Prem576

No content yet

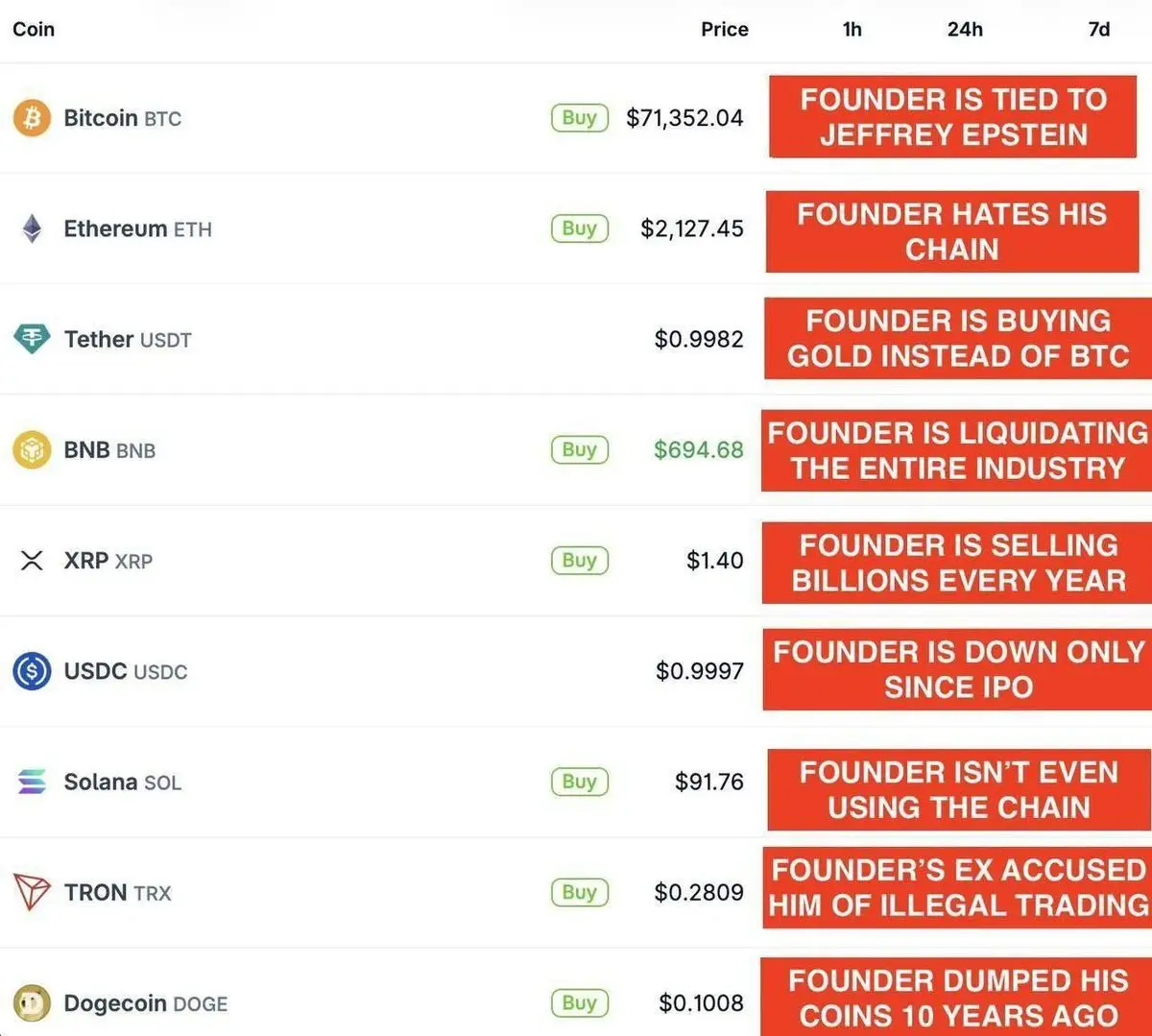

TOP 10 Crypto Market Cap 🥲

- Reward

- like

- Comment

- Repost

- Share

Since the October 2025 crash, altcoin dominance has been hovering in the same range for nearly five months…

- Reward

- like

- Comment

- Repost

- Share

2025 was just a trailor 😂

- Reward

- like

- Comment

- Repost

- Share

X User: “While extreme FUD is being launched against Binance, Binance is buying 200M”.CZ: “best time to buy.”

- Reward

- like

- Comment

- Repost

- Share

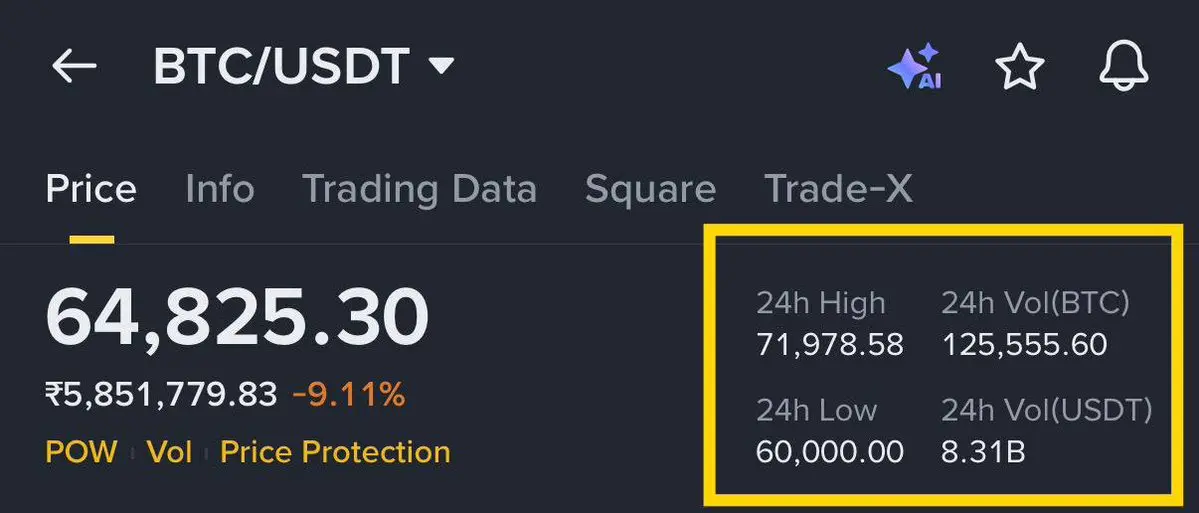

BTC/Gold ratio is hovering above the key supply zone. Do you think this marks a macro bottom for BTC or is this just a fakeout for btc at $74.6k? Especially when CZ says the supercycle is over,while Binance itself has accumulated billions of dollars worth of BTC during this dip…

- Reward

- like

- Comment

- Repost

- Share