1783CLUB

No content yet

1783CLUB

In 2025, ETH rose from $1,400 to $4,800

Must see Yilihua

Full of vigor and vitality

Proud and confident

By the end of January and early February 2026, Yilihua lost over $734 million in a week, roughly 5 billion RMB.

Starting February 6, 2026, a mysterious fund with a Hong Kong background began to scoop up the bottom.

Hong Kong's underwater still runs very deep.

Must see Yilihua

Full of vigor and vitality

Proud and confident

By the end of January and early February 2026, Yilihua lost over $734 million in a week, roughly 5 billion RMB.

Starting February 6, 2026, a mysterious fund with a Hong Kong background began to scoop up the bottom.

Hong Kong's underwater still runs very deep.

ETH0,79%

- Reward

- like

- Comment

- Repost

- Share

Everyone disperse. The emperor is not in a hurry, but the eunuchs are anxious. Over the past week, a loss of $734 million has occurred, roughly 5 billion RMB. The male protagonist, Yilihua, is chatting and joking with old OGs like Kong Jianping, eating and drinking as if nothing happened.

View Original

- Reward

- like

- 1

- Repost

- Share

Morison :

:

That is him.Yili Hu, the brave warrior, has cut off his arm. His subsidiary Trend Research held over 600,000 ETH at its peak, but now, in just over a week, nearly all of it has been sold. As a single entity, they have sold over 1 billion USD worth of spot ETH assets.

ETH0,79%

- Reward

- like

- Comment

- Repost

- Share

A rural kid from Hunan studying at a pretty average school in Shanghai, married the daughter of a bank president in Hangzhou, Zhejiang through Crypto, and also became business partners, achieving a social leap. Yi Li Hua truly is the most suitable to say: Thank you Crypto

View Original- Reward

- like

- Comment

- Repost

- Share

The entire year of 2025 will be a "roller coaster market," with very poor profit-making effects. At the beginning of 2026, it will explode out of nowhere, and the market will remain sluggish. However, currently, we have not yet reached the "darkest hour." In extreme pessimism, we might see Bitcoin drop to around $30,000, Ethereum fall by three digits, below $1,000. Profitability is not guaranteed, but we have plenty of experience losing money.

