# XAUUSDT

2.42K

SultanDedenHidayatulla

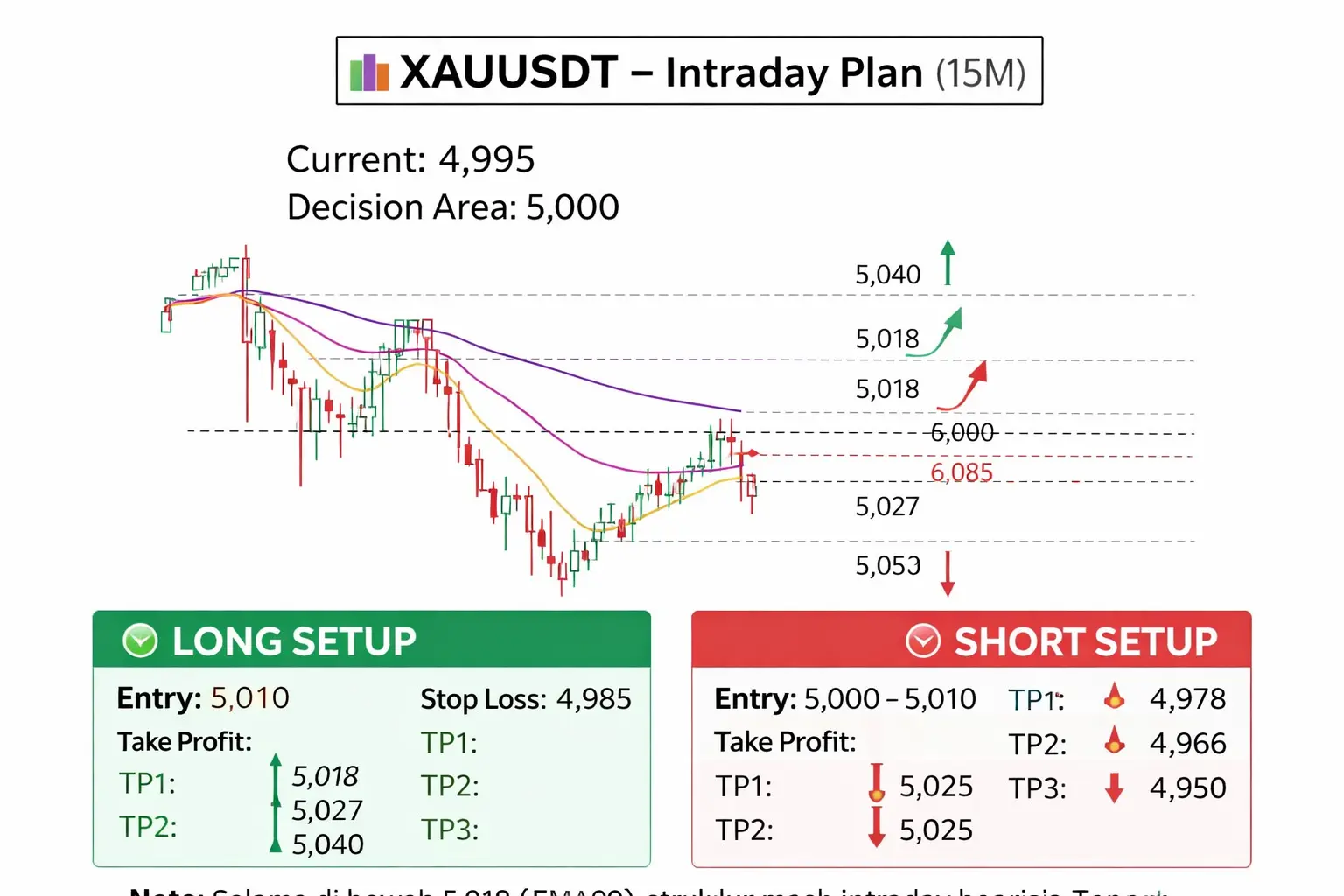

📊 XAUUSDT – Intraday Plan (15M)

Current: 4,995

Decision Area: 5,000

🟢 Long Setup

Entry: 5,010 after a strong close above 5,005

SL: 4,985

TP:

• 5,018

• 5,027

• 5,040

🔴 Short Setup

Entry: 5,000 – 5,010 if clear rejection

SL: 5,025

TP:

• 4,978

• 4,966

• 4,950

Note:

As long as below 5,018 EMA99(, the structure remains intraday bearish.

