KLUO

No content yet

KLUO

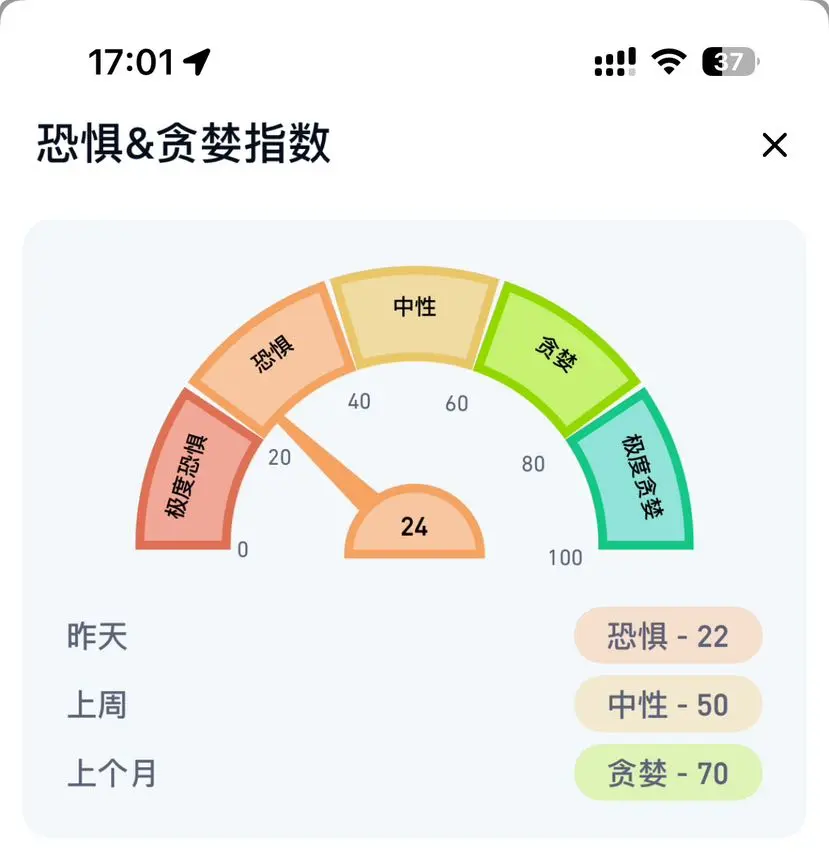

The market's current fear index has reached around 20, which is on the edge of extreme panic. The overall market sentiment is very negative, and long orders have basically been wiped out. The market urgently needs some favourable information to stop the fall. Tonight's ADP employment data is hoped to bring some favourable information to ease the market. The release of the ADP employment data will also influence the interest rate cut decision in December, so everyone can follow it.

Last night, the market experienced another deep fall. The price of Bitcoin dropped to a low of 98888 aroun

View OriginalLast night, the market experienced another deep fall. The price of Bitcoin dropped to a low of 98888 aroun

- Reward

- like

- Comment

- Repost

- Share

The market continues to decline, and market sentiment is low. How should we interpret the upcoming market trends?

In recent days, Bitcoin has reached new lows continuously, and other mainstream cryptocurrencies are the same, not to mention altcoins, where any drop of less than fifty percent can be considered good. In the previous article's analysis, it was mentioned that the overall market sentiment is bearish, and I have reminded everyone of this. Currently, it still shows an overall bearish trend. Bitcoin's monthly line in October has dropped over 5%, ending a seven-year streak of Oc

View OriginalIn recent days, Bitcoin has reached new lows continuously, and other mainstream cryptocurrencies are the same, not to mention altcoins, where any drop of less than fifty percent can be considered good. In the previous article's analysis, it was mentioned that the overall market sentiment is bearish, and I have reminded everyone of this. Currently, it still shows an overall bearish trend. Bitcoin's monthly line in October has dropped over 5%, ending a seven-year streak of Oc

- Reward

- like

- 1

- Repost

- Share

LiangxiYyds :

:

