BuffyCryptonian

No content yet

- Reward

- 1

- 1

- Repost

- Share

GateUser-c094e03d :

:

80,000?- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

upcoming macro events

Wednesday

NVIDIA ($NVDA) earnings – after market close

Consensus: ~$65.5B revenue | $4.69 EPS

Beat → lifts AI, semis, data-center stocks (AMD, TSMC, SMCI etc.)

Miss → drags NASDAQ broadly

Key watch: any comment on China GPU sales resuming → very bullish signal

Thursday

Initial Jobless Claims

Prior: 227K

< 235K → labor market healthy, Fed patient → neutral/bullish

245K → rising recession fears

Friday

January PPI inflation data

Consensus: +0.3% MoM

Hot print → "higher for longer" rates → bearish for growth stocks & crypto

Cool print → higher June r

Wednesday

NVIDIA ($NVDA) earnings – after market close

Consensus: ~$65.5B revenue | $4.69 EPS

Beat → lifts AI, semis, data-center stocks (AMD, TSMC, SMCI etc.)

Miss → drags NASDAQ broadly

Key watch: any comment on China GPU sales resuming → very bullish signal

Thursday

Initial Jobless Claims

Prior: 227K

< 235K → labor market healthy, Fed patient → neutral/bullish

245K → rising recession fears

Friday

January PPI inflation data

Consensus: +0.3% MoM

Hot print → "higher for longer" rates → bearish for growth stocks & crypto

Cool print → higher June r

- Reward

- 1

- Comment

- Repost

- Share

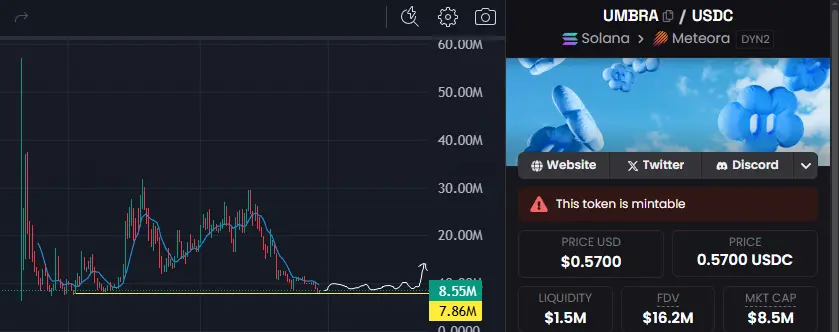

$UMBRA is bottomed but i wanna see it moving sideways in a calm channel here

- Reward

- like

- Comment

- Repost

- Share

$AUTOMATON

this is a good r/r zone to start DCA

this is a good r/r zone to start DCA

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 5

- 3

- Repost

- Share

AYATTAC :

:

LFG 🔥View More

$BUTTCOIN

if the yellow line gets weaker, we are going to 94% retracement before the next leg

if the yellow line gets weaker, we are going to 94% retracement before the next leg

- Reward

- 1

- Comment

- Repost

- Share

$SNOWBALL cup and handle?

full cup formation at 5M resistance level if it goes there

handle consolidation before breaking 5M level

near term resistance 1.5M

full cup formation at 5M resistance level if it goes there

handle consolidation before breaking 5M level

near term resistance 1.5M

- Reward

- 2

- Comment

- Repost

- Share

Gut says Liquidity Cycle is projected to turn bullish around late 2026. Everything has been delayed by geopolitics. We got more politics getting in the way this time round.

Bears' trump card has always been TRUMP after all. The crypto president everyone voted.

$BTC deeper correction toward $50K.

$ETH toward $1.7k.

Buy some AJINOMOTO stock kudasai.

AI is gonna cause a lot of price inflation in a lot of places and some AJINOMOTO

Bears' trump card has always been TRUMP after all. The crypto president everyone voted.

$BTC deeper correction toward $50K.

$ETH toward $1.7k.

Buy some AJINOMOTO stock kudasai.

