Chidifinance

No content yet

Chidifinance

Self custody was the original promise of DeFi. But for years, traditional assets like stocks and ETFs lived outside that promise. You could trade tokens permissionlessly, yet global benchmarks still required brokers, paperwork, and regional gatekeeping.

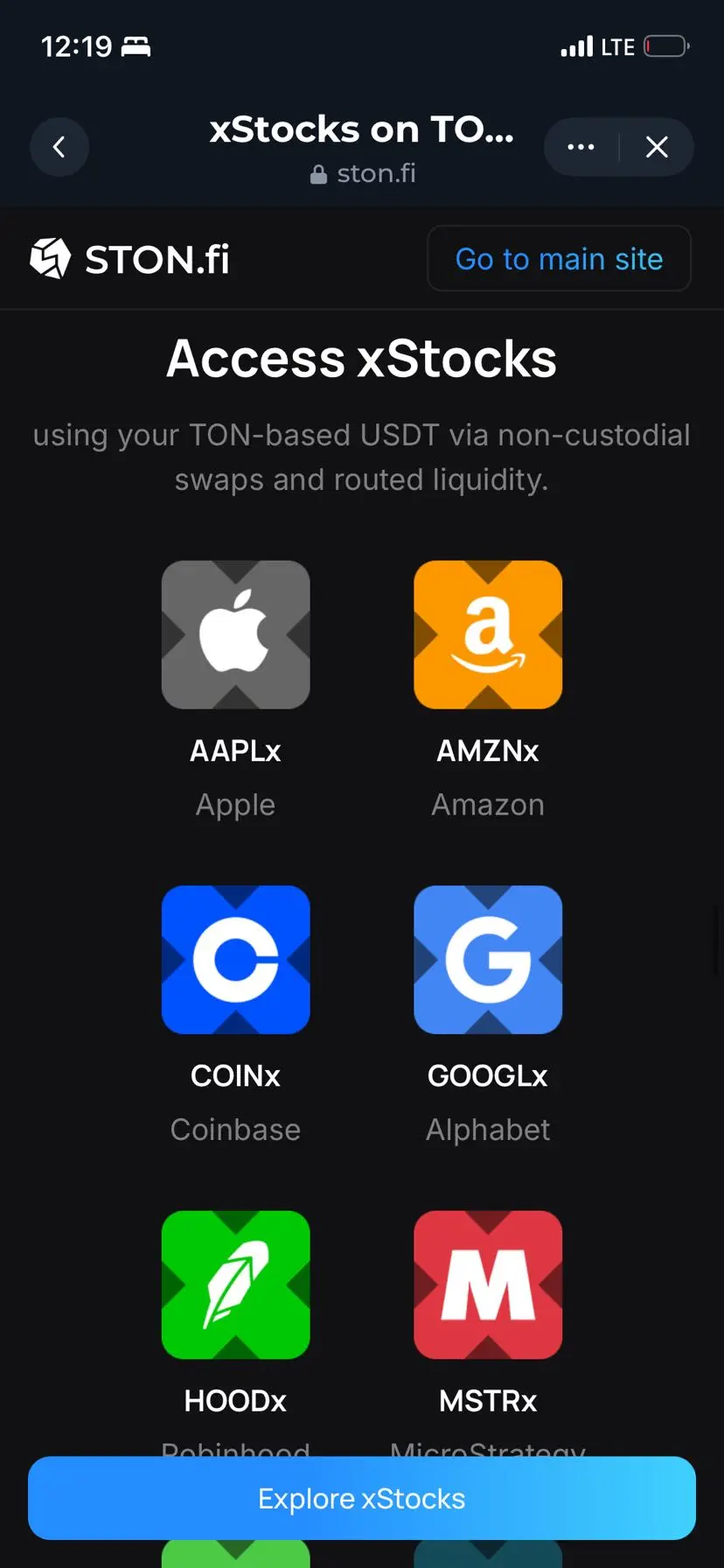

xStocks on STONfi change that structure.

