Before00zero

No content yet

Before00zero

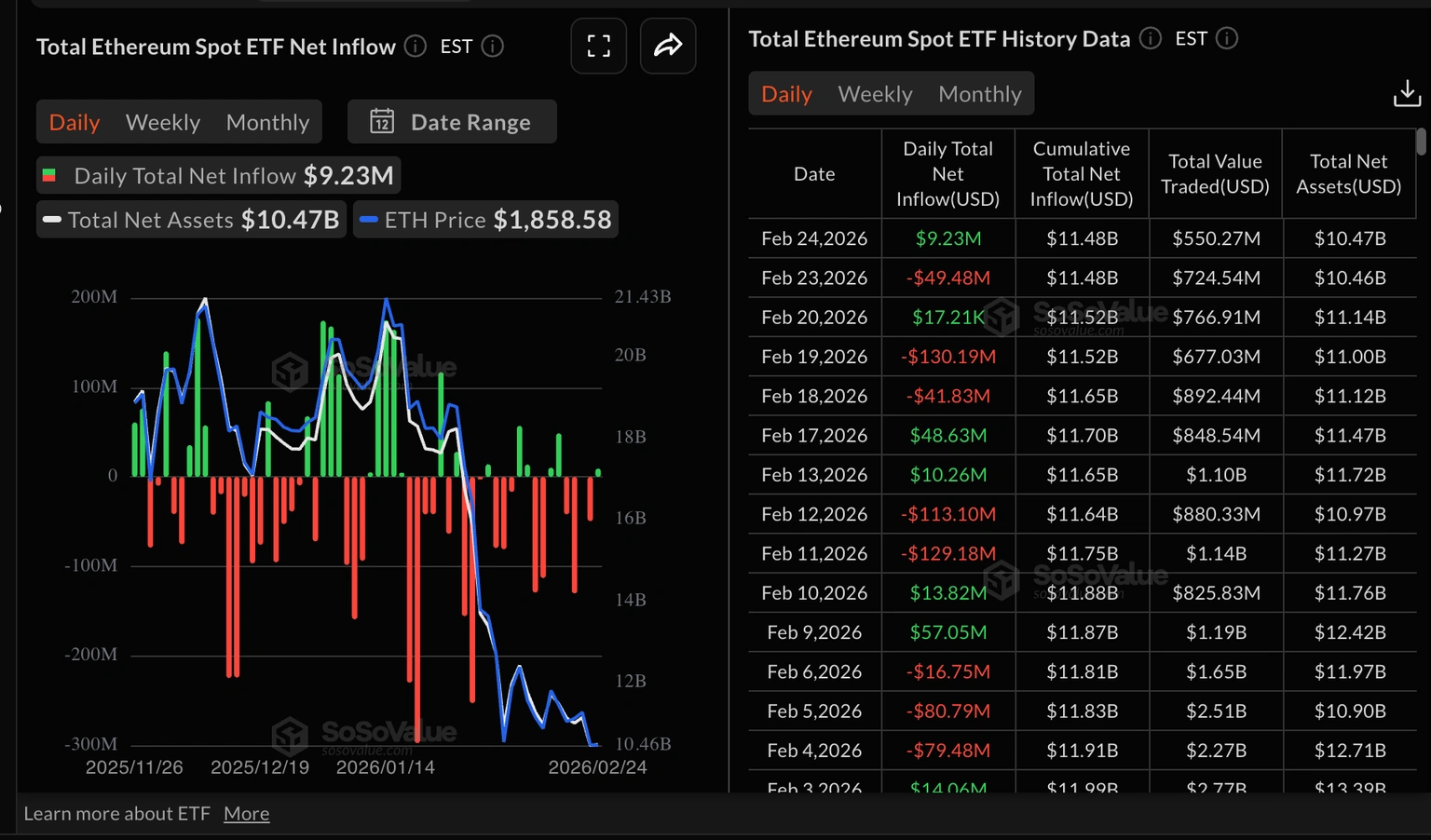

- Ethereum Price Outlook: Ethereum faces resistance near the 20-day Exponential Moving Average (EMA)

Ethereum experienced liquidations totaling $78.3 million over the past 24 hours, driven by $48 million in long liquidations, according to Coinglass data.

On the daily chart, Ethereum is trading at $1,980. The short-term trend remains slightly bearish as the price stays below the 20-day EMA(EMA) near $2,025, keeping the spot price confined below the short-term trend indicator.

The Relative Strength Index (RSI)(RSI) remains in the mid-40s after bouncing from the oversold region, indicating a wani

Ethereum experienced liquidations totaling $78.3 million over the past 24 hours, driven by $48 million in long liquidations, according to Coinglass data.

On the daily chart, Ethereum is trading at $1,980. The short-term trend remains slightly bearish as the price stays below the 20-day EMA(EMA) near $2,025, keeping the spot price confined below the short-term trend indicator.

The Relative Strength Index (RSI)(RSI) remains in the mid-40s after bouncing from the oversold region, indicating a wani

ETH3,83%

- Reward

- 4

- 1

- 1

- Share

Mhmdqase :

:

Bullish market at its peak 🐂- Ethereum Price Expectations: Ethereum's price is trending downward after rejection at the 20-day Exponential Moving Average

Ethereum experienced liquidations totaling $81.4 million over the past 24 hours, with long positions accounting for $65.5 million, according to Coinglass data.

On the daily chart, Ethereum's price (ETH) remains below the 20-day Exponential Moving Average (EMA), near $2045, maintaining a broader bearish structure despite a rebound from last week’s lows. The daily Relative Strength Index (RSI) has fallen toward 39 after recovering from oversold territory, indicating a slo

Ethereum experienced liquidations totaling $81.4 million over the past 24 hours, with long positions accounting for $65.5 million, according to Coinglass data.

On the daily chart, Ethereum's price (ETH) remains below the 20-day Exponential Moving Average (EMA), near $2045, maintaining a broader bearish structure despite a rebound from last week’s lows. The daily Relative Strength Index (RSI) has fallen toward 39 after recovering from oversold territory, indicating a slo

ETH3,83%

- Reward

- 1

- 1

- Repost

- Share

Before00zero :

:

The open trading volume of the Ethereum network has increased by 500,000 ETH, but funding rates remain negative. The price of Ethereum is trending downward after facing rejection at the 20-day exponential moving average and the resistance level at $2108.

- Technical Outlook on Altcoins: Bullish Momentum for Ethereum and XRP Weakens Amidst Ongoing Correction:

Ethereum is trading below the key $2000 level, confirming a short-term bearish trend, while investors remain cautiously optimistic after the token rebounded from its weekly low of $1800.

