EyeOnChain

No content yet

EyeOnChain

NEWS FLASH ON #BTC : About 12 minutes ago, a wallet linked to the U.S. government moved out 0.0378 $BTC ... roughly $2,520.

It’s a tiny amount, which usually hints at a test transaction rather than a full transfer. No big follow-up yet… but these things sometimes come in waves.

We’re watching the wallet closely and will update if any larger movements hit. Stay tuned.

It’s a tiny amount, which usually hints at a test transaction rather than a full transfer. No big follow-up yet… but these things sometimes come in waves.

We’re watching the wallet closely and will update if any larger movements hit. Stay tuned.

BTC-2,14%

- Reward

- 2

- 1

- Repost

- Share

CryptosTalker :

:

LFG 🔥Three completely new Bitcoin wallets just showed up on-chain today ... and they didn’t arrive empty. Together, they received 1,298.46 $BTC , worth around $86.4 million, straight from BitGo.

The BTC was split across these three wallets:👇

bc1qkqds78fcj9pcyfxkxl4jdc3r3x64l2h0chqj6hh87pvu4qy39khqgw3paf

bc1qklh6c0z6hx4ak2nwhmutq5atmr2s8zwldc3x4uf725qdy5vv3wxq3807p7

bc1qy0wfyh2gus85c3cq5pag3e3zath0mfltne8484zlklv0h82kqtvsafmm2j

The BTC was split across these three wallets:👇

bc1qkqds78fcj9pcyfxkxl4jdc3r3x64l2h0chqj6hh87pvu4qy39khqgw3paf

bc1qklh6c0z6hx4ak2nwhmutq5atmr2s8zwldc3x4uf725qdy5vv3wxq3807p7

bc1qy0wfyh2gus85c3cq5pag3e3zath0mfltne8484zlklv0h82kqtvsafmm2j

BTC-2,14%

- Reward

- like

- Comment

- Repost

- Share

No swaps. Just 1.2 million USDC sitting there like it was on pause.

Then 4NitxB wakes up ... not with a bang, not with some giant “all in” move .... but with these small, steady buys. Little scoops of $WAR , spaced out.

So far it’s picked up 103,459 #war . That’s only about $2.86K worth. Which, compared to the $1.2M stablecoin pile, feels tiny.

Address, if you’re watching:

4NitxBZafw9UGEqMBmzgyvZDvYtY88meF86ngXtVNPh5

Then 4NitxB wakes up ... not with a bang, not with some giant “all in” move .... but with these small, steady buys. Little scoops of $WAR , spaced out.

So far it’s picked up 103,459 #war . That’s only about $2.86K worth. Which, compared to the $1.2M stablecoin pile, feels tiny.

Address, if you’re watching:

4NitxBZafw9UGEqMBmzgyvZDvYtY88meF86ngXtVNPh5

- Reward

- like

- Comment

- Repost

- Share

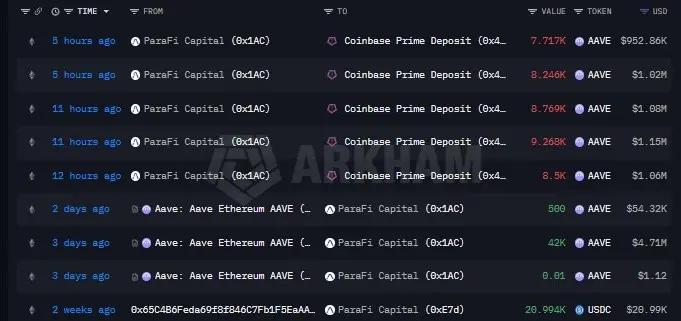

ParaFi Moves Again ... And the Timing Feels Familiar with $AAVE .

THEY just shifted a sizable chunk of AAVE. In the past 12 hours, they deposited 42,500 #AAVE roughly $5.27 million into Coinbase Prime. That’s not a random wallet shuffle. Coinbase Prime usually means institutional flow, custody, or potentially preparing for liquidity.

About six months ago, #ParaFi sent 17,000 AAVE (worth $5.32 million at the time) to Coinbase Prime as well. Back then, AAVE was trading around $313.

Now they’re moving more than double the token amount for roughly the same dollar value.

PLEASE NOTE: Deposits to p

THEY just shifted a sizable chunk of AAVE. In the past 12 hours, they deposited 42,500 #AAVE roughly $5.27 million into Coinbase Prime. That’s not a random wallet shuffle. Coinbase Prime usually means institutional flow, custody, or potentially preparing for liquidity.

