TraderShenman

No content yet

TraderShenman

ETH Spot Strategy:

Buy 10% at 2700

Buy 10% at 2400

Buy 10% at 2100

Sell 10% at 1800

Go all-in and relax between 1500-1200

Wait for the next ETH rise to 4000, and your account will double!

Buy 10% at 2700

Buy 10% at 2400

Buy 10% at 2100

Sell 10% at 1800

Go all-in and relax between 1500-1200

Wait for the next ETH rise to 4000, and your account will double!

ETH0,66%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 1

- Repost

- Share

TraderShenman :

:

ETH Spot Strategy: Buy 10% at 2700

Buy 10% at 2400

Buy 10% at 2100

Sell 10% at 1800

Go all-in and relax between 1500-1200

When ETH rises to 4000 in the next round, your account will double!

Recently, everyone has been saying that the first target for BTC will drop to 76,000, the second target to 60,000, and there is even panic selling down to around 53,000-55,000.

76,000 is just a small shake, it can be reached very easily!

Friends who like spot trading can consider positioning at the above levels.

If you have 1 million U,

Buy 100,000 U at 76,000

Buy 100,000 U at 70,000

Buy 100,000 U at 65,000

Go all-in and relax at 60,000-55,000

Use time to exchange for space; your account will eventually double!

76,000 is just a small shake, it can be reached very easily!

Friends who like spot trading can consider positioning at the above levels.

If you have 1 million U,

Buy 100,000 U at 76,000

Buy 100,000 U at 70,000

Buy 100,000 U at 65,000

Go all-in and relax at 60,000-55,000

Use time to exchange for space; your account will eventually double!

