Post content & earn content mining yield

placeholder

FenerliBaba

#Web3FebruaryFocus

Ethereum co-founder Vitalik Buterin stated that future on-chain mechanism designs will have a “two-layered” structure.

Accordingly, the first layer will be a transparent and accountable execution layer where correct decisions are rewarded and incorrect decisions incur costs. Prediction markets were cited as an example.

The second layer will be a decentralized, pluralistic, and hijackable preference and judgment layer. This layer will utilize anonymous voting, prefer systems like MACI to prevent collusion, and will not be token-based to avoid 51% attacks.

$BTC

#ETHUn

Ethereum co-founder Vitalik Buterin stated that future on-chain mechanism designs will have a “two-layered” structure.

Accordingly, the first layer will be a transparent and accountable execution layer where correct decisions are rewarded and incorrect decisions incur costs. Prediction markets were cited as an example.

The second layer will be a decentralized, pluralistic, and hijackable preference and judgment layer. This layer will utilize anonymous voting, prefer systems like MACI to prevent collusion, and will not be token-based to avoid 51% attacks.

$BTC

#ETHUn

BTC-0,15%

- Reward

- 4

- 4

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

$Swarms perfect fallingwedge Break out retest With bullish divergence No better bottomed out chart Will be easiest 2x + trade Buy the bottom

SWARMS2,43%

- Reward

- like

- Comment

- Repost

- Share

chn

chojny

Created By@GateUser-3bbb703e

Subscription Progress

0.00%

MC:

