Original content no longer visible

MrBTC666

No content yet

MrBTC666

Empty to the bottom of the bear

View Original[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Empty to the bottom of the bear

View Original[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Empty to the bottom of the bear

View Original[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

A robot that has fallen to the bottom of the bear market

View Original[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

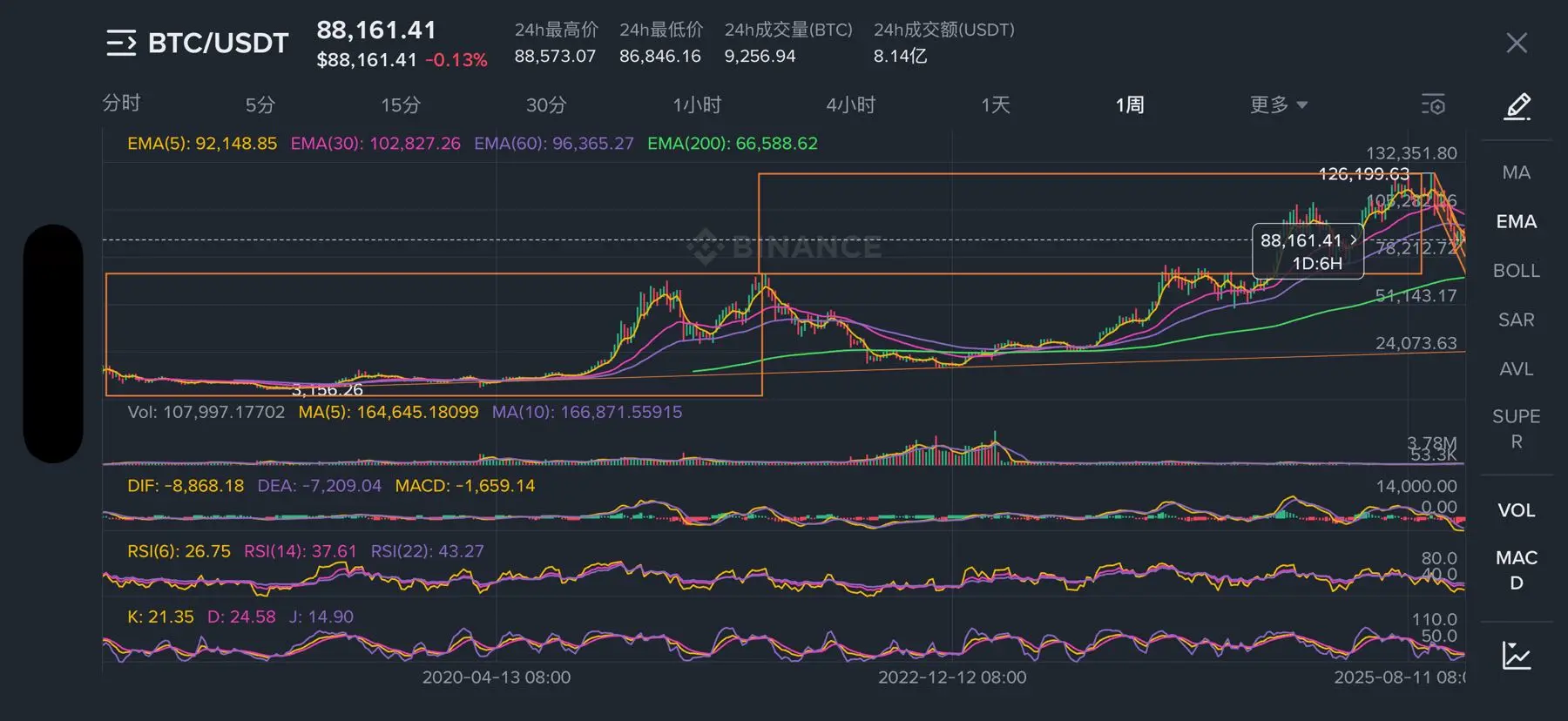

Attention⚠️Attention⚠️This wave of market movement is different from the previous one where BTC hit 94,000 and ETH 3400!

Simply analyzing from technical and market sentiment perspectives, the last wave from 8 to 9.4 was a rebound after an oversold condition, driven by short-term oversold rebounds and short covering!

