KyleChassé

No content yet

KyleChassé

The 14 year honeymoon between Bitcoin and the 4 year cycle is officially over.

For over a decade, the Bitcoin halving was the ultimate cheat code for retail wealth, an unbroken law that guaranteed a green year following the supply cut.

As of January 2026, that law has been shattered.

While the herd waited for a 2025 moon mission, the market recorded a negative performance of 15.5%, marking the first time in history Bitcoin has failed to follow its post-halving script.

Under the surface, the halving has been demoted to a secondary signal.

We have transitioned from a retail-led scarcity model

For over a decade, the Bitcoin halving was the ultimate cheat code for retail wealth, an unbroken law that guaranteed a green year following the supply cut.

As of January 2026, that law has been shattered.

While the herd waited for a 2025 moon mission, the market recorded a negative performance of 15.5%, marking the first time in history Bitcoin has failed to follow its post-halving script.

Under the surface, the halving has been demoted to a secondary signal.

We have transitioned from a retail-led scarcity model

BTC0,64%

- Reward

- like

- Comment

- Repost

- Share

$SUI just absorbed a $60M token unlock without breaking a sweat.

The numbers don't lie:

real on-chain activity is holding at 866 TPS, supported by the Mysticeti v2 rollout that just dropped latency into the floor.

Why the whales aren't flinching:

- ETF Momentum: Bitwise and Canary Capital have both filed for Spot SUI ETFs. If approved this quarter, SUI becomes the third "Must-Own" asset for Wall Street.

- TVL Powerhouse: Sui’s TVL just smashed back over the $1 Billion mark, fueled by a 30% jump in DEX volume and massive BTCfi integrations.

- The "January Effect": SUI is already up 9% to star

The numbers don't lie:

real on-chain activity is holding at 866 TPS, supported by the Mysticeti v2 rollout that just dropped latency into the floor.

Why the whales aren't flinching:

- ETF Momentum: Bitwise and Canary Capital have both filed for Spot SUI ETFs. If approved this quarter, SUI becomes the third "Must-Own" asset for Wall Street.

- TVL Powerhouse: Sui’s TVL just smashed back over the $1 Billion mark, fueled by a 30% jump in DEX volume and massive BTCfi integrations.

- The "January Effect": SUI is already up 9% to star

SUI2,04%

- Reward

- like

- Comment

- Repost

- Share

Liquidity exhaustion has officially hit the US banking system.

The narrative of ample reserves just collided with reality.

They told you the banking system was flush with cash but they lied.

When the year end squeeze hit the banks got caught short and sprinted to the Fed for a fix.

The Standing Repo Facility is the emergency room for the dollar system. And the waiting room just got crowded.

While you were watching the ball drop the banks were begging for liquidity.

SRF Usage spiked to $75 Billion which is the highest since 2021.

Fed Balance Sheet is still churning $40B per month in bills.

Res

The narrative of ample reserves just collided with reality.

They told you the banking system was flush with cash but they lied.

When the year end squeeze hit the banks got caught short and sprinted to the Fed for a fix.

The Standing Repo Facility is the emergency room for the dollar system. And the waiting room just got crowded.

While you were watching the ball drop the banks were begging for liquidity.

SRF Usage spiked to $75 Billion which is the highest since 2021.

Fed Balance Sheet is still churning $40B per month in bills.

Res

- Reward

- like

- Comment

- Repost

- Share

The volatility that scared the world in 2014 is the growth that funded the elite in 2026.

While everyone was arguing about bubbles and utility the network was quietly doing the math.

A simple list tells the entire story of the last decade.

2014 was $772.

2018 was $13,412.

2022 was $46,211.

2026 is $90,000.

This is not about the daily candle. It is about the unstoppable hardening of the world's only neutral reserve asset.

The message is still the same. HODL.

The cost of being right too early is the volatility. The cost of being late is the regret.

While everyone was arguing about bubbles and utility the network was quietly doing the math.

A simple list tells the entire story of the last decade.

2014 was $772.

2018 was $13,412.

2022 was $46,211.

2026 is $90,000.

This is not about the daily candle. It is about the unstoppable hardening of the world's only neutral reserve asset.

The message is still the same. HODL.

The cost of being right too early is the volatility. The cost of being late is the regret.