$0

Create My Token

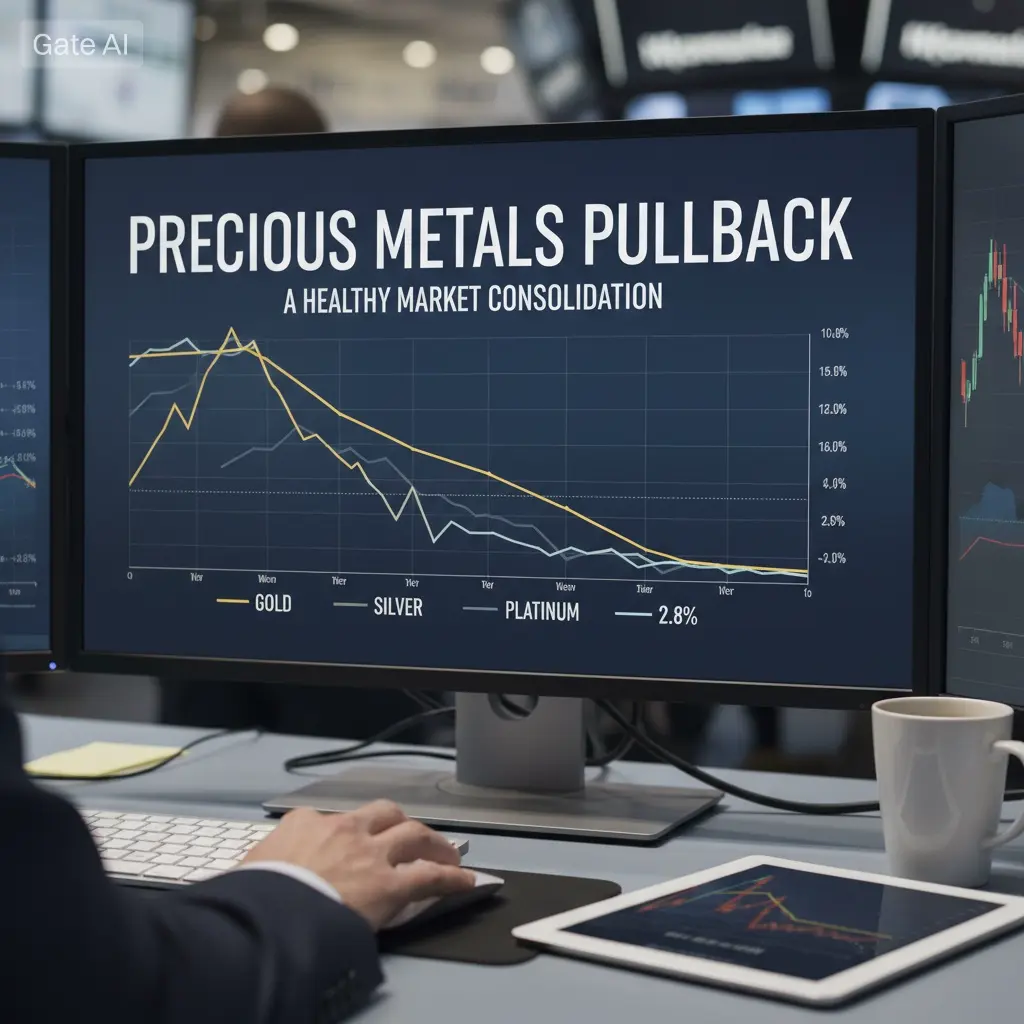

#PreciousMetalsPullBack A Healthy Market Consolidation

Global markets are experiencing a sharp and synchronized correction across precious metals and cryptocurrencies following historic rallies in late 2025 and early January 2026. Gold surged to nearly $5,595/oz, silver spiked around $121/oz, Bitcoin approached $90,000, and Ethereum traded above $3,000. As February begins, both asset classes have pulled back decisively. Crucially, this move reflects profit-taking, technical exhaustion, and macro repricing, not a breakdown of long-term bullish fundamentals.

Understanding the Pullback

A pullbac

Global markets are experiencing a sharp and synchronized correction across precious metals and cryptocurrencies following historic rallies in late 2025 and early January 2026. Gold surged to nearly $5,595/oz, silver spiked around $121/oz, Bitcoin approached $90,000, and Ethereum traded above $3,000. As February begins, both asset classes have pulled back decisively. Crucially, this move reflects profit-taking, technical exhaustion, and macro repricing, not a breakdown of long-term bullish fundamentals.

Understanding the Pullback

A pullbac

- Reward

- 2

- Comment

- Repost

- Share

Watch-to-Earn Lucky Draw Carnival

Complete daily tasks to win prizes!

Join Now!

https://www.gate.com/activities/watch-to-earn/?now_period=15&refUid=7675356

Complete daily tasks to win prizes!

Join Now!

https://www.gate.com/activities/watch-to-earn/?now_period=15&refUid=7675356

- Reward

- 1

- Comment

- Repost

- Share

Gate Live 2026 Lunar New Year On-Chain Gala · Non-Stop Market Insights https://www.gate.com/campaigns/3937?ref=VLIXXFKJAQ&ref_type=132

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

Watching Closely 🔍️View More

#FedLeadershipImpact 0xB27604bC46d98e9b25DFc015bA39Fe610cf6d3Aa

- Reward

- like

- Comment

- Repost

- Share

#Web3FebruaryFocus

February is shaping up to be a pivotal month for the Web3 ecosystem, as the market shifts its focus from short-term hype toward real adoption, infrastructure growth, and long-term value creation. After the volatility seen in January, developers, investors, and communities are now realigning their strategies around utility-driven narratives such as decentralized identity, on-chain data, scalable Layer-2 solutions, and cross-chain interoperability. This change in focus highlights a broader maturity within Web3, where attention is gradually moving away from pure speculation an

February is shaping up to be a pivotal month for the Web3 ecosystem, as the market shifts its focus from short-term hype toward real adoption, infrastructure growth, and long-term value creation. After the volatility seen in January, developers, investors, and communities are now realigning their strategies around utility-driven narratives such as decentralized identity, on-chain data, scalable Layer-2 solutions, and cross-chain interoperability. This change in focus highlights a broader maturity within Web3, where attention is gradually moving away from pure speculation an

- Reward

- 5

- 6

- Repost

- Share

HighAmbition :

:

1000x VIbes 🤑View More

May I ask if this skill can be used to apply for a job at Lanzhou Ramen? #DailySourceOfHappiness

View Original- Reward

- like

- Comment

- Repost

- Share

Mu Feng Analyzes Trends: 2.2 Bitcoin/Ethereum Evening Market Analysis and Trading Recommendations

Daily Chart Level: KDJ bearish divergence with decreasing volume, BOLL lower band opening wide and breaking down, MACD remains strongly bearish, trading volume increasing (expect a rebound in the evening); MA moving averages show a death cross indicating a bearish trend, but the gap between the price and the 5-day MA widens, completing support level testing. Short-term technical rebound is highly probable, with resistance at the daily MA5.

