CryptoZeno

No content yet

CryptoZeno

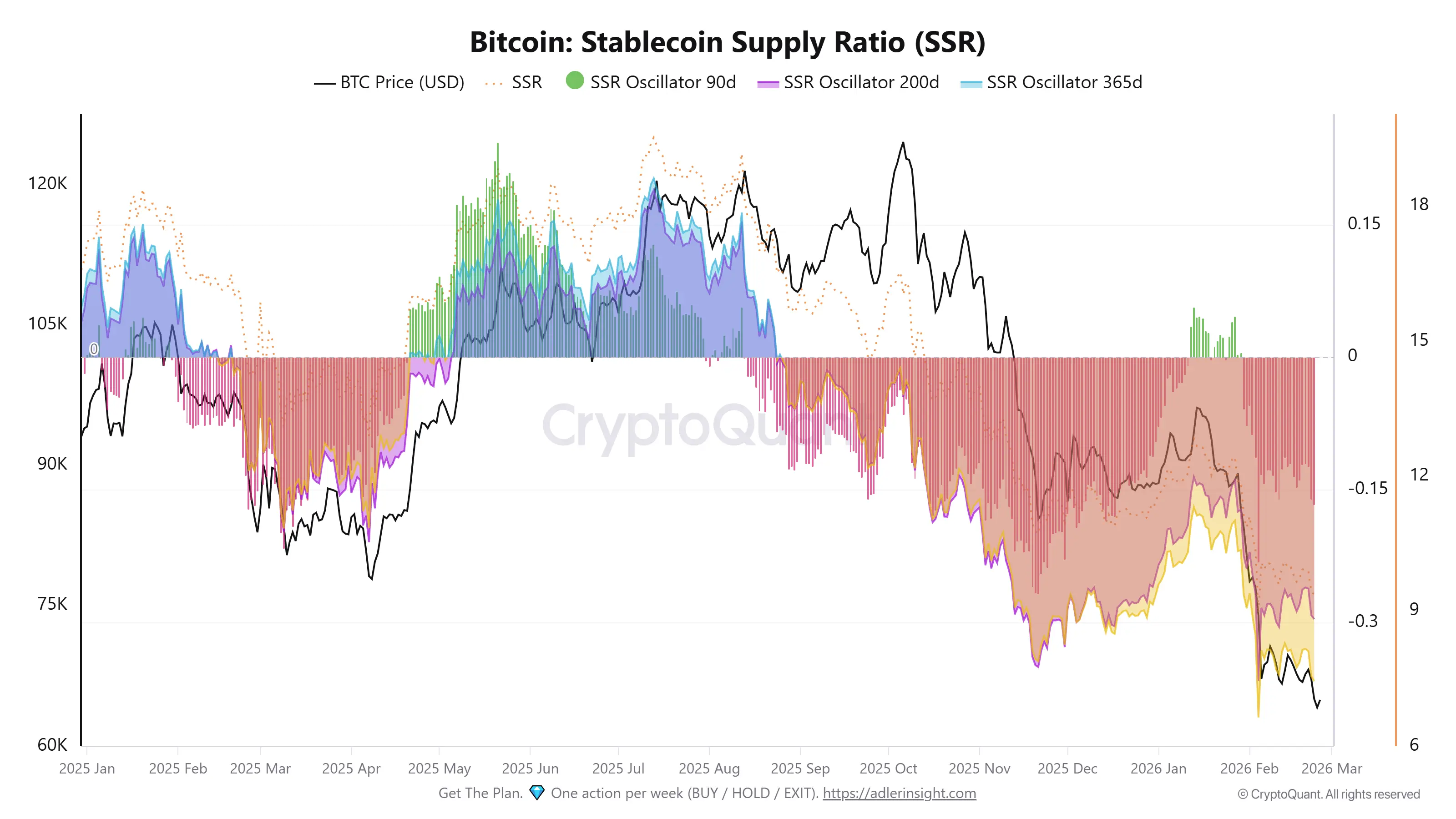

$BTC Under Structural Pressure as Stablecoin Liquidity Remains on the SidelinesBitcoin continues to trade under structural pressure as the Stablecoin Supply Ratio holds in a prolonged negative regime across the 90-day, 200-day and 365-day oscillators. After peaking above 120K mid-year, price shifted from expansion to contraction, forming successive lower highs into Q4 and early Q1. The decisive break below the zero line marked a structural change in liquidity conditions rather than a brief fluctuation.

A compressed SSR signals that stablecoin supply is relatively large compared to Bitcoin mark

A compressed SSR signals that stablecoin supply is relatively large compared to Bitcoin mark

BTC-1,69%

- Reward

- 2

- Comment

- Repost

- Share

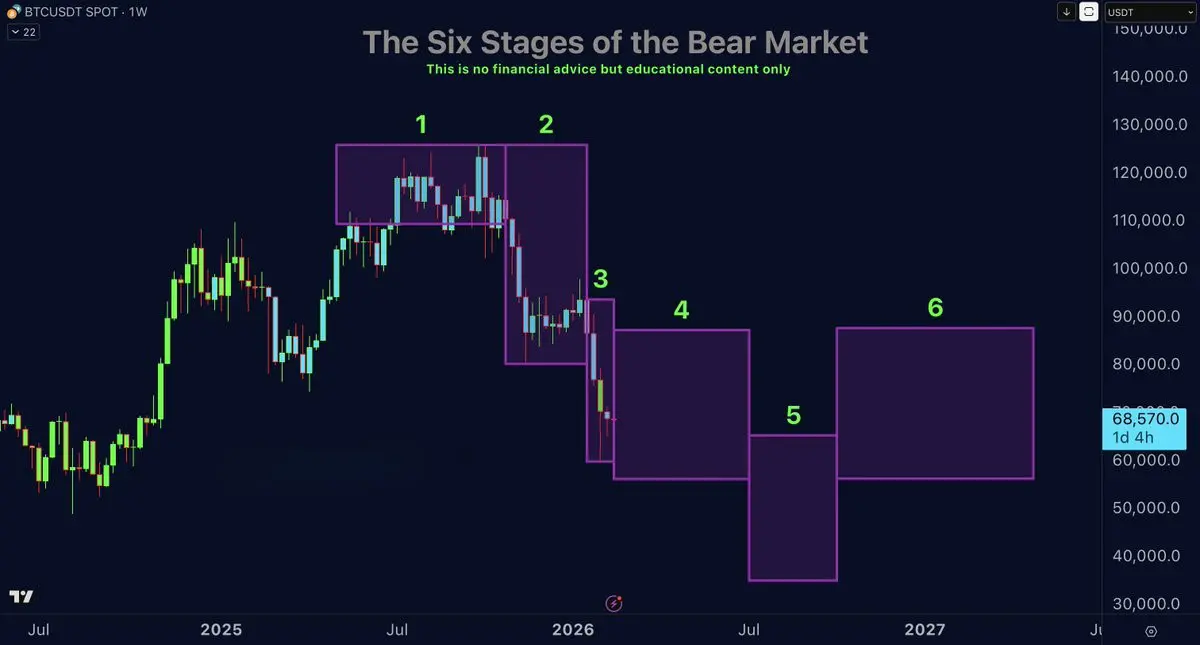

#BTC Bear Market Blueprint: Stage 4 Psychological Trap Before Final Flush

$BTC is currently in Stage 4 of my 6 stage bear market framework, built from observing every major cycle. The structure repeats because liquidity mechanics, leverage positioning and human psychology repeat.

Stage 1 was euphoria between 115k and 125k. Extreme greed, insane upside targets and heavy leverage.

Stage 2 began with the loss of 100k, a key psychological level. The breakdown was fast and unforgiving, triggering massive liquidations.

Stage 3 delivered the most brutal move. From 97k to 60k in 30 days, nearly 50 pe

$BTC is currently in Stage 4 of my 6 stage bear market framework, built from observing every major cycle. The structure repeats because liquidity mechanics, leverage positioning and human psychology repeat.

Stage 1 was euphoria between 115k and 125k. Extreme greed, insane upside targets and heavy leverage.

Stage 2 began with the loss of 100k, a key psychological level. The breakdown was fast and unforgiving, triggering massive liquidations.