About six months ago, #ParaFi sent 17,000 AAVE (worth $5.32 million at the time) to Coinbase Prime as well. Back then, AAVE was trading around $313.

Now they’re moving more than double the token amount for roughly the same dollar value.

PLEASE NOTE: Deposits to p

- Reward

- like

- Comment

- Repost

- Share

When One Whale Isn’t Enough.....At first glance it looks like two separate players.

Two different addresses. Two different dashboards. But the positions are the same… almost too similar. And when you dig out, the size starts to feel coordinated.

Between 0xa5B0…1D41 and 0x6C85…84F6, there’s roughly 120,000 ETH on the table. That’s about $241 million worth.

And as if that wasn’t loud enough, one of them just added a fresh 20x long on 400 $BTC --- another $27 million layered on top.

The first wallet is carrying the bulk of the weight. Around $168 million in total perp exposure. Account value flo

Two different addresses. Two different dashboards. But the positions are the same… almost too similar. And when you dig out, the size starts to feel coordinated.

Between 0xa5B0…1D41 and 0x6C85…84F6, there’s roughly 120,000 ETH on the table. That’s about $241 million worth.

And as if that wasn’t loud enough, one of them just added a fresh 20x long on 400 $BTC --- another $27 million layered on top.

The first wallet is carrying the bulk of the weight. Around $168 million in total perp exposure. Account value flo

- Reward

- 1

- Comment

- Repost

- Share

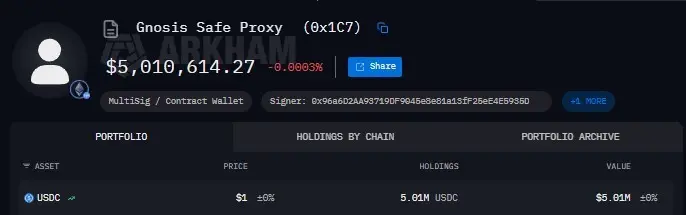

When Stablecoins Start Turning Into #Gold … You Pay Attention.

There’s something about old wallets waking up that always feels intentional.

This guy had been completely quiet for five months.

In the last six hours.... It moved. About $1 million USDC went straight into $PAXG and $XAU ( XAUT ), that is tokenized gold. The digital version of “I’d rather hold something heavy.”

The wallet still has roughly $5 million USDC parked and ready. Which kind of makes the first $1M feel like a test order.

Address for tracking:

0x1C7041D8DbE7a4e036AF52000669286647B5D70d

There’s something about old wallets waking up that always feels intentional.

This guy had been completely quiet for five months.

In the last six hours.... It moved. About $1 million USDC went straight into $PAXG and $XAU ( XAUT ), that is tokenized gold. The digital version of “I’d rather hold something heavy.”

The wallet still has roughly $5 million USDC parked and ready. Which kind of makes the first $1M feel like a test order.

Address for tracking:

0x1C7041D8DbE7a4e036AF52000669286647B5D70d

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

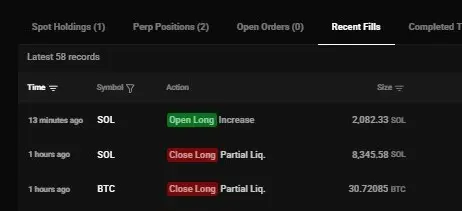

LFG 🔥Keeps Pressing the Button #Bitcoin slipped to $65,056 before most people had finished their morning coffee. Quick drop. The kind that doesn’t look dramatic on a weekly chart but absolutely wrecks you on 40x leverage. And yeah… it did.

Wallet 0xdf13e8eadca683420c89eb2539ac04a59806f0b0 took another punch. About 395 $BTC gone in liquidation --- roughly $520K evaporated.

There was a moment where $SOL tried to play hero. Around 76,000 SOL closed green, booking about $101K in profit. A small win. A “hey, maybe it balances out” kind of win.

It didn’t.

Because the latest SOL liquidation started leanin

Wallet 0xdf13e8eadca683420c89eb2539ac04a59806f0b0 took another punch. About 395 $BTC gone in liquidation --- roughly $520K evaporated.

There was a moment where $SOL tried to play hero. Around 76,000 SOL closed green, booking about $101K in profit. A small win. A “hey, maybe it balances out” kind of win.

It didn’t.

