Arnau4Bet

No content yet

Arnau4Bet

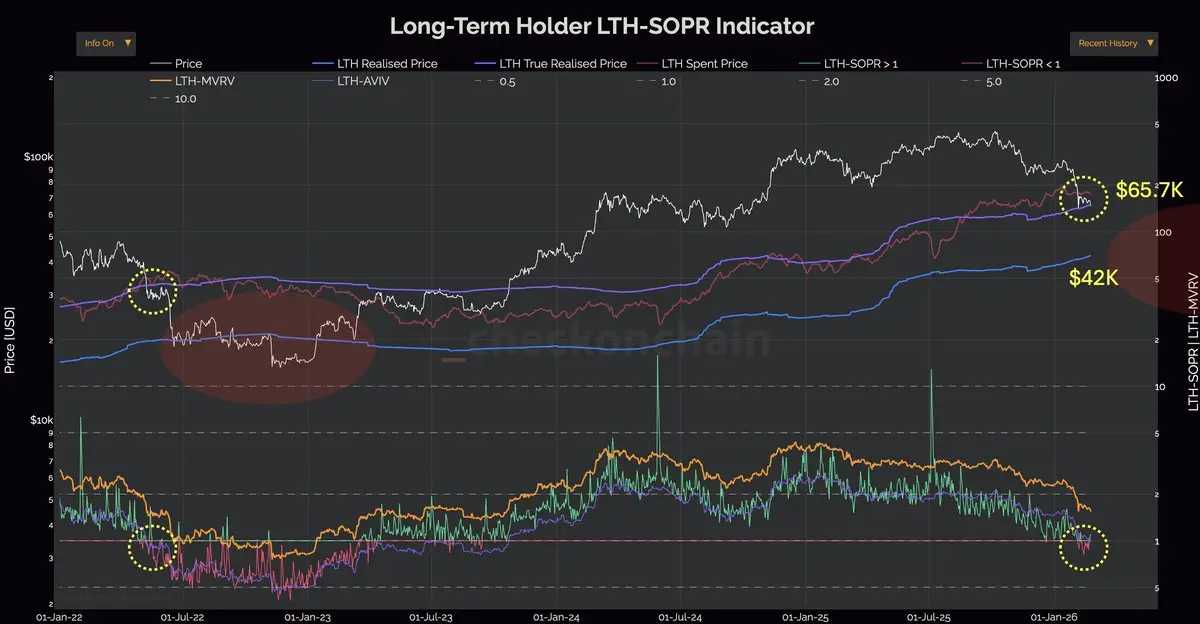

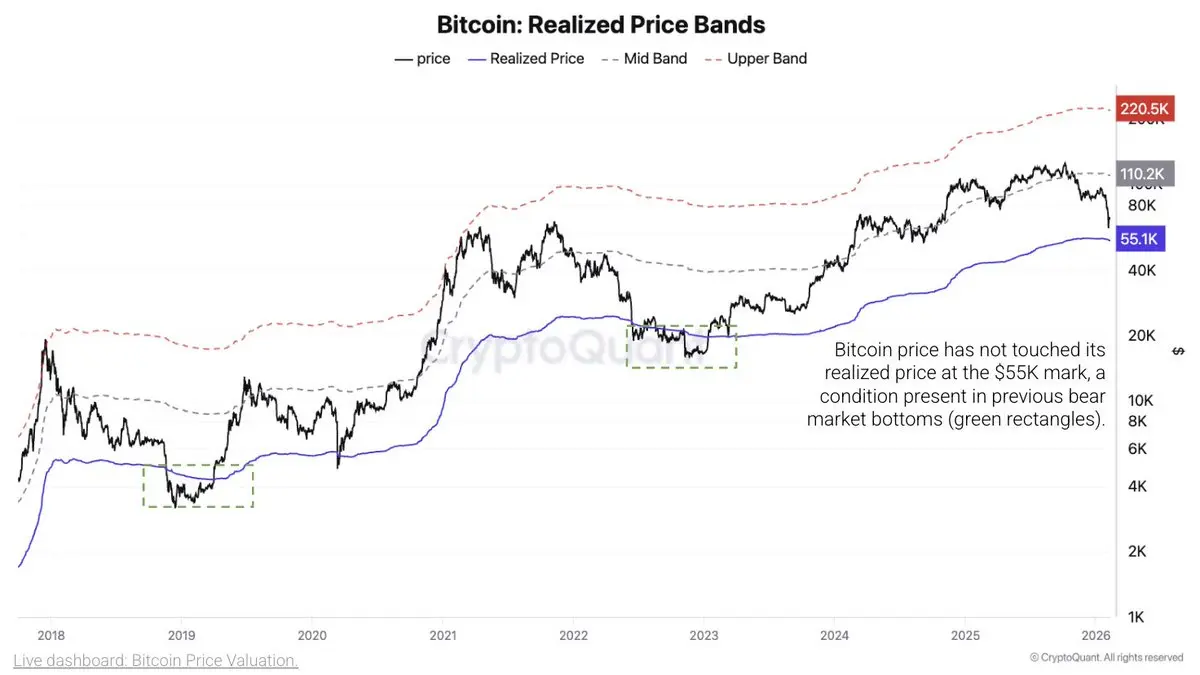

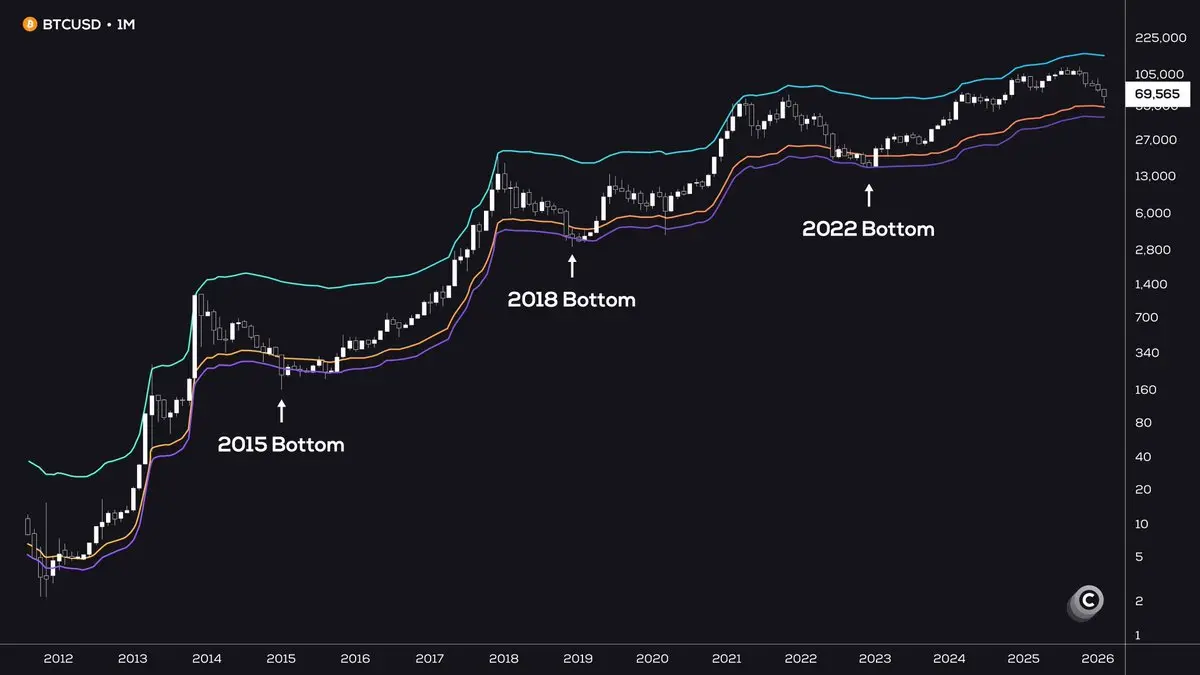

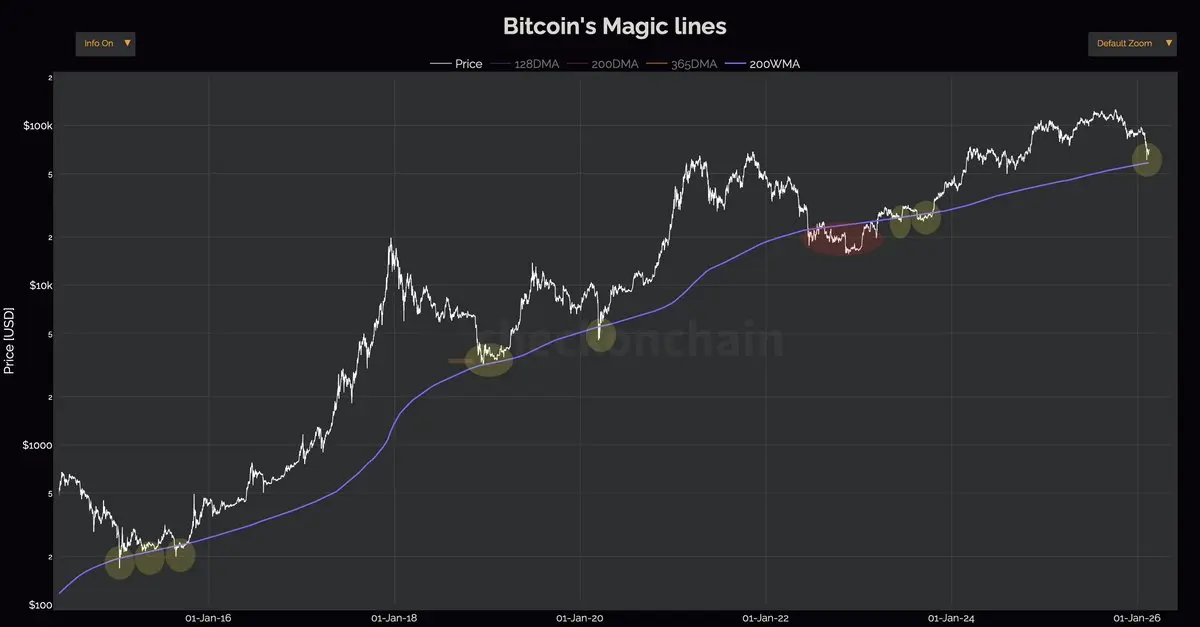

Bitcoin at maximum oversold levels. We are at Covid levels or FTX collapse levels.

If markets continue to fall due to tariffs, Iran, or Nvidia results, Bitcoin could lose the key level without recovering it, which would open up a much worse scenario. Stay tuned for the coming days.

If markets continue to fall due to tariffs, Iran, or Nvidia results, Bitcoin could lose the key level without recovering it, which would open up a much worse scenario. Stay tuned for the coming days.

BTC5,52%

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin in a decision zone.

Below, large buy orders between 61,500 and 59,600. Above, if it manages to rebound strongly, the levels to target are 72,000 and 75,000.

It's very important to start gaining strength; it’s likely that we will drop a bit more to absorb liquidity.

Below, large buy orders between 61,500 and 59,600. Above, if it manages to rebound strongly, the levels to target are 72,000 and 75,000.

It's very important to start gaining strength; it’s likely that we will drop a bit more to absorb liquidity.