12-Hour Chart Level: KDJ and MACD form a death cross and c

View OriginalDaily Chart Level: KDJ bearish divergence with decreasing volume, BOLL lower band opening wide and breaking down, MACD remains strongly bearish, trading volume increasing (expect a rebound in the evening); MA moving averages show a death cross indicating a bearish trend, but the gap between the price and the 5-day MA widens, completing support level testing. Short-term technical rebound is highly probable, with resistance at the daily MA5.

12-Hour Chart Level: KDJ and MACD form a death cross and c

- Reward

- 1

- Comment

- Repost

- Share

Dora

Doraemon

Created By@Kukun

Subscription Progress

0.00%

MC:

$0

Create My Token

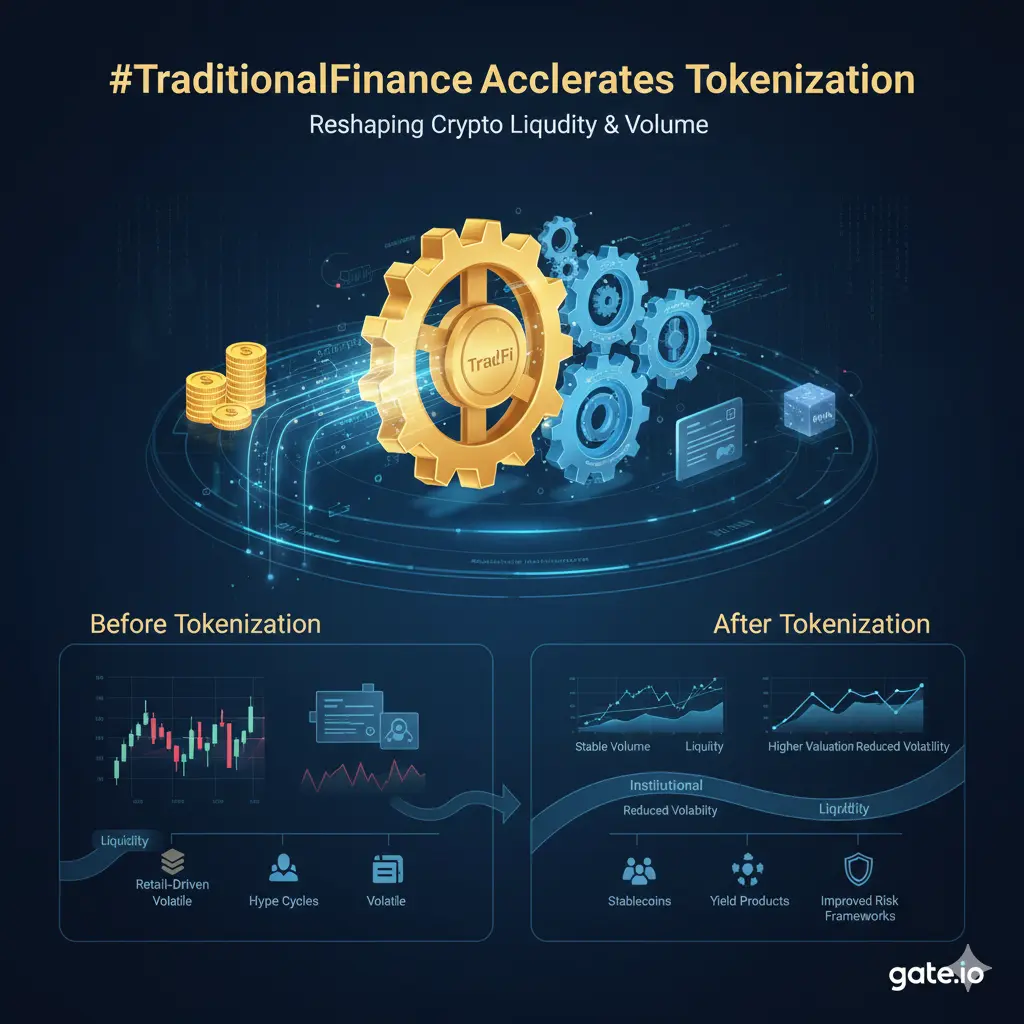

#TraditionalFinanceAcceleratesTokenization

Tokenization is the process of converting real-world assets or financial instruments into digital tokens on the blockchain, unlocking liquidity, transparency, and 24/7 tradability. This is not hype or speculation; it is a structural liquidity event quietly reshaping crypto markets from the inside out. When traditional finance accelerates tokenization, the first changes appear not in headlines, but in capital flow, liquidity deployment, and price stability. Markets evolve quietly, long before public sentiment catches up.

For traders like Trader Hazrat

Tokenization is the process of converting real-world assets or financial instruments into digital tokens on the blockchain, unlocking liquidity, transparency, and 24/7 tradability. This is not hype or speculation; it is a structural liquidity event quietly reshaping crypto markets from the inside out. When traditional finance accelerates tokenization, the first changes appear not in headlines, but in capital flow, liquidity deployment, and price stability. Markets evolve quietly, long before public sentiment catches up.

For traders like Trader Hazrat

- Reward

- 2

- Comment

- Repost

- Share