- Reward

- like

- Comment

- Repost

- Share

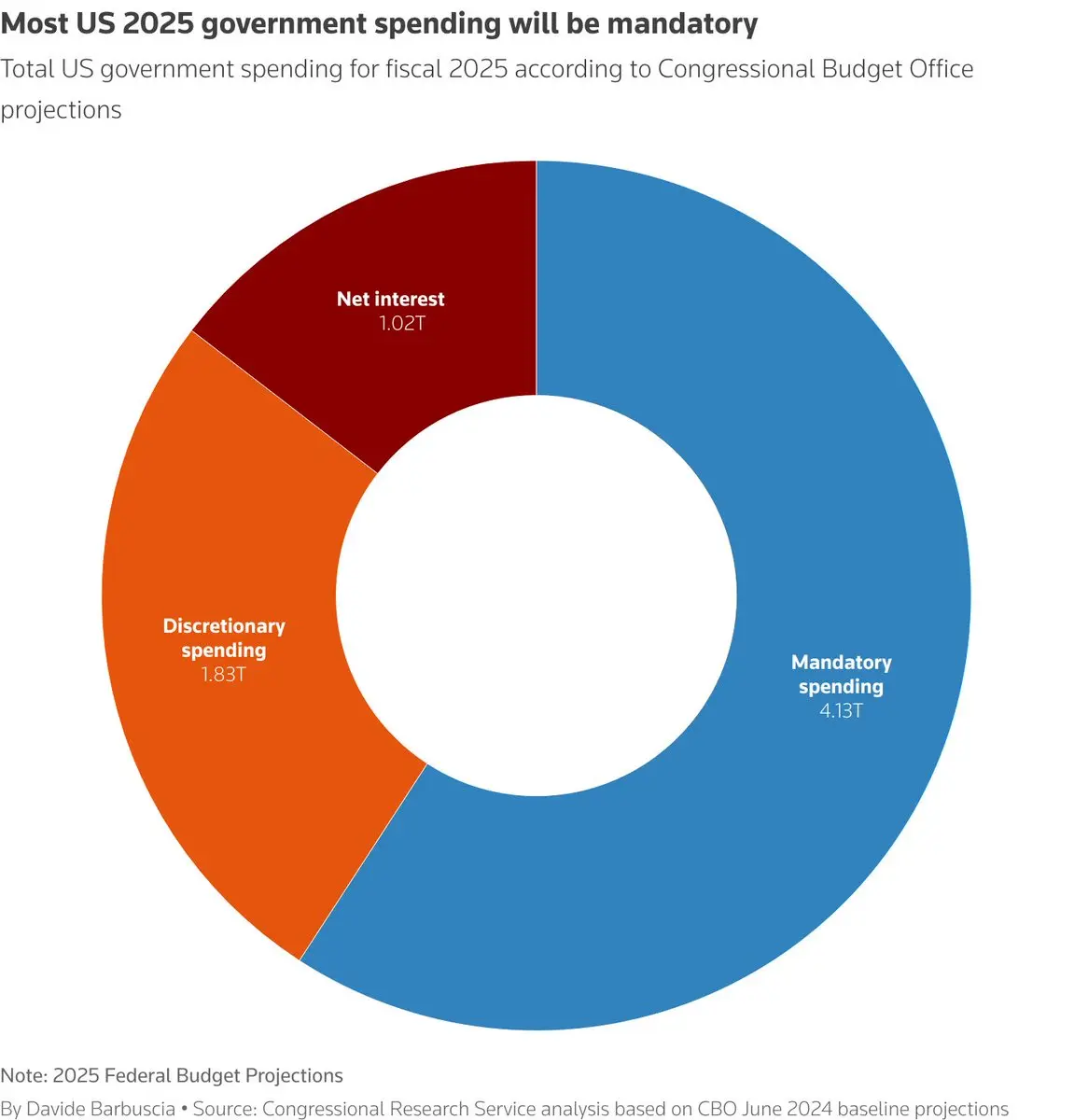

The federal government is facing a massive spending problem.

Government spending is up to $7.0 trillion over the last 12 months.

Meanwhile government revenue is $5.4 trillion over the same period.

This results in a gap of $1.6 trillion between federal spending and revenue.

We are witnessing the widest gap in 23 years.

This is not temporary emergency spending anymore as it has become the new baseline.

You cannot run a deficit equivalent to 6% of GDP indefinitely when the economy is not in a recession.

There is no long term plan here.

Government spending is up to $7.0 trillion over the last 12 months.

Meanwhile government revenue is $5.4 trillion over the same period.

This results in a gap of $1.6 trillion between federal spending and revenue.

We are witnessing the widest gap in 23 years.

This is not temporary emergency spending anymore as it has become the new baseline.

