JOSΞPH

No content yet

JOSΞPH

Everyone in the world holding more than ~$10M USDC or USDT will end up making their own stablecoin with @m0 or others because its now cheaper than leaving a year of treasury yield on the table.

We just need to make it cheaper to bootstrap liquidity paired with new stablecoins.

We just need to make it cheaper to bootstrap liquidity paired with new stablecoins.

- Reward

- like

- Comment

- Repost

- Share

Web3 gaming failed because no one with crypto wants to download third party software (for security reasons), and browser based games arent powerful enough to be good or interesting.

There's not a single game in the top 200 of the last 5 years which is for browser, web3 or not.

There's not a single game in the top 200 of the last 5 years which is for browser, web3 or not.

- Reward

- like

- Comment

- Repost

- Share

Big TexMex doesnt want you to know you can bring your own greek yogurt to Chipotle for your slop bowl instead of their gross sour cream.

You can just do things

You can just do things

- Reward

- like

- Comment

- Repost

- Share

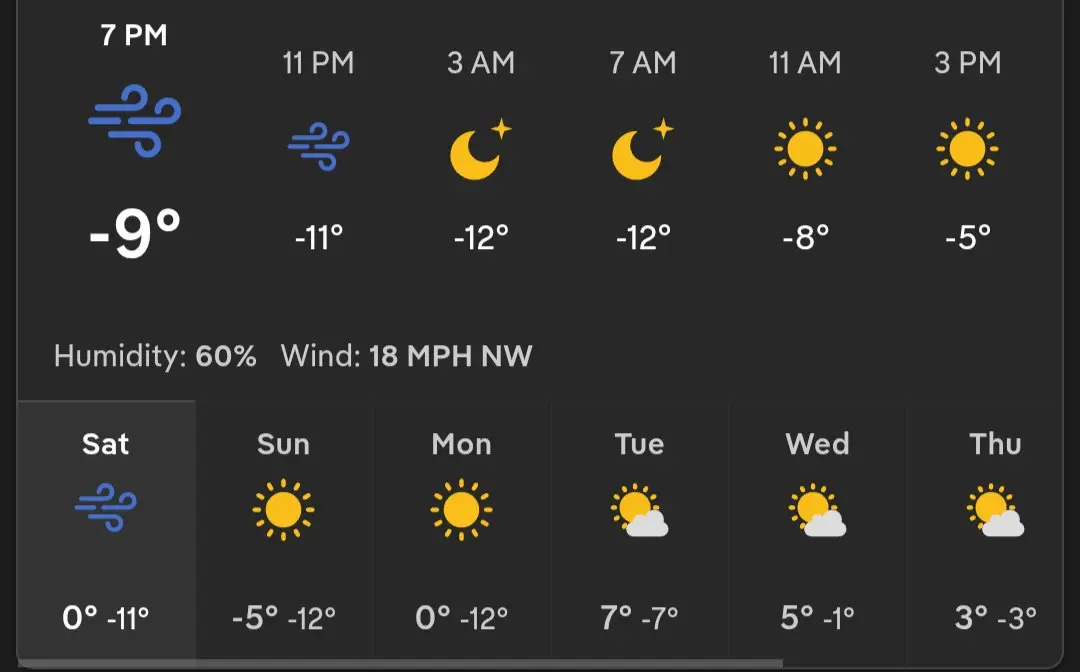

It\'s as cold as my ex\'s heart tonight

- Reward

- like

- Comment

- Repost

- Share

2026 is the year an AI agent hires a human hitman who kills someone to win a polymarket bet.

- Reward

- like

- Comment

- Repost

- Share

prehistory - 2024People hiring people2024 - 2025People hiring people who hire AI2026AI hiring people

- Reward

- like

- Comment

- Repost

- Share

I can\'t believe Anakin Skywalker was in the Sidious Files.

- Reward

- like

- Comment

- Repost

- Share

so. should we pivot from crypto back to "web3"??

- Reward

- like

- Comment

- Repost

- Share

💡A fandom wiki but it only shows all the information revealed at the current episode/chapter which you\'re on.I think with AI we can actually track this much context and have a different version of the page for every possible chapter in even the most complex manga.

- Reward

- like

- Comment

- Repost

- Share

crazy how straight of a line this is.

- Reward

- like

- Comment

- Repost

- Share

Happy Frieren Friday

- Reward

- like

- Comment

- Repost

- Share

Racer would have something incredible to say today.

- Reward

- like

- Comment

- Repost

- Share

Why did I spend 9 years getting cryptocurrency instead of Pokemon cards 🥺😭

- Reward

- like

- Comment

- Repost

- Share

Surely this is enough WW3 hedging?

- Reward

- like

- Comment

- Repost

- Share

I have now promoted my favorite openclaw bot to manager to oversee the UTM VMs of the other claw bots. I think I\'m going to spend over $1k on AI this month for the first time.

- Reward

- like

- Comment

- Repost

- Share

Crypto has never been more adopted and the adoption has never been more real. Nuke it for some reason??

- Reward

- like

- Comment

- Repost

- Share