INVESTERCLUB

No content yet

INVESTERCLUB

$PI #GateSquare$50KRedPacketGiveaway

In-Depth K-Line Analysis for PI/USDT (5-Minute Chart)

Current Price: 0.17147 USDT

24h Change: -10.50%

24h High/Low: 0.20699 / 0.16674

24h Volume: 64.40M PI | 11.82M USDT

The chart shows a significant intraday drop, with price currently trading near the lower end of the daily range. The selected timeframe is 5 minutes, so we are analyzing short-term price action and technical indicators on that scale.

1. Bollinger Bands (20, 2)

· Middle Band (SMA): 0.17007

· Upper Band: 0.17299

· Lower Band: 0.16715

Current price (0.17147) is above the middle band but below

In-Depth K-Line Analysis for PI/USDT (5-Minute Chart)

Current Price: 0.17147 USDT

24h Change: -10.50%

24h High/Low: 0.20699 / 0.16674

24h Volume: 64.40M PI | 11.82M USDT

The chart shows a significant intraday drop, with price currently trading near the lower end of the daily range. The selected timeframe is 5 minutes, so we are analyzing short-term price action and technical indicators on that scale.

1. Bollinger Bands (20, 2)

· Middle Band (SMA): 0.17007

· Upper Band: 0.17299

· Lower Band: 0.16715

Current price (0.17147) is above the middle band but below

PI-6,92%

- Reward

- 1

- 1

- Repost

- Share

TheGreatBeautyOfTheInfinite :

:

$PI $PI The purchased assets are finally trapped. After a harvest is completed, the price continues to fall. It hits a low point in March. From July to December, it will drop to the point of questioning life. Nearly collapsing in 2027. By 2030, the servers are expected to expire. Delist and run!! Everyone, hurry up and buy buy buy... Don't miss the chance to get on board. Invest all your assets and hold until 2030. Financial freedom is in 2030. Let's work hard together...$DN #AIAgentProjectsI’mWatching

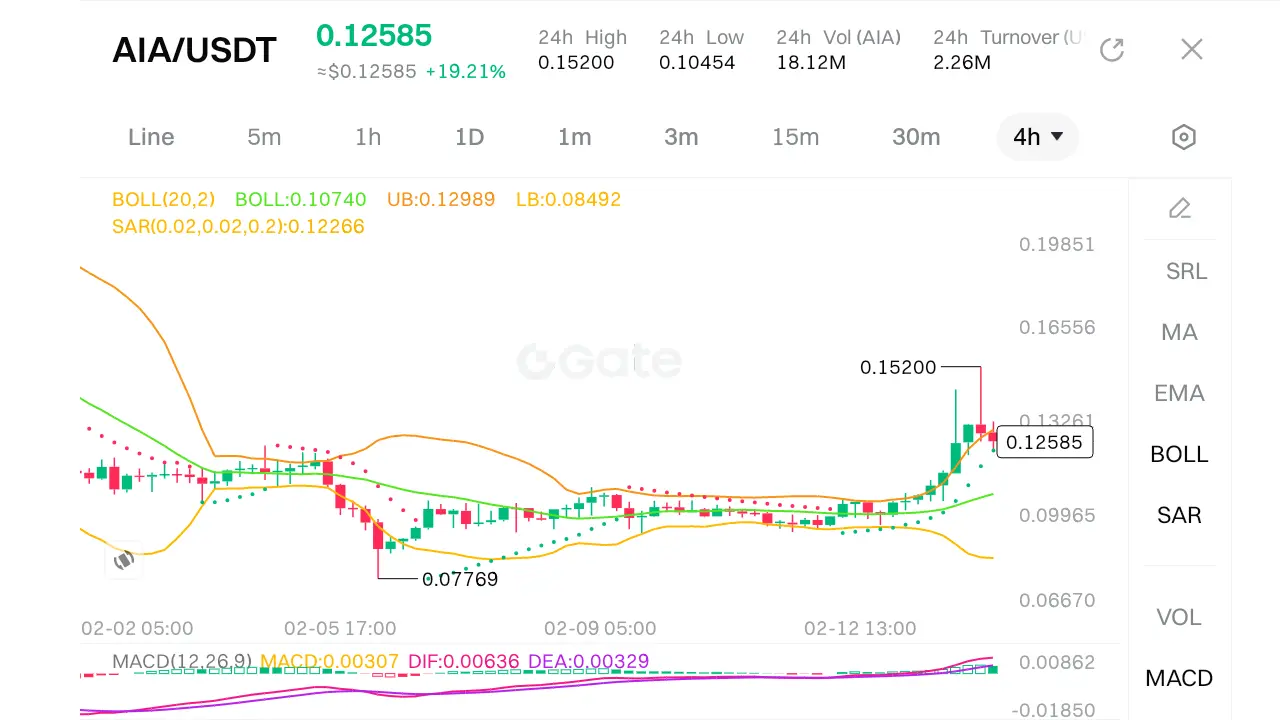

Complete in-depth technical analysis of the DN/USDT chart.

Analysis Summary

· Current Trend: Sideways / Low Volatility Consolidation.

· Market Structure: The price is currently compressing between tight ranges, indicating a buildup of energy. A breakout is imminent but the direction is unclear.

· Key Levels:

· Support: $0.1520 (24h Low & Lower Bollinger Band).

· Resistance: $0.1528 (Upper Bollinger Band) / $0.1575 (24h High).

· Outlook: Neutral to slightly bearish in the ultra-short term, awaiting a catalyst.

1. Market Structure & Price Action

· Current Pri

Complete in-depth technical analysis of the DN/USDT chart.

Analysis Summary

· Current Trend: Sideways / Low Volatility Consolidation.

· Market Structure: The price is currently compressing between tight ranges, indicating a buildup of energy. A breakout is imminent but the direction is unclear.

· Key Levels:

· Support: $0.1520 (24h Low & Lower Bollinger Band).

· Resistance: $0.1528 (Upper Bollinger Band) / $0.1575 (24h High).

· Outlook: Neutral to slightly bearish in the ultra-short term, awaiting a catalyst.

