CasAbbe

Many people are blaming PumpFun for no AltSeason.

Others are blaming VCs for no AltSeason.

But this is very different from reality.

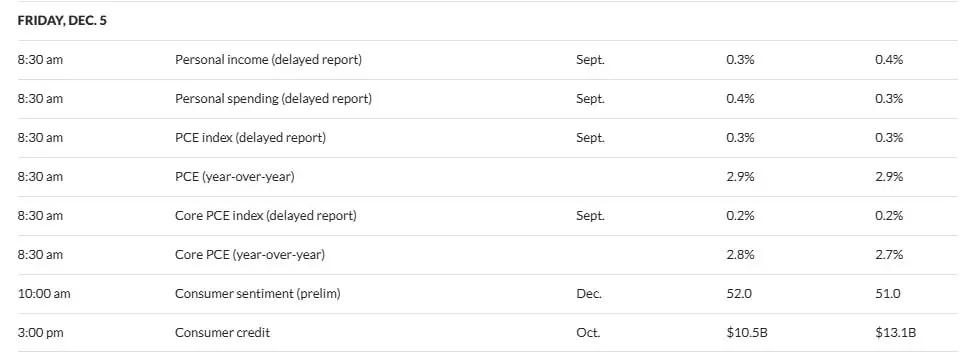

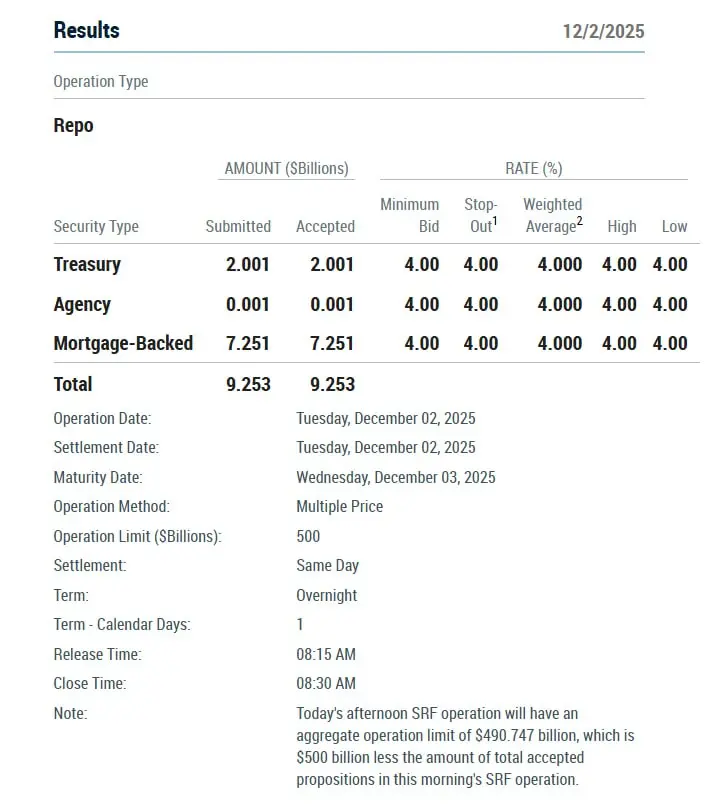

There has never been an AltSeason without liquidity expansion.

Right now, business owners are struggling, people are unable to keep their jobs and savings have been wiped out.

This is not the condition where alts rally.

Also, the top 50 alts have 90%+ of combined market cap which explains there has been no dilution.

Once liquidity arrives, you'll see the same alts going parabolic.

Others are blaming VCs for no AltSeason.

But this is very different from reality.

There has never been an AltSeason without liquidity expansion.

Right now, business owners are struggling, people are unable to keep their jobs and savings have been wiped out.

This is not the condition where alts rally.

Also, the top 50 alts have 90%+ of combined market cap which explains there has been no dilution.

Once liquidity arrives, you'll see the same alts going parabolic.