Post content & earn content mining yield

placeholder

- Reward

- like

- Comment

- Repost

- Share

🇬🇧⚠️ United Kingdom At Risk Of Recession Due To President Trump's Tariffs - The Telegraph #macro

#crypto

#crypto

- Reward

- like

- Comment

- Repost

- Share

Maliang币

神币马良

Created By@HowToMakeMoneyWithou

Listing Progress

0.00%

MC:

$3.44K

Create My Token

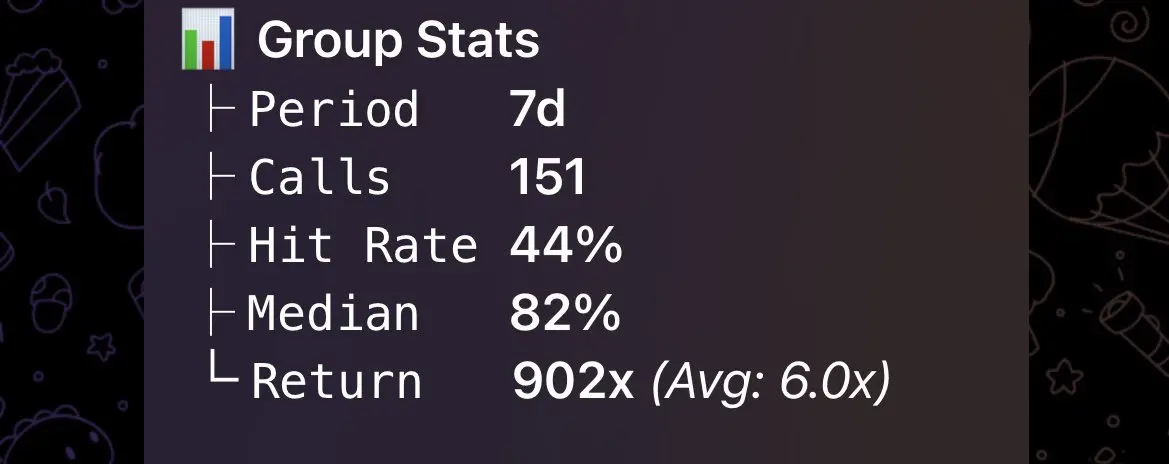

Following countless signal providers, this one currently feels good. Keep it up #欧美关税风波冲击市场

