# What’sNextforBitcoin?

30.31K

Usmanali140793

#What’sNextforBitcoin?

Market Structure Overview

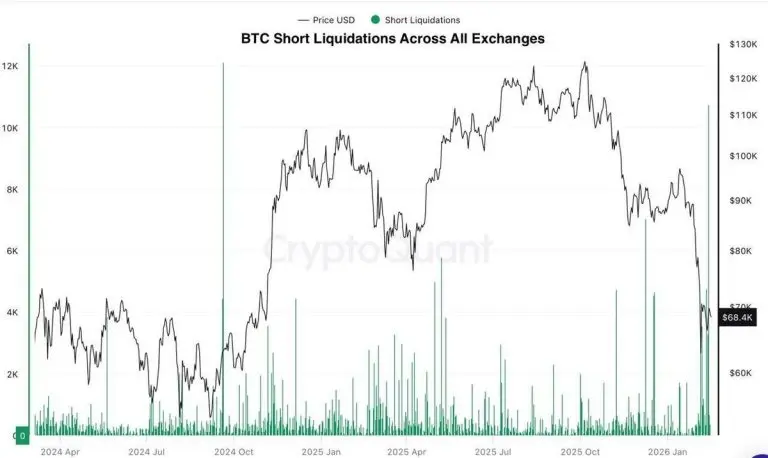

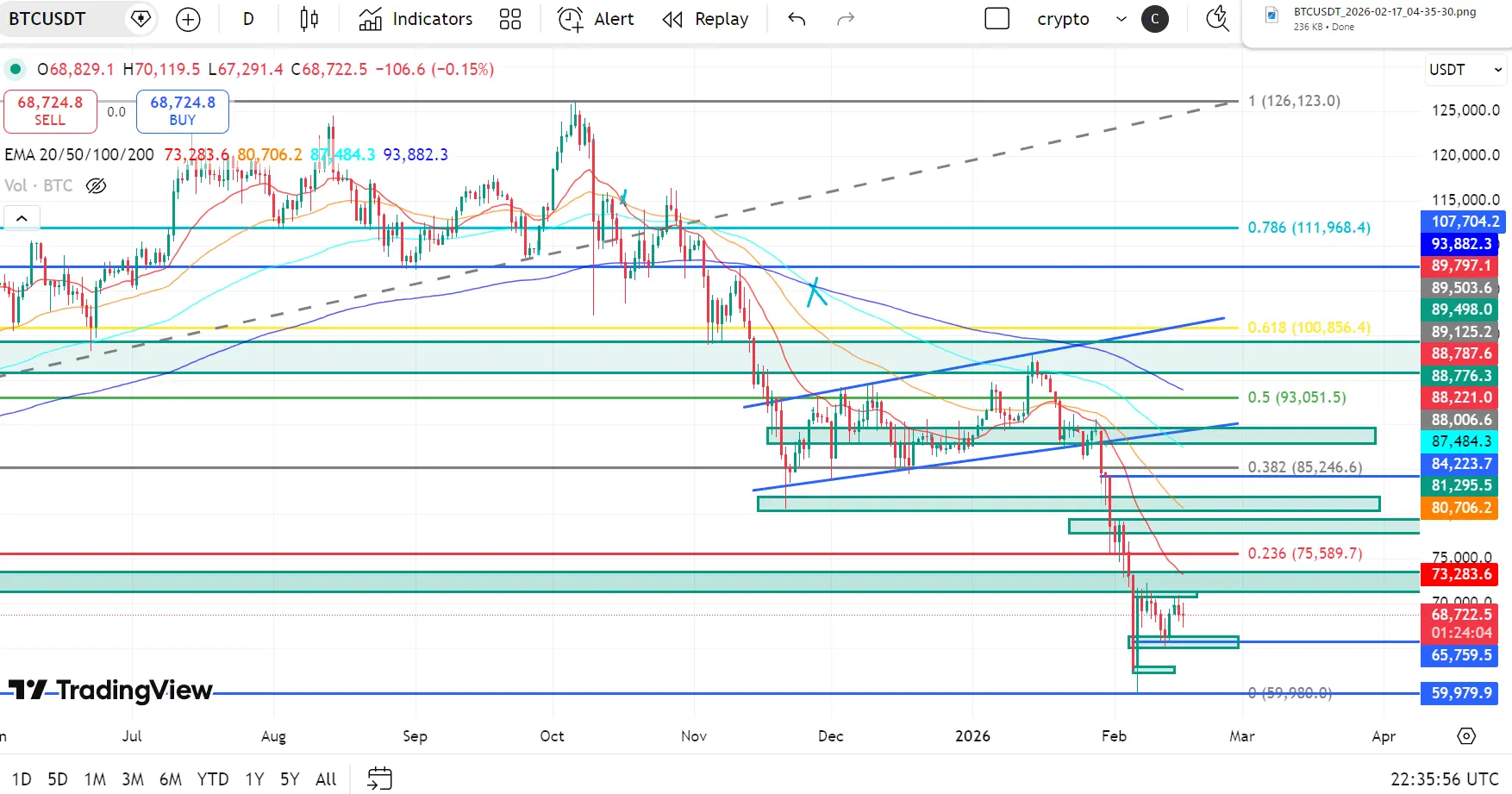

BTC has completed a classic distribution → breakdown → markdown sequence after rejecting the 0.786 supply zone near 112K.

Following that rejection:

Price failed to hold above 0.618 (100,856) and 0.5 (93,051)

Broke decisively below 0.382 (85,246)

Lost 0.236 (75,589) with strong impulsive momentum

This confirms bearish continuation on higher timeframes.

Currently, BTC is consolidating in the 68,000–70,000 range — sitting just above major macro support.

EMA Structure — Strong Bearish Alignment

20 EMA: 73,283

50 EMA: 80,706

100 EMA: 87,484

200 EMA:

Market Structure Overview

BTC has completed a classic distribution → breakdown → markdown sequence after rejecting the 0.786 supply zone near 112K.

Following that rejection:

Price failed to hold above 0.618 (100,856) and 0.5 (93,051)

Broke decisively below 0.382 (85,246)

Lost 0.236 (75,589) with strong impulsive momentum

This confirms bearish continuation on higher timeframes.

Currently, BTC is consolidating in the 68,000–70,000 range — sitting just above major macro support.

EMA Structure — Strong Bearish Alignment

20 EMA: 73,283

50 EMA: 80,706

100 EMA: 87,484

200 EMA:

BTC-0,22%

Agree Or Not

Yes

No

3 ParticipantsEnds In 21 Hour

- Reward

- like

- Comment

- Repost

- Share

#What’sNextforBitcoin? Updated: February 17, 2026

As 2026 progresses, Bitcoin is entering a critical consolidation phase after its sharp correction from the October 2025 all-time high near $126,000. Currently trading around the $68,500–$69,000 range, BTC has retraced nearly 45–50%, allowing the market to reset after last year’s rapid expansion. Despite this pullback, institutional accumulation remains strong, suggesting that long-term confidence in Bitcoin has not weakened.

This period of sideways movement reflects a healthy market structure. After major rallies, consolidation phases often ser

As 2026 progresses, Bitcoin is entering a critical consolidation phase after its sharp correction from the October 2025 all-time high near $126,000. Currently trading around the $68,500–$69,000 range, BTC has retraced nearly 45–50%, allowing the market to reset after last year’s rapid expansion. Despite this pullback, institutional accumulation remains strong, suggesting that long-term confidence in Bitcoin has not weakened.

This period of sideways movement reflects a healthy market structure. After major rallies, consolidation phases often ser

BTC-0,22%

- Reward

- 4

- 4

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

2026 Go Go Go 👊View More

#What’sNextforBitcoin?

