逸尘Eason

No content yet

1.6 Tuesday Intraday Mistress Analysis

On the daily chart, the upward resistance has formed a substantial suppression, KDJ has entered a seriously overbought zone, and the MACD red histogram's growth rate has significantly slowed down. The momentum of the dip is nearly exhausted, and the rebound from 2620 is only a weak rebound. The daily downtrend has not been reversed.

Personal suggestion, for reference only (strictly set defenses)

Mistress around 3275, see 3360 for补, target 3180, 3090

On the daily chart, the upward resistance has formed a substantial suppression, KDJ has entered a seriously overbought zone, and the MACD red histogram's growth rate has significantly slowed down. The momentum of the dip is nearly exhausted, and the rebound from 2620 is only a weak rebound. The daily downtrend has not been reversed.

Personal suggestion, for reference only (strictly set defenses)

Mistress around 3275, see 3360 for补, target 3180, 3090

ETH0,47%

- Reward

- like

- Comment

- Repost

- Share

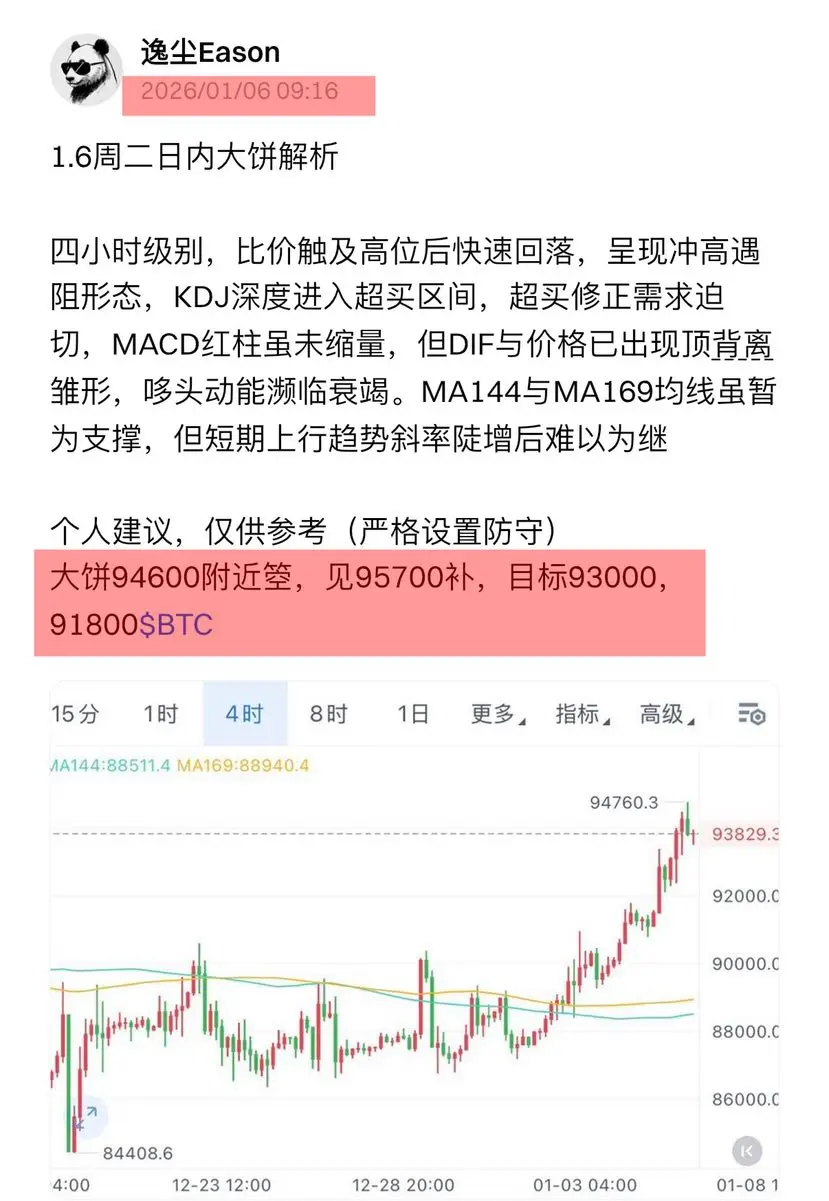

1.6 Tuesday Bitcoin Analysis

At the four-hour level, after the price touched the high, it quickly retreated, showing a resistance pattern during the rally. The KDJ indicator has entered the overbought zone deeply, indicating an urgent need for correction. Although the MACD red bars have not yet contracted, the DIF and price have already shown a top divergence pattern, and the momentum of the rally is nearing exhaustion. The MA144 and MA169 moving averages provide temporary support, but the short-term upward trend's steep slope is unlikely to be sustained.

Personal suggestion, for reference onl

At the four-hour level, after the price touched the high, it quickly retreated, showing a resistance pattern during the rally. The KDJ indicator has entered the overbought zone deeply, indicating an urgent need for correction. Although the MACD red bars have not yet contracted, the DIF and price have already shown a top divergence pattern, and the momentum of the rally is nearing exhaustion. The MA144 and MA169 moving averages provide temporary support, but the short-term upward trend's steep slope is unlikely to be sustained.

Personal suggestion, for reference onl

BTC-2,31%

- Reward

- like

- Comment

- Repost

- Share

1.5 Weekday Intraday Mistress Analysis

