# BitcoinActivityPicksUp

45.1K

Analyst TXMC noted that despite recent price pullbacks, on-chain activity continues to rise, possibly signaling that the bull market is still intact. What do you think? How are you positioning for BTC lately?

inertia_A1

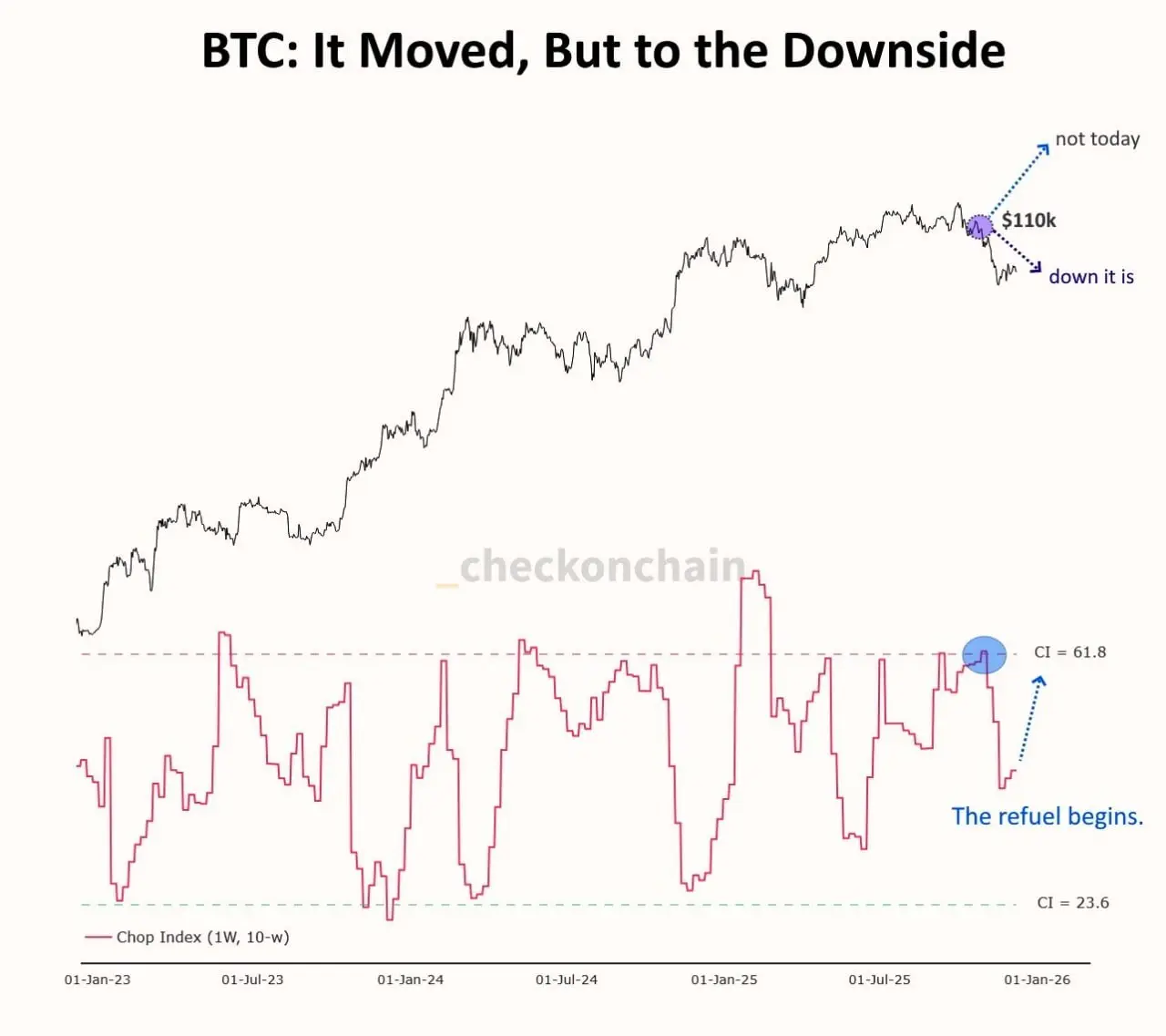

When BTC was trading around 110k last month, the Choppiness Index was flashing a familiar signal. Price had spent enough time compressing to build energy for a decisive move.