#BTCUSDT Take out the 30F chart from the pocket and look together: Structure: 4H oscillation, 30F lower rhythm: current 5F rebound reminder: pay attention to the completion status on the 30F, wait for a 30F central zone, then look for long and short opportunities. The Zen master said, in the mid-term correction, only the lower levels can be traded, so the 30F mid-term correction can only involve the 5F level. Isn’t it tiring? Are the transaction fees high?? What needs to be done now is to wait! This is just a record.

View Original

- Reward

- 1

- 3

- Repost

- Share

GoldenTunnel :

:

Would you like to join your guild?View More

FTX UPDATE — REPAYMENTS BACK ON THE CLOCK ⏰

FTX creditors are set for

another repayment round on March 31.

Fresh liquidity is about to hit the market…

and traders are already watching closely.

💰 Creditors may cash out

📉 Potential short-term selling pressure

🧠 Smart money preparing for volatility

History shows:

Repayment events often move markets.

Relief for creditors —

but uncertainty for prices.

Will this be absorbed smoothly…

or spark the next wave of sell-offs?

Follow for timely, no-noise crypto insights 🚀#CryptoMarketPullback $BTC

FTX creditors are set for

another repayment round on March 31.

Fresh liquidity is about to hit the market…

and traders are already watching closely.

💰 Creditors may cash out

📉 Potential short-term selling pressure

🧠 Smart money preparing for volatility

History shows:

Repayment events often move markets.

Relief for creditors —

but uncertainty for prices.

Will this be absorbed smoothly…

or spark the next wave of sell-offs?

Follow for timely, no-noise crypto insights 🚀#CryptoMarketPullback $BTC

BTC-0,15%

- Reward

- like

- Comment

- Repost

- Share

#CapitalRotation

Capital rotation is the movement of liquidity from one sector of the crypto market to another. Currently, we are seeing a three-stage shift that is putting unique pressure on the market:

1. The Flight to "Quality" Yield

As global interest rates stabilize in early 2026, capital is rotating out of high-risk, low-utility "meme" coins and back into Yield-Bearing Assets. Because Ethereum offers native staking rewards (projected to be more stable following the Glamsterdam upgrade), institutional desks are rotating their stablecoin reserves back into ETH to capture the 3-4% "real" y