The price is currently below the declining 50, 100, and 200-day exponential moving averages, which still indicate a broader downtrend. Meanwhile, the Relative Strength Index (RSI) at 41 on the daily chart aligns with a bearish bias. A daily close below $2000 could further limit upward momentum and trigger

View OriginalEthereum is trading below the key $2000 level, confirming a short-term bearish trend, while investors remain cautiously optimistic after the token rebounded from its weekly low of $1800.

The price is currently below the declining 50, 100, and 200-day exponential moving averages, which still indicate a broader downtrend. Meanwhile, the Relative Strength Index (RSI) at 41 on the daily chart aligns with a bearish bias. A daily close below $2000 could further limit upward momentum and trigger

- Reward

- 3

- 1

- Repost

- Share

Before00zero :

:

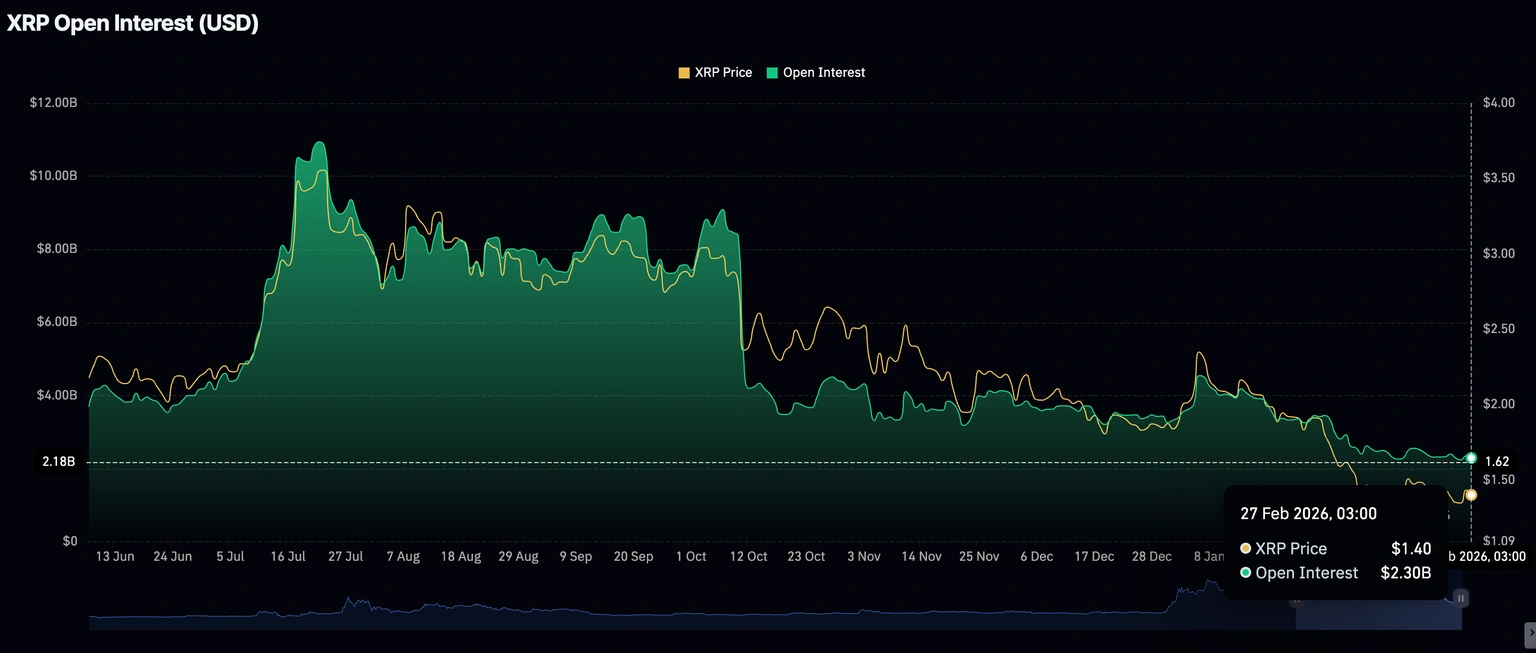

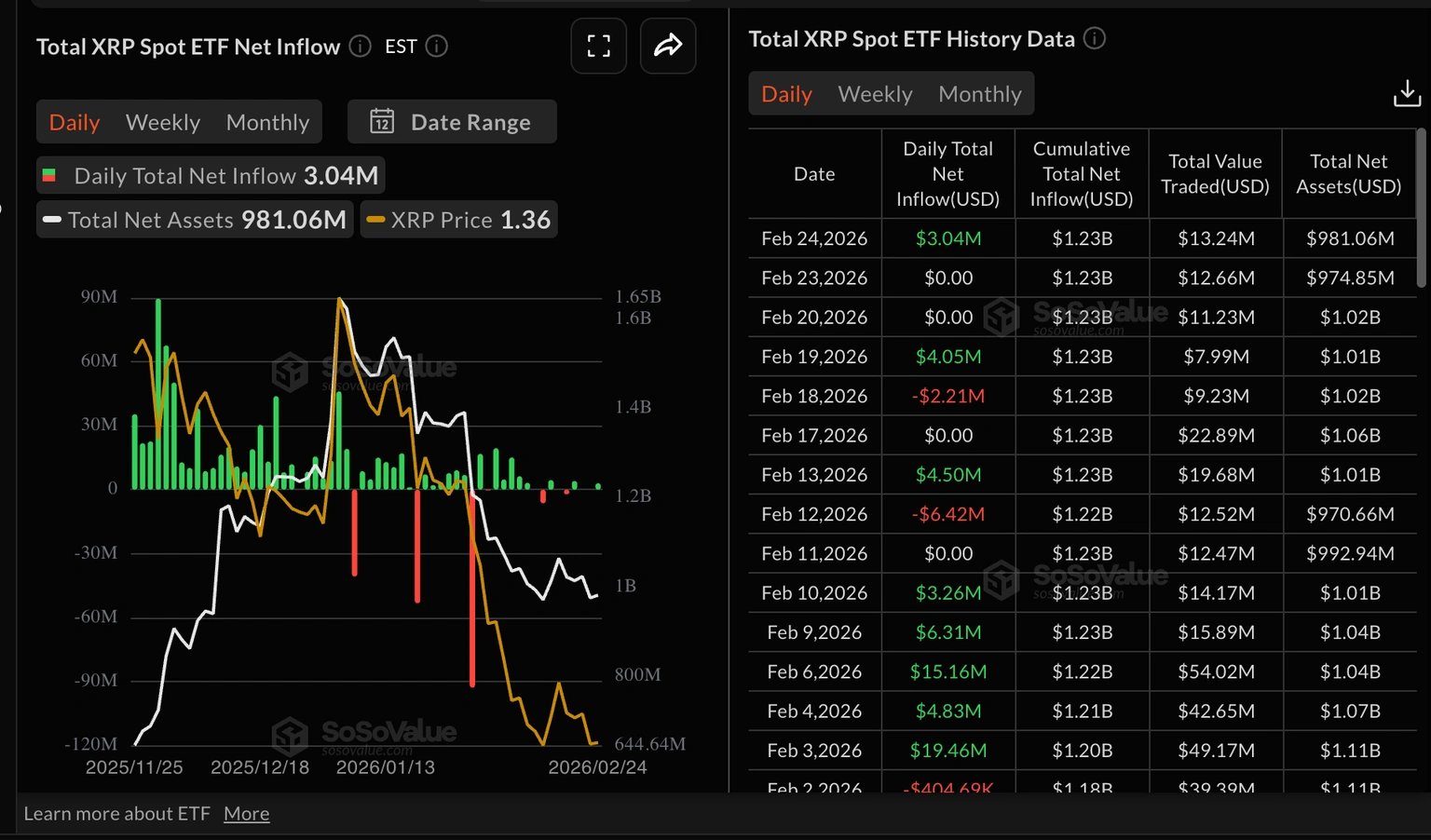

Ethereum tests the upper limit of a narrow range, with the lowest point of the day around $1980 as immediate support. XRP continues to trade within a general downtrend, as evidenced by all major daily exponential moving averages trending downward.

- Daily Chart: Bitcoin Struggles to Recover:

Bitcoin is currently trading around $67,000 after pausing its rally today at $68,000. The price remains well below the 50-day exponential moving average at $75,799, the 100-day EMA at $83,425, and the 200-day EMA at $91,005. All three moving averages are trending downward, reinforcing the overall bearish trend.

The Relative Strength Index (RSI) remains near the 41 level, below the midline of 50, and is trending downward on the daily chart, indicating a cautious bias toward slight decline or neutrality in the near term. However, the Moving Average Co

