#USSECPushesCryptoReform .

Here’s what it really involves:

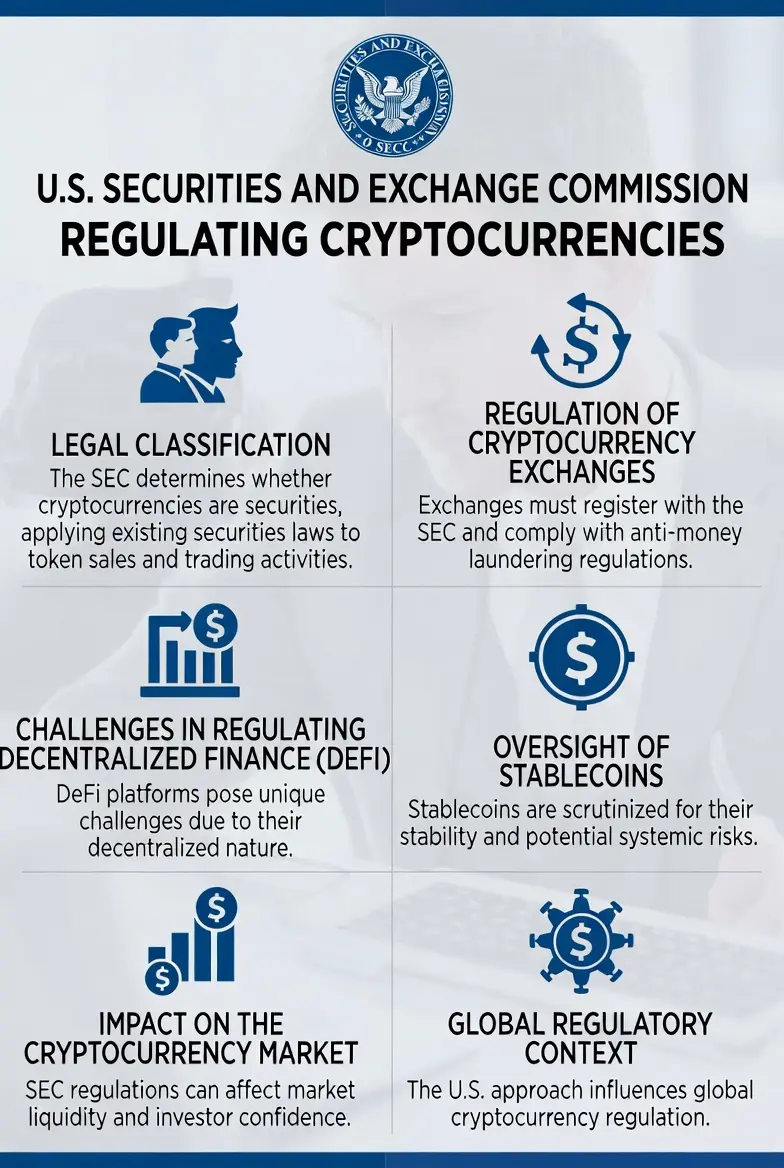

1️⃣ Legal Classification of Crypto Assets

The biggest issue is determining whether certain cryptocurrencies qualify as securities under U.S. law.

If a token is classified as a security:

It must register with the SEC.

The issuing project must provide disclosures.

Strict compliance requirements apply.

This creates major consequences for token launches, fundraising, and exchange listings.

2️⃣ Regulation of Exchanges

Crypto exchanges operating in the U.S. may be required to:

Register as securities exchanges.

Follow stricter reporting standards.

Improve custody protection.

Separate client funds from company funds.

This increases operational transparency but also raises compliance costs.

3️⃣ DeFi and Smart Contracts

Decentralized finance presents complex challenges because:

There may be no central operator.

Protocols run automatically via code.

Governance is distributed among token holders.

Regulators must decide whether developers, DAO members, or users carry responsibility.

4️⃣ Stablecoin Oversight

Stablecoins are under scrutiny due to:

Reserve backing transparency.

Systemic financial risk concerns.

Links to traditional banking infrastructure.

Reform could require stronger audits and oversight, increasing stability but reducing decentralization.

5️⃣ Market Impact

Short-term effects often include:

Increased volatility.

Investor caution.

Reduced leverage.

Liquidity shifts toward larger assets.

Long-term effects depend on how balanced the regulation becomes.

Clear rules can:

Increase institutional confidence.

Improve investor protection.

Strengthen market structure.

Overly strict rules can:

Slow innovation.

Push projects outside the U.S.

Concentrate power in large entities.

