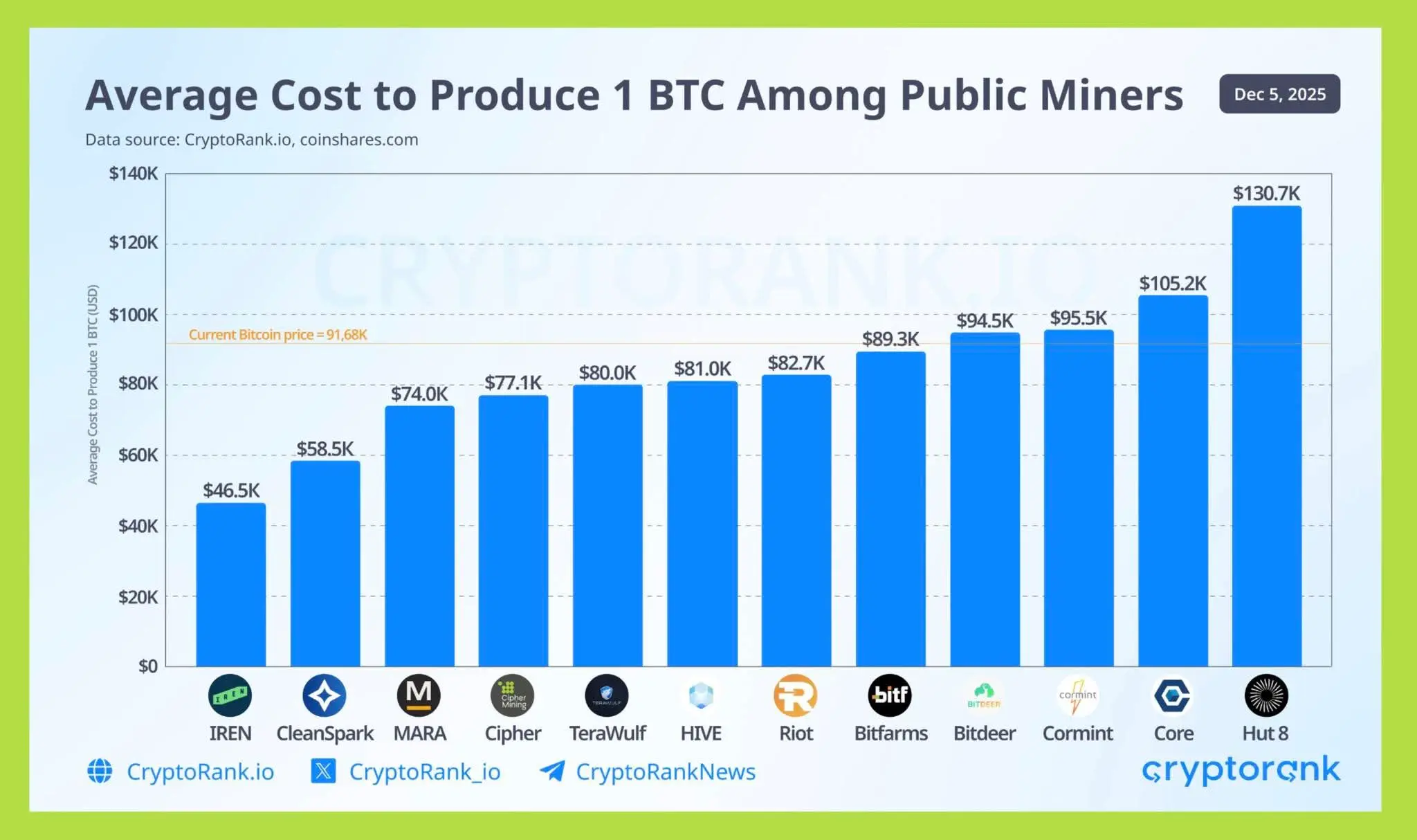

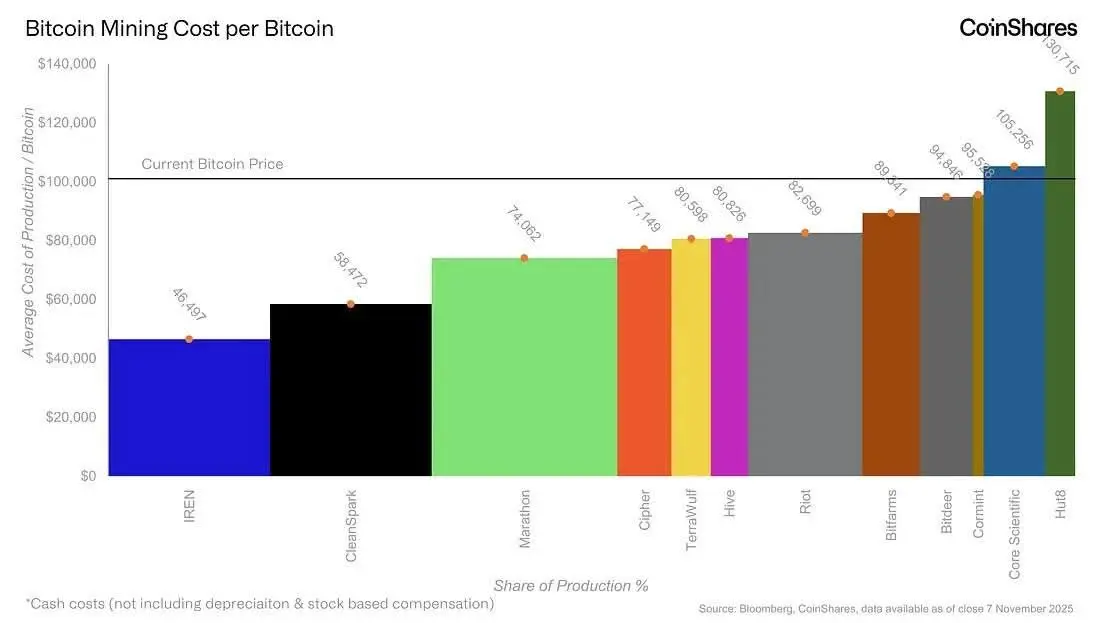

🔥 According to the latest data from publicly listed Bitcoin mining companies, the cost to mine a single Bitcoin is steadily increasing. Specifically, in Q2 of 2025, if only considering actual cash expenses such as electricity, labor, and operations, the average cost to mine one Bitcoin is about $74,600.

However, this figure does not fully reflect the real costs that companies have to bear. When factoring in non-cash expenses such as equipment depreciation over time and stock-based compensation for employees instead of cash, the total actual cost to produce one Bitcoin rises to $137,800.

Notab

View Original