Stage 3 delivered the most brutal move. From 97k to 60k in 30 days, nearly 50 pe

BTC-1,69%

- Reward

- 2

- Comment

- Repost

- Share

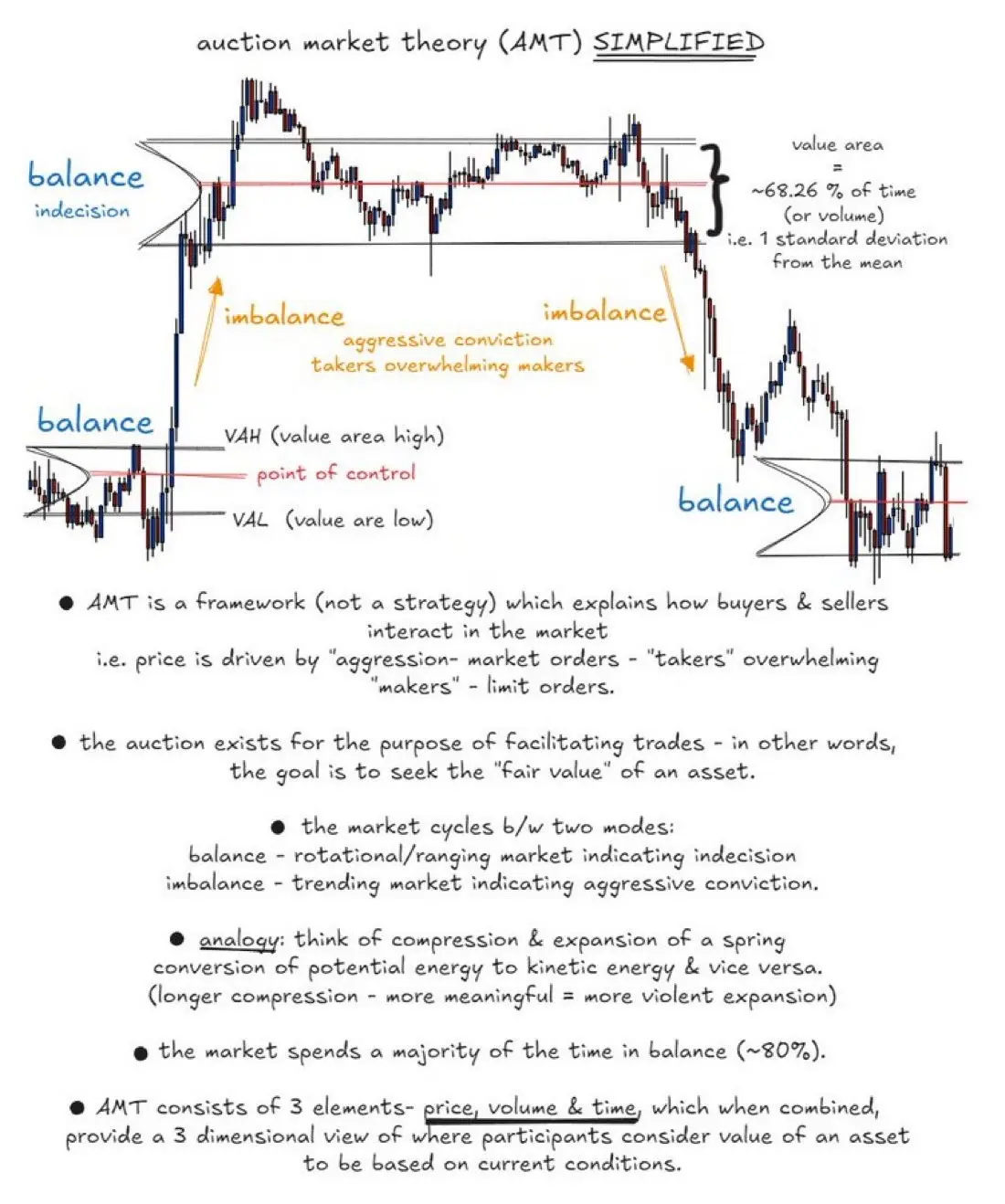

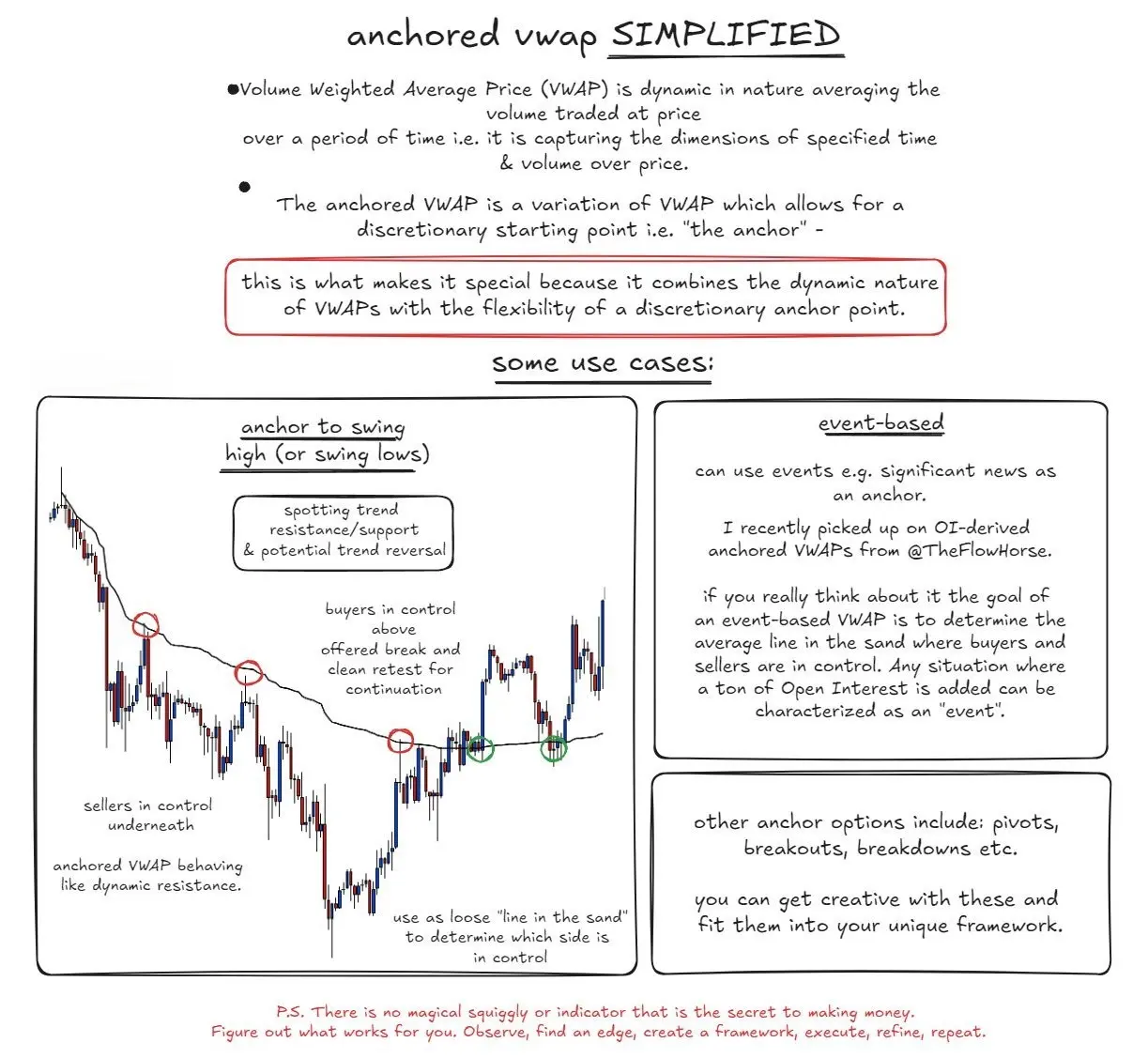

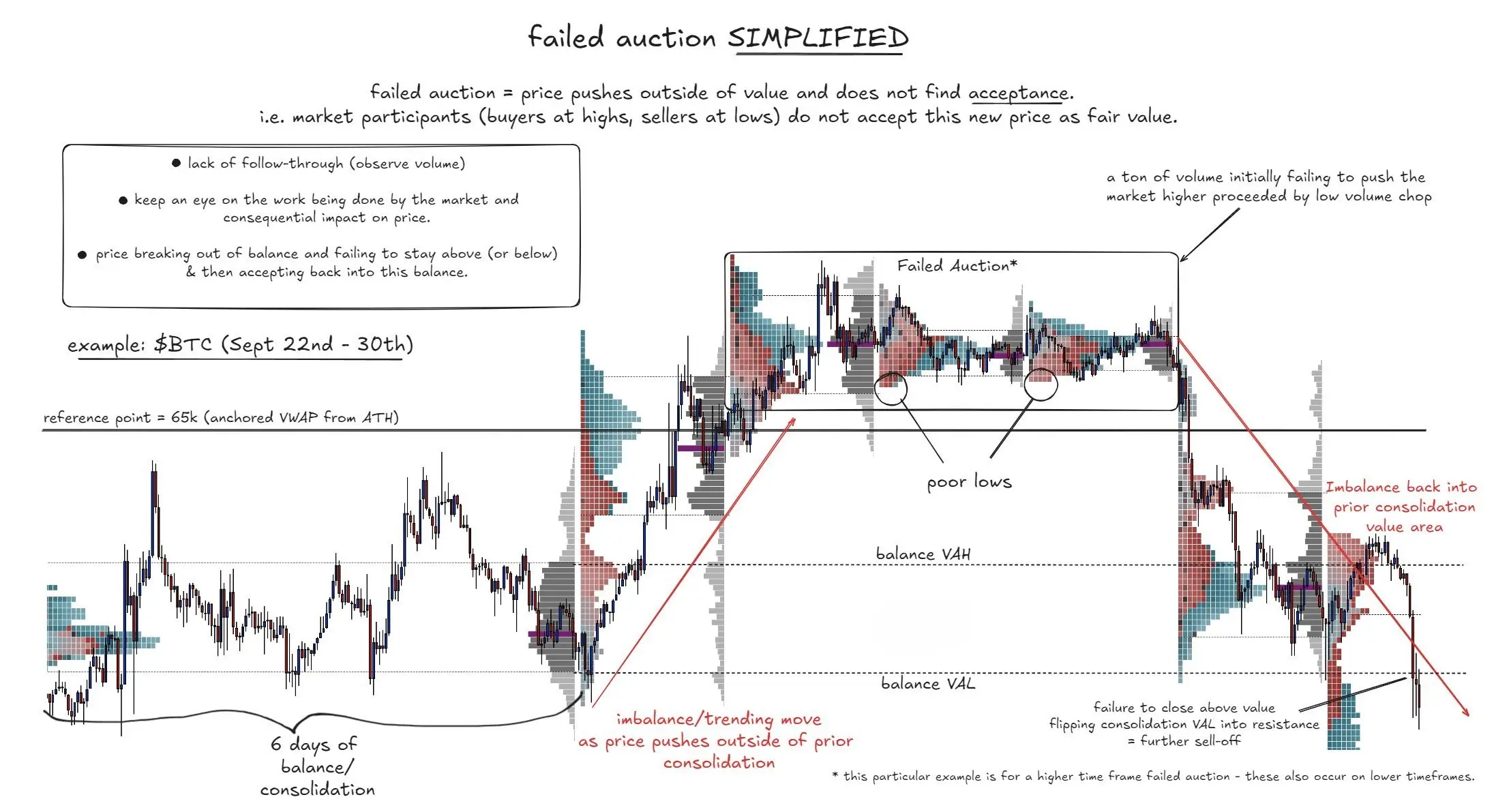

Auction Market Theory + Anchored VWAP + Failed Auction - The Complete Framework

Most traders look at indicators. Professionals study the auction.

Image 1 breaks down Auction Market Theory. Markets rotate between balance and imbalance. Balance is acceptance, rotation, fair value discovery. Imbalance is aggression, when market orders overwhelm passive liquidity and price expands with conviction. Nearly 70 to 80 percent of the time price is in balance. Expansion only happens after compression. The longer the balance, the more violent the move when value shifts

Image 2 shows how Anchored VWAP fit

Most traders look at indicators. Professionals study the auction.

Image 1 breaks down Auction Market Theory. Markets rotate between balance and imbalance. Balance is acceptance, rotation, fair value discovery. Imbalance is aggression, when market orders overwhelm passive liquidity and price expands with conviction. Nearly 70 to 80 percent of the time price is in balance. Expansion only happens after compression. The longer the balance, the more violent the move when value shifts

Image 2 shows how Anchored VWAP fit

- Reward

- 1

- Comment

- Repost

- Share

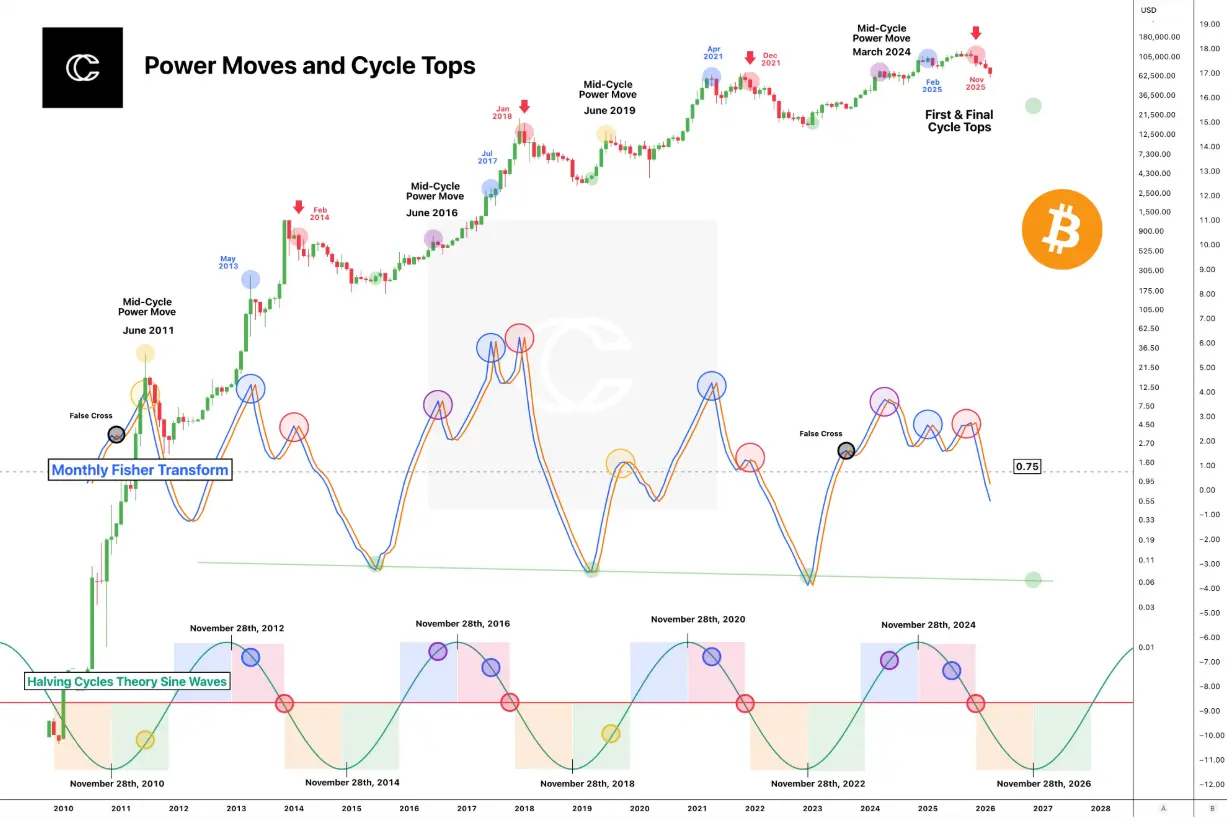

🚨 $BTC Entering Its Most Explosive Decision Zone of the Cycle

#Bitcoin is once again replicating the exact macro structure that preceded every historical cycle climax: a violent mid cycle expansion, momentum peaking at extreme levels, then subtle distribution before volatility expansion.

The Monthly Fisher Transform is now rolling over from the upper extreme band, the same technical behavior seen before the 2013, 2017 and 2021 tops. In each case, price continued pressing higher while momentum quietly weakened, forming clear bearish divergence before the real move unfolded. The danger is nev

#Bitcoin is once again replicating the exact macro structure that preceded every historical cycle climax: a violent mid cycle expansion, momentum peaking at extreme levels, then subtle distribution before volatility expansion.

The Monthly Fisher Transform is now rolling over from the upper extreme band, the same technical behavior seen before the 2013, 2017 and 2021 tops. In each case, price continued pressing higher while momentum quietly weakened, forming clear bearish divergence before the real move unfolded. The danger is nev

BTC-1,69%

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

good luck everyone View More

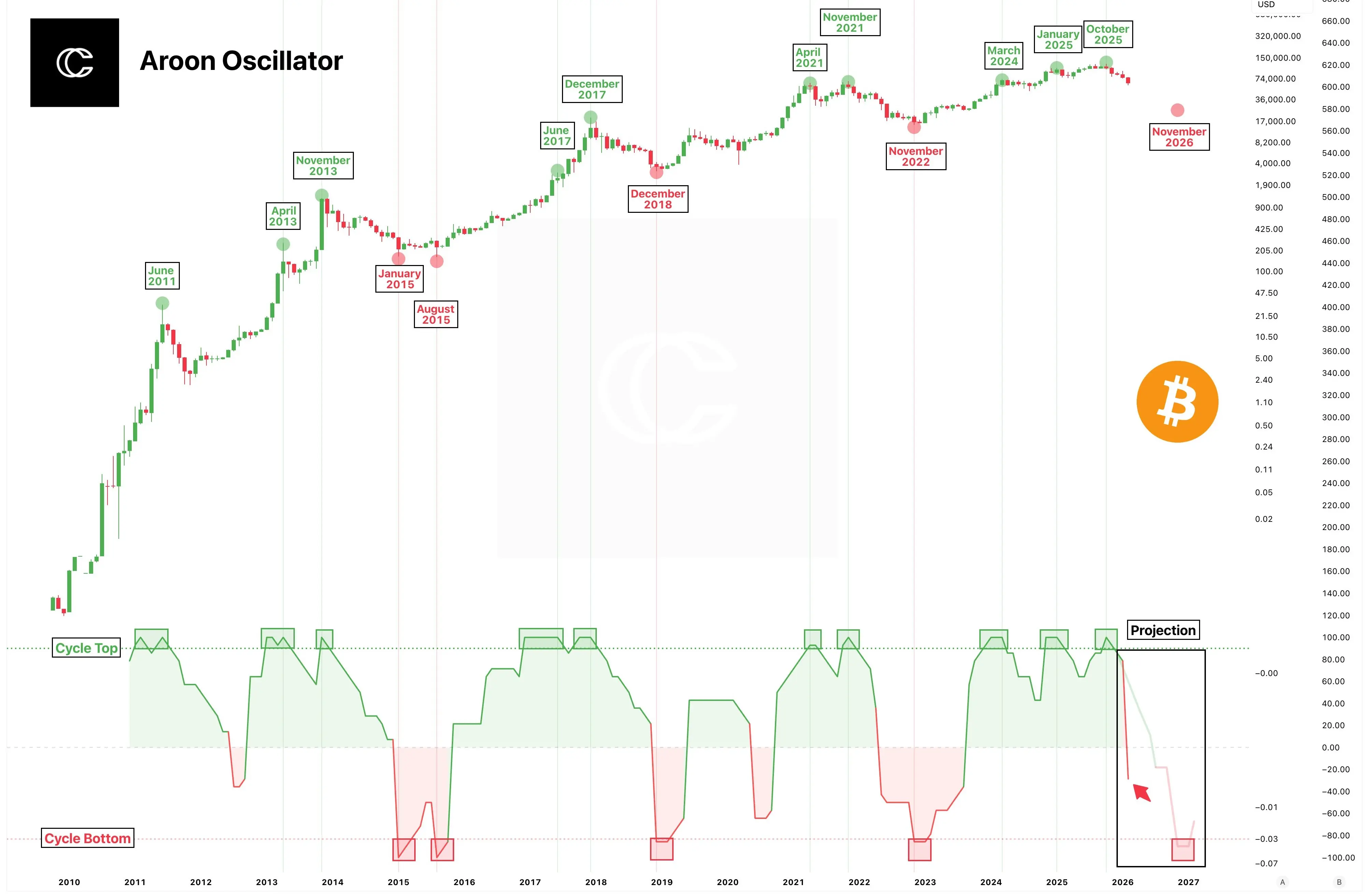

⚡ $BTC Aroon Oscillator Just Flashed a Structural Warning

The macro Aroon Oscillator is rolling over from the cycle top zone, a signal that historically aligned with major distribution phases in 2013, 2017, and 2021. Each peak formed as upside momentum stalled while Aroon Up dominance faded and Aroon Down began expanding beneath the zero line.

We are now seeing the same transition. Momentum compression near highs, weakening trend persistence, and early downside acceleration suggest the market may be entering the late bull to distribution phase.

If the oscillator confirms a sustained move into

The macro Aroon Oscillator is rolling over from the cycle top zone, a signal that historically aligned with major distribution phases in 2013, 2017, and 2021. Each peak formed as upside momentum stalled while Aroon Up dominance faded and Aroon Down began expanding beneath the zero line.

We are now seeing the same transition. Momentum compression near highs, weakening trend persistence, and early downside acceleration suggest the market may be entering the late bull to distribution phase.