BTC-0,23%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

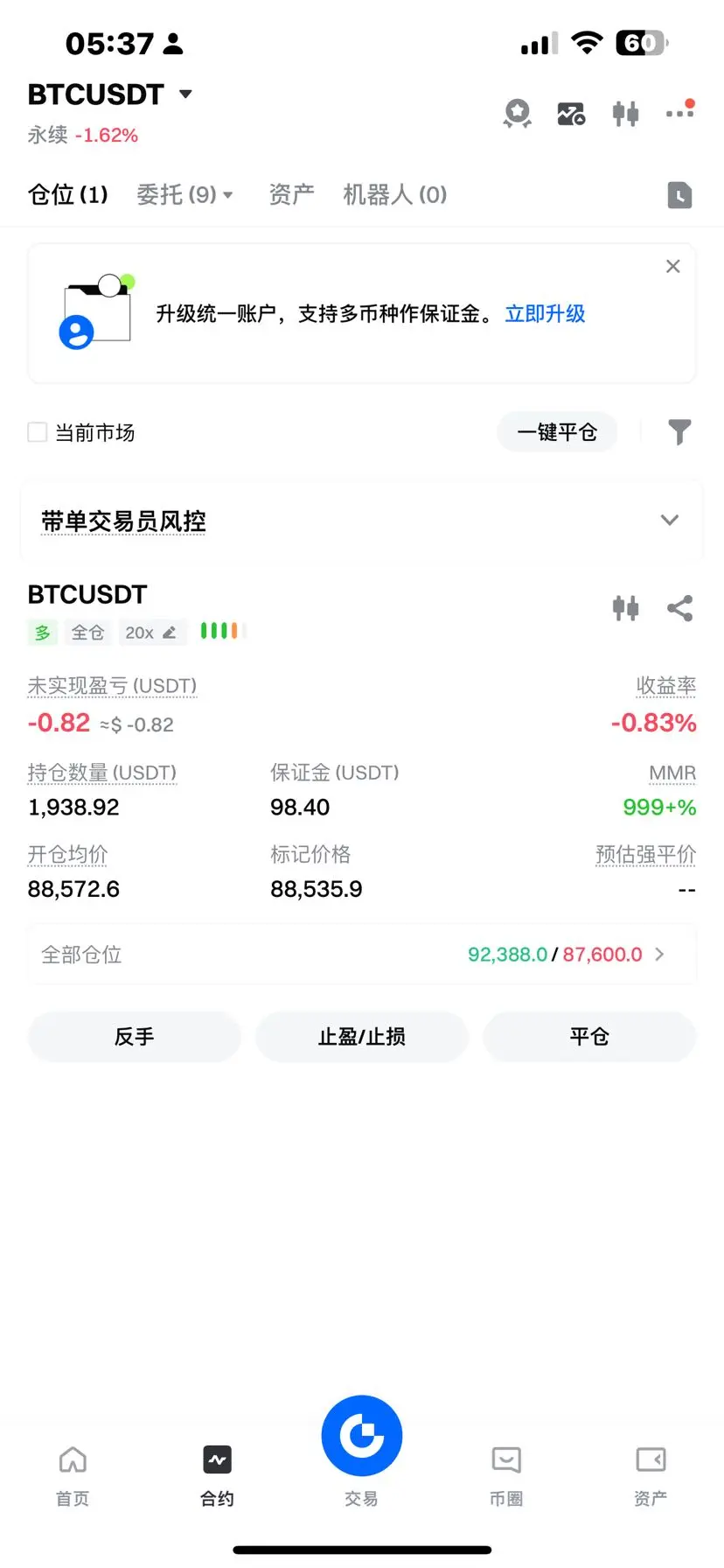

Buy in batches near BTC86000-85000

Stop Loss: 15-minute below 84500

Take Profit: 86800-87800

View OriginalStop Loss: 15-minute below 84500

Take Profit: 86800-87800

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

You need to learn how to control your emotions. When your emotions are good, you will find:

Your family is well,

Your career is thriving,

Your health is good,

Your wealth is increasing.

When your emotions are bad,

You feel uncomfortable physically,

Your family is in chaos,

You can't even earn money.

Remember to remind yourself:

Go out without anger,

Handle matters without resentment,

Sleep without worries,

Deal with things without impatience.

Be clear-headed when doing tasks, read books when feeling confused,

Think during solitude, control your emotions during intense anger.

——In the crypto co

View OriginalYour family is well,

Your career is thriving,

Your health is good,

Your wealth is increasing.

When your emotions are bad,

You feel uncomfortable physically,

Your family is in chaos,

You can't even earn money.

Remember to remind yourself:

Go out without anger,

Handle matters without resentment,

Sleep without worries,

Deal with things without impatience.

Be clear-headed when doing tasks, read books when feeling confused,

Think during solitude, control your emotions during intense anger.

——In the crypto co

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

【Repost】Determinism and Uncertainty in Contract Trading🀄

Many people engage in trading, and the biggest issue isn't not understanding the market, but being unable to accept uncertainty. They always want a 100% correct answer, always hoping someone will tell them exactly what to do next. But the reality is, the market itself is uncertain.

True trading isn't about eliminating uncertainty but about finding the probabilities that are favorable to you within uncertainty. You don't need to know whether the market will definitely go up or down; you only need to know:

How to profit if it goes up;

How

View OriginalMany people engage in trading, and the biggest issue isn't not understanding the market, but being unable to accept uncertainty. They always want a 100% correct answer, always hoping someone will tell them exactly what to do next. But the reality is, the market itself is uncertain.

True trading isn't about eliminating uncertainty but about finding the probabilities that are favorable to you within uncertainty. You don't need to know whether the market will definitely go up or down; you only need to know:

How to profit if it goes up;

How

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

ETH Short Selling Plan:

Gradually reduce positions and short at 3188-3255-3355-3400!

If you use 100x leverage, it's best not to exceed 5% of your total position!

Bet on the floodgate rally caused by Japan 🇯🇵 raising interest rates!

Take profit targets: 3050-3000-2900-2700

Investing involves risks! If you follow the trade, you bear the profit and loss!

If you have questions, feel free to leave a comment, and I will reply to each one!

Looking forward to everyone’s big gains!

Gradually reduce positions and short at 3188-3255-3355-3400!

If you use 100x leverage, it's best not to exceed 5% of your total position!

Bet on the floodgate rally caused by Japan 🇯🇵 raising interest rates!

Take profit targets: 3050-3000-2900-2700

Investing involves risks! If you follow the trade, you bear the profit and loss!

If you have questions, feel free to leave a comment, and I will reply to each one!

Looking forward to everyone’s big gains!

ETH0,66%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 1

- Repost

- Share

TraderShenman :

:

ETH Short Selling Plan: Build short positions in batches at 3188-3255-3355-3400!

If you use 100x leverage, your total position should not exceed 5%!

Bet on the floodgate effect of Japan 🇯🇵 interest rate hikes!

Take profit targets: 3050-3000-2900-2700

Investing involves risks! If you follow the trades, you bear the profits and losses!

If you have questions, leave a comment in the comment section, and I will reply to each one!