BTC5,52%

- Reward

- like

- Comment

- Repost

- Share

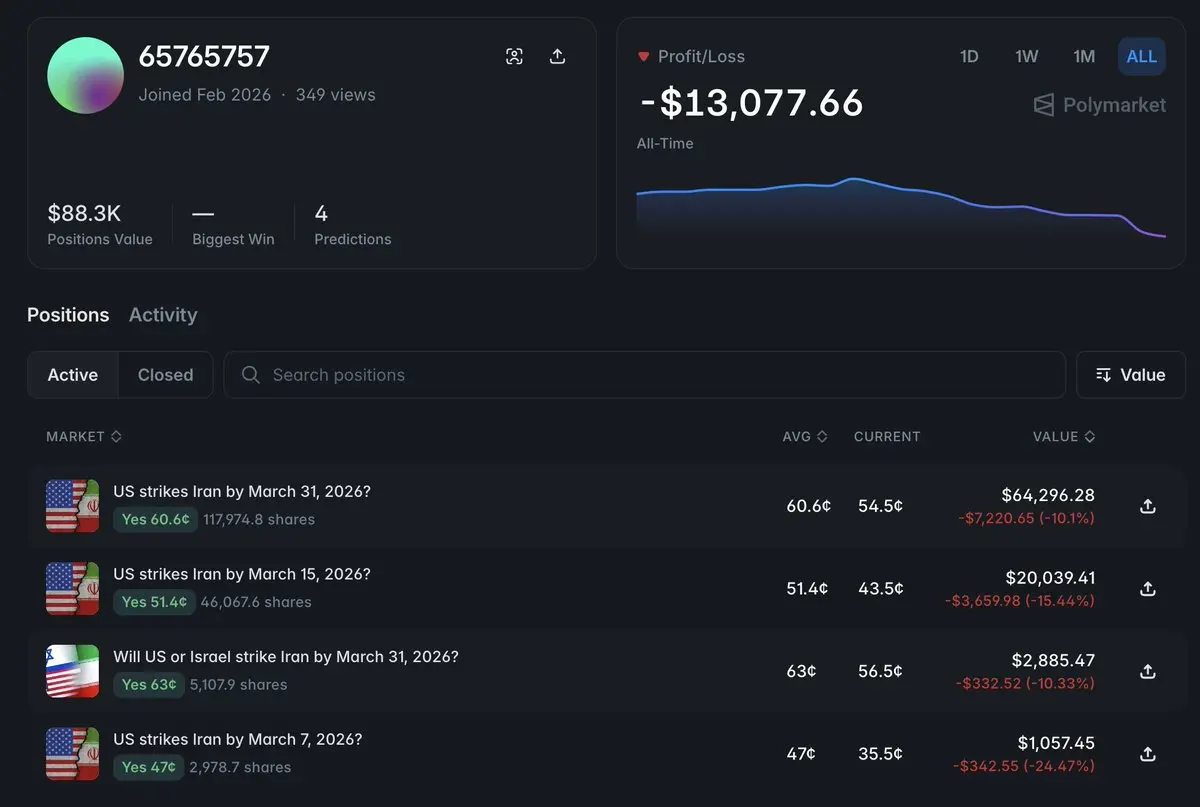

Someone created a new wallet and bet +$100,000 that the United States will attack Iran in March.

Right now, they are at a loss, but they are holding the position. They are very confident.

Gambler or insider?

View OriginalRight now, they are at a loss, but they are holding the position. They are very confident.

Gambler or insider?

- Reward

- 2

- Comment

- Repost

- Share

Gold, silver, and oil rise. Bitcoin falls.

When there is geopolitical uncertainty, capital rushes into safe-haven assets. Bitcoin is still not one of them. It is priced as a leveraged risk asset, not as the digital gold that many want it to be.

When there is geopolitical uncertainty, capital rushes into safe-haven assets. Bitcoin is still not one of them. It is priced as a leveraged risk asset, not as the digital gold that many want it to be.

BTC5,52%

- Reward

- 2

- Comment

- Repost

- Share

We've been stuck in this loop for months, but remember: nothing ever happens until something happens.