Stay strong and HODL💎BTC, Ether recent market trend depth analysis

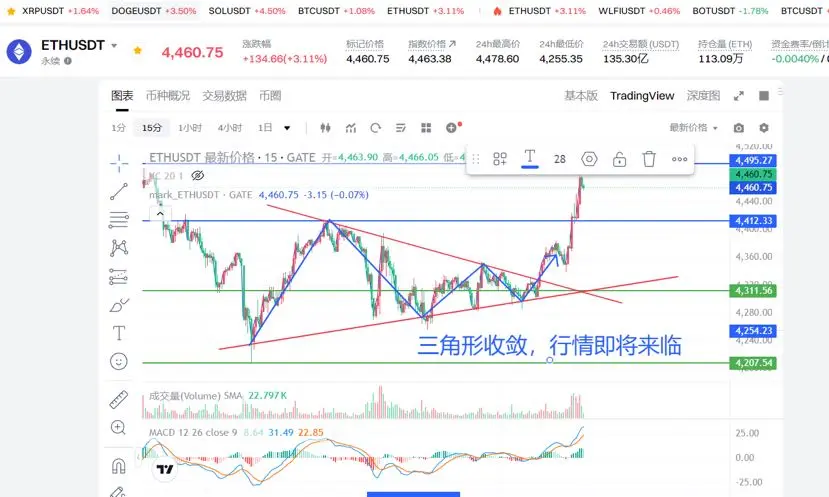

The trading volume has been very low in the past few days, with almost no fluctuations. The CPI data released last Friday had little impact on the entire market. The CPI data announced on Friday was favorable for BTC and Ether, but it only caused a brief spike before a downward trend began. Additionally, the interest rate meeting on the 30th of this month is approaching, and it can be basically confirmed that there will be a 25 basis point cut, similar to September. If the market continues to be sluggish, a 50 basis point cut may be possible in Dec

View OriginalThe trading volume has been very low in the past few days, with almost no fluctuations. The CPI data released last Friday had little impact on the entire market. The CPI data announced on Friday was favorable for BTC and Ether, but it only caused a brief spike before a downward trend began. Additionally, the interest rate meeting on the 30th of this month is approaching, and it can be basically confirmed that there will be a 25 basis point cut, similar to September. If the market continues to be sluggish, a 50 basis point cut may be possible in Dec