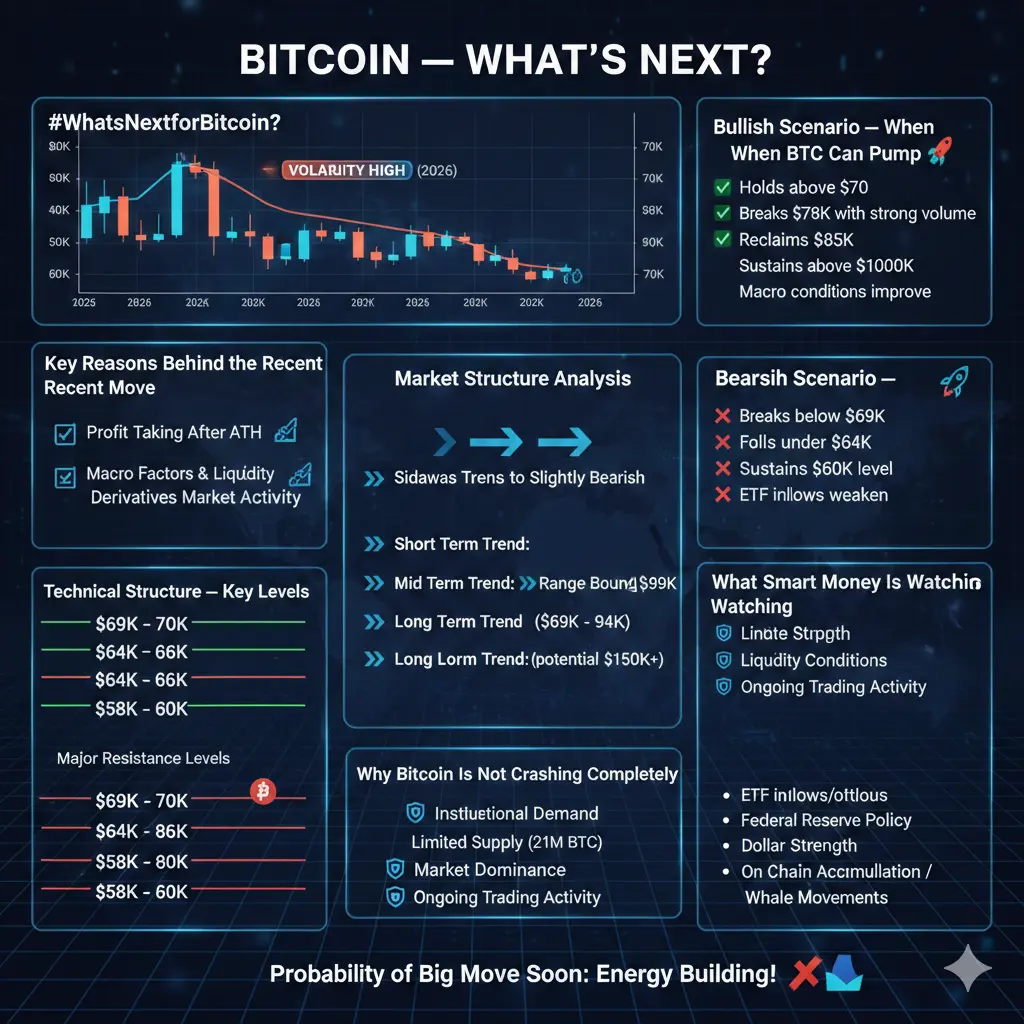

Bitcoin — What’s Next for Bitcoin?

Current Situation (2026)

Bitcoin recently experienced a sharp correction followed by a recovery. After dropping close to $60K, BTC bounced back above the $70K region, showing that strong buyers are still active.

The market is now in a fragile phase where volatility is high and direction is uncertain.

Key Reasons Behind the Recent Move

1. Profit Taking After All Time High

Bitcoin previously reached extremely high levels, and large investors locked in profits. This created selling pressure and triggered a cascade of liquidations.

2. Macr

Bitcoin — What’s Next for Bitcoin?

Current Situation (2026)

Bitcoin recently experienced a sharp correction followed by a recovery. After dropping close to $60K, BTC bounced back above the $70K region, showing that strong buyers are still active.

The market is now in a fragile phase where volatility is high and direction is uncertain.

Key Reasons Behind the Recent Move

1. Profit Taking After All Time High

Bitcoin previously reached extremely high levels, and large investors locked in profits. This created selling pressure and triggered a cascade of liquidations.

