# BTCvsGold

6.65K

Lions_Lionish

Liquidity Sweep → IFVG → CISD

1. Liquidity sweep of Asia or London high or low

2. IFVG forms (inversion FVG)

3. CISD shows a clear shift in direction

4. DOL aligns and confirms overall bias

Study.and bookmark 🔖

FOLLOW 👑

#CPIWatch #BTCVSGOLD #MarketRebound #WhoIsNextFedChair $XRP $SOL $BNB $btc$ $ada$

1. Liquidity sweep of Asia or London high or low

2. IFVG forms (inversion FVG)

3. CISD shows a clear shift in direction

4. DOL aligns and confirms overall bias

Study.and bookmark 🔖

FOLLOW 👑

#CPIWatch #BTCVSGOLD #MarketRebound #WhoIsNextFedChair $XRP $SOL $BNB $btc$ $ada$

- Reward

- like

- Comment

- Repost

- Share

🚨 Just saw the numbers and wow…

In only 2 years, Bitcoin ETFs have already pulled in $57B in net inflows.

Gold ETFs? Just $8B at the same point in their history.

That’s over 7× more money flowing into BTC ETFs.

Looks like digital gold is taking the lead in this inflow battle 👀

$BTC $XAU $MUBARAK

#BTCvsGold #BitcoinETFs #CryptoNews #bitcoin #WriteToEarnUpgrade

In only 2 years, Bitcoin ETFs have already pulled in $57B in net inflows.

Gold ETFs? Just $8B at the same point in their history.

That’s over 7× more money flowing into BTC ETFs.

Looks like digital gold is taking the lead in this inflow battle 👀

$BTC $XAU $MUBARAK

#BTCvsGold #BitcoinETFs #CryptoNews #bitcoin #WriteToEarnUpgrade

BTC-1,47%

- Reward

- like

- Comment

- Repost

- Share

#BitcoinGoldBattle ✨

2026 Outlook: Why I’m Favoring Bitcoin Over Gold & Silver

2025 was a dramatic year for investors looking to hedge against inflation. Gold and silver stole the spotlight — breaking records and delivering huge gains — while Bitcoin spent much of the year consolidating after a volatile correction.

As we step into 2026, the key question is clear: should your hedge be traditional metals, or is it time to give Bitcoin the spotlight? Here’s my take.

📈 Gold & Silver: Strong, but Limited

Gold and silver had incredible runs in 2025:

Gold surged on a weaker dollar, central bank dema

2026 Outlook: Why I’m Favoring Bitcoin Over Gold & Silver

2025 was a dramatic year for investors looking to hedge against inflation. Gold and silver stole the spotlight — breaking records and delivering huge gains — while Bitcoin spent much of the year consolidating after a volatile correction.

As we step into 2026, the key question is clear: should your hedge be traditional metals, or is it time to give Bitcoin the spotlight? Here’s my take.

📈 Gold & Silver: Strong, but Limited

Gold and silver had incredible runs in 2025:

Gold surged on a weaker dollar, central bank dema

BTC-1,47%

- Reward

- 10

- 11

- Repost

- Share

natadoz :

:

Paying Close Attention🔍View More

#BitcoinGoldBattle ✨

2026 Outlook: Why I’m Favoring Bitcoin Over Gold & Silver

2025 was a dramatic year for investors looking to hedge against inflation. Gold and silver stole the spotlight — breaking records and delivering huge gains — while Bitcoin spent much of the year consolidating after a volatile correction.

As we step into 2026, the key question is clear: should your hedge be traditional metals, or is it time to give Bitcoin the spotlight? Here’s my take.

📈 Gold & Silver: Strong, but Limited

Gold and silver had incredible runs in 2025:

Gold surged on a weaker dollar, central bank dema

2026 Outlook: Why I’m Favoring Bitcoin Over Gold & Silver

2025 was a dramatic year for investors looking to hedge against inflation. Gold and silver stole the spotlight — breaking records and delivering huge gains — while Bitcoin spent much of the year consolidating after a volatile correction.

As we step into 2026, the key question is clear: should your hedge be traditional metals, or is it time to give Bitcoin the spotlight? Here’s my take.