View Original

- Reward

- 2

- Comment

- Repost

- Share

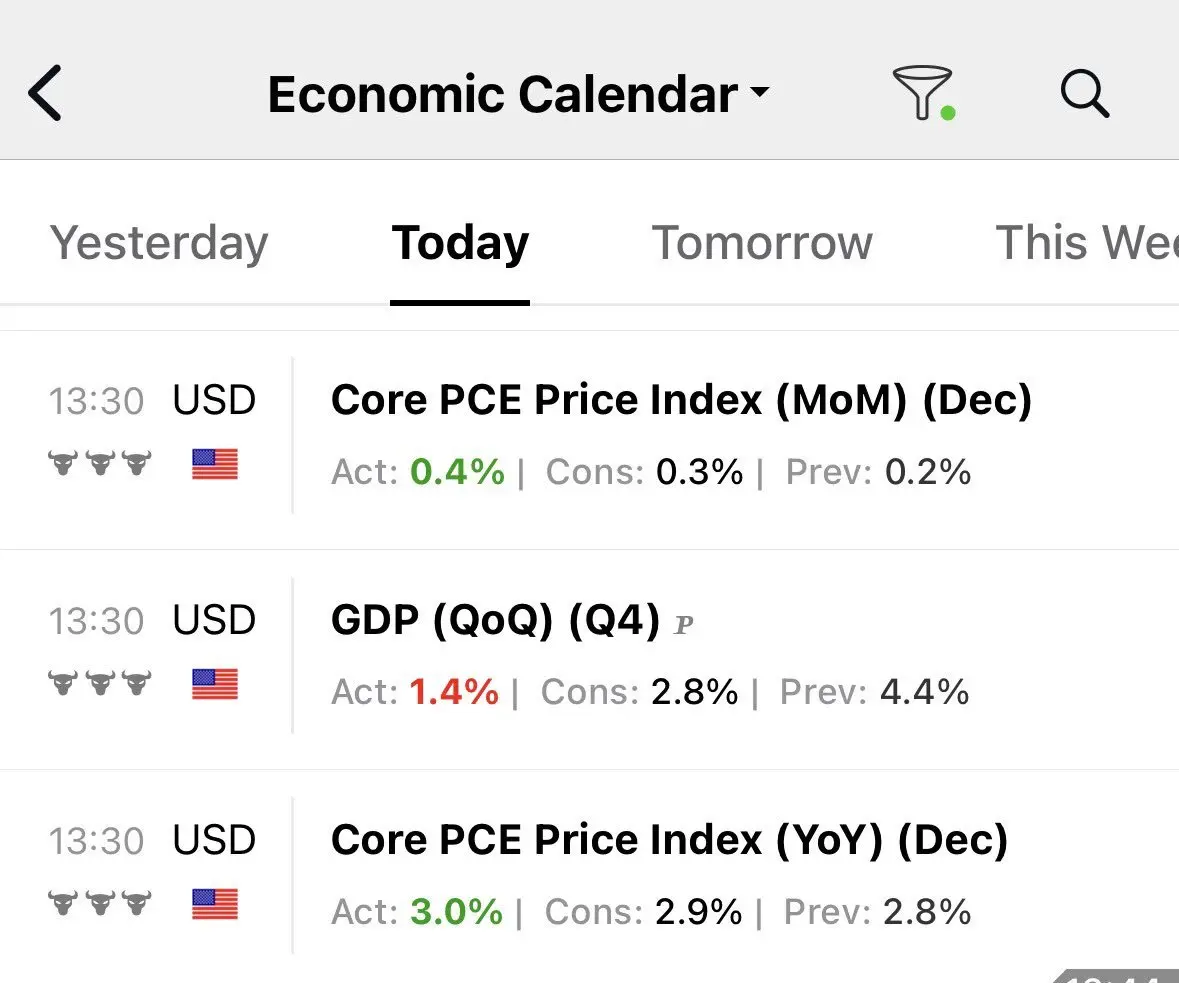

We have poor macroeconomic data:

GDP grew by 1.4%, well below the expected 3.0%, indicating a sharper slowdown than the market had anticipated.

December's PCE inflation rose to 2.9% (vs. 2.8% expected), while Core PCE climbed to 3.0%, its highest level since November 2023.

Deceleration + rising inflation.

View OriginalGDP grew by 1.4%, well below the expected 3.0%, indicating a sharper slowdown than the market had anticipated.

December's PCE inflation rose to 2.9% (vs. 2.8% expected), while Core PCE climbed to 3.0%, its highest level since November 2023.

Deceleration + rising inflation.

- Reward

- 1

- Comment

- Repost

- Share

Is China quietly accumulating Bitcoin?

One of the largest holders of the Bitcoin ETF is a Chinese shell company called Laurore Ltd.

Almost nothing is known about them, only that the address is in Hong Kong.

Since China cannot buy crypto directly, they use this vehicle to gain exposure through BlackRock. Chinese institutional money has already entered. And no one saw it coming.

One of the largest holders of the Bitcoin ETF is a Chinese shell company called Laurore Ltd.

Almost nothing is known about them, only that the address is in Hong Kong.

Since China cannot buy crypto directly, they use this vehicle to gain exposure through BlackRock. Chinese institutional money has already entered. And no one saw it coming.