2. Macr

BTC-0,22%

- Reward

- 3

- 3

- Repost

- Share

Vortex_King :

:

LFG 🔥View More

#What’sNextforBitcoin? Updated: February 17, 2026

As 2026 progresses, Bitcoin is entering a critical consolidation phase after its sharp correction from the October 2025 all-time high near $126,000. Currently trading around the $68,500–$69,000 range, BTC has retraced nearly 45–50%, allowing the market to reset after last year’s rapid expansion. Despite this pullback, institutional accumulation remains strong, suggesting that long-term confidence in Bitcoin has not weakened.

This period of sideways movement reflects a healthy market structure. After major rallies, consolidation phases often ser

As 2026 progresses, Bitcoin is entering a critical consolidation phase after its sharp correction from the October 2025 all-time high near $126,000. Currently trading around the $68,500–$69,000 range, BTC has retraced nearly 45–50%, allowing the market to reset after last year’s rapid expansion. Despite this pullback, institutional accumulation remains strong, suggesting that long-term confidence in Bitcoin has not weakened.

This period of sideways movement reflects a healthy market structure. After major rallies, consolidation phases often ser

BTC-0,22%

- Reward

- 3

- 9

- Repost

- Share

Yusfirah :

:

To The Moon 🌕View More

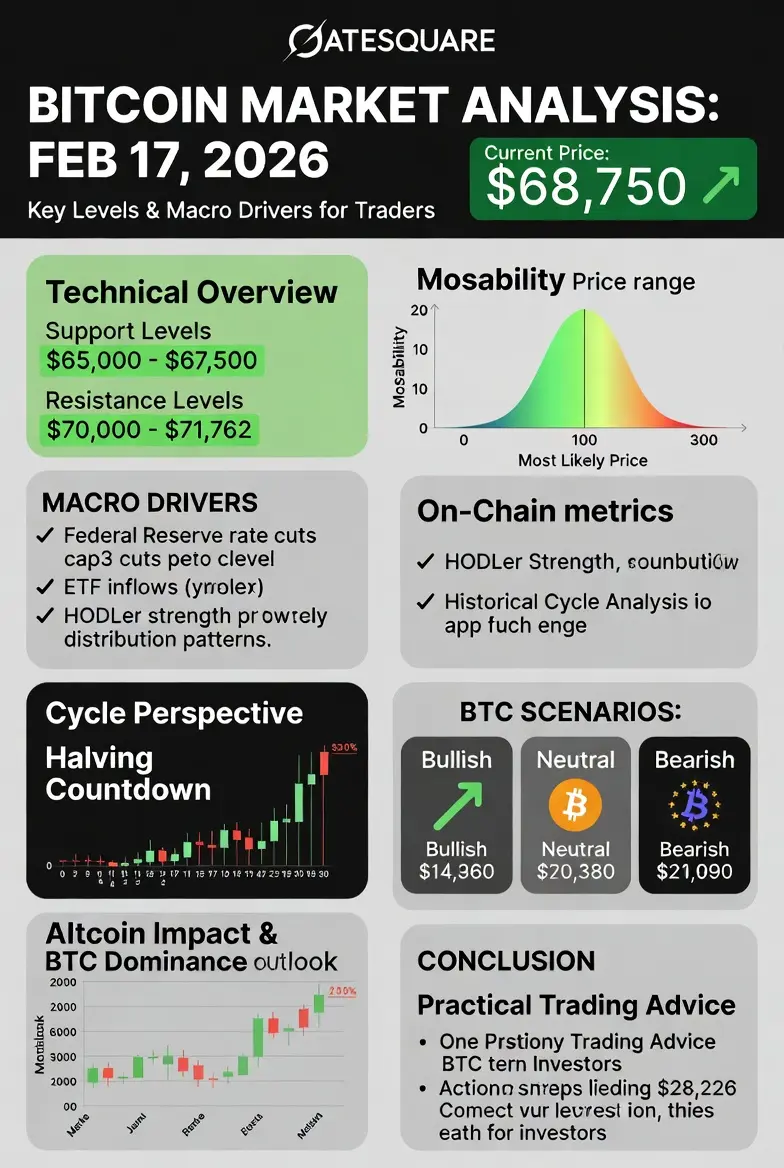

#What’sNextforBitcoin? Bitcoin (BTC) — Market Outlook February 2026

Bitcoin recently experienced a sharp correction followed by a notable recovery. After dipping near the $60,000 level, BTC bounced back above $70,000, showing that strong buyers, including institutions and whales, remain active. Despite this rebound, the market remains in a fragile and volatile phase, with direction uncertain and short-term momentum fragile.