📈 Gold & Silver: Strong, but Limited

Gold and silver had incredible runs in 2025:

Gold surged on a weaker dollar, central bank dema

BTC-1,47%

- Reward

- 7

- 5

- Repost

- Share

Crypto_Teacher :

:

HODL Tight 💪View More

Walking on glass above thousands of gold bars in Gold Avenue Guangzhou 💛

Feels unreal wealth right under your feet ✨

#BTCvsGold

$BTC

Feels unreal wealth right under your feet ✨

#BTCvsGold

$BTC

BTC-1,47%

- Reward

- like

- Comment

- Repost

- Share

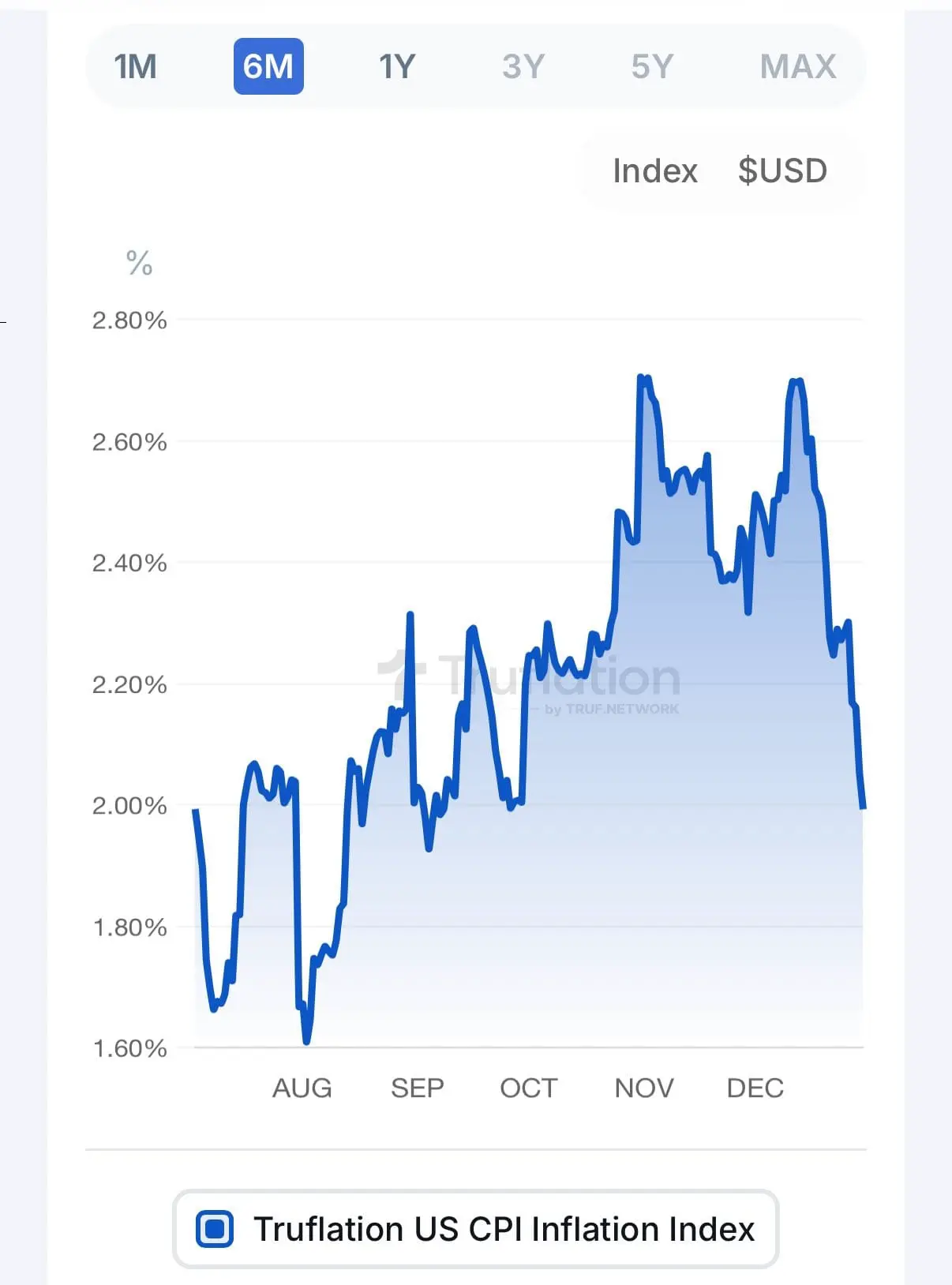

JUST IN: INFLATION SLIPS BELOW 2%

🎯 FED'S TARGET HAS FINALLY BEEN ACHIEVED

Today's macro headline could be a game-changer for the market. Inflation dropping below 2% is not just a number — it signals that the real impact of the Federal Reserve's tight monetary policy over the past several months is now clearly visible 📉💡

When inflation is above 2%, the Fed takes an aggressive stance — rate hikes, tight liquidity, and pressure on risk assets 💥

But now that the goal level has been touched, the narrative seems to be shifting a bit 👀

⚖️ This does not mean that rates will be cut tomorrow.

The

🎯 FED'S TARGET HAS FINALLY BEEN ACHIEVED

Today's macro headline could be a game-changer for the market. Inflation dropping below 2% is not just a number — it signals that the real impact of the Federal Reserve's tight monetary policy over the past several months is now clearly visible 📉💡

When inflation is above 2%, the Fed takes an aggressive stance — rate hikes, tight liquidity, and pressure on risk assets 💥

But now that the goal level has been touched, the narrative seems to be shifting a bit 👀

⚖️ This does not mean that rates will be cut tomorrow.