You cannot run a deficit equivalent to 6% of GDP indefinitely when the economy is not in a recession.

There is no long term plan here.

- Reward

- like

- Comment

- Repost

- Share

The ultimate Bitcoin leverage trade just became the ultimate trap.

For years the market treated MicroStrategy as a cheat code but that narrative just broke.

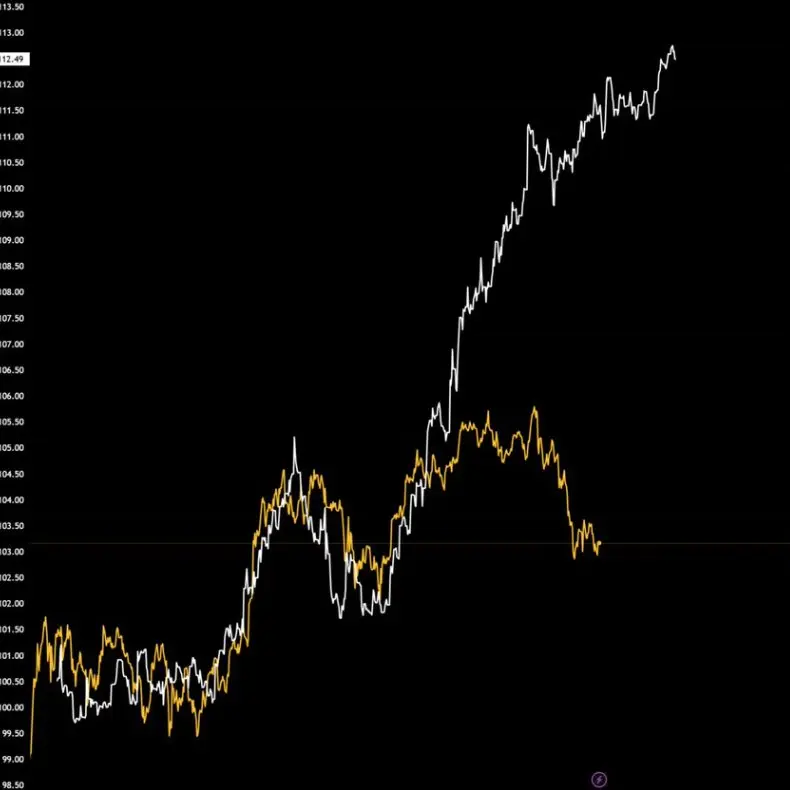

While the S&P 500 rallied to all time highs the proxy trade completely collapsed erasing years of perceived value.

The divergence is brutal.

S&P 500 is up 17%.

Bitcoin is down 6%.

MicroStrategy is down 49%.

MSTR amplified the losses of the asset it was built to track by nearly eight fold. It did not just fail as a hedge. It failed as a proxy.

Leverage works until it doesn't. When the liquidity tide goes out the proxies get punished the h

For years the market treated MicroStrategy as a cheat code but that narrative just broke.

While the S&P 500 rallied to all time highs the proxy trade completely collapsed erasing years of perceived value.

The divergence is brutal.

S&P 500 is up 17%.

Bitcoin is down 6%.

MicroStrategy is down 49%.

MSTR amplified the losses of the asset it was built to track by nearly eight fold. It did not just fail as a hedge. It failed as a proxy.

Leverage works until it doesn't. When the liquidity tide goes out the proxies get punished the h

BTC0,64%

- Reward

- like

- Comment

- Repost

- Share

The Four Year Cycle is officially a legacy myth that just cost the herd billions.

For a decade the market was synchronized but 2025 broke the machine.

We hit an All Time High before the halving and then endured the worst Q4 in years while the altcoin rally never came.

The market is being rewired for institutional grinding.

While everyone was waiting for the alt season that was guaranteed by history the mechanics changed.

Bitcoin is set for its first yearly loss since 2022 despite the 2024 halving. Institutional ETFs rebalanced in January effectively front running retail FOMO.

Legacy altcoins

For a decade the market was synchronized but 2025 broke the machine.

We hit an All Time High before the halving and then endured the worst Q4 in years while the altcoin rally never came.

The market is being rewired for institutional grinding.

While everyone was waiting for the alt season that was guaranteed by history the mechanics changed.

Bitcoin is set for its first yearly loss since 2022 despite the 2024 halving. Institutional ETFs rebalanced in January effectively front running retail FOMO.