If the oscillator confirms a sustained move into

BTC-1,69%

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

good luck everyone View More

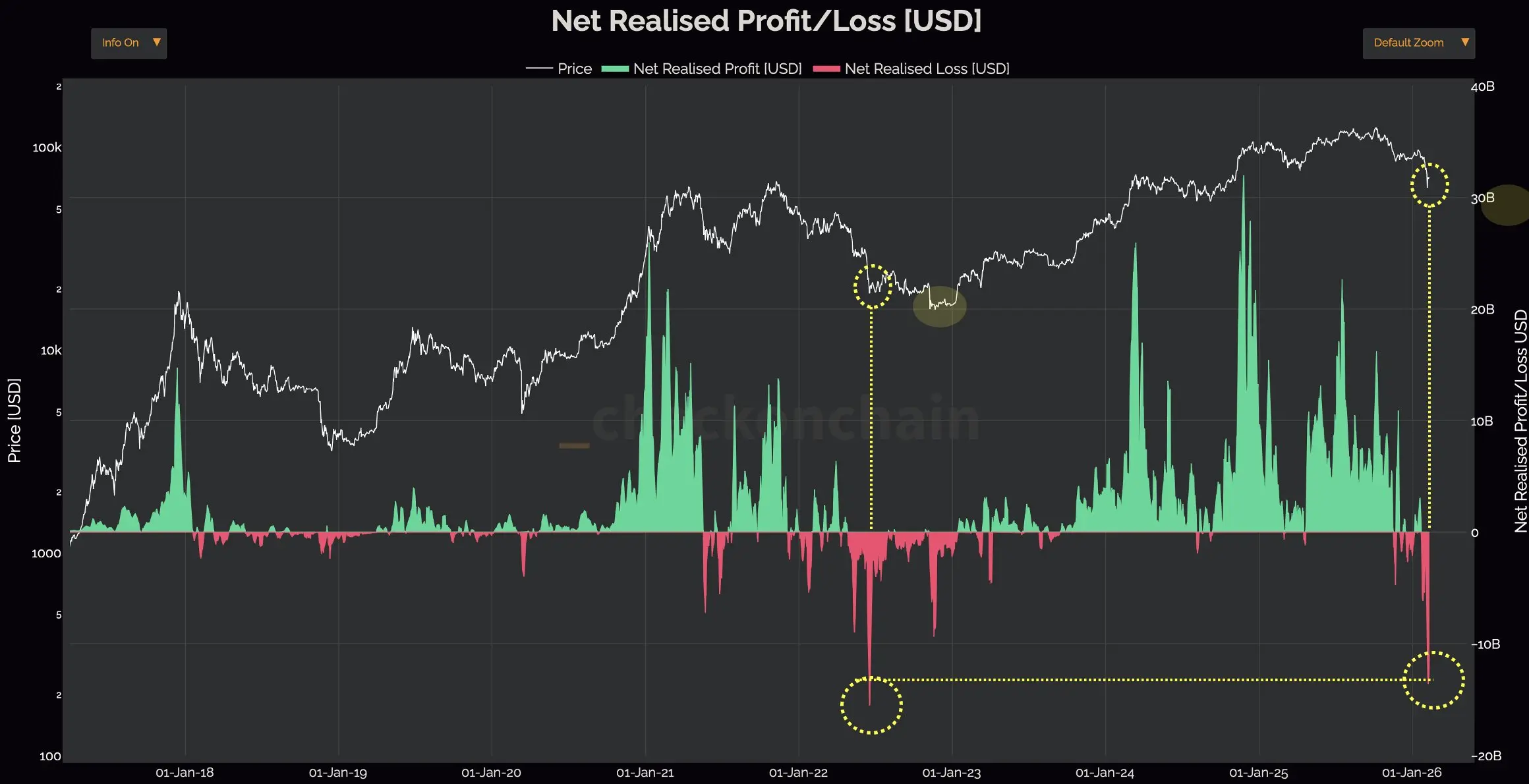

🚨 $BTC at a Critical Inflection Point: Profit Euphoria vs Capitulation ShockNet Realized Profit/Loss is flashing a high tension signal right at elevated price structureRealized profits recently surged toward extreme historical bands, echoing prior late cycle distribution phases. When green spikes expand aggressively while price grinds near highs, it typically reflects strategic profit taking rather than fresh impulsive accumulationThe latest sharp red print marks one of the deepest realized loss events since the 2022 capitulation. Such violent downside spikes historically occur during liquidi