1. Market Structure & Price Action

· Current Pri

DN-0,84%

- Reward

- 1

- Comment

- Repost

- Share

$ZEC #GateSpringFestivalHorseRacingEvent

ZEC/USDT Technical Analysis – Dow Theory Context

Market Overview

ZEC/USDT is currently trading around $295.90** after a 24h range of **$280.74 – $332.95. Two screenshots provide multi-timeframe data:

· Higher timeframe (likely 4h/1D): Price at 295.93, Bollinger Bands (20,2) with middle at 271.79, upper at 339.15, lower at 204.42. SAR at 332.95 (above price, bearish). Key annotated levels: 332.95, 310.92, 295.93, 268.57, 226.22, 220.67.

· Lower timeframe (5m): Price at 295.89, Bollinger Bands (20,2) with middle at 298.81, upper at 306.83, lower at 290.7

ZEC/USDT Technical Analysis – Dow Theory Context

Market Overview

ZEC/USDT is currently trading around $295.90** after a 24h range of **$280.74 – $332.95. Two screenshots provide multi-timeframe data:

· Higher timeframe (likely 4h/1D): Price at 295.93, Bollinger Bands (20,2) with middle at 271.79, upper at 339.15, lower at 204.42. SAR at 332.95 (above price, bearish). Key annotated levels: 332.95, 310.92, 295.93, 268.57, 226.22, 220.67.

· Lower timeframe (5m): Price at 295.89, Bollinger Bands (20,2) with middle at 298.81, upper at 306.83, lower at 290.7