- Reward

- like

- Comment

- Repost

- Share

BTC and Ether recent trend opinion sharing

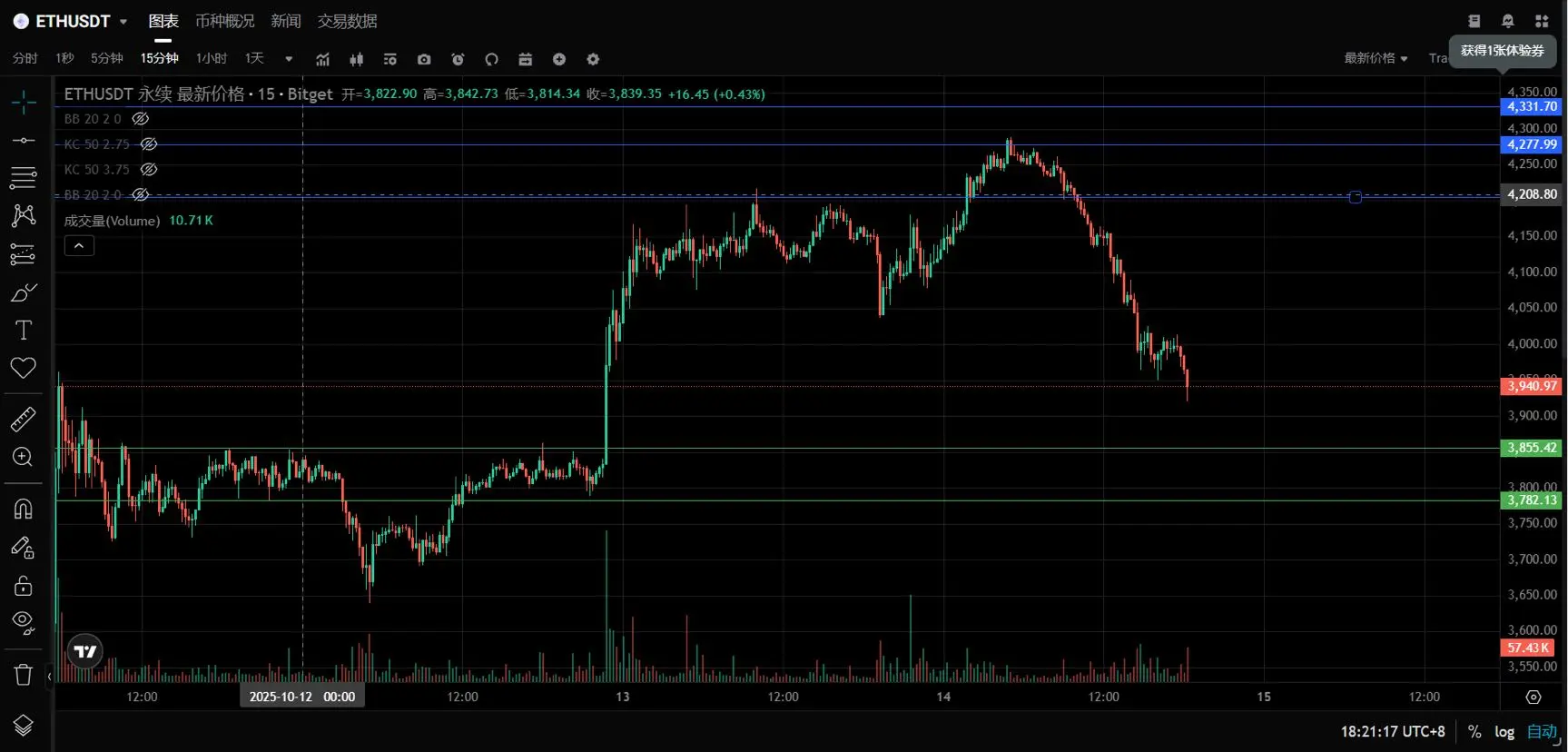

The recent market situation can be described as a bloodbath. On October 11th, there was the most brutal drop in history, with BTC falling by 20,000 points, Ether by 1,000 points, and even more severe drops in altcoins, which fell by 90%. What does this mean? It means that no matter how much leverage you use, you can't withstand it! The drop occurred in the early morning, when everyone was resting and their vigilance was at its lowest. This once again highlights the importance of quality assets, especially during extreme events, when some can still

View OriginalThe recent market situation can be described as a bloodbath. On October 11th, there was the most brutal drop in history, with BTC falling by 20,000 points, Ether by 1,000 points, and even more severe drops in altcoins, which fell by 90%. What does this mean? It means that no matter how much leverage you use, you can't withstand it! The drop occurred in the early morning, when everyone was resting and their vigilance was at its lowest. This once again highlights the importance of quality assets, especially during extreme events, when some can still

- Reward

- like

- Comment

- Repost

- Share

BTC and Ether recent market trend analysis

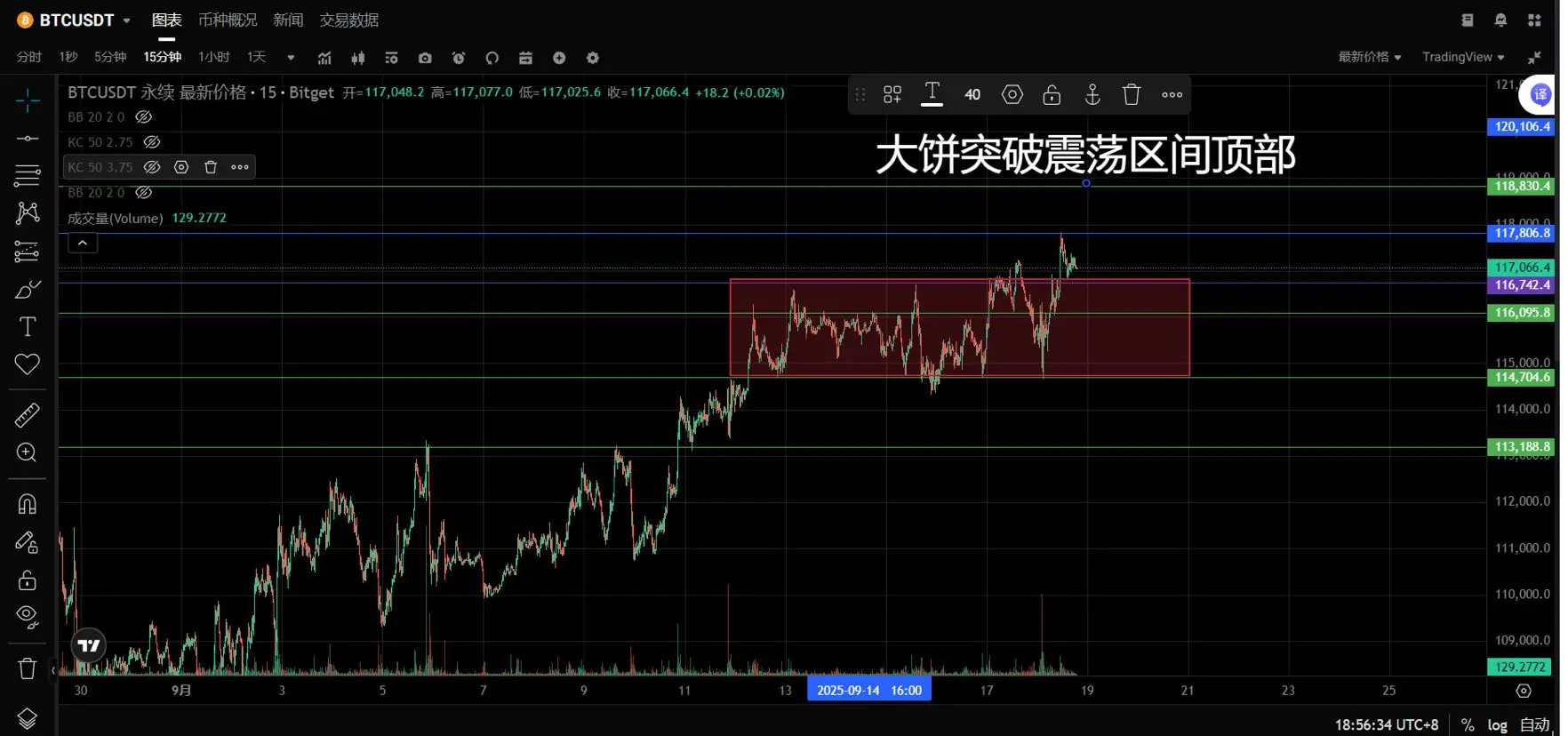

In the blink of an eye, the eight-day holiday is coming to an end, and I will return to my workstation to fulfill my duties. The market has been quite good in the past few days, with strong upward momentum, but I chose not to watch the market closely. During these days of vacation, I only looked at it for a few minutes each day before sliding away, spending more time on my life. Trading itself is a very tedious and dull activity, so we occasionally need to engage with new environments and new things.