View Original- Reward

- like

- Comment

- Repost

- Share

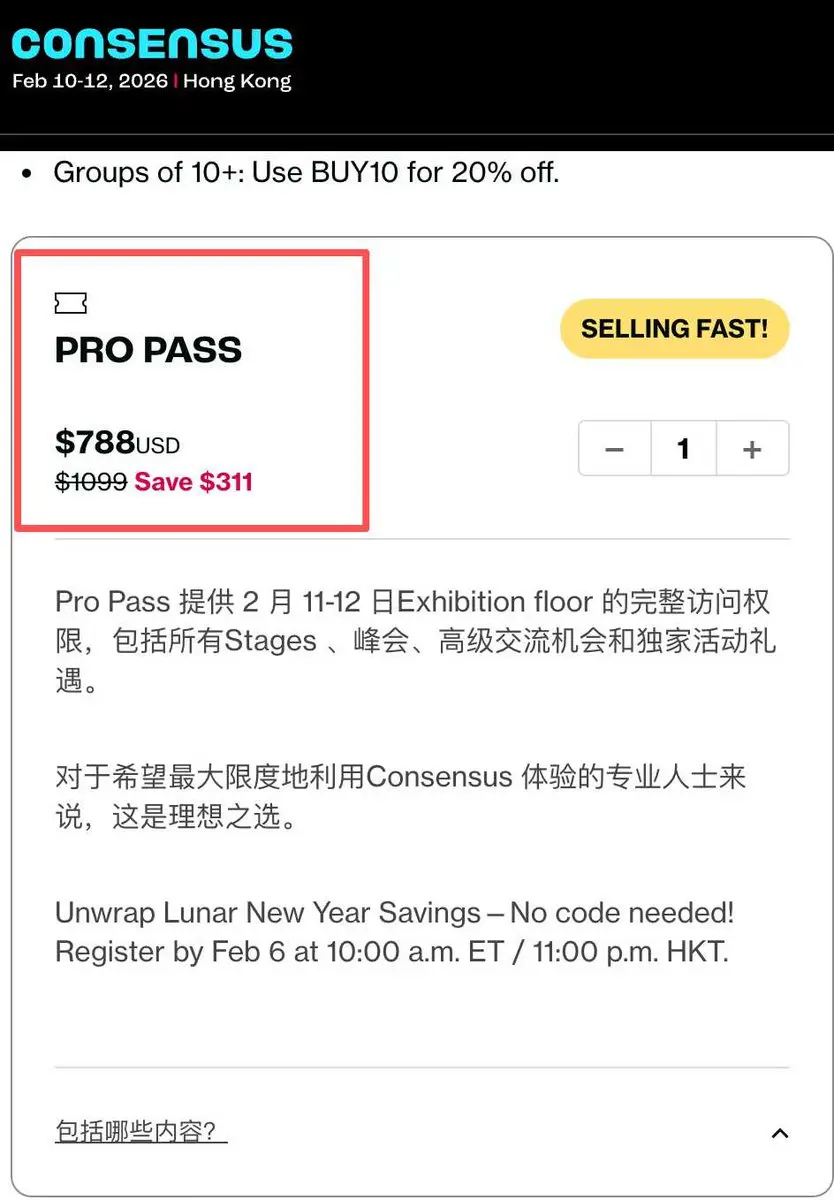

Everyone thinks that during the Spring Festival, there will be very few people going, but in fact, many Chinese in North America and Europe are high-level executives. They return to Asia to celebrate the Spring Festival and will attend the Hong Kong Consensus Conference (Consenus HK) from February 10-12. There are also quite a few people coming from Japan and Korea. Nearly 100 surrounding events have been held, and some of these events have already attracted over 1,000 registrations. The current lowest-priced main venue ticket is $788 USD, definitely not targeting the poor. #Consenus #HongKong

View Original

- Reward

- like

- Comment

- Repost

- Share

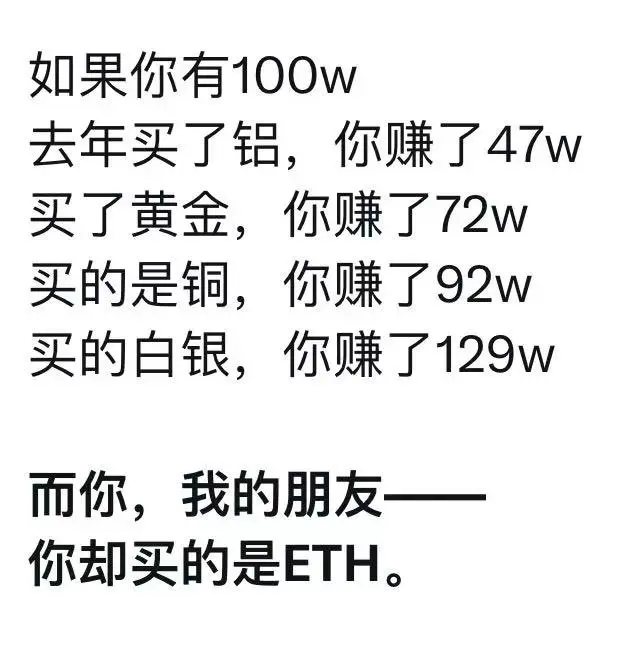

Grandma who buys gold won, dad who invests in stocks won, mom who likes buying silver won, even the younger brother who loves playing on the computer won, only you lost because you play in the crypto circle.

View Original

- Reward

- like

- Comment

- Repost

- Share

As BTC drops to $88,000 and ETH falls to around $2,900

The distribution of chips is undergoing fundamental changes

As of January 21

BitMine $BMNR holds 4.203 million ETH, accounting for 3.48% of the total ETH supply

Strategy $MSTR holds 709,700 BTC, accounting for 3.38% of the total Bitcoin supply.

An easily overlooked but very critical fact:

The control ratio of a single institution over $ETH has already exceeded $BTC .