BTC5,52%

- Reward

- like

- Comment

- Repost

- Share

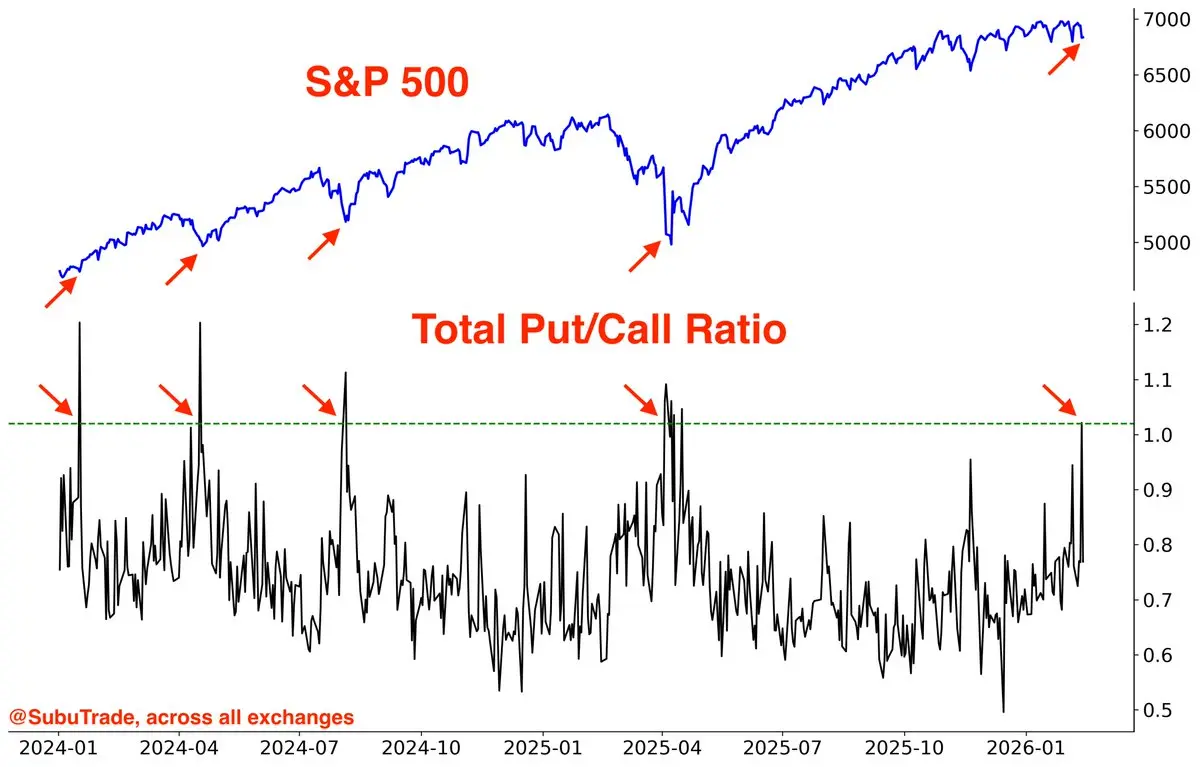

Will the markets rise soon? Watch out for this.

When the Put/Call ratio exceeds 1.0, it indicates panic in the SP500. Historically, when fear reaches these levels, the SP500 and markets tend to rebound.

View OriginalWhen the Put/Call ratio exceeds 1.0, it indicates panic in the SP500. Historically, when fear reaches these levels, the SP500 and markets tend to rebound.

- Reward

- 2

- Comment

- Repost

- Share

Bitcoin is approaching a key zone: the area above 58,000.

It has served as support in the past, as shown by the marked points. Bitcoin bounced there on previous occasions.

But beware, it is not infallible. It should be viewed as an area of interest, not as a guarantee of a bottom.

It has served as support in the past, as shown by the marked points. Bitcoin bounced there on previous occasions.

But beware, it is not infallible. It should be viewed as an area of interest, not as a guarantee of a bottom.

BTC5,52%

- Reward

- 3

- Comment

- 1

- Share

Is the AI bubble coming to an end?