AI is gonna cause a lot of price inflation in a lot of places and some AJINOMOTO

- Reward

- 1

- 1

- Repost

- Share

Lions_Lionish :

:

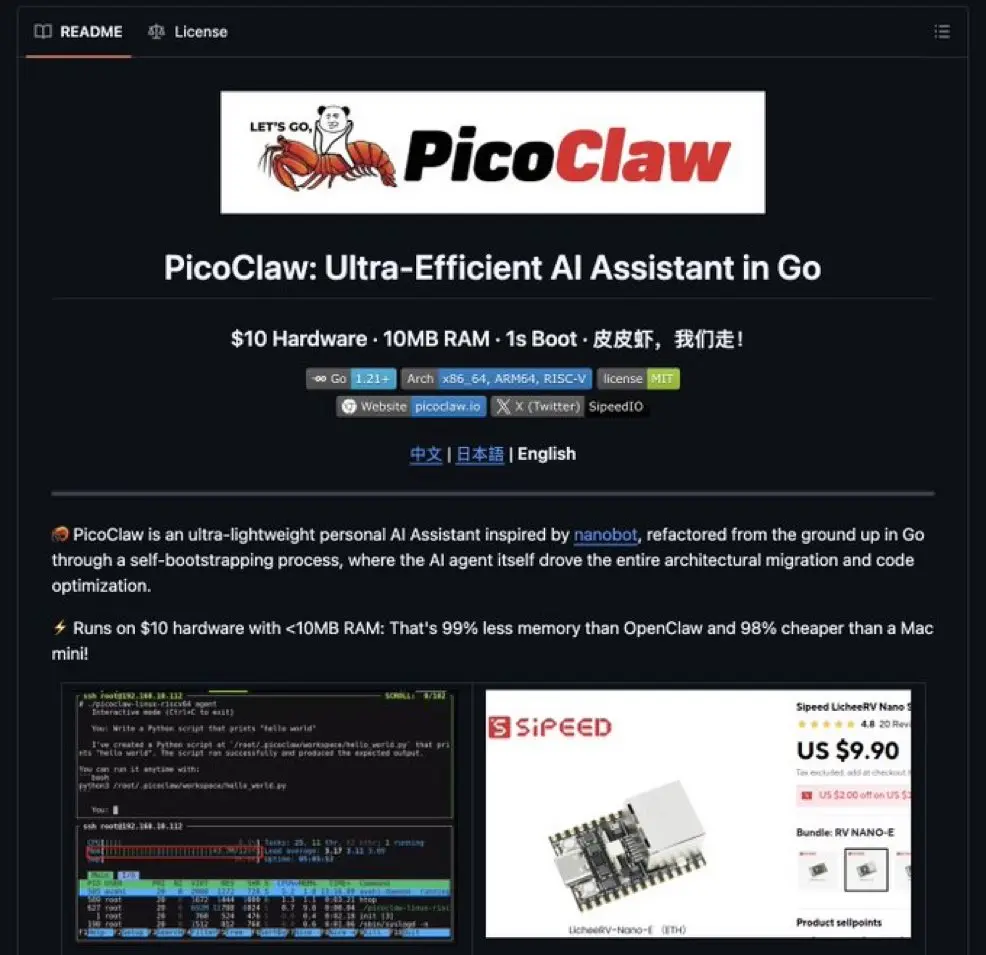

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵We can now close claw. Costs only $10. 98% cheaper than a Mac mini!

Will this be an openclaw killer?

Will this be an openclaw killer?

- Reward

- like

- Comment

- Repost

- Share

this is my contrarian take on $ETH

especially with X opening up direct $ETH trading on the platform

i believe it will onboard more panic

followed by the lower dip, the phase of losing hope, and the massive rise

lets see if my totally inaccurate analysis is correct

original image by Merlijn with yellow line by me

especially with X opening up direct $ETH trading on the platform

i believe it will onboard more panic

followed by the lower dip, the phase of losing hope, and the massive rise

lets see if my totally inaccurate analysis is correct

original image by Merlijn with yellow line by me

ETH-2,42%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

1. CPI RELEASE:

Markets are on edge for the U.S. CPI data (Feb 13).

A hotter-than-expected print could invalidate the current recovery and push BTO back toward the $60,000 zone.

2. EQUITY CORRELATION

High correlation remains between BTC and the tech sector (Al stocks), which has seen its own bubble concerns.

BEAR CASE:

BTC failure to hold $69K on the back of high inflation data could lead to a retest of the

$60K lows

I suspect a further slide toward the $49,632

"line in the sand" last seen in August 2024.

BULL CASE:

If $BTC can close and hold above $72K, a relief rally toward $78K is likely as

Markets are on edge for the U.S. CPI data (Feb 13).

A hotter-than-expected print could invalidate the current recovery and push BTO back toward the $60,000 zone.

2. EQUITY CORRELATION

High correlation remains between BTC and the tech sector (Al stocks), which has seen its own bubble concerns.

BEAR CASE:

BTC failure to hold $69K on the back of high inflation data could lead to a retest of the

$60K lows

I suspect a further slide toward the $49,632

"line in the sand" last seen in August 2024.

BULL CASE:

If $BTC can close and hold above $72K, a relief rally toward $78K is likely as

BTC-0,95%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share