This indicates that the market pricing power of ETH is shifting

Is the "decentralization narrative" and the actual holding structure beginning to diverge significantly?

View OriginalThe distribution of chips is undergoing fundamental changes

As of January 21

BitMine $BMNR holds 4.203 million ETH, accounting for 3.48% of the total ETH supply

Strategy $MSTR holds 709,700 BTC, accounting for 3.38% of the total Bitcoin supply.

An easily overlooked but very critical fact:

The control ratio of a single institution over $ETH has already exceeded $BTC .

This indicates that the market pricing power of ETH is shifting

Is the "decentralization narrative" and the actual holding structure beginning to diverge significantly?

- Reward

- like

- Comment

- Repost

- Share

The blockchain media from the last cycle, SanYan Finance, was not shut down because of blockchain operations.

On the contrary, after transforming into internet media, it was shut down.

View OriginalOn the contrary, after transforming into internet media, it was shut down.

- Reward

- like

- Comment

- Repost

- Share

A-shares, Hong Kong stocks, US stocks, and Crypto are all rising

The profit-making effect of the big A-shares has outperformed all markets

Currently, Crypto surprisingly has become the drag

View OriginalThe profit-making effect of the big A-shares has outperformed all markets

Currently, Crypto surprisingly has become the drag

- Reward

- like

- Comment

- Repost

- Share

Elon Musk has monopolized the overall narrative of technological innovation.

View Original

- Reward

- like

- Comment

- Repost

- Share

There has always been a superstition that during holidays in China,

the crypto market tends to experience a surge.

In this wave, $PEPE had the largest increase, soaring nearly 60% in a few days, surpassing $DOGE to become the meme king.

It's also considered a small but meaningful红包 for everyone.

View Originalthe crypto market tends to experience a surge.

In this wave, $PEPE had the largest increase, soaring nearly 60% in a few days, surpassing $DOGE to become the meme king.

It's also considered a small but meaningful红包 for everyone.

- Reward

- like

- Comment

- Repost

- Share

Meta invests $2.5 billion in AI Agent platform Manus

Meta's acquisition of Manus is valued at approximately $2.5 billion, which also includes long-term retention incentives for the core team.

Interestingly, Manus only completed Series B funding in May 2025, led by Benchmark, raising $75 million, with a valuation of just $500 million at the time.

In just half a year, Manus's valuation has directly multiplied several times.

ZhenFund, Sequoia China, Tencent, and other early investors have become the biggest winners, achieving returns of dozens of times.

Manus's main focus is not on chatbots, but

View OriginalMeta's acquisition of Manus is valued at approximately $2.5 billion, which also includes long-term retention incentives for the core team.

Interestingly, Manus only completed Series B funding in May 2025, led by Benchmark, raising $75 million, with a valuation of just $500 million at the time.

In just half a year, Manus's valuation has directly multiplied several times.

ZhenFund, Sequoia China, Tencent, and other early investors have become the biggest winners, achieving returns of dozens of times.

Manus's main focus is not on chatbots, but

- Reward

- like

- Comment

- Repost

- Share

When the era leaves you behind, there isn't even a goodbye.

On the weekend, I accompanied my idol to the North Fifth Ring and happened to visit a high-end villa.

The sales team talked about the changes in buyers over the years: years ago, most were from the internet and finance circles; now, many of those receiving keys come from the new energy industry.

This development has been on sale since 2015, and even now, nearly half of it remains undeveloped.

The market is changing, and the flow of wealth is quietly shifting.

Currently, China's IPO enthusiasm remains high, but the true wealt

View OriginalOn the weekend, I accompanied my idol to the North Fifth Ring and happened to visit a high-end villa.

The sales team talked about the changes in buyers over the years: years ago, most were from the internet and finance circles; now, many of those receiving keys come from the new energy industry.

This development has been on sale since 2015, and even now, nearly half of it remains undeveloped.

The market is changing, and the flow of wealth is quietly shifting.

Currently, China's IPO enthusiasm remains high, but the true wealt

- Reward

- like

- Comment

- Repost

- Share