Elite_Block

No content yet

Elite_Block

DDY chart right now be like:

🚀 Ran hard

😮💨 Took a breather

😌 Still standing strong

Early buyers booked profits.

Weak hands got nervous.

Price said: “I’m fine right here.”

Not a rug.

Not a one-candle story.

Just DDY doing its thing.

If this move scares you,

you probably buy green candles anyway 😏

Zoom out.

Patience wins.

$DDY

#DDY #DUDDY

🚀 Ran hard

😮💨 Took a breather

😌 Still standing strong

Early buyers booked profits.

Weak hands got nervous.

Price said: “I’m fine right here.”

Not a rug.

Not a one-candle story.

Just DDY doing its thing.

If this move scares you,

you probably buy green candles anyway 😏

Zoom out.

Patience wins.

$DDY

#DDY #DUDDY

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

BITCOIN WHALES SELL $3.37 BILLION, CREATING VOLATILITY

Bitcoin is hovering around $87,500, sliding about 2% over the last 24 hours as large holders continue to unload size. Roughly $3.37B in BTC has been distributed by whales, keeping price action unstable, especially with ETF flows leaning negative despite pockets of institutional interest still showing up.

From a market-read perspective, pressure is visible but not one-sided. Momentum remains heavy, yet oversold conditions are starting to form, suggesting sellers may be losing force. The $81,000 zone stands out as the key reference; holding

Bitcoin is hovering around $87,500, sliding about 2% over the last 24 hours as large holders continue to unload size. Roughly $3.37B in BTC has been distributed by whales, keeping price action unstable, especially with ETF flows leaning negative despite pockets of institutional interest still showing up.

From a market-read perspective, pressure is visible but not one-sided. Momentum remains heavy, yet oversold conditions are starting to form, suggesting sellers may be losing force. The $81,000 zone stands out as the key reference; holding

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

#LUMIA LUMIA ripped +32% in the last 24h and is trading around 0.128, with heavy volume backing the move; MACD is still leaning bullish and EMAs are pointed up, but RSI is overheated and volatility (ATR/STDEV) is elevated, so this is the zone where late-chasing gets punished fast. Notably, the tape shows ~90K+ of large-order net inflows over the last 8 hours, which reads like accumulation rather than pure hype, but crowded longs remain the risk. Hold 0.128–0.125 to keep the push alive; a clean reclaim/hold above 0.130 opens continuation, while a drop back under 0.120 increases pullback odds. $

LUMIA-4,64%

- Reward

- 1

- Comment

- Repost

- Share

$H Short Setup

Bias: Bearish continuation

Leverage: 5x

Entry: 0.1540 – 0.1580

💥 Stop: 0.1665

Targets: 0.1450 ➜ 0.1320 ➜ 0.1180

Strong impulsive sell-off after a parabolic run, followed by weak sideways action below the breakdown zone. Buyers failed to reclaim prior support, and momentum remains heavy to the downside — continuation favors sellers while price stays capped under the reclaim level.#H

Bias: Bearish continuation

Leverage: 5x

Entry: 0.1540 – 0.1580

💥 Stop: 0.1665

Targets: 0.1450 ➜ 0.1320 ➜ 0.1180

Strong impulsive sell-off after a parabolic run, followed by weak sideways action below the breakdown zone. Buyers failed to reclaim prior support, and momentum remains heavy to the downside — continuation favors sellers while price stays capped under the reclaim level.#H

H0,06%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

[The user has shared a Space. Please check the app for more details.]