ZEC-3,51%

- Reward

- 4

- Comment

- Repost

- Share

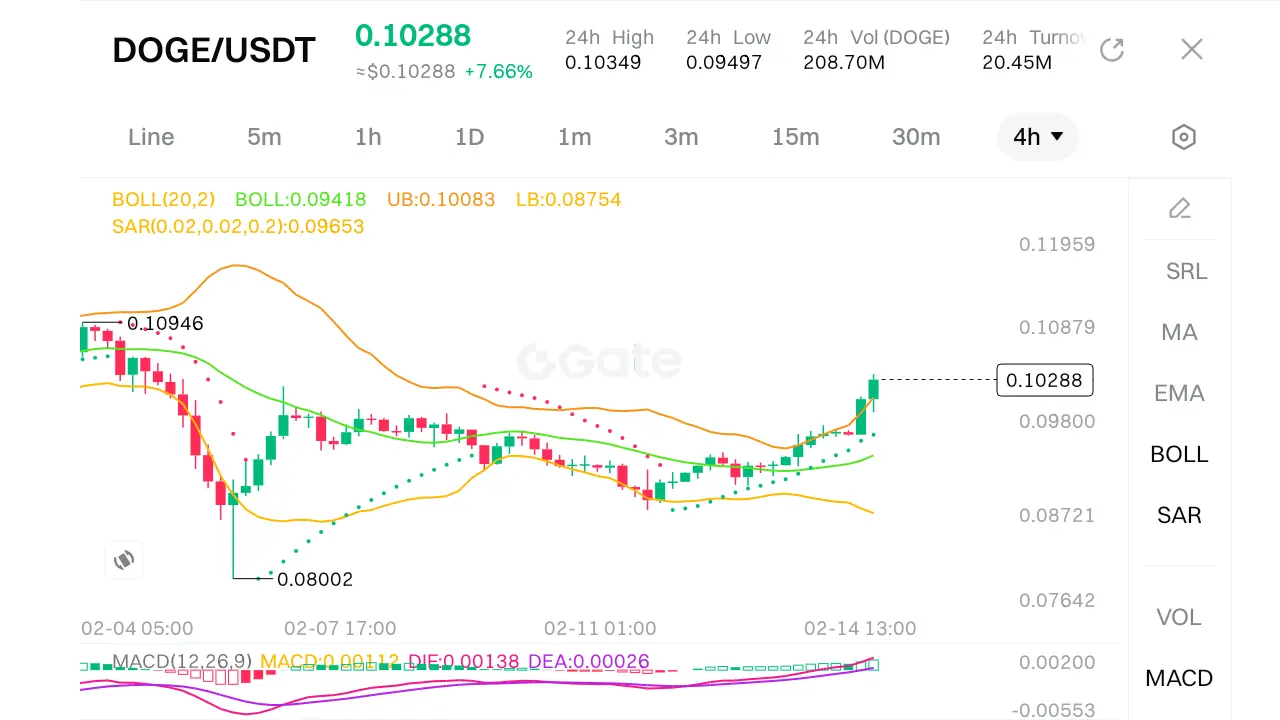

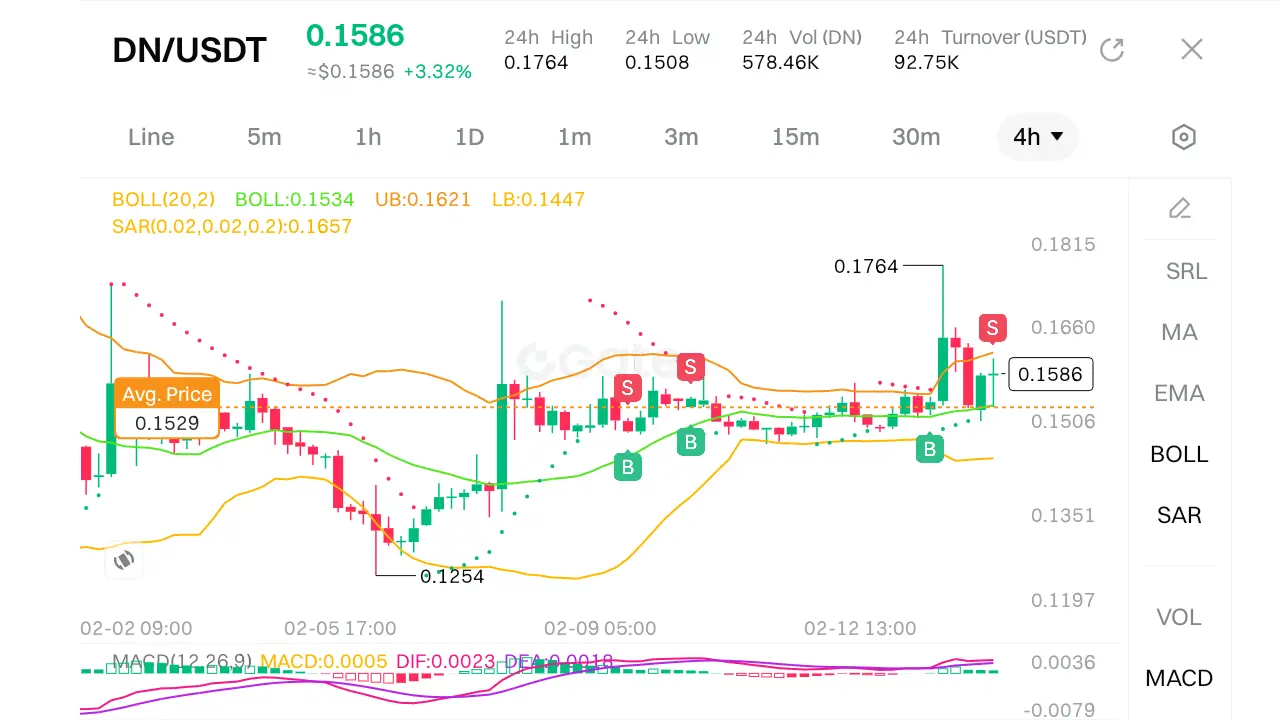

$DOGE #USCoreCPIHitsFour-YearLow

DOGE/USDT 1-hour chart, here is a comprehensive technical analysis using indicators and price levels.

1. Current Market Snapshot

· Price: 0.10768 USDT (+6.58% daily)

· 24h Range: 0.10076 – 0.11758

· Perpetual Contract: 0.10760 (+6.67%)

· Timeframe: 1-hour (selected)

· Indicators: Bollinger Bands (20,2) and Parabolic SAR (0.02, 0.02, 0.2)

2. Bollinger Bands Analysis

· Middle Band (20-period SMA): 0.11237

· Upper Band: 0.11787

· Lower Band: 0.10687

Observation:

Price is currently trading at 0.10768, which is below the middle band and just above the lower band (0

DOGE/USDT 1-hour chart, here is a comprehensive technical analysis using indicators and price levels.

1. Current Market Snapshot

· Price: 0.10768 USDT (+6.58% daily)

· 24h Range: 0.10076 – 0.11758

· Perpetual Contract: 0.10760 (+6.67%)

· Timeframe: 1-hour (selected)

· Indicators: Bollinger Bands (20,2) and Parabolic SAR (0.02, 0.02, 0.2)

2. Bollinger Bands Analysis

· Middle Band (20-period SMA): 0.11237

· Upper Band: 0.11787

· Lower Band: 0.10687

Observation:

Price is currently trading at 0.10768, which is below the middle band and just above the lower band (0

DOGE-9,5%

- Reward

- 5

- 2

- Repost

- Share

windx :

:

watching closelyView More

$SOL #What’sNextforBitcoin?

In-Depth K-Line Technical Analysis for SOL/USDT

Current Price: $87.22 (+0.40%)

**Indicators:** Bollinger Bands (20,2) – Middle: $88.74, Upper: $90.82, Lower: $86.66

Parabolic SAR (0.02,0.2): $87.88

**Key Levels:** $91.69, $90.32, $88.94, $87.57, $87.22 (current), $86.67, $86.19

24h Range: High $91.24, Low $86.56 | Volume: 602.54K SOL / 53.28M USDT

1. Price Action and Trend Context

SOL is currently trading at $87.22, slightly above the 24h low of $86.56 but well below the 24h high of $91.24. The price has retreated from recent highs, as indicated by the descending l

In-Depth K-Line Technical Analysis for SOL/USDT

Current Price: $87.22 (+0.40%)

**Indicators:** Bollinger Bands (20,2) – Middle: $88.74, Upper: $90.82, Lower: $86.66

Parabolic SAR (0.02,0.2): $87.88

**Key Levels:** $91.69, $90.32, $88.94, $87.57, $87.22 (current), $86.67, $86.19

24h Range: High $91.24, Low $86.56 | Volume: 602.54K SOL / 53.28M USDT

1. Price Action and Trend Context

SOL is currently trading at $87.22, slightly above the 24h low of $86.56 but well below the 24h high of $91.24. The price has retreated from recent highs, as indicated by the descending l

SOL-4,02%

- Reward

- 3

- Comment

- Repost

- Share

$GT #What’sNextforBitcoin?

GT/USDT In-Depth K-Line Analysis

Current Price: $7.21 (-1.64%)

**24h High/Low:** $7.39 / $7.19

**24h Volume:** 69.48K GT | **Turnover:** 508.44K USDT

**Perpetual Contract:** $7.152 (-2.00%)

1. Price Action and Trend

The current spot price of $7.21 is trading near the lower end of the 24h range, having tested a low of $7.19. The slight discount on the perpetual contract ($7.152) suggests mild bearish sentiment in the derivatives market. The 1.64% decline on the day indicates selling pressure, but the price is holding just above the 24h low.

2. Bollinger Bands (20,2)

GT/USDT In-Depth K-Line Analysis

Current Price: $7.21 (-1.64%)

**24h High/Low:** $7.39 / $7.19

**24h Volume:** 69.48K GT | **Turnover:** 508.44K USDT

**Perpetual Contract:** $7.152 (-2.00%)

1. Price Action and Trend

The current spot price of $7.21 is trading near the lower end of the 24h range, having tested a low of $7.19. The slight discount on the perpetual contract ($7.152) suggests mild bearish sentiment in the derivatives market. The 1.64% decline on the day indicates selling pressure, but the price is holding just above the 24h low.

2. Bollinger Bands (20,2)

GT-2,86%

- Reward

- 3

- Comment

- Repost

- Share

$DOGE #What’sNextforBitcoin?

Here’s a concise analysis and potential setup for DOGE/USDT:

Current Market Snapshot

· Price: 0.10282 (+7.60%)

· 24h High: 0.10349

· 24h Low: 0.09497

· Bollinger Bands (20,2): Upper 0.10412, Middle 0.10217, Lower 0.10021

· SAR: 0.10268 (below price, indicating uptrend)

· MACD: Near zero (DIF -0.00076, DEA 0.00077, histogram -0.00001) – showing consolidation.