BTC-1,69%

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

good luck everyone View More

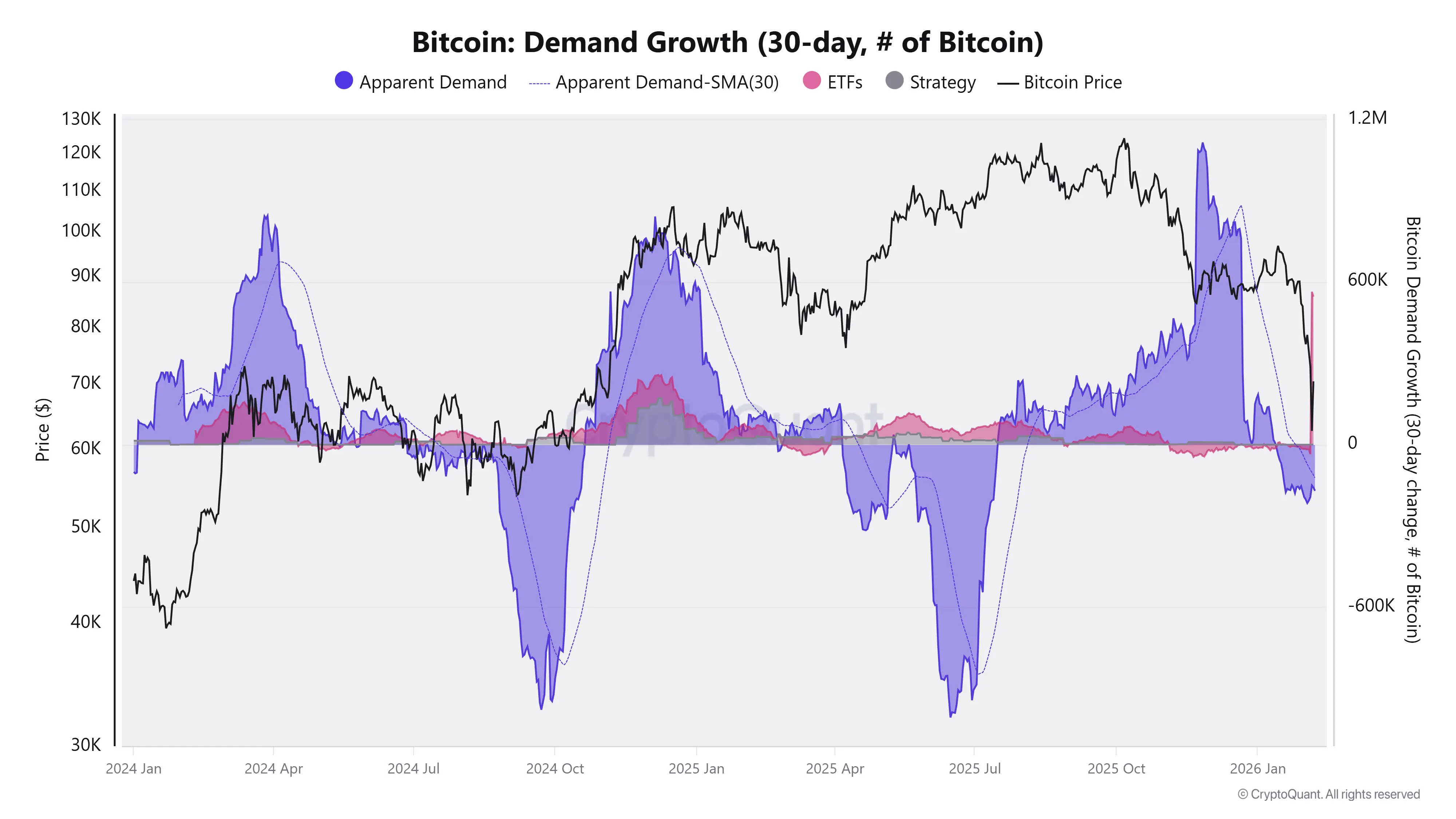

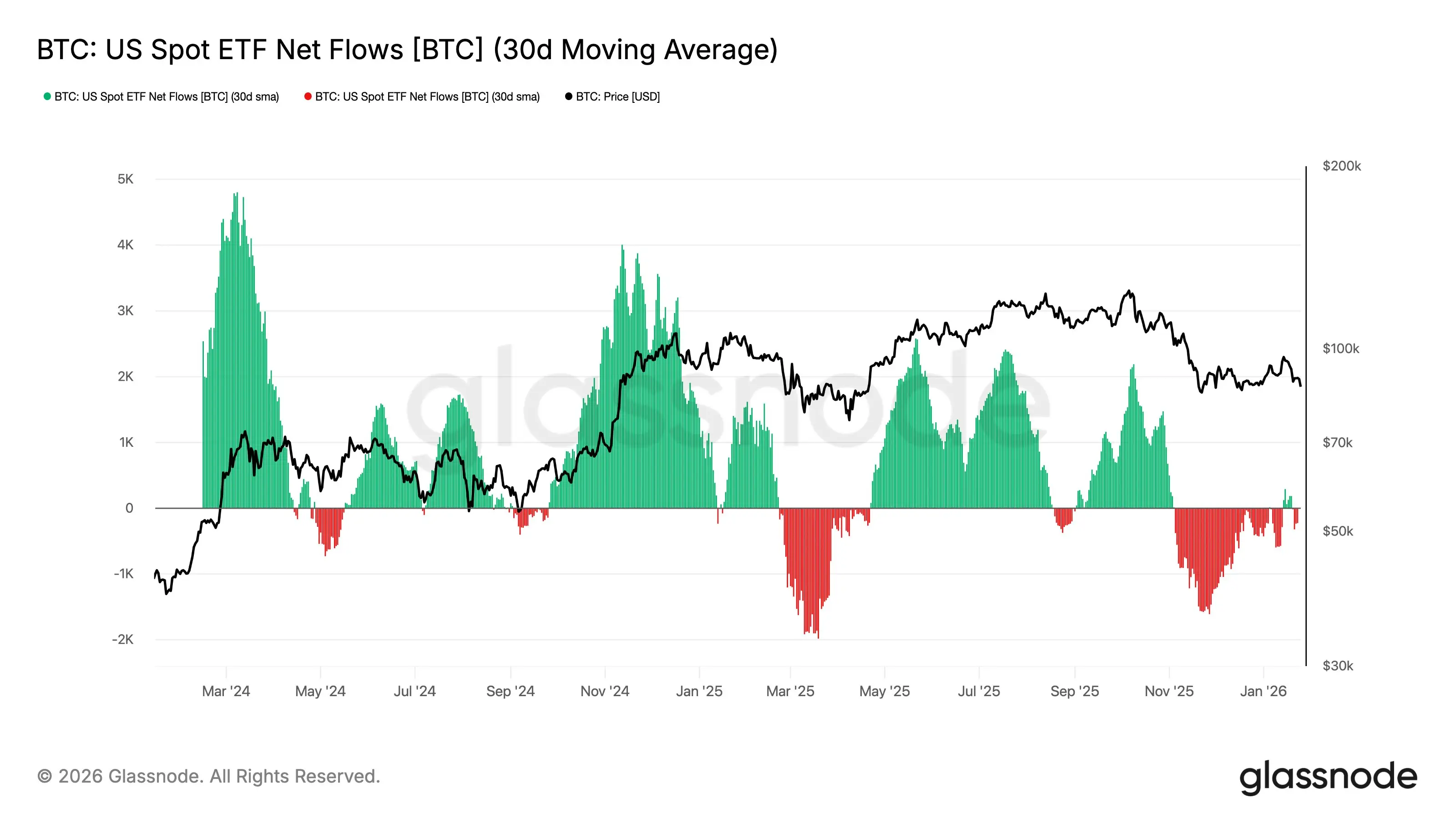

ETF Outflows Reshape Institutional Demand Dynamics

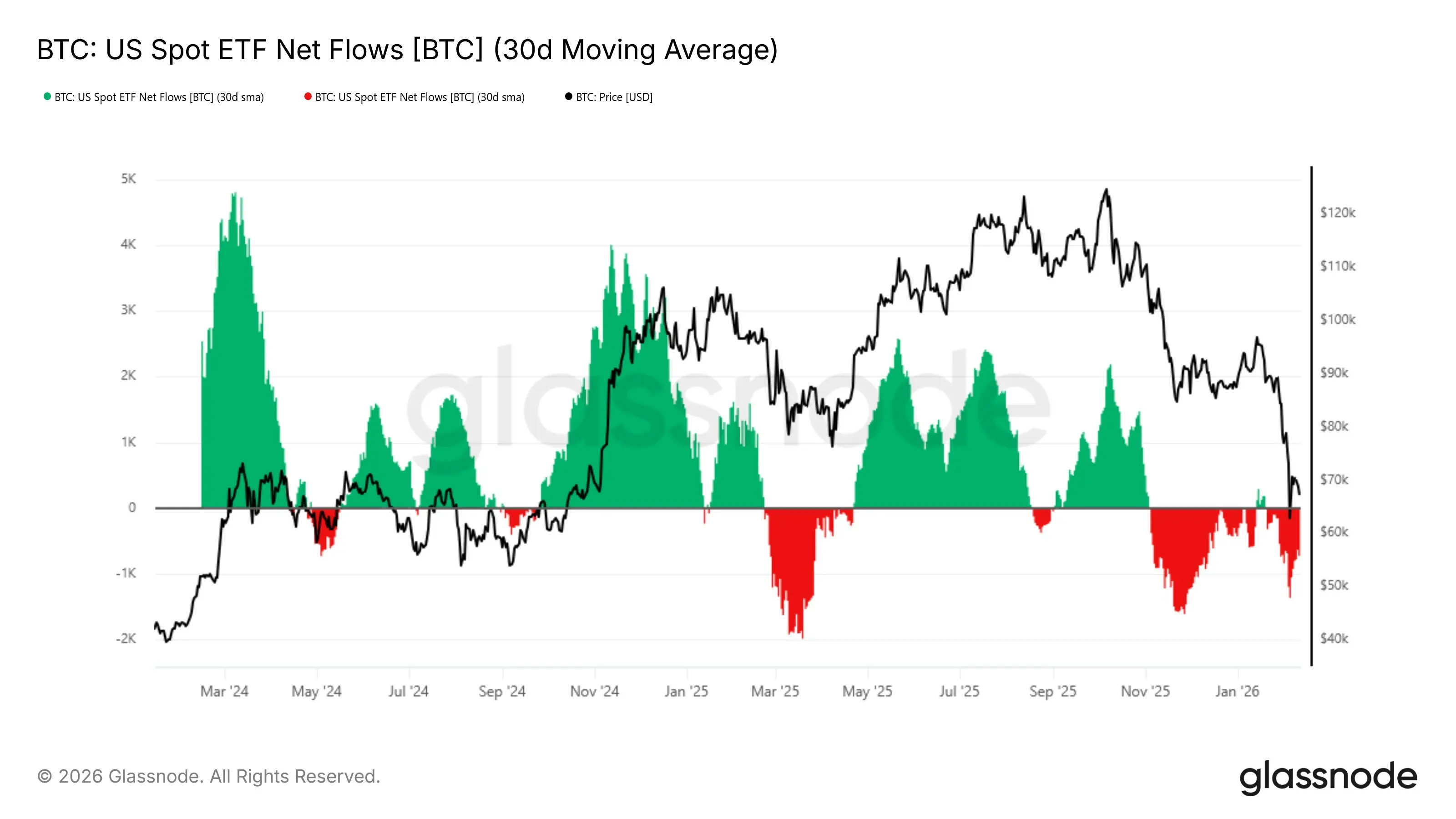

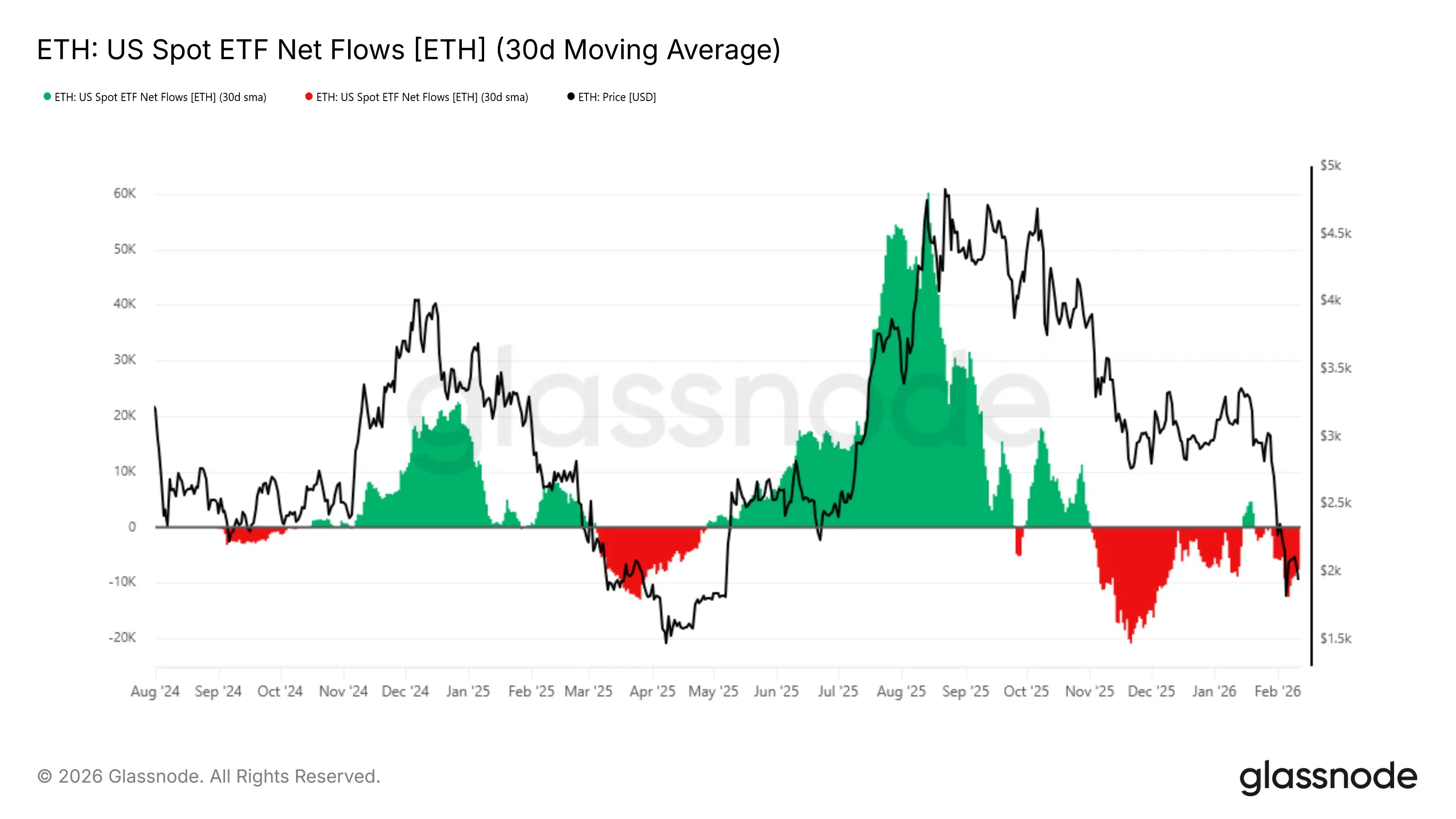

Recent on-chain data tracking the 30-day moving average of US Spot ETF net flows highlights a clear deterioration in institutional demand across both $BTC and $ETH , signaling a shift in the macro liquidity backdrop supporting crypto markets.

For #Bitcoin, ETF inflows that previously sustained the 2024–2025 expansion have faded, with flows now turning persistently negative. This reversal coincides with BTC retracement from the $100k+ region, suggesting that institutional capital is no longer providing the same absorptive buy-side pressure. Hi

Recent on-chain data tracking the 30-day moving average of US Spot ETF net flows highlights a clear deterioration in institutional demand across both $BTC and $ETH , signaling a shift in the macro liquidity backdrop supporting crypto markets.

For #Bitcoin, ETF inflows that previously sustained the 2024–2025 expansion have faded, with flows now turning persistently negative. This reversal coincides with BTC retracement from the $100k+ region, suggesting that institutional capital is no longer providing the same absorptive buy-side pressure. Hi

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

good luck everyone View More

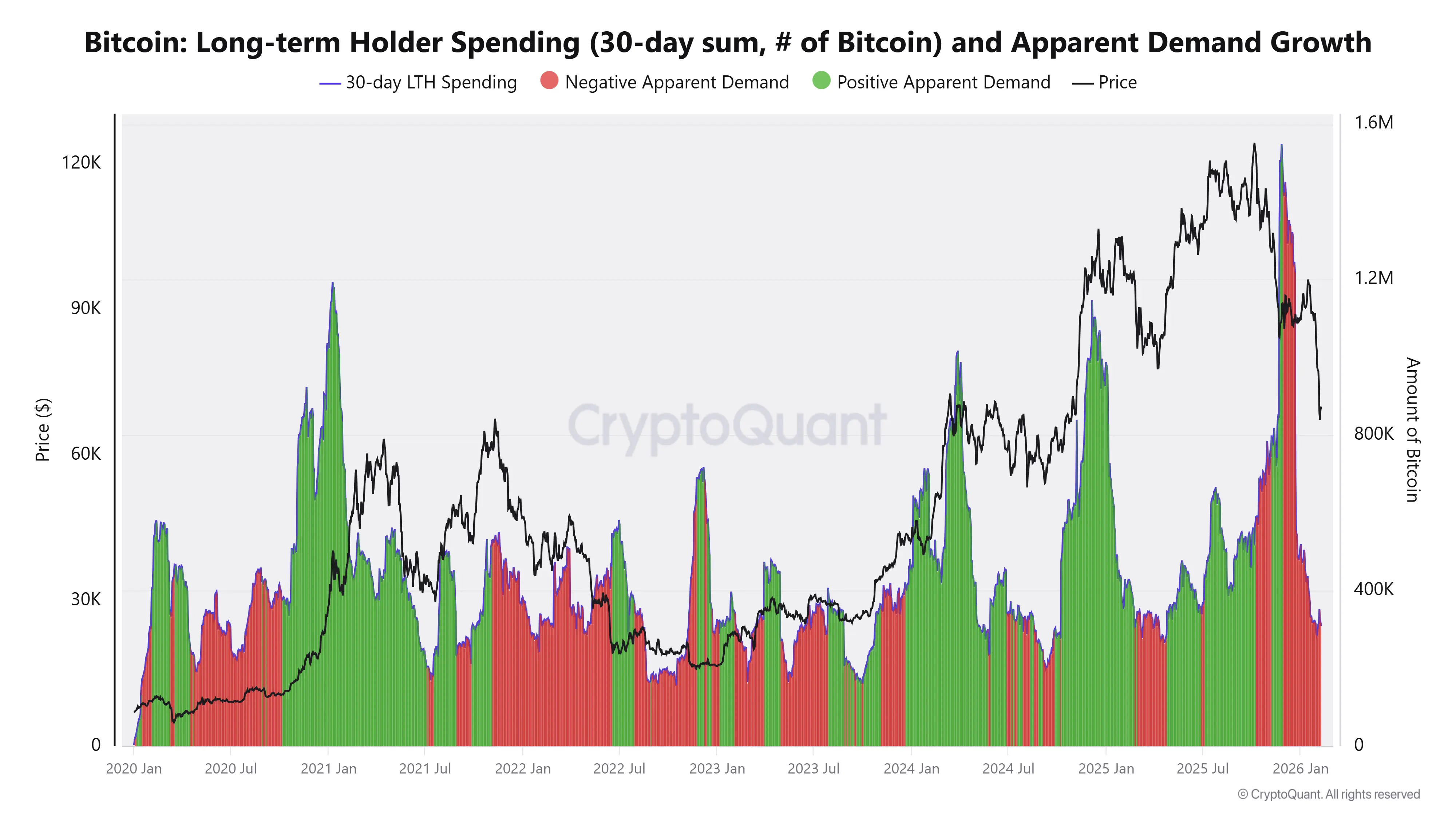

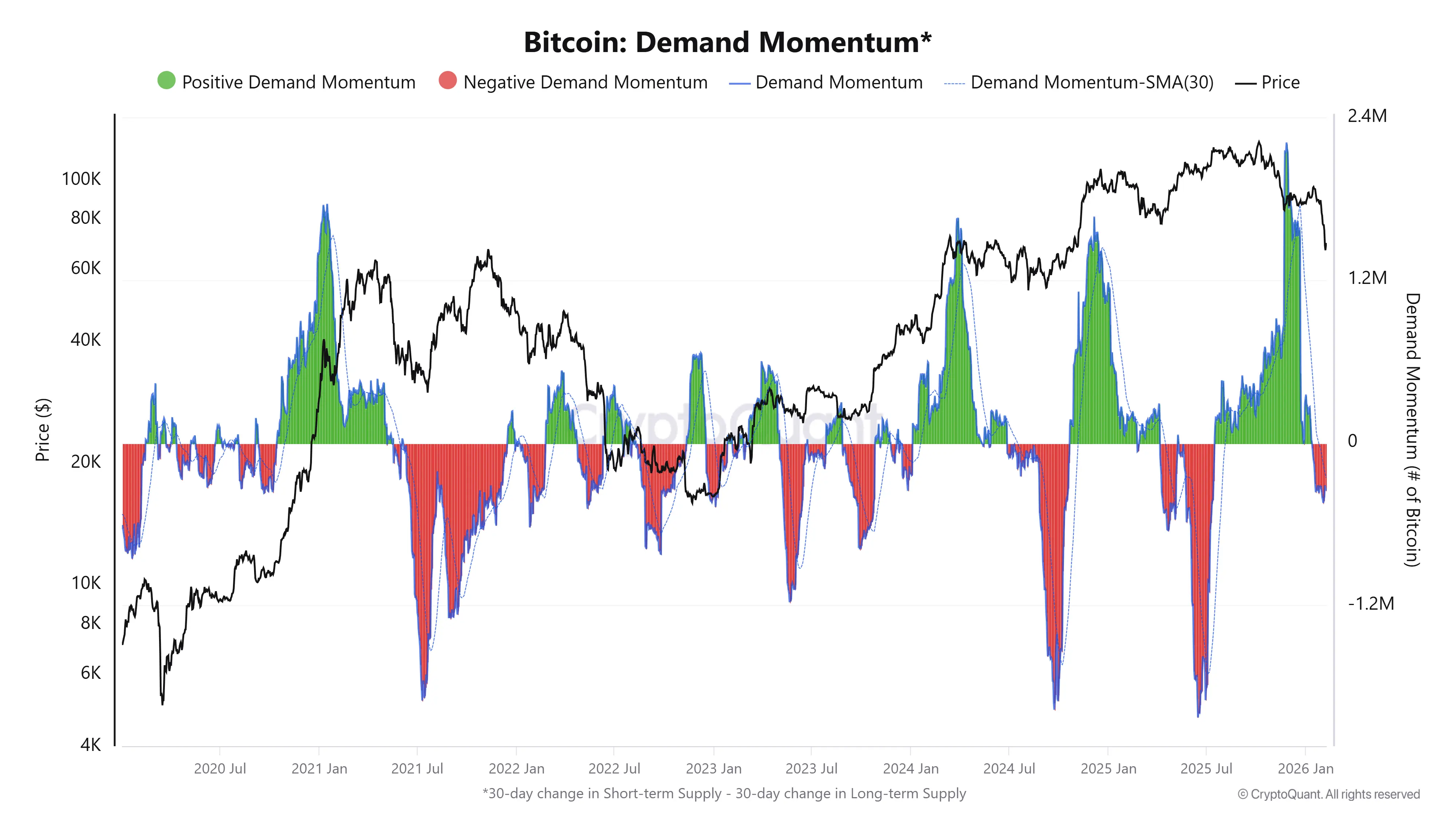

Rising Long-Term Holder Spending Meets Fading Demand - #Bitcoin Enters Redistribution Territory

On-chain data is beginning to reflect a structural shift as Long-Term Holder (LTH) spending accelerates sharply. The 30-day cumulative outflow from this cohort has climbed toward cycle highs, a pattern historically associated with late-stage bullish environments. Rather than accumulating, seasoned investors appear to be distributing into market strength, transferring supply to newer participants as price trades near elevated levels.

What makes the current setup more nuanced is the simultaneous deter

On-chain data is beginning to reflect a structural shift as Long-Term Holder (LTH) spending accelerates sharply. The 30-day cumulative outflow from this cohort has climbed toward cycle highs, a pattern historically associated with late-stage bullish environments. Rather than accumulating, seasoned investors appear to be distributing into market strength, transferring supply to newer participants as price trades near elevated levels.