Because the latest SOL liquidation started leanin

- Reward

- 1

- Comment

- Repost

- Share

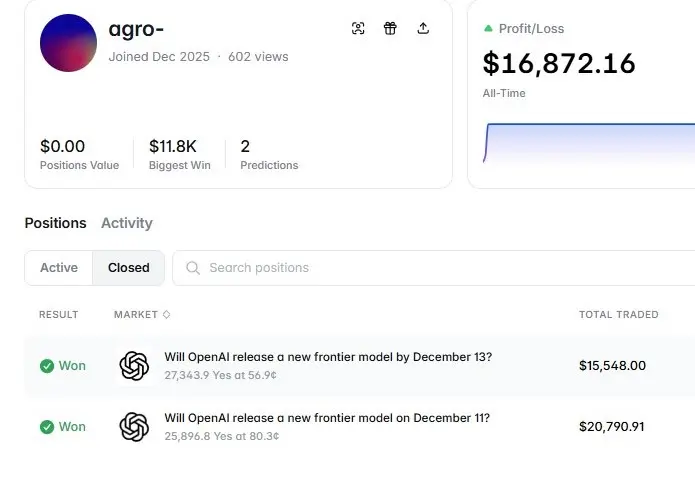

Really one’s… awkward. In that quiet, wait-a-second kind of way.

So rewind to Dec 10, 2025. A new wallet shows up out of nowhere and immediately makes a very specific call: OpenAI is about to drop a new frontier model. Not “soon.” Not “this month.” But Dec 11, or at the latest before Dec 13. Sharp timing.

And then .....yes,,,,, it happens. The model launches right in that window. The wallet closes out and pockets $16,872. of course, Not life-changing money, but also not nothing.

Now today, and suddenly there’s news floating around that OpenAI fired an employee over prediction-market insider tr

So rewind to Dec 10, 2025. A new wallet shows up out of nowhere and immediately makes a very specific call: OpenAI is about to drop a new frontier model. Not “soon.” Not “this month.” But Dec 11, or at the latest before Dec 13. Sharp timing.

And then .....yes,,,,, it happens. The model launches right in that window. The wallet closes out and pockets $16,872. of course, Not life-changing money, but also not nothing.

Now today, and suddenly there’s news floating around that OpenAI fired an employee over prediction-market insider tr

- Reward

- 3

- 1

- 1

- Share

Karik254 :

:

I do business, I deal on deals if you have a good deal you get it to me if I like it i buy your deal if you have money to buy my own i give you my deal you pay that's business 😂This one was #GOLD not a small nudge -- more like a full-on shove.

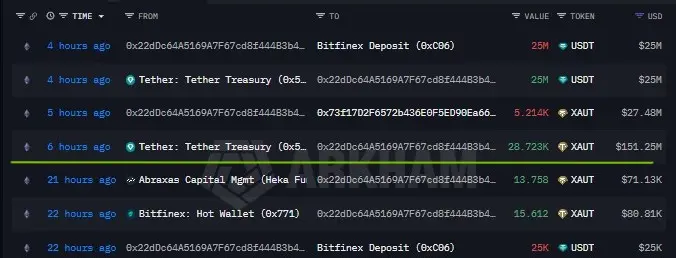

6 hours ago, the Tether treasury moved 28,723 #XAUT in a single shot. That’s around $151 million, making it the largest $XAUT transfer by size we’ve seen in the last three weeks.

The destination is Abraxas Capital Management and that’s where it gets interesting. Abraxas, through its Heka Funds, isn’t just some random counterparty ... it’s one of #Tether ’s most important institutional relationships. At one point, Heka reportedly held around 1.5% of all USDT in circulation, which is… massive. Even today, looking only at Tether’s

6 hours ago, the Tether treasury moved 28,723 #XAUT in a single shot. That’s around $151 million, making it the largest $XAUT transfer by size we’ve seen in the last three weeks.

The destination is Abraxas Capital Management and that’s where it gets interesting. Abraxas, through its Heka Funds, isn’t just some random counterparty ... it’s one of #Tether ’s most important institutional relationships. At one point, Heka reportedly held around 1.5% of all USDT in circulation, which is… massive. Even today, looking only at Tether’s

XAUT-4,53%

- Reward

- 2

- Comment

- Repost

- Share

Trending Topics

View More819.82K Popularity

307.48K Popularity

145K Popularity

404.02K Popularity

34.3K Popularity

Pin