#GlobalTechSell-OffHitsRiskAssets

Dragon Fly Official Analysis

Global tech stocks experienced a sharp sell-off today, and as expected, **risk assets across the board followed suit** — including Bitcoin, ETH, and GT token. This coordinated decline reflects **systemic market stress** rather than isolated news.

📊 **Deep Research Insights**

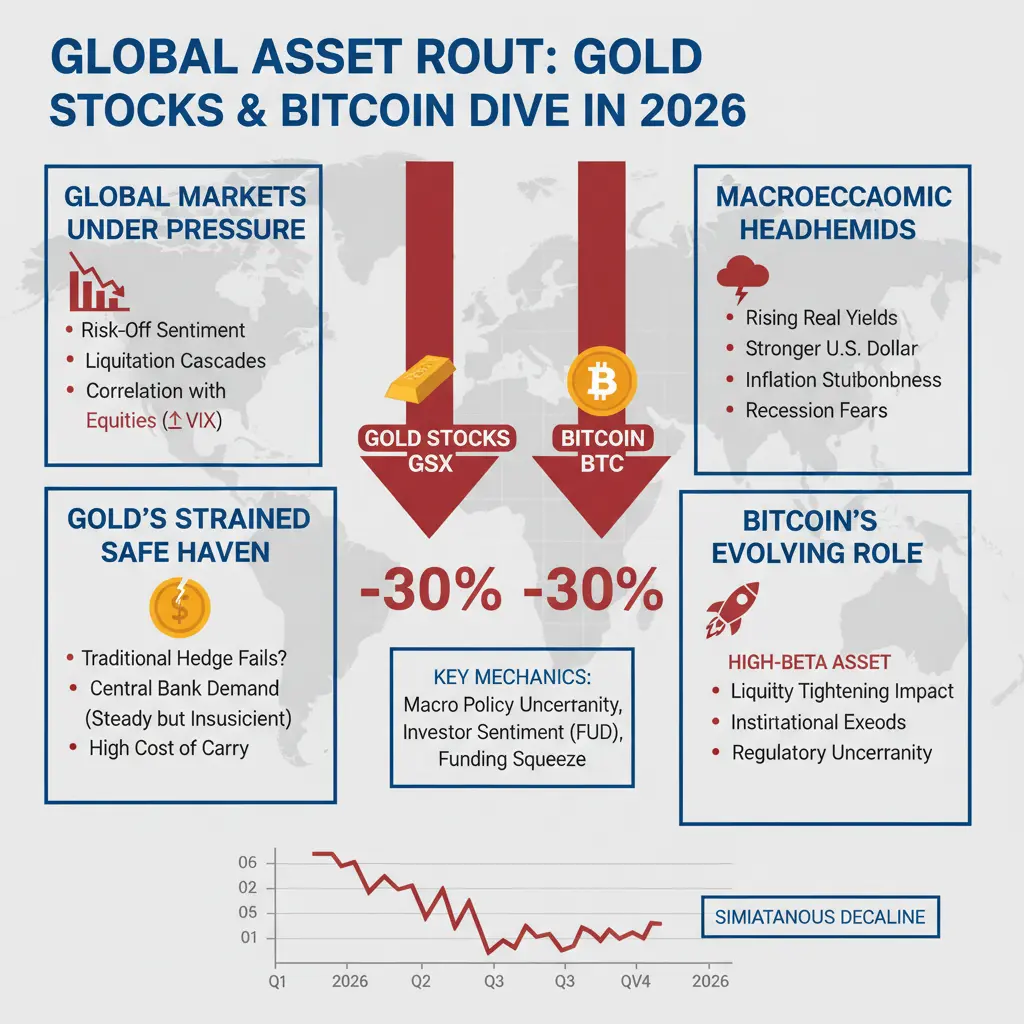

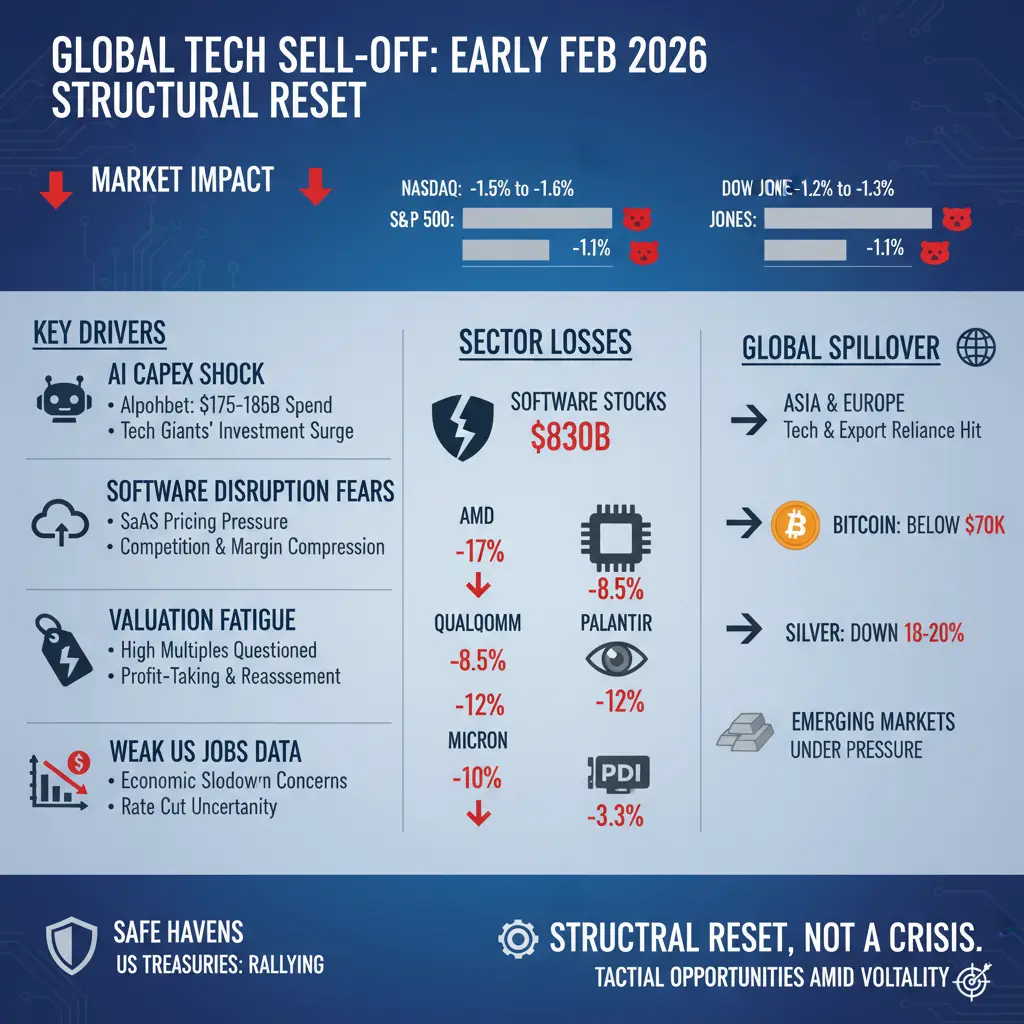

**1️⃣ Macro & Market Drivers**

* Rising real yields and tightening monetary policy triggered the tech sell-off.

* Liquidity rotations caused crypto and other risk assets to drop simultaneously.

* Investor sentiment shifted to **risk-off**, leading to temporary liquidation pressures.

**2️⃣ GT Token in Context**

* Unlike many high-beta altcoins, GT’s **holding rewards and ecosystem utility** provide resilience.

* Fee discounts, staking incentives, and loyalty benefits create **structural demand**, helping GT absorb volatility better than speculative tokens.

* For traders practicing patience, GT **rewards long-term positioning** while other assets fluctuate wildly.

**3️⃣ Technical & Strategic Notes**

* BTC support zones: mid-$60K range. A break below could trigger further corrections.

* GT shows relative strength compared to other altcoins due to platform adoption.

* Strategic traders focus on **position scaling, risk management, and macro trend awareness**, avoiding emotional trades during this volatility.

💡 **Takeaway:**

Systemic risk is testing both equities and crypto simultaneously. Understanding **macro drivers + token-specific structural benefits** is key for survival and capital growth. GT holders with discipline are positioned to **benefit from the next recovery cycle**.