Returning to the market, BTC has once again broken

In the blink of an eye, the eight-day holiday is coming to an end, and I will return to my workstation to fulfill my duties. The market has been quite good in the past few days, with strong upward momentum, but I chose not to watch the market closely. During these days of vacation, I only looked at it for a few minutes each day before sliding away, spending more time on my life. Trading itself is a very tedious and dull activity, so we occasionally need to engage with new environments and new things.

Returning to the market, BTC has once again broken

BTC-3,01%

- Reward

- like

- Comment

- Repost

- Share

In the past few days, BTC has once again become the leader, with a rapid rise, climbing more than 10,000 points from the low to the high! How should we analyze this wave of upward trend? Could the recent Crypto Summit indirectly be a piece of Favourable Information? Additionally, there are expectations for interest rate cuts in the future, with a high possibility of a cut in October. The market sentiment driven by these two pieces of news is what has led to this wave of rise. As for the interest rate cut in September that resulted in a fall instead of a rise, it was because the sentiment was a

View Original

- Reward

- like

- Comment

- Repost

- Share

There hasn't been much fluctuation over the weekend, are you still watching the market?

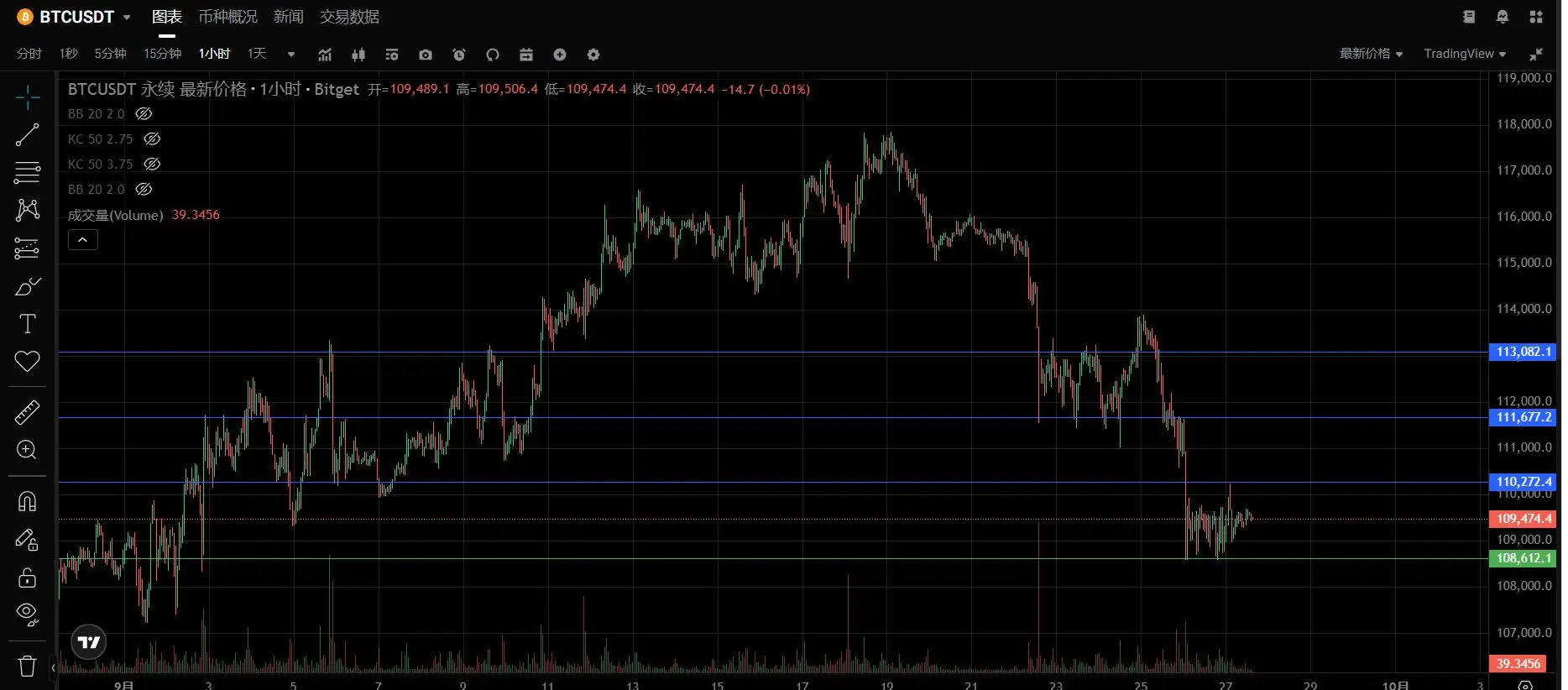

The support below the pancake is in the range of 107000 to 108000, pay attention to this range recently. #今日你看涨还是看跌?