Legacy altcoins

- Reward

- like

- Comment

- Repost

- Share

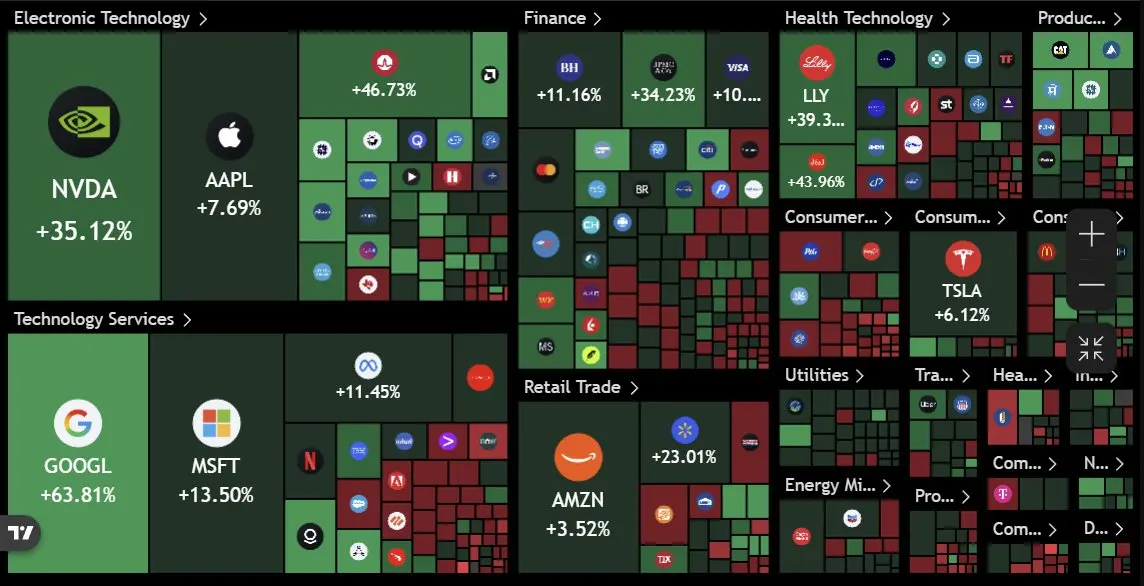

The Oracle of Omaha is officially being liquidated by the 21st century.

For decades Warren Buffett used cheap leverage to dominate the old world but underneath the surface a silent crash has occurred.

Buffett has officially underperformed Gold since the year 2000.

The market mechanics are broken.

The Buffett Indicator just hit a record 218% which is 78 points higher than the 2000 Dot Com peak.

We are seeing a massive divergence.

The stock market has grown twice as fast as the economy since the 2020 pandemic.

The quits rate is flashing a warning signal at 2008 Financial Crisis levels.

Tech gia

For decades Warren Buffett used cheap leverage to dominate the old world but underneath the surface a silent crash has occurred.

Buffett has officially underperformed Gold since the year 2000.

The market mechanics are broken.

The Buffett Indicator just hit a record 218% which is 78 points higher than the 2000 Dot Com peak.

We are seeing a massive divergence.

The stock market has grown twice as fast as the economy since the 2020 pandemic.

The quits rate is flashing a warning signal at 2008 Financial Crisis levels.

Tech gia

- Reward

- like

- Comment

- Repost

- Share

Crypto Amnesty in Europe is officially DEAD.

For years the EU allowed digital assets to move under the radar but that era is over.

As of January 1 2026 the EU has activated DAC8 which is its most aggressive surveillance tool yet.

Under the surface this is not just about transparency. It is a structural trap.

We are witnessing the end of the private invisible asset in Europe. The data flow is now cross border and automated.

The RCASP Mandate means every exchange must now report EU resident transactions regardless of platform location.

HMRC and EU member states now auto swap your transaction hi

For years the EU allowed digital assets to move under the radar but that era is over.

As of January 1 2026 the EU has activated DAC8 which is its most aggressive surveillance tool yet.

Under the surface this is not just about transparency. It is a structural trap.

We are witnessing the end of the private invisible asset in Europe. The data flow is now cross border and automated.

The RCASP Mandate means every exchange must now report EU resident transactions regardless of platform location.

HMRC and EU member states now auto swap your transaction hi

- Reward

- like

- Comment

- Repost

- Share

One of the world's biggest safe havens just wiped out a third of its value.

For decades Japanese Government Bonds were the bedrock of stability but underneath the surface a silent crash has been playing out.

While investors were distracted by the Fed, Japan's 7 to 10 year bonds collapsed 32% in USD terms over the last 7 years.

This is not just volatility. It is a structural break.