Applying Your 5-Step Strategy

1. 4H Liquidity

· Key level: The 24h high at 0.10349 is a recent resistance. On a 4H chart, this likely represents a liquidity zone where stop orders and sell limits cluster.

· An

Here’s a concise analysis and potential setup for DOGE/USDT:

Current Market Snapshot

· Price: 0.10282 (+7.60%)

· 24h High: 0.10349

· 24h Low: 0.09497

· Bollinger Bands (20,2): Upper 0.10412, Middle 0.10217, Lower 0.10021

· SAR: 0.10268 (below price, indicating uptrend)

· MACD: Near zero (DIF -0.00076, DEA 0.00077, histogram -0.00001) – showing consolidation.

Applying Your 5-Step Strategy

1. 4H Liquidity

· Key level: The 24h high at 0.10349 is a recent resistance. On a 4H chart, this likely represents a liquidity zone where stop orders and sell limits cluster.

· An

DOGE-9,5%

- Reward

- 7

- 1

- Repost

- Share

EqunixHub :

:

wiw great amazing$GT #USCoreCPIHitsFour-YearLow

GT/USDT, here is a technical analysis:

Price Action and Trend

· Current Price: 7.37 USDT, up +3.51% over the last 24 hours.

· 24h Range: High of 7.39, low of 7.01, indicating a strong upward move from the daily low.

· The price is currently trading near the 24h high, showing bullish momentum.

Bollinger Bands (20,2)

· Upper Band (UB): 7.30

· Middle Band (BOLL): 7.02

· Lower Band (LB): 6.74

· Observation: Price (7.37) is above the upper band, suggesting an overbought condition and strong bullish momentum. However, this can also signal a potential pullback or conso

GT/USDT, here is a technical analysis:

Price Action and Trend

· Current Price: 7.37 USDT, up +3.51% over the last 24 hours.

· 24h Range: High of 7.39, low of 7.01, indicating a strong upward move from the daily low.

· The price is currently trading near the 24h high, showing bullish momentum.

Bollinger Bands (20,2)

· Upper Band (UB): 7.30

· Middle Band (BOLL): 7.02

· Lower Band (LB): 6.74

· Observation: Price (7.37) is above the upper band, suggesting an overbought condition and strong bullish momentum. However, this can also signal a potential pullback or conso

GT-2,86%

- Reward

- 4

- 1

- Repost

- Share

HighAmbition :

:

To The Moon 🌕$XRP #What’sNextforBitcoin?

ICT Judas Swing Setup, here’s an analysis of XRP/USDT using the provided screenshots:

1. Confirm Daily Bias

· (Daily/4H): Price is at 1.470, above SAR (1.185) but below the middle Bollinger band (1.560). MACD is negative but showing a potential bullish crossover (DIF > DEA).

The overall trend from the 2.417 high is bearish, but the bounce from 1.119 suggests a possible reversal. The daily bias is cautiously bullish as price makes higher lows.

2. Locate High-Probability Liquidity

· Key levels: Recent highs at 1.477 (24h high) and 1.495 (from third screenshot) act

ICT Judas Swing Setup, here’s an analysis of XRP/USDT using the provided screenshots:

1. Confirm Daily Bias

· (Daily/4H): Price is at 1.470, above SAR (1.185) but below the middle Bollinger band (1.560). MACD is negative but showing a potential bullish crossover (DIF > DEA).

The overall trend from the 2.417 high is bearish, but the bounce from 1.119 suggests a possible reversal. The daily bias is cautiously bullish as price makes higher lows.

2. Locate High-Probability Liquidity

· Key levels: Recent highs at 1.477 (24h high) and 1.495 (from third screenshot) act