- Reward

- like

- Comment

- Repost

- Share

🟡 Gold Prints New All-Time High — Macro Signals Shift from Risk to Protection

Gold has just surged to fresh record highs, breaking above $4,400 per ounce and extending one of the most powerful rallies in years. This isn’t a fleeting headline grab — it’s a macro signal forming in real time. �

Today’s break above key levels reflects persistent demand from both institutional and safe-haven buyers, driven by a convergence of fundamental forces rather than short-term speculative flows. �

📊 Current Market Landscape — What’s Happening Now

Fresh ATH Break: Gold is trading above $4,400/oz, marking a

Gold has just surged to fresh record highs, breaking above $4,400 per ounce and extending one of the most powerful rallies in years. This isn’t a fleeting headline grab — it’s a macro signal forming in real time. �

Today’s break above key levels reflects persistent demand from both institutional and safe-haven buyers, driven by a convergence of fundamental forces rather than short-term speculative flows. �

📊 Current Market Landscape — What’s Happening Now

Fresh ATH Break: Gold is trading above $4,400/oz, marking a

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

Watching Closely 🔍️View More

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

HODL Tight 💪View More

LIGHT Rebound Attempt After Heavy Flush

Sharp sell-off swept liquidity down to 0.81, followed by a fast bounce. Price is now stabilizing above short-term MAs, showing buyers stepping in after panic selling. This looks like a relief move first continuation only if momentum holds above intraday resistance.

🟢 Buy Zone: 0.88 – 0.91

🎯 TP1: 0.95

🎯 TP2: 1.00

🎯 TP3: 1.08

Stop: 0.83

Trade it light — volatility is still elevated after such a deep drop.

$LIGHT #light

Sharp sell-off swept liquidity down to 0.81, followed by a fast bounce. Price is now stabilizing above short-term MAs, showing buyers stepping in after panic selling. This looks like a relief move first continuation only if momentum holds above intraday resistance.

🟢 Buy Zone: 0.88 – 0.91

🎯 TP1: 0.95

🎯 TP2: 1.00

🎯 TP3: 1.08

Stop: 0.83

Trade it light — volatility is still elevated after such a deep drop.

$LIGHT #light

LIGHT-0,63%

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

Christmas Bull Run! 🐂#BTC is trading in a tight range after the recent sell-off. Selling pressure has slowed, but buyers still haven’t shown enough strength for a clean rebound. This looks like a pause, not a reversal yet — patience matters here. Let price show intent before taking fresh risk.