View Original

- Reward

- like

- Comment

- Repost

- Share

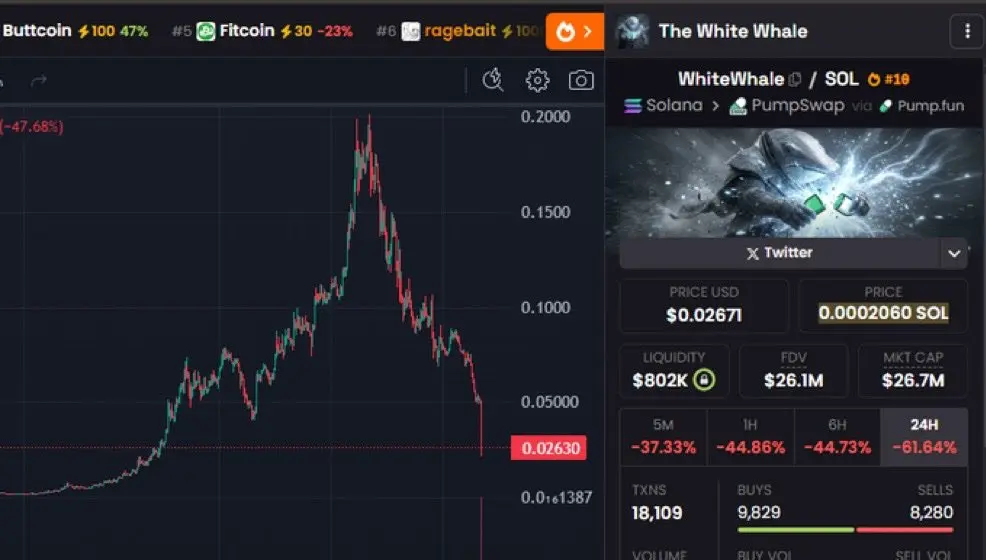

Market Analysis

- Reward

- like

- Comment

- Repost

- Share

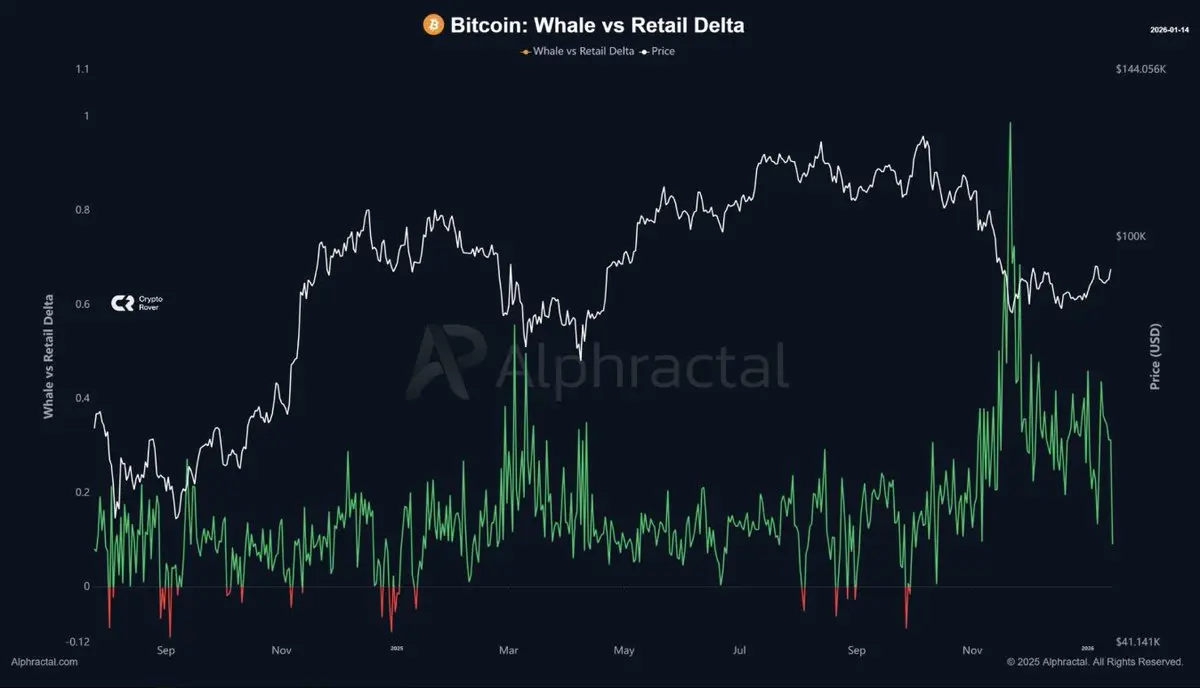

The "Elite Tier" Insight Institutional distribution is a masterclass in patience.

Whales closed the longs. The crash followed. It’s a script as old as time.

Smart money doesn't gamble; they exit.

Whales closed the longs. The crash followed. It’s a script as old as time.

Smart money doesn't gamble; they exit.