These assets exist as native tokens on The Open Network. They behave like any other DeFi asset in your wallet. You can swap them. Hold them. Integrate them into strategies. All without traditional custody friction.

Here is the important distinction.

Issuers and custodians manage the off chain economic ba

xStocks on STONfi change that structure.

These assets exist as native tokens on The Open Network. They behave like any other DeFi asset in your wallet. You can swap them. Hold them. Integrate them into strategies. All without traditional custody friction.

Here is the important distinction.

Issuers and custodians manage the off chain economic ba

TON-5,93%

- Reward

- like

- Comment

- Repost

- Share

Markets are global. Access isn’t.

That’s the gap xStocks on STONfi are closing.

Traditional stocks and ETFs, the backbone of finance, often come with paperwork, intermediaries, regional restrictions, and custody friction.

xStocks flip that model.

Tokenized on The Open Network as jettons, they reference real-world assets like Apple or the S&P 500, while behaving like any DeFi token in your wallet.

That means:

• 24/7 on-chain access

• Self-custody control

• Seamless integration with DeFi tools

• No traditional brokerage friction

Off-chain custodians manage the underlying asset economics.

But you

That’s the gap xStocks on STONfi are closing.

Traditional stocks and ETFs, the backbone of finance, often come with paperwork, intermediaries, regional restrictions, and custody friction.

xStocks flip that model.

Tokenized on The Open Network as jettons, they reference real-world assets like Apple or the S&P 500, while behaving like any DeFi token in your wallet.

That means:

• 24/7 on-chain access

• Self-custody control

• Seamless integration with DeFi tools

• No traditional brokerage friction

Off-chain custodians manage the underlying asset economics.

But you

TON-5,93%

- Reward

- like

- Comment

- Repost

- Share

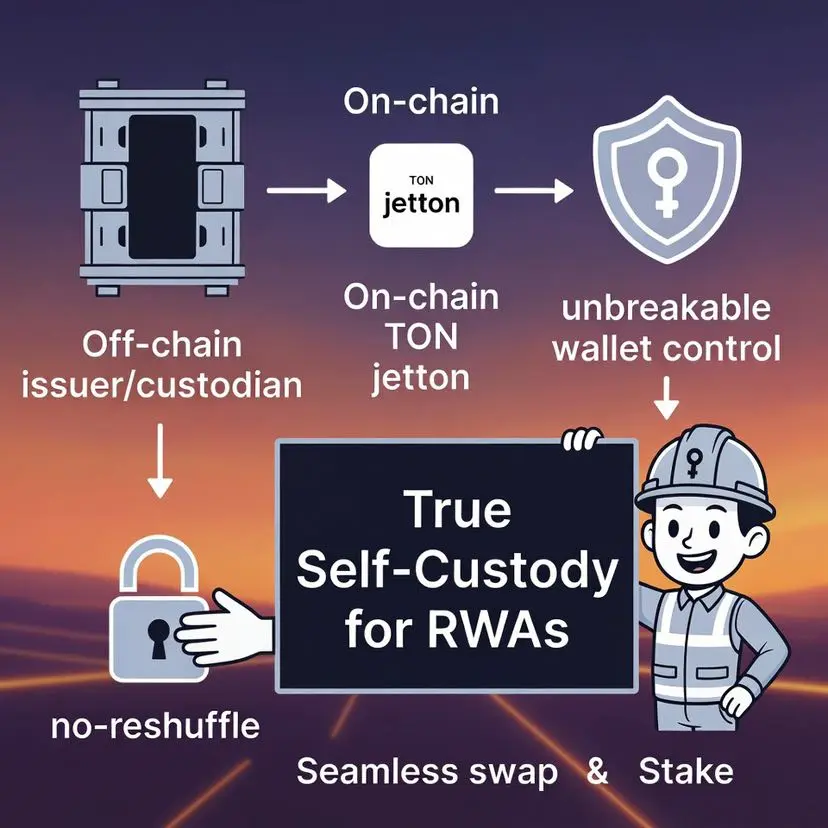

xStocks aren’t just tokens. They’re where Wall Street meets Web3.