Bitcoin is currently trading around $67,000 after pausing its rally today at $68,000. The price remains well below the 50-day exponential moving average at $75,799, the 100-day EMA at $83,425, and the 200-day EMA at $91,005. All three moving averages are trending downward, reinforcing the overall bearish trend.

The Relative Strength Index (RSI) remains near the 41 level, below the midline of 50, and is trending downward on the daily chart, indicating a cautious bias toward slight decline or neutrality in the near term. However, the Moving Average Co

BTC5,05%

- Reward

- 2

- 1

- Repost

- Share

Before00zero :

:

The price of Bitcoin hovers around $67,000, with MACD and RSI momentum indicators indicating a slight bullish trend.- Bitcoin, Ethereum, and XRP bullish momentum threatened amid weak retail investor interest:

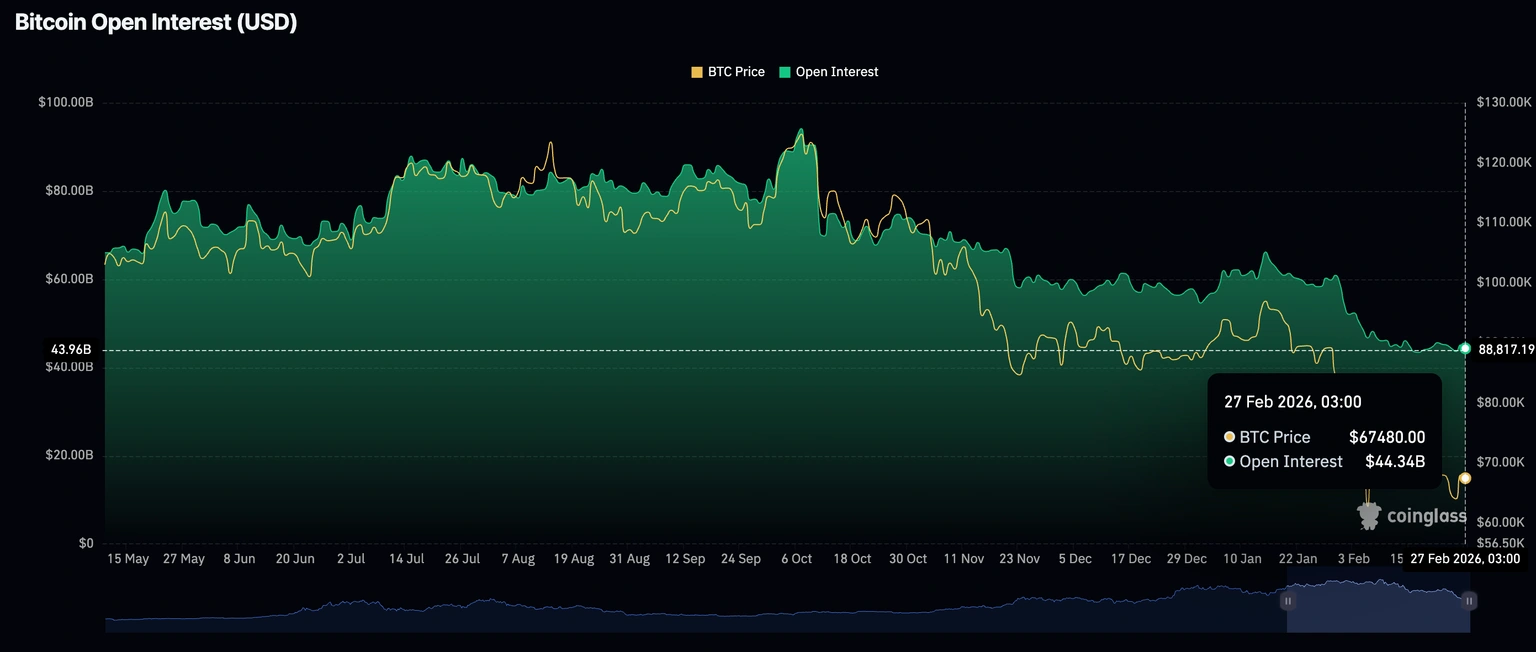

Bitcoin has rebounded from its weekly low of $62,513 despite declining retail investor interest, as evidenced by the drop in open futures contracts to $44.34 billion on Friday, a level last seen on February 17, down from $45.13 billion the previous day.

Since the "King of Cryptocurrencies" derivatives hit a record high of $94.12 billion in October, the downward trend has continued, indicating that investors lack confidence in the market and in Bitcoin's ability to sustain an upward trend.

Daily Trading

Bitcoin has rebounded from its weekly low of $62,513 despite declining retail investor interest, as evidenced by the drop in open futures contracts to $44.34 billion on Friday, a level last seen on February 17, down from $45.13 billion the previous day.

Since the "King of Cryptocurrencies" derivatives hit a record high of $94.12 billion in October, the downward trend has continued, indicating that investors lack confidence in the market and in Bitcoin's ability to sustain an upward trend.

