# Stablecoins

1.18M

Nimmakayala

0

0

🚨 Stablecoins Are Back on Meta’s Radar

Big news in the fintech + crypto space 👀

Reports suggest Mark Zuckerberg is gearing up for a stablecoin comeback, with Meta Platforms exploring payments integration in the second half of the year.

💳 What’s being planned:

• A new digital wallet designed for seamless crypto payments

• Third-party vendor support to manage stablecoin infrastructure

• Focus on real-world payment use cases across Meta’s ecosystem

This move signals that big tech hasn’t given up on blockchain rails for global payments. If executed well, it could accelerate mainstream adoption

Big news in the fintech + crypto space 👀

Reports suggest Mark Zuckerberg is gearing up for a stablecoin comeback, with Meta Platforms exploring payments integration in the second half of the year.

💳 What’s being planned:

• A new digital wallet designed for seamless crypto payments

• Third-party vendor support to manage stablecoin infrastructure

• Focus on real-world payment use cases across Meta’s ecosystem

This move signals that big tech hasn’t given up on blockchain rails for global payments. If executed well, it could accelerate mainstream adoption

MC:$0.1Holders:1

0.00%

- Reward

- like

- Comment

- Repost

- Share

#TrumpGroupMullsGazaStablecoin #TrumpGroupMullsGazaStablecoin

Recent reports indicate that the Trump Group is exploring the potential of launching a stablecoin linked to economic initiatives in Gaza. This development underscores how digital currencies are increasingly becoming tools not just for investment, but for regional economic strategy and financial inclusion.

Stablecoins, by design, provide a bridge between traditional currencies and blockchain-based assets. They offer stability in value while maintaining the efficiency, transparency, and accessibility of digital finance. For regions li

Recent reports indicate that the Trump Group is exploring the potential of launching a stablecoin linked to economic initiatives in Gaza. This development underscores how digital currencies are increasingly becoming tools not just for investment, but for regional economic strategy and financial inclusion.

Stablecoins, by design, provide a bridge between traditional currencies and blockchain-based assets. They offer stability in value while maintaining the efficiency, transparency, and accessibility of digital finance. For regions li

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

very informative post1️⃣ Understand the Regulatory Direction

Stay informed about White House discussions and potential policy changes around yield-bearing stablecoins.

2️⃣ Evaluate Risk Exposure

If you’re investing in stablecoins offering yields, assess counterparty risk, reserve transparency, and platform credibility.

3️⃣ Monitor Compliance Requirements

Projects and platforms should review how future regulations may affect licensing, disclosures, and reporting obligations.

4️⃣ Diversify Smartly

Avoid concentrating funds in a single yield product—spread risk across trusted platforms and asset types.

5️⃣ Prepare fo

Stay informed about White House discussions and potential policy changes around yield-bearing stablecoins.

2️⃣ Evaluate Risk Exposure

If you’re investing in stablecoins offering yields, assess counterparty risk, reserve transparency, and platform credibility.

3️⃣ Monitor Compliance Requirements

Projects and platforms should review how future regulations may affect licensing, disclosures, and reporting obligations.

4️⃣ Diversify Smartly

Avoid concentrating funds in a single yield product—spread risk across trusted platforms and asset types.

5️⃣ Prepare fo

- Reward

- 2

- Comment

- Repost

- Share

#WhiteHouseTalksStablecoinYields 🇺🇸💵

The Battle Over Stablecoin Yield Is Reaching a Turning Point

On Feb 19, 2026, the White House hosted its third closed-door meeting on stablecoin yields — bringing together:

• Coinbase

• Ripple

• Major bank trade groups (ABA, ICBA)

• Administration negotiators

Sources describe the session as “productive” — but no final deal yet.

The core issue remains explosive:

👉 Should Stablecoins Pay Yield?

💰 What’s at Stake?

The stablecoin market now exceeds $300B, largely backed by U.S. Treasuries.

If issuers like Circle (USDC) or Tether (USDT) offer 3–5% passive y

The Battle Over Stablecoin Yield Is Reaching a Turning Point

On Feb 19, 2026, the White House hosted its third closed-door meeting on stablecoin yields — bringing together:

• Coinbase

• Ripple

• Major bank trade groups (ABA, ICBA)

• Administration negotiators

Sources describe the session as “productive” — but no final deal yet.

The core issue remains explosive:

👉 Should Stablecoins Pay Yield?

💰 What’s at Stake?

The stablecoin market now exceeds $300B, largely backed by U.S. Treasuries.