For years, DeFi tried to ignore traditional finance’s anchors, stocks and ETFs. But sidelining trillions in real-world value isn’t innovation. It’s limitation.

On STONfi, xStocks represent that overlap.

How the structure works:

• Off-chain issuers and custodians manage the real-world backing

• On-chain, assets exist as TON-native jettons

• They swap, stake, and integrate like any DeFi token

Built on The Open Network, this enables seamless transfers, low fees, and fast execution.

The key shift? True self-custody.

Issuers may mana

For years, DeFi tried to ignore traditional finance’s anchors, stocks and ETFs. But sidelining trillions in real-world value isn’t innovation. It’s limitation.

On STONfi, xStocks represent that overlap.

How the structure works:

• Off-chain issuers and custodians manage the real-world backing

• On-chain, assets exist as TON-native jettons

• They swap, stake, and integrate like any DeFi token

Built on The Open Network, this enables seamless transfers, low fees, and fast execution.

The key shift? True self-custody.

Issuers may mana

- Reward

- like

- Comment

- Repost

- Share

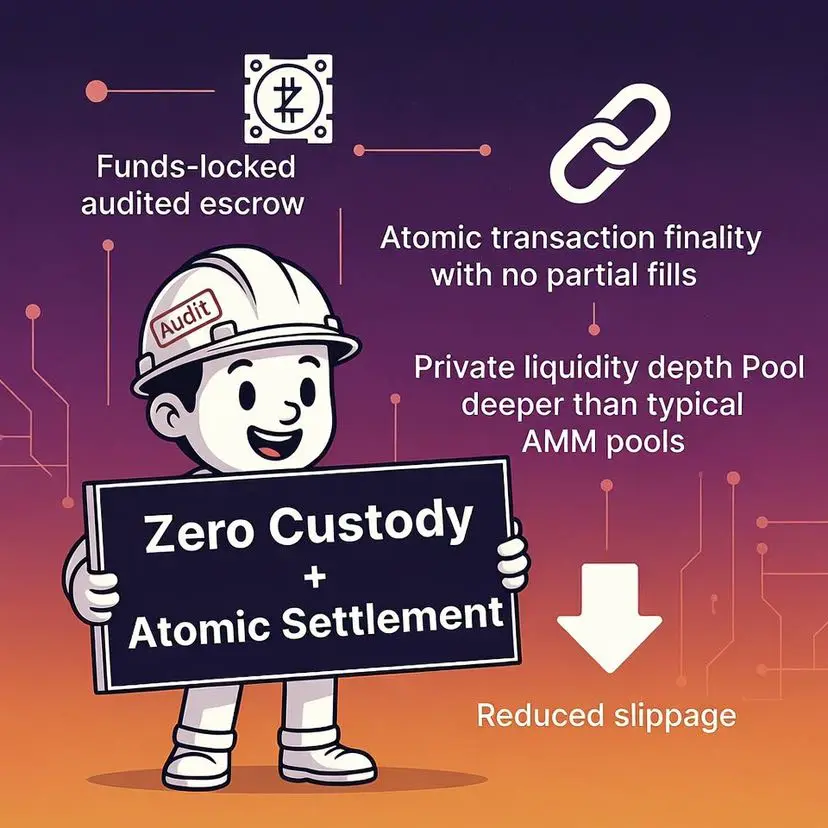

OTC trading shouldn’t require blind trust.

Traditional OTC desks depend on counterparties and custody risk. Escrow Swaps on STONfi replace that trust layer with code.

Here’s why that matters:

• Zero-custody execution — funds lock inside audited escrow smart contracts

• Private liquidity access — deeper routing than standard AMM pools

• Atomic on-chain settlement — no partial fills, no settlement risk

Want to swap tokenized S&P exposure for TON? Escrow routing sources competitive off-chain quotes and settles on-chain in one transaction, reducing slippage compared to shallow public liquidity.