Looking forward to everyone making huge profits!

Today, the overseas crypto media Cointelegraph raised a market-moving judgment: if the Bank of Japan raises interest rates as scheduled on December 19, BTC Bitcoin may face a new round of correction, potentially falling below $70,000.

This conclusion is not an emotional prediction but a comprehensive analysis based on macro policies, historical data, and technical patterns.

1. Why is the Bank of Japan important?

Japan has maintained ultra-low interest rates for a long time, forming a large-scale "Yen arbitrage trading": borrowing low-interest yen and investing in high-risk assets such as US st

This conclusion is not an emotional prediction but a comprehensive analysis based on macro policies, historical data, and technical patterns.

1. Why is the Bank of Japan important?

Japan has maintained ultra-low interest rates for a long time, forming a large-scale "Yen arbitrage trading": borrowing low-interest yen and investing in high-risk assets such as US st

BTC-0,23%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

30-Year High Interest Rate! Bank of Japan May Hit the “Nuclear Button” on December 19: Will Bitcoin Repeat the $15,000 Crash?

A storm is gathering in the East. While you’re still bored with Bitcoin’s oscillation between $88,000 and $94,000, this “gray rhino” in the global financial markets has quietly turned around, ready to launch a deadly charge. According to Coin Bureau and multiple sources, the Bank of Japan (BoJ) is highly likely to announce a 25 basis point rate hike to 0.75% at the upcoming December 18-19 meeting. 0.75% sounds insignificant? But in Japan, a country that has long impleme

A storm is gathering in the East. While you’re still bored with Bitcoin’s oscillation between $88,000 and $94,000, this “gray rhino” in the global financial markets has quietly turned around, ready to launch a deadly charge. According to Coin Bureau and multiple sources, the Bank of Japan (BoJ) is highly likely to announce a 25 basis point rate hike to 0.75% at the upcoming December 18-19 meeting. 0.75% sounds insignificant? But in Japan, a country that has long impleme

BTC-0,23%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- Comment

- Repost

- Share

This morning, the entire crypto market plummeted! Over 110,000 traders were liquidated!

On December 15th, Bitcoin continued its downward trend, falling below $88,000 during trading. As of press time, Bitcoin was at $87,967.8, down 2.48%.