AI performance has been excessive, similar to past explosions that ended badly. The market knows this, and it's something that cannot be ignored.

History never repeats, but it rhymes.

View OriginalAI performance has been excessive, similar to past explosions that ended badly. The market knows this, and it's something that cannot be ignored.

History never repeats, but it rhymes.

- Reward

- 1

- Comment

- Repost

- Share

Chart: Epstein Files vs BTC.

- It was obvious in summer that they would be published.

- On October 25, the workers began sorting them for release.

- On November 19, it was announced that they would be published within 30 days at most.

- On December 19, the first were released with heavy censorship and nothing about crypto.

- On January 30, all were declassified.

I don't blame the files, but they have clearly collaborated. 👇

- It was obvious in summer that they would be published.

- On October 25, the workers began sorting them for release.

- On November 19, it was announced that they would be published within 30 days at most.

- On December 19, the first were released with heavy censorship and nothing about crypto.

- On January 30, all were declassified.

I don't blame the files, but they have clearly collaborated. 👇

BTC5,52%

- Reward

- like

- Comment

- Repost

- Share

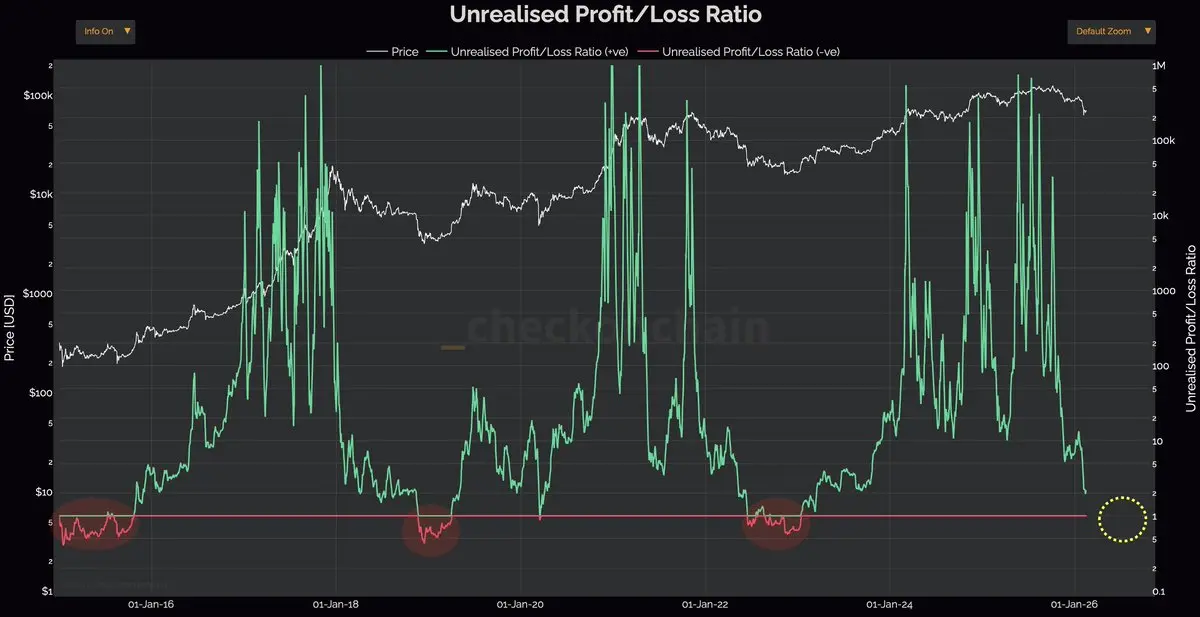

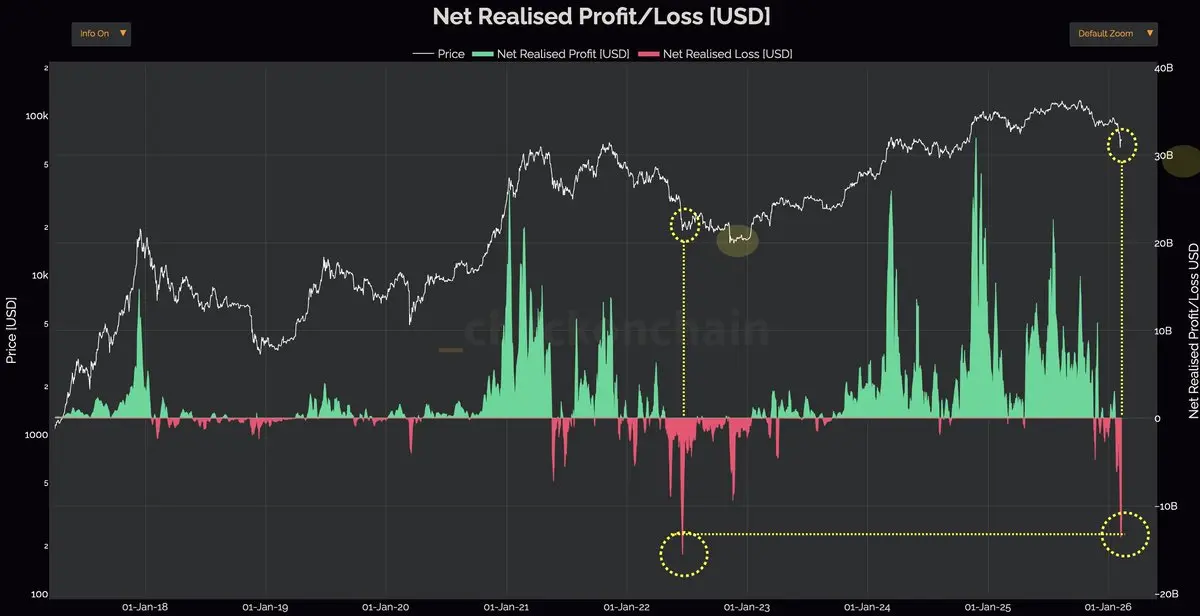

Pay attention to this chart.

We are at levels equivalent to the 2022 bear market, and we are seeing huge losses.

But if you look closely at 2022, we didn't see the bottom until about 5 months later. Maybe history won't repeat itself, but it's something to keep in mind.

View OriginalWe are at levels equivalent to the 2022 bear market, and we are seeing huge losses.

But if you look closely at 2022, we didn't see the bottom until about 5 months later. Maybe history won't repeat itself, but it's something to keep in mind.

- Reward

- like