What makes the current setup more nuanced is the simultaneous deter

BTC-1,69%

- Reward

- 2

- 2

- Repost

- Share

CryptoZeno :

:

good luck everyone View More

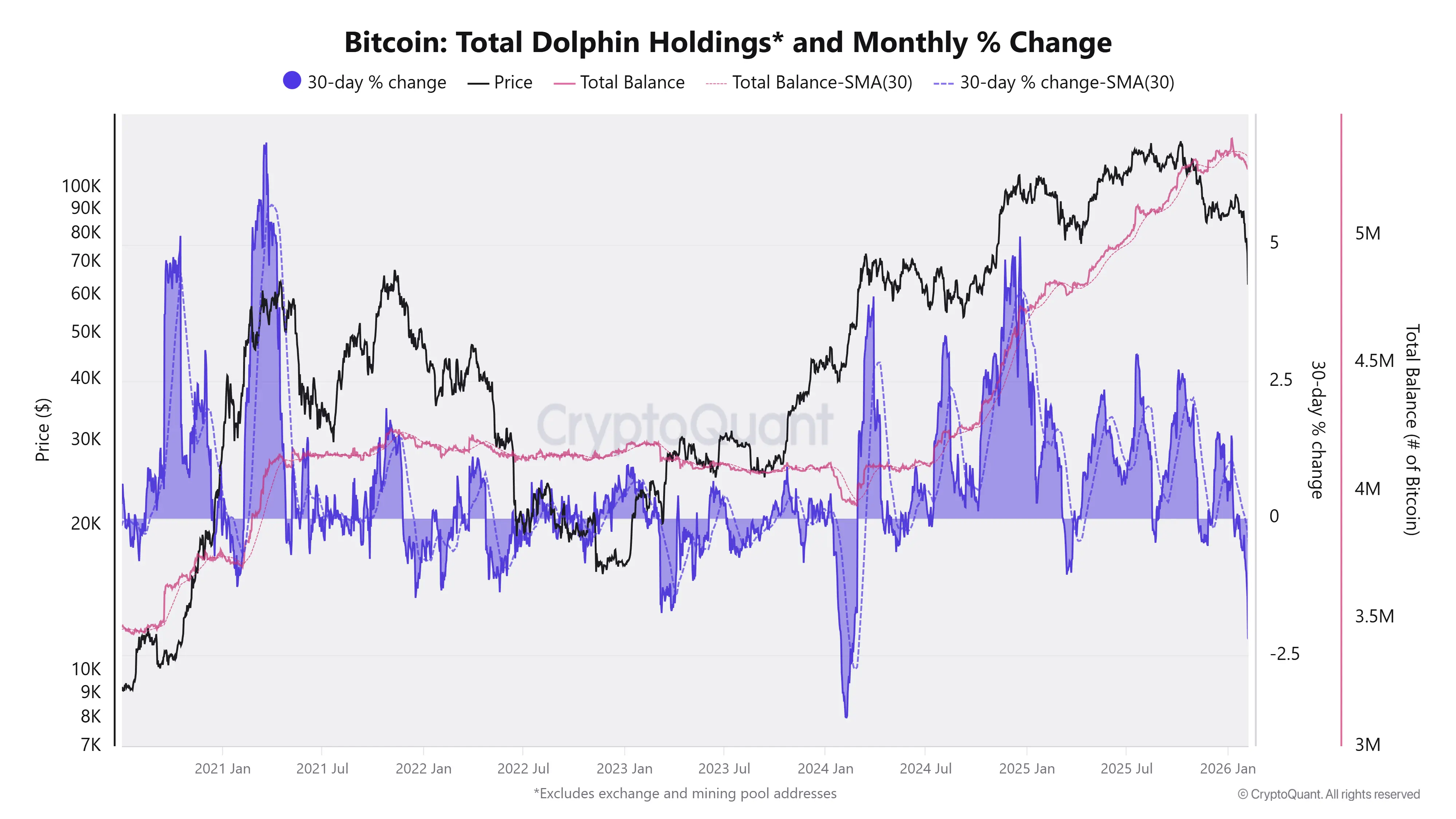

#Bitcoin Divergence Deepens as Dolphin Holdings Rise While Demand Growth Breaks DownBitcoin on-chain structure is showing a clear divergence between mid-sized holder positioning and broader market demand. Dolphin cohorts continue expanding their total $BTC balances, with holdings recently pressing toward new cycle highs despite weakening price momentum. The 30-day change in balances remains structurally positive, reinforcing that this group is still absorbing supply rather than distributing into strength.

However, the pace of accumulation is beginning to moderate. Monthly percentage change ac

However, the pace of accumulation is beginning to moderate. Monthly percentage change ac

BTC-1,69%

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

good luck everyone View More

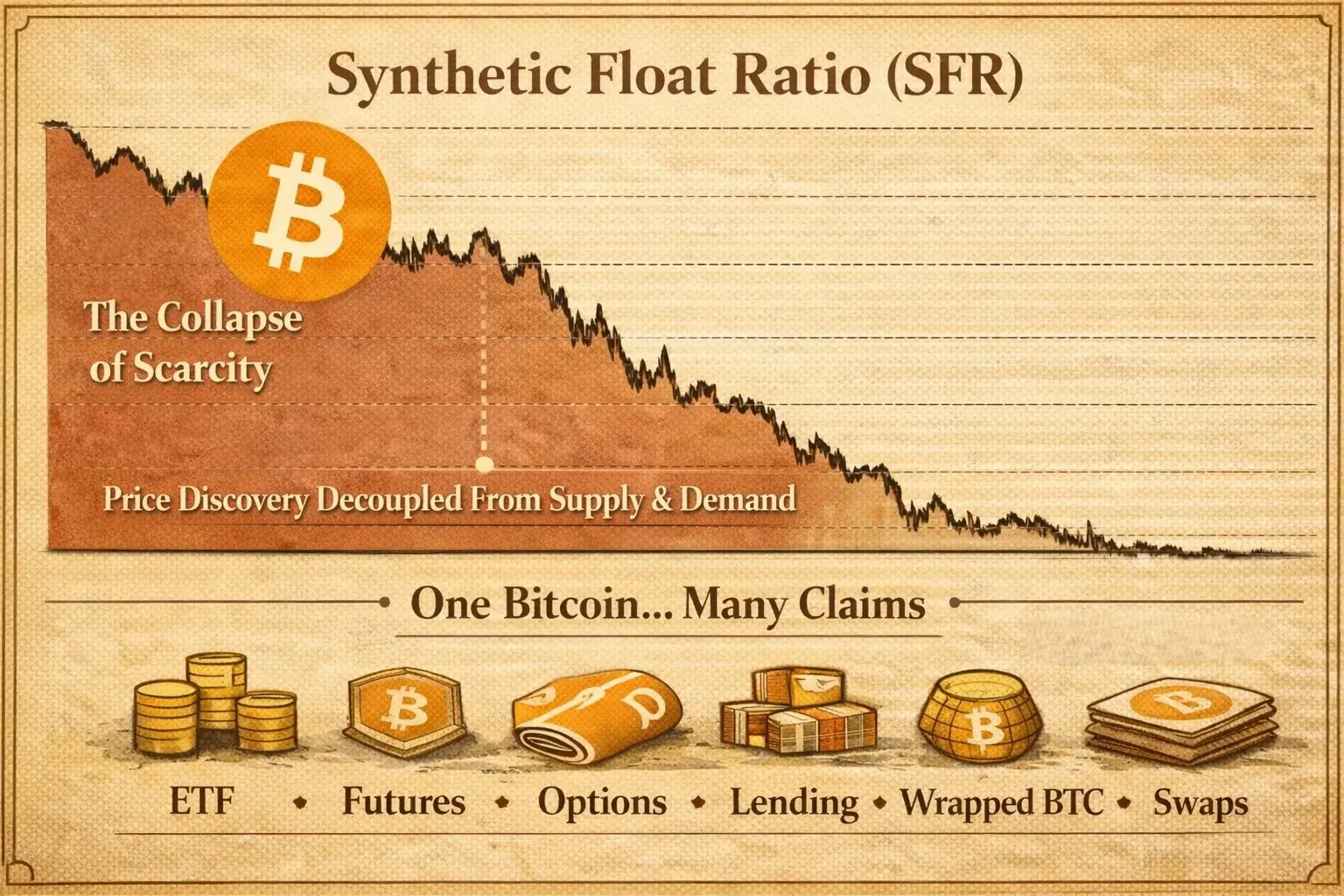

WHY BITCOIN IS BEING SOLD RELENTLESSLY - A TRUTH FEW ARE SEEING

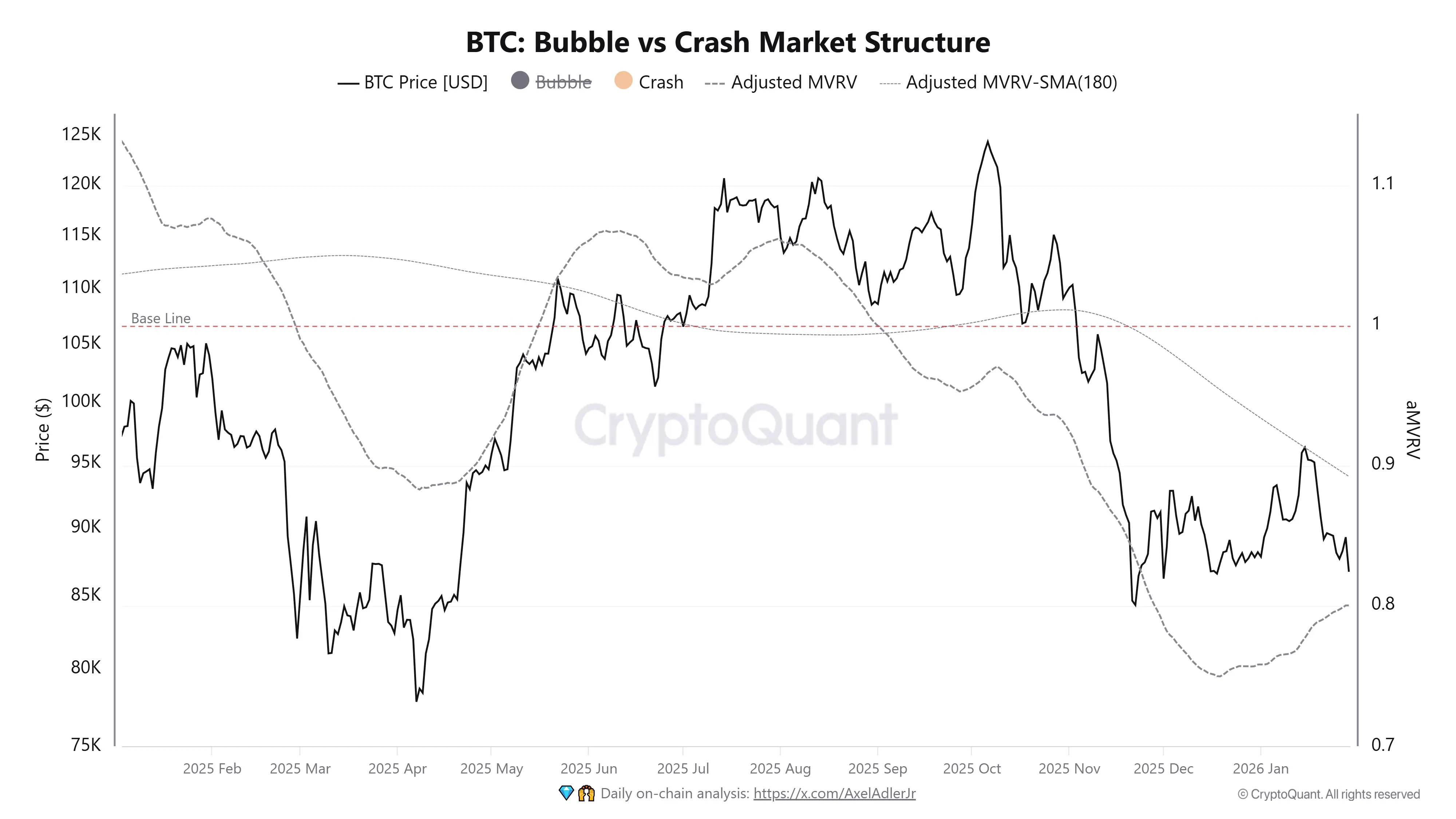

If Bitcoin were still trading as a pure supply-and-demand asset, the current price action would not make sense. What the market is experiencing is not sentiment-driven selling, not weak hands exiting, and not retail capitulation. It is the result of a structural shift in how Bitcoin is priced.

This shift has been building quietly for months and is now accelerating.

$BTC original valuation framework rested on two assumptions: a fixed supply capped at 21 million coins and the absence of rehypothecation. That framework effectively br

If Bitcoin were still trading as a pure supply-and-demand asset, the current price action would not make sense. What the market is experiencing is not sentiment-driven selling, not weak hands exiting, and not retail capitulation. It is the result of a structural shift in how Bitcoin is priced.

This shift has been building quietly for months and is now accelerating.

$BTC original valuation framework rested on two assumptions: a fixed supply capped at 21 million coins and the absence of rehypothecation. That framework effectively br