Wi

Traditional OTC desks depend on counterparties and custody risk. Escrow Swaps on STONfi replace that trust layer with code.

Here’s why that matters:

• Zero-custody execution — funds lock inside audited escrow smart contracts

• Private liquidity access — deeper routing than standard AMM pools

• Atomic on-chain settlement — no partial fills, no settlement risk

Want to swap tokenized S&P exposure for TON? Escrow routing sources competitive off-chain quotes and settles on-chain in one transaction, reducing slippage compared to shallow public liquidity.

Wi

- Reward

- 1

- Comment

- Repost

- Share

Security is not a feature.

It’s infrastructure.

On STONfi, protection is built into the protocol design:

Immutable liquidity pools

Once deployed, core pool contracts cannot be altered. Code stays locked.

7-day upgrade delay

Any upgrade goes through a transparent timelock, giving the community time to review before execution.

MEV resistance by design

Running on The Open Network, sharded architecture reduces common Ethereum-style front-running and sandwich attack patterns.

Independent audits

Security reviews conducted by Trail of Bits and TonTech strengthen contract reliability.

Smart trader ha

It’s infrastructure.

On STONfi, protection is built into the protocol design:

Immutable liquidity pools

Once deployed, core pool contracts cannot be altered. Code stays locked.

7-day upgrade delay

Any upgrade goes through a transparent timelock, giving the community time to review before execution.

MEV resistance by design

Running on The Open Network, sharded architecture reduces common Ethereum-style front-running and sandwich attack patterns.

Independent audits

Security reviews conducted by Trail of Bits and TonTech strengthen contract reliability.

Smart trader ha

- Reward

- 3

- 1

- Repost

- Share

kossy :

:

the LPs are already something people need to understand better eventually StonFi makes it not just for trading but also for learning along the way

Think you’re safe in DeFi? One wrong click can cost you everything.

TON stands out because architecture matters. Built on The Open Network ($TON), it uses asynchronous design and sharding, reducing transaction reordering and front-running risks that plague other chains.

On STONfi, security is built into every layer:

• Fully non-custodial swaps, your funds, your keys

• Open-source codebase on GitHub

• Bug bounty programs via CertiK

• Transparent governance and upgrade processes

Security habits that save:

• Ticker ≠ contract; always verify the address

• Check liquidity depth before large trades

TON stands out because architecture matters. Built on The Open Network ($TON), it uses asynchronous design and sharding, reducing transaction reordering and front-running risks that plague other chains.

On STONfi, security is built into every layer:

• Fully non-custodial swaps, your funds, your keys

• Open-source codebase on GitHub

• Bug bounty programs via CertiK

• Transparent governance and upgrade processes

Security habits that save:

• Ticker ≠ contract; always verify the address

• Check liquidity depth before large trades

TON-5,93%

- Reward

- 2

- Comment

- Repost

- Share

What if the real alpha in 2026 isn’t yield… but security?

On STONfi, protection isn’t marketing. It’s built into the system.

Time-locked upgrades

Any protocol change goes through a delay window. If something feels off, you have time to withdraw before it goes live. No surprises.

Fairer trade execution

Built on The Open Network, TON avoids a single global mempool. That means fewer front-running games and more balanced execution.

Proof of Reserves (PoR)

xStocks reserves are verifiable, adding transparency for tokenized assets.

As Africa’s crypto adoption grows, trust becomes the real competitive

On STONfi, protection isn’t marketing. It’s built into the system.

Time-locked upgrades

Any protocol change goes through a delay window. If something feels off, you have time to withdraw before it goes live. No surprises.

Fairer trade execution

Built on The Open Network, TON avoids a single global mempool. That means fewer front-running games and more balanced execution.

Proof of Reserves (PoR)

xStocks reserves are verifiable, adding transparency for tokenized assets.

As Africa’s crypto adoption grows, trust becomes the real competitive

- Reward

- 2

- Comment

- Repost

- Share

On STONfi, staking unlocks:

GEMSTON yields

Earn protocol rewards while supporting ecosystem growth.