The support below the pancake is in the range of 107000 to 108000, pay attention to this range recently. #今日你看涨还是看跌?

BTC-3,01%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin, Ethereum recent market analysis

After the interest rate cut, market sentiment has明显低落, and funds are slowly flowing out of the market. The market is experiencing a全面回调, and the depth of the pullback is still比较大. Many traders feel that the market has已经走熊. However, I believe there will still be a wave of强势的上涨 in the future. Why? Because, regarding interest rate cuts, there may still be两次降息 this year, and the利好 from the rate cuts is still there, so from a long-term perspective, the market is看涨. A market with涨 and 跌 is healthy and is a正常的走势.

In this wave of decline, the Bitcoin drop is ar

View OriginalAfter the interest rate cut, market sentiment has明显低落, and funds are slowly flowing out of the market. The market is experiencing a全面回调, and the depth of the pullback is still比较大. Many traders feel that the market has已经走熊. However, I believe there will still be a wave of强势的上涨 in the future. Why? Because, regarding interest rate cuts, there may still be两次降息 this year, and the利好 from the rate cuts is still there, so from a long-term perspective, the market is看涨. A market with涨 and 跌 is healthy and is a正常的走势.

In this wave of decline, the Bitcoin drop is ar

- Reward

- 2

- 6

- Repost

- Share

GateUser-d1bfb89a :

:

Hello. That's a very good insight.

I will take it into consideration.

View More

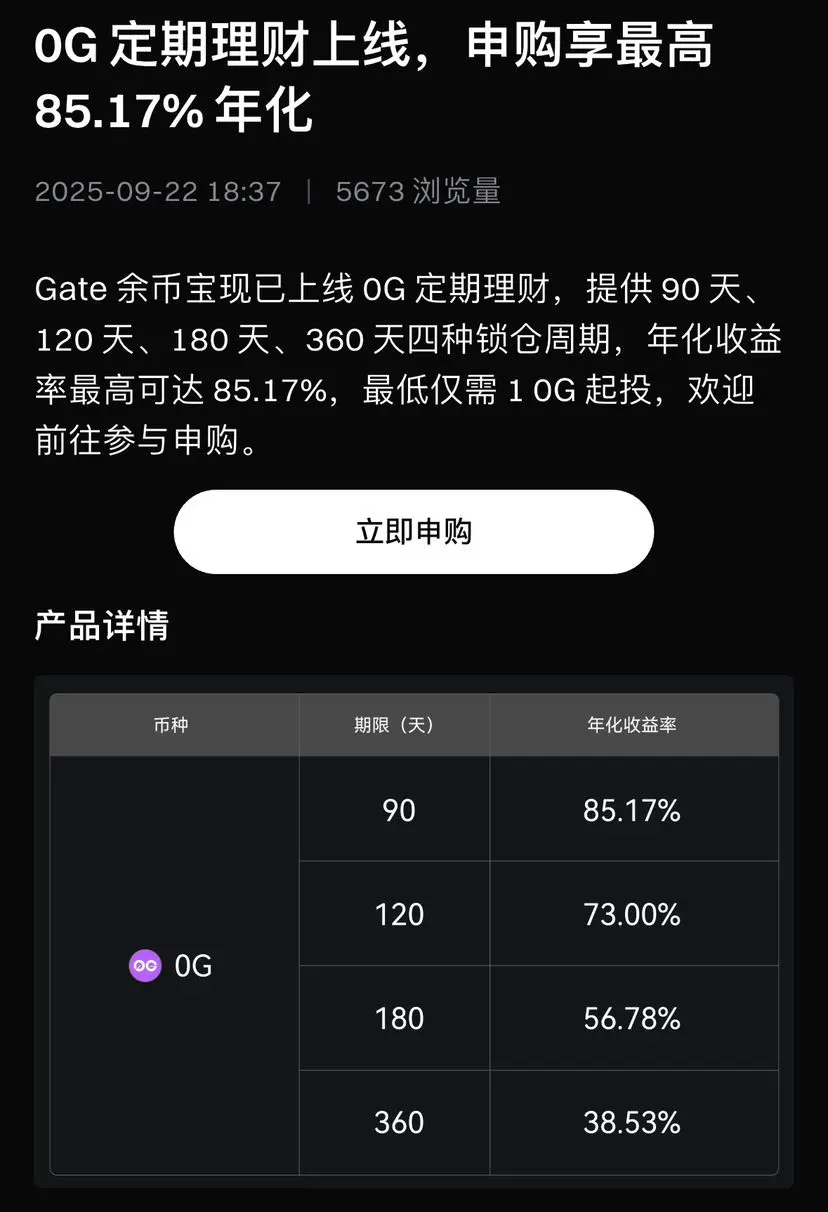

0g——Oh Oh Modular AI Blockchain

Several new coins have recently been launched, and they are all quite good, steadily rising since their launch. However, in my opinion, the most outstanding one is 0g.