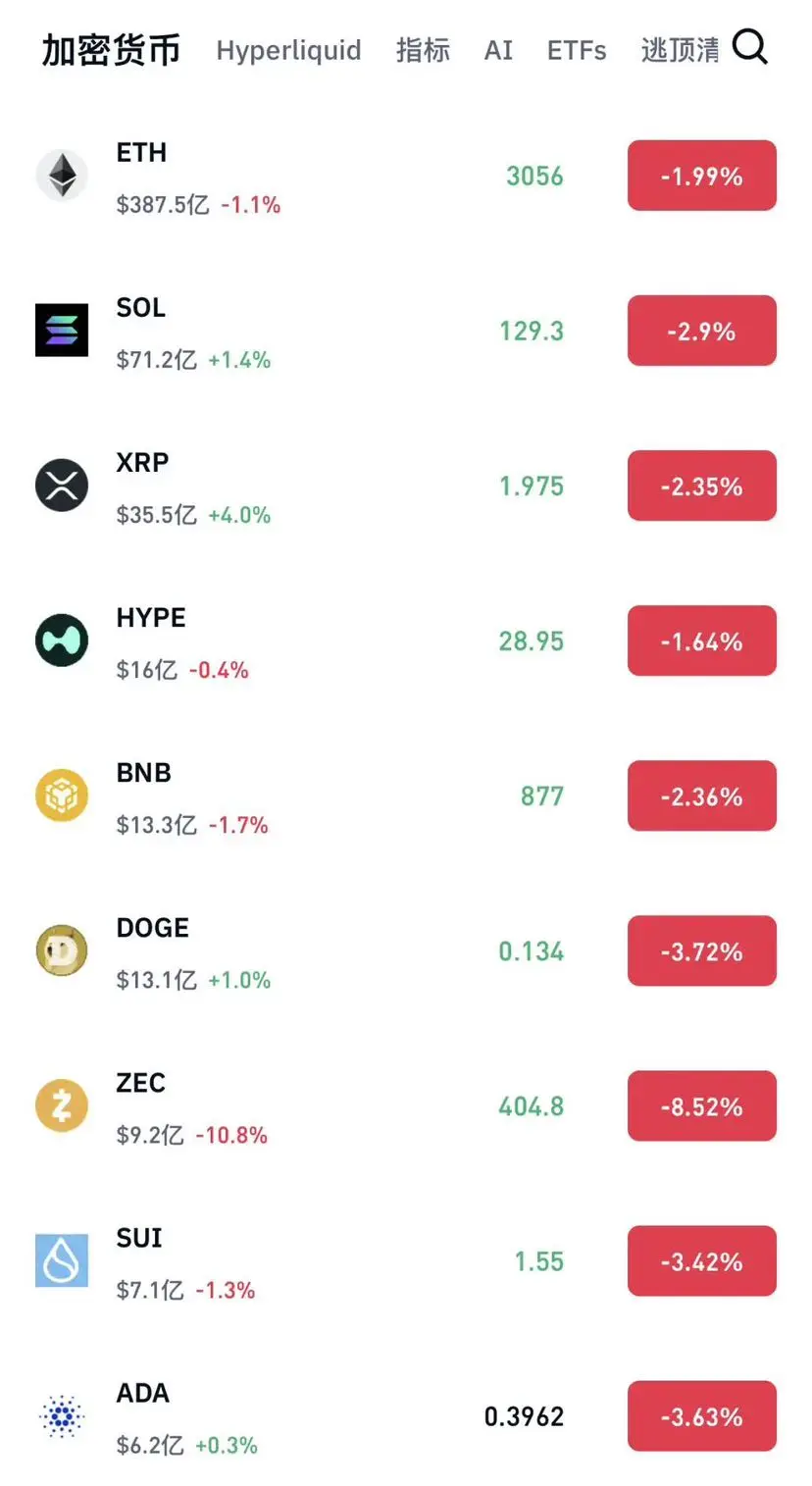

In addition to Bitcoin, Ethereum decreased by 1.99%, SOL coin dropped 2.9%, XRP declined 2.35%, Dogecoin fell 3.72%, and ADA decreased 3.63%.

Data from Coinglass shows that in the past 24 hours, the total liquidation of cryptocurrency contracts across the network reached $270 million, involving 115,700 traders. Among these, long positions were liquidated for $

View OriginalOn December 15th, Bitcoin continued its downward trend, falling below $88,000 during trading. As of press time, Bitcoin was at $87,967.8, down 2.48%.

In addition to Bitcoin, Ethereum decreased by 1.99%, SOL coin dropped 2.9%, XRP declined 2.35%, Dogecoin fell 3.72%, and ADA decreased 3.63%.

Data from Coinglass shows that in the past 24 hours, the total liquidation of cryptocurrency contracts across the network reached $270 million, involving 115,700 traders. Among these, long positions were liquidated for $

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- 1

- Repost

- Share

求大饼姨太暴跌 :

:

End of this year: 100,000; Year 3026: 200,000Trader pension-usdt.eth closed 1000 BTC short positions and switched to going long

According to Foresight News, trader pension-usdt.eth closed 1000 BTC shorts, earning $960,000, and then switched to going long with 358.86 BTC. Currently, their total profit has reached $23.2 million.

Comment: After the trader's short positions are closed for profit, switching to long—can this be interpreted as a sign of weakening bearish momentum and a potential opportunity for bulls to rally?

According to Foresight News, trader pension-usdt.eth closed 1000 BTC shorts, earning $960,000, and then switched to going long with 358.86 BTC. Currently, their total profit has reached $23.2 million.

Comment: After the trader's short positions are closed for profit, switching to long—can this be interpreted as a sign of weakening bearish momentum and a potential opportunity for bulls to rally?

BTC-0,23%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

This Week's US Economic Data Releases and Index Rebalancing May Trigger Market Volatility

According to BlockBeats, on December 15, the market remains highly risky this week, as delayed economic data releases and index rebalancing could trigger market fluctuations. The US will release the November employment report and inflation readings, which will influence the Federal Reserve's interest rate outlook.

This week, the US will also publish the November Consumer Price Index (CPI) report, with an expected year-over-year increase of 3.1%. Mizuho Securities USA's Farzin Azam stated that this is one

View OriginalAccording to BlockBeats, on December 15, the market remains highly risky this week, as delayed economic data releases and index rebalancing could trigger market fluctuations. The US will release the November employment report and inflation readings, which will influence the Federal Reserve's interest rate outlook.