DAO voting power

Governance is on-chain. Your stake = your influence. Proposals follow a clear structure:

• Problem

• Proposed solution

• Risks & tradeoffs

Tokenomics edge

• 100M max supply

• Deflationary burns

• Utility tied to staking + governance

Why it matters:

The more you stake, the more weight your voice carries in shaping upgrades, incentives, and liquidity strategy.

Built on $TON , staking remains fast, low-cost, and fully non-custodial.

Think of it like Lagos’ crypto builders. Strong c

GEMSTON yields

Earn protocol rewards while supporting ecosystem growth.

DAO voting power

Governance is on-chain. Your stake = your influence. Proposals follow a clear structure:

• Problem

• Proposed solution

• Risks & tradeoffs

Tokenomics edge

• 100M max supply

• Deflationary burns

• Utility tied to staking + governance

Why it matters:

The more you stake, the more weight your voice carries in shaping upgrades, incentives, and liquidity strategy.

Built on $TON , staking remains fast, low-cost, and fully non-custodial.

Think of it like Lagos’ crypto builders. Strong c

TON-5,93%

- Reward

- 2

- Comment

- Repost

- Share

Omniston vs Traditional Bridges

With STONfi Omniston, swaps are routed through aggregated liquidity across 80+ chains, without relying on typical wrapped-asset bridge models.

Why that matters

• No dependency on single bridge contracts

• Reduced counterparty exposure

• Competitive pricing via RFQ quote competition

• Smarter execution across multiple liquidity sources

Roadmap highlights:

• BTC and ETH routing expansion

• Closed alpha phase rollout

• Continued cross-chain scaling across the TON ecosystem

Built on The Open Network, users benefit from low fees, fast confirmations, and seamless Tele

With STONfi Omniston, swaps are routed through aggregated liquidity across 80+ chains, without relying on typical wrapped-asset bridge models.

Why that matters

• No dependency on single bridge contracts

• Reduced counterparty exposure

• Competitive pricing via RFQ quote competition

• Smarter execution across multiple liquidity sources

Roadmap highlights:

• BTC and ETH routing expansion

• Closed alpha phase rollout

• Continued cross-chain scaling across the TON ecosystem

Built on The Open Network, users benefit from low fees, fast confirmations, and seamless Tele

- Reward

- 1

- Comment

- Repost

- Share

Turn on smarter routing, save more per swap.

With STONfi Omniston enabled, a $1,000 USDT → TON swap that might lose 0.8% to slippage ($8) on basic routing can be optimized through RFQ and smart path splitting. Even if the route looks “longer,” it often delivers better final pricing.

Omniston aggregates deep liquidity across the ecosystem, helping reduce slippage and hidden costs. With millions in TVL and billions in cumulative volume, routing depth keeps improving.

Powered by The Open Network, users also benefit from near-instant execution and very low transaction fees. And with Telegram walle

With STONfi Omniston enabled, a $1,000 USDT → TON swap that might lose 0.8% to slippage ($8) on basic routing can be optimized through RFQ and smart path splitting. Even if the route looks “longer,” it often delivers better final pricing.

Omniston aggregates deep liquidity across the ecosystem, helping reduce slippage and hidden costs. With millions in TVL and billions in cumulative volume, routing depth keeps improving.

Powered by The Open Network, users also benefit from near-instant execution and very low transaction fees. And with Telegram walle

TON-5,93%

- Reward

- 3

- 1

- Repost

- Share

JusticeJomi :

:

1000x VIbes 🤑Why expand cross-chain?

Because liquidity grows where interoperability exists.

With STONfi Omniston, cross-chain swaps are powered by:

RFQ-based pricing

Resolvers compete to give the best executable quote.

Escrow-backed execution

Funds are secured during the swap process, reducing risks often associated with traditional bridge designs.

Instead of relying solely on single bridge pathways, Omniston aggregates routes and optimizes settlement across chains.

Built on The Open Network, users benefit from low fees, fast confirmations, and growing cross-chain connectivity.