That move eventually resolved to the downside. Liquidity was taken, momentum cooled, and late positioning was cleared out.

Now BTC looks to be entering a phase of chopsolidation. This is not weakness. It is the market resetting its structure, absorbing supply, and allowing indicators to unwind after a directional move.

Choppy ranges are where fuel is rebuilt. If $BTC can hold key support and continue compressing, the nex

That move eventually resolved to the downside. Liquidity was taken, momentum cooled, and late positioning was cleared out.

Now BTC looks to be entering a phase of chopsolidation. This is not weakness. It is the market resetting its structure, absorbing supply, and allowing indicators to unwind after a directional move.

Choppy ranges are where fuel is rebuilt. If $BTC can hold key support and continue compressing, the nex

BTC2,12%

- Reward

- 6

- 3

- Repost

- Share

JEENA :

:

1000x VIbes 🤑View More

#BitcoinActivityPicksUp #BitcoinPriceWatch

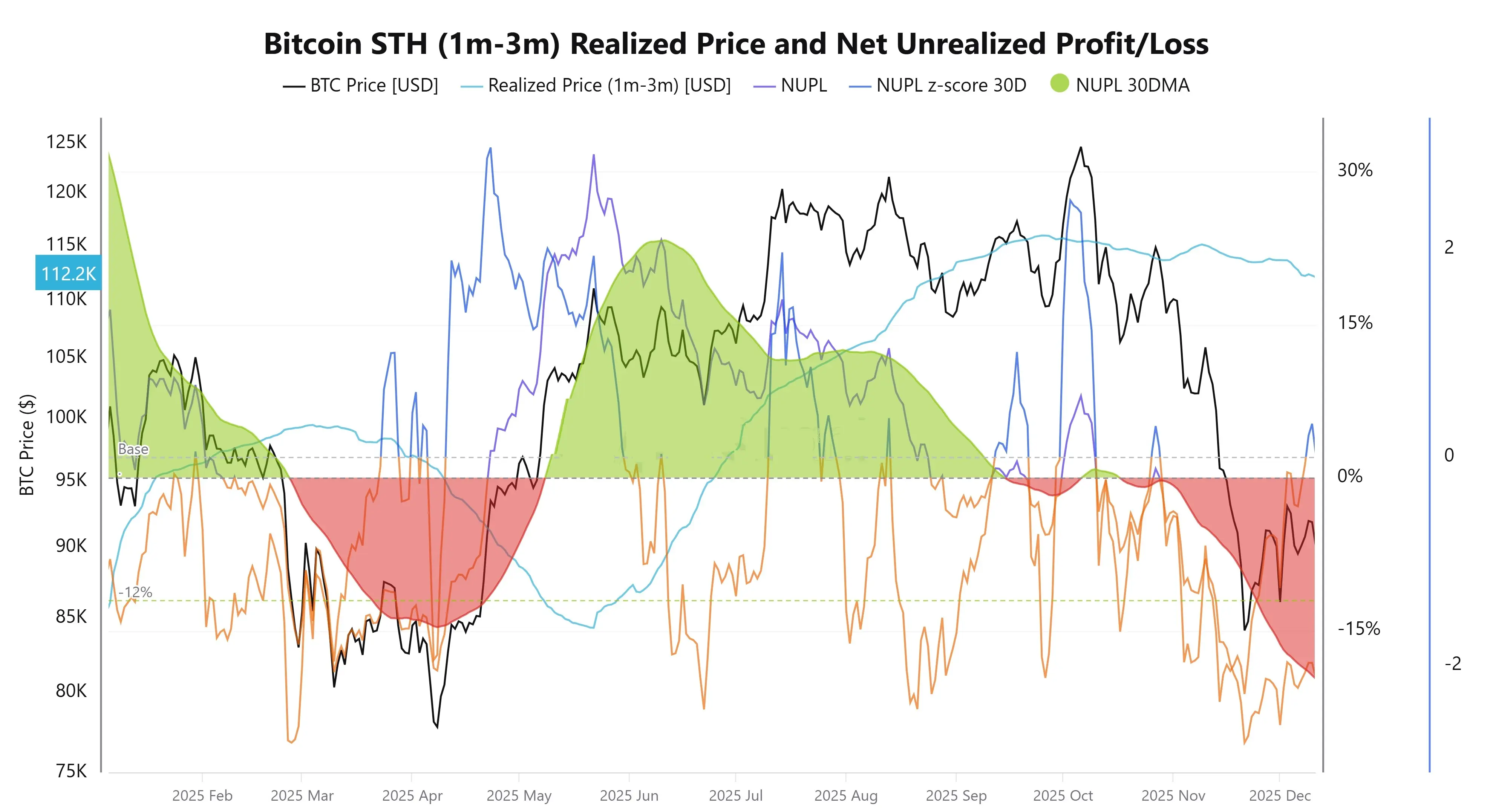

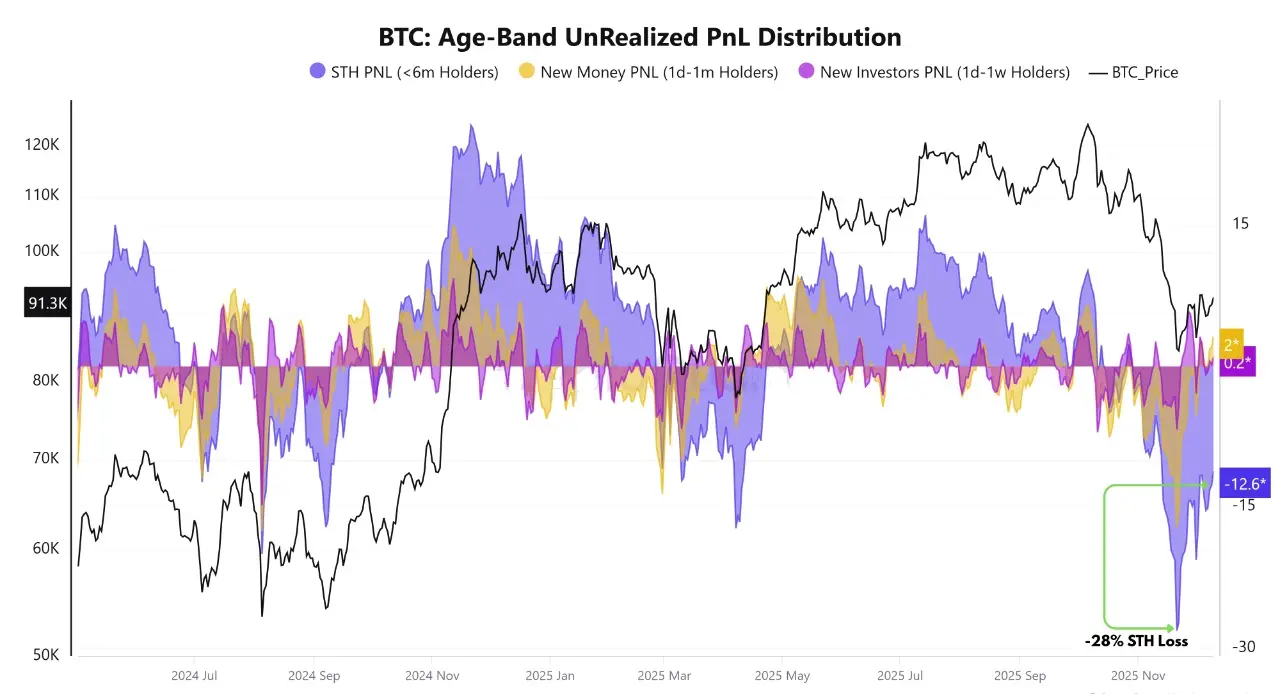

How did short-term investors remain profitable in 2025?

The data shows that while Bitcoin recorded negative returns in 2025, short-term holders profited on a large portion of the days.

Short-term Bitcoin holders (STH) remained profitable on 229 out of 345 days, despite negative year-to-date returns and BTC struggling to trade above $100,000. This result seems contradictory at first glance.

However, beneath the weak headline performance, the structure of on-chain positioning reveals a different picture.

Bitcoin short-term holders recorded profits on 6

How did short-term investors remain profitable in 2025?

