# USNonFarmPayrollReport

5.4K

Crypto_Knowledge

🚨 BREAKING: Global Finance Is Quietly Crossing the Line 🚨

This isn’t another pilot.

This is infrastructure.

SWIFT, the backbone of global banking, has teamed up with 30+ major banks to design a new blockchain-based ledger for tokenized assets — and it plugs directly into the existing financial core. 👀

$XRP

🌍 What makes this seismic: • SWIFT connects 11,500+ financial institutions

• Coverage spans 200+ countries

• The goal isn’t experimentation — it’s circulation at scale

Instead of just sending messages about money, the system is moving toward moving the value itself — instantly, on-chain

This isn’t another pilot.

This is infrastructure.

SWIFT, the backbone of global banking, has teamed up with 30+ major banks to design a new blockchain-based ledger for tokenized assets — and it plugs directly into the existing financial core. 👀

$XRP

🌍 What makes this seismic: • SWIFT connects 11,500+ financial institutions

• Coverage spans 200+ countries

• The goal isn’t experimentation — it’s circulation at scale

Instead of just sending messages about money, the system is moving toward moving the value itself — instantly, on-chain

- Reward

- 8

- 4

- Repost

- Share

I_am_ready :

:

1000x VIbes 🤑View More

#BTCMarketAnalysis BTC remains capped below $92,000 as risk-off sentiment dominates the market

Bitcoin (BTC) continues to struggle to hold above the $92,000 level for more than a month, clearly reflecting the weakening risk appetite across global financial markets. While the S&P 500 has only seen a mild correction and is still hovering near its all-time high, Bitcoin’s price has dropped nearly 30% from its $126,200 peak, indicating capital is moving away from high-volatility assets.

One of the main factors comes from the tightening liquidity policy of the U.S. Federal Reserve (Fed). For most o

Bitcoin (BTC) continues to struggle to hold above the $92,000 level for more than a month, clearly reflecting the weakening risk appetite across global financial markets. While the S&P 500 has only seen a mild correction and is still hovering near its all-time high, Bitcoin’s price has dropped nearly 30% from its $126,200 peak, indicating capital is moving away from high-volatility assets.

One of the main factors comes from the tightening liquidity policy of the U.S. Federal Reserve (Fed). For most o

BTC-2,27%

- Reward

- 2

- 8

- Repost

- Share

映月 :

:

DYOR 🤓View More

GLOBAL OIL SHOCK | GEOPOLITICS IGNITE 🚨

A second oil tanker seized by the U.S. near Venezuela has now been confirmed as Chinese-owned — and the scale is impossible to ignore.

🛢️ 1.8 million barrels

🇻🇪 Merey 16 — Venezuela’s top-tier crude blend

🇨🇳 Destination: China

This wasn’t just a ship.

It was a signal.

⚠️ WHY THIS MATTERS

Merey 16 is Venezuela’s crown-jewel crude — heavy, high-value, and critical for complex refineries.

Losing 1.8 million barrels isn’t background noise. It’s a real supply shock.

Now zoom out 👇

• 🇺🇸 U.S. enforcement around Venezuela is tightening

• 🇨🇳 China is d

A second oil tanker seized by the U.S. near Venezuela has now been confirmed as Chinese-owned — and the scale is impossible to ignore.

🛢️ 1.8 million barrels

🇻🇪 Merey 16 — Venezuela’s top-tier crude blend

🇨🇳 Destination: China

This wasn’t just a ship.

It was a signal.

⚠️ WHY THIS MATTERS

Merey 16 is Venezuela’s crown-jewel crude — heavy, high-value, and critical for complex refineries.

Losing 1.8 million barrels isn’t background noise. It’s a real supply shock.

Now zoom out 👇

• 🇺🇸 U.S. enforcement around Venezuela is tightening

• 🇨🇳 China is d

MC:$3.56KHolders:2

0.00%

- Reward

- 1

- Comment

- Repost

- Share

$BEAT Absolute Beast Mode!

BEAT is ripping at $2.4347, up a solid +5.35% — bulls are clearly in control

24H Range: $1.7419 – $2.4921

Massive Volume: 305.86M BEAT | $657.14M USDT

On the 15-min chart, price is holding above MA60 (2.4155) after a sharp dip-and-rip move — classic bullish reclaim

📈 Volume is ticking back up, signaling fresh buyers stepping in, not just short covering.