The current price of 0g is around 3.7, with a highest price of 7.31. It is currently in a downward trend of consolidation, forming support around the price of 3.2 and facing resistance around the price of 5.

Entry suggestion: Currently, it is advisable to wait and observe, as the current price is not suitable for entry. Those who already have spot positions can continue to hold. If you are conside

Several new coins have recently been launched, and they are all quite good, steadily rising since their launch. However, in my opinion, the most outstanding one is 0g.

The current price of 0g is around 3.7, with a highest price of 7.31. It is currently in a downward trend of consolidation, forming support around the price of 3.2 and facing resistance around the price of 5.

Entry suggestion: Currently, it is advisable to wait and observe, as the current price is not suitable for entry. Those who already have spot positions can continue to hold. If you are conside

0G18,39%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin, Ethereum recent trend analysis

In this wave of decline, it caught everyone off guard, and there was no time for stop-loss, and some even broke through... the total liquidation was nearly 1.8 billion! Every time there is such a large drop, the square is filled with wails, attributing the losses entirely to the market makers, without reviewing or reflecting, and just endlessly talking about this and that, which is truly meaningless. Think from another perspective, if you accumulated your chips at a low point, would you sell at a high point? Would you try every possible way to lower the

View OriginalIn this wave of decline, it caught everyone off guard, and there was no time for stop-loss, and some even broke through... the total liquidation was nearly 1.8 billion! Every time there is such a large drop, the square is filled with wails, attributing the losses entirely to the market makers, without reviewing or reflecting, and just endlessly talking about this and that, which is truly meaningless. Think from another perspective, if you accumulated your chips at a low point, would you sell at a high point? Would you try every possible way to lower the

- Reward

- 1

- Comment

- Repost

- Share

Interest rates cut by 25 basis points, how should we view the subsequent trend?

At 2:00 AM, the Federal Reserve announced a rate cut, reducing the rate from 4.5 to 4.25, which aligns with the expected drop of 25 basis points. Therefore, when the rate cut was implemented last night, there was actually not much fluctuation in the market. Last night, I was also watching the market with everyone, and in the few minutes before the cut, it was still routine trading with some ups and downs, so stop fantasizing about going in heavily in front of the news with a 50% chance of winning; dispel that thoug

View OriginalAt 2:00 AM, the Federal Reserve announced a rate cut, reducing the rate from 4.5 to 4.25, which aligns with the expected drop of 25 basis points. Therefore, when the rate cut was implemented last night, there was actually not much fluctuation in the market. Last night, I was also watching the market with everyone, and in the few minutes before the cut, it was still routine trading with some ups and downs, so stop fantasizing about going in heavily in front of the news with a 50% chance of winning; dispel that thoug

- Reward

- like

- Comment

- Repost

- Share

BTC Ether recent trend analysis

The market in the past couple of days has been mainly fluctuating, with little volatility up and down, making it suitable for short-term operations. BTC has fluctuated between 2000 to 3000 points, while Ether has seen fluctuations of 100 to 200 points. The bulls and bears are still in a tug-of-war, and a real one-sided trend has not yet emerged, but it should be coming soon. The trading volume of BTC and Ether in the last two days has clearly been insufficient to drive up prices, which is something everyone needs to pay attention to. Only when the trading volume

View OriginalThe market in the past couple of days has been mainly fluctuating, with little volatility up and down, making it suitable for short-term operations. BTC has fluctuated between 2000 to 3000 points, while Ether has seen fluctuations of 100 to 200 points. The bulls and bears are still in a tug-of-war, and a real one-sided trend has not yet emerged, but it should be coming soon. The trading volume of BTC and Ether in the last two days has clearly been insufficient to drive up prices, which is something everyone needs to pay attention to. Only when the trading volume

