward

- 14

- 22

- Repost

- Share

Sazib_Akash :

:

Buy To Earn 💎View More

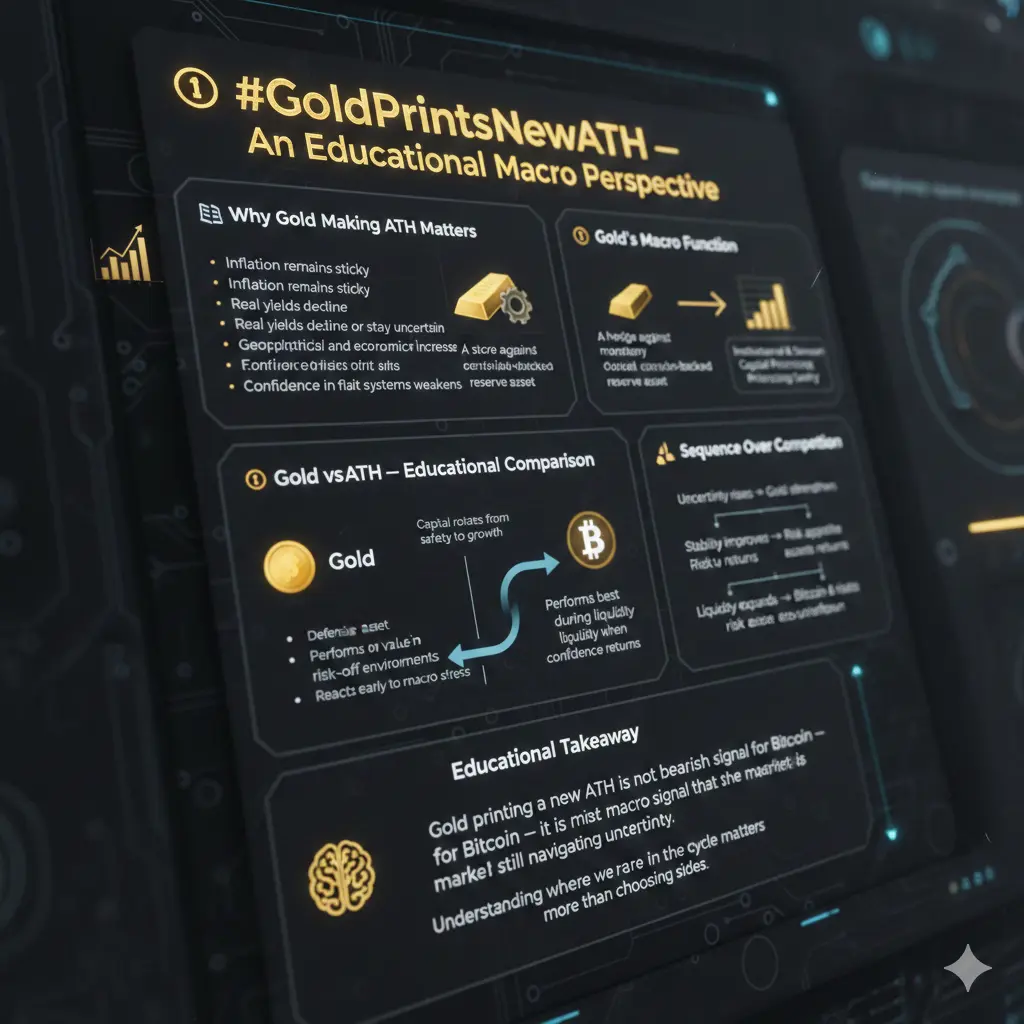

🟡 #GoldPrintsNewATH — An Educational Macro Perspective

Gold has officially printed a new All-Time High, and this move is not just about price — it’s about macro behavior, capital psychology, and market structure.

Understanding why gold moves helps investors interpret what may come next across equities, bonds, and crypto markets.

📚 Why Gold Making ATH Matters

Gold typically outperforms when:

Inflation remains sticky

Real yields decline or stay uncertain

Geopolitical and economic risks increase

Confidence in fiat systems weakens

Unlike speculative assets, gold reflects capital preservation dem

Gold has officially printed a new All-Time High, and this move is not just about price — it’s about macro behavior, capital psychology, and market structure.

Understanding why gold moves helps investors interpret what may come next across equities, bonds, and crypto markets.

📚 Why Gold Making ATH Matters

Gold typically outperforms when:

Inflation remains sticky

Real yields decline or stay uncertain

Geopolitical and economic risks increase

Confidence in fiat systems weakens

Unlike speculative assets, gold reflects capital preservation dem

BTC3,49%

- Reward

- 7

- 4

- Repost

- Share

MissCrypto :

:

Happy New Year! 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

428.42K Popularity

304.73K Popularity

133.65K Popularity

372.15K Popularity

29.3K Popularity

180.05K Popularity

223.4K Popularity

193.3K Popularity

271.76K Popularity

727 Popularity

6.07M Popularity

53.99K Popularity

5.37M Popularity

387.91K Popularity

52.53K Popularity

News

View MoreFormer Los Angeles police officer convicted of kidnapping a teenager and stealing Bitcoin: $350,000 in digital assets stolen

3 m

Delin Holdings disclosed that in February, mining output was 51.712 BTC, with an expected annual Bitcoin production of 640-660 coins.

5 m

Kalshi's "Death Clause" Sparks Controversy: Traders Betting on Khamenei's Death Suffer Heavy Losses

7 m

GOOSE surged 824.59% after launching Alpha, current price 0.0005474 USDT

7 m

Billionaire Peter Thiel plans to cash out $280 million worth of Palantir shares

7 m

Pin