We are witnessing the end of the synchronized global market. Just look at the massive fracture in performance.

China is up 35%.

USA is up 13%.

Germany is down 8%.

Japan is down 32%.

In the 20th century bonds moved

For decades Japanese Government Bonds were the bedrock of stability but underneath the surface a silent crash has been playing out.

While investors were distracted by the Fed, Japan's 7 to 10 year bonds collapsed 32% in USD terms over the last 7 years.

This is not just volatility. It is a structural break.

We are witnessing the end of the synchronized global market. Just look at the massive fracture in performance.

China is up 35%.

USA is up 13%.

Germany is down 8%.

Japan is down 32%.

In the 20th century bonds moved

- Reward

- like

- Comment

- Repost

- Share

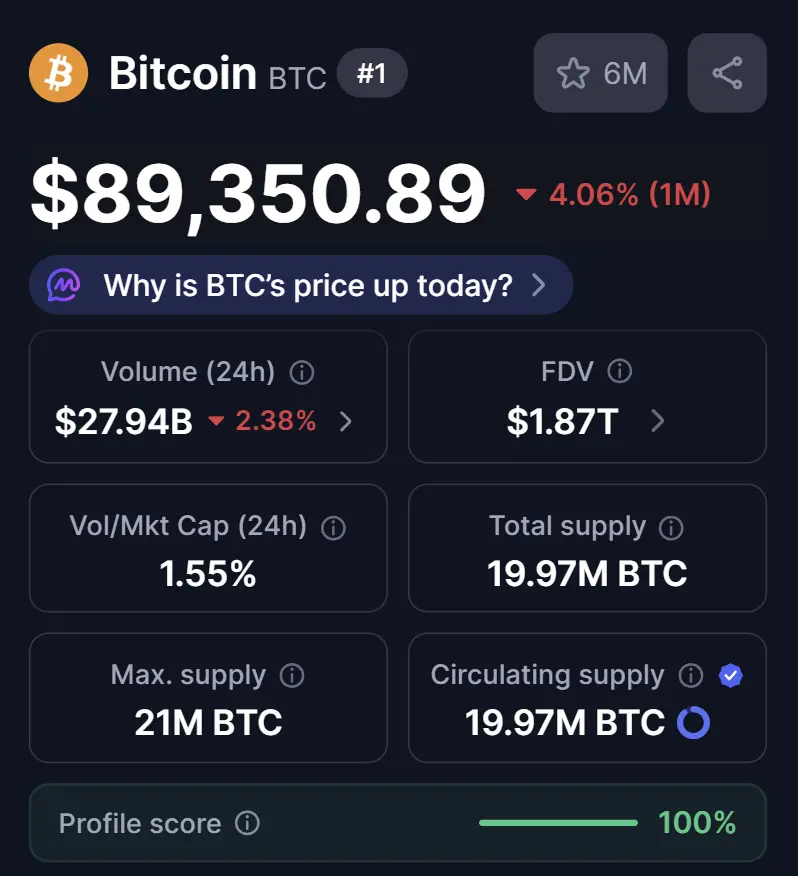

The volatility that scared the world in 2014 is the growth that funded the elite in 2026.

A simple list tells the entire story of the last decade:

2014: $772

2018: $13,412

2022: $46,211

2026: $89,350

While everyone was arguing about "bubbles" and "utility," the network was quietly doing the math.

This isn't about the daily candle; it is about the UNSTOPPABLE HARDENING of the world's only neutral reserve asset.

The message is still the same: HODL.

The price may be $89,350 today, but the supply is still capped at 21 million.

The cost of being "right" too early is the volatility; the cost of bein

A simple list tells the entire story of the last decade:

2014: $772

2018: $13,412

2022: $46,211

2026: $89,350

While everyone was arguing about "bubbles" and "utility," the network was quietly doing the math.

This isn't about the daily candle; it is about the UNSTOPPABLE HARDENING of the world's only neutral reserve asset.

The message is still the same: HODL.

The price may be $89,350 today, but the supply is still capped at 21 million.

The cost of being "right" too early is the volatility; the cost of bein

- Reward

- like

- Comment

- Repost

- Share

Don't trade the chart… INFLATION is the indicator

US M2 growth has rebounded to 4.27% YOY, signaling the end of the tightening era.

Historically, crypto market caps follow the GLOBAL LIQUIDITY CYCLE with a 90% correlation.

We are 34 months into a cycle that typically peaks at month 60, putting the LIQUIDITY SUPERNOVA on a direct collision course with late 2026.