Why it matters:

• More liqui

Because liquidity grows where interoperability exists.

With STONfi Omniston, cross-chain swaps are powered by:

RFQ-based pricing

Resolvers compete to give the best executable quote.

Escrow-backed execution

Funds are secured during the swap process, reducing risks often associated with traditional bridge designs.

Instead of relying solely on single bridge pathways, Omniston aggregates routes and optimizes settlement across chains.

Built on The Open Network, users benefit from low fees, fast confirmations, and growing cross-chain connectivity.

Why it matters:

• More liqui

TON-5,93%

- Reward

- 1

- Comment

- Repost

- Share

Turn on smarter routing, save more per swap.

With STONfi Omniston enabled, a $1,000 USDT → TON swap that might lose 0.8% to slippage ($8) on basic routing can be optimized through RFQ and smart path splitting. Even if the route looks “longer,” it often delivers better final pricing.

Omniston aggregates deep liquidity across the ecosystem, helping reduce slippage and hidden costs. With millions in TVL and billions in cumulative volume, routing depth keeps improving.

Powered by The Open Network, users also benefit from near-instant execution and very low transaction fees. And with Telegram walle

With STONfi Omniston enabled, a $1,000 USDT → TON swap that might lose 0.8% to slippage ($8) on basic routing can be optimized through RFQ and smart path splitting. Even if the route looks “longer,” it often delivers better final pricing.

Omniston aggregates deep liquidity across the ecosystem, helping reduce slippage and hidden costs. With millions in TVL and billions in cumulative volume, routing depth keeps improving.

Powered by The Open Network, users also benefit from near-instant execution and very low transaction fees. And with Telegram walle

TON-5,93%

- Reward

- 1

- Comment

- Repost

- Share

Impermanent loss reducing your LP profits? STONfi V2 pools introduce advanced liquidity models designed to help LPs manage risk better.

WSS (Weighted Stable Swap)

Designed for stable or closely related assets. It uses peg-friendly pricing and dynamic weighting to reduce slippage and maintain smoother trades around equilibrium levels.

WCPI (Weighted Constant Product)

Supports custom ratios and multi-asset pools, allowing LPs to build portfolio-style liquidity instead of being locked into strict 50/50 exposure.

Why it matters

• Reduced impermanent loss

• Tighter trading spreads

• Better capital

WSS (Weighted Stable Swap)

Designed for stable or closely related assets. It uses peg-friendly pricing and dynamic weighting to reduce slippage and maintain smoother trades around equilibrium levels.

WCPI (Weighted Constant Product)

Supports custom ratios and multi-asset pools, allowing LPs to build portfolio-style liquidity instead of being locked into strict 50/50 exposure.

Why it matters

• Reduced impermanent loss

• Tighter trading spreads

• Better capital

TON-5,93%

- Reward

- 1

- Comment

- Repost

- Share

The smarter pool types introduced by STONfi V2 is designed for better efficiency and lower impermanent loss on The Open Network.

WSS (Weighted Stable Swap)

Built for correlated assets like tsTON/TON or stable pairs. It uses a peg-friendly pricing curve and dynamic amplification to reduce slippage, especially during large trades. Ideal for liquid staking tokens and stablecoin liquidity.

WCPI (Weighted Constant Product Invariant)

Lets LPs set custom ratios like 70/30 or create multi-asset pools with 3+ tokens. This allows portfolio-style liquidity and helps align exposure with your risk strategy

WSS (Weighted Stable Swap)

Built for correlated assets like tsTON/TON or stable pairs. It uses a peg-friendly pricing curve and dynamic amplification to reduce slippage, especially during large trades. Ideal for liquid staking tokens and stablecoin liquidity.

WCPI (Weighted Constant Product Invariant)

Lets LPs set custom ratios like 70/30 or create multi-asset pools with 3+ tokens. This allows portfolio-style liquidity and helps align exposure with your risk strategy

TON-5,93%

- Reward

- like

- Comment

- Repost

- Share

STONfi Escrow Swaps bring trustless OTC-style liquidity into DeFi through its Omniston routing system.