Daily Trading

BTC5,05%

- Reward

- 1

- 1

- Repost

- Share

Before00zero :

:

Bitcoin (BTC) price fluctuates around $67,000 USD as of the time of writing this report on Friday, as investors appear to be cautiously optimistic within the overall downtrend. Meanwhile, altcoins, including Ethereum (ETH) and Ripple (XRP), are experiencing general stability. Ethereum's price remains just below $2000, while Ripple hovers around $1.40, reflecting stability in the cryptocurrency market.

- Technical Outlook on Altcoins: Ethereum and XRP Rebound Gaining Momentum:

Ethereum, the leading smart contract platform, remains stable above the $2000 level, indicating a moderate bullish outlook, with the price holding above its weekly low of $1800.

The MACD indicator remains above its signal line on the daily chart, with a slight expansion in the green bars, suggesting increasing bullish momentum.

Meanwhile, the Relative Strength Index (RSI) stays around 46, just below the neutral level, but has moved up from the oversold zone, indicating diminishing downward pressure rather than new sell

View OriginalEthereum, the leading smart contract platform, remains stable above the $2000 level, indicating a moderate bullish outlook, with the price holding above its weekly low of $1800.

The MACD indicator remains above its signal line on the daily chart, with a slight expansion in the green bars, suggesting increasing bullish momentum.

Meanwhile, the Relative Strength Index (RSI) stays around 46, just below the neutral level, but has moved up from the oversold zone, indicating diminishing downward pressure rather than new sell

- Reward

- 2

- 1

- Repost

- Share

Before00zero :

:

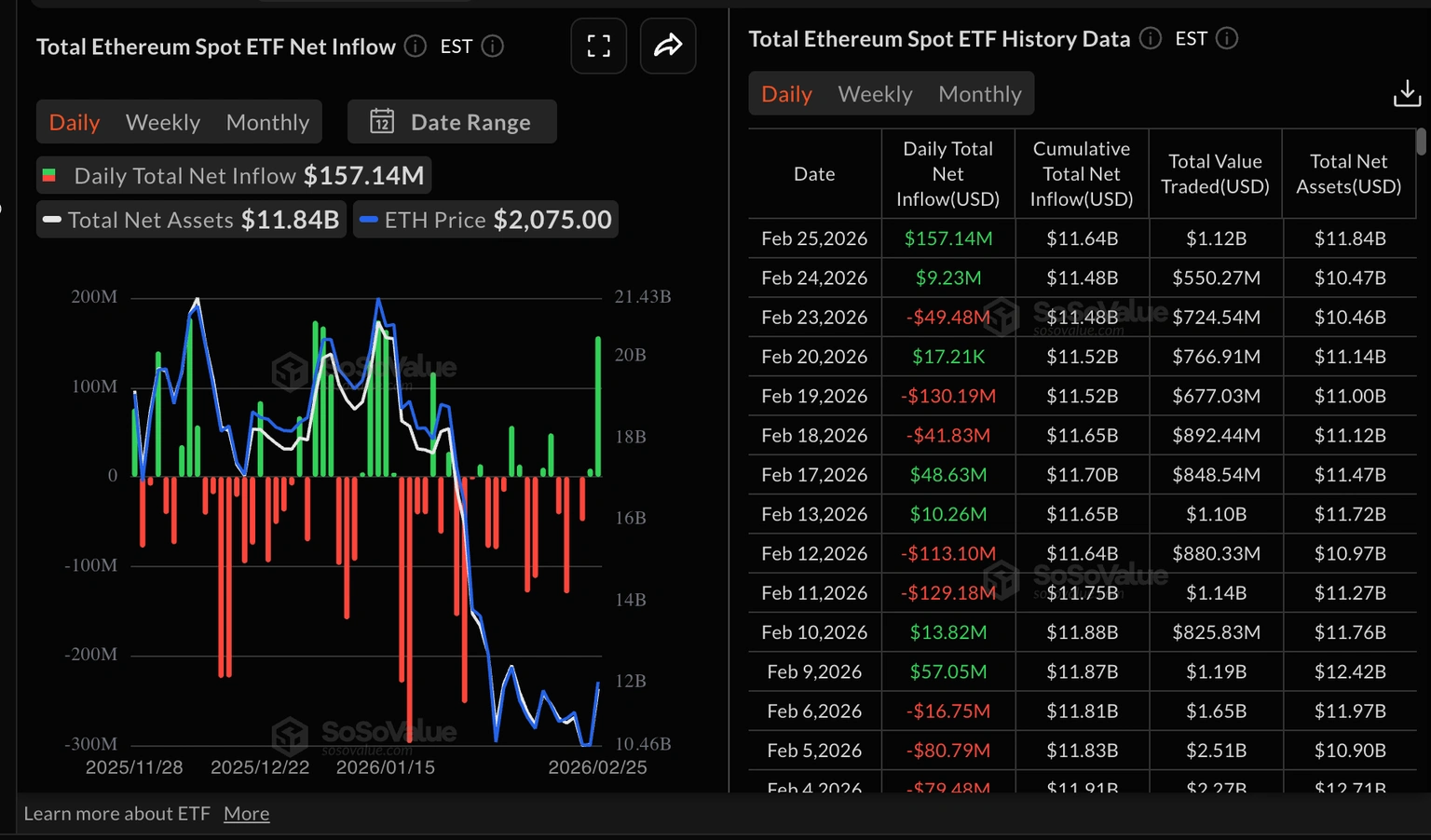

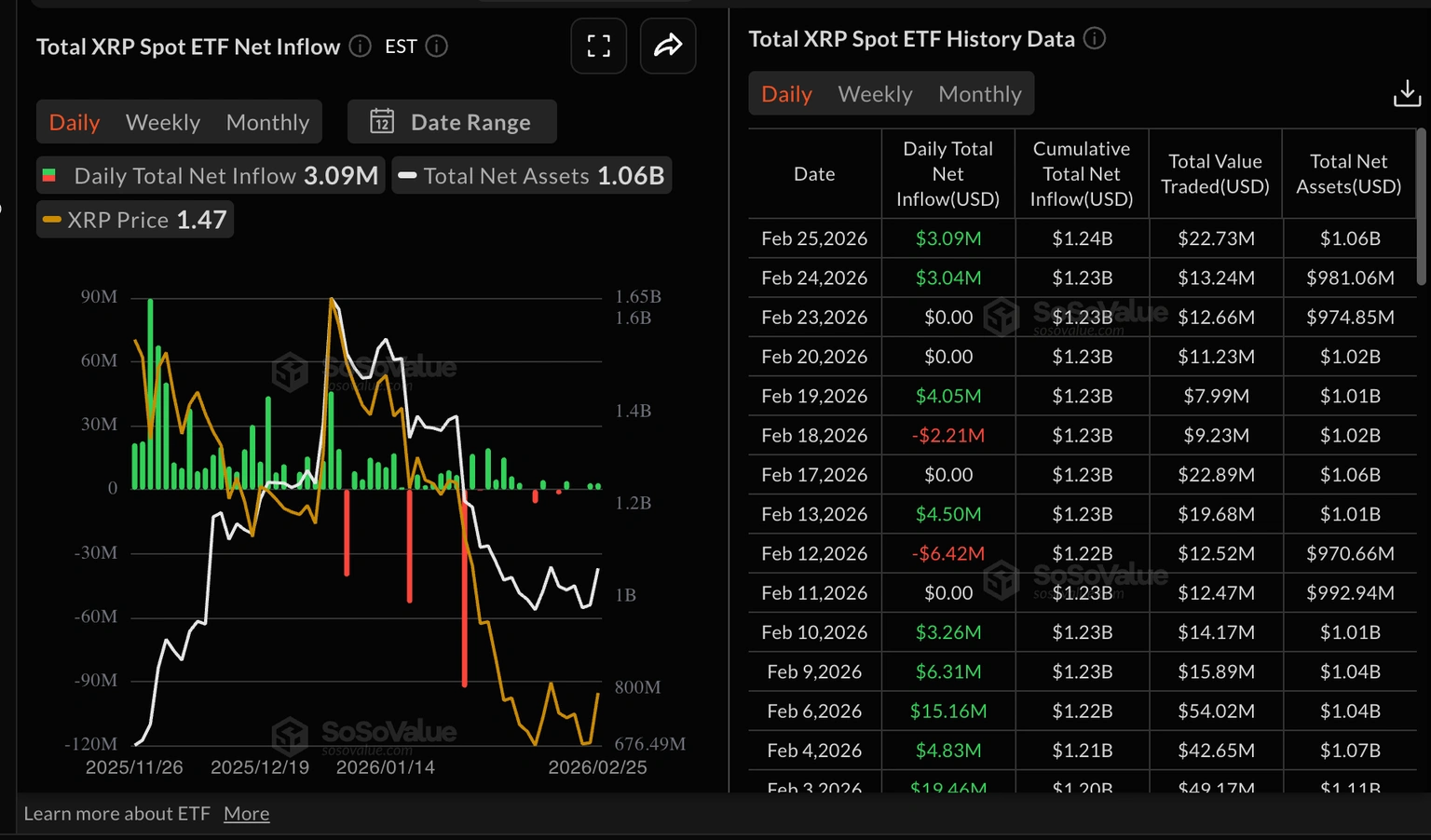

Ethereum's price remains above $2000 after rising from its weekly low of $1800, supported by a steady return of institutional investors. XRP continues to recover, reaching around $1.45 amid moderate inflows into exchange-traded funds and increasing bullish technical forecasts.

- Today’s Chart: Bitcoin Tests Short-Term Breakout Strength:

Bitcoin price hovers above $68,000, with a cautious bullish trend shifting in the short term. The MACD( remains above the signal line on the daily chart, confirming emerging bullish pressure.

Similarly, the RSI) is hovering in the low 40s on the same chart, still below the midline of 50 but rising from oversold territory, indicating a slowdown in bearish momentum rather than strong buying conviction.

Daily chart for BTC/USDT pair

Meanwhile, initial resistance appears around $70,600, aligning with recent daily highs, followed by the $

Bitcoin price hovers above $68,000, with a cautious bullish trend shifting in the short term. The MACD( remains above the signal line on the daily chart, confirming emerging bullish pressure.

Similarly, the RSI) is hovering in the low 40s on the same chart, still below the midline of 50 but rising from oversold territory, indicating a slowdown in bearish momentum rather than strong buying conviction.

Daily chart for BTC/USDT pair

Meanwhile, initial resistance appears around $70,600, aligning with recent daily highs, followed by the $

BTC5,05%

MC:$2.43KHolders:1

0.00%

- Reward

- 2

- 1

- Repost

- Share

Before00zero :

:

Bitcoin maintained its price above $68,000, supported by ETF inflows totaling $507 million on Wednesday.- Bitcoin, Ethereum, and XRP prices rise amid renewed risk appetite.