M2 growth is the only LEAD INDICATOR that matters.

M2 is vertical... holding cash is now a GUARANTEED loss.

US M2 growth has rebounded to 4.27% YOY, signaling the end of the tightening era.

Historically, crypto market caps follow the GLOBAL LIQUIDITY CYCLE with a 90% correlation.

We are 34 months into a cycle that typically peaks at month 60, putting the LIQUIDITY SUPERNOVA on a direct collision course with late 2026.

M2 growth is the only LEAD INDICATOR that matters.

M2 is vertical... holding cash is now a GUARANTEED loss.

- Reward

- like

- Comment

- Repost

- Share

The bottleneck is TRUST and SUI just solved it.

As of January 2026, the market has realized that "fast enough" is already here, but the lack of privacy is the new bottleneck.

We are seeing a MASSIVE capital rotation away from transparent "fishbowl" ledgers and into Protocol-Level Privacy that actually allows institutions to move weight without being front-run.

The market is finally realizing that the hurdle for 2026 isn't TPS; it is STATE SECRECY.

And $SUI just redefined privacy.

As of January 2026, the market has realized that "fast enough" is already here, but the lack of privacy is the new bottleneck.

We are seeing a MASSIVE capital rotation away from transparent "fishbowl" ledgers and into Protocol-Level Privacy that actually allows institutions to move weight without being front-run.

The market is finally realizing that the hurdle for 2026 isn't TPS; it is STATE SECRECY.

And $SUI just redefined privacy.

SUI2,04%

- Reward

- like

- Comment

- Repost

- Share

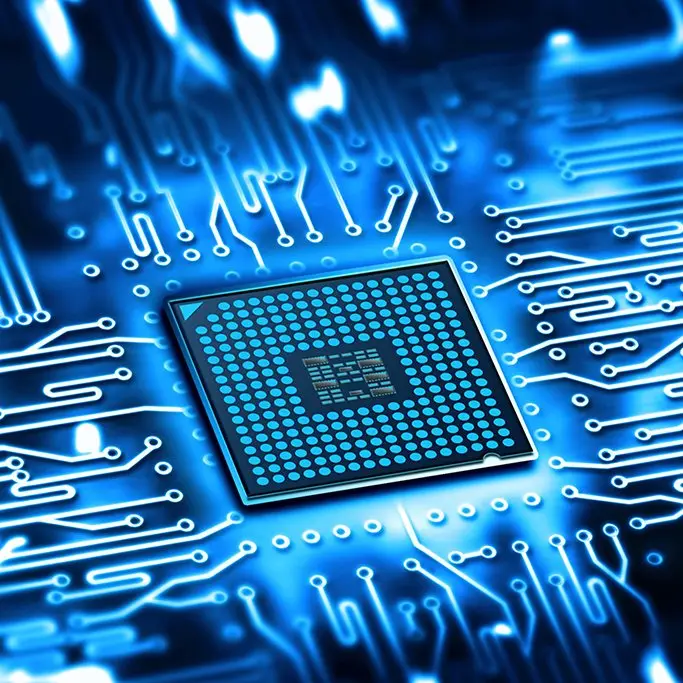

BITCOIN has always been an unstoppable kinetic force.

While the market obsesses over daily candles, the Bitcoin hashrate just pierced 900 EH/s with difficulty hitting a record 148 TRILLION.

Let that sink in.

Bitcoin just built a wall so high that no ladder exists to climb it.

Even if a country had INFINITE money, they couldn't buy enough hardware to attack the network because the factories can't build the chips fast enough.

It is now physically IMPOSSIBLE to cheat the system.

Meanwhile, the cost to 'make' a Bitcoin is skyrocketing.

When the cost to produce goes up, the floor price usually foll

While the market obsesses over daily candles, the Bitcoin hashrate just pierced 900 EH/s with difficulty hitting a record 148 TRILLION.

Let that sink in.

Bitcoin just built a wall so high that no ladder exists to climb it.

Even if a country had INFINITE money, they couldn't buy enough hardware to attack the network because the factories can't build the chips fast enough.

It is now physically IMPOSSIBLE to cheat the system.

Meanwhile, the cost to 'make' a Bitcoin is skyrocketing.

When the cost to produce goes up, the floor price usually foll

BTC0,64%

- Reward

- like

- Comment

- Repost

- Share

Justice isn't blind anymore... WALL STREET is the judge, jury, and executioner.

The passage of the GENIUS Act has officially integrated public blockchains into the US banking system.