The data shows that while Bitcoin recorded negative returns in 2025, short-term holders profited on a large portion of the days.

Short-term Bitcoin holders (STH) remained profitable on 229 out of 345 days, despite negative year-to-date returns and BTC struggling to trade above $100,000. This result seems contradictory at first glance.

However, beneath the weak headline performance, the structure of on-chain positioning reveals a different picture.

Bitcoin short-term holders recorded profits on 6

BTC2,12%

- Reward

- 37

- 19

- Repost

- Share

Zamin528 :

:

time to buy bitcoin in low prizeView More

#BitcoinActivityPicksUp

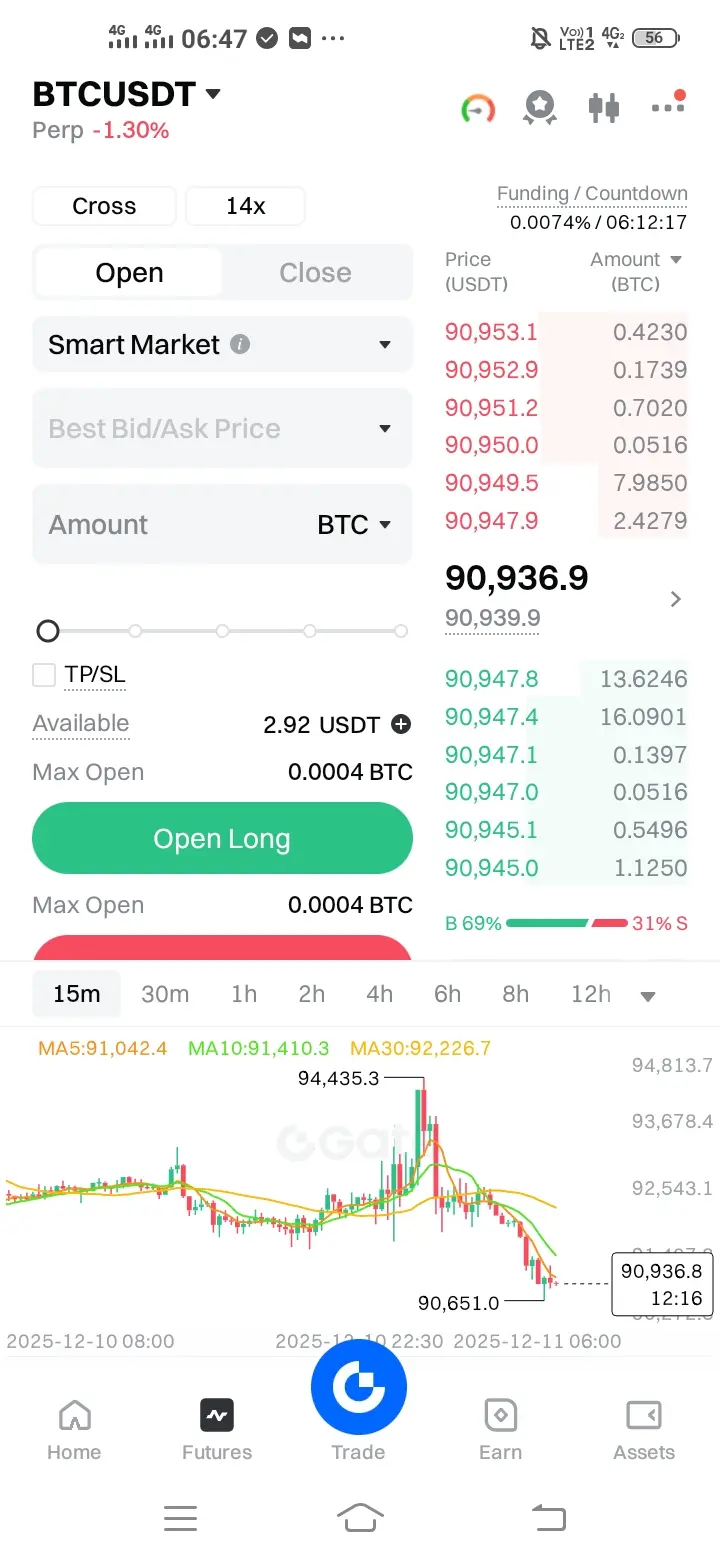

🚀 Bitcoin (BTC) Market Update — Live Price & Key Levels

🔸 Current BTC Price (Live): ≈ $89,611 USD

📉 Support Levels:

• $87,000 – $90,500 — Major immediate support zone

• $100,000 — Key psychological level for trend reversal

📈 Resistance Levels:

• $98,000 – $100,000 — Short-term challenge zone

• $108,000 – $113,600+ — Strong medium-term resistance range

📊 Market Insight:

Bitcoin is currently trading near the $89K area, holding key support around $87K-$90K. A break below this could open deeper correction levels — but holding here could lead to a retest of strong resi

🚀 Bitcoin (BTC) Market Update — Live Price & Key Levels

🔸 Current BTC Price (Live): ≈ $89,611 USD

📉 Support Levels:

• $87,000 – $90,500 — Major immediate support zone

• $100,000 — Key psychological level for trend reversal

📈 Resistance Levels:

• $98,000 – $100,000 — Short-term challenge zone

• $108,000 – $113,600+ — Strong medium-term resistance range

📊 Market Insight:

Bitcoin is currently trading near the $89K area, holding key support around $87K-$90K. A break below this could open deeper correction levels — but holding here could lead to a retest of strong resi

BTC2,12%

- Reward

- 7

- 3

- Repost

- Share

chartking :

:

HODL Tight 💪View More

#BitcoinActivityPicksUp

Bitcoin Activity Picks Up: What's Driving the Momentum?

The cryptocurrency market is buzzing, with on-chain data and trading metrics showing a significant pickup in Bitcoin (\text{BTC}) activity. This renewed energy suggests a shift in market sentiment, moving away from recent consolidation and hinting at potential volatility ahead. Several key factors are contributing to this surge in engagement, from large-scale institutional movements to changes in retail investor behavior.

I. On-Chain Metrics Signal Increased Participation

The most compelling evidence of increased

Bitcoin Activity Picks Up: What's Driving the Momentum?

The cryptocurrency market is buzzing, with on-chain data and trading metrics showing a significant pickup in Bitcoin (\text{BTC}) activity. This renewed energy suggests a shift in market sentiment, moving away from recent consolidation and hinting at potential volatility ahead. Several key factors are contributing to this surge in engagement, from large-scale institutional movements to changes in retail investor behavior.

I. On-Chain Metrics Signal Increased Participation

The most compelling evidence of increased

BTC2,12%

- Reward

- 24

- 20

- Repost

- Share

Falcon_Official :

:

HODL Tight 💪View More

#DecemberMarketOutlook

#BitcoinActivityPicksUp

Bitcoin (BTC) — December 2025 Forecast

📊 Price Recap (Early December)

Dec 1: $90,372

Dec 6: $89,305

Dec 8: $90,163

Today: $90,824

💡 Market Pulse

Personally, I see Bitcoin showing resilience above $90K, and this gives me cautious optimism for the rest of December. The first week’s dip reminded me how volatile BTC can be, but the current momentum suggests buyers are stepping in stronger. I feel the market is in a delicate balance, testing key resistance and support levels, and December could be a decisive month for year-end positioning.

📈 What

#BitcoinActivityPicksUp

Bitcoin (BTC) — December 2025 Forecast

📊 Price Recap (Early December)

Dec 1: $90,372

Dec 6: $89,305

Dec 8: $90,163

Today: $90,824

💡 Market Pulse

Personally, I see Bitcoin showing resilience above $90K, and this gives me cautious optimism for the rest of December. The first week’s dip reminded me how volatile BTC can be, but the current momentum suggests buyers are stepping in stronger. I feel the market is in a delicate balance, testing key resistance and support levels, and December could be a decisive month for year-end positioning.