On the daily chart, signals are gradually emerging. The KDJ indicator is severely overbought, and the momentum of the rally is nearly exhausted. After a price surge, it failed to stabilize, and after reaching the upper band at 3172, it quickly retreated. Resistance above is prominent. Although the MACD red histogram is still expanding, the trading volume has not increased in tandem with the price. If it cannot effectively break through the resistance level later, focus should be on the support at 3115.

Personal suggestion, for reference only (strictly set

On the daily chart, signals are gradually emerging. The KDJ indicator is severely overbought, and the momentum of the rally is nearly exhausted. After a price surge, it failed to stabilize, and after reaching the upper band at 3172, it quickly retreated. Resistance above is prominent. Although the MACD red histogram is still expanding, the trading volume has not increased in tandem with the price. If it cannot effectively break through the resistance level later, focus should be on the support at 3115.

Personal suggestion, for reference only (strictly set

ETH0,47%

- Reward

- like

- 1

- Repost

- Share

ThirteenAunts :

:

Delusional disorder, a pullback to around 70 would be the biggest success.12.30 Tuesday Intraday Mistress Analysis

On the daily chart, the relative price has completely broken below the middle band at 2976 support. Intraday, it surged to 3056 and then quickly fell back to 2908. The rebound strength is weak, with no signs of support. If the 2900 integer level is broken, the relative price will directly test the lower band at 2795.

Personal suggestion, for reference only (strictly set stop-loss)

Mistress around 2965, see 3035 for补, target 2900, 2800$ETH

On the daily chart, the relative price has completely broken below the middle band at 2976 support. Intraday, it surged to 3056 and then quickly fell back to 2908. The rebound strength is weak, with no signs of support. If the 2900 integer level is broken, the relative price will directly test the lower band at 2795.

Personal suggestion, for reference only (strictly set stop-loss)

Mistress around 2965, see 3035 for补, target 2900, 2800$ETH

ETH0,47%

- Reward

- like

- Comment

- Repost

- Share

12.30 Tuesday Intraday Bitcoin Analysis

Four-hour timeframe, price not only broke below the support of MA144 and MA169 moving averages, but also surged to 90373 before quickly falling back. The low was tested at 86760, and the rebound was extremely weak. The MACD indicator's DIF and DEA continued to decline, and the momentum further dissipated. Despite entering the oversold zone, there are no signs of a reversal. The overall trend is clearly weak.