Drivers Behind the Recent Move

Profit-Taking After All-Time Highs

Bitcoin had reached unprecedented levels in late 2025, and large holders locked in profits. This created s

Bitcoin recently experienced a sharp correction followed by a notable recovery. After dipping near the $60,000 level, BTC bounced back above $70,000, showing that strong buyers, including institutions and whales, remain active. Despite this rebound, the market remains in a fragile and volatile phase, with direction uncertain and short-term momentum fragile.

Drivers Behind the Recent Move

Profit-Taking After All-Time Highs

Bitcoin had reached unprecedented levels in late 2025, and large holders locked in profits. This created s

BTC-0,22%

- Reward

- 6

- 10

- Repost

- Share

SheenCrypto :

:

2026 GOGOGO 👊View More

#What’sNextforBitcoin? 🚀

Bitcoin has once again captured global attention, leaving investors, traders, and crypto enthusiasts asking one big question: What’s next for Bitcoin? As the world’s leading cryptocurrency, Bitcoin continues to shape the digital asset landscape. From price fluctuations to institutional adoption, every move it makes sends ripples across the financial markets.

Over the past few years, Bitcoin has demonstrated remarkable resilience. Despite market corrections, regulatory pressures, and macroeconomic uncertainties, it has maintained its position as the dominant cryptocurr

Bitcoin has once again captured global attention, leaving investors, traders, and crypto enthusiasts asking one big question: What’s next for Bitcoin? As the world’s leading cryptocurrency, Bitcoin continues to shape the digital asset landscape. From price fluctuations to institutional adoption, every move it makes sends ripples across the financial markets.

Over the past few years, Bitcoin has demonstrated remarkable resilience. Despite market corrections, regulatory pressures, and macroeconomic uncertainties, it has maintained its position as the dominant cryptocurr

BTC-0,22%

- Reward

- 2

- 3

- Repost

- Share

ybaser :

:

To The Moon 🌕View More

#What’sNextforBitcoin?

#WhatsNextForBitcoin?

Updated: Feb 17, 2026

💰 Current Price: ~$68,500–$69,000

BTC is consolidating after a ~45–50% drop from October 2025 ATH (~$126k).

Institutional support remains strong, accumulation ongoing.

📊 Key Levels

Support: $65k–$67.5k | $60k–$62k

Resistance: $70k–$71.7k | next breakout $73k–$75k

Indicators: MACD slightly bearish, RSI neutral, low volume → sideways likely

🌍 Market Drivers

Fed & Macro: Soft inflation → mid-2026 rate cuts possible → bullish

Institutions: ETFs & corporate treasuries accumulating → price floor

Global Risk: Geo/political events

#WhatsNextForBitcoin?

Updated: Feb 17, 2026

💰 Current Price: ~$68,500–$69,000

BTC is consolidating after a ~45–50% drop from October 2025 ATH (~$126k).

Institutional support remains strong, accumulation ongoing.

📊 Key Levels

Support: $65k–$67.5k | $60k–$62k

Resistance: $70k–$71.7k | next breakout $73k–$75k

Indicators: MACD slightly bearish, RSI neutral, low volume → sideways likely

🌍 Market Drivers

Fed & Macro: Soft inflation → mid-2026 rate cuts possible → bullish

Institutions: ETFs & corporate treasuries accumulating → price floor

Global Risk: Geo/political events

BTC-0,22%

- Reward

- 12

- 14

- Repost

- Share

ShizukaKazu :

:

Wishing you great wealth in the Year of the Horse 🐴View More

#What’sNextforBitcoin?

Bitcoin has once again captured global attention, leaving investors, traders, and institutions asking the same question: what comes next? While short-term price movements always dominate headlines, the real story lies in the bigger picture — adoption, macroeconomics, regulation, and market structure.

