$SPACE (USDT)

Timeframe: 1D

Bias: LONG

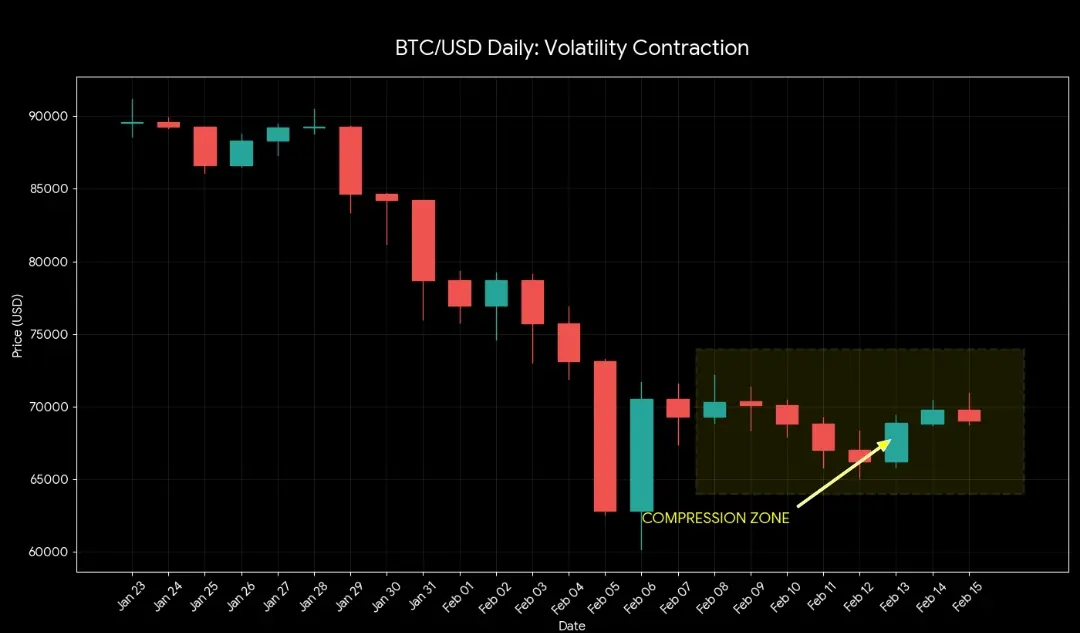

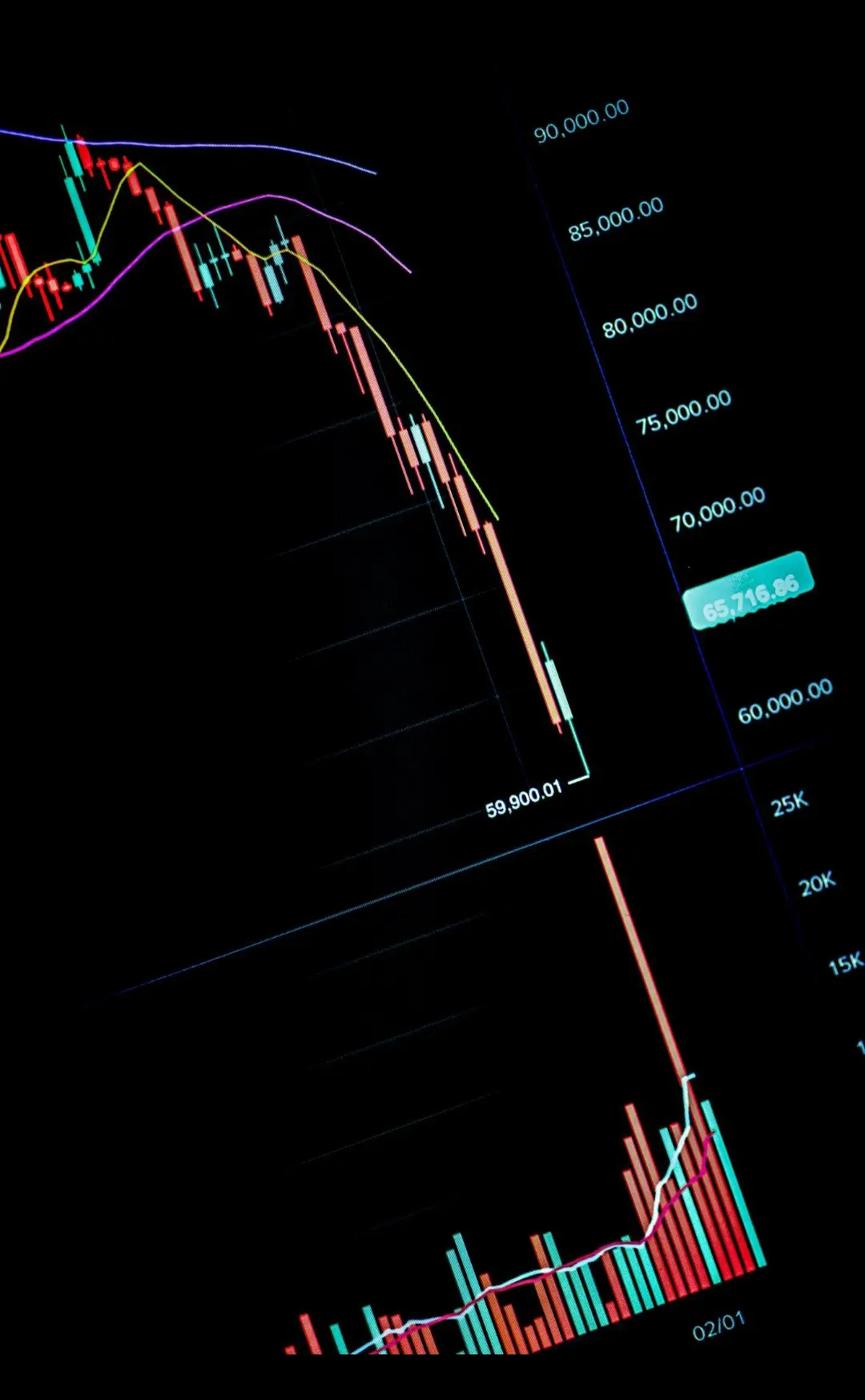

Structure: Base expansion after prolonged downtrend compression

Entry:

0.0066 – 0.0071 (prefer shallow pullback toward breakout base)

Targets:

1️⃣ 0.0079

2️⃣ 0.0092

3️⃣ 0.0115

4️⃣ 0.0148 (extension if momentum builds)

Invalidation:

Daily close below 0.0062

Leverage: 2x–6x (daily structure trade)

Technical Context:

After a sustained distribution phase, price printed a clear volatility expansion candle from a tight compression range. This type of move on the daily often signals early phase reversal rather than a simple relief bounce.

Momentum shift is visible through:

Large bullish body after multiple small indecision candles

Higher relative volume expansion

First meaningful attempt at reclaiming prior micro-supply

As long as 0.0062 holds on a daily close basis, downside pressure remains absorbed. Continuation depends on holding above 0.0066 during any pullback.

If price consolidates above 0.0072 instead of retracing — probability of direct expansion toward 0.009 increases.

This isn’t a chase-at-top setup.

Best positioning comes from controlled pullback entries.

#spaceusdt $SPACE

Timeframe: 1D

Bias: LONG

Structure: Base expansion after prolonged downtrend compression

Entry:

0.0066 – 0.0071 (prefer shallow pullback toward breakout base)

Targets:

1️⃣ 0.0079

2️⃣ 0.0092

3️⃣ 0.0115

4️⃣ 0.0148 (extension if momentum builds)

Invalidation:

Daily close below 0.0062

Leverage: 2x–6x (daily structure trade)

Technical Context:

After a sustained distribution phase, price printed a clear volatility expansion candle from a tight compression range. This type of move on the daily often signals early phase reversal rather than a simple relief bounce.

Momentum shift is visible through:

Large bullish body after multiple small indecision candles

Higher relative volume expansion

First meaningful attempt at reclaiming prior micro-supply

As long as 0.0062 holds on a daily close basis, downside pressure remains absorbed. Continuation depends on holding above 0.0066 during any pullback.

If price consolidates above 0.0072 instead of retracing — probability of direct expansion toward 0.009 increases.

This isn’t a chase-at-top setup.

Best positioning comes from controlled pullback entries.

#spaceusdt $SPACE