BTC-1,69%

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

good luck everyone View More

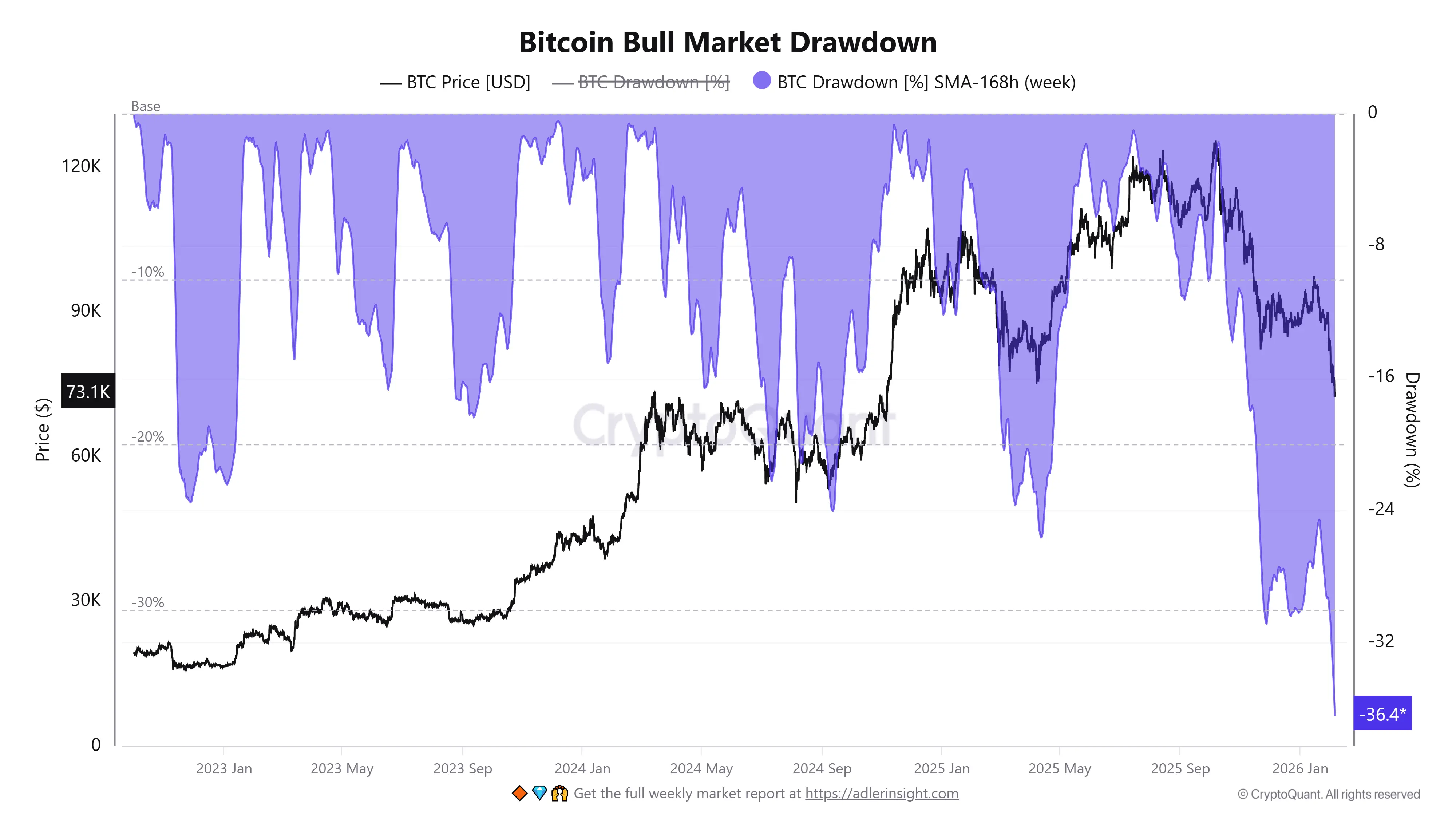

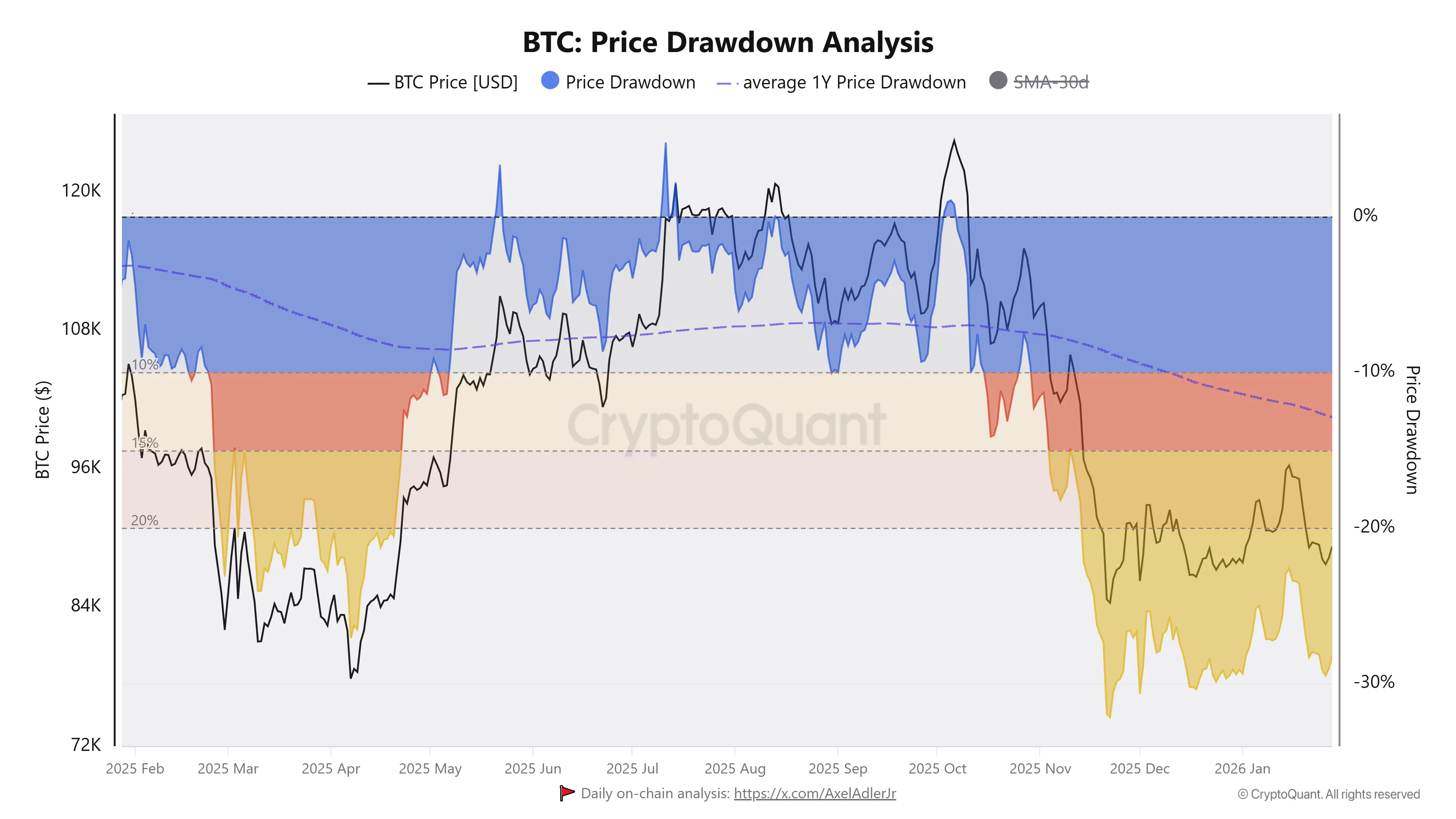

#Bitcoin Bull Market Corrections Deepen While On Chain Structure Remains Within Historical Range

Current on chain drawdown data shows $BTC has declined roughly 36% from its recent cycle high, marking one of the sharpest pullbacks of this bull phase. In isolation this magnitude appears severe, but historical cycle comparison suggests the correction remains structurally consistent with prior bull market behavior rather than signaling a confirmed macro top.

Previous expansion cycles regularly recorded interim drawdowns between 30% and 50%. Both the 2011 to 2015 and 2015 to 2017 bull markets expe

Current on chain drawdown data shows $BTC has declined roughly 36% from its recent cycle high, marking one of the sharpest pullbacks of this bull phase. In isolation this magnitude appears severe, but historical cycle comparison suggests the correction remains structurally consistent with prior bull market behavior rather than signaling a confirmed macro top.

Previous expansion cycles regularly recorded interim drawdowns between 30% and 50%. Both the 2011 to 2015 and 2015 to 2017 bull markets expe

BTC-1,69%

- Reward

- 2

- 3

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

#Bitcoin Social Sentiment Falls Into Extreme Fear, Mirroring Conditions Seen Near Previous Local Bottoms

$BTC social sentiment has continued to deteriorate, with negative commentary now overtaking positive discussions for the first time in nearly two months. Data from Santiment shows that bearish narratives are once again dominating social media, pushing market psychology into an “extreme fear” zone similar to levels observed during early and late November.

Those prior sentiment spikes coincided with periods of intense uncertainty and widespread retail capitulation, which ultimately aligned w

$BTC social sentiment has continued to deteriorate, with negative commentary now overtaking positive discussions for the first time in nearly two months. Data from Santiment shows that bearish narratives are once again dominating social media, pushing market psychology into an “extreme fear” zone similar to levels observed during early and late November.

Those prior sentiment spikes coincided with periods of intense uncertainty and widespread retail capitulation, which ultimately aligned w

BTC-1,69%

- Reward

- 1

- 3

- Repost

- Share

ZongJing :

:

Hold on tight, we're about to take off 🛫View More

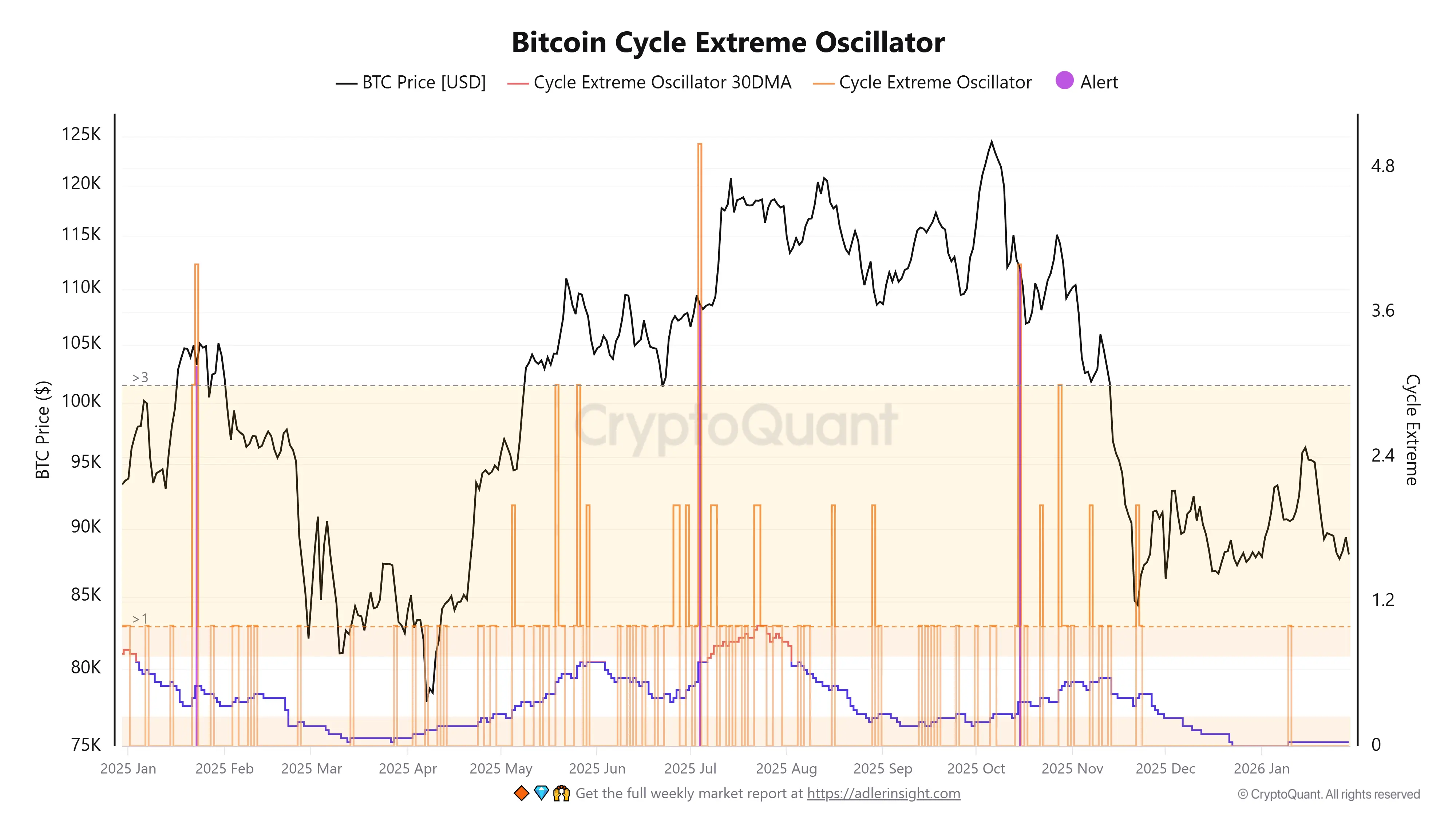

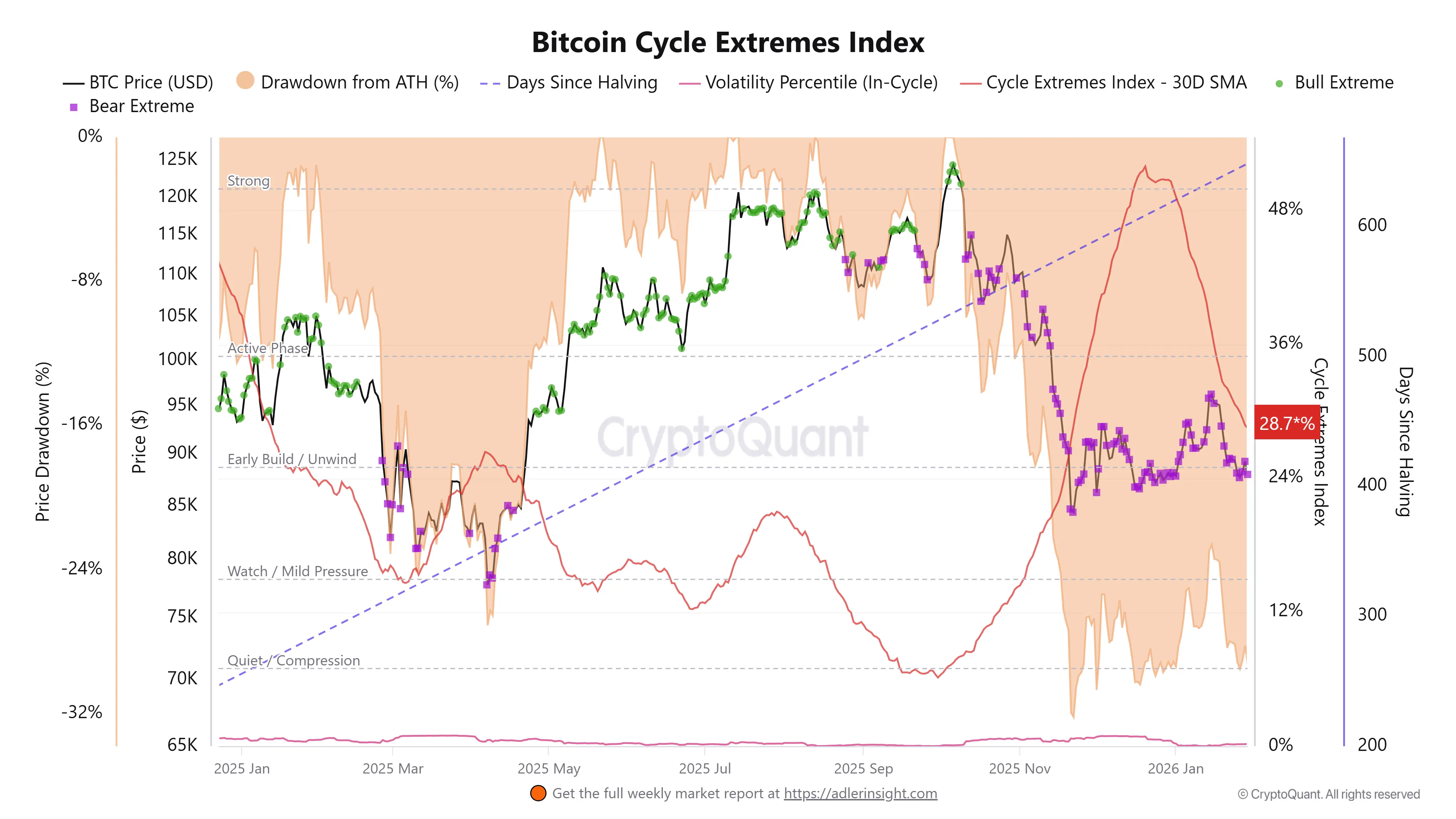

#Bitcoin Enters a Cycle Cooldown Phase as Extreme Signals Fade

On-chain cycle indicators suggest $BTC is moving into a cooling phase rather than a full capitulation. Despite price weakness from recent highs, extreme cycle conditions remain limited, indicating the market is releasing excess rather than undergoing a structural reset.

The Bitcoin Cycle Extreme Oscillator shows that recent drawdowns were not accompanied by persistent extreme spikes. Historically, cycle tops are marked by clustered and sustained extreme readings, reflecting synchronized speculative excess. In contrast, recent signa

On-chain cycle indicators suggest $BTC is moving into a cooling phase rather than a full capitulation. Despite price weakness from recent highs, extreme cycle conditions remain limited, indicating the market is releasing excess rather than undergoing a structural reset.