First, let’s talk about the macro environment. Bitcoin does not exist in isolation. Interest rate expectations, inflation trends, and global liquidity continue to shape market sentiment. If the Federal Reserve signals monetary easing or a shift toward lower rates, risk asset

Bitcoin has once again captured global attention, leaving investors, traders, and institutions asking the same question: what comes next? While short-term price movements always dominate headlines, the real story lies in the bigger picture — adoption, macroeconomics, regulation, and market structure.

First, let’s talk about the macro environment. Bitcoin does not exist in isolation. Interest rate expectations, inflation trends, and global liquidity continue to shape market sentiment. If the Federal Reserve signals monetary easing or a shift toward lower rates, risk asset

BTC-0,22%

- Reward

- 3

- 5

- Repost

- Share

MoonGirl :

:

To The Moon 🌕View More

BTC Technical Outlook: Breakdown Below 0.236, Testing Macro Support

BTC has completed a clear distribution → breakdown → markdown phase after rejecting from the 0.786 supply region near 112K.

Price failed to sustain above 0.618 (100,856) and 0.5 (93,051), then decisively broke below 0.382 (85,246) and 0.236 (75,589) — confirming strong bearish continuation.

BTC is now consolidating near 68,000–70,000, just above macro support.

EMA Structure (Strong Bearish Alignment)

20 EMA: 73,283

50 EMA: 80,706

100 EMA: 87,484

200 EMA: 93,882

Price is trading below all major EMAs, confirming full bearish str

BTC has completed a clear distribution → breakdown → markdown phase after rejecting from the 0.786 supply region near 112K.

Price failed to sustain above 0.618 (100,856) and 0.5 (93,051), then decisively broke below 0.382 (85,246) and 0.236 (75,589) — confirming strong bearish continuation.

BTC is now consolidating near 68,000–70,000, just above macro support.

EMA Structure (Strong Bearish Alignment)

20 EMA: 73,283

50 EMA: 80,706

100 EMA: 87,484

200 EMA: 93,882

Price is trading below all major EMAs, confirming full bearish str

BTC-0,22%

- Reward

- 5

- 6

- Repost

- Share

GateUser-72918cdd :

:

Ape In 🚀View More

#What’sNextforBitcoin? 🚀🚀

Bitcoin has entered 2026 in a phase of cautious optimism, following a period of consolidation after the dramatic volatility of the past few years. Its price has stabilized relative to prior bull and bear cycles, reflecting a growing maturity in the market as institutional adoption deepens and macroeconomic factors exert a strong influence. While Bitcoin remains highly sensitive to U.S. Federal Reserve policy, global liquidity conditions, and investor sentiment, several trends suggest that its role is evolving beyond a speculative asset toward a more recognized store

Bitcoin has entered 2026 in a phase of cautious optimism, following a period of consolidation after the dramatic volatility of the past few years. Its price has stabilized relative to prior bull and bear cycles, reflecting a growing maturity in the market as institutional adoption deepens and macroeconomic factors exert a strong influence. While Bitcoin remains highly sensitive to U.S. Federal Reserve policy, global liquidity conditions, and investor sentiment, several trends suggest that its role is evolving beyond a speculative asset toward a more recognized store

BTC-0,22%

- Reward

- 6

- 5

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

166.3K Popularity

33.53K Popularity

30.31K Popularity

74.83K Popularity

14.41K Popularity

276.7K Popularity

370.48K Popularity

26.66K Popularity

15.91K Popularity

14.47K Popularity

14.53K Popularity

13.31K Popularity

13.37K Popularity

40.86K Popularity

News

View MoreZeroLend will cease operations. Users are advised to withdraw their remaining funds from the platform.

4 m

AC launches the Flying Tulip public offering, emphasizing "Principal Protection" ftPUT mechanism

10 m

Spot gold's decline accelerates, falling to $4,860 per ounce, down 2.60% intraday.

10 m

BTC drops below 68,000 USDT

25 m

Traditional Finance Downtrend Alert: GBPJPY drops over 0.5%

28 m

Pin