Stablecoins are now legally classified as non securities, ending the war between the SEC and CFTC.

By July 2026, every major pension fund in America will have the green light to settle trades ON CHAIN.

Position in the L1s and infra protocols being HARD WIRED into the new legal framework.

They didn't beat crypto, they absorbed it. The question isn't if you like the new system... it's whether you'll own a piece of i

The passage of the GENIUS Act has officially integrated public blockchains into the US banking system.

Stablecoins are now legally classified as non securities, ending the war between the SEC and CFTC.

By July 2026, every major pension fund in America will have the green light to settle trades ON CHAIN.

Position in the L1s and infra protocols being HARD WIRED into the new legal framework.

They didn't beat crypto, they absorbed it. The question isn't if you like the new system... it's whether you'll own a piece of i

- Reward

- like

- Comment

- Repost

- Share

Banks aren’t pretending anymore. YOU are the collateral.

Bitcoin ETFs enter 2026 with $147 BILLION in AUM, now controlling nearly 7% of the total circulating supply.

With titans like Bank of America and Wells Fargo finally opening the floodgates to 401k and pension funds, the liquid float on exchanges has hit a 2018 level low.

Demand is no longer a retail choice; it is now a BANK REQUIREMENT.

We have pivoted from retail speculation to a permanent institutional supply shock.

The four-year cycle is DEAD.

Bitcoin ETFs enter 2026 with $147 BILLION in AUM, now controlling nearly 7% of the total circulating supply.

With titans like Bank of America and Wells Fargo finally opening the floodgates to 401k and pension funds, the liquid float on exchanges has hit a 2018 level low.

Demand is no longer a retail choice; it is now a BANK REQUIREMENT.

We have pivoted from retail speculation to a permanent institutional supply shock.

The four-year cycle is DEAD.