Personal suggestion, for reference only (strictly set stop-loss)

Around 88000 for Bitcoin, look for a rebound at 89000, with a target of 86000, 8430

Four-hour timeframe, price not only broke below the support of MA144 and MA169 moving averages, but also surged to 90373 before quickly falling back. The low was tested at 86760, and the rebound was extremely weak. The MACD indicator's DIF and DEA continued to decline, and the momentum further dissipated. Despite entering the oversold zone, there are no signs of a reversal. The overall trend is clearly weak.

Personal suggestion, for reference only (strictly set stop-loss)

Around 88000 for Bitcoin, look for a rebound at 89000, with a target of 86000, 8430

BTC-2,31%

- Reward

- 1

- Comment

- Repost

- Share

Analysis of Bitcoin over the Weekend on 12.27 Saturday and Sunday

The four-hour timeframe shows that the price continues to face resistance below the MA144 and MA169, which are the medium- and long-term moving averages, forming a strong resistance zone. The rebound attempts have repeatedly been blocked and pushed back down. The bears have no resistance, and the MACD indicator's DIF and DEA remain in the negative zone. Although the green bars have slightly narrowed, the downward trend remains unchanged. The current short-term support at 86,619 is becoming increasingly fragile. Once this level i

The four-hour timeframe shows that the price continues to face resistance below the MA144 and MA169, which are the medium- and long-term moving averages, forming a strong resistance zone. The rebound attempts have repeatedly been blocked and pushed back down. The bears have no resistance, and the MACD indicator's DIF and DEA remain in the negative zone. Although the green bars have slightly narrowed, the downward trend remains unchanged. The current short-term support at 86,619 is becoming increasingly fragile. Once this level i