XRP-4,69%

- Reward

- 4

- Comment

- Repost

- Share

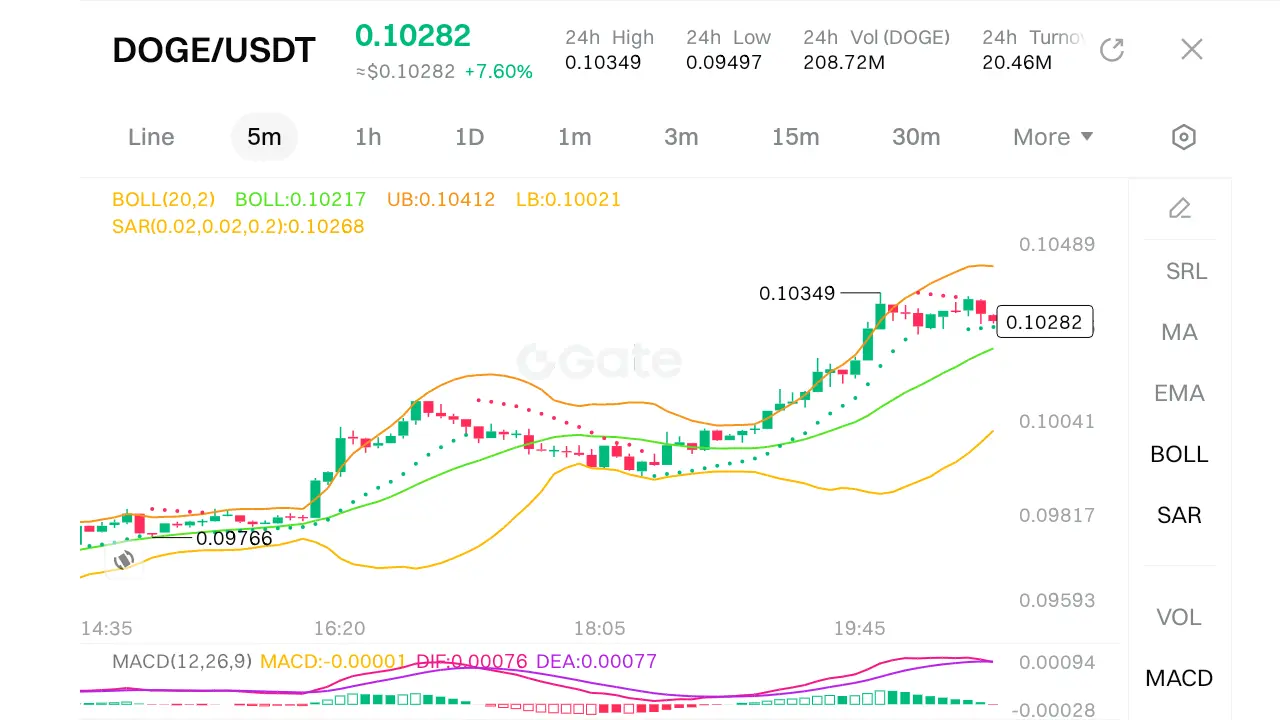

$AIA #AIAgentProjectsI’mWatching

Below is a professional multi-timeframe analysis of AIA/USDT. The analysis follows structure: 4H (Direction) → 1H (Liquidity) → 15M (Structure) → 5M (Execution) .

1. 4-Hour Chart – The Directional Bias

· Current Price: 0.12585

· Market Structure: Price is trading within a wide range after a sharp move down from the high of 0.19851. We are currently seeing a recovery phase.

· Key Levels:

· Resistance: 0.12989 (Upper Bollinger Band) / 0.15200 (Recent Swing High)

· Support: 0.10489 (Recent Low) / 0.09965 (Structural Low)

· Indicators:

· MACD (12,26,9): MACD

Below is a professional multi-timeframe analysis of AIA/USDT. The analysis follows structure: 4H (Direction) → 1H (Liquidity) → 15M (Structure) → 5M (Execution) .

1. 4-Hour Chart – The Directional Bias

· Current Price: 0.12585

· Market Structure: Price is trading within a wide range after a sharp move down from the high of 0.19851. We are currently seeing a recovery phase.

· Key Levels:

· Resistance: 0.12989 (Upper Bollinger Band) / 0.15200 (Recent Swing High)

· Support: 0.10489 (Recent Low) / 0.09965 (Structural Low)

· Indicators:

· MACD (12,26,9): MACD

AIA-14,18%

- Reward

- 5

- 1

- Repost

- Share

EqunixHub :

:

amazing hope you get some handsome profits$DN #GateSquare$50KRedPacketGiveaway

Trading strategy (4H Liquidity → 5 Min Sweep → FVG → Entry → 3RR), here’s a step-by-step analysis and potential trade setup for DN/USDT.

1. Identify 4H Liquidity

Liquidity on the 4-hour chart typically resides at recent swing highs/lows where stop orders cluster.

· From the 4 hour, notable levels include:

· 24h High: 0.1764 (potential sell-side liquidity)

· 24h Low: 0.1508 (potential buy-side liquidity)

· Other levels: 0.1660, 0.1586 (current), 0.1506, 0.1351, 0.1197 – these may represent prior highs/lows or order blocks.

· The chart also shows a SAR

Trading strategy (4H Liquidity → 5 Min Sweep → FVG → Entry → 3RR), here’s a step-by-step analysis and potential trade setup for DN/USDT.

1. Identify 4H Liquidity

Liquidity on the 4-hour chart typically resides at recent swing highs/lows where stop orders cluster.

· From the 4 hour, notable levels include:

· 24h High: 0.1764 (potential sell-side liquidity)

· 24h Low: 0.1508 (potential buy-side liquidity)

· Other levels: 0.1660, 0.1586 (current), 0.1506, 0.1351, 0.1197 – these may represent prior highs/lows or order blocks.

· The chart also shows a SAR

DN-0,84%

- Reward

- 3

- 1

- Repost

- Share

INVESTERCLUB :

:

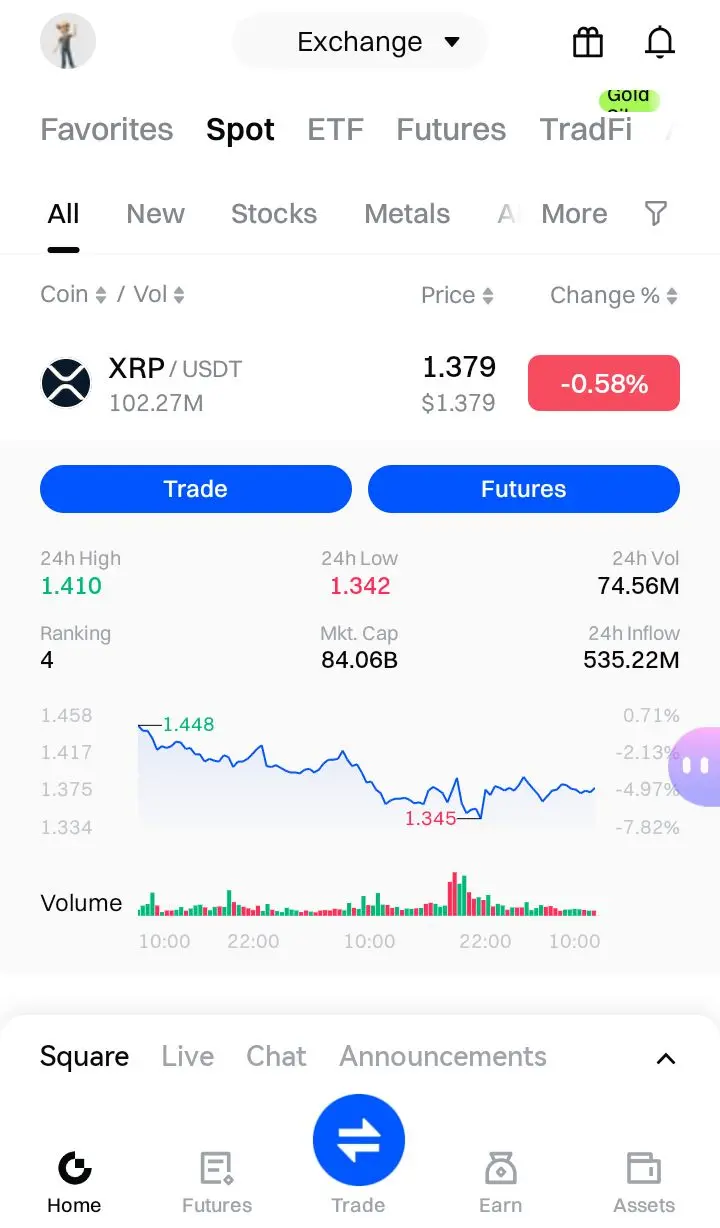

To The Moon 🌕$XRP #NFPBeatsExpectations 4H XRP/USDT chart, here’s a structured trade analysis incorporating your noted concepts:

1. Market Structure – Consolidation Range

Price is trading within a well-defined 4H consolidation zone:

· Resistance: 1.449 (previous swing high) and 1.410 (24h high).