Wait for confirmation, do not enter without validation.

XAUUSDT 15M

Key level: 5,000

Break & hold → Long

Rejection → Short

Plan your trade. Trade your plan.

Current: 4,995

Decision Area: 5,000

🟢 Long Setup

Entry: 5,010 after a strong close above 5,005

SL: 4,985

TP:

• 5,018

• 5,027

• 5,040

🔴 Short Setup

Entry: 5,000 – 5,010 if clear rejection

SL: 5,025

TP:

• 4,978

• 4,966

• 4,950

Note:

As long as below 5,018 EMA99(, the structure remains intraday bearish.

Wait for confirmation, do not enter without validation.

XAUUSDT 15M

Key level: 5,000

Break & hold → Long

Rejection → Short

Plan your trade. Trade your plan.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

The precious metals liquidity crisis wipes out $7.4 trillion 💥

#الذهب and #الفضة markets together lost an estimated $7.4 trillion in market value during the historic crash that began on January 30, 2026.

The main reason: Kevin Warsh's nomination for Federal Reserve Chair, which led to a sharp collapse in long speculative positions heavily concentrated in precious metals markets.

Gold:

Prices plummeted by 9-12% in one day, dropping from around $5,600 to a low of $4,700.

Silver:

Experienced its worst daily decline since 1980, falling by 26-31% to settle below $80 per ounce.

Concentrated trade

#الذهب and #الفضة markets together lost an estimated $7.4 trillion in market value during the historic crash that began on January 30, 2026.

The main reason: Kevin Warsh's nomination for Federal Reserve Chair, which led to a sharp collapse in long speculative positions heavily concentrated in precious metals markets.

Gold:

Prices plummeted by 9-12% in one day, dropping from around $5,600 to a low of $4,700.

Silver:

Experienced its worst daily decline since 1980, falling by 26-31% to settle below $80 per ounce.

Concentrated trade

XAG3L-2,18%

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

Crowded trades are quickly unwound. Liquidity disappears even faster.Current situation Trend: On the 15-minute timeframe, a sharp "liquidation" is visible. The price has broken through all moving averages (MA5, MA10, MA30) from top to bottom, indicating a strong bearish impulse at the moment.

Indicators: MACD is deep in the negative zone, the histogram is red, confirming the strength of the decline.

Levels: The price touched the mark of 4,823.55, after which there was a slight rebound to 4,864.65.

Fundamental background for today

Today, January 30, a "black swan" of local scale occurred in the gold market. After yesterday's record around $5 500 – $5 600,

View OriginalIndicators: MACD is deep in the negative zone, the histogram is red, confirming the strength of the decline.

Levels: The price touched the mark of 4,823.55, after which there was a slight rebound to 4,864.65.

Fundamental background for today

Today, January 30, a "black swan" of local scale occurred in the gold market. After yesterday's record around $5 500 – $5 600,

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

160.13K Popularity

31.37K Popularity

27.85K Popularity

73.83K Popularity

13.73K Popularity

277.96K Popularity

362.98K Popularity

25.62K Popularity

15.1K Popularity

13.67K Popularity

13.79K Popularity

12.92K Popularity

12.64K Popularity

40.46K Popularity

News

View MoreWhale Swaps 86 BTC Worth $5.86M for 2,943 ETH via ThorChain

4 m

The Bank of Japan may raise interest rates in April

7 m

The probability that the Federal Reserve will keep interest rates unchanged in March is 92.2%.

20 m

Harvard University established its first Ethereum ETF position in Q4 2025 and reduced its Bitcoin ETF holdings by approximately 21%.

24 m

Wintermute launches institutional-grade tokenized gold trading, with an expected market size of $15 billion by 2026

1 h

Pin