Dragon Fly Official Analysis

Global tech stocks experienced a sharp sell-off today, and as expected, **risk assets across the board followed suit** — including Bitcoin, ETH, and GT token. This coordinated decline reflects **systemic market stress** rather than isolated news.

📊 **Deep Research Insights**

**1️⃣ Macro & Market Drivers**

* Rising real yields and tightening monetary policy triggered the tech sell-off.

* Liquidity rotations caused crypto and other risk assets to drop simultaneously.

* Investor sentiment shifted to **risk-off**, leading to temporary liquidation pressures.

**2️⃣ GT Token in Context**

* Unlike many high-beta altcoins, GT’s **holding rewards and ecosystem utility** provide resilience.

* Fee discounts, staking incentives, and loyalty benefits create **structural demand**, helping GT absorb volatility better than speculative tokens.

* For traders practicing patience, GT **rewards long-term positioning** while other assets fluctuate wildly.

**3️⃣ Technical & Strategic Notes**

* BTC support zones: mid-$60K range. A break below could trigger further corrections.

* GT shows relative strength compared to other altcoins due to platform adoption.

* Strategic traders focus on **position scaling, risk management, and macro trend awareness**, avoiding emotional trades during this volatility.

💡 **Takeaway:**

Systemic risk is testing both equities and crypto simultaneously. Understanding **macro drivers + token-specific structural benefits** is key for survival and capital growth. GT holders with discipline are positioned to **benefit from the next recovery cycle**.