- Reward

- like

- Comment

- Repost

- Share

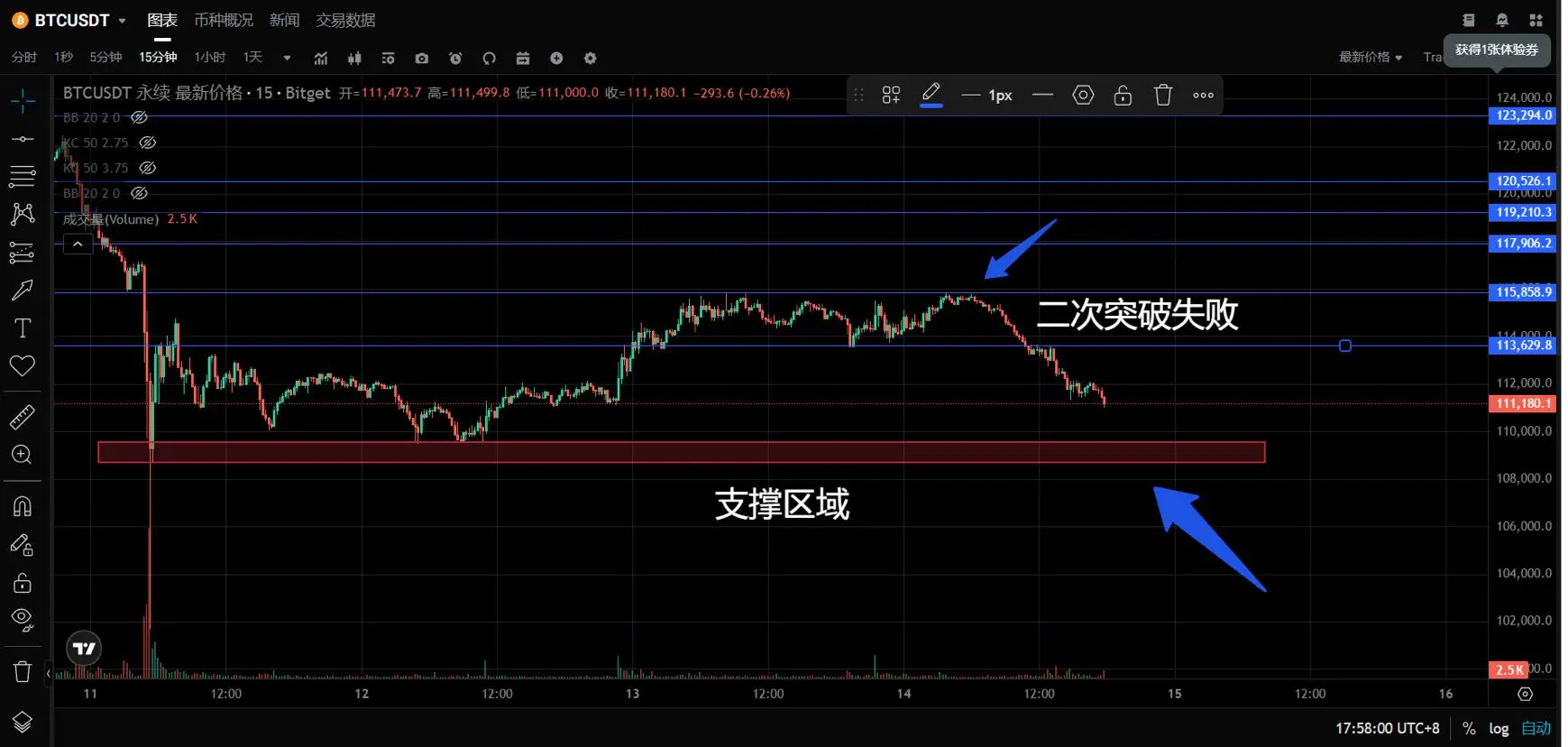

BTC, Ethereum trend analysis

BTC had a slight rally last night, but it remains weak, with insufficient upward momentum. During the day, it has already broken below the support level of the previous 15-minute consolidation range around 110500. BTC rebounded from a low of around 107200 to about 112500, which coincides with the resistance level given in the analysis from the day before yesterday, marking a rebound of over 5000 points. This is not a particularly strong rally, and a pullback of one to two thousand points is likely. For BTC to continue breaking upwards, it needs to stay above around

View OriginalBTC had a slight rally last night, but it remains weak, with insufficient upward momentum. During the day, it has already broken below the support level of the previous 15-minute consolidation range around 110500. BTC rebounded from a low of around 107200 to about 112500, which coincides with the resistance level given in the analysis from the day before yesterday, marking a rebound of over 5000 points. This is not a particularly strong rally, and a pullback of one to two thousand points is likely. For BTC to continue breaking upwards, it needs to stay above around

- Reward

- like

- Comment

- Repost

- Share

BTC around 107200, enter long order, Margin Replenishment at 105100, stop loss at 104500. First take profit at 110500, second take profit at 111500.