The

- Reward

- like

- 1

- Repost

- Share

GateUser-3e127dc6 :

:

Send it to me via transfer to my bank account at OTP BANK NOVI PAZAR 36300 SERBIAJapan's central bank just dropped a bombshell: rate hikes are coming in 2026 🔥.

* After 37 years of near-zero rates, the Bank of Japan is finally raising them.

* Inflation and rising wages are the reasons.

* This move will shock markets, end cheap yen carry trades, and impact global liquidity and risk assets like Bitcoin.

$TRUMP #USGDPUpdate #USCryptoStakingTaxReview #BTCVSGOLD #USJobsData

TRUMP

* After 37 years of near-zero rates, the Bank of Japan is finally raising them.

* Inflation and rising wages are the reasons.

* This move will shock markets, end cheap yen carry trades, and impact global liquidity and risk assets like Bitcoin.

$TRUMP #USGDPUpdate #USCryptoStakingTaxReview #BTCVSGOLD #USJobsData

TRUMP

- Reward

- 2

- 1

- Repost

- Share

Joban :

:

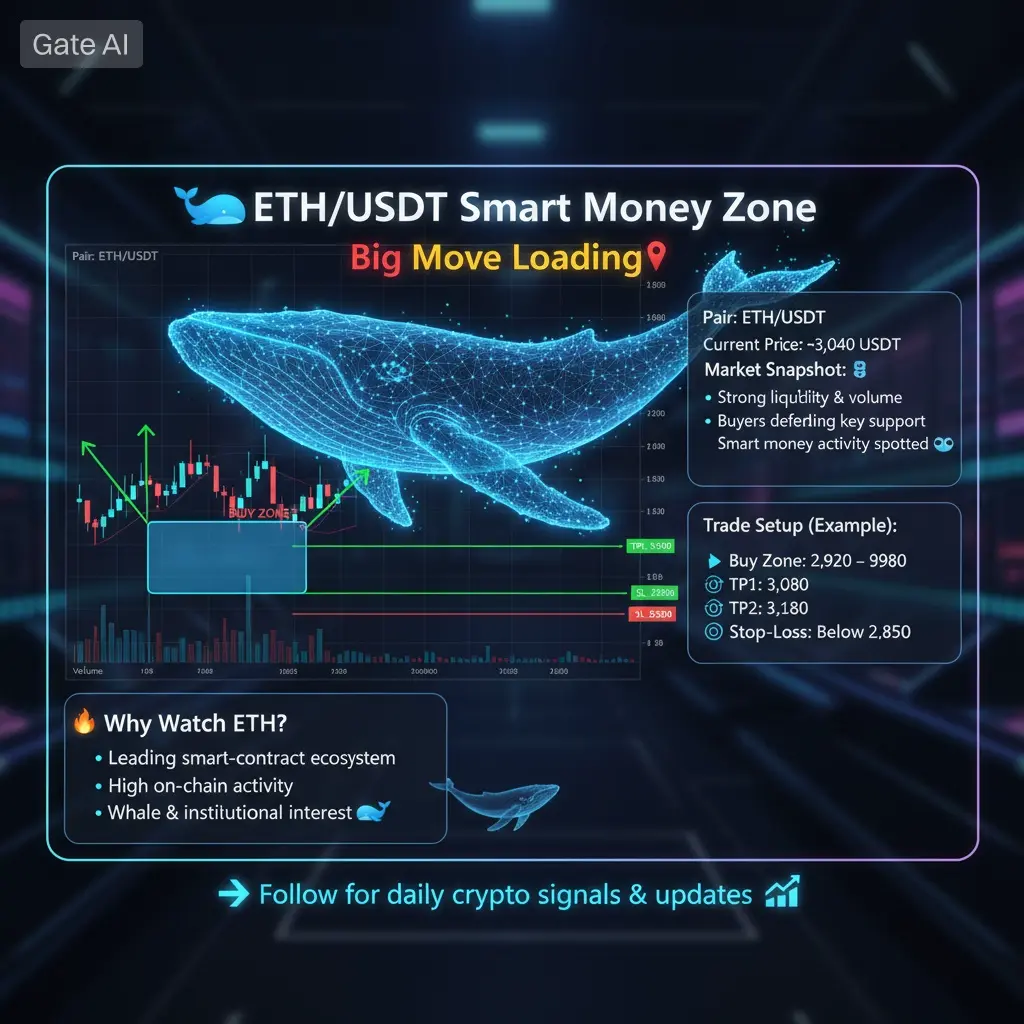

Christmas Bull Run! 🐂🐋 ETH/USDT Smart Money Zone | Big Move Loading

📌 Pair: ETH/USDT

💰 Current Price: ~3,040 USDT

📊 Market Snapshot:

• Strong liquidity & volume

• Buyers defending key support

• Smart money activity spotted 👀

🧠 Trade Setup (Example):

🔹 Buy Zone: 2,920 – 2,980

🎯 Targets:

• TP1: 3,080

• TP2: 3,180

• TP3: 3,300

🛑 Stop-Loss: Below 2,850

🔥 Why Watch ETH?