· Support: 1.342–1.346 (lower Bollinger Band and 24h low).

Current price (1.378) sits near the middle, below the SAR (1.402) and mid-BB (1.404), reflecting bearish momentum but range‑bound behavior.

2. Lower Timeframe Liquidity Grab

The sweep to 1.342 (24h low) tapped into sell‑side liquidity (stop losses below

1. Market Structure – Consolidation Range

Price is trading within a well-defined 4H consolidation zone:

· Resistance: 1.449 (previous swing high) and 1.410 (24h high).

· Support: 1.342–1.346 (lower Bollinger Band and 24h low).

Current price (1.378) sits near the middle, below the SAR (1.402) and mid-BB (1.404), reflecting bearish momentum but range‑bound behavior.

2. Lower Timeframe Liquidity Grab

The sweep to 1.342 (24h low) tapped into sell‑side liquidity (stop losses below

XRP-4,69%

- Reward

- 3

- 1

- Repost

- Share

RjHaroon :

:

HODL Tight 💪#我最中意的加密货币 Technical Analysis: GT/USDT (GateToken)

Data Snapshot: Price $6.93 (+0.29%), 24h Range $6.77–$7.00, 24h Vol 116.55K GT / 801.46K USDT.$GT

1. Market Overview

GT is trading at $6.93**, marginally above the 24h low of $6.77 and below the 24h high of $7.00. The perpetual contract is priced at a slight **$0.03 discount to spot, suggesting cautious short-term sentiment. With a 24h turnover of only $801K, liquidity is relatively thin for a top‑4 exchange token, indicating reduced speculative interest or consolidation.

2. Technical Indicators

Bollinger Bands (20,2)

· Middle Band (20‑peri

Data Snapshot: Price $6.93 (+0.29%), 24h Range $6.77–$7.00, 24h Vol 116.55K GT / 801.46K USDT.$GT

1. Market Overview

GT is trading at $6.93**, marginally above the 24h low of $6.77 and below the 24h high of $7.00. The perpetual contract is priced at a slight **$0.03 discount to spot, suggesting cautious short-term sentiment. With a 24h turnover of only $801K, liquidity is relatively thin for a top‑4 exchange token, indicating reduced speculative interest or consolidation.

2. Technical Indicators

Bollinger Bands (20,2)

· Middle Band (20‑peri

GT-2,86%

- Reward

- 2

- Comment

- Repost

- Share

$BTC #GateSquare$50KRedPacketGiveaway

4H Chart Direction

· Price: 67,198.5

· Bollinger Bands (20,2): Middle 68,687.5 | Upper 71,403.7 | Lower 65,971.3

· Parabolic SAR: 68,042.0 (above price)

· MACD (12,26,9): Histogram +73.0 | DIF +887.0 | DEA +814.0 (bullish histogram, DIF > DEA)

· Interpretation: Price is trading below the middle Bollinger Band and below the SAR – both bearish indicators. Despite the positive MACD histogram (which signals slowing bearish momentum), the structure remains firmly bearish: lower highs and lower lows are intact. The 24h high/low (68,827.5 / 65,754.9) confirms th

4H Chart Direction

· Price: 67,198.5

· Bollinger Bands (20,2): Middle 68,687.5 | Upper 71,403.7 | Lower 65,971.3

· Parabolic SAR: 68,042.0 (above price)

· MACD (12,26,9): Histogram +73.0 | DIF +887.0 | DEA +814.0 (bullish histogram, DIF > DEA)

· Interpretation: Price is trading below the middle Bollinger Band and below the SAR – both bearish indicators. Despite the positive MACD histogram (which signals slowing bearish momentum), the structure remains firmly bearish: lower highs and lower lows are intact. The 24h high/low (68,827.5 / 65,754.9) confirms th