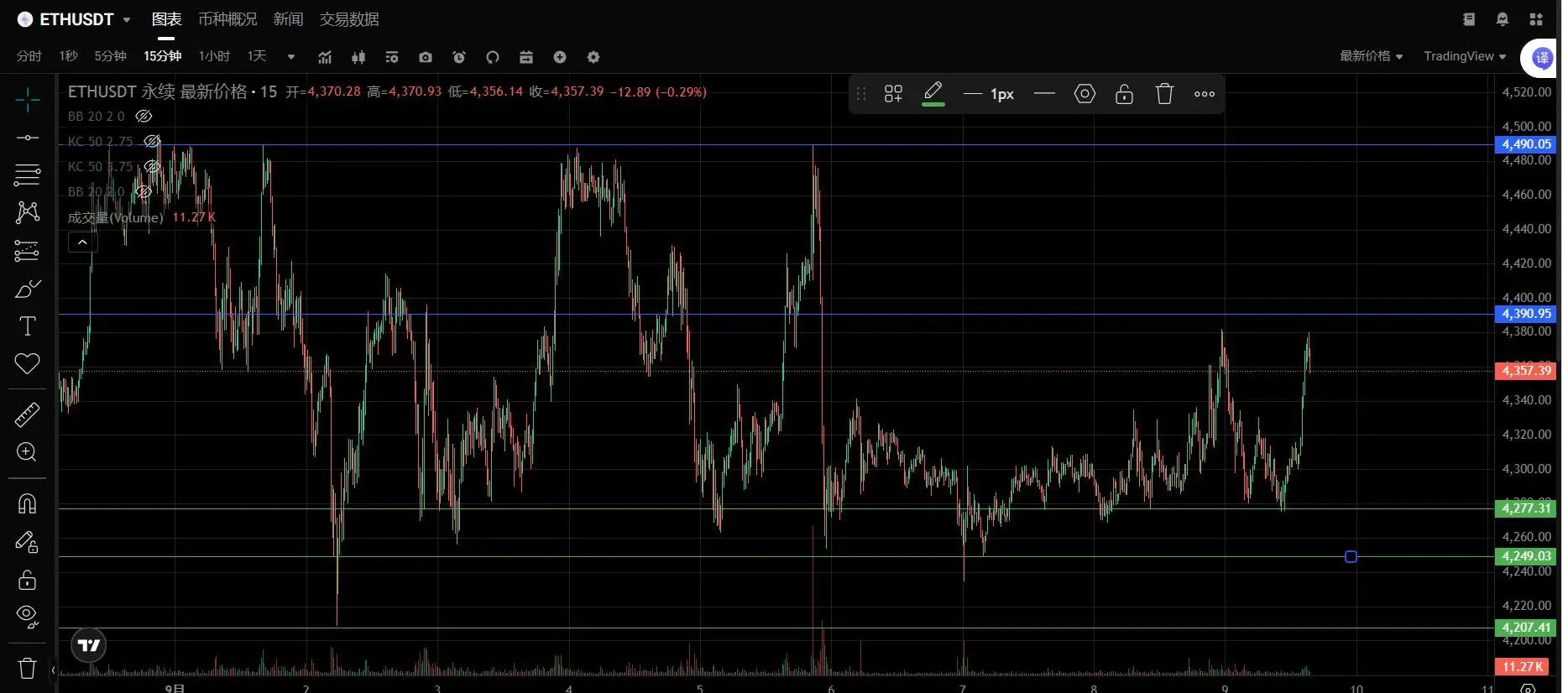

Enter a long order near 4330 for ETH, margin replenishment near 4210, stop loss at 4150, first take profit at 4400, second take profit at 4490.

BTC order placement points: 106100 105100 long order

ETH 4210 4160 4050 place long order

#ETH走势分析

View OriginalEnter a long order near 4330 for ETH, margin replenishment near 4210, stop loss at 4150, first take profit at 4400, second take profit at 4490.

BTC order placement points: 106100 105100 long order

ETH 4210 4160 4050 place long order

#ETH走势分析

- Reward

- 1

- 2

- Repost

- Share

EveryDayThereIsUComing :

:

Buy near 80000 for BTC Buy near 800 for ETH

This is the correct approach

For reference only

View More

Bitcoin, Ethereum trend analysis

The article from the day before yesterday analyzed that Bitcoin could be positioned for a long order in the range of 108000 to 106000. It also mentioned that Bitcoin would have a second pullback near 107300, and last night Bitcoin pulled back near 107300, then strongly rebounded to 110000, a strong rebound of 3000 points. The analysis indicated that 110500 is the dividing line between long and short positions, and this rebound just happened to reach 110500. Therefore, my analysis is logical and based on evidence, not just spoken casually.

The interest rate cut

View OriginalThe article from the day before yesterday analyzed that Bitcoin could be positioned for a long order in the range of 108000 to 106000. It also mentioned that Bitcoin would have a second pullback near 107300, and last night Bitcoin pulled back near 107300, then strongly rebounded to 110000, a strong rebound of 3000 points. The analysis indicated that 110500 is the dividing line between long and short positions, and this rebound just happened to reach 110500. Therefore, my analysis is logical and based on evidence, not just spoken casually.

The interest rate cut

- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More22.54K Popularity

10.17K Popularity

4.58K Popularity

36.58K Popularity

247.29K Popularity

Pin