- Reward

- like

- Comment

- Repost

- Share

Verified or not

I wanna help you grow

Say “hi” let’s grow

I wanna help you grow

Say “hi” let’s grow

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

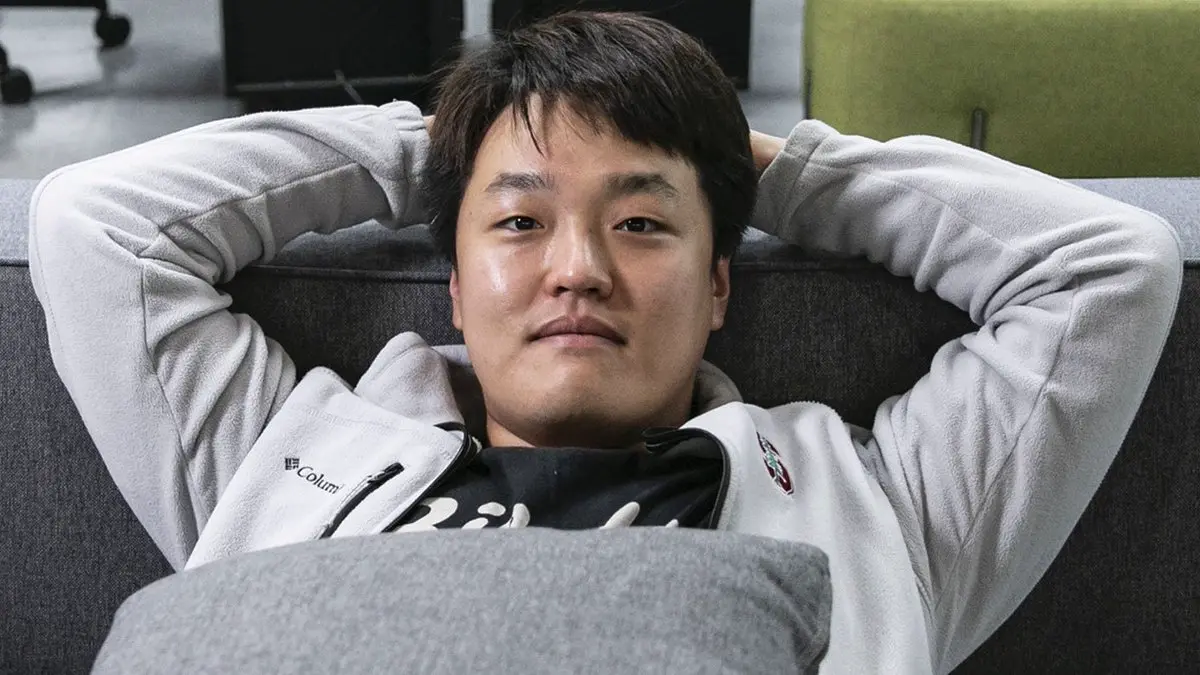

Do you remember Do Know?

The one and only founder of TERRA LUNA

Back in 2021 - 2022, he was running TERRA Luna, a crypto ecosystem worth $60 billion at its peak

Confident, loud, untouched

He told investors that stablecoin was safe

He mocked his critics

He said people questioning him were 'too poor to understand'

he even joked about watching companies die, days before Luna actually did

Then May 2022 happened..

LUNA went from $80 to basically zero in 48 hours

The USD peg broke

Panic was everywhere

Around $40 billion disappeared

and after all that?

How did he respond

He said this doesn't bother m

The one and only founder of TERRA LUNA

Back in 2021 - 2022, he was running TERRA Luna, a crypto ecosystem worth $60 billion at its peak

Confident, loud, untouched

He told investors that stablecoin was safe

He mocked his critics

He said people questioning him were 'too poor to understand'

he even joked about watching companies die, days before Luna actually did

Then May 2022 happened..

LUNA went from $80 to basically zero in 48 hours

The USD peg broke

Panic was everywhere

Around $40 billion disappeared

and after all that?

How did he respond

He said this doesn't bother m

LUNA-6,29%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$ARPA A strong 50%😳 surge has just occurred, and the momentum looks very strong.

Buyers are actively supporting the price, keeping it stable, which indicates great potential for the future. This is a clear trading opportunity—seize it!

#ARPA Network is a decentralized computing network designed to enhance privacy and security through threshold signature schemes (TSS). Its future outlook focuses on the expansion of Randcast, an on-chain verifiable random number generator (RNG), which is crucial for fair gaming, NFT minting, and DAO voting. Recently, ARPA has been integrating with major ecosyst

Buyers are actively supporting the price, keeping it stable, which indicates great potential for the future. This is a clear trading opportunity—seize it!