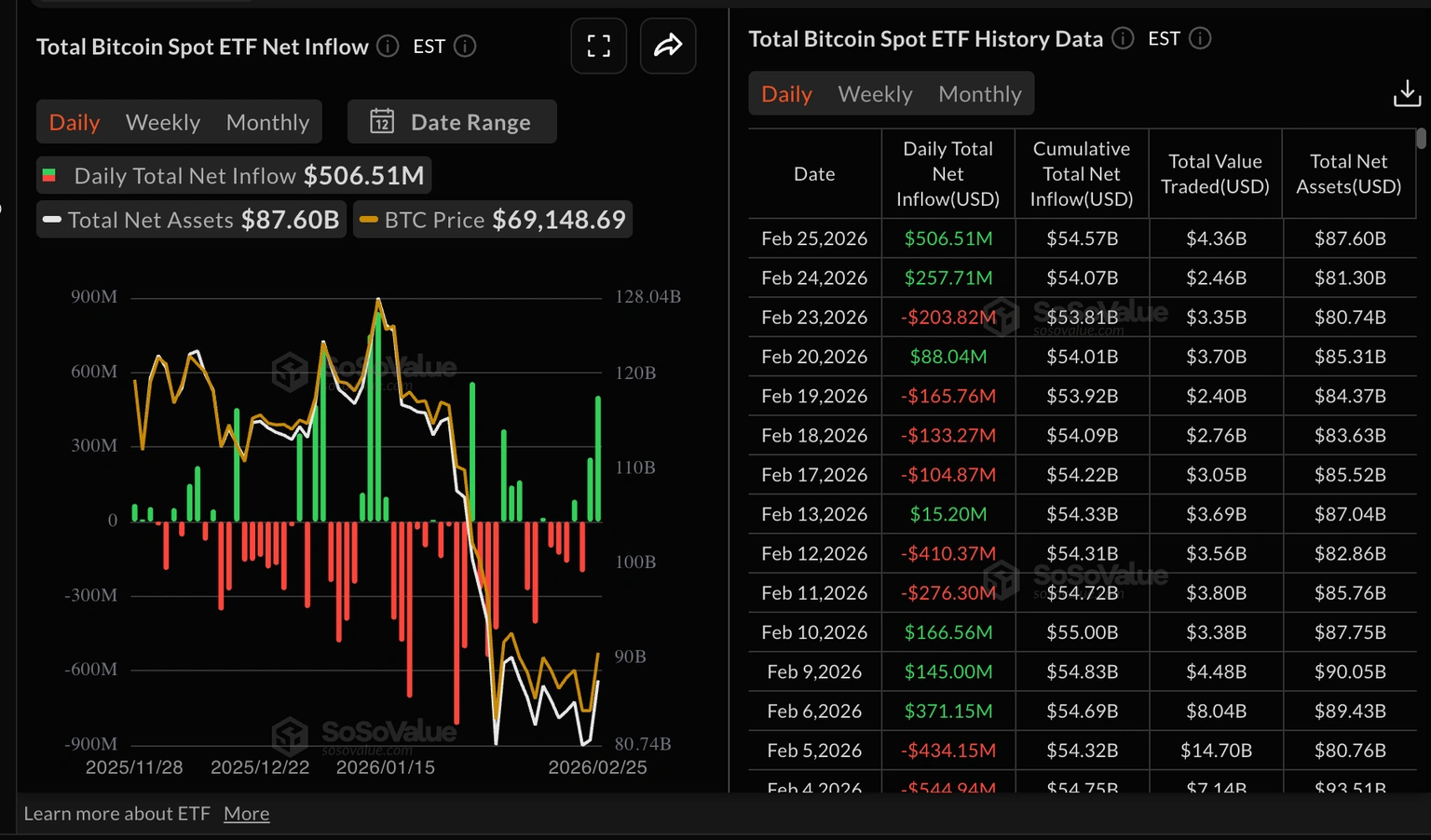

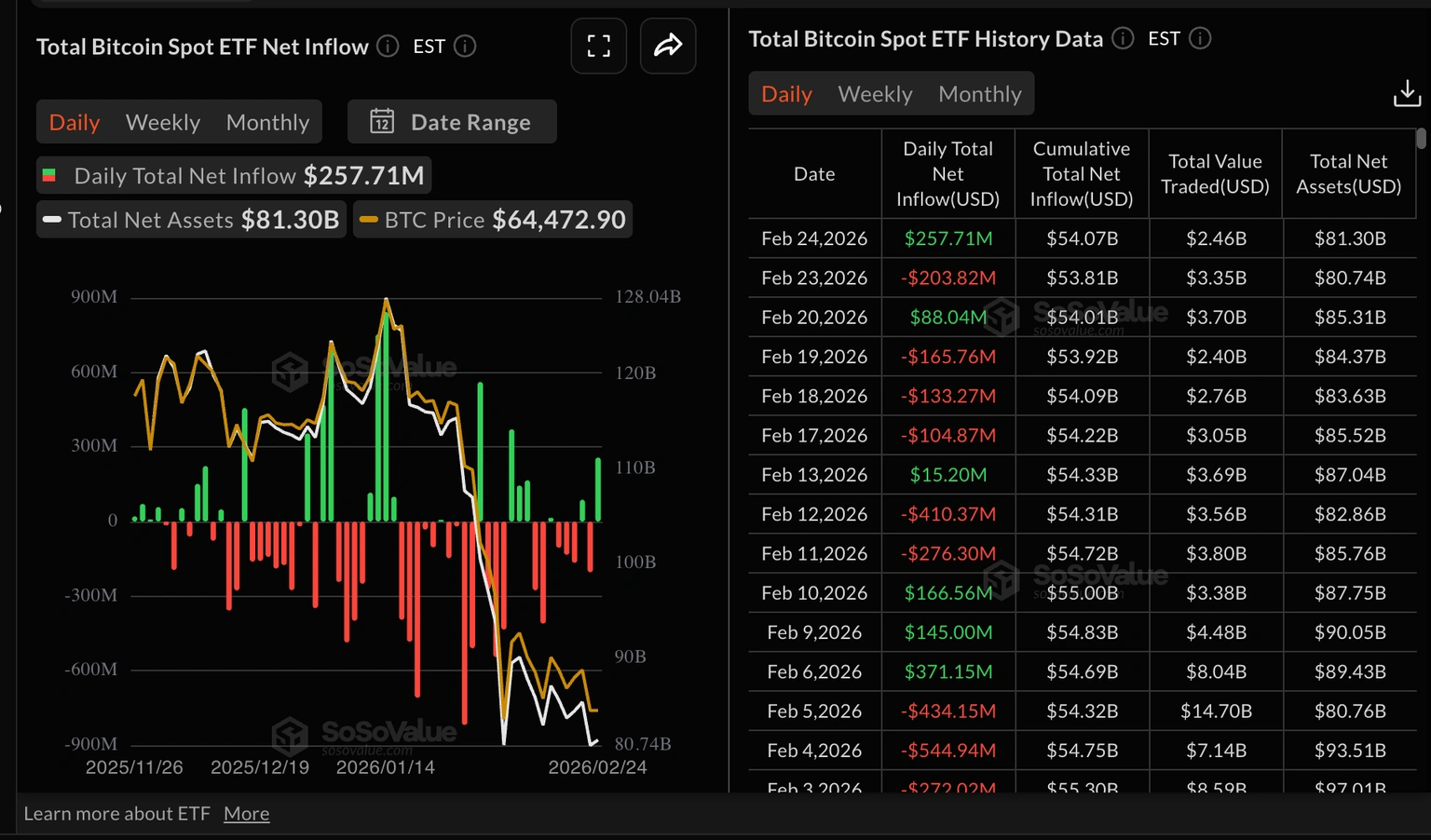

Cash flows into spot Bitcoin ETFs increased to approximately $507 million on Wednesday, up from $258 million on Tuesday. The BlackRock IBIT fund led the most inflows with $297 million, followed by Grayscale's GBTC fund with $102 million. Total cash flows currently stand at $54.57 billion, while the total assets under management average $867.6 billion.

Steady inflows into ETFs help boost positive sentiment, encouraging investors to increase their exposure with expectations of steady price rises.

Bitcoin ETF Cash Flows | Source

View OriginalCash flows into spot Bitcoin ETFs increased to approximately $507 million on Wednesday, up from $258 million on Tuesday. The BlackRock IBIT fund led the most inflows with $297 million, followed by Grayscale's GBTC fund with $102 million. Total cash flows currently stand at $54.57 billion, while the total assets under management average $867.6 billion.

Steady inflows into ETFs help boost positive sentiment, encouraging investors to increase their exposure with expectations of steady price rises.

Bitcoin ETF Cash Flows | Source

- Reward

- 4

- 1

- Repost

- Share

Before00zero :

:

Bitcoin price (BTC) remains above $68,000 USD at the time of writing this report on Thursday, reflecting a positive trend in the cryptocurrency market. Altcoins, including Ethereum (ETH) and Ripple (XRP), are stabilizing above key levels of $2,000 USD and $1.45 USD respectively.- Altcoin Update: Slight Rise in Ethereum and XRP as Technical Indicators Improve:

Ethereum price hovers around $1914, remaining below the 50, 100, and 200-day exponential moving averages, reinforcing the prevailing downtrend. The long-term descending resistance line, originating from its all-time high of $4956, continues to suppress recovery attempts. The MACD indicator rises above the signal line, indicating a slight improvement in momentum, though still fragile, within a broader bearish trend.