This week, the US will also publish the November Consumer Price Index (CPI) report, with an expected year-over-year increase of 3.1%. Mizuho Securities USA's Farzin Azam stated that this is one

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

Is there a pattern? I wonder if it will be broken this time?

Every time Japan raises interest rates, BTC and ETH inevitably crash. The impact is no less than on the US data release days. Is it because Satoshi Nakamoto is Japanese?

View OriginalEvery time Japan raises interest rates, BTC and ETH inevitably crash. The impact is no less than on the US data release days. Is it because Satoshi Nakamoto is Japanese?

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

Crypto Circle Morning Report (December 15, 2025)

1) Market Trends

1. In the last 24 hours, both BTC and ETH declined, with altcoins showing mixed gains and losses. The total market capitalization of cryptocurrencies fell by 2.03% to approximately $3.01 trillion, mainly due to ETF fund outflows and macroeconomic impacts, resulting in an overall weak market;

2. US stocks closed last Friday (Dec 12), with the S&P 500 down by 1.07%, the Dow Jones down by 0.51%, and the NASDAQ down by 1.69%. Broadcom's earnings report caused a nearly 11% plunge;

2) Market Hotspots

1. Bitcoin briefly dropped below $

View Original1) Market Trends

1. In the last 24 hours, both BTC and ETH declined, with altcoins showing mixed gains and losses. The total market capitalization of cryptocurrencies fell by 2.03% to approximately $3.01 trillion, mainly due to ETF fund outflows and macroeconomic impacts, resulting in an overall weak market;

2. US stocks closed last Friday (Dec 12), with the S&P 500 down by 1.07%, the Dow Jones down by 0.51%, and the NASDAQ down by 1.69%. Broadcom's earnings report caused a nearly 11% plunge;

2) Market Hotspots

1. Bitcoin briefly dropped below $

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

This week we will see unemployment rate / Consumer Price Index (CPI) data, followed by Japan's interest rate hike on December 19!

If the weekly closing price falls below 88,200 points, it's not looking good! It may lead to an accelerated decline.

View OriginalIf the weekly closing price falls below 88,200 points, it's not looking good! It may lead to an accelerated decline.

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

Try one more BTC!

BTC-0,23%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

DOGE, converging triangle. If the support holds, there is a chance to initiate a mid-term rally.

That being said, it still depends on BTC's performance. If BTC keeps falling, all coins might go to zero...

View OriginalThat being said, it still depends on BTC's performance. If BTC keeps falling, all coins might go to zero...

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 2

- Repost

- Share

TraderShenman :

:

Recommend 1%~2% position, 5-20x leverage, to make a small bet for a big gainView More

[Repost] This is why I have been calling it the "Tea Break Moment" since November. This current dull period carries multiple objectives: one is to create liquidity below, and the only goal is to prevent market makers from panic selling, thereby guiding the market to a controlled downward correction. Investors holding for one to two years now firmly believe that this is just a "technical correction." They look at the $90,000 level, think everything is fine, and expect the price to rebound. But this time, reality will prove their misjudgment. When the price drops to the $60,000 to $70,000 range,

BTC-0,23%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 1

- Repost

- Share

TraderShenman :

:

My dear followers, I will definitely follow back!🙏🤝The overall trend is still downward; shorting on rallies is the way to go!

View Original[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

90% of people in the contract market want to get rich overnight, but if you stay in the contract market for a few years, your heart will change.

View Original[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

BTC (Bitcoin) is currently oscillating within a symmetrical triangle pattern, indicating market indecision and volatility compression.

The price is now hovering around the 100-day Exponential Moving Average (EMA), which serves as a key support zone. Neither bulls nor bears have gained a clear advantage yet.

If the price breaks above the upper trendline (around 59.5-60%), it will confirm Bitcoin's strength and may exert pressure on altcoins. Conversely, if the price falls below the lower trendline (around 58.5%), it will indicate a weakening of Bitcoin's dominance, creating opportunities fo

The price is now hovering around the 100-day Exponential Moving Average (EMA), which serves as a key support zone. Neither bulls nor bears have gained a clear advantage yet.

If the price breaks above the upper trendline (around 59.5-60%), it will confirm Bitcoin's strength and may exert pressure on altcoins. Conversely, if the price falls below the lower trendline (around 58.5%), it will indicate a weakening of Bitcoin's dominance, creating opportunities fo

BTC-0,23%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share