#ARPA Network is a decentralized computing network designed to enhance privacy and security through threshold signature schemes (TSS). Its future outlook focuses on the expansion of Randcast, an on-chain verifiable random number generator (RNG), which is crucial for fair gaming, NFT minting, and DAO voting. Recently, ARPA has been integrating with major ecosyst

ARPA42,77%

- Reward

- like

- Comment

- Repost

- Share

Tariff fears resurface! Under renewed macro shocks in Europe and the U.S., the crypto market saw a sudden flash crash on Monday

- Reward

- like

- Comment

- Repost

- Share

MYJB

蚂蚁金币

Created By@MunanYiBufan

Listing Progress

100.00%

MC:

$15.22K

Create My Token

#GateTradFiExperience jshsv sjajssv wkajasvs kwjasgs lahssggss wkwkshdgs wowksdgejwz sosisdyev wkajsjdhdhhekw sksjdhdh wkaksjdjhds kasjsjhshsvdjs

- Reward

- like

- Comment

- Repost

- Share

#CryptoMarketPullback

This is not panic.

This is a breath.

The market doesn't always go up.

Sometimes excessive leverage is cleared,

sometimes emotions are cooled,

sometimes space is made for strong hands.

The question isn't: “Did it fall?”

The real question is: “Where will it stop and who is ready?”

The chart speaks.

We just listen.

#CryptoMarketPullback

#BitcoinAnalysis

#MarketSentiment

#RiskOff

View OriginalThis is not panic.

This is a breath.

The market doesn't always go up.

Sometimes excessive leverage is cleared,

sometimes emotions are cooled,

sometimes space is made for strong hands.

The question isn't: “Did it fall?”

The real question is: “Where will it stop and who is ready?”

The chart speaks.

We just listen.

#CryptoMarketPullback

#BitcoinAnalysis

#MarketSentiment

#RiskOff

- Reward

- 2

- 2

- Repost

- Share

Sagittarius24 :

:

Watching Closely 🔍️View More

Gm looking to add some new faces to the group

What you guys bidding today ?

What you guys bidding today ?

- Reward

- like

- Comment

- Repost

- Share

Basically, I've finished watching all the shows I want to watch. I've also finished all the fan works and derivative works. I'm feeling motivated to go out again.

After browsing recommendations on Xiaohongshu, I found myself flipping through posts about the 39 and 40 thresholds on Xiaohongshu—it's a hurdle... Surpassing 40 is an abyss of aging... They've all built up my expectations.

Since I was young, I've heard about these thresholds so many times that I'm tired of them: 25 is a hurdle, 30 is a hurdle, 35 is a hurdle... Let's put it this way— for women, besides marriage and childbirth, t

View OriginalAfter browsing recommendations on Xiaohongshu, I found myself flipping through posts about the 39 and 40 thresholds on Xiaohongshu—it's a hurdle... Surpassing 40 is an abyss of aging... They've all built up my expectations.

Since I was young, I've heard about these thresholds so many times that I'm tired of them: 25 is a hurdle, 30 is a hurdle, 35 is a hurdle... Let's put it this way— for women, besides marriage and childbirth, t

- Reward

- like

- Comment

- Repost

- Share

Existence is the full meaning you have given me.

View Original

- Reward

- like

- 2

- Repost

- Share

Shamsulhuda :

:

Buy To Earn 💎View More

Gate Annual Report is out! Let's take a look at my yearly performance

Click the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VLESA15CAQ&ref_type=126&shareUid=VlZMV1paAwQO0O0O

View OriginalClick the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VLESA15CAQ&ref_type=126&shareUid=VlZMV1paAwQO0O0O

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More16.04K Popularity

332.08K Popularity

39.88K Popularity

5.52K Popularity

5.05K Popularity

Hot Gate Fun

View More- MC:$3.68KHolders:21.01%

- MC:$3.45KHolders:10.00%

- MC:$3.44KHolders:10.00%

- MC:$3.44KHolders:10.00%

- MC:$3.45KHolders:10.00%

News

View MoreData: If BTC breaks through $97,499, the total liquidation strength of mainstream CEX short positions will reach $1.654 billion.

1 h

Data: If ETH breaks through $3,369, the total liquidation strength of short positions on mainstream CEXs will reach $1.402 billion.

1 h

Trump Announces 10% EU Tariffs; Hong Kong Group Seeks CARF Rule Changes

1 h

1. After launching Alpha, it increased by 52.18%, current price is 0.008487 USDT

1 h

Federal Reserve Chairman Powell will attend the Supreme Court hearing of Director Cook

2 h

Pin