BTC-2,31%

- Reward

- like

- Comment

- Repost

- Share

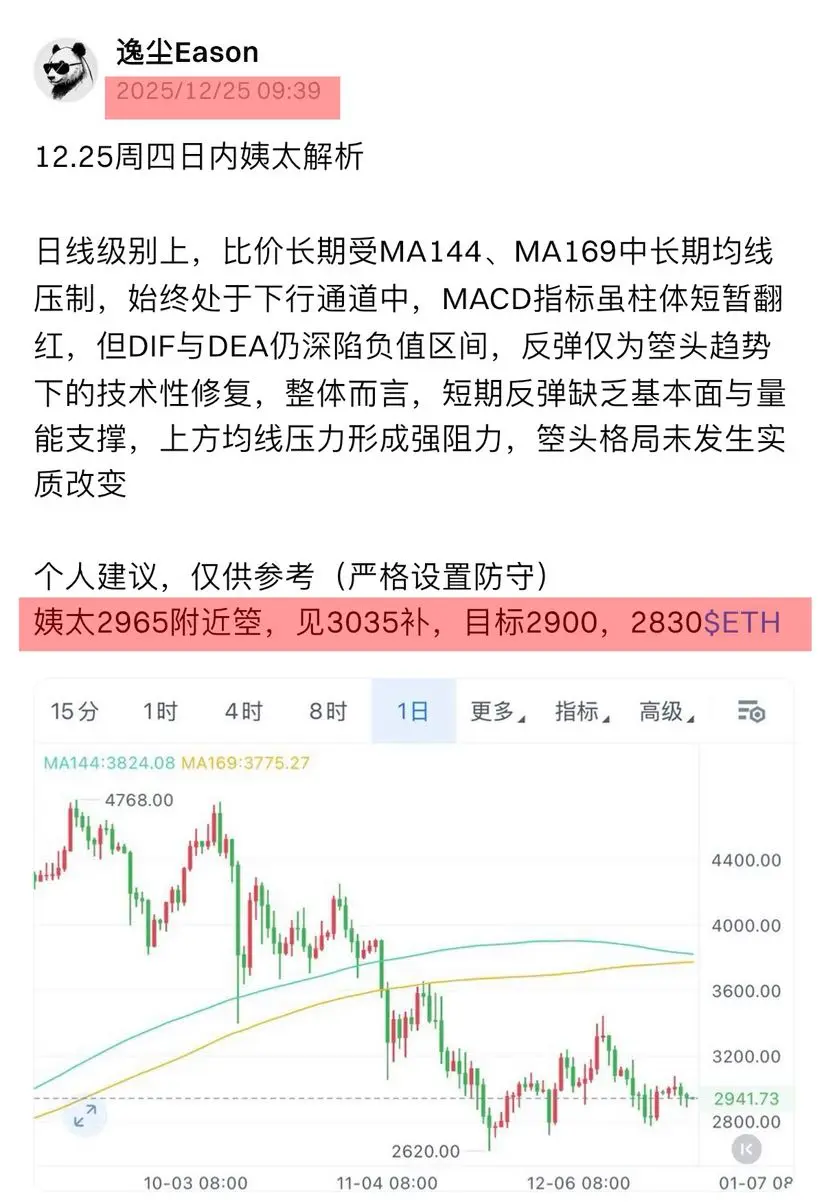

December 25 Thursday Intraday Mistress Analysis

On the daily chart, the price remains suppressed by the long-term MA144 and MA169 moving averages, staying within a downward channel. Although the MACD indicator's histogram briefly turned red, the DIF and DEA are still deep in negative territory. The rebound is merely a technical correction within a downtrend. Overall, the short-term rebound lacks fundamental and volume support, with resistance from the moving averages forming a strong barrier. The downtrend pattern has not undergone a substantial change.

Personal advice, for reference only (str

On the daily chart, the price remains suppressed by the long-term MA144 and MA169 moving averages, staying within a downward channel. Although the MACD indicator's histogram briefly turned red, the DIF and DEA are still deep in negative territory. The rebound is merely a technical correction within a downtrend. Overall, the short-term rebound lacks fundamental and volume support, with resistance from the moving averages forming a strong barrier. The downtrend pattern has not undergone a substantial change.