6️⃣ Broader Context

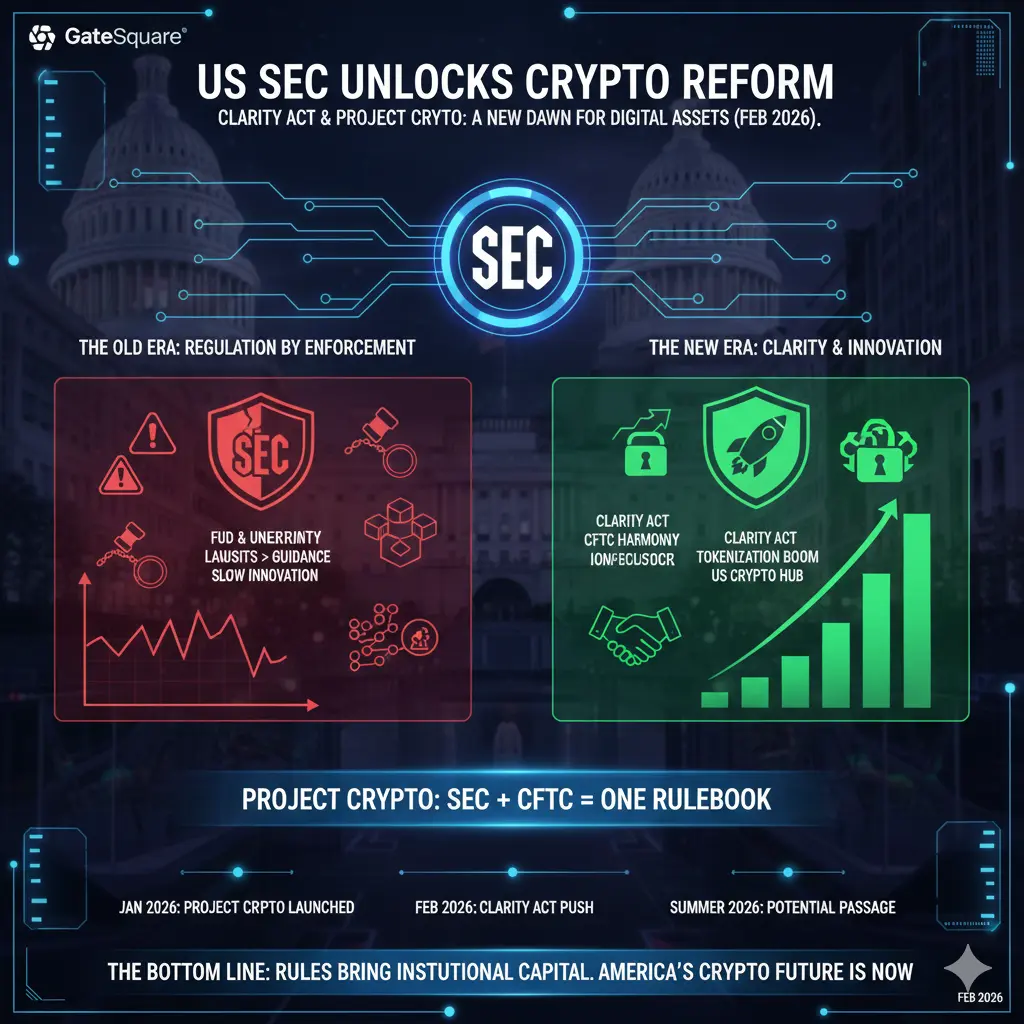

Other regulators like the Commodity Futures Trading Commission also influence crypto oversight. Global regulatory bodies, including the European Securities and Markets Authority, are shaping similar frameworks internationally.

This creates global regulatory competition.

Final Perspective

Crypto reform is not mainly about price — it is about legitimacy, structure, and long-term integration into the global financial system.

It represents a transition phase where crypto moves from experimental innovation toward institutional recognition and regulatory clarity.

Here’s what it really involves:

1️⃣ Legal Classification of Crypto Assets

The biggest issue is determining whether certain cryptocurrencies qualify as securities under U.S. law.

If a token is classified as a security:

It must register with the SEC.

The issuing project must provide disclosures.

Strict compliance requirements apply.

This creates major consequences for token launches, fundraising, and exchange listings.

2️⃣ Regulation of Exchanges

Crypto exchanges operating in the U.S. may be required to:

Register as securities exchanges.

Follow stricter reporting standards.

Improve custody protection.

Separate client funds from company funds.

This increases operational transparency but also raises compliance costs.

3️⃣ DeFi and Smart Contracts

Decentralized finance presents complex challenges because:

There may be no central operator.

Protocols run automatically via code.

Governance is distributed among token holders.

Regulators must decide whether developers, DAO members, or users carry responsibility.

4️⃣ Stablecoin Oversight

Stablecoins are under scrutiny due to:

Reserve backing transparency.

Systemic financial risk concerns.

Links to traditional banking infrastructure.

Reform could require stronger audits and oversight, increasing stability but reducing decentralization.

5️⃣ Market Impact

Short-term effects often include:

Increased volatility.

Investor caution.

Reduced leverage.

Liquidity shifts toward larger assets.

Long-term effects depend on how balanced the regulation becomes.

Clear rules can:

Increase institutional confidence.

Improve investor protection.

Strengthen market structure.

Overly strict rules can:

Slow innovation.

Push projects outside the U.S.

Concentrate power in large entities.

6️⃣ Broader Context

Other regulators like the Commodity Futures Trading Commission also influence crypto oversight. Global regulatory bodies, including the European Securities and Markets Authority, are shaping similar frameworks internationally.

This creates global regulatory competition.

Final Perspective

Crypto reform is not mainly about price — it is about legitimacy, structure, and long-term integration into the global financial system.

It represents a transition phase where crypto moves from experimental innovation toward institutional recognition and regulatory clarity.