The Bitcoin Cycle Extreme Oscillator shows that recent drawdowns were not accompanied by persistent extreme spikes. Historically, cycle tops are marked by clustered and sustained extreme readings, reflecting synchronized speculative excess. In contrast, recent signa

BTC-1,69%

- Reward

- 2

- 3

- Repost

- Share

DragonFlyOfficial :

:

Happy New Year! 🤑View More

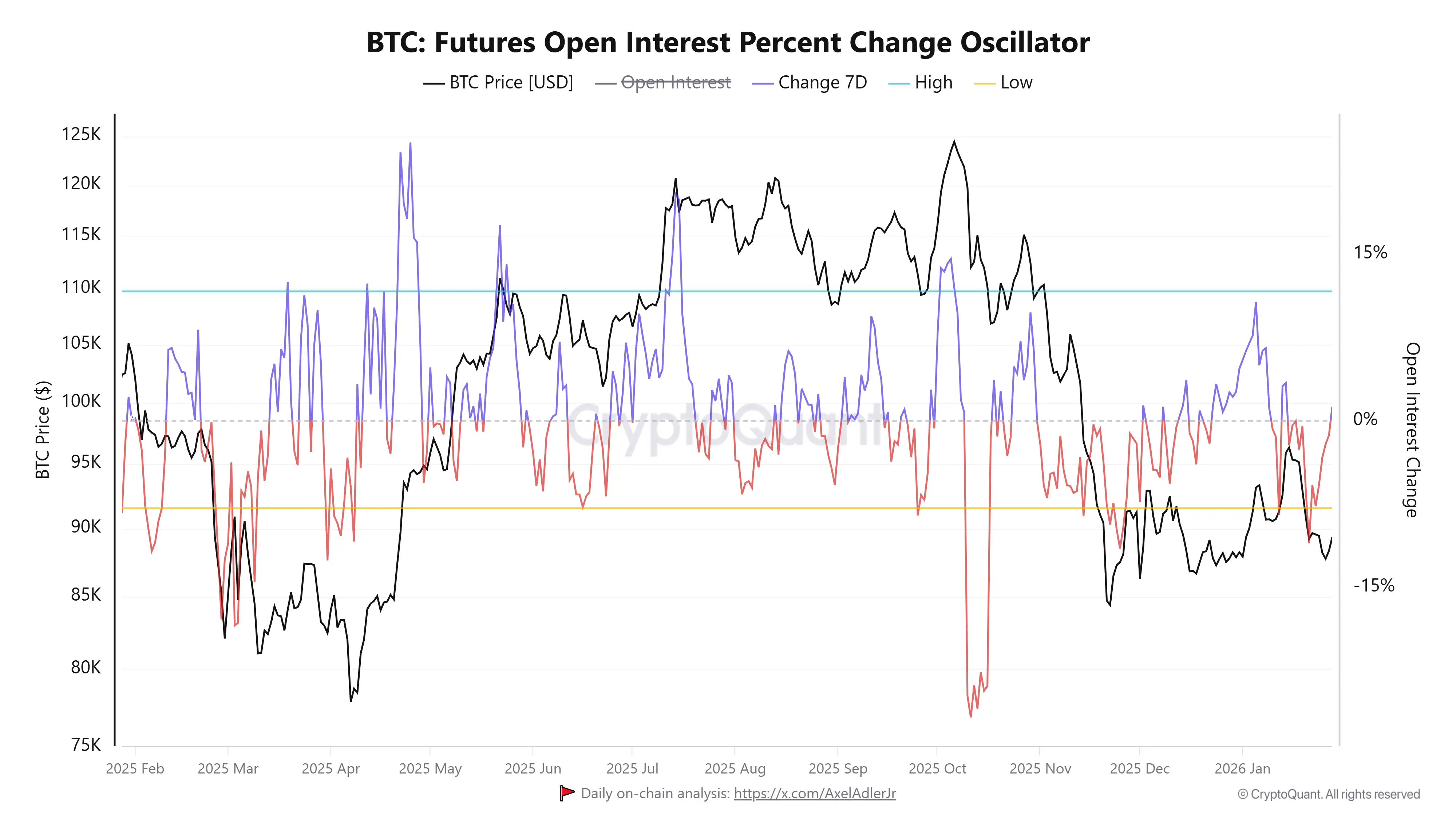

🚨 #Bitcoin ETF flows just printed a major signal.

Over the past 7 days, spot $BTC ETFs recorded around $1.86B in net outflows while price continues to compress. This divergence shows distribution pressure from institutions, yet volatility remains controlled, suggesting sellers are active but not panicked.

Historically, similar ETF driven outflows have marked late phase corrections rather than trend breakdowns. If selling momentum weakens while price stabilizes, this zone can shift from distribution to absorption.

Watch for declining outflow intensity and volume contraction. That combination o

Over the past 7 days, spot $BTC ETFs recorded around $1.86B in net outflows while price continues to compress. This divergence shows distribution pressure from institutions, yet volatility remains controlled, suggesting sellers are active but not panicked.

Historically, similar ETF driven outflows have marked late phase corrections rather than trend breakdowns. If selling momentum weakens while price stabilizes, this zone can shift from distribution to absorption.

Watch for declining outflow intensity and volume contraction. That combination o

BTC-1,69%

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

Good luck everyone View More

#Bitcoin Shows Signs of Macro Fatigue Amid Ongoing Leverage Reset

Recent quarterly performance highlights a clear shift in $BTC market structure. After a strong mid-2025 expansion phase marked by consistent positive quarterly returns, performance has turned negative in recent periods. This transition suggests the market has moved away from trend continuation and into a corrective or consolidation regime. Such shifts typically reflect weakening marginal demand rather than a structural breakdown, especially following an extended rally.

Drawdown analysis provides further context. Current pullbac

Recent quarterly performance highlights a clear shift in $BTC market structure. After a strong mid-2025 expansion phase marked by consistent positive quarterly returns, performance has turned negative in recent periods. This transition suggests the market has moved away from trend continuation and into a corrective or consolidation regime. Such shifts typically reflect weakening marginal demand rather than a structural breakdown, especially following an extended rally.

Drawdown analysis provides further context. Current pullbac

BTC-1,69%

- Reward

- 3

- 2

- Repost

- Share

CryptoZeno :

:

Good luck everyone View More

- Reward

- 1

- Comment

- Repost

- Share

#Ethereum open interest has recovered to its pre October 10 levels while the price remains roughly thirty two percent below the breakdown zone.

Leverage is returning faster than spot demand which is typical in crypto as traders rush in before any real structural recovery forms.

$ETH is still hovering around the three thousand level as OI ticks higher indicating volatility is building and a sharp move in either direction is likely.

Leverage is returning faster than spot demand which is typical in crypto as traders rush in before any real structural recovery forms.

$ETH is still hovering around the three thousand level as OI ticks higher indicating volatility is building and a sharp move in either direction is likely.

ETH-3,18%

- Reward

- 1

- Comment

- Repost

- Share

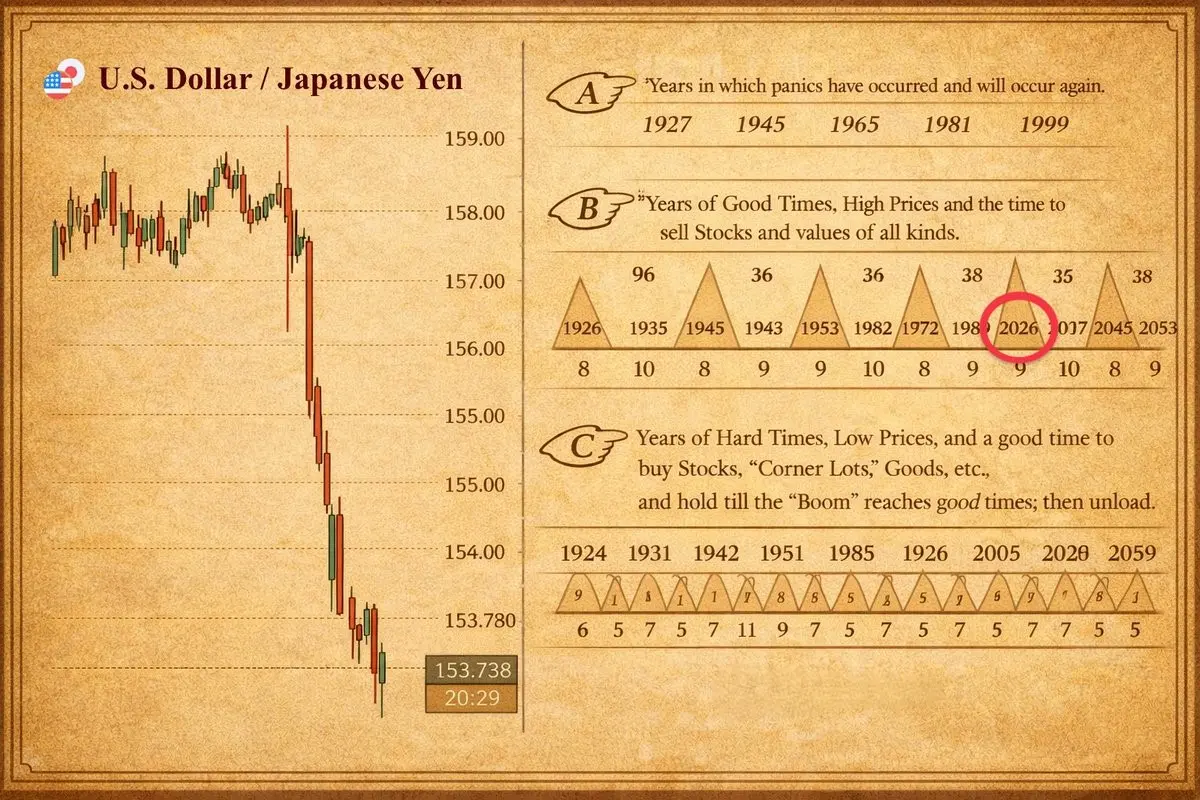

🔥 The Move That Could Flip Global Markets And Shock #Bitcoin Holders

The #Fed preparing for a real US dollar intervention within the next is the coming time not a routine policy shift. It is a stress signal. The last time the Fed stepped in to stabilize FX markets was in 2011 and global assets dropped sharply afterward. The real pressure point sits inside Japan where bond yields continue rising and the Yen keeps weakening, a dynamic that only appears when the financial system strains to the limit.

If the US starts buying Yen, the intention is clear. They weaken the dollar deliberately to prev

The #Fed preparing for a real US dollar intervention within the next is the coming time not a routine policy shift. It is a stress signal. The last time the Fed stepped in to stabilize FX markets was in 2011 and global assets dropped sharply afterward. The real pressure point sits inside Japan where bond yields continue rising and the Yen keeps weakening, a dynamic that only appears when the financial system strains to the limit.

If the US starts buying Yen, the intention is clear. They weaken the dollar deliberately to prev

BTC-1,69%

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

Good luck everyone View More

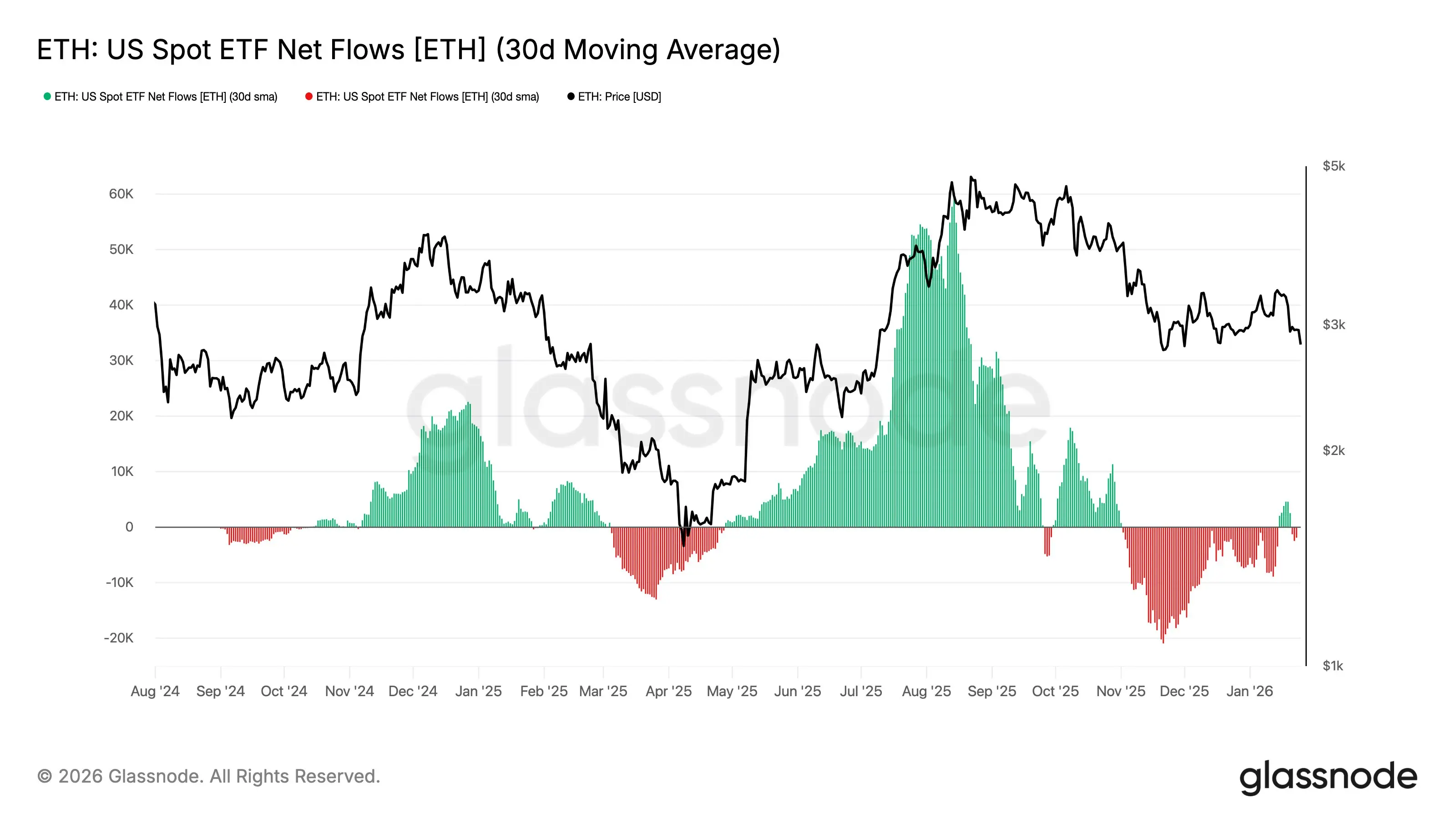

ETF Flow Divergence Highlights Structural Differences Between #Bitcoin and #Ethereum Demand

The 30-day moving average of US spot ETF net flows reveals a clear divergence between Bitcoin and Ethereum, offering insight into how institutional demand is evolving across the two assets. While both benefited from ETF-driven inflows during the mid-2025 risk-on phase, the persistence and price impact of those flows differ materially.

Bitcoin ETF flows show a more cyclical but resilient pattern. Periods of strong inflows tend to coincide with sustained price appreciation, and even during outflow phases,

The 30-day moving average of US spot ETF net flows reveals a clear divergence between Bitcoin and Ethereum, offering insight into how institutional demand is evolving across the two assets. While both benefited from ETF-driven inflows during the mid-2025 risk-on phase, the persistence and price impact of those flows differ materially.