Personal advice, for reference only (str

ETH0,47%

- Reward

- like

- Comment

- Repost

- Share

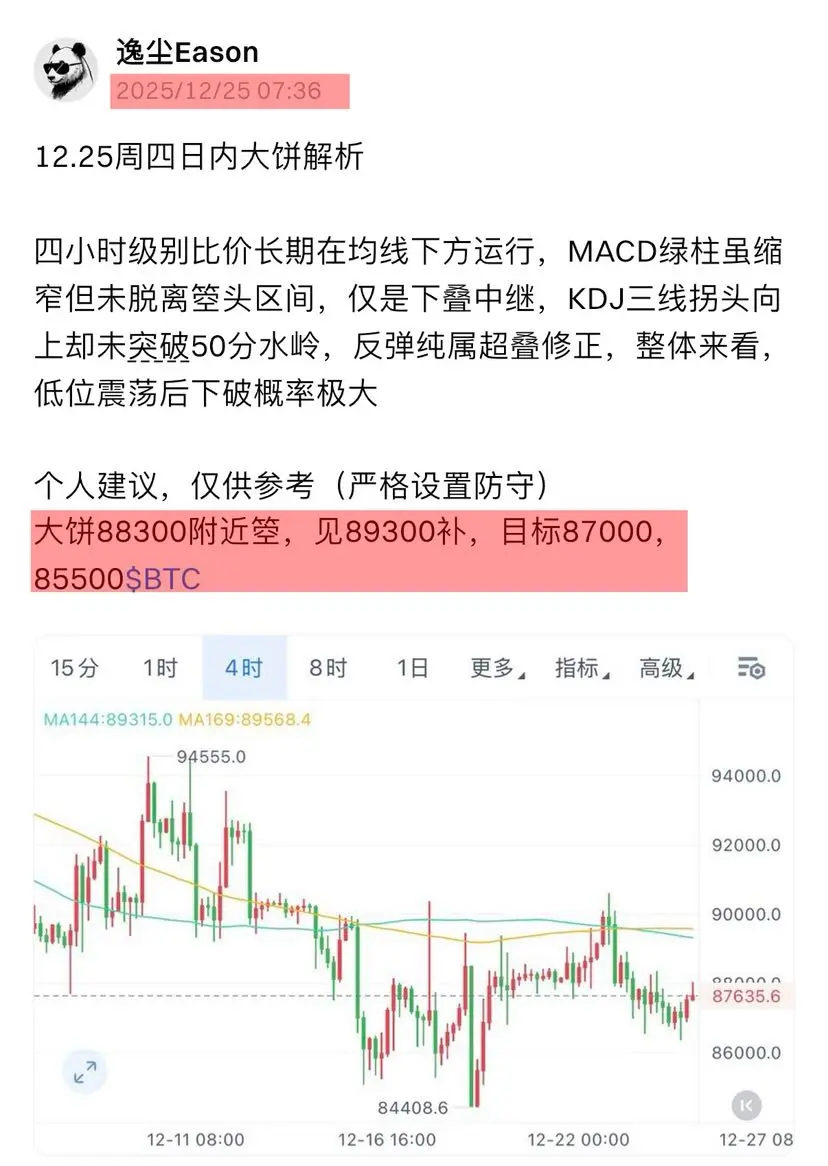

12.25 Thursday Intraday Bitcoin Analysis

The four-hour timeframe has been consistently trading below the moving averages. Although the MACD green bars are narrowing, they have not exited the consolidation zone, indicating a continuation of the downward trend. The KDJ indicator's three lines are turning upward but have not broken through the 50 level. The rebound is purely a correction from oversold conditions. Overall, after a low-volume consolidation, there is a high probability of a breakdown.

Personal suggestion, for reference only (strictly set stop-loss)

Bitcoin around 88,300, see for a r

The four-hour timeframe has been consistently trading below the moving averages. Although the MACD green bars are narrowing, they have not exited the consolidation zone, indicating a continuation of the downward trend. The KDJ indicator's three lines are turning upward but have not broken through the 50 level. The rebound is purely a correction from oversold conditions. Overall, after a low-volume consolidation, there is a high probability of a breakdown.

Personal suggestion, for reference only (strictly set stop-loss)

Bitcoin around 88,300, see for a r

BTC-2,31%

- Reward

- like

- Comment

- Repost

- Share

December 24, Wednesday, Intraday Mistress Analysis

The daily level comparison remains firmly suppressed by the middle band. The Bollinger Bands are narrowing, which is not a reversal signal; instead, it highlights heavy selling pressure above, and upward momentum is severely lacking. If the comparison cannot quickly break through the middle band, the lower support at 2780 is likely to be broken, and the subsequent downward space will further open.

Personal suggestion, for reference only (strictly set defensive stops)

Mistress around 2980, buy on dip at 3050, target 2880, 2750

The daily level comparison remains firmly suppressed by the middle band. The Bollinger Bands are narrowing, which is not a reversal signal; instead, it highlights heavy selling pressure above, and upward momentum is severely lacking. If the comparison cannot quickly break through the middle band, the lower support at 2780 is likely to be broken, and the subsequent downward space will further open.

Personal suggestion, for reference only (strictly set defensive stops)

Mistress around 2980, buy on dip at 3050, target 2880, 2750

ETH0,47%

- Reward

- like

- Comment

- Repost

- Share

12.24 Wednesday Intraday Bitcoin Analysis

The four-hour timeframe shows the price continuously trading below MA144 and MA169, with medium to long-term moving averages forming clear resistance. The momentum of the candlestick is still being released, and the KDJ indicator's three lines are in the oversold zone. Short-term oversold signs are emerging, but no clear reversal signal has appeared yet. Overall, the short-term is under pressure from moving average resistance. Without volume confirmation for a breakout, it is likely to remain in a low-range consolidation pattern.