BTC-1,93%

- Reward

- 3

- Comment

- Repost

- Share

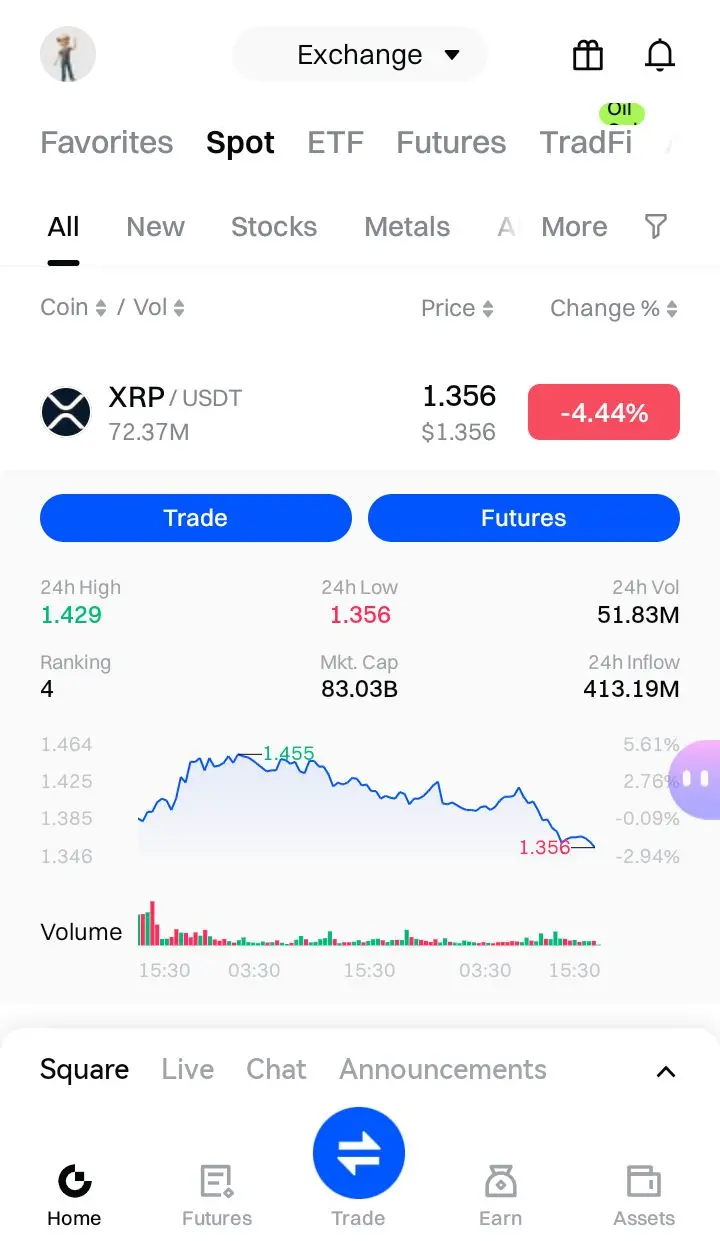

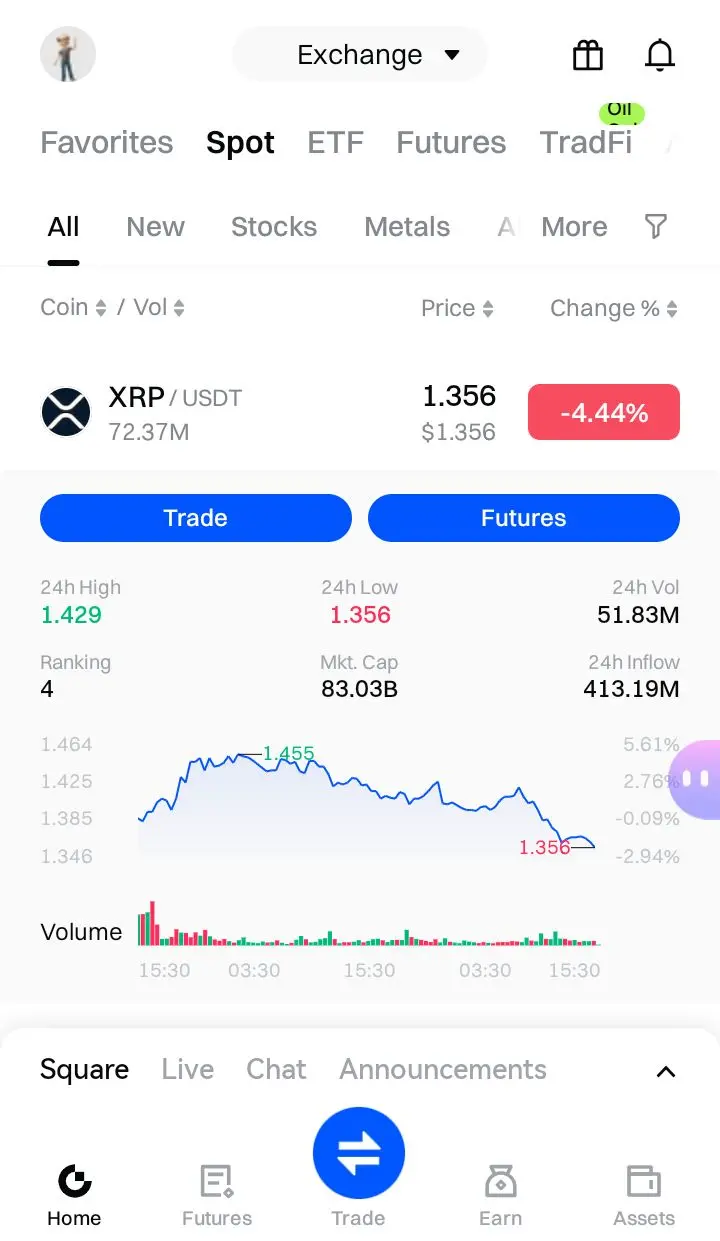

$XRP #CryptoSurvivalGuide

XRP Price Retreats After Rejecting $1.55, Support at $1.34 in Focus

XRP faced renewed selling pressure after failing to clear the $1.55 resistance, mirroring pullbacks in Bitcoin and Ethereum. The token has since dropped below $1.45 and $1.48, entering a corrective phase that brought it under the 23.6% Fibonacci retracement level—calculated from the $1.1356 swing low to the $1.5435 high.

On the hourly chart, a declining channel has formed, with immediate resistance now resting at $1.43. XRP is trading beneath both $1.42 and the 100-hour simple moving average, signali

XRP Price Retreats After Rejecting $1.55, Support at $1.34 in Focus

XRP faced renewed selling pressure after failing to clear the $1.55 resistance, mirroring pullbacks in Bitcoin and Ethereum. The token has since dropped below $1.45 and $1.48, entering a corrective phase that brought it under the 23.6% Fibonacci retracement level—calculated from the $1.1356 swing low to the $1.5435 high.

On the hourly chart, a declining channel has formed, with immediate resistance now resting at $1.43. XRP is trading beneath both $1.42 and the 100-hour simple moving average, signali

XRP-4,69%

- Reward

- 3

- Comment

- Repost

- Share

$ETH #CryptoSurvivalGuide

ETH/USDT chart data and trading terminology, here is a concise technical analysis summary:

📈 Multi-Timeframe Analysis (ETH/USDT)

Current Price: ≈ $1,957.91 (4h chart)

Overall Trend: Bearish across all timeframes, price below Bollinger Band mid-line, MACD negative.

⏳ Timeframe Breakdown:

1. 5-min Chart (Very Short-Term)

· BOLL: Price near lower band (LB: 1,944.35), slight rebound visible.

· MACD: DIF (15.26) > DEA (11.34), histogram positive → short-term momentum slightly bullish.