If issuers like Circle (USDC) or Tether (USDT) offer 3–5% passive y

DEFI-6,4%

- Reward

- 16

- 25

- Repost

- Share

AylaShinex :

:

2026 GOGOGO 👊View More

#WhiteHouseTalksStablecoinYields 🇺🇸💵

The Battle Over Stablecoin Yield Is Reaching a Turning Point

On Feb 19, 2026, the White House hosted its third closed-door meeting on stablecoin yields — bringing together:

• Coinbase

• Ripple

• Major bank trade groups (ABA, ICBA)

• Administration negotiators

Sources describe the session as “productive” — but no final deal yet.

The core issue remains explosive:

👉 Should Stablecoins Pay Yield?

💰 What’s at Stake?

The stablecoin market now exceeds $300B, largely backed by U.S. Treasuries.

If issuers like Circle (USDC) or Tether (USDT) offer 3–5% passive y

The Battle Over Stablecoin Yield Is Reaching a Turning Point

On Feb 19, 2026, the White House hosted its third closed-door meeting on stablecoin yields — bringing together:

• Coinbase

• Ripple

• Major bank trade groups (ABA, ICBA)

• Administration negotiators

Sources describe the session as “productive” — but no final deal yet.

The core issue remains explosive:

👉 Should Stablecoins Pay Yield?

💰 What’s at Stake?

The stablecoin market now exceeds $300B, largely backed by U.S. Treasuries.

If issuers like Circle (USDC) or Tether (USDT) offer 3–5% passive y

DEFI-6,4%

- Reward

- 12

- 18

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Good luck and prosperity 🧧View More

📢🇺🇸 #WhiteHouseTalksStablecoinYields – Policy Talks in Motion

The White House has held high-level meetings with banks and crypto industry leaders to discuss stablecoin yields, a key topic in shaping U.S. digital asset legislation, including the CLARITY Act. 🏛️💬

🔹 Key Points:

• Negotiations are progressing but no final agreement has been reached on stablecoin yields.

• Banks argue yields could compete with traditional deposits, seeking limits or bans 🏦⚠️.

• Crypto industry advocates want flexibility to maintain consumer incentives and innovation 🚀.

• Policymakers aim to finalize a frame

The White House has held high-level meetings with banks and crypto industry leaders to discuss stablecoin yields, a key topic in shaping U.S. digital asset legislation, including the CLARITY Act. 🏛️💬

🔹 Key Points:

• Negotiations are progressing but no final agreement has been reached on stablecoin yields.

• Banks argue yields could compete with traditional deposits, seeking limits or bans 🏦⚠️.

• Crypto industry advocates want flexibility to maintain consumer incentives and innovation 🚀.

• Policymakers aim to finalize a frame

DEFI-6,4%

- Reward

- 4

- Comment

- Repost

- Share

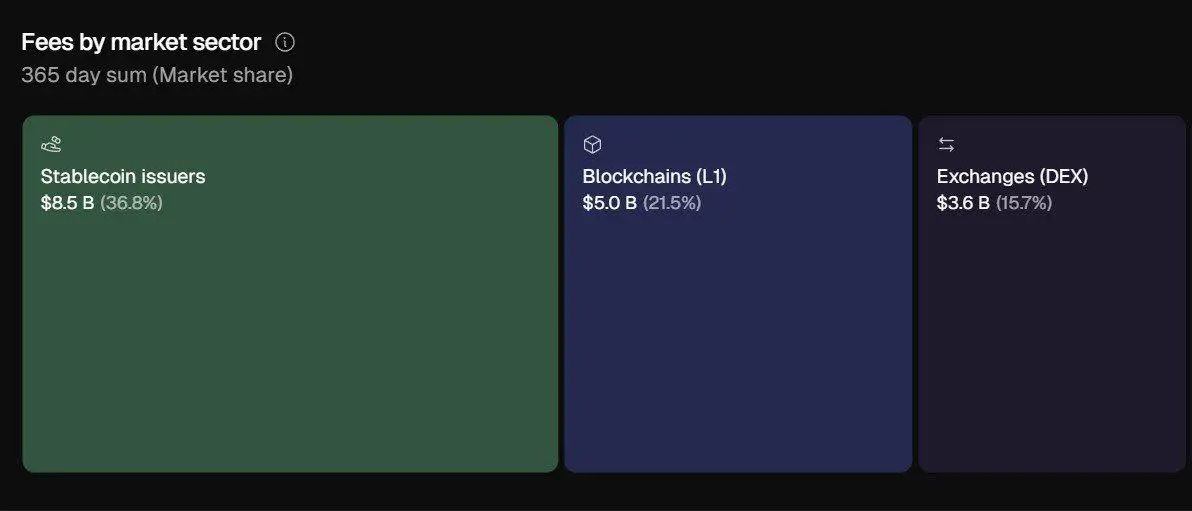

Stablecoins are no longer a side narrative — they’re becoming the liquidity backbone of crypto.

Stables are now nearly as large as L1 ecosystems and DeFi combined.

That changes the hierarchy of value on-chain.