#BTC $BTC

#BTC $BTC

BTC-0,64%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

Christmas to the Moon! 🌕View More

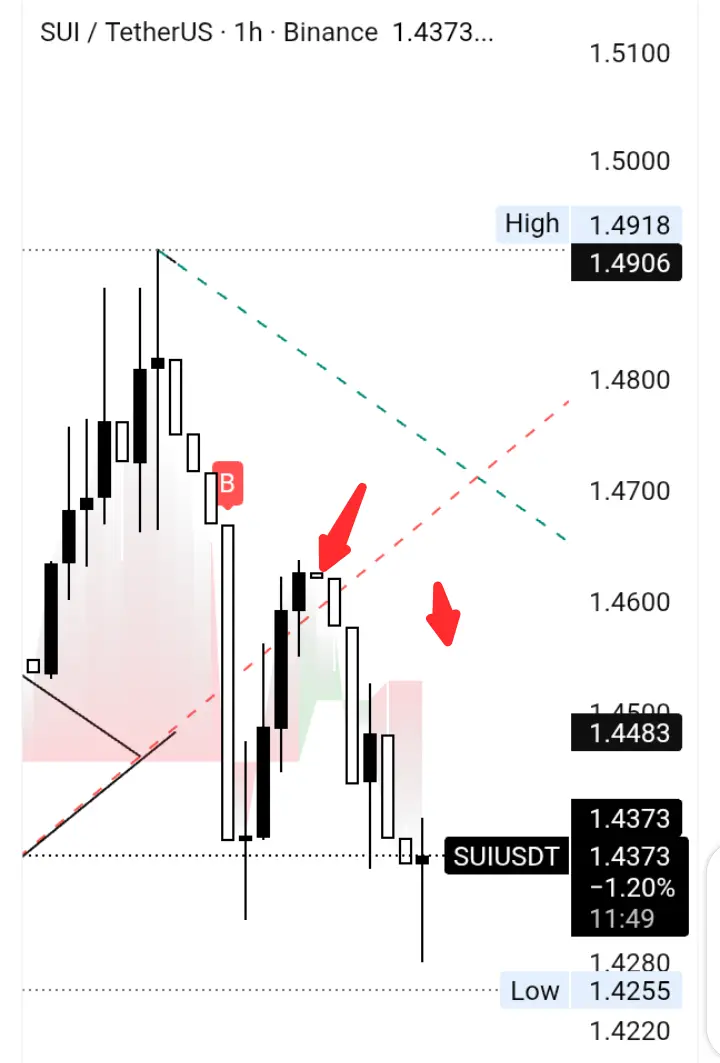

#SUI Tests Support Amid Inflows

SUI is trading around $1.42 (-2.15%), leaning on that $1.43 area like it actually matters. What’s interesting is the split personality here: price is soft, but large-order inflows in the last stretch hint that someone’s still building a position. Just keep one eye on the risk side — crowded longs can turn a small dip into a quick flush.

The bigger headline is institutional: Bitwise filed an S-1 for a spot SUI ETF. That doesn’t pump price overnight, but it does raise the ceiling on future liquidity and demand if this track keeps moving.

On-chain, SUI’s usage pic

SUI is trading around $1.42 (-2.15%), leaning on that $1.43 area like it actually matters. What’s interesting is the split personality here: price is soft, but large-order inflows in the last stretch hint that someone’s still building a position. Just keep one eye on the risk side — crowded longs can turn a small dip into a quick flush.

The bigger headline is institutional: Bitwise filed an S-1 for a spot SUI ETF. That doesn’t pump price overnight, but it does raise the ceiling on future liquidity and demand if this track keeps moving.

On-chain, SUI’s usage pic

SUI-2,45%

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

Merry Christmas ⛄- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

The Fed’s Pivot: December 2025 Rate Cuts and the Road to 2026

A Turning Point in U.S. Monetary Policy

The December 9–10 FOMC meeting closes a year defined by a controlled pivot from restrictive monetary policy to early-cycle easing. After two 25-basis-point cuts in September and October, markets expect a third in December, placing the federal funds rate at 3.50%–3.75%.

The Fed’s objective has shifted: preserve labor market stability while finishing the disinflation process without reigniting price pressure. With growth cooling from post-pandemic highs and early stress appearing in employme

A Turning Point in U.S. Monetary Policy

The December 9–10 FOMC meeting closes a year defined by a controlled pivot from restrictive monetary policy to early-cycle easing. After two 25-basis-point cuts in September and October, markets expect a third in December, placing the federal funds rate at 3.50%–3.75%.

The Fed’s objective has shifted: preserve labor market stability while finishing the disinflation process without reigniting price pressure. With growth cooling from post-pandemic highs and early stress appearing in employme

BTC-0,64%

- Reward

- 1

- Comment

- Repost

- Share

#GLM — Trendline Rejection Signals Bearish Continuation 🔻📉

GLM is rejecting the descending trendline after multiple failed attempts to break above 0.22949, showing sellers still in strong control. Price is now turning down from the upper rejection zone, confirming bearish momentum. Lower highs continue forming, and momentum is shifting back into seller territory.

$GLM

If price stays below 0.22590, bearish continuation remains valid toward lower support levels. Trend stays bearish unless buyers reclaim the breakdown zone.

🔻 Entry Zone (Short)

0.22590 – 0.22530

🎯 Downside Targets

• 0.22380

GLM is rejecting the descending trendline after multiple failed attempts to break above 0.22949, showing sellers still in strong control. Price is now turning down from the upper rejection zone, confirming bearish momentum. Lower highs continue forming, and momentum is shifting back into seller territory.

$GLM

If price stays below 0.22590, bearish continuation remains valid toward lower support levels. Trend stays bearish unless buyers reclaim the breakdown zone.

🔻 Entry Zone (Short)

0.22590 – 0.22530

🎯 Downside Targets

• 0.22380

GLM-2,32%

- Reward

- 1

- Comment

- Repost

- Share