Personal suggestion, f

The four-hour timeframe shows the price continuously trading below MA144 and MA169, with medium to long-term moving averages forming clear resistance. The momentum of the candlestick is still being released, and the KDJ indicator's three lines are in the oversold zone. Short-term oversold signs are emerging, but no clear reversal signal has appeared yet. Overall, the short-term is under pressure from moving average resistance. Without volume confirmation for a breakout, it is likely to remain in a low-range consolidation pattern.

Personal suggestion, f

BTC-2,31%

- Reward

- like

- Comment

- Repost

- Share

12.23 Tuesday Daily ETH Analysis

The four-hour level price comparison has always operated below the middle track of 2994, where the middle track forms strong pressure, and the price comparison approaches the lower track of 2945. In the MACD indicator, both DIF and DEA remain in the negative value range, with DIF crossing below DEA. Bearish momentum continues, and although it is at a low level, the turning force is very weak, with no effective rebound signal seen.

Personal advice, for reference only (strictly set defense)

ETH around 3000, see 3060 to add, target 2930, 2800$ETH

The four-hour level price comparison has always operated below the middle track of 2994, where the middle track forms strong pressure, and the price comparison approaches the lower track of 2945. In the MACD indicator, both DIF and DEA remain in the negative value range, with DIF crossing below DEA. Bearish momentum continues, and although it is at a low level, the turning force is very weak, with no effective rebound signal seen.

Personal advice, for reference only (strictly set defense)

ETH around 3000, see 3060 to add, target 2930, 2800$ETH

ETH0,47%

- Reward

- like

- Comment

- Repost

- Share

12.23 Tuesday Daily BTC Analysis

On the four-hour level, the price has significantly broken through the key moving averages MA144 and MA169. The MACD histogram is continuously expanding, and the KDJ indicator has formed a deep death cross, with the short-term technical outlook completely turning bearish, showing no strength in the rebound.

Personal suggestion, for reference only (strictly set defense)

BTC is around 88800, see 89800 for a supplement, target 87000, 85000$ETH

On the four-hour level, the price has significantly broken through the key moving averages MA144 and MA169. The MACD histogram is continuously expanding, and the KDJ indicator has formed a deep death cross, with the short-term technical outlook completely turning bearish, showing no strength in the rebound.

Personal suggestion, for reference only (strictly set defense)