· Watch for: Possible TS (Turtle Soup) or pullback to mid-band (1,993.84).

2. 1-hour Ch

ETH/USDT chart data and trading terminology, here is a concise technical analysis summary:

📈 Multi-Timeframe Analysis (ETH/USDT)

Current Price: ≈ $1,957.91 (4h chart)

Overall Trend: Bearish across all timeframes, price below Bollinger Band mid-line, MACD negative.

⏳ Timeframe Breakdown:

1. 5-min Chart (Very Short-Term)

· BOLL: Price near lower band (LB: 1,944.35), slight rebound visible.

· MACD: DIF (15.26) > DEA (11.34), histogram positive → short-term momentum slightly bullish.

· Watch for: Possible TS (Turtle Soup) or pullback to mid-band (1,993.84).

2. 1-hour Ch

ETH-4,14%

- Reward

- 2

- 1

- Repost

- Share

EqunixHub :

:

nice trading style and strategy#BuyTheDipOrWaitNow? SUI/USDT, here is an analysis and actionable trade plan following your 5-step strategy:

1) 4H Liquidity (Higher Timeframe Context)

· Chart Reference: (1D/4H view).

· Key Levels:

· Resistance (Sell-Side Liquidity): The recent high near 0.9785 (24h High) and the BOLL Upper Band (UB) at 1.0196 are key liquidity zones. The price was rejected from this area.

· Support (Buy-Side Liquidity): The 24h Low at 0.9277 aligns almost perfectly with the BOLL Lower Band (LB) at 0.9272. This is a major support and liquidity zone.

· Bias: The price is in the lower half of the 4H Bolling

1) 4H Liquidity (Higher Timeframe Context)

· Chart Reference: (1D/4H view).

· Key Levels:

· Resistance (Sell-Side Liquidity): The recent high near 0.9785 (24h High) and the BOLL Upper Band (UB) at 1.0196 are key liquidity zones. The price was rejected from this area.

· Support (Buy-Side Liquidity): The 24h Low at 0.9277 aligns almost perfectly with the BOLL Lower Band (LB) at 0.9272. This is a major support and liquidity zone.

· Bias: The price is in the lower half of the 4H Bolling

SUI-4,16%

- Reward

- 3

- 5

- Repost

- Share

DEATHLESS :

:

Happy New Year! 🤑View More

$XAUT #GateSpringFestivalHorseRacingEvent

comprehensive in-depth K-line analysis for the XAUT/USDT (Tether Gold perpetual) chart:

1. Overall Trend & Market Context

· Primary Trend: The chart depicts a market in a downtrend, followed by a period of consolidation. The price has fallen from highs around 5,088.2 and appears to be stabilizing after finding a low near 4,494.3.

· Current Phase: The market is in a consolidation/range-bound phase between approximately 4,900 and 5,070. This follows a significant decline, indicating a potential pause or accumulation before the next directional move.

2.

comprehensive in-depth K-line analysis for the XAUT/USDT (Tether Gold perpetual) chart:

1. Overall Trend & Market Context

· Primary Trend: The chart depicts a market in a downtrend, followed by a period of consolidation. The price has fallen from highs around 5,088.2 and appears to be stabilizing after finding a low near 4,494.3.

· Current Phase: The market is in a consolidation/range-bound phase between approximately 4,900 and 5,070. This follows a significant decline, indicating a potential pause or accumulation before the next directional move.

2.

XAUT-0,5%

- Reward

- 3

- Comment

- Repost

- Share

$GT #GateSpringFestivalHorseRacingEvent

Here's a technical analysis for GT/USDT on the 4-hour timeframe:

Current Snapshot & Trend

· Price: ~6.97 USDT (Spot) / 6.885 USDT (Perp Futures, down -1.61%)

· Short-Term Trend: Bearish. The futures price is significantly below the spot, and the chart shows a clear decline from the ~7.79 level.

Key Technical Indicators

1. Bollinger Bands (20,2):

· Price is trading at the Lower Band (LB: 6.87), indicating the asset is in oversold territory for this timeframe.

· The middle band (BOLL: 7.01) and upper band (UB: 7.15) are acting as immediate resistanc

Here's a technical analysis for GT/USDT on the 4-hour timeframe:

Current Snapshot & Trend

· Price: ~6.97 USDT (Spot) / 6.885 USDT (Perp Futures, down -1.61%)

· Short-Term Trend: Bearish. The futures price is significantly below the spot, and the chart shows a clear decline from the ~7.79 level.

Key Technical Indicators

1. Bollinger Bands (20,2):

· Price is trading at the Lower Band (LB: 6.87), indicating the asset is in oversold territory for this timeframe.

· The middle band (BOLL: 7.01) and upper band (UB: 7.15) are acting as immediate resistanc

GT-2,86%

- Reward

- 2

- Comment

- Repost

- Share

$ETH #GateSpringFestivalHorseRacingEvent

ETH/USDT, here is a technical analysis:

1. Current Price Action & Trend

· Current Price: ~$2,011.96

· 24h Change: -1.02% (bearish short-term momentum)

· 24h Range: $1,996.00 – $2,147.60

· The price is currently trading below the Bollinger Band midline ($2,073.83), indicating bearish pressure.

2. Bollinger Bands (20,2) Analysis

· Midline (BOLL): $2,073.83

· Upper Band (UB): $2,150.69

· Lower Band (LB): $1,996.97

· Price Position: Currently near the lower band, suggesting oversold conditions in the very short term.

· Band Width: The distance between UB a

ETH/USDT, here is a technical analysis:

1. Current Price Action & Trend

· Current Price: ~$2,011.96

· 24h Change: -1.02% (bearish short-term momentum)

· 24h Range: $1,996.00 – $2,147.60

· The price is currently trading below the Bollinger Band midline ($2,073.83), indicating bearish pressure.

2. Bollinger Bands (20,2) Analysis

· Midline (BOLL): $2,073.83

· Upper Band (UB): $2,150.69

· Lower Band (LB): $1,996.97

· Price Position: Currently near the lower band, suggesting oversold conditions in the very short term.

· Band Width: The distance between UB a

ETH-4,14%

- Reward

- 2

- Comment

- Repost

- Share