Capital isn’t just chasing volatility anymore. It’s parking in dollar liquidity, settling trades, bridging chains, and powering payments. L1s host activity. DeFi deploys capital. But stables are the capital.

Follow the liquidity — that’s where the real signal sits.

#defi #Stablecoins

Stables are now nearly as large as L1 ecosystems and DeFi combined.

That changes the hierarchy of value on-chain.

Capital isn’t just chasing volatility anymore. It’s parking in dollar liquidity, settling trades, bridging chains, and powering payments. L1s host activity. DeFi deploys capital. But stables are the capital.

Follow the liquidity — that’s where the real signal sits.

#defi #Stablecoins

DEFI-6,4%

- Reward

- 3

- Comment

- Repost

- Share

📢 #WhiteHouseTalksStablecoinYields Update 🇺🇸

The White House is holding key discussions with banking leaders and crypto industry representatives over stablecoin yields.

💬 The debate centers on whether stablecoins — digital tokens pegged to the U.S. dollar — should be allowed to offer interest or rewards to holders. Crypto firms argue it’s essential for innovation, while traditional banks warn it could divert deposits from conventional financial systems.

📍 Recent meetings report constructive talks, but no final agreement has been reached. The White House is exploring a compromise that may

The White House is holding key discussions with banking leaders and crypto industry representatives over stablecoin yields.

💬 The debate centers on whether stablecoins — digital tokens pegged to the U.S. dollar — should be allowed to offer interest or rewards to holders. Crypto firms argue it’s essential for innovation, while traditional banks warn it could divert deposits from conventional financial systems.

📍 Recent meetings report constructive talks, but no final agreement has been reached. The White House is exploring a compromise that may

- Reward

- 9

- 12

- Repost

- Share

AYATTAC :

:

2026 GOGOGO 👊View More

#WhiteHouseTalksStablecoinYields

Discussions emerging from the White House around stablecoin yields signal a pivotal moment for the future of digital finance. As policymakers evaluate how yield-bearing stablecoins fit within the broader financial system, the focus remains on balancing innovation with investor protection and market stability. Clear regulatory direction could unlock greater institutional confidence, encourage responsible growth in the crypto sector, and shape how digital dollars compete on the global stage. Market participants should watch closely — policy clarity often becomes

Discussions emerging from the White House around stablecoin yields signal a pivotal moment for the future of digital finance. As policymakers evaluate how yield-bearing stablecoins fit within the broader financial system, the focus remains on balancing innovation with investor protection and market stability. Clear regulatory direction could unlock greater institutional confidence, encourage responsible growth in the crypto sector, and shape how digital dollars compete on the global stage. Market participants should watch closely — policy clarity often becomes

- Reward

- 7

- 15

- Repost

- Share

CryptoChampion :

:

Ape In 🚀View More

#DigitalDollarDebate #StablecoinPolicy

🏛️ The future of dollar-backed stablecoins is quickly becoming one of the most important financial policy discussions in United States today.

This isn’t merely a crypto issue — it’s about how digital dollars could reshape payments, savings, and global capital movement.

🔍 What’s Under Discussion?

Regulators are evaluating how stablecoins like USD Coin and Tether should operate within the financial system.

If clear frameworks emerge:

• Stablecoins could become a trusted digital cash layer

• Cross-border payments may become faster and cheaper

• Traditional

🏛️ The future of dollar-backed stablecoins is quickly becoming one of the most important financial policy discussions in United States today.

This isn’t merely a crypto issue — it’s about how digital dollars could reshape payments, savings, and global capital movement.

🔍 What’s Under Discussion?

Regulators are evaluating how stablecoins like USD Coin and Tether should operate within the financial system.

If clear frameworks emerge:

• Stablecoins could become a trusted digital cash layer

• Cross-border payments may become faster and cheaper

• Traditional

- Reward

- 7

- 10

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Good luck and prosperity 🧧View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

68.8K Popularity

163.15K Popularity

40.3K Popularity

3.96K Popularity

416.09K Popularity

328.94K Popularity

37.27K Popularity

79.96K Popularity

168 Popularity

3.04K Popularity

6.22K Popularity

4.08K Popularity

4.97K Popularity

30.17K Popularity

31.32K Popularity

News

View MoreChan Maobo: Studying tax incentives for qualified institutions engaged in gold trading and settlement in Hong Kong

5 m

Wallet Turns $180K into $6.7M with $PIPPIN Investment in Four Months

10 m

Alibaba Cloud launches four major open-source models including Qwen3.5

13 m

Paul Chan: The first stablecoin issuer licenses will be issued in March, and a draft of the digital asset policy ordinance will be submitted within the year.

22 m

Chan Maobo: Launching an electronic bond trading platform in the second half of the year

23 m

Pin