Bitcoin ETF flows show a more cyclical but resilient pattern. Periods of strong inflows tend to coincide with sustained price appreciation, and even during outflow phases,

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

Good luck everyone View More

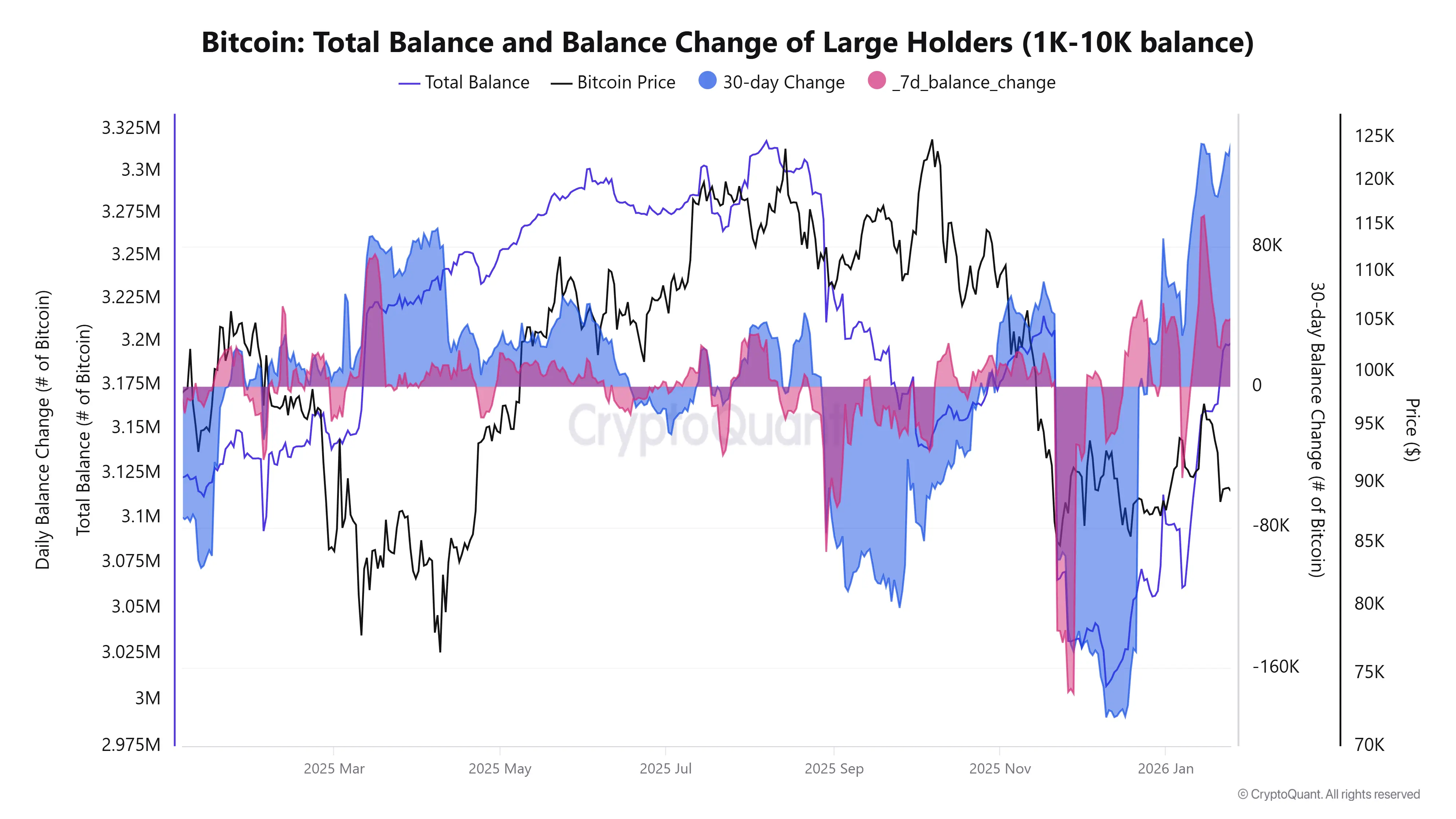

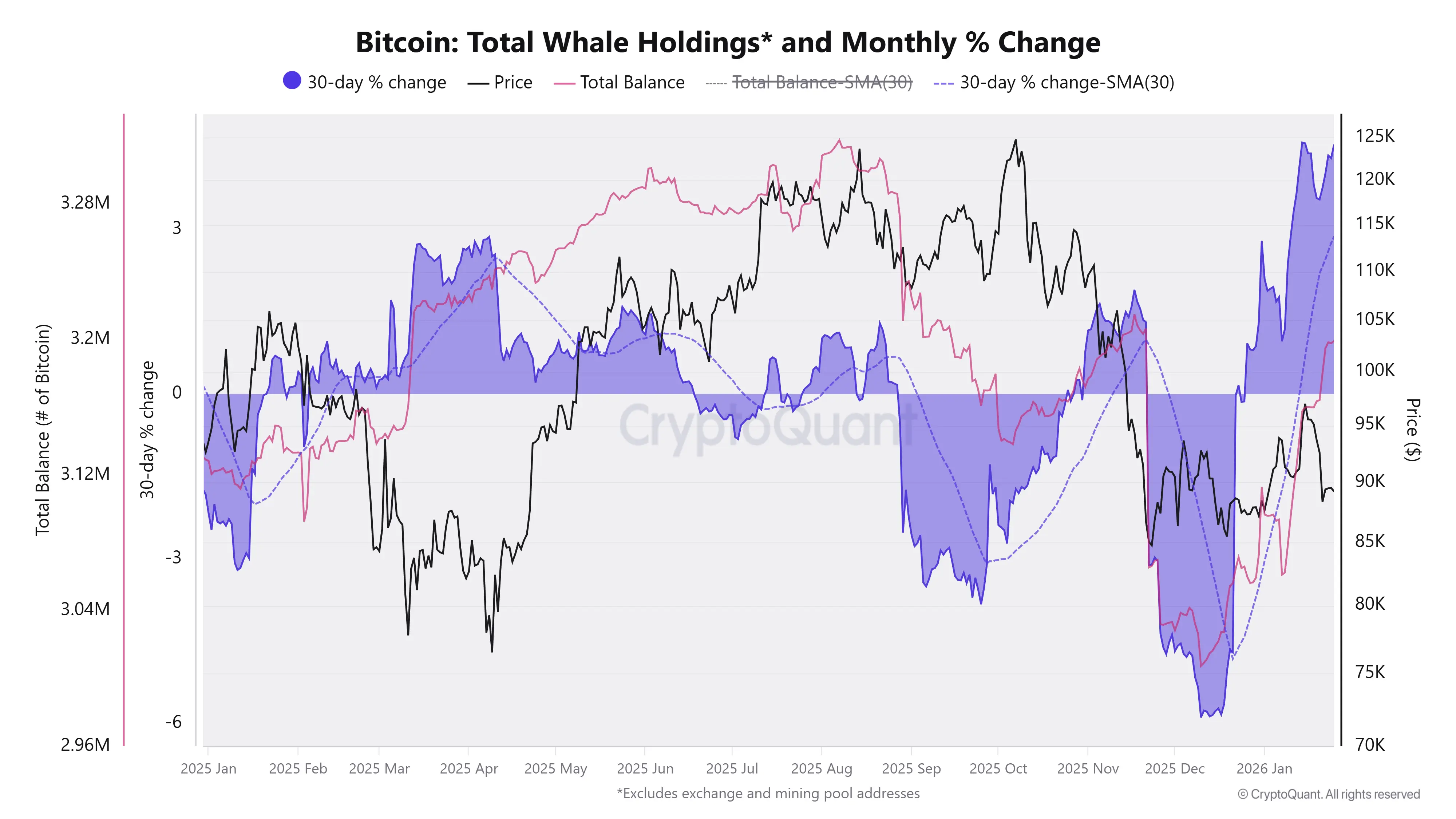

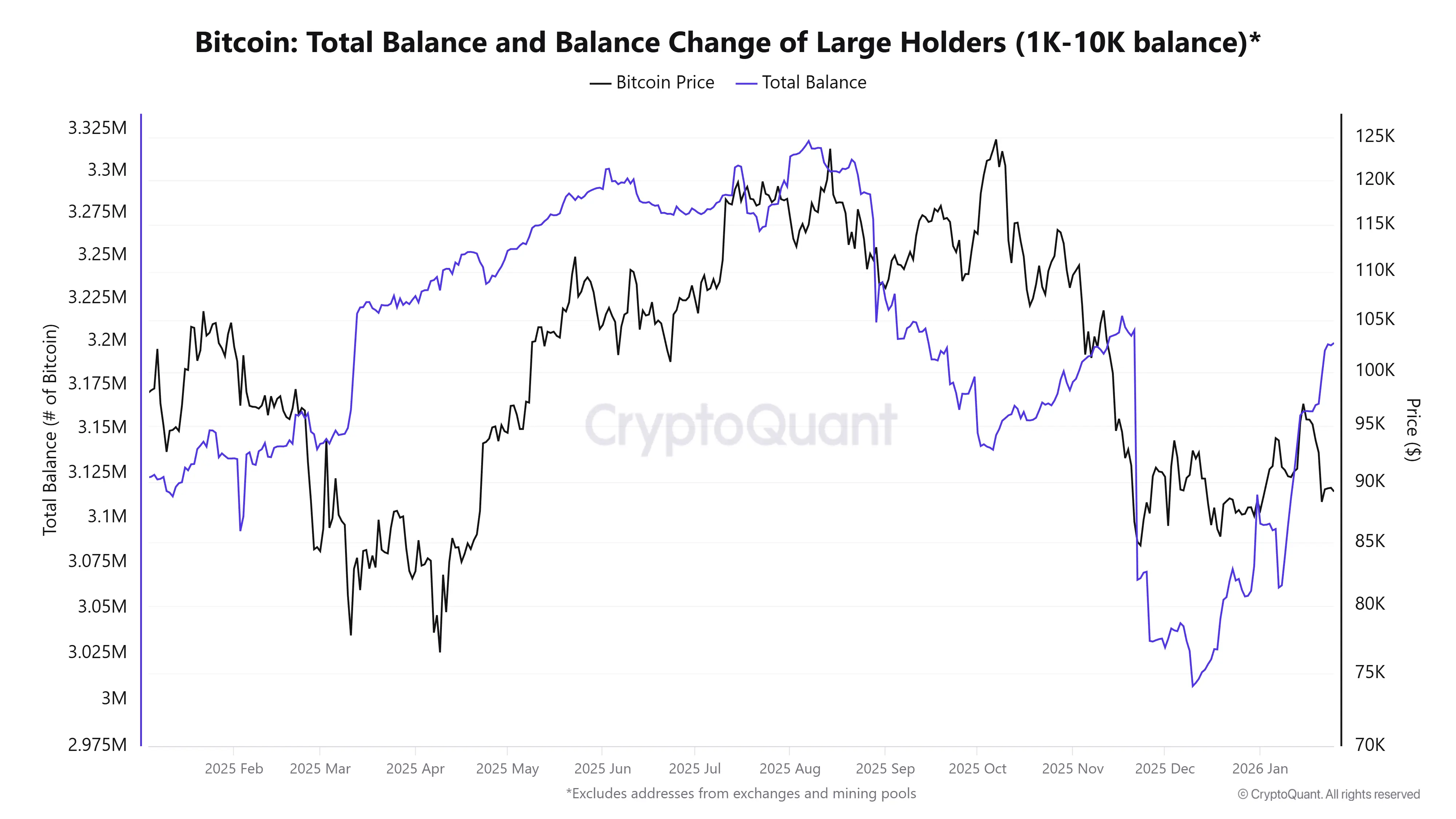

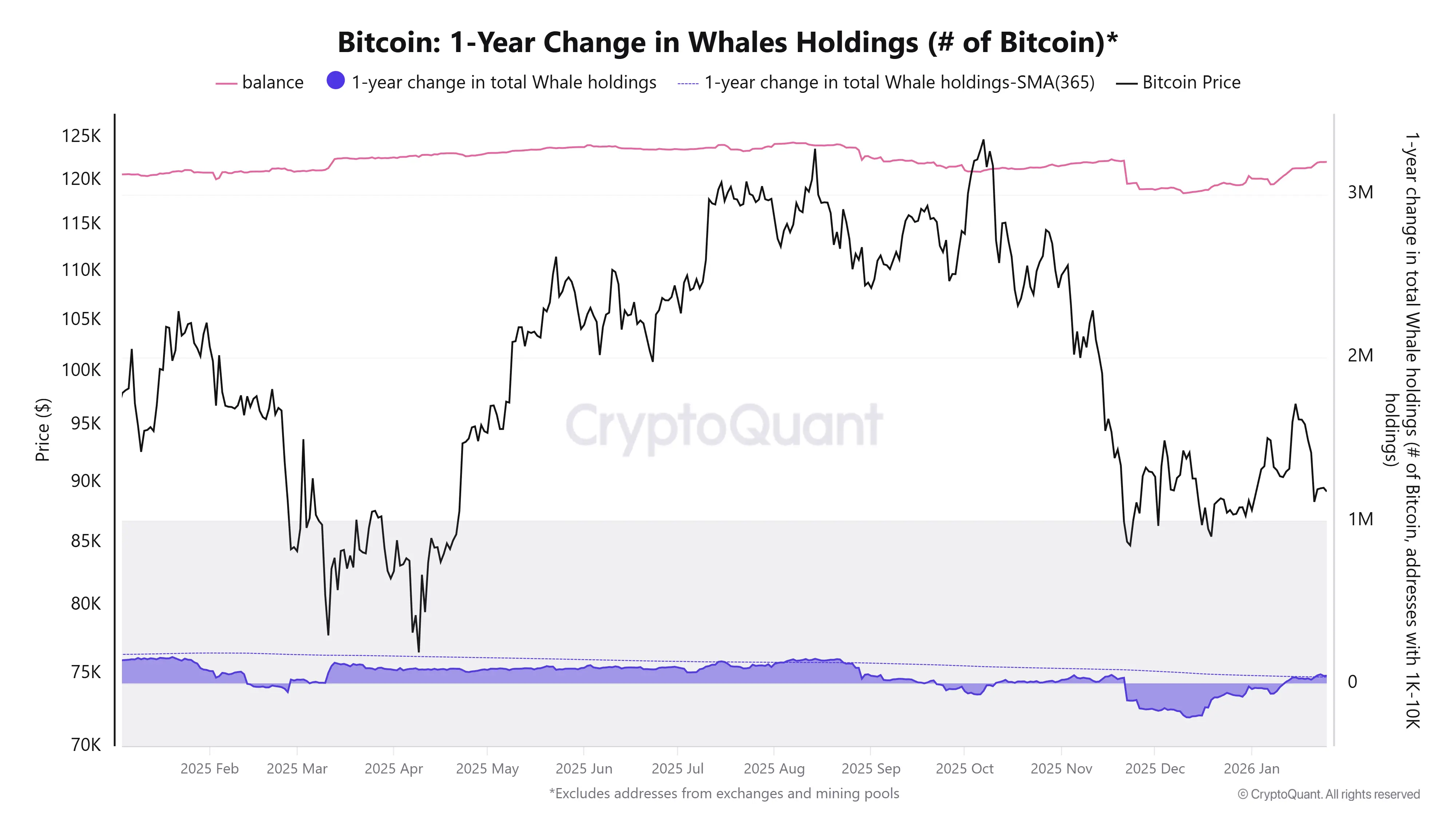

#Bitcoin Whale Positioning Shows Early Signs of Re-Accumulation After Distribution Phase

On-chain data tracking large holders (1K–10K $BTC , excluding exchanges and mining pools) suggests a notable shift in whale behavior following a prolonged distribution phase in late 2025. After reaching a local peak around mid-2025, total whale balances declined steadily as Bitcoin price remained elevated, indicating classic distribution into strength rather than forced selling.

The 30-day balance change metric confirms this dynamic. Throughout Q3 and early Q4, whale balances consistently posted negative m

On-chain data tracking large holders (1K–10K $BTC , excluding exchanges and mining pools) suggests a notable shift in whale behavior following a prolonged distribution phase in late 2025. After reaching a local peak around mid-2025, total whale balances declined steadily as Bitcoin price remained elevated, indicating classic distribution into strength rather than forced selling.

The 30-day balance change metric confirms this dynamic. Throughout Q3 and early Q4, whale balances consistently posted negative m

BTC-1,69%

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

Good luck everyone View More