BTC is around 88800, see 89800 for a supplement, target 87000, 85000$ETH

ETH0,47%

- Reward

- like

- Comment

- Repost

- Share

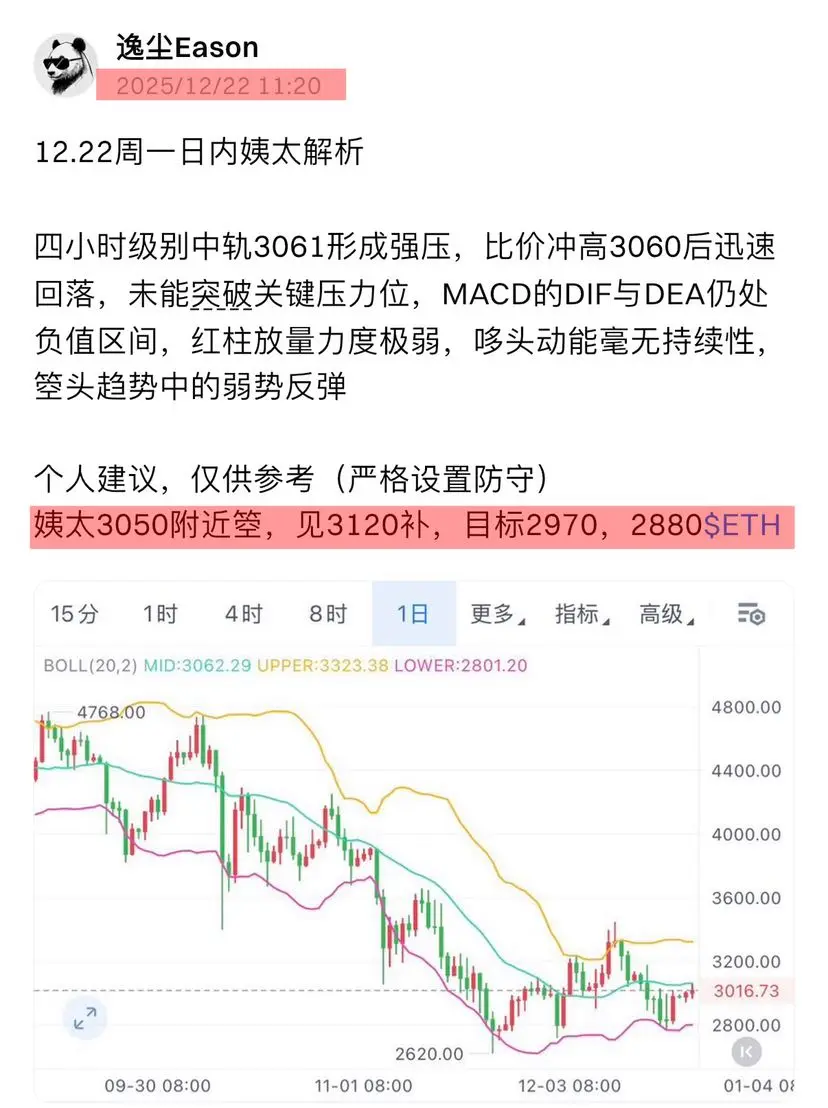

12.22 Monday Daily ETH Analysis

The mid-level pressure at 3061 on the four-hour chart formed a strong resistance. After the price rose to 3060, it quickly fell back, failing to break through the key resistance level. The MACD's DIF and DEA are still in negative territory, with the red bars showing very weak volume, and the momentum exhibits no sustainability, indicating a weak rebound in the trend.

Personal advice, for reference only (strictly set defense)

ETH around 3050, see 3120 for补, target 2970, 2880$ETH

The mid-level pressure at 3061 on the four-hour chart formed a strong resistance. After the price rose to 3060, it quickly fell back, failing to break through the key resistance level. The MACD's DIF and DEA are still in negative territory, with the red bars showing very weak volume, and the momentum exhibits no sustainability, indicating a weak rebound in the trend.

Personal advice, for reference only (strictly set defense)