Here’s how it works: Resolvers provide off-chain price quotes, lock assets inside audited escrow smart contracts, and complete swaps atomically on-chain. This enables direct Asset-1 → Asset-2 trading with no custody risks.

Why it matters:

• Access deeper OTC liquidity for better pricing on large or specialized trades

• Lower slippage compared to shallow liquidity pools

• Ideal for trading tokenized assets like stocks from Apple Inc. or Tesla, Inc. through xStocks

• Fully non-custodial executi

Here’s how it works: Resolvers provide off-chain price quotes, lock assets inside audited escrow smart contracts, and complete swaps atomically on-chain. This enables direct Asset-1 → Asset-2 trading with no custody risks.

Why it matters:

• Access deeper OTC liquidity for better pricing on large or specialized trades

• Lower slippage compared to shallow liquidity pools

• Ideal for trading tokenized assets like stocks from Apple Inc. or Tesla, Inc. through xStocks

• Fully non-custodial executi

TON-5,93%

- Reward

- like

- Comment

- Repost

- Share

STONfi Omniston aggregates liquidity across multiple TON DEXs like DeDust, Tonco, and Swapcoffee, while also connecting to 80+ cross-chain networks through Rango Exchange. This allows users to get the best swap rates in a single transaction without liquidity fragmentation.

Omniston uses RFQ resolvers to fetch optimal pricing and intelligently split trades across liquidity sources. This helps reduce slippage, sometimes as low as 0.01% even on large trades.

Powered by The Open Network, swaps benefit from near-instant speed and very low transaction fees, making it highly competitive compared to m

Omniston uses RFQ resolvers to fetch optimal pricing and intelligently split trades across liquidity sources. This helps reduce slippage, sometimes as low as 0.01% even on large trades.

Powered by The Open Network, swaps benefit from near-instant speed and very low transaction fees, making it highly competitive compared to m

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

To The Moon 🌕Traditional aggregators often struggle with high fees, single-chain limits, and MEV attacks. Omniston on STONfi solves this by combining TON-native liquidity with cross-chain access across 80+ networks through Rango.

Omniston also uses RFQ (Request for Quote) routing to deliver institutional-level pricing and executes swaps atomically for better efficiency and reliability.

Why it stands out:

• Access to deeper, aggregated liquidity across multiple sources

• Very low fees and sub-second transactions powered by TON

• Built-in protection against front-running and MEV

• Improved slippage performan

Omniston also uses RFQ (Request for Quote) routing to deliver institutional-level pricing and executes swaps atomically for better efficiency and reliability.

Why it stands out:

• Access to deeper, aggregated liquidity across multiple sources

• Very low fees and sub-second transactions powered by TON

• Built-in protection against front-running and MEV

• Improved slippage performan

TON-5,93%

- Reward

- like

- Comment

- Repost

- Share

STONfi focuses on strong, transparent security to keep DeFi safer for users.

• Immutable pool contracts – Pool logic is permanently locked after deployment, preventing hidden changes or malicious updates.

• 7-day time-locked upgrades – Router updates are publicly delayed, giving users time to review or withdraw liquidity if they disagree.

• Fully non-custodial – You always control your funds through your wallet.

• Audited and open-source – STONfi V2 was audited by Trail of Bits, escrow contracts by TonTech, and the platform runs ongoing bug bounty programs through Certik and HackenProof.

• TON

• Immutable pool contracts – Pool logic is permanently locked after deployment, preventing hidden changes or malicious updates.

• 7-day time-locked upgrades – Router updates are publicly delayed, giving users time to review or withdraw liquidity if they disagree.

• Fully non-custodial – You always control your funds through your wallet.

• Audited and open-source – STONfi V2 was audited by Trail of Bits, escrow contracts by TonTech, and the platform runs ongoing bug bounty programs through Certik and HackenProof.

• TON

TON-5,93%

- Reward

- like

- Comment

- Repost

- Share