Key Levels to Watch:

Support: $2.41 → $2.39

Resistance: $2.49 (24H high)

📈Performance Check:

Today: +10.16%

7D: +36.74%

30D: +508.14%

Expect explosive volatility & fast breakouts — BEAT is dancing on the ed

BEAT is ripping at $2.4347, up a solid +5.35% — bulls are clearly in control

24H Range: $1.7419 – $2.4921

Massive Volume: 305.86M BEAT | $657.14M USDT

On the 15-min chart, price is holding above MA60 (2.4155) after a sharp dip-and-rip move — classic bullish reclaim

📈 Volume is ticking back up, signaling fresh buyers stepping in, not just short covering.

Key Levels to Watch:

Support: $2.41 → $2.39

Resistance: $2.49 (24H high)

📈Performance Check:

Today: +10.16%

7D: +36.74%

30D: +508.14%

Expect explosive volatility & fast breakouts — BEAT is dancing on the ed

BEAT-9,17%

- Reward

- like

- Comment

- Repost

- Share

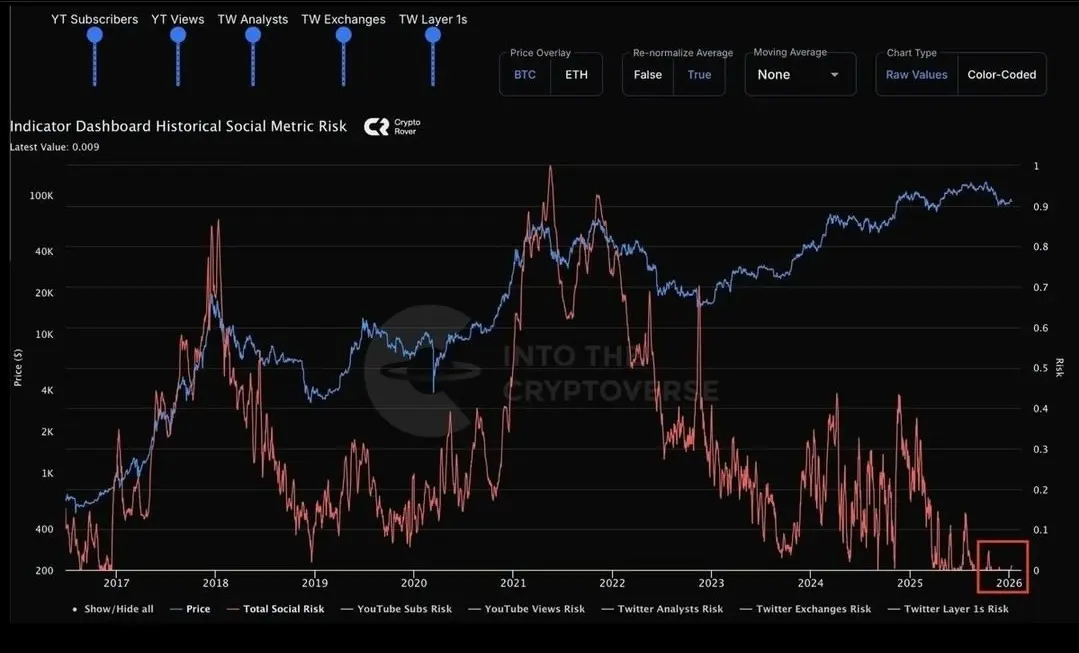

It seems that the price of #البيتكوين has reached its lowest level.

Public interest and search indicators for #Bitcoin are experiencing a historic decline. The chart suggests a possible upcoming increase.

Some analysts see this as a potential sign that the price has reached its lowest point.

All eyes are on macroeconomic events and the movement of #BTC in the coming weeks.

#USNonFarmPayrollReport

$BTC

Public interest and search indicators for #Bitcoin are experiencing a historic decline. The chart suggests a possible upcoming increase.

Some analysts see this as a potential sign that the price has reached its lowest point.

All eyes are on macroeconomic events and the movement of #BTC in the coming weeks.

#USNonFarmPayrollReport

$BTC

BTC-2,27%

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

Bullish market at its peak 🐂Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

368.18K Popularity

32.36K Popularity

80.31K Popularity

18.57K Popularity

480.26K Popularity

6.91K Popularity

5.91K Popularity

5.2K Popularity

2.73K Popularity

81.4K Popularity

43.97K Popularity

100.27K Popularity

16.01K Popularity

103.58K Popularity

5.19K Popularity

News

View MoreLAYER (Solayer) has increased by 12.56% in the past 24 hours, now trading at $0.10

6 m

AINFT launches Bank of AI, now deeply integrated with five core components including x402

12 m

$BTT exceeds $1.55 million in supply on JustLend DAO

12 m

Hong Kong's first real estate RWA project approved, Delin Holdings' two asset tokenization products implemented

15 m

Data: Hyperliquid platform whale's current holdings are $2.818 billion, with a long-short position ratio of 0.95

18 m

Pin