BTC0,64%

- Reward

- like

- Comment

- Repost

- Share

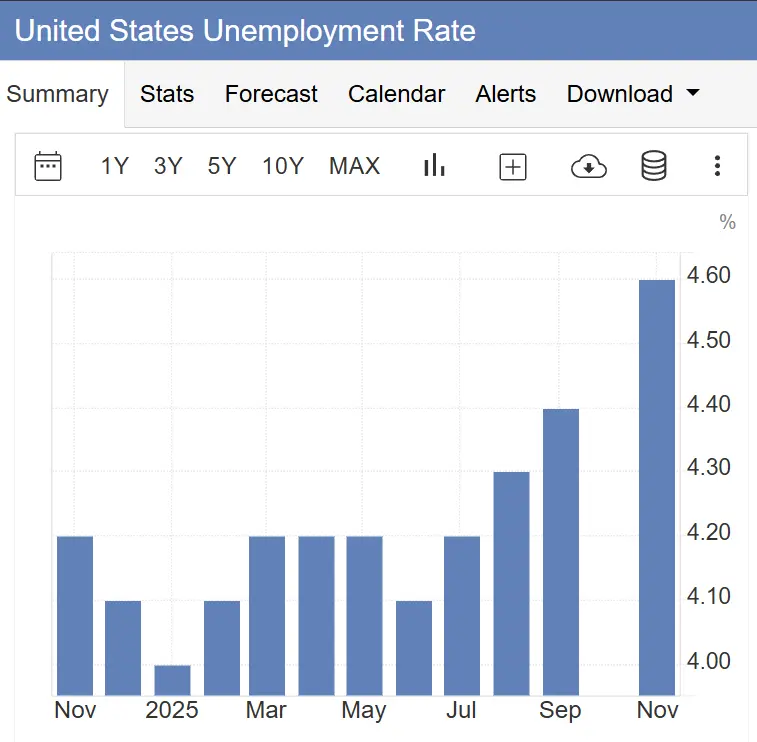

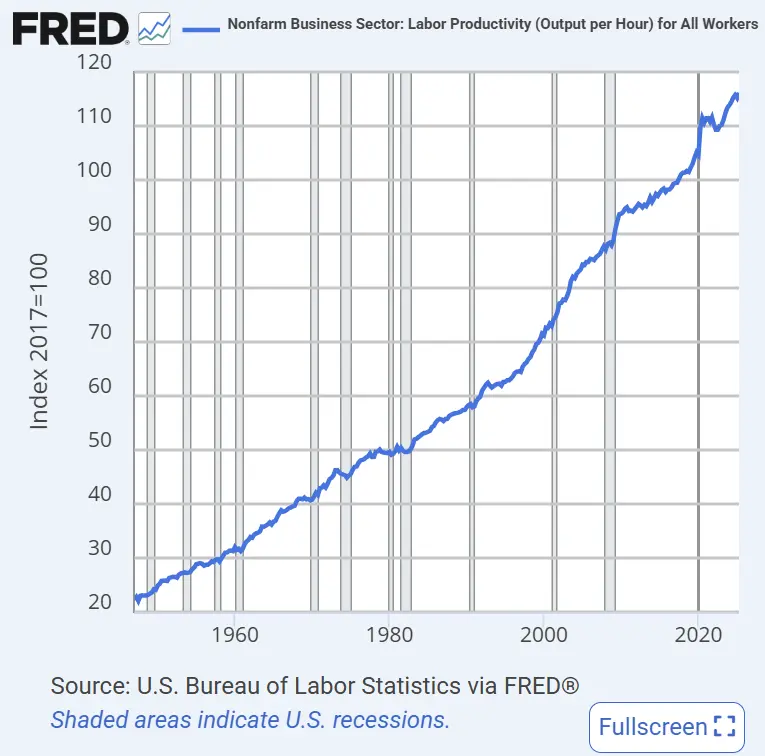

30% fewer employees while white collar productivity hits a 50-year HIGH.

New data for Q1 2026 shows that mid level management roles in finance and legal sectors have been gutted by autonomous agents.

While the headlines focus on "unemployment," the real story is the EXPLOSION of solo entrepreneurship.

One person companies are generating $10M+ in revenue using autonomous stacks, creating a HUGE wealth gap between those who use agents and those who are replaced by them.

Your degree is now a legacy credential.

Your ability to ORCHESTRATE a swarm of autonomous agents is your only 2026 survival met

New data for Q1 2026 shows that mid level management roles in finance and legal sectors have been gutted by autonomous agents.

While the headlines focus on "unemployment," the real story is the EXPLOSION of solo entrepreneurship.

One person companies are generating $10M+ in revenue using autonomous stacks, creating a HUGE wealth gap between those who use agents and those who are replaced by them.

Your degree is now a legacy credential.

Your ability to ORCHESTRATE a swarm of autonomous agents is your only 2026 survival met

- Reward

- like

- Comment

- Repost

- Share

We aren't running out of chips… It’s the KILOWATTS!

As of January 2026, the initial hype around LLMs has cooled, but the energy consumption of data centers has surged 160% YOY.

We are seeing a MASSIVE capital rotation away from "wrapper" apps and into the POWER GRID and SEMICONDUCTOR hardware that actually runs the intelligence.

The market is finally realizing that the bottleneck for 2026 isn't code; it is KILOWATTS.

And Thorium-based nuclear energy could be the solution.

The next 100x isn't a new chatbot, it is the modular nuclear reactor tech and the thermal cooling protocols keeping the ser

As of January 2026, the initial hype around LLMs has cooled, but the energy consumption of data centers has surged 160% YOY.

We are seeing a MASSIVE capital rotation away from "wrapper" apps and into the POWER GRID and SEMICONDUCTOR hardware that actually runs the intelligence.

The market is finally realizing that the bottleneck for 2026 isn't code; it is KILOWATTS.

And Thorium-based nuclear energy could be the solution.

The next 100x isn't a new chatbot, it is the modular nuclear reactor tech and the thermal cooling protocols keeping the ser

- Reward

- like

- Comment

- Repost

- Share

You don't need a law degree to see this SCAM.

Prediction markets are now pricing in a 57% chance that California passes the new AI Safety Bill.

The media calls it "Consumer Protection." I call it Regulatory Capture.

The bill mandates "safety testing" that costs UPWARDS of $100,000,000 per model.

OpenAI/Google? They can write that check from petty cash.

The Open Source Startup? INSTANTLY bankrupt.

Stop calling it 'Safety.' Call it what it is. A Protection Racket.

They aren't protecting you from Skynet. They are protecting their profit margins from the kid in the garage who could build it better

Prediction markets are now pricing in a 57% chance that California passes the new AI Safety Bill.

The media calls it "Consumer Protection." I call it Regulatory Capture.

The bill mandates "safety testing" that costs UPWARDS of $100,000,000 per model.

OpenAI/Google? They can write that check from petty cash.

The Open Source Startup? INSTANTLY bankrupt.

Stop calling it 'Safety.' Call it what it is. A Protection Racket.

They aren't protecting you from Skynet. They are protecting their profit margins from the kid in the garage who could build it better

- Reward

- like

- Comment

- Repost

- Share