ETH around 3050, see 3120 for补, target 2970, 2880$ETH

ETH0,47%

- Reward

- like

- Comment

- Repost

- Share

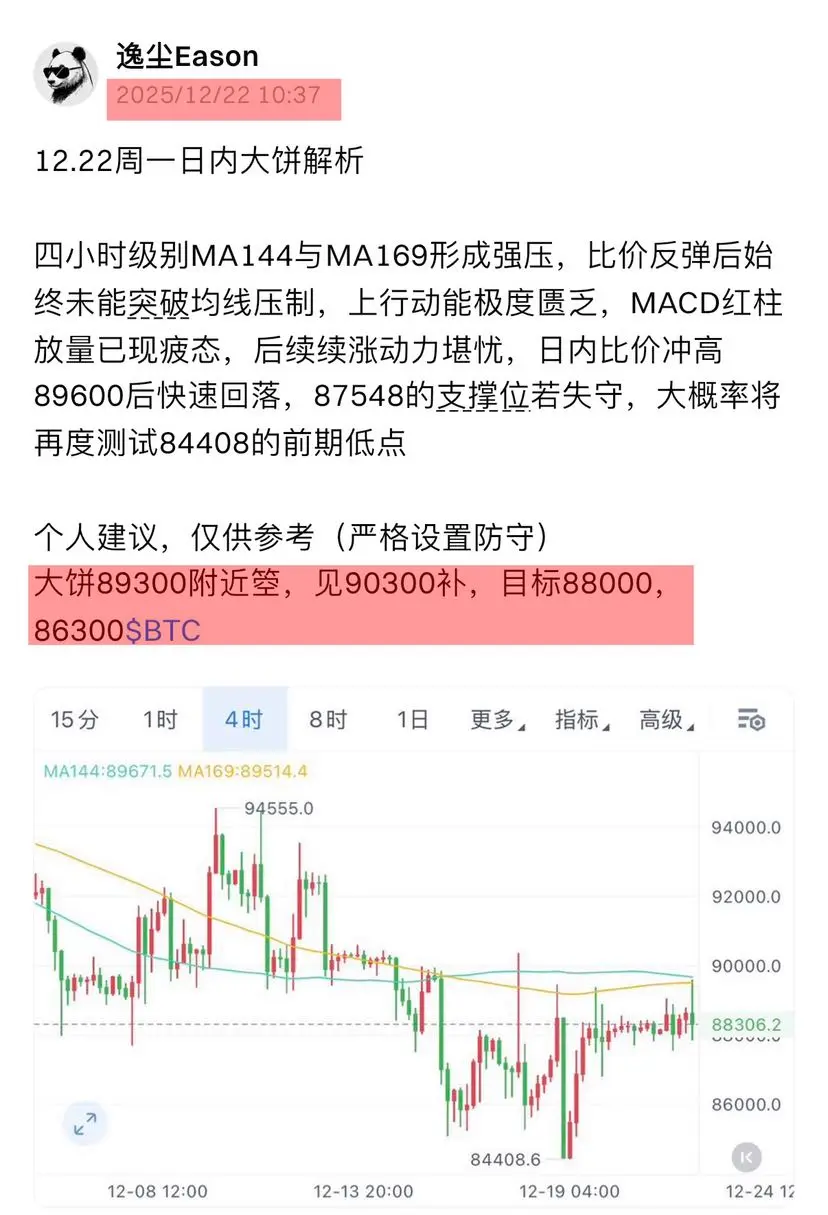

12.22 Monday Daily BTC Analysis

At the four-hour level, MA144 and MA169 form a strong resistance. After a price rebound, it has consistently failed to break through the moving average resistance, showing extremely weak upward momentum. The MACD red histogram is expanding but has already shown signs of fatigue. The follow-up upward momentum is concerning. After a quick rise to 89600 during the day, the price rapidly fell back. If the support level at 87548 is broken, it is highly likely that it will test the previous low of 84408 again.

Personal suggestion, for reference only (strictly set defe

At the four-hour level, MA144 and MA169 form a strong resistance. After a price rebound, it has consistently failed to break through the moving average resistance, showing extremely weak upward momentum. The MACD red histogram is expanding but has already shown signs of fatigue. The follow-up upward momentum is concerning. After a quick rise to 89600 during the day, the price rapidly fell back. If the support level at 87548 is broken, it is highly likely that it will test the previous low of 84408 again.

Personal suggestion, for reference only (strictly set defe

BTC-2,31%

- Reward

- like

- Comment

- Repost

- Share

12.19 Friday Intraday Mistress Analysis

The four-hour level tested 2997 and faced resistance, constrained by the upper band at 3019, and significantly below the previous high of 3446. The rebound momentum is weak, entering a seriously overbought zone, with a high probability of a short-term reversal. Although the MACD shows a red histogram, the momentum correction is only a short-term phenomenon.

Personal suggestion, for reference only (strictly set stop-loss):

Mistress around 3000, buy on dip at 3060, target 2880, 2750$ETH

The four-hour level tested 2997 and faced resistance, constrained by the upper band at 3019, and significantly below the previous high of 3446. The rebound momentum is weak, entering a seriously overbought zone, with a high probability of a short-term reversal. Although the MACD shows a red histogram, the momentum correction is only a short-term phenomenon.

Personal suggestion, for reference only (strictly set stop-loss):

Mistress around 3000, buy on dip at 3060, target 2880, 2750$ETH

ETH0,47%

- Reward

- like

- Comment

- Repost

- Share