• Leading smart-contract ecosystem

• High on-chain activity

• Whale & institutional interest 🐋

📌 Not financial advice. Trade with proper risk management. #USGDPUpdate #USJobsData #CPIWatch #BTCVSGOLD #AreYouBullishOrBearishToday?

👉 Follow

📌 Pair: ETH/USDT

💰 Current Price: ~3,040 USDT

📊 Market Snapshot:

• Strong liquidity & volume

• Buyers defending key support

• Smart money activity spotted 👀

🧠 Trade Setup (Example):

🔹 Buy Zone: 2,920 – 2,980

🎯 Targets:

• TP1: 3,080

• TP2: 3,180

• TP3: 3,300

🛑 Stop-Loss: Below 2,850

🔥 Why Watch ETH?

• Leading smart-contract ecosystem

• High on-chain activity

• Whale & institutional interest 🐋

📌 Not financial advice. Trade with proper risk management. #USGDPUpdate #USJobsData #CPIWatch #BTCVSGOLD #AreYouBullishOrBearishToday?

👉 Follow

MC:$3.57KHolders:2

0.00%

- Reward

- like

- Comment

- Repost

- Share

GOLD MADE THE FIRST MOVE.

BITCOIN IS STILL LOADING.

Gold just broke a multi-year ceiling.

That usually marks the moment capital starts to reposition.

Bitcoin hasn’t reacted yet, but the conditions are clear:

• Long-term compression still intact

• Volatility crushed to extremes

• Structure holding while pressure builds

Gold tends to move first when liquidity seeks safety.

Bitcoin follows when risk appetite turns back on.

These phases don’t fade out slowly.

They resolve with expansion the kind that resets the entire cycle.

#CryptoNews

#BTCvsGold

BITCOIN IS STILL LOADING.

Gold just broke a multi-year ceiling.

That usually marks the moment capital starts to reposition.

Bitcoin hasn’t reacted yet, but the conditions are clear:

• Long-term compression still intact

• Volatility crushed to extremes

• Structure holding while pressure builds

Gold tends to move first when liquidity seeks safety.

Bitcoin follows when risk appetite turns back on.

These phases don’t fade out slowly.

They resolve with expansion the kind that resets the entire cycle.

#CryptoNews

#BTCvsGold

BTC-1,47%

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: Global Finance Is Quietly Crossing the Line 🚨

This isn’t another pilot.

This is infrastructure.

SWIFT, the backbone of global banking, has teamed up with 30+ major banks to design a new blockchain-based ledger for tokenized assets — and it plugs directly into the existing financial core. 👀

$XRP

🌍 What makes this seismic: • SWIFT connects 11,500+ financial institutions

• Coverage spans 200+ countries

• The goal isn’t experimentation — it’s circulation at scale

Instead of just sending messages about money, the system is moving toward moving the value itself — instantly, on-chain

This isn’t another pilot.

This is infrastructure.

SWIFT, the backbone of global banking, has teamed up with 30+ major banks to design a new blockchain-based ledger for tokenized assets — and it plugs directly into the existing financial core. 👀

$XRP

🌍 What makes this seismic: • SWIFT connects 11,500+ financial institutions

• Coverage spans 200+ countries

• The goal isn’t experimentation — it’s circulation at scale

Instead of just sending messages about money, the system is moving toward moving the value itself — instantly, on-chain

- Reward

- 8

- 4

- Repost

- Share

I_am_ready :

:

1000x VIbes 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

145.56K Popularity

34.05K Popularity

392.76K Popularity

14.69K Popularity

13.62K Popularity

11.5K Popularity

11.73K Popularity

11.21K Popularity

7.99K Popularity

3.32K Popularity

19.94K Popularity

12.42K Popularity

24.77K Popularity

32.68K Popularity

28.16K Popularity

News

View MoreMarket Report: Top 5 Cryptocurrency Gainers on February 8, 2026, led by MemeCore

14 m

Browser cache issues cause abnormal display of Arweave network block data.

20 m

Illinois proposes bill to establish state-level Bitcoin reserve

39 m

Multiple traditional financial assets experience price fluctuations, with gold, silver, and crude oil strengthening.

1 h

South African Reserve Bank Governor warns that the growth in stablecoin usage could impact monetary unity

1 h

Pin