Meanwhile, the Relative Strength Index (RSI) has risen to 35 from oversold territory but remains b

View OriginalEthereum price hovers around $1914, remaining below the 50, 100, and 200-day exponential moving averages, reinforcing the prevailing downtrend. The long-term descending resistance line, originating from its all-time high of $4956, continues to suppress recovery attempts. The MACD indicator rises above the signal line, indicating a slight improvement in momentum, though still fragile, within a broader bearish trend.

Meanwhile, the Relative Strength Index (RSI) has risen to 35 from oversold territory but remains b

- Reward

- 1

- 1

- Repost

- Share

Before00zero :

:

The decline in Ethereum's price remains protected above $1800, as bullish traders aim for a breakout to reach higher levels above $2000. Renewed institutional interest and strong support increase the likelihood of a sustainable rebound for XRP.

- Daily Chart: Bitcoin Moving Toward Higher Support Levels:

Bitcoin is trading at $65,510 at the time of writing on Wednesday, as the short-term trend shifts to a cautious bullish outlook after regaining ground above its recent lows near $62,510. Meanwhile, the MACD( remains above its signal line on the daily chart, indicating improving bullish momentum.

The RSI) stayed at 35 below the midpoint of 50 after rising from oversold territory, suggesting a decrease in bearish pressure rather than strong buying. At the same time, Bitcoin's price( is trading below the 50, 100, and 200-day EMAs), which

Bitcoin is trading at $65,510 at the time of writing on Wednesday, as the short-term trend shifts to a cautious bullish outlook after regaining ground above its recent lows near $62,510. Meanwhile, the MACD( remains above its signal line on the daily chart, indicating improving bullish momentum.

The RSI) stayed at 35 below the midpoint of 50 after rising from oversold territory, suggesting a decrease in bearish pressure rather than strong buying. At the same time, Bitcoin's price( is trading below the 50, 100, and 200-day EMAs), which

BTC5,05%

MC:$2.43KHolders:1

0.00%

- Reward

- 5

- 1

- Repost

- Share

Before00zero :

:

The price of Bitcoin rose above $65,000, supported by improved risk sentiment and capital inflows into spot exchange-traded funds.- The resurgence of institutional demand has led to a rally in Bitcoin, Ethereum, and Ripple.

Interest from institutions in spot Bitcoin ETFs is rebounding, with total inflows reaching approximately $258 million on Tuesday. The Fidelity Bitcoin ETF (FBTC ETF) leads the list with inflows of around $83 million, followed by BlackRock's iBIT ETF with $79 million, and 21Shares' ARKB ETF with $71 million.

Total inflows amount to $54 billion, while net assets stand at $81 billion. Continued inflows are expected to boost investor confidence in Bitcoin as risk appetite improves.

Bitcoin ETF Inflows | S

View OriginalInterest from institutions in spot Bitcoin ETFs is rebounding, with total inflows reaching approximately $258 million on Tuesday. The Fidelity Bitcoin ETF (FBTC ETF) leads the list with inflows of around $83 million, followed by BlackRock's iBIT ETF with $79 million, and 21Shares' ARKB ETF with $71 million.

Total inflows amount to $54 billion, while net assets stand at $81 billion. Continued inflows are expected to boost investor confidence in Bitcoin as risk appetite improves.

Bitcoin ETF Inflows | S

- Reward

- 2

- 1

- Repost

- Share

Before00zero :

:

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) are experiencing a significant rise at the time of writing this report on Wednesday, amid ongoing market stagnation. The price of Bitcoin, the king of digital currencies, has increased by more than 2% during the trading session, surpassing $65,000, after opening at $64,058. Bitcoin had tested the support level at $62,500 on Tuesday.- Technical Outlook on Altcoins: Ethereum and XRP Decline as Selling Fears Intensify:

Ethereum is currently trading below the support level that has turned into resistance at $1900, while maintaining its price above the daily low of $1847. The leading smart contract token is also trading below the 50-day exponential moving average at $2428, the 100-day EMA at $2767, and the 200-day EMA at $3027.

The Relative Strength Index (RSI) at 33 is approaching oversold territory, a scenario that could amplify the prevailing bearish trend. If Ethereum's price drops below the daily low, the downtrend could

View OriginalEthereum is currently trading below the support level that has turned into resistance at $1900, while maintaining its price above the daily low of $1847. The leading smart contract token is also trading below the 50-day exponential moving average at $2428, the 100-day EMA at $2767, and the 200-day EMA at $3027.

The Relative Strength Index (RSI) at 33 is approaching oversold territory, a scenario that could amplify the prevailing bearish trend. If Ethereum's price drops below the daily low, the downtrend could

MC:$2.43KHolders:1

0.00%

- Reward

- 2

- 1

- Repost

- Share

Before00zero :

:

Ethereum continues its downward trend below $1900, influenced by a decline in retail investor participation. XRP's losses expand for the second consecutive day amid deteriorating technical conditions.

- Daily Chart: Bitcoin Sellers Tighten Their Grip:

The price of Bitcoin hovers above $66,000, below the 50-day exponential moving average (EMA) at $77,427, the 100-day exponential moving average at $84,845, and the 200-day exponential moving average at $92,085.

Key technical indicators, such as the Relative Strength Index (RSI) at 34 on the daily chart, suggest the bearish momentum may continue in the upcoming sessions. The SuperTrend indicator appears to be capping Bitcoin's rise at $72,271. Therefore, traders should watch the daily low at $64,291, which is likely to absorb selling pressure a

The price of Bitcoin hovers above $66,000, below the 50-day exponential moving average (EMA) at $77,427, the 100-day exponential moving average at $84,845, and the 200-day exponential moving average at $92,085.