- Comment

- Repost

- Share

China no longer trusts the dollar in the long term.

They are continuously selling American bonds, especially the 10 and 30-year ones.

U.S. debt is unpayable, and China knows it. Who would trust a 30-year bond? In 30 years, the dollar will be worth much less. That's why they are selling bonds and buying gold.

View OriginalThey are continuously selling American bonds, especially the 10 and 30-year ones.

U.S. debt is unpayable, and China knows it. Who would trust a 30-year bond? In 30 years, the dollar will be worth much less. That's why they are selling bonds and buying gold.

- Reward

- like

- Comment

- Repost

- Share

The United States is about to activate the largest money printing in history.

HOW DOES THIS AFFECT YOUR INVESTMENTS?

The 30-year US bond is pushing 5%. That’s the red line. If it surpasses that, the system collapses. The US has so much debt that it cannot pay it at those interest rates.

That’s why every time yields approach 5%, the Fed or Trump intervene. They do whatever it takes to lower it. But the problem is they can’t do it forever.

The only viable solution for the US is Yield Curve Control (YCC). The Fed will buy bonds whenever yields rise. Infinitely. Printing dollars nonstop.

It’s the

HOW DOES THIS AFFECT YOUR INVESTMENTS?

The 30-year US bond is pushing 5%. That’s the red line. If it surpasses that, the system collapses. The US has so much debt that it cannot pay it at those interest rates.

That’s why every time yields approach 5%, the Fed or Trump intervene. They do whatever it takes to lower it. But the problem is they can’t do it forever.

The only viable solution for the US is Yield Curve Control (YCC). The Fed will buy bonds whenever yields rise. Infinitely. Printing dollars nonstop.

It’s the

BTC5,52%

- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More77.6K Popularity

169.07K Popularity

35.06K Popularity

9.13K Popularity

422.45K Popularity

Pin