Capital rotation is the movement of liquidity from one sector of the crypto market to another. Currently, we are seeing a three-stage shift that is putting unique pressure on the market:

1. The Flight to "Quality" Yield

As global interest rates stabilize in early 2026, capital is rotating out of high-risk, low-utility "meme" coins and back into Yield-Bearing Assets. Because Ethereum offers native staking rewards (projected to be more stable following the Glamsterdam upgrade), institutional desks are rotating their stablecoin reserves back into ETH to capture the 3-4% "real" y

- Reward

- 2

- 1

- Repost

- Share

GateUser-bc705547 :

:

Nice#WhaleActivityWatch

Whale activity is once again drawing attention across the crypto market, making #WhaleActivityWatch a key narrative for traders and long-term investors alike. Large on-chain movements often act as early signals of shifting market dynamics, especially during periods of consolidation or uncertainty. As prices hover around important technical levels, the behavior of whales entities holding significant amounts of crypto can provide insight into accumulation, distribution, or strategic repositioning ahead of the next major move. While not every large transfer signals immediate

Whale activity is once again drawing attention across the crypto market, making #WhaleActivityWatch a key narrative for traders and long-term investors alike. Large on-chain movements often act as early signals of shifting market dynamics, especially during periods of consolidation or uncertainty. As prices hover around important technical levels, the behavior of whales entities holding significant amounts of crypto can provide insight into accumulation, distribution, or strategic repositioning ahead of the next major move. While not every large transfer signals immediate

- Reward

- 3

- 4

- Repost

- Share

HighAmbition :

:

Watching Closely 🔍️View More

$OP Price drops -5.81% accompanied by a trading volume of 70 million, with open interest reaching 86 million, showing a pattern of increasing volume and high open interest. Market logic suggests that open interest should be considered to determine whether it’s a long liquidation or main force distribution. The current market trend leans towards a bearish dominance, with risks outweighing opportunities.

🎯Direction: No position

Waiting for price action to provide clear signals of bullish absorption or bearish exhaustion. It is not advisable to trade against the trend at this time to avoid poten

🎯Direction: No position

Waiting for price action to provide clear signals of bullish absorption or bearish exhaustion. It is not advisable to trade against the trend at this time to avoid poten

OP-1,32%

- Reward

- like

- Comment

- Repost

- Share

Macro vs. Technical: Like Liberal Arts Students and Science Students in a Relationship

The macro camp likes to talk about logical chains:

Interest rates → Liquidity → Risk appetite → Asset pricing.

The technical camp only looks at one phrase:

Candlestick charts don’t lie.

In reality, mature traders are often “hybrid types”:

Looking at the macro perspective, finding positions through technical analysis.

Currently, the Fed’s discussions are heating up, essentially reflecting the market’s anxiety about future liquidity. This will influence the valuation center but won’t determine shor

View OriginalThe macro camp likes to talk about logical chains:

Interest rates → Liquidity → Risk appetite → Asset pricing.

The technical camp only looks at one phrase:

Candlestick charts don’t lie.

In reality, mature traders are often “hybrid types”:

Looking at the macro perspective, finding positions through technical analysis.

Currently, the Fed’s discussions are heating up, essentially reflecting the market’s anxiety about future liquidity. This will influence the valuation center but won’t determine shor

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 3

- 3

- Repost

- Share

CoinWay :

:

2026 Go Go Go 👊View More

Bitcoin continues to probe lower approaching a new 2025 low Could panic be hiding a turning point

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More378.2K Popularity

6.81K Popularity

6.67K Popularity

4.02K Popularity

2.58K Popularity

News

View MoreSUN Clone Battle Team Invitation Ranking Opens

5 m

Trump plans to launch a $12 billion mineral reserve program, with U.S. rare earth companies rising pre-market

19 m

JPMorgan: Expect WASH to cater to Trump's rate cuts in the short term, returning to a hawkish stance after the midterm elections

20 m

BTC Breaks Through 78,000 USDT

21 m

Gonka v0.2.9 mainnet upgrade has been completed, and PoC v2 is now officially activated.

26 m

Pin