This round of market movement has formed a local bottom after oscillating between 8-9! As selling pressure is digested during the oscillation, the selling diminishes, and the bulls gradually strengthen! Institutional investors are more willing to buy long positions! This has driven

View OriginalSimply analyzing from technical and market sentiment perspectives, the last wave from 8 to 9.4 was a rebound after an oversold condition, driven by short-term oversold rebounds and short covering!

This round of market movement has formed a local bottom after oscillating between 8-9! As selling pressure is digested during the oscillation, the selling diminishes, and the bulls gradually strengthen! Institutional investors are more willing to buy long positions! This has driven

- Reward

- like

- Comment

- Repost

- Share

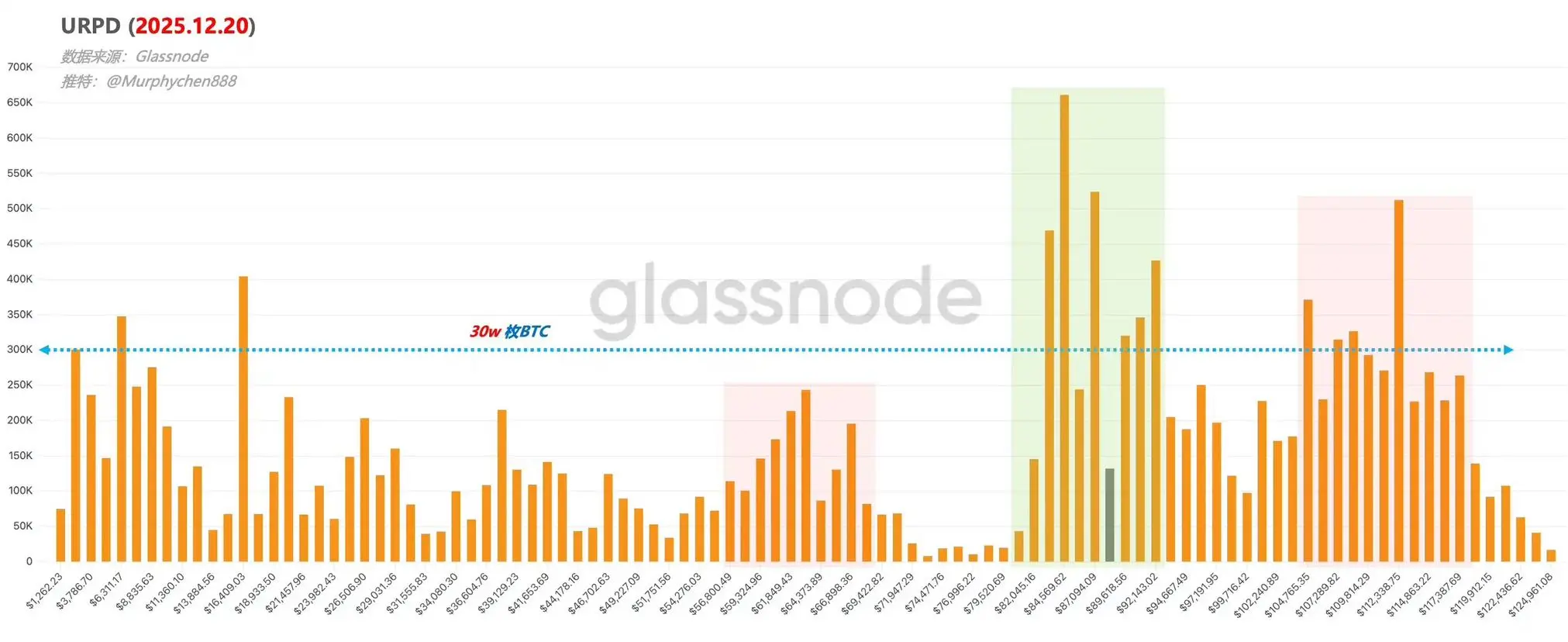

On December 22, on-chain data analyst Murphy viewed the big dump of 10.11 as the starting point of this round of decline, analyzing the significant changes in the BTC cost structure over the past 2 months as follows:

The highest accumulation range for BTC is between 80,000 and 90,000 USD, totaling 2.536 million coins, an increase of 1.874 million coins compared to October 11, making it the strongest support range so far, followed by the range of 90,000 to 100,000 USD (an increase of 324,000 coins) and the range of 100,000 to 110,000 USD (an increase of 87,000 coins);

With the current price of

The highest accumulation range for BTC is between 80,000 and 90,000 USD, totaling 2.536 million coins, an increase of 1.874 million coins compared to October 11, making it the strongest support range so far, followed by the range of 90,000 to 100,000 USD (an increase of 324,000 coins) and the range of 100,000 to 110,000 USD (an increase of 87,000 coins);

With the current price of

ETH-5,27%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

#晒出我的合约收益 #成长值抽奖赢iPhone17和周边 It's better to stay away from altcoin contracts! Look at how this loss happened.

View Original- Reward

- like

- Comment

- Repost

- Share

So much, but paying out of pocket has killed me! It's really too difficult #广场发币瓜分千U奖池 #参与创作者认证计划月领$10,000

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#晒出我的持仓收益#

- Reward

- like

- Comment

- Repost

- Share

What's wrong with OKI?

View Original

- Reward

- like

- Comment

- Repost

- Share

What should the Trump family do to maintain the continuous rise of WLFI?

With the WIFL spot unlocking and listing approaching on September 1st, facing a surge of potential selling pressure, what strategies would be more effective for the Trump family to continuously drive the coin price up in the coming days? Let's boldly suggest a few!

Strengthening the narrative of "reflexive cycle" and visibility

The project team needs to continuously strengthen and fulfill the core economic model of "USD1 stablecoin yield buyback and destruction of WLFI." This is not just a narrative; it needs to become

View OriginalWith the WIFL spot unlocking and listing approaching on September 1st, facing a surge of potential selling pressure, what strategies would be more effective for the Trump family to continuously drive the coin price up in the coming days? Let's boldly suggest a few!

Strengthening the narrative of "reflexive cycle" and visibility

The project team needs to continuously strengthen and fulfill the core economic model of "USD1 stablecoin yield buyback and destruction of WLFI." This is not just a narrative; it needs to become

- Reward

- like

- Comment

- Repost

- Share

When playing in the crypto world, you must learn to focus on the big picture and let go of the small stuff.

What does it mean to catch big?

When the overall trend of BTC is upward, one can operate more aggressively, buying altcoins even without checking the price levels. At this time, one must be bold in taking positions and holding on.

What does it mean to scale down?

After BTC peaks (which may not necessarily be the peak of a bull market; a short-term peak is the same), the trend will decline, and there will be some small opportunities in the altcoin market to varying degrees. Some individua

What does it mean to catch big?

When the overall trend of BTC is upward, one can operate more aggressively, buying altcoins even without checking the price levels. At this time, one must be bold in taking positions and holding on.

What does it mean to scale down?

After BTC peaks (which may not necessarily be the peak of a bull market; a short-term peak is the same), the trend will decline, and there will be some small opportunities in the altcoin market to varying degrees. Some individua

BTC-4,23%

- Reward

- like

- Comment

- Repost

- Share

Market Analysis for 8-29

Yesterday, $BTC surged to 113000 before retreating, with heavy selling pressure above and weak upward momentum. It will continue to test the support at 108000-110000. If the support holds and can stimulate buying momentum, it will continue to push towards 115000. However, if it breaks below the previous low of 108000, it will further drop towards around 105000!

$ETH attempted to break 4700 in the past two days but failed, facing selling pressure that brought it down. The upward momentum is insufficient, and it has retreated to around the 4400 Bollinger middle band. If

Yesterday, $BTC surged to 113000 before retreating, with heavy selling pressure above and weak upward momentum. It will continue to test the support at 108000-110000. If the support holds and can stimulate buying momentum, it will continue to push towards 115000. However, if it breaks below the previous low of 108000, it will further drop towards around 105000!

$ETH attempted to break 4700 in the past two days but failed, facing selling pressure that brought it down. The upward momentum is insufficient, and it has retreated to around the 4400 Bollinger middle band. If

ETH-5,27%

Weekend market speculation

Weekend watching fluctuations

1

1

Weekend watch pump 📈

2

2

Check the fall this weekend 📉

0

0

3 ParticipantsVoting Finished

- Reward

- like

- Comment

- Repost

- Share