📈 What

BTC2,12%

- Reward

- 24

- 12

- Repost

- Share

BabaJi :

:

1000x Vibes 🤑View More

Bitcoin's market situation is characterized by range-bound trading around the $90,000 to $92,000 level, with price action being highly sensitive to macro-economic developments, especially the US Federal Reserve's stance on interest rates. Despite a recent slip from the $94,000 area following cautious remarks from the Fed, the overall market sentiment remains cautiously optimistic, supported by signs of renewed institutional demand, a tightening supply from coins moving off exchanges, and a key technical support level around $90,000. A decisive breakout above $94,140 is the technical hurdle req

- Reward

- 1

- 1

- Repost

- Share

SiamSarkar :

:

Bitcoin's market situation is characterized by range-bound trading around the $90,000 to $92,000 level, with price action being highly sensitive to macro-economic#BitcoinActivityPicksUp

Bitcoin Market Dynamics Amid Recent Pullbacks: Rising On-Chain Activity Signals Possible Bull Market Continuation or a Temporary Consolidation Phase – How Are You Positioning?

Analyst TXMC recently pointed out a fascinating trend: despite recent price pullbacks, on-chain activity for Bitcoin continues to rise, suggesting that the broader bull market may still be intact. This observation is critical for anyone trying to gauge whether current market movements are just short-term volatility or part of a larger trend. Historically, strong on-chain activity including risin

Bitcoin Market Dynamics Amid Recent Pullbacks: Rising On-Chain Activity Signals Possible Bull Market Continuation or a Temporary Consolidation Phase – How Are You Positioning?

Analyst TXMC recently pointed out a fascinating trend: despite recent price pullbacks, on-chain activity for Bitcoin continues to rise, suggesting that the broader bull market may still be intact. This observation is critical for anyone trying to gauge whether current market movements are just short-term volatility or part of a larger trend. Historically, strong on-chain activity including risin

BTC2,12%

- Reward

- 11

- 8

- Repost

- Share

BabaJi :

:

Watching Closely 🔍View More

🚨 Bitcoin Market Flash | Gate.io

• BTC falls below $88,000

• 24H Change: −2.38%

• Short-term downside pressure remains active

• Bears holding control on lower timeframes

• Key support zones being tested

• Volatility rising as positions adjust

• Market sentiment turning risk-off

• Eyes on demand for the next direction

📊 Stay disciplined. Trade with strategy.

🔔 Follow Gate.io for real-time crypto insights#BitcoinActivityPicksUp

• BTC falls below $88,000

• 24H Change: −2.38%

• Short-term downside pressure remains active

• Bears holding control on lower timeframes

• Key support zones being tested

• Volatility rising as positions adjust

• Market sentiment turning risk-off

• Eyes on demand for the next direction

📊 Stay disciplined. Trade with strategy.

🔔 Follow Gate.io for real-time crypto insights#BitcoinActivityPicksUp

BTC2,12%

- Reward

- 1

- Comment

- Repost

- Share

Crypto yearly returns

Bitcoin: -9.99%

Ethereum: -20%

Solana: -41%

BNB: +24%

SUI: -66%

AVAX: -74%

ADA: -62%

TON: -74%

LINK: -52%

XRP: -15%

This is not the bull run we expected#GateNovTransparencyReportReleased #BitcoinActivityPicksUp #DecemberMarketOutlook #CryptoMarketWatch

Bitcoin: -9.99%

Ethereum: -20%

Solana: -41%

BNB: +24%

SUI: -66%

AVAX: -74%

ADA: -62%

TON: -74%

LINK: -52%

XRP: -15%

This is not the bull run we expected#GateNovTransparencyReportReleased #BitcoinActivityPicksUp #DecemberMarketOutlook #CryptoMarketWatch

- Reward

- 2

- 1

- Repost

- Share

User_any :

:

Bull Run 🐂Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

785.75K Popularity

304.33K Popularity

112.02K Popularity

370.16K Popularity

26.83K Popularity

179.08K Popularity

219.73K Popularity

192.95K Popularity

271.73K Popularity

194 Popularity

6.07M Popularity

53.59K Popularity

5.37M Popularity

388.35K Popularity

48.66K Popularity

News

View MoreA certain address made a profit of $1,275,000 from a three-week gold swing.

3 m

Developers reverse engineer Apple's private API for the Neural Engine and implement neural network training on the ANE for the first time.

4 m

Analysis: Bitcoin futures demand drops to the lowest level since 2024

5 m

Thomasg.eth Sells 12,131 ETH Worth $24.24M to Repay Loan

5 m

TradFi上涨提醒:USDZAR上涨超0.5%

7 m

Pin