Key technical indicators, such as the Relative Strength Index (RSI) at 34 on the daily chart, suggest the bearish momentum may continue in the upcoming sessions. The SuperTrend indicator appears to be capping Bitcoin's rise at $72,271. Therefore, traders should watch the daily low at $64,291, which is likely to absorb selling pressure a

BTC5,05%

- Reward

- 2

- 1

- Repost

- Share

Before00zero :

:

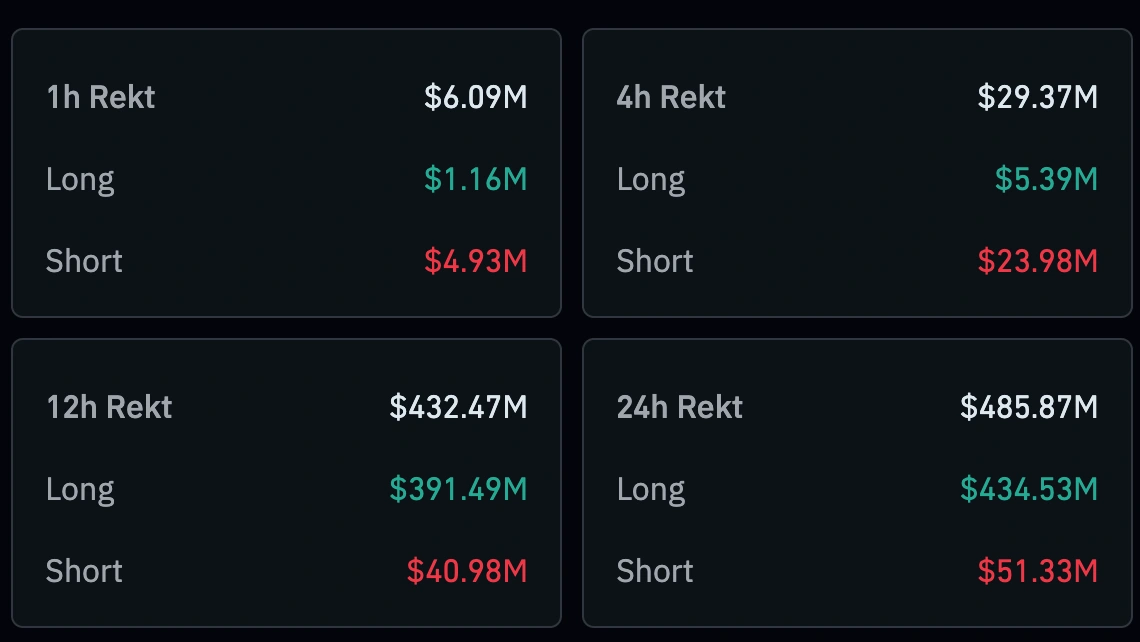

The price of Bitcoin remains above $66,000, but it is still under pressure as the total cryptocurrency liquidations approach $500 million over the past 24 hours.- Accelerating Cryptocurrency Sell-Offs Amid Continued Tariff Pressures:

In a historic ruling issued on Friday, the U.S. Supreme Court determined that President Trump exceeded his authority by imposing tariffs on global trade. The ruling confirmed that the International Emergency Economic Powers Act (IEEPA) does not grant the president the authority to impose such taxes without congressional approval, which holds the constitutional power to levy taxes and regulate commerce.

However, President Trump criticized the ruling and quickly signed another executive order imposing a comprehensive global

View OriginalIn a historic ruling issued on Friday, the U.S. Supreme Court determined that President Trump exceeded his authority by imposing tariffs on global trade. The ruling confirmed that the International Emergency Economic Powers Act (IEEPA) does not grant the president the authority to impose such taxes without congressional approval, which holds the constitutional power to levy taxes and regulate commerce.

However, President Trump criticized the ruling and quickly signed another executive order imposing a comprehensive global

- Reward

- 1

- 1

- Repost

- Share

Before00zero :

:

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) are trading amid increasing selling pressure at the time of writing this report on Monday, as investors react to the new trade uncertainty surrounding President Donald Trump's efforts to impose additional tariffs.- Ethereum Price Expectations: Vitalik Buterin hints at an "embedded" upgrade to the L1 network inspired by the Safer Bank approach:

- Ethereum Price Today: $1960

Vitalik Buterin, co-founder of Ethereum, revealed plans for the future of blockchain technology in response to comments about network shutdowns.

Buterin proposed an upgrade called "Unattractive and cryptography-based Ethereum" as an alternative to the current system.

Ethereum needs to recover its 20-day exponential moving average to mitigate downside risks.

Vitalik Buterin, co-founder of Ethereum, sparked excitement in the crypto com

- Ethereum Price Today: $1960

Vitalik Buterin, co-founder of Ethereum, revealed plans for the future of blockchain technology in response to comments about network shutdowns.

Buterin proposed an upgrade called "Unattractive and cryptography-based Ethereum" as an alternative to the current system.

Ethereum needs to recover its 20-day exponential moving average to mitigate downside risks.

Vitalik Buterin, co-founder of Ethereum, sparked excitement in the crypto com

ETH3,83%

- Reward

- 7

- 3

- Repost

- Share

WhaleProtocolOfficial :

:

Bullish market at its peak 🐂View More

- Technical Outlook on Altcoins: Ethereum and XRP Continue to Recover:

Ethereum's price is rising toward the psychological resistance level at $2000, with bullish momentum increasing from its lowest point of the day at $1932. Although the leading smart contract token is trading sideways within a support range around $1900 and resistance near $2000, the MACD indicator remains above the signal line on the daily chart, indicating increasing bullish momentum. The green histogram bars are expanding above the MACD zero line, encouraging investors to increase their investments.

However, traders shoul

View OriginalEthereum's price is rising toward the psychological resistance level at $2000, with bullish momentum increasing from its lowest point of the day at $1932. Although the leading smart contract token is trading sideways within a support range around $1900 and resistance near $2000, the MACD indicator remains above the signal line on the daily chart, indicating increasing bullish momentum. The green histogram bars are expanding above the MACD zero line, encouraging investors to increase their investments.

However, traders shoul

MC:$2.43KHolders:1

0.00%

- Reward

- 2

- 1

- Repost

- Share

Before00zero :

:

Ethereum is trading sideways within a defined range amid mixed technical signals and a slight increase in open futures contracts to $24.15 billion. The price of XRP is $1.40, supported by a return of ETF inflows.

- Today’s Chart: Bitcoin Traders Tighten Their Grip:

It looks like Bitcoin is on the verge of breaking through the short-term resistance level of $68,000, supported by the Moving Average Convergence Divergence (MACD) indicator, which remains above its signal line on the daily chart with expanding green bars.

A decisive breakout above $68,000 will reinforce the bullish trend for Bitcoin, making it the leading digital currency attractive to both individual and institutional investors. Among the key areas to watch is the psychological threshold at $70,000, which, if surpassed, could open the door

It looks like Bitcoin is on the verge of breaking through the short-term resistance level of $68,000, supported by the Moving Average Convergence Divergence (MACD) indicator, which remains above its signal line on the daily chart with expanding green bars.

A decisive breakout above $68,000 will reinforce the bullish trend for Bitcoin, making it the leading digital currency attractive to both individual and institutional investors. Among the key areas to watch is the psychological threshold at $70,000, which, if surpassed, could open the door

BTC5,05%

MC:$3.8KHolders:1

0.00%

- Reward

- 3

- 1

- Repost

- Share

Before00zero :

:

Bitcoin price recovers to approach $68,000 with slight signs of retail investors returning to the market.